Which Resale Two-Bedroom Condos Quietly Made Buyers Six-Figure Profits In Singapore?

August 26, 2025

Due to rising prices, a greater number of buyers are turning toward two-bedders, or some variant of this layout (e.g., 2+1 units). Given that new launch two-bedders are hovering in the $1.8 million category, it’s also unsurprising that buyers may seek resale alternatives. Whilst the supply is tight right now (fewer people are selling due to high replacement costs), interest is likely to remain, so we’ve put together a list of the top-performing resale two-bedder units over the past 10 years. Here are the chart toppers:

Top performing two-bedders since 2015

We’ve divided this into 99-year and 999-year/freehold top performers to get a fairer result. We’ve also excluded Executive Condominiums (ECs), which would distort the results as they start off at lower price points.

We then picked the top results from each region, CCR, RCR, and OCR.

Finally, we also picked units with at least five transactions within the past 12 months, so the results won’t be distorted by low volumes, but this naturally means boutique condos (i.e., projects with 50 units or less) would be filtered out.

| Gains | Losses | |||||||

| Project | Average ROI | Average gains | Average holding period (years) | Tnx volume | Average ROI | Average losses | Average holding period (years) | Tnx volume |

| MARTIN MODERN | 16.63% | $318,117 | 7.0 | 7 | -2.80% | -$58,431 | 5.8 | 6 |

| THE SAIL @ MARINA BAY | 13.28% | $233,333 | 5.1 | 6 | ||||

| SOPHIA HILLS | 11.44% | $153,357 | 7.5 | 14 | -2.51% | -$33,000 | 6.7 | 1 |

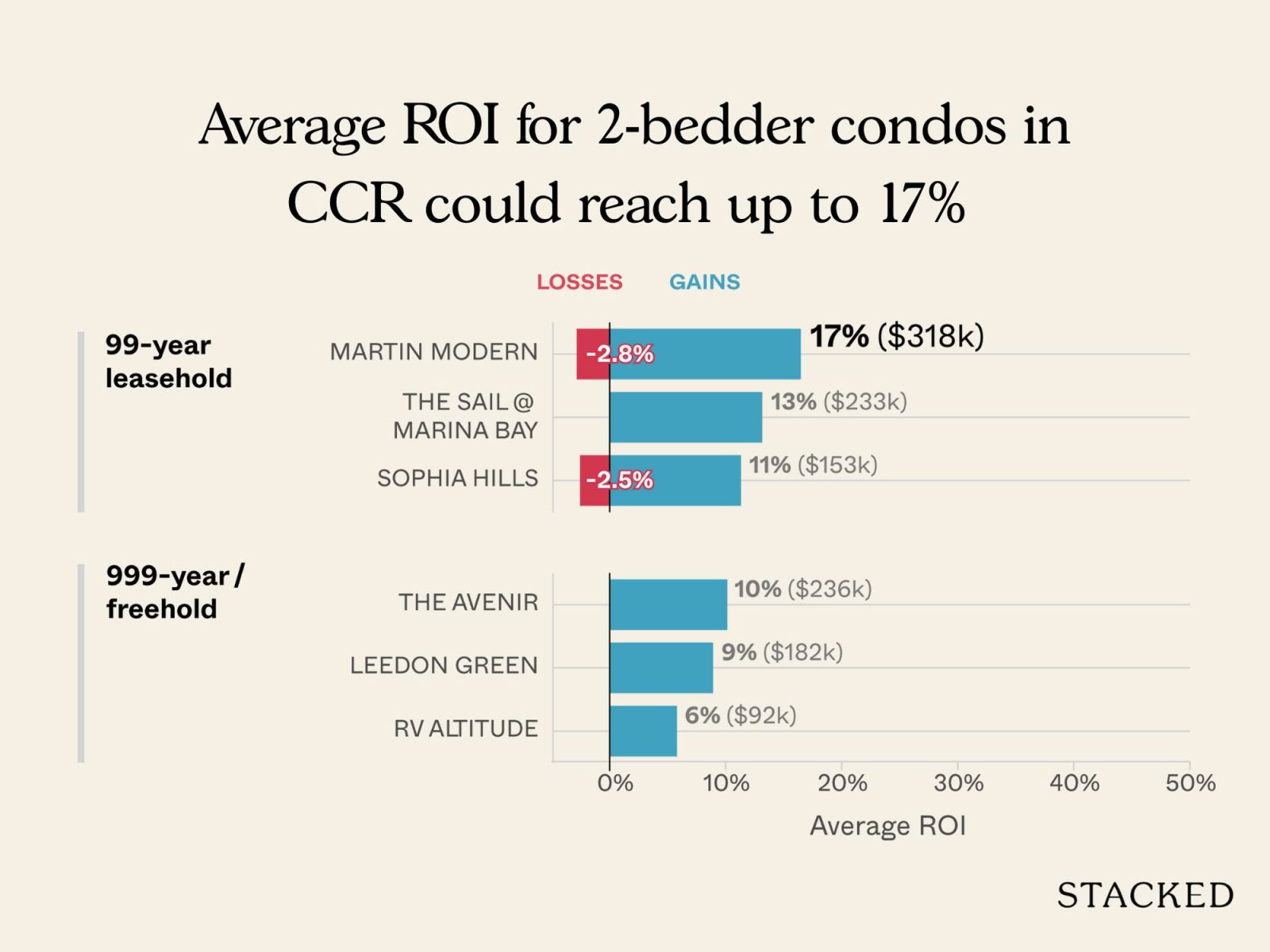

CCR 99-year leasehold

| Gains | Losses | |||||||

| Project | Average ROI | Average gains | Average holding period (years) | Tnx volume | Average ROI | Average losses | Average holding period (years) | Tnx volume |

