These Homes Costs About The Same As A Toto Ticket: But Here’s Why Singaporeans Wouldn’t Buy Them Anyway

September 24, 2023

They’d need a very different marketing strategy to make Singaporeans buy dollar-homes abroad.

For those who don’t know, Japan isn’t the only place with super-cheap homes. Italy also has homes going for a single euro, and cities like Detroit in the US have homes you can buy for a dollar. There is, of course, a catch.

For the most part, there is an oversupply of homes in certain areas (apparently more than 10 million of such homes in Japan), and the intent is to preserve these homes if possible. Otherwise, the town or city has to pay to demolish them (which is very expensive, and is a pure overhead.) So in many cases, the caveat is having to restore the home in a given time limit. Deals like this can now be found in Italy, Spain, Croatia, and many of the small towns in Europe.

In other countries, people tend to see renovation and upkeep as the main issue. They may even call it the “real cost” of buying the home. Singaporeans are a different story.

Most of us have no issues with the renovation costs. We’re used to paying upward of $50,000 to renovate a 900 sq. ft. apartment, so we have no sticker-shock there (especially if the rest of the house costs around $1, and really all we’re paying for is the renovation.) And as for upkeep, please, have you seen the maintenance fees for our condos?

No, our issue is one of distance, and town infrastructure. We consider anything more than a 10-minute walk to the train station to be very inconvenient, which means every rural area is inconvenient to us. And by rural, I mean farms in Spain, Italy, Japan, etc., not Punggol or Sengkang. Even our definition of rural is incredibly urban, compared to where most $1 homes are found.

And when it comes to town infrastructure, Singaporeans are spoiled by a very high quality built environment, where agencies have a near-immediate response to issues. If NEA or PUB or any of a dozen three-letter-acronym-bodies leaves a drain unclogged for more than a day, Stomp and Mothership will probably have enough content for a week.

Abroad, politicians are seldom tied to tiny areas the size of an HDB estate, and have wider concerns. Here, you can write to your MP about the community centre canceling Friday taichi classes or whatnot, and still be taken seriously. Abroad, the mayor’s secretary will have your letter in the recycle bin before the first comma.

If anyone wants to market $1 homes to Singaporeans, they shouldn’t start with talking about the town’s long history, scenic views, etc. Rather, they should explain the sheer size of the mall/train station/future commercial hub that could be built there. Which means that quite possibly, they uh…won’t want us.

In any case, if you’re the sort that’s looking for more peace and quiet, or just want a holiday home that you can fix up yourself, here’s a list of places where you can find such affordable homes (besides Japan and Italy):

- Switzerland

Grab a Swiss countryside gem for just one Swiss franc in Monti Scìaga, a quaint town straddling the Swiss-Italian border (40 miles from Lake Como). The plan was to give away nine homes at such prices, so as long as buyers would commit to renovate them.

- Croatia

Legrad, once bustling, now offers homes for a mere one kuna ($0.19 SGD). While they require renovation, the town adds a refurbishing bonus of up to $3,979. Note: Buyers under 40 should commit to a 15-year stay.

- France

In Saint-Amand-Montrond, a spacious 90 sqm home awaits for just one euro. You’re required to initiate renovations within six months and live there — no rentals or Airbnb (and finish by 2 years).

- USA

Buffalo’s decades-old program offers homes at USD 1. Fix up the property within 18 months, reside for three years, and enjoy minimal yearly costs thereafter (do note that according to reports these typically require a huge renovation revamp). - England

Liverpool’s deal: homes for just a pound. Over 100 families have already dived in, with the stipulation that the home isn’t sold for at least five years (have a look here at some of the transformed homes!). - Greece

Antikythera isn’t just offering free homes; it’s paying families EUR 500 monthly for 3 years to reside there! With azure waters and a need for a population boost, it’s a win-win. Like what I mentioned earlier, Singaporeans do need to know that there’s just the one shop on the island, and no banks/ATMs. - Spain

Spain took these real estate deals to a whole new level by selling an entire village for $230,000. In any case, the same terms apply here, you’d likely have to commit a sizeable sum to renovating the place.

Meanwhile, in other property news…

More from Stacked

99-year leasehold: What happens when the lease runs out?

99-year leasehold properties in Singapore have been the subject of intense debate this year. In June 2017, the first of…

- Buy a landed home from just $3 million or under. Yes, FREEHOLD landed. It’s possible, if you check out these places.

- Check out the view from this $60.6 million penthouse, which is one of the most stunning we’ve seen. BONUS: If you can afford that view, you can probably also whatever you see.

- Are the worst rated condos on Google really that bad? There are some good explanations behind it, and let’s try to keep it fair.

- Bukit Merah, and Marina Square: two places to watch, because we may see some interesting changes soon.

