5-Room Tampines HDB With Large Balcony Sold For A Record $1,068,000

September 16, 2025

When Centrale 8 was a new flat, you wouldn’t believe the amount of flak it got online. I still remember the gripes about how the 5-room flats could reach $880,000 (in 2011, no less), and later the slew of complaints which followed. But if there’s one thing DBSS flats have excelled in, it’s their ability to induce amnesia in the markets. So here we are again on Centrale 8, where a 5-room flat just broke a record by transacting at $1.068 million.

Where was the unit?

Located at Block 519D, between the 13th and 15th floors, the roughly 1,162 sq ft. unit is the fifth million-dollar flat to transact in Centrale 8.

This sale also beats the previous Tampines record of $1.05 million at The Premiere @ Tampines by $18,000. Current asking prices on PropertyGuru suggest 5-room flats at Centrale 8 now start from about $968,000, so the million-dollar mark is not as far out as it seems, although it’s still a record.

A bit of background on Centrale 8

For extensive details, you can check out our review here.

Centrale 8 has a colourful history. When it launched in June 2011, prices were already causing heat: 3-room flats ranged from $397,000 to $510,000, 4-room flats from $531,000 to $683,000, and 5-room flats from $685,000 to $880,000.

| Type of Flat | Indicative Price Range |

| 3-Room | $397,000 – $510,000 |

| 4-Room | $531,000 – $683,000 |

| 5-Room | $685,000 – $880,000 |

I can also say that, on the ground, I distinctly remember some agents cautioning buyers against these high-priced DBSS projects; a common sentiment was that, at Centrale 8’s prices, upgraders would be better off getting an Executive Condominium (EC). There were concerns that gains would be limited when the launch price was already so high.

Consider that Tampines GreenLeaf next door – a standard flat – started its 5-room flats at just $371,000, almost half the price!

From the public reaction, it was widely said that the uproar over Centrale 8’s high launch prices was the final nail in the DBSS coffin, causing it to be scrapped.

So how much was the real gain from this record-breaker?

If you had bought a 5-room flat here at the lowest launch price of $685,000, this record transaction would mean a gain of $383,000 after 14 years, or about 56 per cent. Compared to the returns from regular BTO launches of the same period, this is actually on the lower end. And bear in mind, this is for a record-breaking transaction.

So overall, the warnings about lower gains, getting an EC instead, etc., weren’t entirely wrong.

More from Stacked

ABSD remission in Singapore – Everything you need to know

Once the latest cooling measures was announced, there was a mad last minute scramble as thousands of prospective homebuyers rushed…

But what makes people willing to pay so much for it anyway?

