This New Upper Bukit Timah Condo Starts From $993K: But Would You Trade MRT Convenience for Greenery?

October 29, 2025

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Overview of The Sen

| Project Name | The Sen |

| Location | 222. 224, 226, 228 and 230 Jalan Jurong Kechil |

| Developer | SL Capital |

| Tenure | 99-year Leasehold from 20 Jan 2025 |

| Site area | ~207,156 sq ft |

| GFA Harmonised? | Yes |

| No. of Units | 347 |

| Est. TOP | Q2 2029 |

Would you trade MRT convenience for a quieter, greener address, if it meant saving a few hundred thousand dollars?

That’s the choice The Sen puts on the table. Nestled within Upper Bukit Timah and surrounded by four nature parks, it offers prices that edge closer to OCR than city fringe. One-bedders start from $993K ($2,199 psf), and three-bedders from $1.936 million ($2,220 psf), these are numbers that would be attractive to buyers in the new launch market in 2025.

Sustained Land secured the site for $278.9 million ($841 psf ppr), a record for the area, yet still one of the more affordable GLS plots transacted in recent years. The timing of its debut couldn’t be more interesting: it follows the success of Faber Residence, which sold 86 per cent of its units on launch day. That performance sent a clear message, demand for well-priced west-side projects remains strong, even in today’s market.

Now, all eyes are on whether The Sen can build on that momentum. It doesn’t have the advantage of immediate MRT access, but it offers something different. Whether buyers see that as compromise or opportunity will come down to how well it delivers on space, design, and long-term value.

Here’s what we know so far.

The Sen is a 347-unit, 99-year leasehold condominium developed by local builder Sustained Land. The project comprises five 10-storey blocks, with a basement car park offering a 1:1 car park lot ratio. That’s generous by today’s standards, though perhaps expected given its distance from the nearest MRT station.

Sustained Land may not be the most recognisable name out there, but it’s a familiar one for those who follow the market.

The developer’s portfolio includes Sky Everton, Coastline Residences, One Meyer, and 3 Cuscaden.

Unit Mix and Configurations

At The Sen, the unit mix spans from 1- to 4-bedroom + study unit. Here’s a quick overview:

| Unit Type | Est. Size (SQFT) | Total Units | Unit Breakdown | Est. Maintenance Fee |

