This $92 Million Dollar Lawsuit Exposes A Problem In Singapore’s Property Market

February 4, 2024

The notorious furniture rebate deal

UOB is suing a developer over 38 units at the Marina Collection. The developer allegedly gave rebates of 22 to 34 per cent, resulting in UOB now claiming $92 million in losses from the loans. What exactly is this nonsense?

Well, in essence, the developer and the real estate agent work together to let you get a bigger loan amount. For new launches, the valuation is always considered to be the same as the property price (unlike a resale unit, where if there’s a disparity between the sale price and valuation, the loan only covers the lower of the two).

This is a strange quirk in real estate, where banks are prepared to lend you money based on whatever the developer decides to price the home (even if the property was exorbitantly priced).

At some point, some people worked out that they could use this to help buyers take bigger loans. All they need to do is sell at an inflated price, but later give a discount to offset this.

For example: if they want to sell a unit at $4 million, they sell it at $4.2 million instead. The bank, thinking this is the valuation, extends a maximum possible loan of 75 per cent of $4.2 million – that’s $3.15 million, instead of the correct limit which is $3 million. So buyers are getting a higher loan.

After the transaction is made, the developer then refunds the $200,000 difference, by using terms such as “furniture rebates.”

All of this, by the way, pushes up home prices for everybody; not least because the full amount is recorded under URA transactions, and it anchors property prices higher. This is far from a new trick – it was being done way back in the ‘90s even.

Would we be seeing more of such things happening soon?

Besides cash back deals or furniture rebates on the buy side, I could see some agents competing further on the sell side.

Given the increasing number of agents, coupled with a seemingly slowing market, you can expect competition to increase between agents looking for inventory to sell.

I’d be prepared to get inundated with flyers and calls (if you’re not on the PDPA) to sell (if you weren’t already flooded with those). While house sellers have always been a hot commodity, there will be more desperate attempts to secure sellers this time of year.

From what I’ve heard on the ground, the advertising to get sellers has been getting even more hot and heavy.

High property prices, you see, aren’t just an automatic windfall for sellers. As the old saying goes, “you sell high, you buy high.” It’s considerably less exciting when your flat has appreciated by 30 per cent, but every condo you want to upgrade to has gone up by the same amount – you’re basically back at square one.

More from Stacked

The Difficult Relationship We Have With Condo Security Guards In Singapore

Over the past week, we were looking for condos that had negative reviews, and the possible reasons. It occurs to…

This situation is also a pain for realtors. When no one can afford to upgrade to something – or if they feel that way – then increasingly no one wants to sell.

Of course, this will start to change as we see more supply come on the market (and we are already seeing signs of this happening).

But for the next few months – get your inbox ready.

Meanwhile in other property news…

- Are HDB upgraders priced out of condos at today’s prices? You think I’m going to tell you something reassuring here, but that’s the exact reason I don’t get money from property agencies and developers. Because I’m not saying something reassuring.

- Would you like a private property near an MRT, and are you the sort who doesn’t care about the pool and gym? If so, here are some affordable freehold walk-ups for around $1.25 million or under.

- Bugis is going to replace Orchard at this rate. Check out its top-most properties, which can rival the best of districts 9 and 10.

- Some condos are just built different, like this one that has a free balcony.

Weekly Sales Roundup (22 January – 28 January)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| 19 NASSIM | $6,000,000 | 1830 | $3,279 | 99 yrs (2019) |

| MIDTOWN MODERN | $4,539,000 | 1464 | $3,101 | 99 yrs (2019) |

| GRAND DUNMAN | $4,395,000 | 1787 | $2,460 | 99 yrs (2022) |

| THE CONTINUUM | $2,893,000 | 1066 | $2,715 | 99 yrs (2022) |

| LENTOR HILLS RESIDENCES | $2,889,000 | 1356 | $2,130 | FH |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE MYST | $1,214,000 | 517 | $2,350 | 99 yrs (2023) |

| HILLHAVEN | $1,378,020 | 678 | $2,032 | 99 years |

| THE LANDMARK | $1,430,400 | 495 | $2,889 | 99 yrs (2020) |

| THE ARCADY AT BOON KENG | $1,718,000 | 678 | $2,533 | FH |

| GRAND DUNMAN | $1,880,000 | 721 | $2,607 | 99 yrs (2022) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| NASSIM JADE | $9,250,000 | 3380 | $2,737 | FH |

| ARDMORE II | $6,960,000 | 2024 | $3,439 | FH |

| THE REGALIA | $5,760,000 | 2573 | $2,239 | FH |

| SOMMERVILLE PARK | $5,500,000 | 2799 | $1,965 | FH |

| GLENTREES | $4,350,000 | 3412 | $1,275 | 999 yrs (1885) |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| SKYSUITES17 | $650,000 | 355 | $1,830 | FH |

