Should You Right-Size To A Flat, Or Just A Smaller Condo?

January 31, 2022

Perhaps the children have moved out, or perhaps right-sizing was part of your retirement plans all along. Whatever the case, it’s time to sell – and if you’ve done well for yourself, you might be wondering: why do you have to right-size to a flat? Here are the factors to consider when deciding:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Right-sizing doesn’t always mean moving back to a flat

A common long-term strategy, which we hear from many home buyers, goes like this:

“I’ll upgrade to a private property in my 40’s, let the property appreciate, and when I am 65 to 70+ I’ll sell it and move into an HDB flat.”

There’s certainly nothing wrong with that, it’s a time-tested formula.

However, some homeowners end up doing better than they expected. They may find that, after selling, they have enough to both retire, and afford something in the $800,000 to $1 million range.

This is enough for smaller condo units, such as resale shoebox units and some two-bedders.

Right-sizing to a smaller condo unit has some advantages:

- You don’t have to sacrifice common facilities

- Integrated developments can be great for retirees

- There could be better legacy value

- Dual-key units can provide continued rental income

- Reverse mortgages can top up your CPF

1. You don’t have to sacrifice common facilities

The most obvious benefit, to right-sizing to a condo, is that you don’t lose access to facilities like pools, BBQ pits, clubhouses, and so forth.

There’s often an inaccurate assumption that, as retirees, you would not appreciate such facilities anyway. Our experience on the ground tells us otherwise: many retirees don’t want to move from a condo, because the facilities help to maintain family ties.

It’s easier, for instance, to have regular family BBQs when you have access to private BBQ pits downstairs; and the children/grandchildren can enjoy pool or clubhouse facilities when they come to visit. So while the lifestyle benefits aren’t for you to enjoy, having these moments with grandchildren can be a priceless experience.

Another benefit to condos is that, sometimes, there are commercial spaces downstairs. These can include minimarts, clinics, dentists, hair salons, etc. Even if a condo is not a fully integrated development (see below), these can be a major convenience, should travelling becomes harder in your later years.

2. Integrated developments can be great for retirees

If you’re right-sizing because you’re near retirement, chances are your next home will be the home for the rest of your life. As such, it’s important to ensure it’s convenient for the decades to come.

Integrated developments include shops, eateries, transport nodes (including MRT stations), and sometimes even civic institutions like the neighbourhood library. Some examples include Pasir Ris 8 and Woodleigh Residences.

While some HDB flats also have amenities nearby (you may be lucky and land a flat that’s across the road from the MRT station, or close to a famous hawker centre), they rarely have so much variety (e.g., supermarkets, pharmacies, libraries, sometimes even theatres and libraries) right downstairs. While being just across the road may seem to be close enough, sometimes when you are advanced in years this can make a world of difference. Plus, it’s an added peace of mind for your children, that you don’t have to traverse up stairs or cross the road daily to get to your morning coffee.

Incidentally, reunion dinners and the like are much easier, when the restaurant is just a lift ride away.

3. There could be better legacy value

It’s not possible to own two HDB properties at once. If your children already have a private property, they often can’t inherit and also keep your flat (situation depending*). With a homeownership rate of over 90 per cent, it’s safe to say most older Singaporeans will find their children in this position.

If you leave your children a private property, however, they have more options. They could upgrade by moving into your condo and selling their flat, if they have one; this could leave them with a hopefully better appreciating asset. If they already have an existing private property, they can retain yours and use it for rental income.

Besides this, private property can be freehold, and have greater legacy value for your children or grandchildren.

*With some exceptions, based on when the flat was acquired. Your children may keep the flat and their private property, provided your flat was acquired on or before 30th August 2010. Even then, they would have to move into your flat if they want to keep their private property. This clause usually results in children surrendering the flat anyway.

4. Dual-key units can provide continued rental income

It’s well known that, in a pinch, older Singaporeans can rent out rooms in their flat for added income. In our experience, most retirees are more inclined to suffer in silence than do this.

It’s simply uncomfortable to rent out a room to a stranger, and have your privacy invaded for…well, possibly the rest of your twilight years.