| MARTIN MODERN | 16.63% | $318,117 | 7.0 | 7 | -2.80% | -$58,431 | 5.8 | 6 |

| THE SAIL @ MARINA BAY | 13.28% | $233,333 | 5.1 | 6 | ||||

| SOPHIA HILLS | 11.44% | $153,357 | 7.5 | 14 | -2.51% | -$33,000 | 6.7 | 1 |

CCR 999-year/freehold

| Gains | ||||

| Project | Average ROI | Average gains | Average holding period (years) | Tnx volume |

| LEEDON GREEN | 10.26% | $181,761 | 3.7 | 11 |

| THE AVENIR | 9.01% | $236,375 | 3.4 | 8 |

| RV ALTITUDE | 5.89% | $91,800 | 3.7 | 5 |

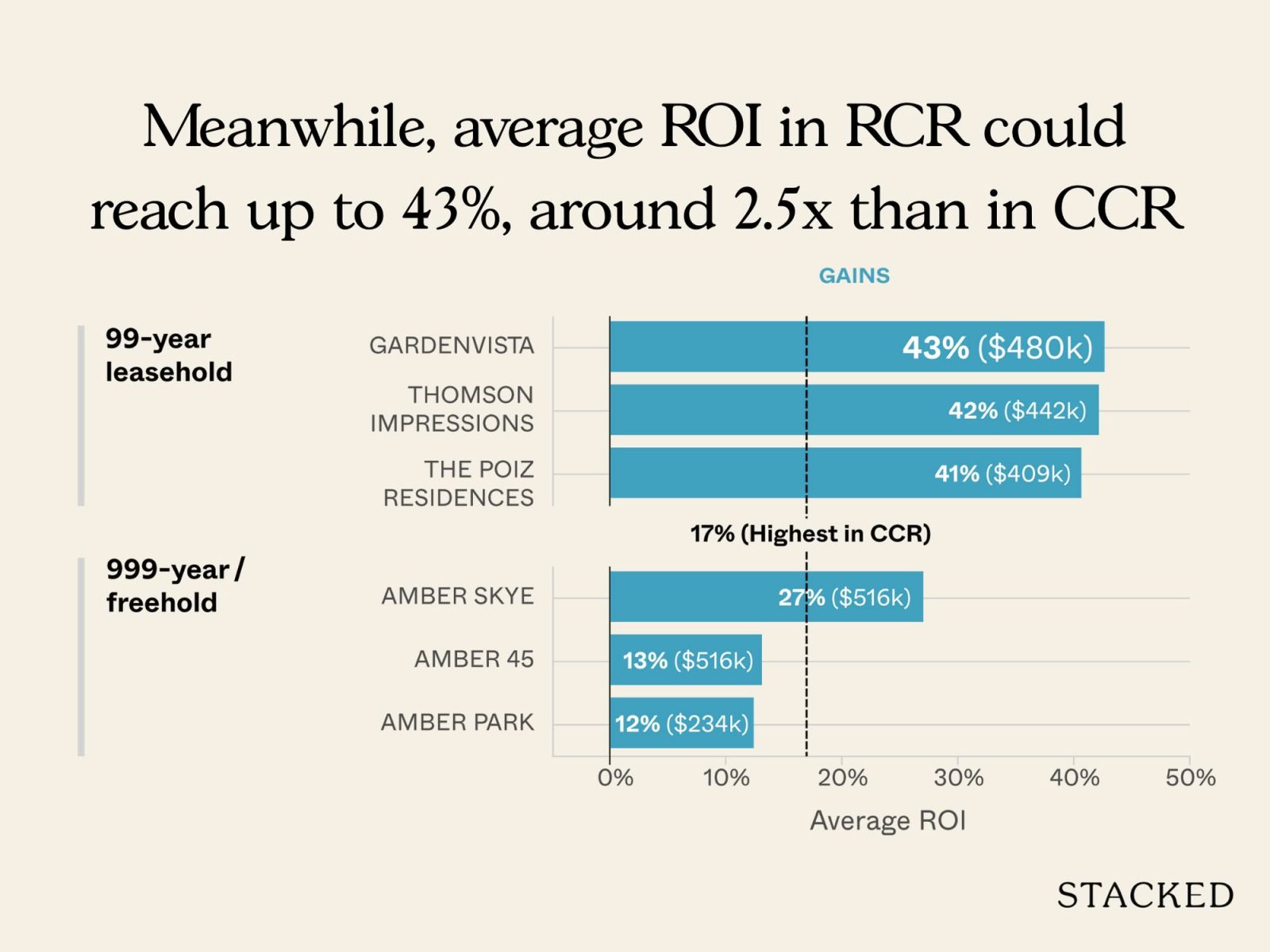

RCR Overall

| Gains | ||||

| Project | Average ROI | Average gains | Average holding period (years) | Tnx volume |

| GARDENVISTA | 42.95% | $479,600 | 6.3 | 5 |

| THE POIZ RESIDENCES | 42.47% | $408,984 | 8.3 | 15 |

| THOMSON IMPRESSIONS | 40.94% | $442,340 | 8.9 | 5 |

RCR 99-year leasehold

| Gains | ||||

| Project | Average ROI | Average gains | Average holding period (years) | Tnx volume |