| AVANT RESIDENCES | $680,000 | 452 | $1,504 | 99 yrs (2012) |

| HILLSTA | $718,000 | 527 | $1,361 | 99 yrs (2011) |

| THE PALETTE | $723,000 | 506 | $1,429 | 99 yrs (2010) |

| EUHABITAT | $740,000 | 538 | $1,375 | 99 yrs (2010) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| SPRING @ KATONG | $2,920,000 | 1679 | $1,739 | $2,055,000 | 19 Years |

| THE REGALIA | $5,760,000 | 2573 | $2,239 | $1,760,000 | 11 Years |

| THE ESTA | $3,680,000 | 1593 | $2,310 | $1,664,855 | 13 Years |

| THE SPRINGBLOOM | $2,250,000 | 1432 | $1,572 | $1,615,193 | 25 Years |

| ARDMORE II | $6,960,000 | 2024 | $3,439 | $1,610,000 | 5 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE PEAK @ CAIRNHILL II | $2,138,000 | 904 | $2,365 | -$250,000 | 5 Year |

| AVANT RESIDENCES | $680,000 | 452 | $1,504 | -$55,000 | 6 Years |

| THE SAIL @ MARINA BAY | $3,500,000 | 1625 | $2,153 | -$50,000 | 8 Years |

| SKYSUITES@ANSON | $1,515,000 | 700 | $2,165 | -$36,000 | 13 Years |

| SEAHILL | $775,000 | 527 | $1,469 | -$18,000 | 11 Years |

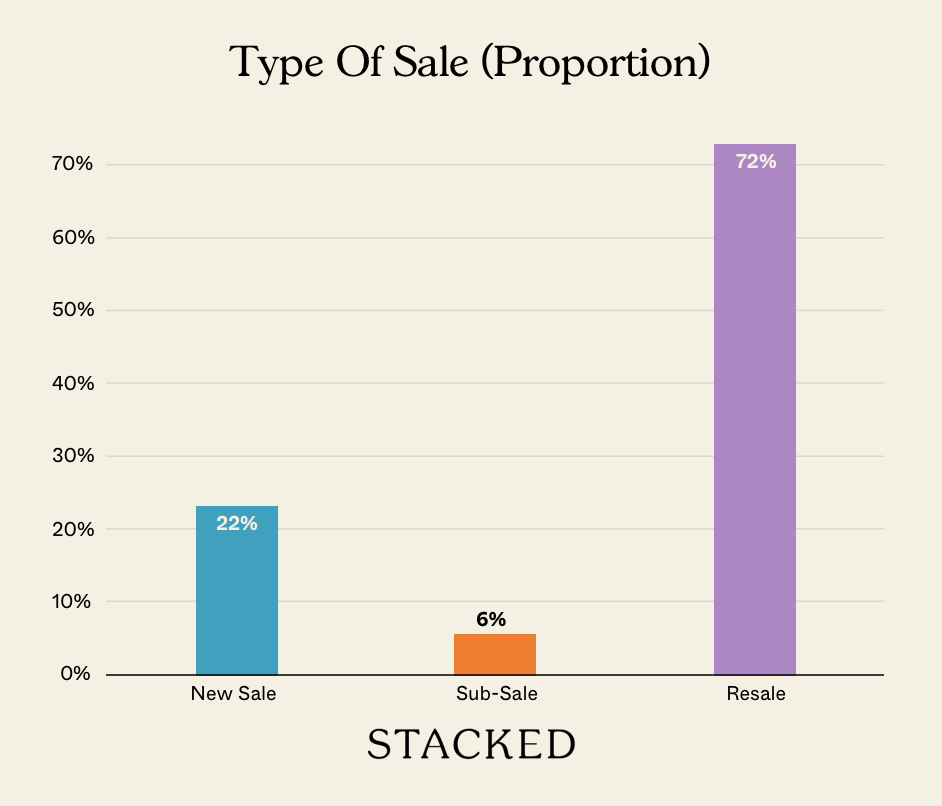

Transaction Breakdown

For more news on the Singapore property market, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is the furniture rebate deal involved in Singapore's property market controversy?

How does the rebate scheme affect property prices and loans in Singapore?

Why are real estate agents and developers likely to compete more aggressively in Singapore's property market?

What challenges do homeowners face in upgrading their properties in Singapore's current market?

Are there signs of increased property supply in Singapore, and how might this affect the market?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Singapore Property News The Most Expensive Resale Flat Just Sold for $1.7M in Queenstown — Is There No Limit to What Buyers Will Pay?

Singapore Property News Why Housing Took A Back Seat In Budget 2026

Singapore Property News An Older HDB Executive Maisonette Just Sold For $1.07M — And It Wasn’t In A Mature Estate

Latest Posts

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

On The Market Here Are The Cheapest 4-Room HDB Flats Near An MRT You Can Still Buy From $450K

3 Comments

don’t understand the rational behind listing the most expensive (huge unit) and cheapest (1rm unit). Another meaningless comparison….

Nothing new here. We see the same thing with cars. Dealers list a car at a higher price then give a bunch of discounts and “overtrade” to offer a higher max loan to the buyer.