| 1 Bedroom | 452 | 10 | 2.9% | $375 |

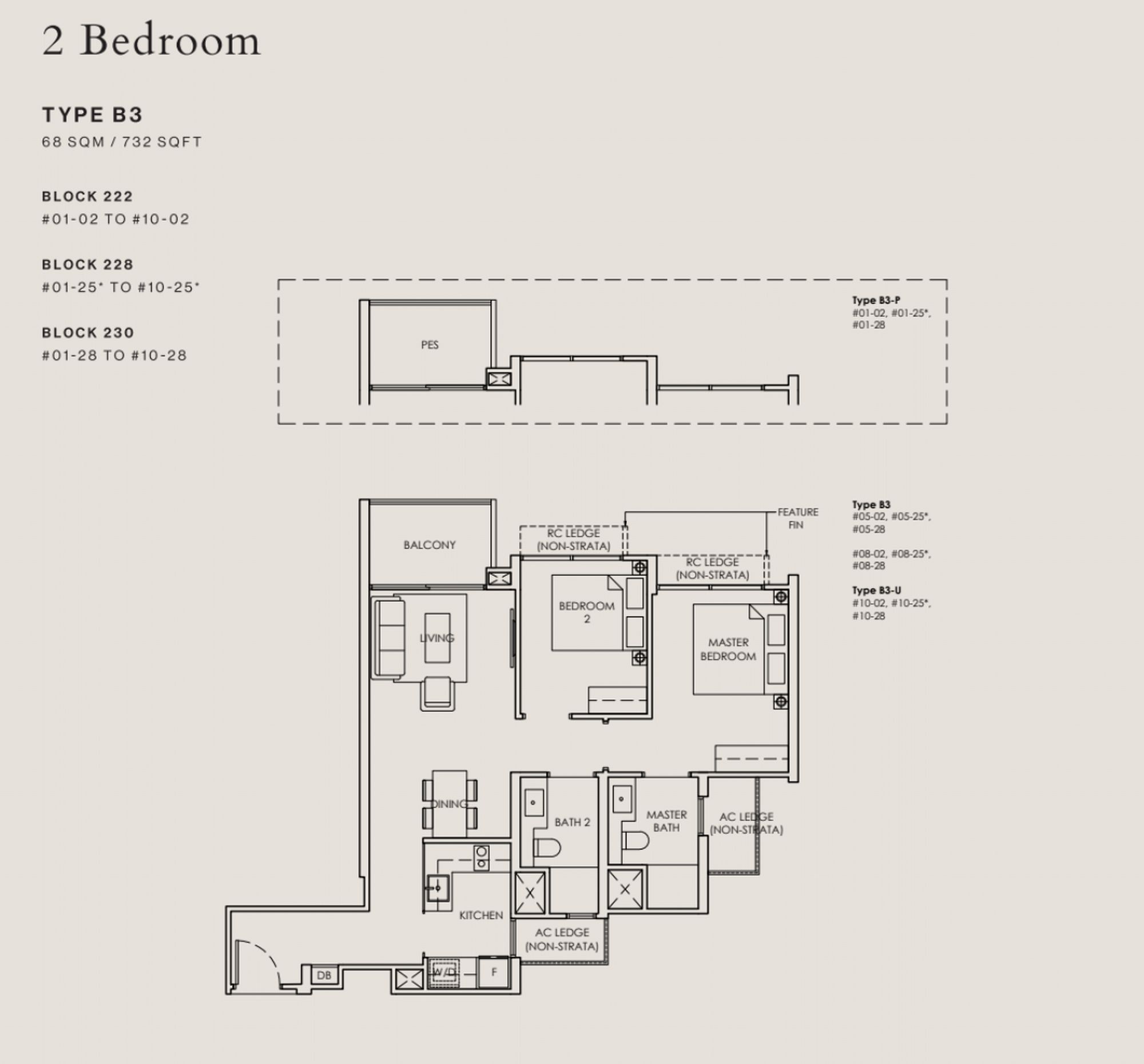

| 2 Bedroom | 678 / 732 | 110 | 48.1% | $450 |

| 2 Bedroom + Study | 764 / 775 | 57 | ||

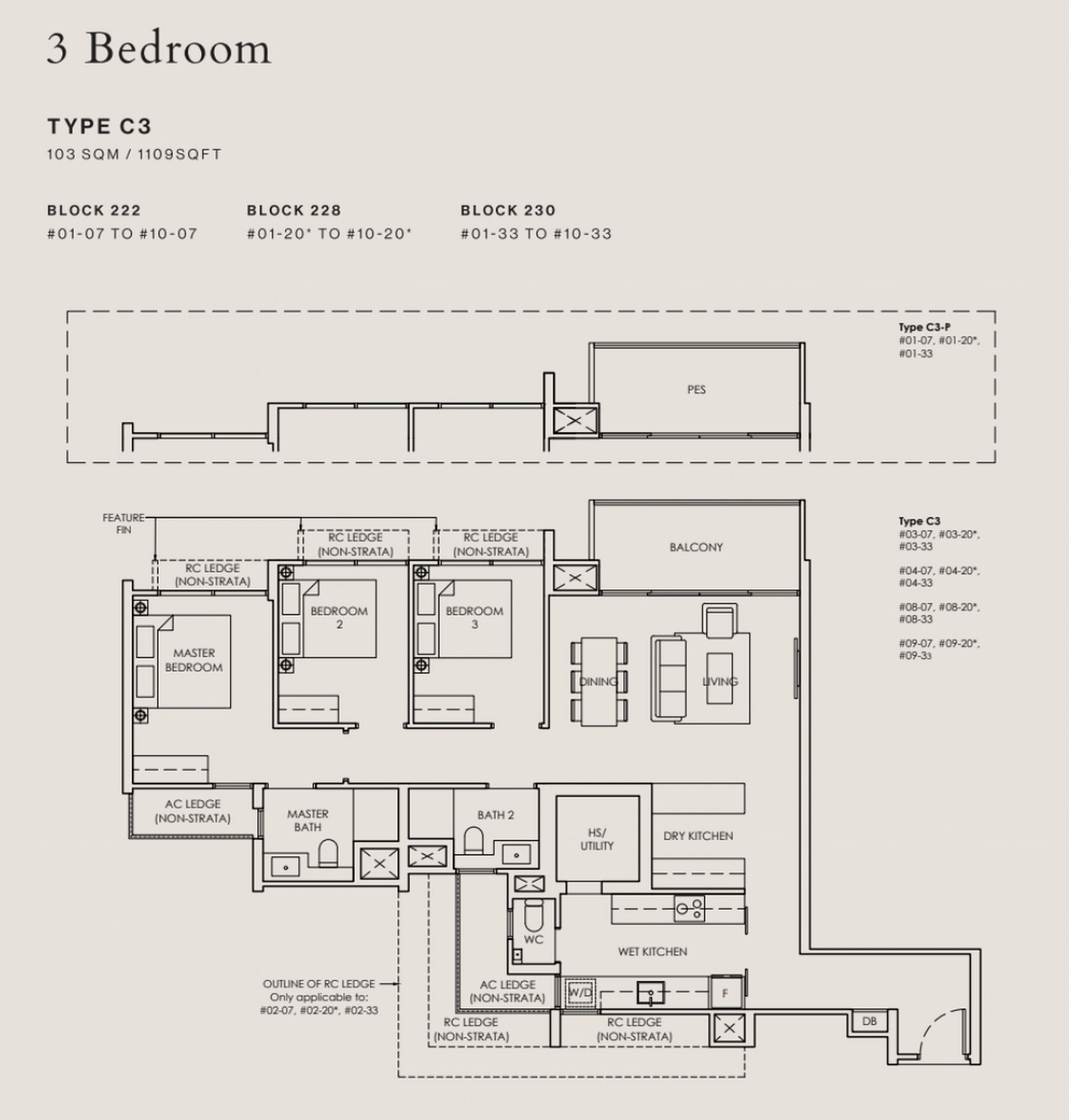

| 3 Bedroom | 872 / 936 / 1,109 | 90 | 37.5% | |

| 3 Bedroom + Study | 1,259 | 40 | $525 | |

| 4 Bedroom + Study | 1,453 | 40 | 11.5% | |

| 347 | 100% | |||

At The Sen, the unit mix is fairly straightforward, with a bigger percentage of 2-bedders which make up close to half the development. Predictably, one bedders here are in short supply, as shown in previous projects they are the slowest unit type to move.

It’s also a post-GFA harmonisation project, meaning AC ledges are no longer part of the stated floor area. In short: more usable space and layouts that should feel a touch more generous.

Take the 2-bedrooms for instance. The entry unit starts at 678 sq ft, which is sizeable by today’s standards. Compare that to Springleaf Residences, where the smallest 2-bedder is 527 sq ft, and you’ll get a sense of how much more room you’re getting here. The largest 2-bedder at The Sen goes up to 775 sq ft and includes a study; roughly the size of a compact 3-bedder at Springleaf Residences.

From what we can see, some 2-bedroom units come with enclosed kitchens complete with a window for natural ventilation, and that all bathrooms are naturally ventilated as well. The 3-bedders make up about 37.5 per cent of the project, and this is where we can see the larger sizes on offer here. Typical 3-bedrooms here go up to 1,109 sq ft, and if you’d like a bit more, the 3-bedroom + study hits 1,259 sq ft, which is larger than some 4-bedders we’ve seen recently.

