The Harsh Math Of HDB Ownership After SERS

September 21, 2025

If you own an older HDB flat, how would you feel about the announced end of SERS?

A little nervous now?

This is the question I’ve been asking since August, when it was announced that the last SERS exercises were done. There’s now nothing to look forward to (if you can use that term) except VERS, of which we may see the first few exercises in around 2030.

Now, most buyers knew what they were getting into – the concept of the 99-year bomb has been talked about for decades, before this point. But two things have now made it all the more urgent: first, the fact that even the best located new flats now have no hope of escape. Even if you’re in a high-demand area like Tiong Bahru, you know your flat isn’t going to keep appreciating like before. At some point, lease decay will overpower even the best transport infrastructure and amenities.

Second, the introduction of VERS has effectively shortened the psychological clock. Where the countdown was once 99 years, we might now think of it as 70 years. If VERS happens and succeeds, you may need a replacement home much sooner than you expected. If it fails, then the value of your flat only slides from there, with no other way out except to “go to zero.” That uncertainty – will it pass, will it fail, and how will the market view it – makes the passage of time feel much sharper.

And this is where things could get interesting.

If enough owners of older flats start to see VERS as the real expiry point, they may decide to sell earlier rather than later. Add to that the disappearance of the “hope premium” — the belief that even a very old flat in a prime spot might get picked for SERS. Prior to this, owners in estates like Queenstown, Tiong Bahru, or Toa Payoh could still tell themselves they had a chance, since these were historically desirable areas.

(Yes, policymakers always said only five per cent of estates would see SERS. But let’s be honest: many people assumed those five per cent would be the mature, central locations. A few still expected to be among the lucky ones.)

Now that door is closed. For many older Singaporeans, this may not matter. If they’re settled in for the long term and intend to live out their remaining years in the same flat, the theoretical resale value is less of a concern.

But for younger Singaporeans who bought into older flats, the calculus is very different. They may not be at the “final home” stage of life yet, and they’ll need an exit strategy. That could mean selling sooner rather than later, before the psychological impact of VERS sets in and values begin to dip.

I recently spoke to an older couple in a related position. Their flat will last them to the end of their days for sure; but they have a middle-aged child with special needs. He has worked odd jobs for most of his adult life, and they feel it’s unlikely he can handle taking on a home loan once their flat is gone (and of course, he’ll also be much older).

For them, the plan is to sell their ageing flat and move into a property – possibly private – with a newer lease, so it can last the entirety of their child’s lifetime. While it’s been on their mind for a few years, the end of SERS made them feel they can’t put this off anymore.

What might this mean for the wider resale market?

Chances are, we’re not looking at any large-scale impact. Prices for the very oldest flats – the ones from the 1960s and early ’70s – will start to flatten out or even dip a little, but the rest of the resale market will probably keep chugging along. The demand is just softer when you’re at the extreme end of lease decay.

More from Stacked

Neighbourhood Of The Week: Yishun (District 27)

Yishun is one of the most meme-worthy neighbourhoods in Singapore. It’s nicknames include “The Devil’s Ring” and to date, it’s…

The big risk to these oldest flats is if a bigger-than-expected bunch of owners all decide, “okay, VERS is the real expiry point”, and rush to cash out at the same time. If that happens, they’ll see more listings, longer days on the market, and buyers lowballing them all day.

On the flip side, this isn’t necessarily bad for everyone. If you’re older yourself, and the remaining lease still covers you comfortably till 95, this could be your chance to finally get into a mature estate, at a price that won’t spike your blood pressure.

Existing CPF rules already make it tough for younger Singaporeans to buy flats that don’t last them till 95 – so the buyer pool for these homes is naturally tilted toward older, cash-ready households anyway.

But if you are concerned by the ever-encroaching lease decay issues, do reach out to us, we’d love to hear about it; and we might even be able to find solutions for you.

Meanwhile in other property news

- Waiting for property prices to drop, even after you’re in a well-planned position to buy, could be a gamble that doesn’t pay off.