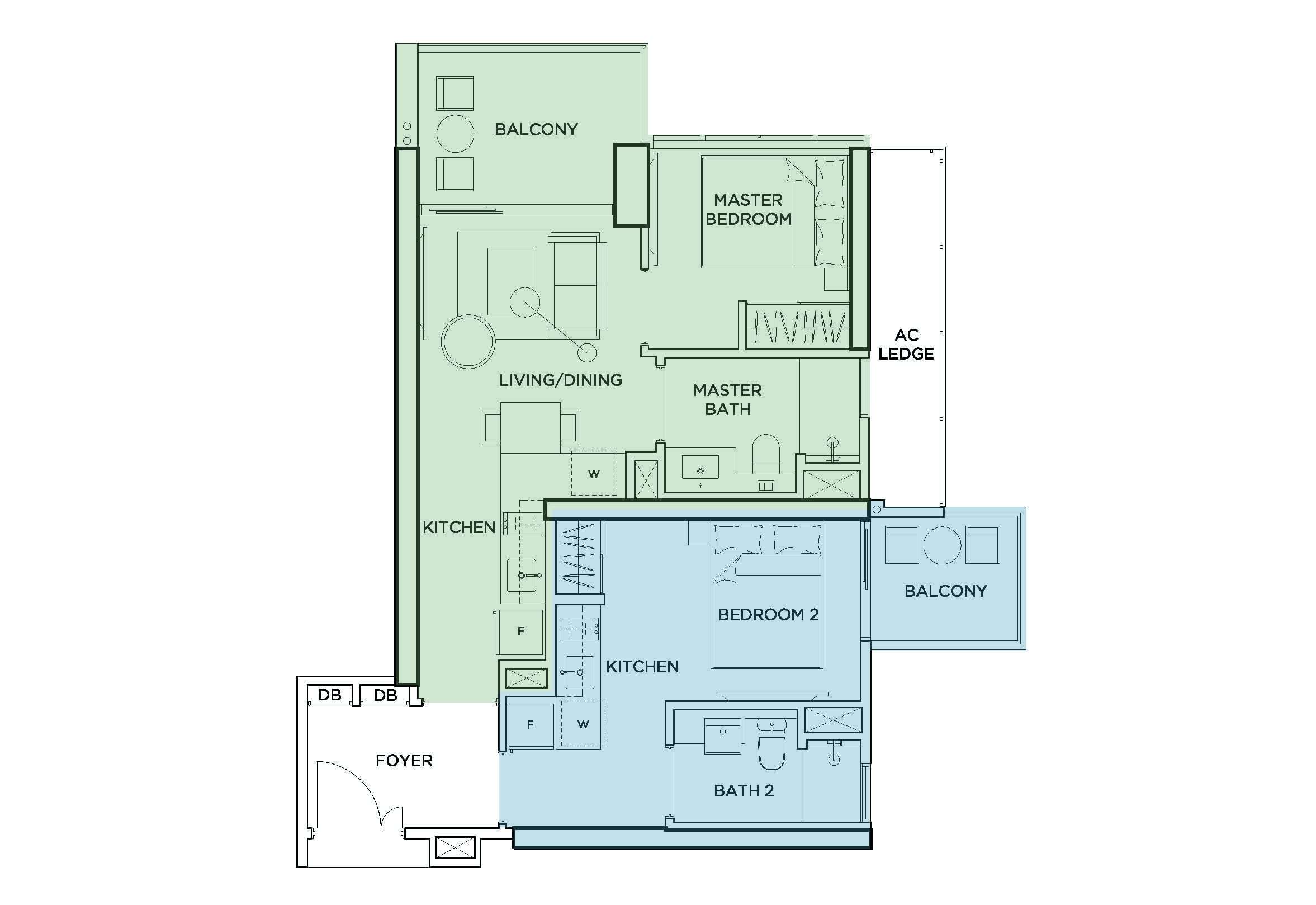

One interesting strategy, if the budget permits, is to right-size into a smaller but dual-key layout. These units divide into two separated sub-units, so you can retain full privacy while renting out the other half.

This makes it a more comfortable, ongoing source of rental income – and one with higher rentability, as tenants like their privacy too.

As an aside, it could be used to house children or grandchildren, if you want to live as an extended family.

That said, dual-key units can be a pricey option but for the most affluent right-sizers. Even the smaller ones can cost as much as a regular condo unit (often up to $1.4 million). Nonetheless, this is an option that you won’t find among HDB properties.

5. Reverse mortgages can top up your CPF

We have a more in-depth discussion of reverse mortgages in this article.

To quickly summarise though, you can take a reverse mortgage on a private property, to raise your CPF payouts. In this case, the bank will top up your CPF, to the maximum of the Enhanced Retirement Sum (ERS).

