Singaporeans Are Buying More Overseas Homes — But Few Have Prepared For These Things

August 23, 2025

Buying property abroad has never been easier. With digital listings, overseas agents, and even remote purchase options, more Singaporeans are eyeing homes beyond our shores, from the sunny coasts of Australia to the historic quarters of Portugal and the bustling hubs of Tokyo and Seoul.

But getting the keys is just the beginning. Whether you plan to live there, rent it out, or split your time, the real test starts when you move in because adaptation is the real key.

Here are some essential tips to turn your overseas property into more than just an investment and truly make it home.

Understand local property norms before you buy

Before signing anything, immerse yourself in how homes work in your destination country. What we take for granted in Singapore, like 4-room HDB flats or compact high-rise condos, may look very different elsewhere.

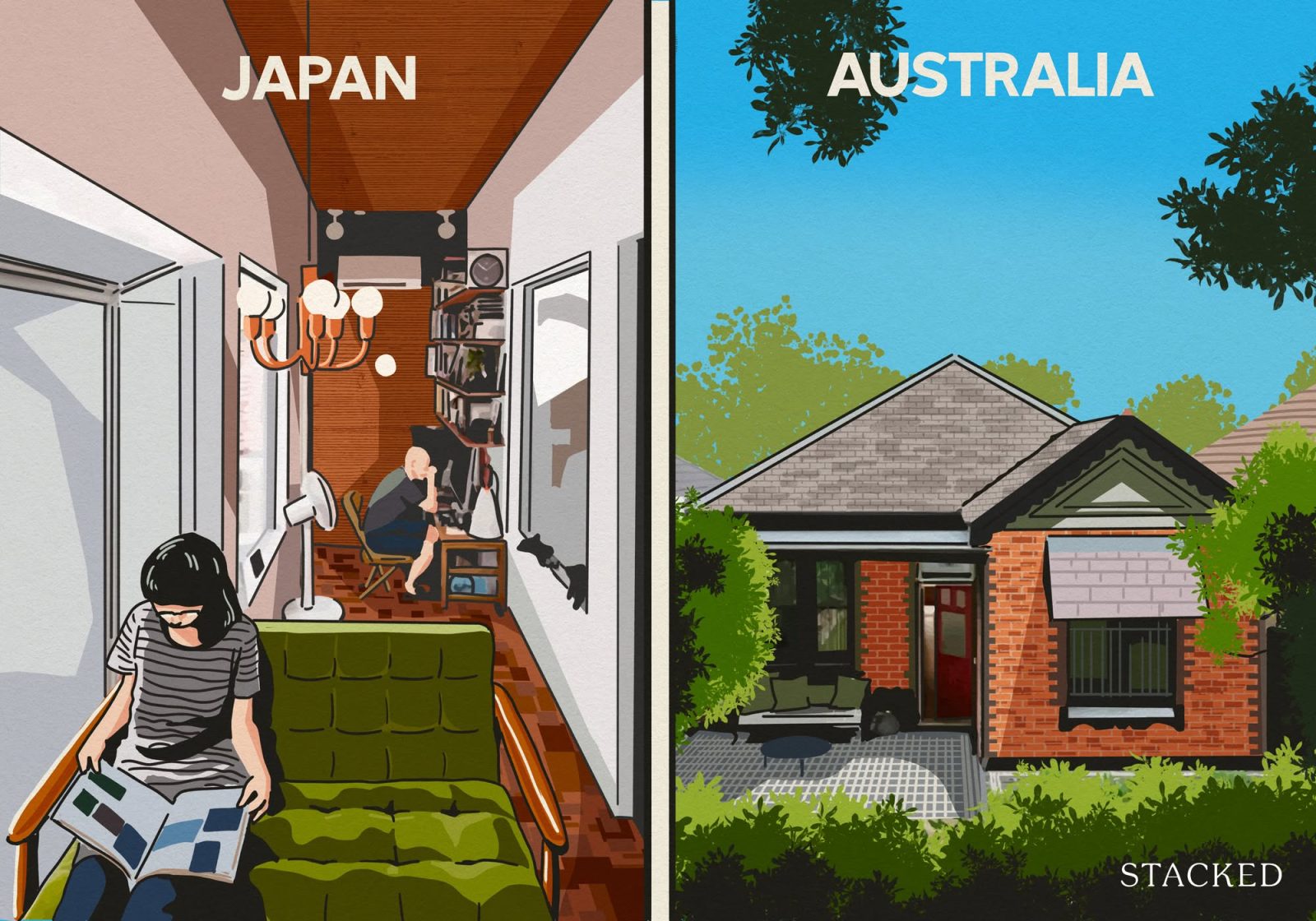

For example, a 40 sqm apartment might be considered ample for a family of three in Tokyo. In suburban Australia, homes are typically single-storey with their own water tanks and septic systems. In some European cities, heritage restrictions could limit what you can renovate.

