Will We Start Seeing More 60-year Lease Condos Soon?

January 14, 2024

There are two types of people who buy freehold properties, and they don’t realise they should hate each other. Not until the en-bloc meeting happens.

You see, for some people, the benefit of a freehold condo is they think that it’s easier to go en-bloc (i.e., is more likely to be torn down and replaced). When the developer doesn’t have to top up the lease back to 99-years, the project gets much more attractive to them.

But on the other hand, there’s another batch of people who buy freehold precisely because they want it to last forever. And it involves absolutely apocalyptic meltdowns that turn every en-bloc-related meeting into a complete mess.

It happens with leasehold properties too, but in my experience, it’s especially bad when it comes to freehold, and some of the owners were looking forward to an intergenerational asset.

Things may be changing though, as a newer generation of home buyers – and the Internet – provides new data. Today, we have seen that sometimes freehold developments may not bring the sort of performance that justifies its premiums. And perhaps most significantly, we have also been able to see when condos tend to go en-bloc. Regardless of whether a property is leasehold or freehold, many don’t last past their 30s (on average, many are gone in 19 to 24 years).

So for those who want an intergenerational family home, it may be time to consider that – outside of landed properties – maybe you’re not getting what you pay for. And for those who worry about the resale value of 99-year leaseholds, well, odds are you’ll be selling (to an individual or a developer) before you’re even halfway past that.

What’s left to contend with, is the psychological hurdle

When I air these views, realtors are quick to correct me, and say I don’t understand the human side of the property market. Buyers aren’t perfectly rational, I’m told, and no amount of data is going to convince old-school homebuyers that leasehold is the way to go.

This may come down to the cost, and how long we pay for it: no one likes feeling, at the end of 25 or 30-years of slaving away at the mortgage, that they haven’t obtained an asset which is going to last forever (at least in their mind).

Then there’s the prestige factor: most freehold homes are in prime areas, whereas to some, “leasehold” carries connotations of a mass-market property. And whenever I try to handwave that, realtors are quick to remind me there’s little reason why Executive Condominiums shouldn’t match private condominiums in value – except for many Singaporeans insistently saying “How can my private condo be worth less/the same/as that EC next door?”

On top of that, the number of freehold properties declines year-after-year, and scarcity value might raise its prestige even more.

It seems that, regardless of what’s uncovered, the freehold versus leasehold argument will never be fully settled. While more buyers are becoming conscious of the myths surrounding freehold, it’s still a nice flex to say your condo is freehold, at the reunion this Chinese New Year.

What does this mean for the future?

This can go a number of ways, but let’s lay out some of the more popular discussions:

The first is that, as freehold properties get scarcer over time (remember, new GLS land is all leasehold), the premium increases even more – and even if it’s not rational (i.e., the freehold doesn’t show its advantage because it’s redeveloped too soon anyway), the gap between freehold and leasehold prices increases even more. Sometimes, all it takes is scarcity value, and a sense of prestige.

More from Stacked

The Biggest Misconceptions About Buying Property In Singapore’s CCR In 2025

Singapore’s Core Central Region (CCR) is as straightforward as HDB eligibility rules. Everyone thinks they have a good idea of…

The second is that the market looks at it with a more rational eye. If freehold developments get too expensive, or the old ones are too difficult to go en bloc and be redeveloped anyway, buyers may just prefer the newer, more modern developments. And if a 99-year leasehold becomes more acceptable – and we accept that properties tend to last less than 30 years – this may be a slippery slope.

Consider that The Hillford is a condo on a 60-year lease, and still finds willing buyers. This was likely a testbed to see the acceptance of shorter leases (like what you see with some commercial developments), and how they would perform. Given the rising land prices, there has to come a point where something has to give – and selling shorter leases on the land may be something that we see happening in the near future.

Perhaps if we go this route, there’ll come a time when Singaporeans are arguing about 60-year leaseholds versus 99-year leaseholds.

Meanwhile in other property news…

- Why do some new launch condos fare so much better, while some perform terribly? It’s sometimes due to reasons other than the property itself.

- A 5-room flat in a central area for $668k or below? Yup, it’s possible, and we found some.

- The Arden is a new launch that offers high-ceiling, loft-style units at a reasonable price. Check it out here.

- Will we finally have affordable homes in Singapore in 2024? Well it uh…it won’t be as bad as last year, probably, if that helps.

- Did you a landed home last year sold for the price of a resale 4-room flat? Here are some of the cheapest transactions to date, and some of them are pretty surprising.

Weekly Sales Roundup (01 January – 07 January)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| WATTEN HOUSE | $7,706,000 | 2368 | $3,254 | FH |

| 19 NASSIM | $4,939,050 | 1410 | $3,503 | 99 yrs (2019) |

| THE RESERVE RESIDENCES | $4,247,192 | 1625 | $2,613 | 99 yrs (2021) |

| ONE BERNAM | $3,600,000 | 1421 | $2,534 | 99 yrs (2019) |

| PINETREE HILL | $3,581,000 | 1464 | $2,446 | 99 yrs (2022) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE MYST | $1,207,000 | 517 | $2,336 | 99 yrs (2023) |