| GARDENVISTA | 42.95% | $479,600 | 6.3 | 5 |

| THE POIZ RESIDENCES | 42.47% | $408,984 | 8.3 | 15 |

| THOMSON IMPRESSIONS | 40.94% | $442,340 | 8.9 | 5 |

RCR 999-year/freehold

| Gains | ||||

| Project | Average ROI | Average gains | Average holding period (years) | Tnx volume |

| AMBER SKYE | 27.19% | $516,200 | 8.0 | 6 |

| AMBER PARK | 13.17% | $234,018 | 4.2 | 13 |

| AMBER 45 | 12.45% | $242,500 | 6.4 | 7 |

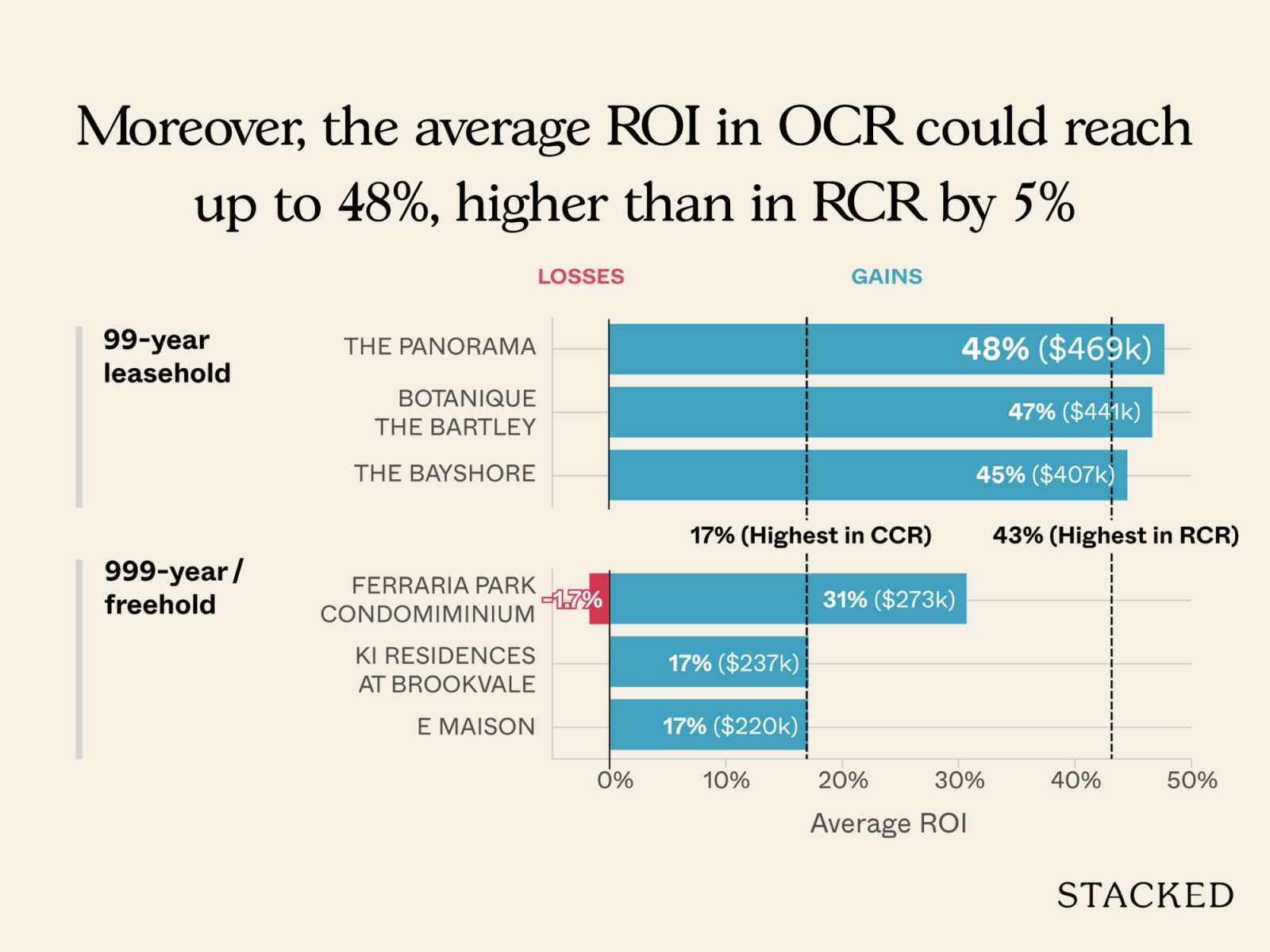

OCR Overall

| Gains | ||||

| Project | Average ROI | Average gains | Average holding period (years) | Tnx volume |

| THE PANORAMA | 48.33% | $469,358 | 7.3 | 9 |

| BOTANIQUE AT BARTLEY | 47.28% | $441,265 | 7.6 | 33 |

| THE BAYSHORE | 45.10% | $406,500 | 5.7 | 16 |

OCR 99-year leasehold

| Gains | ||||

| Project | Average ROI | Average gains | Average holding period (years) | Tnx volume |