Take time to research how homes are built, maintained, and valued locally. Speak to residents, join expat forums, and read up on real estate trends. This helps you realign your expectations, not just about the space, but about whether daily life there suits you.

Be aware of crime and personal safety

One adjustment many Singaporeans overlook is the level of personal safety. In Singapore, crime rates are very low and walking home late at night rarely feels risky. This is not always the case elsewhere.

Some countries have higher rates of burglary, pickpocketing, or even violent crime, depending on the neighbourhood. It’s important not just to look at the crime statistics, but to understand the nature of the crime as well. A high number of pickpocketing incidents in a tourist area, for example, is very different from a neighbourhood with frequent armed robberies or home invasions.

For example, parts of central Paris and Barcelona are well-known for pickpocketing, especially near landmarks and on public transport. In contrast, some suburban areas in the United States report higher rates of home break-ins or even carjackings. In certain Latin American cities, violent crimes, including armed robbery, may occur more frequently after dark, and locals advise avoiding specific streets at night.

As a homeowner, it’s worth checking both the numbers and the type of crime in the specific area you’re buying in, and asking locals about their experiences.

In some places, it’s standard to install alarm systems, motion sensors, or extra locks, not just for peace of mind but because insurers may require them.

Tip: Visit the area during both day and night before you commit to a property, and learn about local emergency services and insurance options.

Review your insurance options, especially international coverage

Owning property abroad means your usual Singapore home insurance won’t apply, and even local policies in your new country may have gaps you’re not aware of. Many standard policies exclude foreign owners or limit coverage to specific risks like fire and basic theft.

Before you move, research what types of property insurance are common in the country. In some places, earthquake or flood insurance is sold separately, and in others, personal liability cover is strongly recommended. For example, homeowners in California often buy earthquake coverage as an add-on, while in Japan, flood and typhoon insurance are considered essential due to frequent natural disasters. In southern Europe, some insurers exclude damage from wildfires or require you to pay a large excess.

It’s also worth noting that home content insurance works very differently in some countries, and in some cases isn’t common at all. In Italy and parts of Southern Europe, home insurance in general is less common, as many homeowners self-insure and focus on the structure. In Germany, like Singapore, home contents insurance (Hausratversicherung) is sold as a separate product to fire or building insurance, and is often skipped by owners.

If you plan to rent out the property, you may also need a landlord’s policy to protect against tenant damage and lost rental income.

For more comprehensive peace of mind, consider an international home insurance or expat-specific plan. These are designed to cover property owned outside your home country and can provide additional benefits like multilingual claims support, emergency assistance, or worldwide liability coverage. Some even include evacuation or temporary housing costs if your property becomes uninhabitable.

Tip: Speak to both a local insurance agent in the country where your property is located and an international broker to compare options. Make sure you understand what is and isn’t covered, especially if the area is prone to natural disasters, higher crime rates, or unique risks like subsidence or civil unrest.

Get familiar with bureaucracy and taxes

Owning property abroad comes with layers of taxes, legal quirks, and administrative hurdles that can catch even experienced buyers off guard. What seems simple in Singapore, with its centralised, transparent systems, is often more fragmented and paper-heavy elsewhere.

Some countries impose restrictions on what foreigners can buy, or even where. For example, Australia allows foreigners to buy only new-build homes or vacant land for development, and you’ll need prior approval from the Foreign Investment Review Board (FIRB), which adds both cost and processing time. In Thailand, foreigners cannot own freehold landed property at all, though condominium ownership is permitted up to a quota.

Taxes can also trip you up. In the UK, even if you don’t remit your rental income to Singapore, you still have to report and pay tax locally. In many countries, capital gains tax applies when you sell, even on your primary residence, and rates can be higher for foreign owners. Some places also levy annual property taxes, stamp duties, or even “vacancy taxes” if the property sits empty for too long, as seen in parts of Canada and Australia.

It’s also essential to consider how overseas property and income could affect your Singapore tax situation. While Singapore does not currently tax foreign-sourced income unless it’s received here, tax treaties and evolving laws mean this could change. If you have multiple properties and plan to rent them out, you might also fall into higher tax brackets abroad or locally.

More from Stacked

13 Condos With The Most Unprofitable Transactions (By Region)

You’ve read dozens of stories about property tycoons and how housing is the best asset – but at the same…

Finally, prepare yourself for the local bureaucratic culture. In some countries, routine processes such as transferring utilities or registering property ownership can take weeks or months, and often require physical appointments, notarised documents, or official translations. In some jurisdictions, bribes or “facilitation fees” are unfortunately common.