- Some people take a grave view of building their properties on burial grounds (see what I did there?) But you’ll be surprised by which areas these include.

- The big news for October is, of course, the gigantic BTO launch, and this time it’s a wide-scale launch with a bit of something for everybody.

- If you’re picking between a condo or a bigger and cheaper resale flat, one of the things to note is location: in some places, the price gaps are so wide you’re better off with a flat, and vice versa. Check out the information on our Stacked Pro deep dive.

Weekly Sales Roundup (08 – 14 September)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PROMENADE PEAK | $6,413,100 | 1884 | $3,405 | 99 yrs (2024) |

| GRAND DUNMAN | $4,498,000 | 1787 | $2,517 | 99 yrs (2022) |

| THE LAKEGARDEN RESIDENCES | $4,380,000 | 2260 | $1,938 | 99 yrs (2023) |

| TEMBUSU GRAND | $4,184,000 | 1711 | $2,445 | 99 yrs (2022) |

| AMBER HOUSE | $3,884,620 | 1238 | $3,138 | FH |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| RIVER GREEN | $1,260,000 | 420 | $3,001 | 99 yrs (2024) |

| CANBERRA CRESCENT RESIDENCES | $1,339,200 | 667 | $2,007 | 99 yrs (2024) |

| HILL HOUSE | $1,393,000 | 431 | $3,235 | 999 yrs (1841) |

| KOVAN JEWEL | $1,425,000 | 624 | $2,283 | FH |

| UPPERHOUSE AT ORCHARD BOULEVARD | $1,502,000 | 474 | $3,171 | 99 yrs (2024) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| GRANGE RESIDENCES | $10,200,000 | 2852 | $3,576 | FH |

| SKY@ELEVEN | $6,450,000 | 2713 | $2,378 | FH |

| 111 EMERALD HILL | $4,650,000 | 2121 | $2,193 | FH |

| SOMMERVILLE PARK | $4,265,000 | 1948 | $2,189 | FH |

| PALM SPRING | $4,250,000 | 1873 | $2,269 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PARC ROSEWOOD | $670,000 | 506 | $1,324 | 99 yrs (2011) |

| THE ALPS RESIDENCES | $708,000 | 441 | $1,604 | 99 yrs (2015) |

| MACKENZIE 88 | $780,000 | 474 | $1,647 | FH |

| HILLION RESIDENCES | $783,000 | 463 | $1,692 | 99 yrs (2013) |

| AFFINITY AT SERANGOON | $805,000 | 474 | $1,700 | 99 yrs (2018) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| GRANGE RESIDENCES | $10,200,000 | 2852 | $2,378 | $6,002,000 | 20 Years |

| SKY@ELEVEN | $6,450,000 | 2713 | $2,177 | $3,180,835 | 19 Years |

| GRANGE HEIGHTS | $4,100,000 | 1884 | $2,815 | $3,050,000 | 21 Years |

| THE SEA VIEW | $3,423,700 | 1216 | $1,892 | $2,490,177 | 19 Years |

| BREEZE BY THE EAST | $3,360,000 | 1776 | $1,892 | $1,849,000 | 16 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| TURQUOISE | $3,298,000 | 2400 | $1,374 | -$2,925,490 | 18 Years |

| TURQUOISE | $3,800,000 | 2562 | $1,483 | -$2,200,000 | 15 Years |

| REFLECTIONS AT KEPPEL BAY | $3,000,000 | 1938 | $1,548 | -$1,018,888 | 12 Years |

| 111 EMERALD HILL | $4,650,000 | 2121 | $2,193 | -$410,674 | 12 Years |

| OUE TWIN PEAKS | $1,088,000 | 549 | $1,982 | -$268,030 | 9 Years |

Top 5 Biggest Winners (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| GRANGE HEIGHTS | $4,100,000 | 1884 | $2,177 | 290.5% | 21 Years |