Certain layouts are designed with landscaped frontages, giving a wider living area and better visual depth. All told, this project seems to have been planned with own-stay buyers in mind.

The best stacks will likely be those facing Bukit Batok Nature Park to the northwest, offering open greenery and quieter views.

And since the project will be built using an advanced precast concrete system (the same one Qingjian first brought in), there’s also a bit more flexibility in how the layouts are configured than in a standard PPVC project.

Here’s a look at the site of The Sen.

At roughly 207,000 square feet, the project sits on a squarish plot of land and comes with the full works, including a 50-metre lap pool, tennis court, clubhouse, children’s pool and playground, along with the usual BBQ pavilions and function spaces.

There will also be a childcare centre within the development (though the vendor has yet to be confirmed), open to both residents and the public.

As for completion, it is expected to TOP in Q2 2029.

The Location of The Sen

The biggest talking point for The Sen will probably be its location. It’s one of those you’ll either really love or not take to at all.

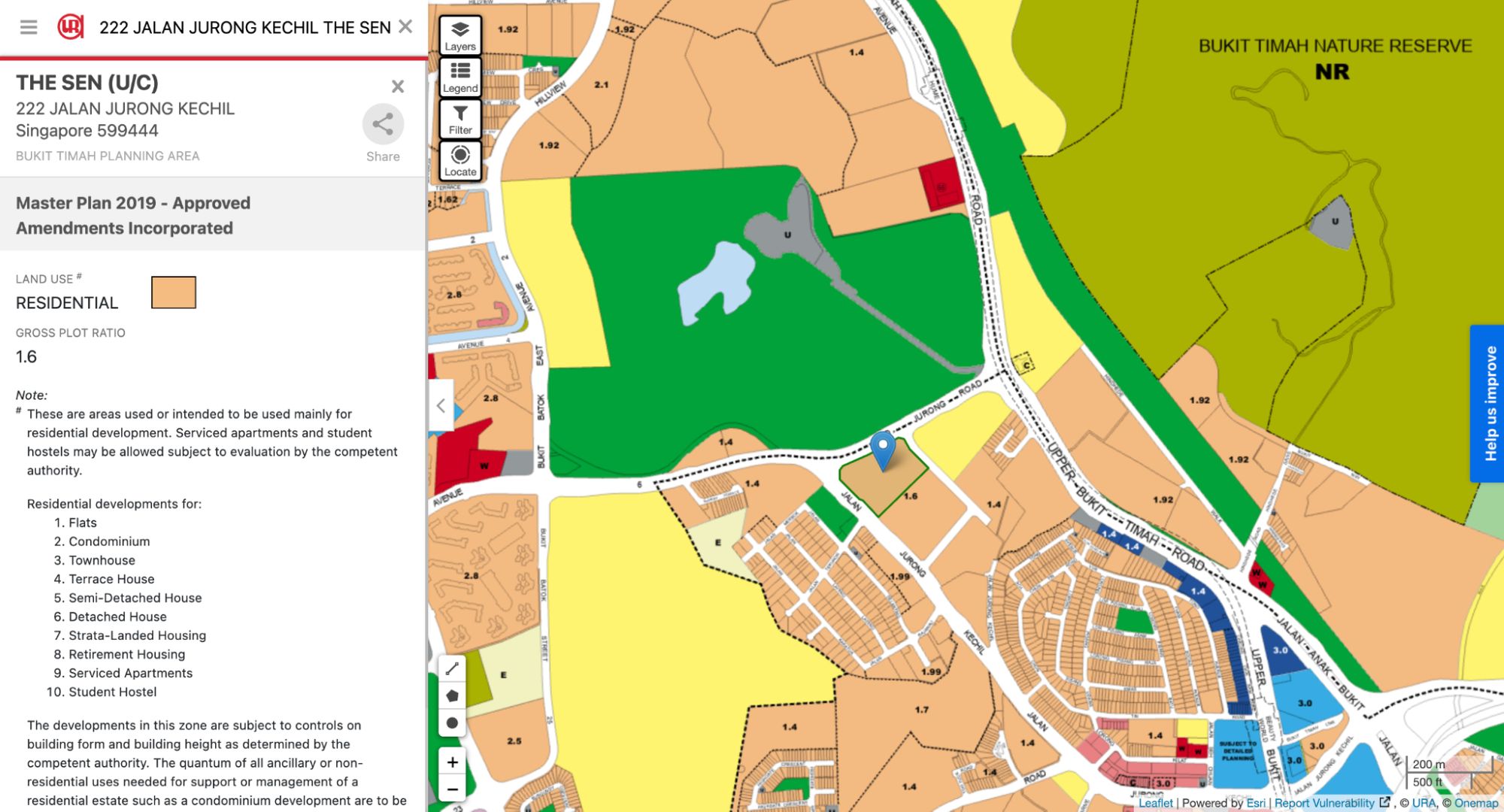

A quick look at the Master Plan gives you a good sense of what to expect. The site is bordered by greenery on almost every side. It faces Bukit Batok Nature Park just across the main road, sits close to the Bukit Timah Nature Reserve, and is flanked by a landed enclave nearby. So, you can expect a tranquil environment that’s quite rare today in Singapore, but that does come with its own inaccessibilities (more on that in a bit).

More from Stacked

Park Infinia at Wee Nam Review: Space Abounds In Novena

It might have just celebrated its 10th anniversary, but Park Infinia’s appreciation trends are a force to be reckoned with.…

Pull up the Google Street View (July 2024) and you’ll see what we mean. Lush, quiet, and almost semi-rural by Singapore standards. This is very much a lifestyle location, the kind you’d appreciate if you enjoy the outdoors or just want to be surrounded by calm.

