This Hasn’t Happened In The Singapore Property Market In 20 Years…

June 23, 2024

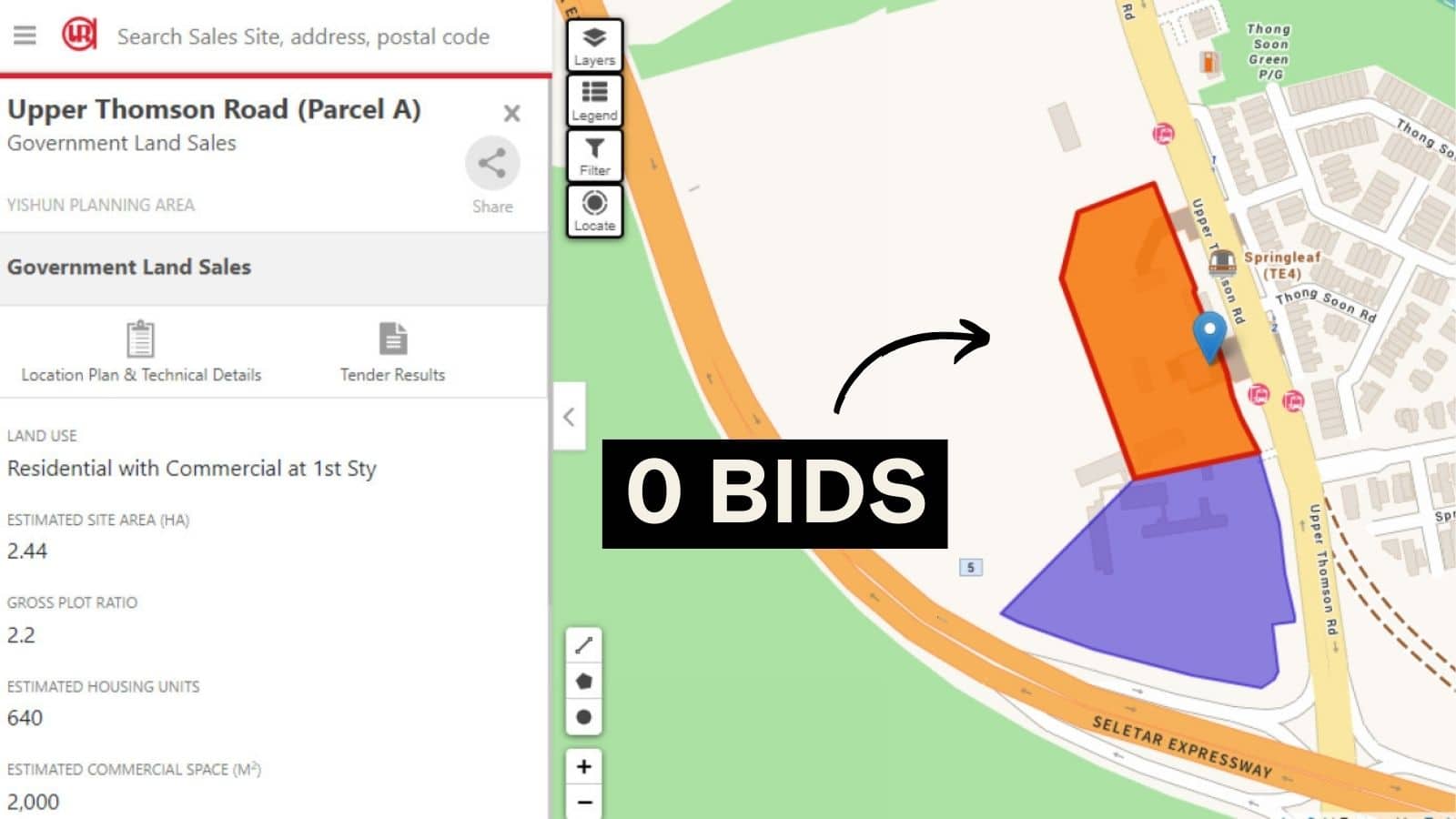

Zero bids for a GLS site, I never thought I’d see the day.

