Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

July 3, 2025

When Singapore emerged from the COVID-19 pandemic, the property market didn’t just bounce back; it saw a steep change in buyer behaviour and preferences, which may well be with us for decades to come. In the years since COVID, we’ve seen price records tumble, new launches sell out within weekends, and resale condos face tight supply. But beneath the headlines, one group of buyers continues to play the most pivotal role: HDB upgraders.

Upgraders’ decisions ripple through both public and private sectors: when they sell, they influence HDB resale prices. When they buy, developers struggle to fit their price ranges.

But upgrading has become far more complex post-Covid. From interest rate spikes and cooling measures to narrowing regional price gaps, today’s upgraders are navigating a vastly different landscape from just five years ago. Even long-held assumptions, like three-bedders being the family norm, or strategies like “sell one, buy two,” have been shaken up over the past years:

What are the main post-COVID changes to be aware of?

Since 2020, the road to private home ownership for HDB upgraders has changed in fundamental ways. That’s not just in terms of prices, but how and where people choose to live.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Here’s a closer look at how these changes are playing out:

- 1. Two-bedder condo units are no longer out of the picture for small families

- 2. The CCR is no longer the playground of just wealthy foreign buyers

- 3. Resale options are much tougher to find

- 4. Simple $PSF comparisons are giving way to layout efficiency concerns

- 5. Taking on two separate mortgages, like financing in general, is tougher

- A parting note for sellers

1. Two-bedder condo units are no longer out of the picture for small families

These were once grouped as “small units” with one-bedders, and largely seen as rental assets. Today though, two‑bedder condos have seen increased acceptance as small family units. We reported on this phenomenon earlier in the year, when we noted that units of around 700 sq ft, at a quantum of $1.8 million to $2 million, were moving fast. This was evident in two-bedder transactions at Parktown Residence, The Orie, and Lentor Central (see the link above).

One subtle added factor needs to be pointed out though: according to agents on the ground, there’s a much stronger preference for two-bedders with two bathrooms. Single bathrooms are much less convenient for families, and some tenants also consider it less desirable (a factor for landlords.)

Some agents have also pointed to this as a factor for rising resale flat prices. If it costs you $1.8 million to buy a 700 sq ft two-bedder, are you certain you’d prefer that over a 5-room flat in Queenstown, or in some other hotspot like Bishan? Due to high private home prices, we may be seeing some upgraders default to larger or better located resale flats, rather than a somewhat cramped two-bedder.

As an additional consideration on the seller side, we do feel the high number of new launches being in the CCR – coupled with lower resale supplies – could soon drive demand for resale two-bedders in fringe regions.

2. The CCR is no longer the playground of just wealthy foreign buyers

Since the ABSD hike in 2023 (foreigners now pay 60 per cent added tax), demand from wealthy foreign buyers – a traditional force in the CCR condo segment – has weakened. Transaction volume in the CCR slid by around 20 per cent in 2024, whilst the price gap with the OCR and RCR has narrowed.

This is also partly due to land sale prices, not just foreigner purchases. Recent CCR GLS land bids are now comparable to those in mature RCR / OCR areas: for example, Holland Drive in the CCR saw land prices at $1,285 psf, versus Lentor (OCR) at $982 psf. Simply put, land prices – and hence developer prices – in the CCR are less far off from other regions, thus making the CCR more viable.

What hasn’t been overcome however – and what may take many more years to overcome – are the lack of heartland-style amenities in the CCR. Many (not all) condos in the central region still lack easy access to Primary schools, such as those within the Marina Bay area; and there’s the simple fact that, for many of us, our friends and favourite hangout spots are probably in areas like Yishun, Bedok, Sengkang, etc. Rarer are the Singaporeans who grew up in Orchard, Tanglin, Marina Bay, etc.