| THE PANORAMA | 48.33% | $469,358 | 7.3 | 9 |

| BOTANIQUE AT BARTLEY | 47.28% | $441,265 | 7.6 | 33 |

| THE BAYSHORE | 45.10% | $406,500 | 5.7 | 16 |

OCR 999-year/freehold

| Gains | Losses | |||||||

| Project | Average ROI | Average gains | Average holding period (years) | Tnx volume | Average ROI | Average losses | Average holding period (years) | Tnx volume |

| FERRARIA PARK CONDOMINIUM | 31.03% | $272,841 | 5.1 | 7 | -1.67% | -$20,000 | 0.6 | 1 |

| E MAISON | 17.26% | $220,339 | 6.7 | 6 | ||||

| KI RESIDENCES AT BROOKVALE | 17.21% | $236,991 | 3.7 | 12 | ||||

Highlights from each region

Let’s take a look at two of the top performers – one freehold and one leasehold – in each region:

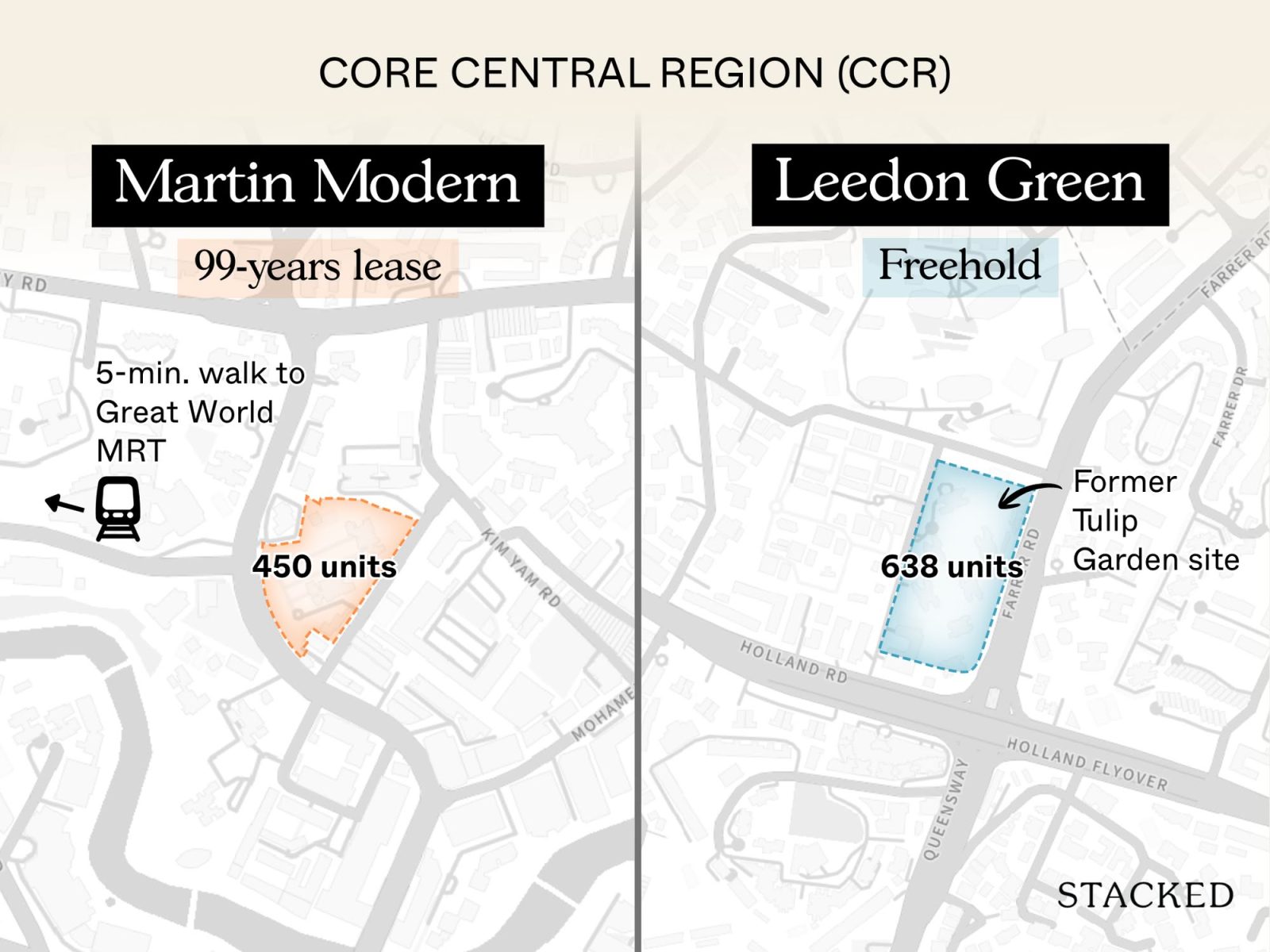

- Martin Modern (99-years lease CCR)

- Leedon Green (Freehold CCR)