That said, public transport isn’t its strongest suit. It’s not walkable to any MRT station unless you don’t mind a 1.3 km stroll. The Sen sits between Beauty World MRT and Hume MRT, and will likely rely on a short bus ride or drive for daily commutes. From what we hear, no shuttle bus service is planned, though there’s a bus stop right outside the development that connects directly to the nearest stations within a few stops.

You’ll also notice a fair bit of upcoming residential projects in the area.

The plot directly beside The Sen has already been earmarked for future housing, with several Reserve Sites scattered nearby. So, this pocket of Upper Bukit Timah feels a little like Lentor in its early days: lush, low-rise, and on the cusp of transformation.

Even so, the character of the neighbourhood is unlikely to change overnight. Its proximity to Bukit Timah Nature Reserve and the surrounding parkland means the area should stay largely green and peaceful for the foreseeable future, even as more residential plots are gradually released.

In terms of buyer profile, The Sen will likely appeal to younger families from the surrounding landed estates that want to live near their parents, as well as nature lovers. That said, Verdale’s resale performance and demand nearby hint that demand in this micro-location has been modest so far.

So while The Sen has a clear lifestyle angle, it’s not a universally convenient one, and that nuance will probably be reflected in how the market responds.

On the schooling front, The Sen falls within 1 km of Bukit Timah Primary School, though Pei Hwa Presbyterian Primary is expected to fall just outside the 1 km radius. That said, its proximity to tertiary institutions such as NUS, Singapore Polytechnic, and Ngee Ann Polytechnic could still make it attractive for families with older children.

RCR Location, OCR Price: Possibly the Lowest Land Bid for an RCR Project in 2025

Technically speaking, The Sen sits within the RCR. But in both spirit and pricing, it feels much closer to an OCR product instead.

With its land rate of $841 psf ppr, it’s the lowest RCR site transacted in 2025 and naturally, a figure that immediately sets expectations for a more accessible entry point.