Tip: Engage a local lawyer or accountant with cross-border property expertise before you buy. They can help you navigate not just the purchase, but also ongoing tax filings, compliance, and estate planning. It is money well spent.

Plan for everyday logistics

Once you move in, the “basics” such as utilities, broadband, waste collection, local banking, and even driving may be nothing like Singapore’s.

In Europe, for instance, you may need a tax ID just to open a utility account. In South Korea, you might need your name registered locally to receive mail properly. Internet installation can take weeks or months, and residency cards can take up to a year to process.

Tip: Many agents abroad offer relocation services to help you set up after the sale. If not, seek referrals from expat communities or hire a local fixer.

Learn the local etiquette

It’s not just about language, it’s about rhythm and social norms.

Every community has its own unwritten rules about how neighbours interact, what’s considered polite, and what crosses a line. In Japan, for example, silence is prized and noise after 8 PM can sour neighbourly ties. In Spain, chatting with strangers in the lift is expected and often seen as a sign of friendliness. In rural France or Italy, showing up with a small gift for new neighbours is a gracious gesture and can help you feel more welcome.

Understanding etiquette extends beyond individual neighbours to community rules and organisations. In many countries, condominium or landed communities have homeowner associations (HOAs) or syndicats that enforce both formal rules and informal expectations. These may dictate things like what you can hang on your balcony, how loud your parties can be, where you can park, and even the colour you’re allowed to paint your front door. This is quite similar to condo management committees in Singapore, but Singaporeans have a tendency to assume landed homes aren’t subject to these issues (as is often the case back home).

In the US and Canada, HOA rules are legally binding and often more strictly enforced than most newcomers expect. In some European cities, the building’s syndic may also expect you to attend meetings or pay into a communal fund; missing these obligations can quickly strain relations.

Be sure to ask your agent or lawyer about the existence of such organisations, and read through their bylaws carefully. What might seem trivial or strange to you could carry serious fines or damage your standing with neighbours.

Watch how locals interact in common areas, attend community meetings if you can, and adapt early. Misreading these social cues and rules can make you feel more isolated than you need to be, or worse, put you in conflict with your new neighbours.

Build a routine and a community

Once the essentials are sorted, focus on making your new surroundings feel familiar.

Start with small routines that ground you in the rhythm of daily life — your morning coffee spot, a favourite walking route, a neighbourhood grocer where the owner learns your name. These little rituals create anchors in what can feel like a sea of change, and they help you feel less like a visitor and more like a resident.

Take time to explore beyond the obvious. Discover the local market day, join a gym or yoga class, or pick a regular park bench where you can people-watch and observe how locals go about their day. Even learning the shopkeeper’s name at the bakery or chatting with the bus driver can help break the invisible wall between “foreigner” and “local.”

Look for local or expat communities for added support and connection. ASEAN groups, international schools, professional associations, or even “Singaporeans in…” Facebook groups can offer a comforting sense of home and a space to ask practical questions without judgment. Volunteering in local charities, animal shelters, or community events is also a wonderful way to meet people and contribute to your new home meaningfully.

If you’re staying long-term, the sooner you start learning the local language, the better. Even if you only pick up a few phrases, it shows respect and helps you feel more connected. Locals often appreciate the effort, no matter how small, and you may find doors opening that would otherwise remain closed. Being able to say a simple hello, thank you, or order your food in the local tongue can make daily life much smoother – and more rewarding.

But resist the urge to replicate your Singaporean lifestyle exactly. You moved abroad for a reason, so let your new environment shape you too. Try embracing local customs and routines even if they feel unfamiliar, like a slower lunch hour in Spain, cycling everywhere in the Netherlands, or enjoying an unhurried Sunday in France when most shops are closed.

You may find your circle of friends takes time to build, and that’s normal. Be patient with yourself and keep showing up. The more you invest in the life around you, the more it will feel like yours. Over time, you’ll notice you’ve created not just a routine, but a real sense of belonging.

Give yourself time to belong

Adaptation is not a checklist. It is a gradual layering of comfort, connection, and participation. Some days will feel thrilling, others lonely, and both are normal.

You didn’t just buy a property abroad. You bought into a new pace, a different culture, and a whole new way of life. Give it time, and what feels foreign today may one day feel like home.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Melody Koh

Melody is a designer who currently works in Tech and writes for fun. Her latest obsession is analysing and writing about real estate affordability for the younger generation. Coming from an Industrial Design background, she has a strong passion for spatial design and furnishing . Having worked in Finance for almost a decade, Melody has a keen interest in sustainable investments and a nose to sniff out numbers that don't make sense.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Latest Posts

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

On The Market Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

1 Comments

You missed out perhaps the most important point , visas! property ownership and the right to live in a country are not necessarily tied together !