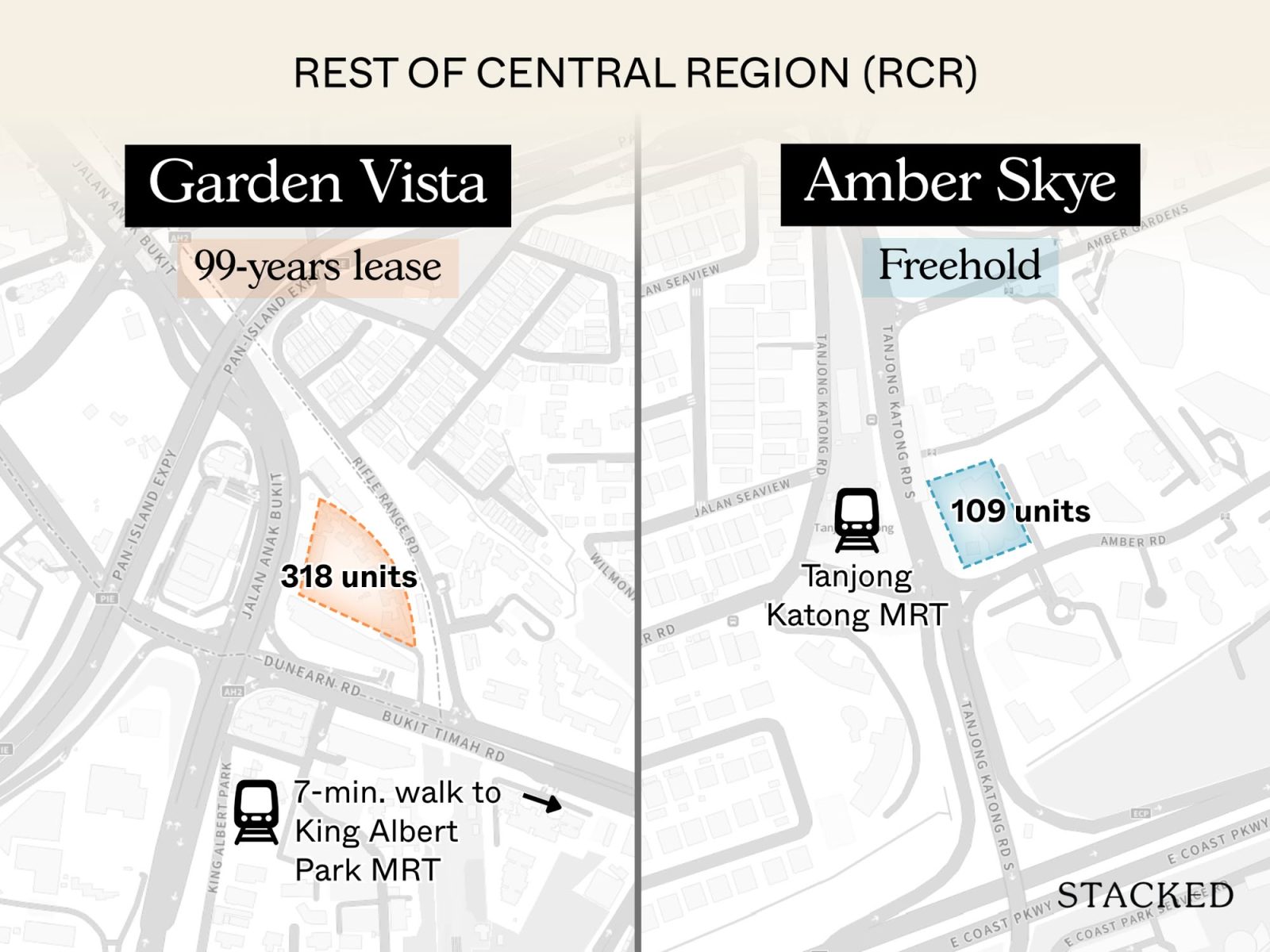

- Garden Vista (99-years RCR)

- Amber Skye (Freehold RCR)