Indicative prices ranges as such:

- 1-bedder: From $993,900 or $2,199 psf

- 2-bedder: From $1.499 million or $2,212 psf

- 3-bedder: From $1.936 million or $2,220 psf

- 3+S: From $2.899 million or $2,303 psf

- 4+S: From $3.34 million or $2,299 psf

On a quantum basis, pricing here feels roughly comparable to Springleaf Residence, though The Sen’s units are notably larger, and it sits within the RCR boundary. By per-square-foot terms, it’s an attractive proposition for buyers looking at the broader 2025 launch landscape.

That said, it’s worth noting that these could well represent the opening stack prices rather than the project’s overall average. Sustained Land’s track record suggests a cautious approach at launch. For instance, Coastline Residences (another Sustained Land project), entered the market at a relatively high price before seeing adjustments later on. Whether The Sen follows a similar trajectory remains to be seen.

Here’s how it compares with recent land bids and launches across regions:

| Project | Location | Land Bid ($PSF PPR) | Launched? |

| The Sen | RCR | $841 psf ppr | No |

| Faber Residence | OCR | $900 psf ppr | Yes, 86% on launch day |

| Springleaf Residence | OCR | $905 psf ppr | Yes, 92% sold at $2,175 psf on launch day |

| Penrith | RCR | $1,154 psf ppr | Yes, 97% on at $2,800 psf on launch day |

| Bloomsbury Residences | RCR | $1,191 psf ppr | Yes, 25.1% sold at $2,474 psf on launch day |

| Zyon Grand | RCR | $1,202 psf ppr | Yes, 83,% on launch day |

| Nava Grove | RCR | $1,223 psf ppr | Yes, 65% sold at $2,448 psf on launch day |

| Skye at Holland | CCR | $1,285 psf ppr | Yes, 99% sold at $2,953 psf on launch day |

| Promenade Peak | RCR | $1,304 psf ppr | Yes, 54% sold at $3,343 psf on launch day |

| The Orie | RCR | $1,360 psf ppr | Yes, 86% sold at $2,704 psf on launch day |

Even the Chuan Grove and Bayshore GLS sites (both OCR plots) changed hands at around $1,376 and $1,360 psf ppr, respectively.

As for resale performance, Verdale remains the closest reference point. It shares a similar scale, buyer profile, and overall positioning. Here’s a look at the recent transactions:

| Contractdate | Address | Unit area(sqft) | Price(S$ psf) | Price(S$) |

| 4 Sep 2025 | 6 DE SOUZA AVENUE #02-XX | 732 | 1,831 | 1,340,000 |

| 25 Aug 2025 | 8 DE SOUZA AVENUE #02-XX | 700 | 1,951 | 1,365,000 |

| 9 May 2025 | 10 De Souza Avenue #04-XX | 614 | 2,021 | 1,240,000 |

| 17 Apr 2025 | 10 De Souza Avenue #02-XX | 1,001 | 2,058 | 2,060,000 |

| 10 Feb 2025 | 12 De Souza Avenue #04-XX | 614 | 1,988 | 1,220,000 |

| 23 Jan 2025 | 12 De Souza Avenue #02-XX | 614 | 1,871 | 1,148,000 |

| 5 Dec 2024 | 6 De Souza Avenue #02-XX | 463 | 2,020 | 935,000 |

Recent transactions show muted gains and relatively few resales, though three-bedroom units continue to hold their value better than smaller ones, suggesting a steady but niche demand driven largely by families and long-term own-stay buyers rather than short-term investors.

In that sense, The Sen will likely appeal more to own-stay buyers who appreciate the neighbourhood’s pace and proximity to nature, rather than investors chasing short-term gains.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Cheryl Teo

Cheryl has been writing about international property investments for the past two years since she has graduated from NUS with a bachelors in Real Estate. As an avid investor herself, she mainly invests in cryptocurrency and stocks, with goals to include real estate, virtual and physical, into her portfolio in the future. Her aim as a writer at Stacked is to guide readers when it comes to real estate investments through her insights.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Latest Posts

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

0 Comments