Upgrading To A Condo By 35: Is That Still Possible For The Average Singaporean In 2025?

February 11, 2025

The idea of upgrading from an HDB flat to a condo is a familiar one for Singaporeans. But given how private property prices rose in the aftermath of Covid, is it still viable? And just as importantly, when does it become doable? By the time we’re in our 40s or 50s, we may face loan restrictions, or simply be too close to retirement to take on further risks. Here’s a look at how realistic it is for one to upgrade by 35, in today’s property market:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Why do we look at 35 as the target age?

We use this because in many (but certainly not all) cases, the age of 35 is a realistic one for an ambitious upgrader.

The first reason is that the maximum loan tenure (to get the full loan quantum) is 30 years or until age 65, whichever is lower. So a 35-year-old can – barring issues such as bad credit – obtain the full 75 per cent Loan-to-value (LTV) ratio on a 30-year loan tenure.

When they’re much older, the available loan tenure starts to decrease (e.g., a 45-year-old can only get a 20-year loan tenure, if they want the full LTV).

The second reason is just on-the-ground experience. Most upgraders we encounter are at least in their mid-thirties to mid-forties. It’s rare for a 25-year-old, for example, to have the income or capital to upgrade; especially at the high private home prices we’re seeing in 2025.

How realistic is this scenario for the average Singaporean?

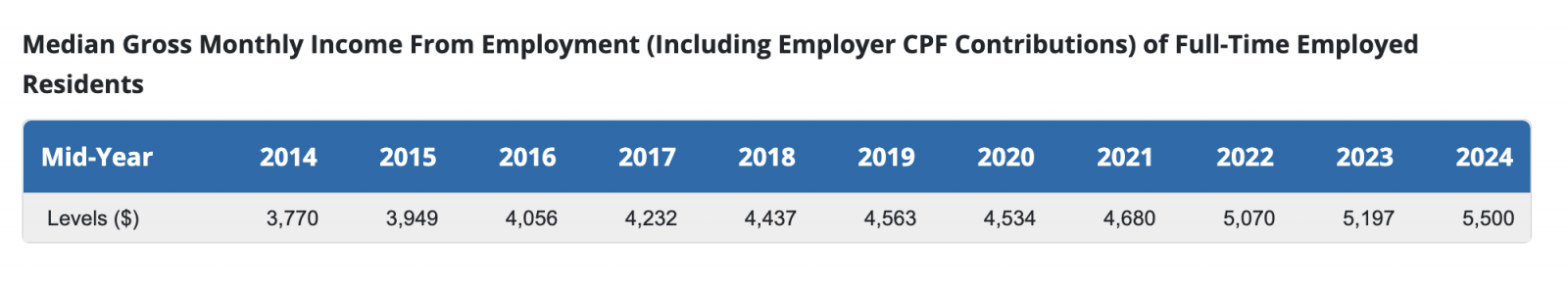

Based on recent official numbers, the median income for a Singaporean today is $5,500 per month. We’re going to assume our upgraders are a couple who both make this amount and who are going to be co-owners (i.e., a monthly household income of $11,000 per month.) For simplicity’s sake, we’ll assume they are the same age, or close to it.

Next, we’ll look at the cost of a typical three-bedder condo unit, which is what most Singaporeans consider to be family-sized. This is roughly around 900 sq. ft. by 2025 standards.

Let’s look at the cost of a suitable condo unit today

We’ll keep our example generalised, rather than using any one specific project. As of 2025, average prices for a new launch condo are about $2,200 psf, whilst resale condos average around $1,600 psf.

For a theoretical 1,000 sq. ft. unit, we’ll assume our couple chooses a resale condo, which has a more realistic quantum of around $1.6 million (as opposed to a new launch three-bedder, which is past the $2 million mark almost everywhere at this point.)

The loan and payments for a $1.6 million condo would look something like the following:

- First five per cent paid in cash: $80,000

- Next 20 per cent paid with CPF: $320,000

- Buyers Stamp Duty (BSD): $49,600

- Additional $53,000 for the down payment, due to TDSR reasons (see below).

This is an initial cash outlay of $502,600, of which $80,000 must be in cash, and the rest can come from CPF.

The remaining amount ($1.2 million) is covered by the bank loan. We’ll assume a 25-year loan tenure, at four per cent interest*.

This comes to a monthly loan repayment of $6,334 per month. This is a problem, since it exceeds the TDSR limit of our buying couple.

The TDSR is capped at 55 per cent of the combined borrowers’ income, so their maximum monthly loan repayment is roughly $6,050 per month.

To get the repayments down to this amount, the loan amount must be reduced to around $1,147,000. This adds another $53,000, which we’ll tack on to the down payment.

*Four per cent is the floor rate used by banks, and is also used to calculate TDSR. The actual rate tends to be lower.

Next, we’ll deduct the sale proceeds of their 4-room flat.

Again for practicality’s sake, we’ll assume they sell their flat before making their condo purchase, thus sparing them from upfront ABSD costs.