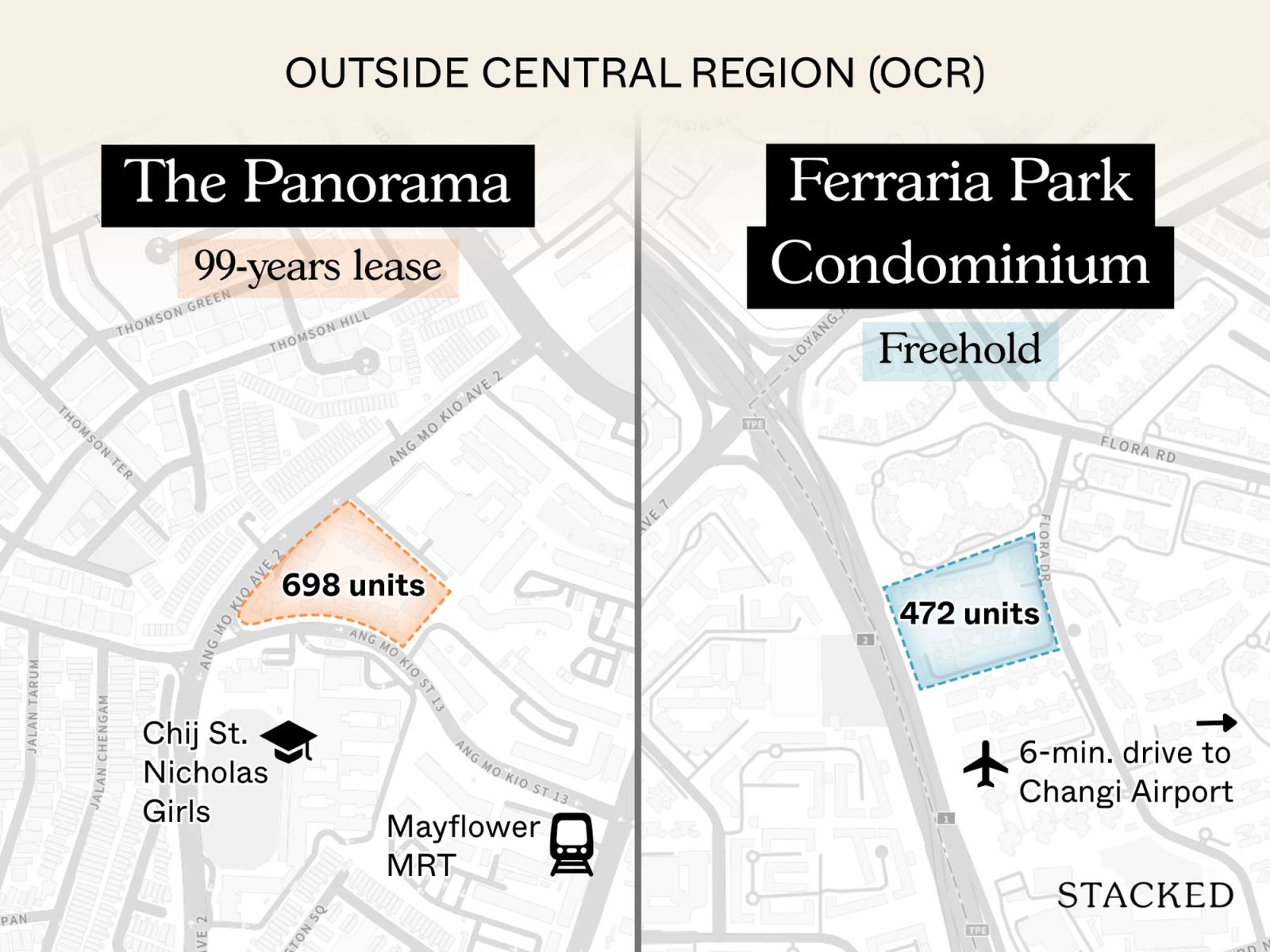

- The Panorama (99-years OCR)

- Ferraria Park Condominium (Freehold OCR)