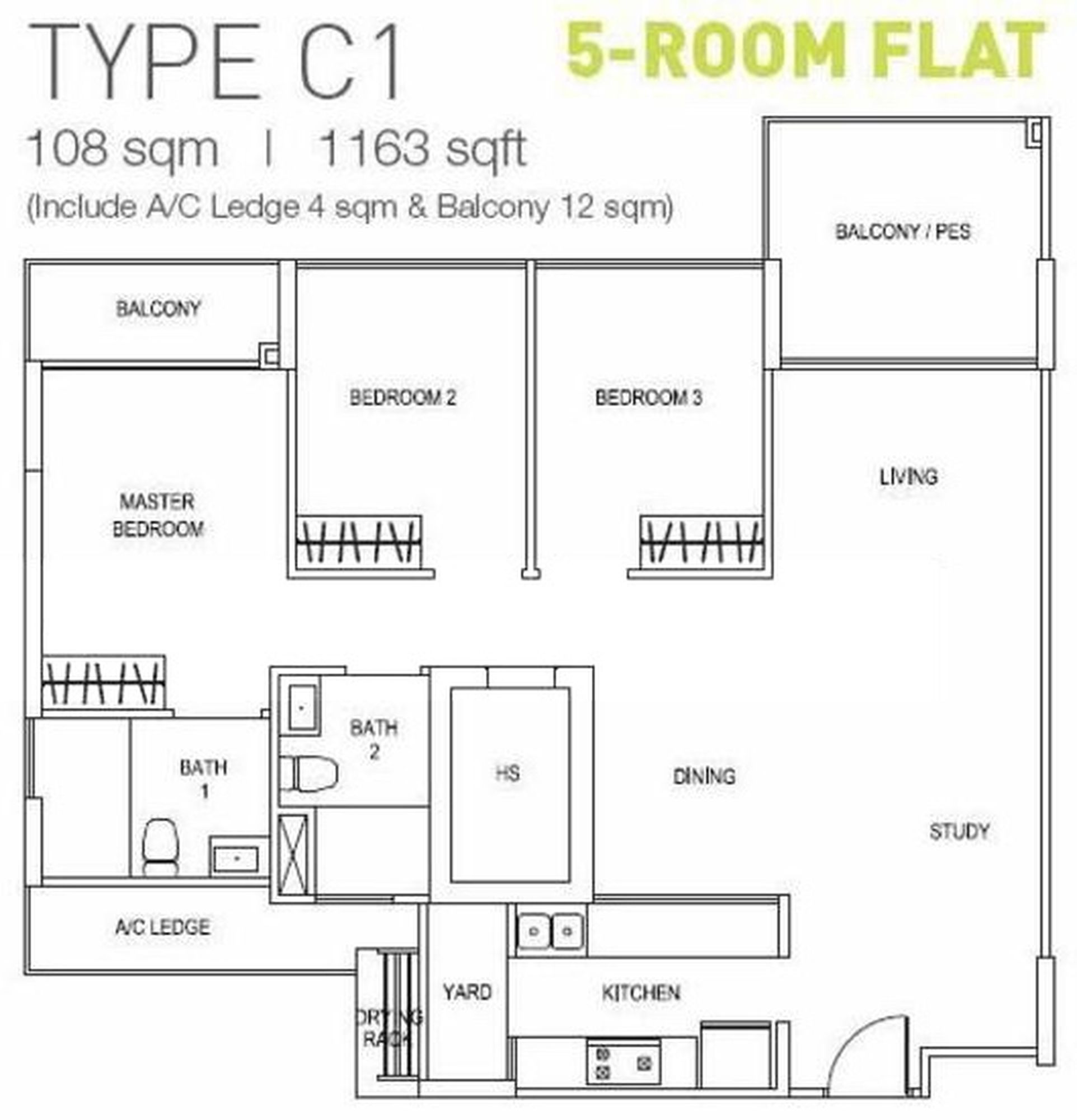

Let’s start by looking at the layout, since that’s what DBSS flats are famed for. Built by private developers, they have features you won’t find in many regular flats:

We can see several features that are quite unique (for an HDB property).

There’s a large balcony attached to the living room, and even a second balcony in the master bedroom. Instead of a wider living and dining area, the space is reconfigured into a study at the foyer, which – depending on your opinion – is either awkward or a good way to add function.

While the balconies add a “condo-like” feel, this particular record-setting unit is in Block 519D; we wouldn’t say it has the best views, as both its north and south facings look directly into the opposite HDB block. But then again, to some buyers, the point of the balcony is fresh air and ventilation; so they may not mind.

The kitchen is enclosed (or at least easily enclosable) with a good layout, optimising both walls for cabinetry and countertops.

But it may be the location, more so than even the layout, which motivates buyers

Set aside the “built by private developers” element, and Centrale 8 still has something strong going for it.

It’s a short walk – mostly sheltered at that – to Tampines MRT (EWL, DTL). This also means Our Tampines Hub, with its hawker centre, NTUC, library, and rooftop pool. Tampines 1, Tampines Mall, and Century Square are all within walking distance.

Inside the development itself, there are commercial units like a food court, 7-Eleven, and even a childcare centre; so the appeal goes beyond the fancier layout.

In any case, the takeaway is that Tampines is no longer just a mass-market upgrader territory.

With five million-dollar Centrale 8 transactions now inked, the town shows that DBSS flats – even if they were once ridiculed for being overpriced – are proving their staying power; if not for the unique layouts, then just on the basis of their strong locations.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why did the record-breaking Tampines flat sell for over a million dollars?

What makes Centrale 8 flats different from regular HDB flats?

How much profit could I have made if I bought a Centrale 8 flat at launch?

Is Tampines a good place to buy high-end flats like Centrale 8?

What impact did the high prices of Centrale 8 flats have on the HDB market?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

2 Comments

Fir this unit it won’t be the tail end of the BTO. So based on bto price of $880k….the owner only make $268k…. excluding interest….

exactly. that is nothing. holding for 14 years somemore I made 300 in 3 years unloading my 2b2b condo recently