As of 2025, typical 4-room flat prices average $650 psf. Assuming the couple’s flat was 960 sq. ft., which is common for a 4-room flat, this comes to about $624,000.

But they don’t get all $624,000: they would still have had an outstanding home loan to clear. They would have had to pay this off before going ahead to buy their condo.

So: let’s say they took the maximum 25-year HDB loan tenure with an initial loan of $400,000 at 2.6 per cent interest, when first buying their flat. We’ll say they made this purchase at the age of 25.

(2.6 per cent is the interest rate for an HDB loan)

After paying for this flat for 10 years, their outstanding loan would be around $285,000. Once you deduct this from the sale proceeds, they have roughly $339,000.

But we’re still not done, as they would need to refund any CPF monies they used

This is where it gets tricky, as different homeowners use different CPF amounts. Some pay their flat loan using a mix of cash and CPF, for example, whilst others may pay using CPF alone.

More from Stacked

We all want buying/selling a home to cost less, and there’s a much better way.

Imagine this: Buying or selling your home in Singapore – Easier, fuss-free, does not cost you an arm or a…

We’ll make a rough estimate that our couple put around $150,000 to $200,000 in CPF refunds, meaning the net cash proceeds could range from $139,000 to $189,000.

With those cash proceeds, is an upgrade possible?

With a total initial outlay of $502,600, and cash proceeds from the flat sale contributing $139,000 to $189,000, our couple will need to have at least another $313,600 to $363,600 in their CPF or savings.

Assuming they have each been contributing to their CPF for about 12 years (from age 23, after university), and assuming their monthly CPF OA contributions are about $1,265 each (based on a $5,500 income), they would have accumulated about $182,000 each in CPF OA, or $364,000 combined (without accounting for CPF withdrawals for their HDB purchase).

Disclaimer: Our calculations assume the undergrad earns $5,500 from the start and did not take into account wage growth for simplicity. CPF accrued interest was also not taken into consideration, so the cash proceeds would be lower.

So we’re left with the following:

Total Initial Outlay Required:

- Down payment (25%) + BSD + additional due to TDSR: $502,600

Funds Available:

- Cash proceeds from flat sale: Estimated between $139,000 to $189,000

- CPF OA savings: Estimated at $364,000

Total Available Funds:

- Best case scenario: $189,000 (cash) + $364,000 (CPF) = $553,000

- Worst case scenario: $139,000 (cash) + $364,000 (CPF) = $503,000

How realistic is the upgrade, based on the above?

While it’s not implausible to upgrade, several factors further impact this.

The first is that we’re looking purely at the costs of the condo. Remember that a resale condo tends to require more renovation work, so this has to be added to the costs as well. This is a highly variable figure though, which leaves us to say it’s doable only if the renovations are not too lavish.

In addition, we should highlight that the scenario becomes much less plausible if it’s a new launch condo, where a quantum of $2 million may prove to be unmanageable. It would seem the average (read: median-income 4-room flat owner) will be looking mainly at resale condos in the OCR.

Finally, we’re making assumptions that the 4-room flat has appreciated to $624,000. This is not necessarily true for everyone: those who had a windfall, with their flats appreciating to $700,000 or higher, will have a much easier time upgrading, and vice versa.

As a final point, we’d say that, quite frankly, this is a bit of a stretch at median income. We’re not financial advisors and can’t dispense financial advice, but ask a financial planner, and you’ll be told that the monthly home loan should be kept to 30 per cent of monthly income. It’s not a coincidence that this is also the amount HDB enforces in the Mortgage Servicing Ratio (MSR).

While an upgrade is possible by 35, it has become much tougher compared to previous eras; and it may no longer be advisable unless (1) you’re an aggressive saver, actively planning to take smaller loans, or (2) you’re willing to consider a smaller condo unit, like a two-bedder.

Waiting Carries Its Risks

While waiting to upgrade may seem like the safer option, it is not without risks.

Property Prices Tend to Rise. So if private home prices increase by 15% over five years, the same resale condo that costs $1.6 million today would rise to roughly $1.84 million. This means:

- The down payment (25%) would increase from $400,000 to $460,000.

- The loan amount would also need to increase, assuming the same LTV limit exists at that time (a maximum of $1.38 million for a $1.84 million home).

Now in the same year, because our buyer turns 40, the maximum loan tenure would drop from 25 years to 20 years. This means higher monthly repayments. At a rough ballpark, a 20-year loan tenure on a $1.38 million loan would be over $8,360.

(This is based on the floor rate of four per cent for the interest).

This could well exceed the TDSR limit: monthly loan repayments cannot exceed 55 per cent of monthly income. So with the shorter loan tenure, our borrower needs to either have higher income, or pay even more for the down payment.

So while waiting may be a sensible choice in some situations, it’s important to weigh the potential increase in costs and financial strain that may come with delaying an upgrade.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

0 Comments