1. Martin Modern (99-year lease CCR)

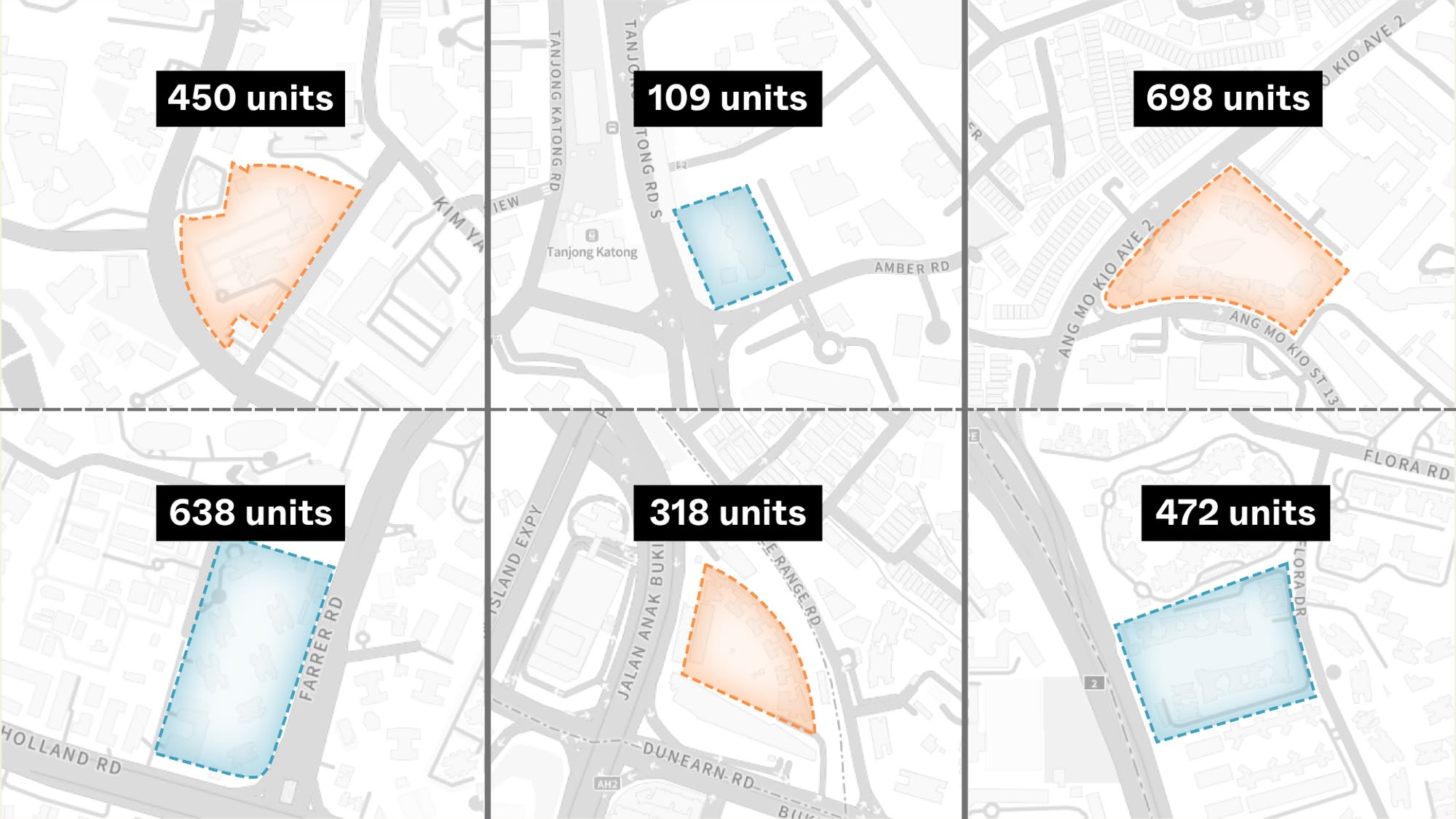

This is a 450-unit project completed in 2021, located at 10 Martin Place (District 9). Set in a quieter stretch of Robertson Quay, it offers a good balance: close enough to walk to the cafes and bars by the Singapore River, but far enough to avoid the weekend chaos. It’s also just a five-minute walk to Great World MRT and practically next door to River Valley Primary School, which ticks the boxes for families.

The reason for the strong performance is launch timing: Martin Modern was up for sale in 2017 during a market dip, and prices here started from around $2,009 to $2,500 psf. It didn’t sell out instantly, but those who bought early have been well rewarded: two-bedder sellers clocked an average return of 16.63 per cent and gains of over $318,000, making this one of the top CCR performers in recent years.

The two-bedroom units come in two main layouts: a 764 sq ft standard format and a more spacious 850 to 883 sq ft two-bedroom plus study. Both feature 3.2 metre ceilings (2.6 metres is the norm), efficient squarish layouts, and finishes like marble flooring, ducted air-con, and branded appliances. We have a full review with the details here.

Around 80 per cent of the land at Martin Modern is dedicated to landscaped greenery, with themed gardens and water features.

One of the most interesting elements here right now, however, is the invariable comparison to the newly launched River Green.

River Green – located at 11 River Valley Road – is launching literally just across the street and a sheltered few steps away from Great World MRT. Because both condos share proximity to Great World MRT and offer two‑bedder options, Martin Modern could be a viable resale alternative to River Green for those who have a bigger budget.

At River Green, compact two-bedroom units start from $1.5 million, while premium versions go from $1.72 million. In contrast, resale two-bedders at Martin Modern are currently trading at around $2.1 million to $2.4 million, depending on size and floor. So River Green is the more affordable entry point based on quantum, although it comes with smaller layouts maxing out at just 603 sq ft. But note that River Green’s square footage is post-GFA harmonisation, whereas Martin Modern is pre-harmonisation and includes elements like football ledges.

We have a more complete pricing comparison here.

2. Leedon Green (Freehold CCR)

Leedon Green is a 638-unit freehold condo in District 10, completed in 2023 on the former Tulip Garden site. It’s in a low-density area near Belmont Park and Cornwall Gardens, so the surroundings are mainly landed

As with most such enclaves, public transport access is a bit further away; you could walk to Holland Village MRT (CCL), but it is still quite a distance. Nonetheless, Holland V is there and will have the main amenities for the area.

Leedon Green does fall within the one-kilometre zone of Nanyang Primary School, but only for certain stacks (check the postal code on OneMap.sg.)

Over 80 per cent of Leedon Green’s 316,000 sq ft site is devoted to landscaping and facilities, including three swimming pools, a tennis court, and a forest walk.

More from Stacked

How A Once “Ulu” Condo Launched In 1997 Became A Top Performer

When Aquarius By The Park launched in October 1997 it was a real challenge for the developer and its marketing…

Two-bedders here range from 614 to 926 sq ft, with a mix of one-bathroom, two-bathroom, and study layouts. Kitchens are surprisingly generous in size, but some layouts compromise on dining space due to the study nook. For more complete details, check out the Insider Tour in our review.

Despite competition from nearby projects like Leedon Residence and D’Leedon, Leedon Green has posted strong gains in a short holding period. As of the past 12 months, two-bedder resale units at Leedon Green saw an average ROI of 10.26 per cent, translating to average gains of $181,761 over an average holding period of just 3.7 years.

3. Garden Vista (99-years RCR)

Gardenvista is a 318-unit leasehold condo located along Dunearn Road in District 21, near the Beauty World and Bukit Timah education belt. Completed in 2006, it has quietly become one of the top-performing two-bedder resale projects in the RCR, despite being an older leasehold condo.

Over the past decade, Gardenvista’s two-bedders posted an impressive average ROI of 42.95 per cent, with average gains of $479,600 over an average holding period of 6.3 years. That’s the highest performance on this list, across all regions and tenures.

The appeal of Gardenvista is in its simple fundamentals. The units are generously sized by today’s standards: compared to newer launches that squeeze two-bedders into 700 sq ft spaces, some two-bedder stacks at Gardenvista exceed 900 sq ft, which is around a three-bedder today.

Facilities are dated but practical, including a wide swimming pool, two tennis courts, and rooftop recreational decks with views of Bukit Timah Hill. The project also enjoys a degree of shelter from traffic noise, being buffered by newer neighbour Jardin, even though it sits near the busy PIE and Bukit Timah Flyover.

In terms of connectivity, the Beauty World MRT station is a short bus ride away; but it’s not within walking distance. In addition, Pei Hwa Presbyterian Primary School (~450 m) and Methodist Girls’ School (~680 m) are both in the priority enrolment range.