This GLS site at Upper Thomson, next to Springleaf MRT station, has attracted a record-breaking zero bids from developers. This is a 53,729 sqm site, with a gross plot ratio of 2.2 that is expected to yield around 540 new units. However, it comes with strings attached (which was probably also one of the dealbreakers):

There must be a childcare facility (a minimum of 1,000 sqm must be reserved for this), and 4,700 sqm has to be set aside for SA2 apartments. SA2 units are a new, untried concept – these “long stay” serviced apartments have a minimum lease of three months, unlike the usual one week for serviced units.

This is, incidentally, the first time in 20 years that a GLS site has found no takers; and it’s hot on the heels of the failed Marina Gardens Crescent site sale.

To some degree, this may be due to the requirement for long-stay serviced units. Consider the perspective of an owner-investor, or a landlord: would you really buy a condo unit if, right downstairs or in the block across from you, there are competing serviced units? And not just the serviced units for short-term stayers (i.e. a few weeks or a month), but tenants who are likely staying as long as yours, given the three-month lease.

On the flip side, I don’t foresee many companies being too interested in running these serviced apartments either. They too, have little interest in engaging nearby landlords in a price war; especially not in the current economic climate.

Owner-investors, who may never rent out the unit, also have to care: in the end, the resale value of the property is still impacted by this consideration (e.g., it filters out future landlords as potential buyers).

Is that the sole reason no one’s bidding though?

I doubt so. For the past two decades, we’ve seen there’s almost always someone willing to try their luck – from developers with depleted land banks and lack of choice to certain foreign developers who are willing to work on razor-thin margins. There always seemed to be someone willing to take a punt – even if it was at a low price. After all, the worst that could happen would be the bid being rejected altogether if it was the sole bid (like the Marina Gardens Crescent site).

As such, it really is quite a shock to see zero interest altogether.

(This may also somewhat be due to the supposed over-saturation of new launch condos at Lentor and the recent awarding of the Upper Thomson Parcel B site).

In other times, perhaps when developers were less squeezed, I can see some still being willing to take the risks. But when you couple the requirements with a five-year ABSD limit, along with recent changes like gross floor harmonisation*, rising interest rates, and higher Land Betterment Charges, developers are left with no room for error.

And the rejection of this novel land parcel is the same reason we see less variety among condos today: few have an interest in trying new things, when there’s a potential multi-million dollar loss attached to it.

In a way, while it is still shocking, there were signs that this was coming. The recent GLS land sites have been drawing fewer bids – the River Valley Green GLS site only received 2, while the Zion Parcel A received just one.

*Preventing developers from min-maxing profits, such as with big bay windows, strata void spaces, and air-con ledges, has an impact on their bottom line.

More from Stacked

“We Spent Just $5k On Reno” Why Some Buyers Are Skipping Big Renovations In 2025

For most Singaporeans, a huge part of moving costs includes renovations and furnishing. It’s not just about the money, it’s…

This also brings into question the three upcoming sites

Land parcels in Dairy Farm, Tengah, and Bayshore are also up for grabs soon. And of the three, only Bayshore seems to be drawing some confidence so far; probably on account of Bayshore also hosting the first batch of Plus model flats.

There is an expectation – probably true in my opinion – that the government won’t allow something as important as its first Plus model launch site to flop. It also helps that it’s very close to East Coast beach, which provides an advantage the other two parcels don’t have.

With regard to Tengah, this is the rawest neighbourhood so far in Singapore. Most of Tengah is still conceptual, including the “car-lite” town idea. And in difficult situations like today, buyers as well as developers are less eager to bank on first-mover advantage. No one doubts the government can transform Tengah into a success, but the issue is how long it’s likely to take.

Dairy Farm is more developed, and you can definitely see they’re trying to turn it into a private residential enclave; something on par with Bukit Timah in its earlier and less expensive days. But again, will developers be attracted to this quiet area, which draws a niche group of buyers (i.e., the sort who love the greenery enough to accept longer commutes and fewer urban conveniences)?