3. Resale options are much tougher to find

Speak to most agents today, and they’ll tell you finding buyers is less difficult than finding sellers. Probably the most common question we get is: Since new launch prices are over $2,200 psf, why doesn’t everyone go for resale where $1,715 psf is still possible?

The answer is they do want to go for it, they just can’t find it. Fewer people are selling their flats or condos to upgrade right now, because of the same reason you’d want a resale unit: new launch prices are high, and the general cost of a replacement property is too expensive.

Some agents also noted that, for sellers who own more than one property, there’s a psychological effect at play. If they bought their second property before there was a high ABSD rate, they’re reluctant to pay the current ABSD of 20 per cent if they replaced it today. While the number of multiple-property owners is small, this still lowers the availability of resale units further.

4. Simple $PSF comparisons are giving way to layout efficiency concerns

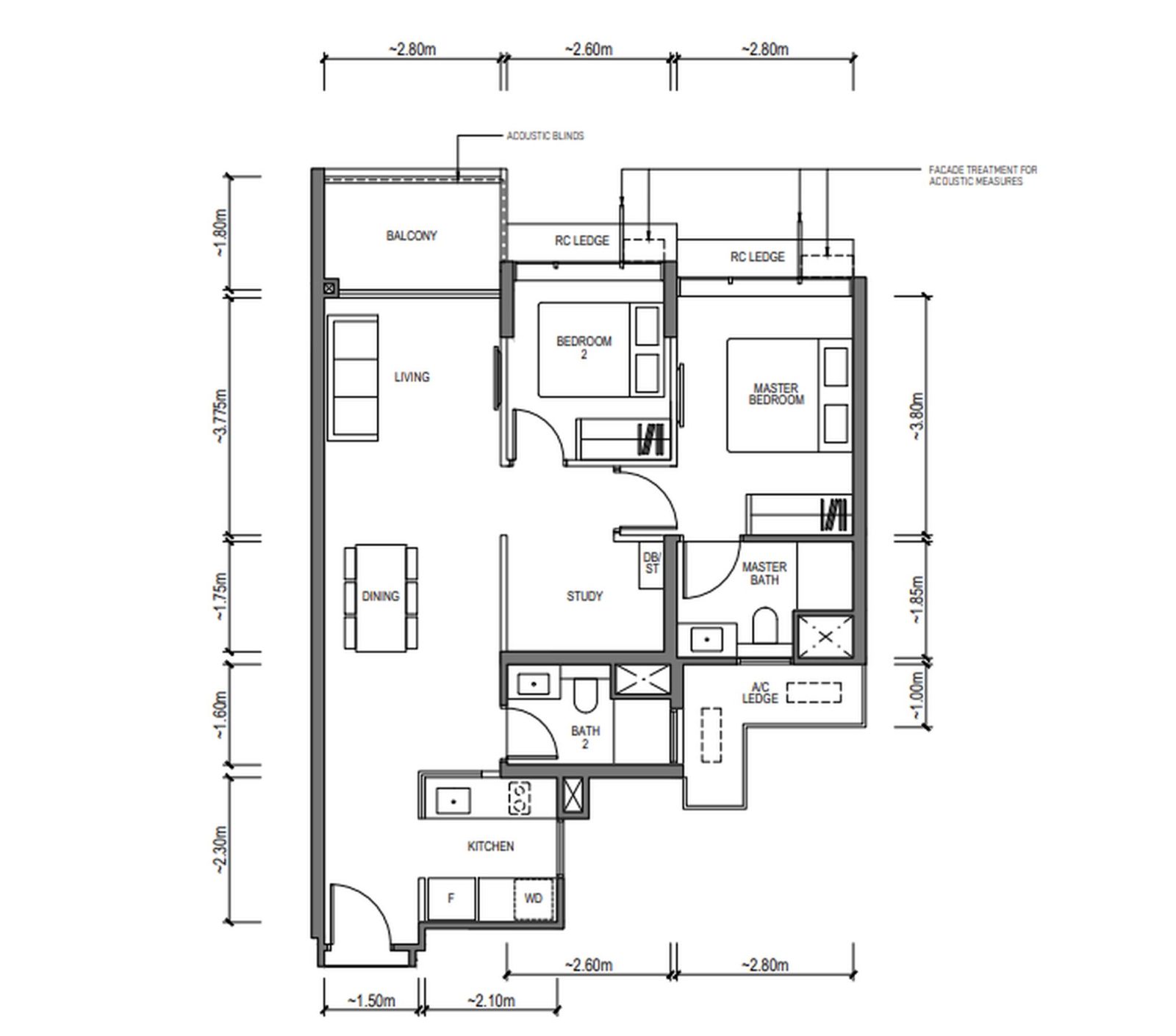

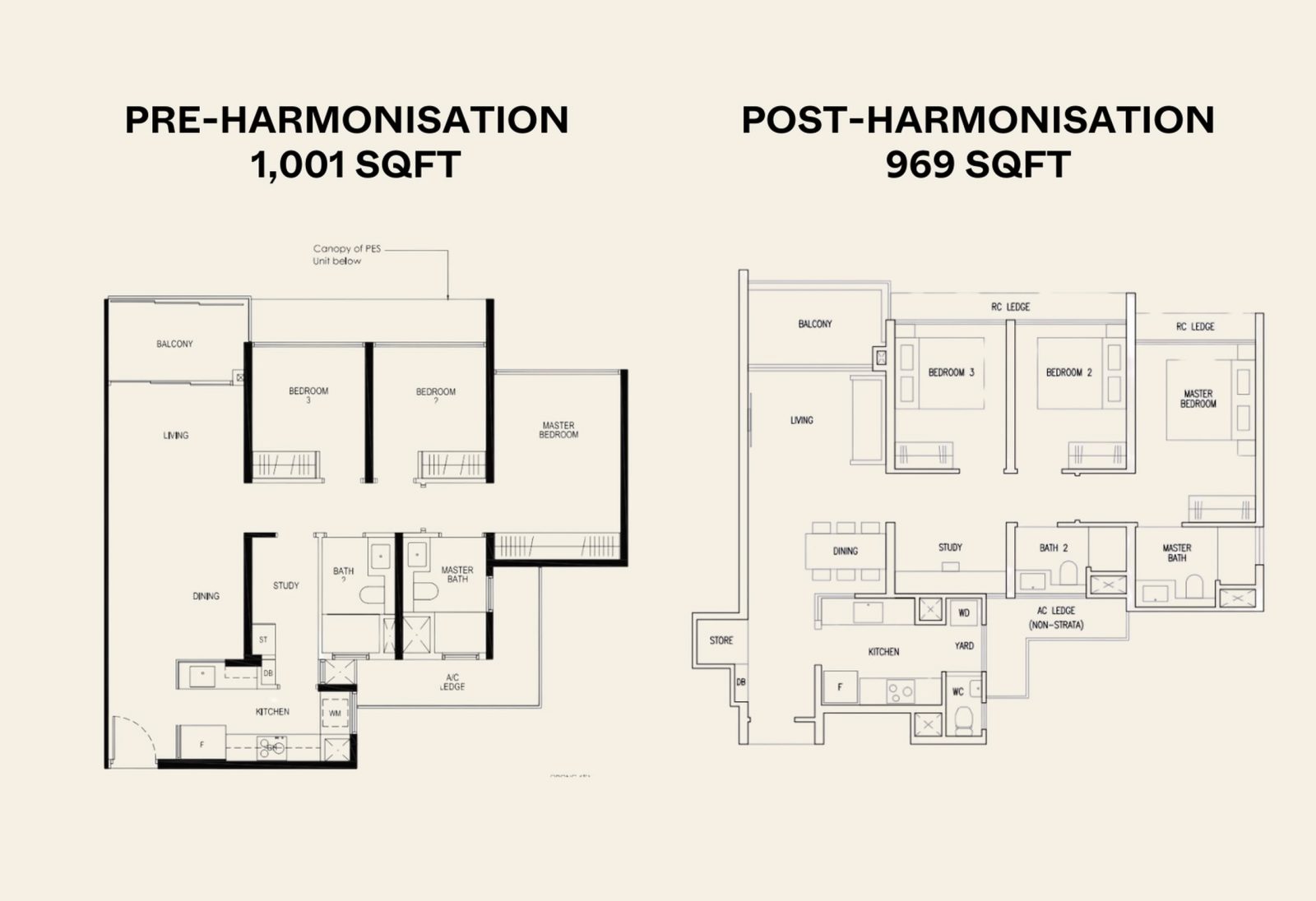

Comparisons between pre- and post- GFA harmonisation condos can get confusing right now. Pre-harmonisation condos include “useless” square footage like air-con ledges, but this makes them appear much bigger than newer, post-harmonisation condos, which can’t count these unlivable spaces.