While we don’t have a full review of Gardenvista yet, we do have a case study on how it managed to outperform even its freehold neighbour.

4. Amber Skye (Freehold RCR)

Amber Skye is a 109-unit freehold condo located along Amber Road in District 15, close to Tanjong Katong MRT station (TEL). Completed in 2017, this is a boutique project offering larger-than-average units and marketed on its direct access to East Coast Park.

We sometimes hear this project being described as having a “seafront” view, which is half true. Some units at Amber Skye, particularly in Stacks 01 and 07, offer partial sea views; but some may be at an angle or partially obstructed by neighbouring developments. A stronger and more justifiable selling point is the greenery visible from East Coast Park, and the walking distance to it. We did do a full review of this condo, although the review is dated now (it was back in 2020).

The project’s unit sizes are significantly larger than many nearby counterparts, with two-bedroom lofts starting from 1,216 square feet and four-bedroom Grandeur units going up to 2,982 square feet. All units have private lift access, including one- and two-bedroom types.

This makes us a bit surprised by its strong performance, as we’d have thought the large unit sizes – and hence high quantum – would work against it. The units here can push past $2 million, which is beyond the comfort zone of most buyers. But then again, District 15 is not exactly an area for price-sensitive buyers.

Facilities are also quite good for a boutique project, which may further support the price. These include a 50-metre lap pool, gym, clubhouse with a kitchen, BBQ area, steam rooms, and a rooftop Sky Terrace. There is no tennis court, though.

With the Tanjong Katong MRT station now up, and the ECP just a minute’s drive away, this is a very well-connected East Coast project. Parkway Parade is five minutes away by car, as is the Katong lifestyle area near i12 Katong and Joo Chiat.

5. The Panorama (99-years OCR)

The Panorama is a 698-unit project completed in 2017, along Ang Mo Kio Avenue 2 (District 20).

Its performance is likely due to a developer relaunch in 2014, with a roughly 10 per cent discount. This happened because after the 2013 property peak, the market was impacted by various cooling measures: the Total Debt Servicing Ratio was introduced in June 2013 and muted the market all throughout the following year. In this article, a while back, we explained how this initially caused poor sales for the Panorama, followed by a sharp rebound due to the discount.

The Panorama is within walking distance of Mayflower MRT station (TEL), and it’s practically next to Chij St. Nicholas Girls. Ang Mo Kio Primary is also within one kilometre. As the name implies, the view is also a selling point, and there’s a landed facing across Ang Mo Kio Avenue 2. That said, amenities such as malls aren’t really present in the area, so it’s mainly heartland amenities for the nearby HDB enclaves.

Typical two‑bedroom units range from 678 to 700 sq ft, while two‑bedroom + study layouts fall between 775 and 797 sq ft. While these sizes were considered quite small in its day, they are not too far off from new launches now. While we don’t have a full review of The Panorama, we’d look mainly at the Type 2a (700 sq ft) unit; this is the more squarish of the two and comes with a wider frontage.

6. Ferraria Park Condominium (Freehold OCR)

This is a 472-unit project along Flora Drive in District 17. It’s a bit of a surprise to see its performance, as Flora Drive is not usually an investor-centric area.

The surrounding enclave is mostly low-rise private residences; and while it’s close to Changi Airport and Loyang industrial areas, it has traditionally catered more to owner-occupiers than landlords. This area is suited to homeowners who like their privacy, and specifically don’t want to be near busy malls or MRT stations.

The project itself offers larger-than-average two-bedroom layouts, typically ranging from around 883 to 1,023 sq ft. By today’s standards, some would consider these three-bedders. Most units come with enclosed kitchens, proper yard areas, and even a utility room; features that are increasingly rare at two-bedder sizes.

Facilities-wise, Ferraria Park is best described as mid-range: a 25-metre lap pool and landscaped gardens, with a clubhouse and function room for social gatherings. There’s also a tennis court, along with a gym, playground, and the usual suite.

What may explain its steady resale appeal is the combination of freehold tenure, spacious layouts (especially for two-bedder size), and a quiet, green setting that appeals to homeowners on the east side.

If there’s one thing these top-performing two-bedders prove, it’s that value doesn’t always lie in the most obvious places.

Some, like Martin Modern or Leedon Green, benefitted from smart timing or premium positioning. Others, like The Panorama, succeeded through a quirk of developer discounting and cooling measures.

It’s also worth noting the range of sizes here. Many of these outperformers are larger two-bedders pushing 800 to even 1,000+ sq ft. So for homebuyers currently priced out of new launches, or who still treasure square footage over novelty, resale two-bedders are definitely worth a look.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are some of the top resale two-bedroom condos in Singapore that have made buyers significant profits?

Why did Martin Modern become a top-performing resale condo in Singapore?

Which resale two-bedroom units in Singapore have shown the highest gains in recent years?

Are freehold or leasehold condos more likely to generate higher resale profits in Singapore?

What features contribute to the high resale value of condos like Amber Skye and Ferraria Park?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights We Compared Lease Decay Across HDB Towns — The Differences Are Significant

Property Investment Insights This Singapore Condo Skipped 1-Bedders And Focused On Space — Here’s What Happened 8 Years Later

Property Investment Insights Why Buyers in the Same Condo Ended Up With Very Different Results

Property Investment Insights What Happens When a “Well-Priced” Condo Hits the Resale Market

Latest Posts

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

0 Comments