| THE SEA VIEW | $3,423,700 | 1216 | $2,815 | 266.8% | 19 Years |

| THE CALROSE | $2,588,000 | 1249 | $2,073 | 246.3% | 19 Years |

| THE SPRINGBLOOM | $1,800,000 | 1119 | $1,608 | 239.9% | 27 Years |

| EASTERN LAGOON | $1,730,088 | 980 | $1,766 | 235.9% | 20 Years |

Top 5 Biggest Losers (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| TURQUOISE | $3,298,000 | 2400 | $1,374 | -47.0% | 18 Years |

| TURQUOISE | $3,800,000 | 2562 | $1,483 | -36.7% | 15 Years |

| REFLECTIONS AT KEPPEL BAY | $3,000,000 | 1938 | $1,548 | -25.4% | 12 Years |

| OUE TWIN PEAKS | $1,088,000 | 549 | $1,982 | -19.8% | 9 Years |

| V ON SHENTON | $980,000 | 452 | $2,168 | -14.0% | 7 Years |

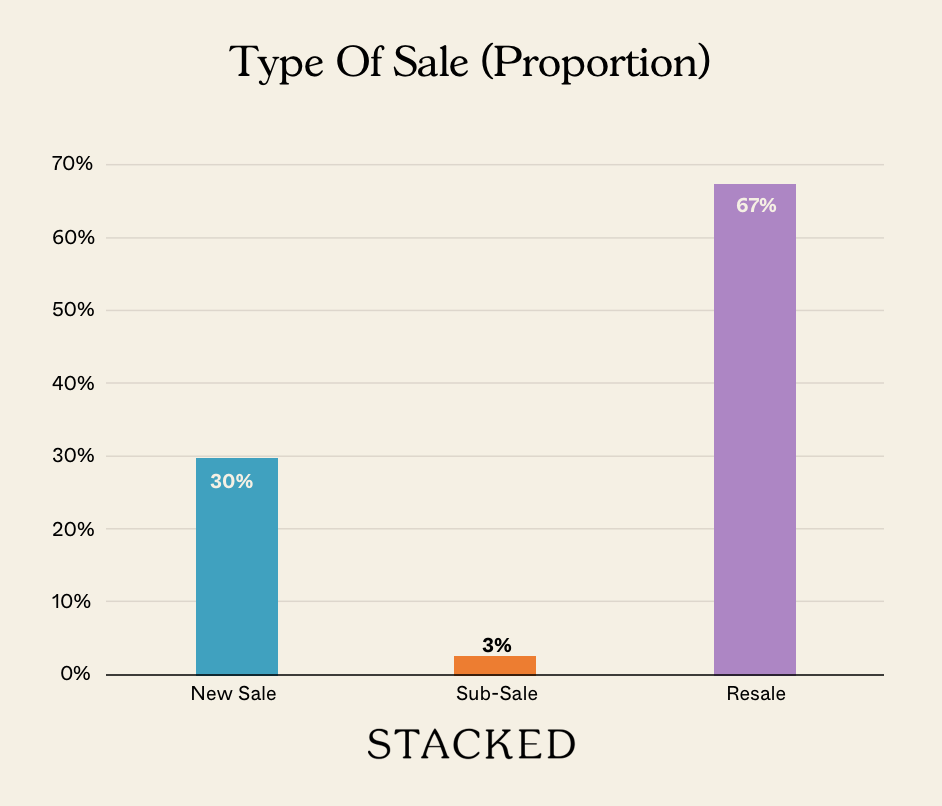

Transaction Breakdown

For more on the Singapore property market, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is the end of SERS and how does it affect older HDB flat owners?

How does VERS influence the value and sale of older HDB flats?

Are older flats in prime locations still likely to benefit from SERS or similar schemes?

What should younger HDB owners of older flats consider given the end of SERS?

How might the resale market for very old flats change after the end of SERS?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Singapore Property News The Most Expensive Resale Flat Just Sold for $1.7M in Queenstown — Is There No Limit to What Buyers Will Pay?

Singapore Property News Why Housing Took A Back Seat In Budget 2026

Latest Posts

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

On The Market Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

0 Comments