| GRAND DUNMAN | $1,627,000 | 667 | $2,438 | 99 yrs (2022) |

| THE LAKEGARDEN RESIDENCES | $1,681,500 | 775 | $2,170 | 99 yrs (2023) |

| THE CONTINUUM | $1,832,000 | 667 | $2,745 | FH |

| THE BOTANY AT DAIRY FARM | $1,885,000 | 926 | $2,036 | 99 yrs (2022) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE AZURE | $5,200,000 | 3165 | $1,643 | 99 yrs (2005) |

| MARTIN MODERN | $4,855,000 | 1733 | $2,801 | 99 yrs (2016) |

| ASCENTIA SKY | $4,700,000 | 3089 | $1,521 | 99 yrs (2008) |

| PARK INFINIA AT WEE NAM | $4,700,000 | 2002 | $2,348 | FH |

| KUM HING COURT | $4,180,000 | 1625 | $2,572 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| URBAN VISTA | $718,000 | 441 | $1,627 | 99 yrs (2012) |

| THE TAPESTRY | $730,000 | 441 | $1,654 | 99 yrs (2017) |

| LE SOMME | $828,000 | 495 | $1,672 | FH |

| WHISTLER GRAND | $855,000 | 441 | $1,937 | 99 yrs (2018) |

| 28 IMPERIAL RESIDENCES | $870,000 | 592 | $1,470 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE GARDENS AT BISHAN | $3,520,000 | 2336 | $1,507 | $2,270,000 | 23 Years |

| CITY SQUARE RESIDENCES | $2,560,000 | 1216 | $2,105 | $1,891,240 | 19 Years |

| RIS GRANDEUR | $2,988,000 | 3703 | $807 | $1,685,982 | 18 Years |

| THOMSON 800 | $2,800,000 | 1625 | $1,723 | $1,613,500 | 22 Years |

| THOMSON GROVE | $2,480,000 | 1485 | $1,670 | $1,310,000 | 13 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| BARTLEY VUE | $1,330,000 | 657 | $2,026 | -$91,000 | 1 Year |

| 18 WOODSVILLE | $907,000 | 495 | $1,832 | -$65,020 | 11 Years |

| LEONIE SUITES | $1,780,000 | 936 | $1,901 | -$10,000 | 11 Years |

| DEVONSHIRE RESIDENCES | $1,160,000 | 495 | $2,343 | $59,912 | 7 Years |

| MAYSPRINGS | $960,000 | 904 | $1,062 | $60,000 | 11 Years |

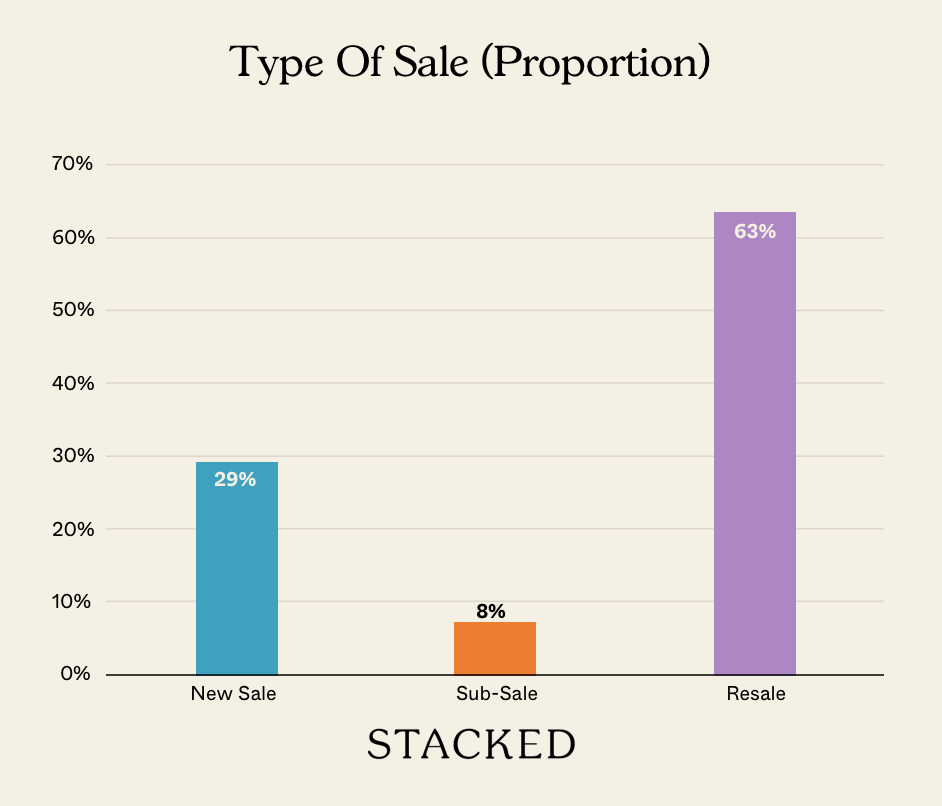

Transaction Breakdown

For more property news around Singapore, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Will we see more 60-year lease condos in Singapore soon?

Are freehold properties always better than leasehold ones?

Why do some buyers prefer freehold condos over leasehold ones?

How does the scarcity of freehold properties affect their prices in the future?

Could shorter leasehold properties like 60-year leases become more common?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

Singapore Property News Some Units At This Freehold Riverfront Condo Could Lose Their Views — But Here’s How Prices Have Actually Moved

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Latest Posts

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Pro Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

2 Comments

Will most condo being enbloc before 99yrs lease end? Or only small percentage. If only 5% would being enbloc in the end, the difference between FH and lease hold may be still valid.