Weekly Sales Roundup (11 September – 17 September)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| MIDTOWN MODERN | $5,617,000 | 1808 | $3,106 | 99 yrs (2019) |

| KLIMT CAIRNHILL | $4,860,000 | 1432 | $3,395 | FH |

| PULLMAN RESIDENCES NEWTON | $4,366,890 | 1378 | $3,169 | FH |

| THE RESERVE RESIDENCES | $4,126,433 | 1625 | $2,539 | 99 yrs (2021) |

| PINETREE HILL | $3,346,000 | 1292 | $2,590 | 99 yrs (2022) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE ARDEN | $1,179,000 | 753 | $1,565 | 99 yrs (1969) |

| ORCHARD SOPHIA | $1,340,000 | 474 | $2,829 | FH |

| GRAND DUNMAN | $1,364,000 | 549 | $2,485 | 99 yrs (2022) |

| THE CONTINUUM | $1,471,000 | 560 | $2,628 | FH |

| THE MYST | $1,479,000 | 678 | $2,181 | 99 yrs (2023) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| SEASCAPE | $5,847,000 | 2669 | $2,190 | 99 yrs (2007) |

| REGENCY PARK | $5,150,000 | 2260 | $2,278 | FH |

| THE PARK VALE | $3,500,000 | 2034 | $1,720 | 999 yrs (1874) |

| ASPEN HEIGHTS | $3,250,000 | 1582 | $2,054 | 999 yrs (1841) |

| COSTA RHU | $3,100,000 | 2056 | $1,508 | 99 yrs (1994) |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PRESTIGE HEIGHTS | $625,000 | 334 | $1,873 | FH |

| PARC ROSEWOOD | $640,888 | 431 | $1,488 | 99 yrs (2011) |

| HAIG 162 | $675,000 | 366 | $1,844 | FH |

| COSMO | $720,000 | 398 | $1,808 | FH |

| THE CITRON RESIDENCES | $840,000 | 431 | $1,951 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE PARK VALE | $3,500,000 | 2034 | $1,720 | $2,370,000 | 17 Years |

| COSTA RHU | $3,100,000 | 2056 | $1,508 | $2,072,000 | 24 Years |

| ASPEN HEIGHTS | $3,250,000 | 1582 | $2,054 | $1,960,000 | 17 Years |

| MANDARIN GARDENS | $2,366,888 | 2024 | $1,170 | $1,776,888 | 18 Years |

| BUKIT REGENCY | $2,335,000 | 1399 | $1,669 | $1,575,000 | 25 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| OUE TWIN PEAKS | $1,228,000 | 549 | $2,237 | -$213,125 | 7 Years |

| SEAHILL | $985,000 | 646 | $1,525 | -$76,973 | 11 Years |

| THE CREST | $1,960,000 | 958 | $2,046 | -$43,000 | 5 Years |

| COSMO | $720,000 | 398 | $1,808 | $70,000 | 8 Years |

| THE CITRON RESIDENCES | $840,000 | 431 | $1,951 | $84,300 | 9 Years |

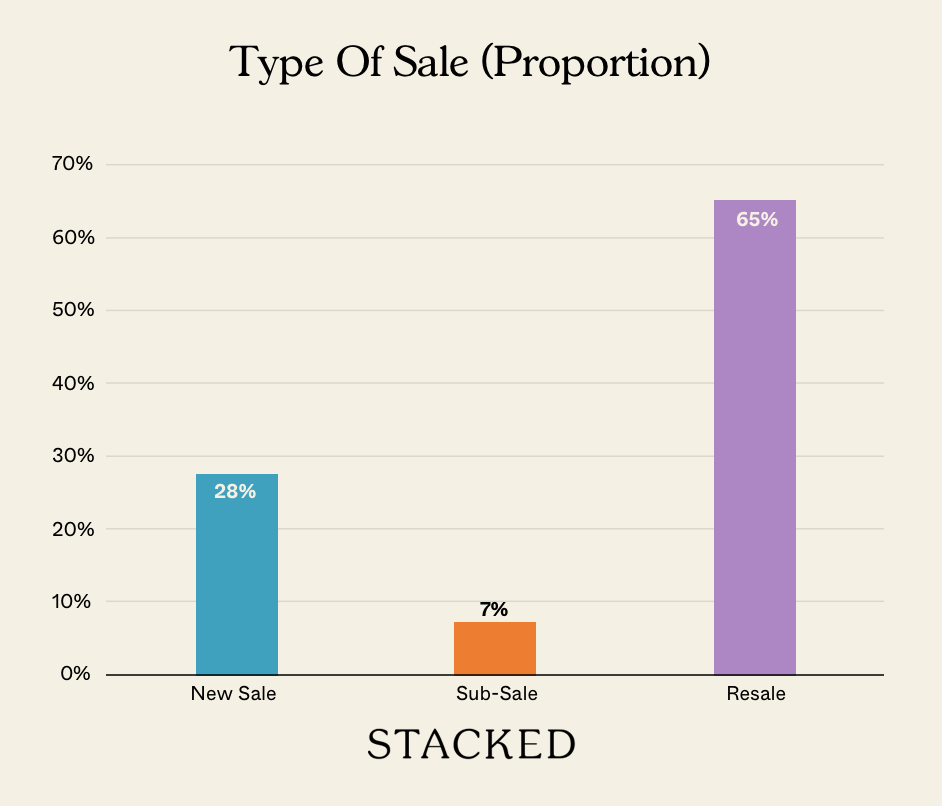

Transaction Breakdown

Follow us on Stacked for more news and updates, on the Singapore property market!

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

Latest Posts

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

0 Comments