This also distorts price perception, as the older pre-harmonisation condo appears cheaper on a $PSF basis. E.g., $2 million for a 1,600 sq ft condo, including air-con ledges, is $1,250 psf. But $2 million for a 1,200 sq ft condo, excluding its air-con ledges, is around $1,667 psf. So the latter looks cheaper, even though the price is the same.

For this reason, oversimplified $PSF comparisons are falling by the wayside. Today, buyers tend to emphasise issues like dumbbell layouts, to avoid space wasted on corridors, or more efficient kitchen designs and actual bedroom sizes (can they all fit queen sized beds?)

Comparing in this way will give you a much better perspective of value, especially when comparing between pre- and post-harmonisation projects. Also, do keep in mind that older projects may not have updated measurements in listings or other descriptions, so the total square footage may be misleading.

5. Taking on two separate mortgages, like financing in general, is tougher

Before 2022, the “Sell One, Buy Two” strategy – where each spouse buys a separate property to sidestep ABSD – was a popular move among some upgraders. But that plan is increasingly difficult to execute in the post-COVID era, not just because of higher prices, but because financing two homes is now much harder across the board.

Singapore’s Total Debt Servicing Ratio (TDSR) remains at 55 per cent. I.e., your monthly home loan repayment, plus outstanding debts, cannot exceed 55 per cent of your combined monthly income. Then add the higher interest rates – around 3.7 per cent, with banks using a floor rate of four per cent for TDSR calculations.

For further details, you can check out this article where we covered it as early as 2023, and it was already visible in the aftershocks of COVID. It’s quite likely that, going forward, simply upgrading to a single larger condo will be the way forward.

A parting note for sellers

For sellers, it’s worth recognising that this new generation of upgraders is more informed than ever. From experiences on the ground, they have a better sense of which layouts work, and they’re increasingly reluctant to overpay for the wrong kind of space – even if it looks good on paper. This can cause significant differences in gains, even between units that are technically the same size and in the same project.

While the market is currently on your side, we would brace for groups of more discerning and demanding buyers.

For more on the Singapore property market, and word-on-the-ground as the situation unfolds, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How has the COVID-19 pandemic changed the property market in Singapore for HDB upgraders?

Why are resale condo options harder to find for buyers today?

In what ways have buyer preferences changed regarding condo units for small families?

How have changes in land prices affected the Singapore property market post-COVID?

What challenges do buyers face when trying to finance multiple properties after COVID?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Trends

Property Trends The Room That Changed the Most in Singapore Homes: What Happened to Our Kitchens?