This will increase your lifetime CPF payouts (from age 65 and after) to around $2,080 to $2,230 per month.

You do not need to make any loan repayments for this top-up, and you can continue to stay in the property (i.e., you may not have to sell and move, should you run low on income).

Instead, when the loan is due (up to 30 years, or until the youngest buyer reaches 95 years old), the private property is sold to pay back the loan amount. Given that most private properties are valued far in excess of the ERS (currently $279,000), there will likely be enough to discharge the loan, plus leave substantial sums in your estate.

Right-sizing to an HDB flat has some advantages too

- More space, or bigger retirement fund

- Maintenance fees are not an issue

- You can use the Lease Buyback Scheme (LBS)

1. More space, or a bigger retirement fund

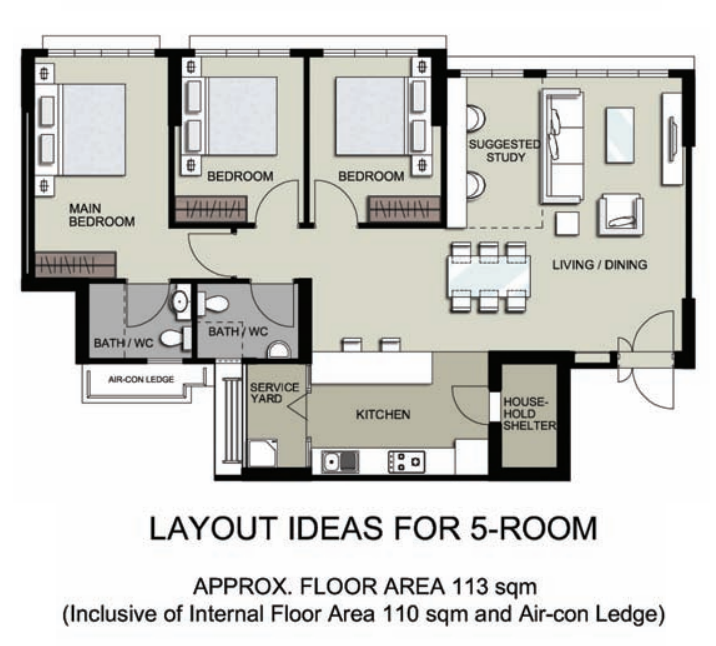

Despite the term “right-sizing”, we know that not every retiree is content with small homes. If you can afford a one or two-bedder condo, you can easily buy a 5-room flat, or sometimes even a jumbo flat/maisonette. If living space matters to you, then HDB is definitely the way to go.

The other concern is, of course, having more for your retirement fund. Sometimes being able to go on holiday once a year, continue expensive passions like photography or golf, etc. mean more than a nice condo.

2. Maintenance fees are not an issue

Even after you pay off a condo in full, maintenance fees won’t stop. You can still expect to be paying around $200 a month for smaller one or two-bedder condo units; way higher than conservancy fees for a flat (even a 5-room flat tends to be around just $80 a month). This can really add up over the years especially with no further income coming in.

For retirees who worry about maintenance fees over the next 20+ years, HDB flats may be the way to go. HDB also tends to be more lenient, toward retirees who can’t make conservancy payments.

Condo MCSTs will just slap on a 15 per cent interest rate, if you miss the quarterly payments.

3. You can use the Lease Buyback Scheme (LBS)

The LBS allows you to sell back a portion of your unused lease, subject to conditions.

So if your flat has a remaining lease of 50 years, but you’re already 70 this year, you could sell back 30 years of your lease. This will top up your CPF, and may also give you a cash bonus. In effect, you can monetise the flat without having to sell and move.

Keep in mind, however, that you cannot sell the flat once you use the LBS; even if someone later offers you more. It also means there’s little in the way of property for the children to inherit.

This is a decision that should be made with qualified financial planners

We can’t dispense financial advice or recommend anyone; but we suggest you find a qualified professional you trust, to discuss the numbers. Don’t trust gut instinct or emotion, as it can be much difficult to move, sell, etc. in your twilight years.

We can help with any data that you need on the properties, however, as well as questions on the real estate portion – so do reach out to us on Stacked if you need help.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

1 Comments

hi I really like you’re apartment reviews. I don’t know if this would be possible, but can you do a review at TwentyOne Angullia Park Orchard? I really appreciate it if you review that apartment. thanks