For the first time in a decade, developers have the supply but not the interest. It’s exactly how I feel when I walk down Orchard Road these days: I’m impressed by the amount of things on offer, and I also have zero interest in buying anything I see.

Meanwhile in other property news…

- Where can you find the cheapest “young resale flats” near MRT stations? Here are some that are $740,000 or under.

- Which are the top BTO launch sites this year? Check out some of the best places to look.

- Did you know Korea has a rental system where you pay a big deposit, then never pay again and get the deposit back when you leave? Check out alternative housing systems that we might learn something from.

- Landed homes from $660,000? It’s possible, if you want to retire and buy some place with a garden.

Weekly Sales Roundup (10 June – 16 June)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| MIDTOWN MODERN | $5,488,000 | 1733 | $3,167 | 99 yrs (2019) |

| WATTEN HOUSE | $4,884,000 | 1539 | $3,173 | FH |

| IKIGAI | $3,635,800 | 1604 | $2,267 | FH |

| PINETREE HILL | $3,292,000 | 1292 | $2,549 | 99 yrs |

| J’DEN | $3,182,000 | 1259 | $2,527 | 99 yrs |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| HILLHAVEN | $1,474,470 | 678 | $2,174 | 99 yrs (2023) |

| THE LANDMARK | $1,481,000 | 517 | $2,866 | 99 yrs (2020) |

| THE MYST | $1,572,000 | 678 | $2,318 | 99 yrs |

| THE ARCADY AT BOON KENG | $1,760,195 | 667 | $2,638 | FH |

| THE LAKEGARDEN RESIDENCES | $1,900,000 | 926 | $2,052 | 99 yrs (2023) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| REFLECTIONS AT KEPPEL BAY | $13,600,000 | 5576 | $2,439 | 99 yrs (2006) |

| SKY@ELEVEN | $5,900,000 | 2820 | $2,092 | FH |

| BEAVERTON COURT | $5,880,000 | 3229 | $1,821 | FH |

| SILVERSEA | $5,000,000 | 2530 | $1,977 | 99 yrs (2007) |

| THE TRILLIUM | $4,888,888 | 1798 | $2,720 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| SMART SUITES | $700,000 | 452 | $1,548 | FH |

| PARC BOTANNIA | $750,888 | 431 | $1,744 | 99 yrs (2016) |

| ISUITES @ TANI | $790,000 | 624 | $1,265 | 999 yrs (1883) |

| THE GLADES | $810,000 | 452 | $1,792 | 99 yrs (2013) |

| THE VUE | $820,000 | 484 | $1,693 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| SKY@ELEVEN | $5,900,000 | 2820 | $2,092 | $3,097,000 | 17 Years |

| VIZ AT HOLLAND | $2,900,000 | 1927 | $1,505 | $1,901,900 | 18 Years |

| EMERALD GARDEN | $2,830,000 | 1259 | $2,247 | $1,860,000 | 21 Years |

| ASPEN HEIGHTS | $2,950,000 | 1324 | $2,228 | $1,770,000 | 19 Years |

| MONTVIEW | $2,500,000 | 1227 | $2,037 | $1,518,000 | 18 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| OUE TWIN PEAKS | $3,330,000 | 1399 | $2,380 | -$1,105,000 | 14 Years |

| THE BERTH BY THE COVE | $1,768,000 | 1152 | $1,535 | -$472,000 | 12 Years |

| OUE TWIN PEAKS | $1,300,000 | 570 | $2,279 | -$299,371 | 8 Years |

| ALTEZ | $1,080,000 | 603 | $1,792 | -$220,000 | 9 Years |

| CUBIK | $2,480,000 | 2121 | $1,170 | -$200,000 | 15 Years |

Transaction Breakdown

For more on the Singapore property market, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why did the GLS site at Upper Thomson receive no bids in the recent sale?

What impact do the new requirements for long-stay serviced apartments have on property bidding?

Is the lack of interest in the recent GLS site unique, or has this happened before?

How do recent market conditions influence developers' willingness to bid on new land sites?

What are some upcoming land parcels, and how are they expected to perform?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

0 Comments