Property Trends Condo vs HDB: The Estates With the Smallest (and Widest) Price Gaps

Property Trends Should You Wait For The Property Market To Dip? Here’s What Past Price Crashes In Singapore Show

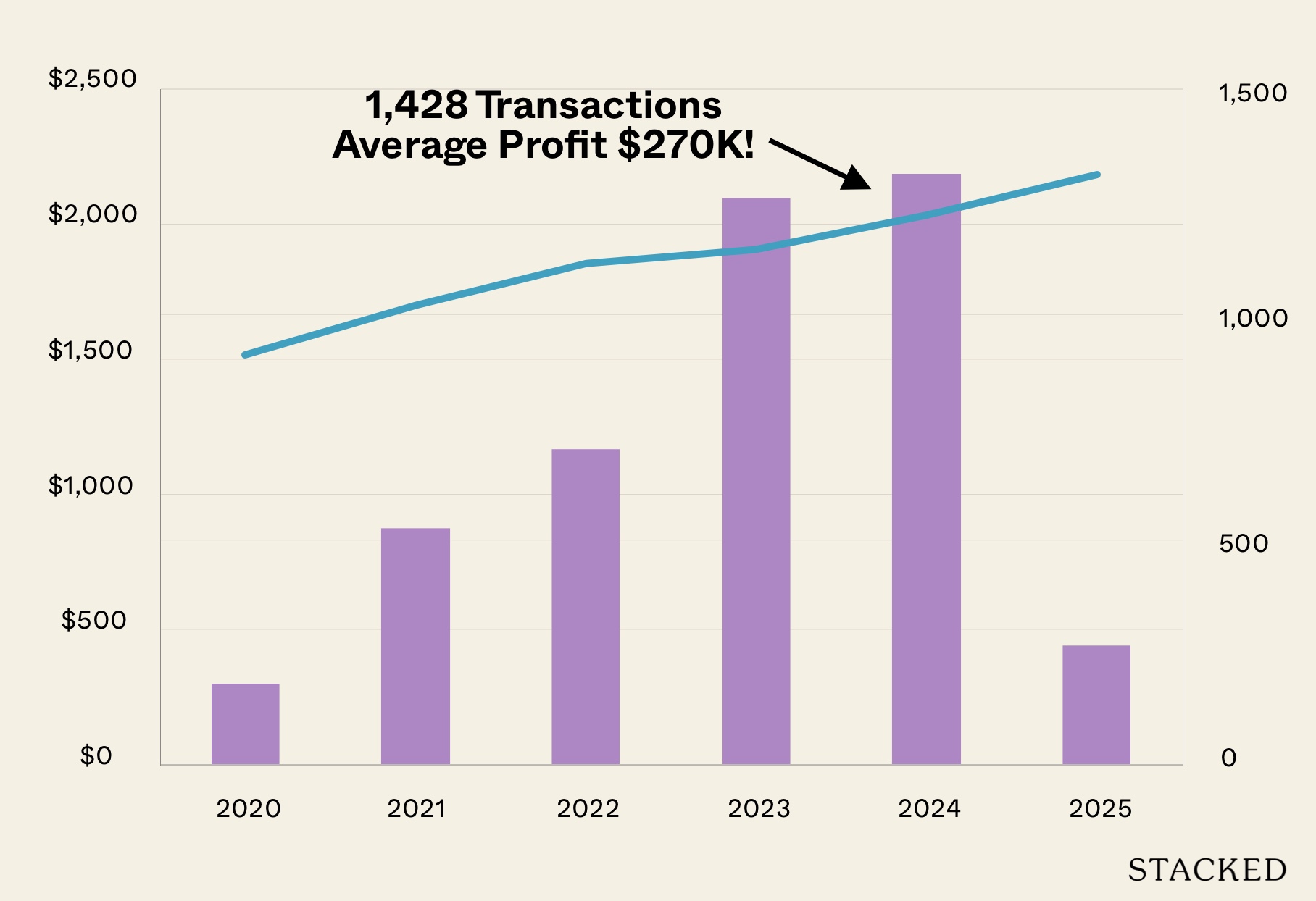

Editor's Pick Condo Profits Averaged $270K In 2024 Sub Sales: Could This Grow In 2025?

Latest Posts

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

0 Comments