Why We Chose A $1.23 Million 2-Bedroom Unit At Parc Vista Over An HDB: A Buyer’s Case Study

June 3, 2025

In Singapore’s competitive property market, buyers often find themselves caught between their aspirations and crushing reality. Budget constraints often force compromises and trade-offs, and leave buyers facing numerous tough choices. This case study examines how our team guided a young couple in their early 30s through this challenging landscape, helping them discover happiness in the unexpected property choice of Parc Vista.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

The Buyers’ Profile: Young Professionals with Clear Constraints

Our clients, a young dual-PR couple (Singapore PR/Malaysian), approached us with a clear but challenging brief. They had a non-negotiable budget ceiling of $1.25 million and were looking for a private condominium with a minimum 2-bedroom, 2-bathroom configuration.

Their preferred location was Jurong West or Jurong East, and they needed to move in by July, when their rental agreement would end.

Above all else, they insisted the property must “feel good” and be near transportation options. They also expressed a love for park spaces and concerns about long-term flexibility, given the possibility they might someday return to Malaysia.

An initial conflict in decision-making

During our first consultation, we identified a disparity in their decision-making framework. The couple were considering their purchase through two distinct and potentially conflicting lenses: investment performance versus lifestyle enhancement.

We recognised this dual-focus as a common challenge among first-time buyers: one that often leads to analysis paralysis. Our approach was to help them clarify which of these frameworks would ultimately serve their happiness better, given their budget constraints.

Our search strategy across multiple home viewings

Rather than just presenting a list of properties that (on paper) met their stated criteria, we developed a viewing strategy designed to test their assumptions about what they truly valued.

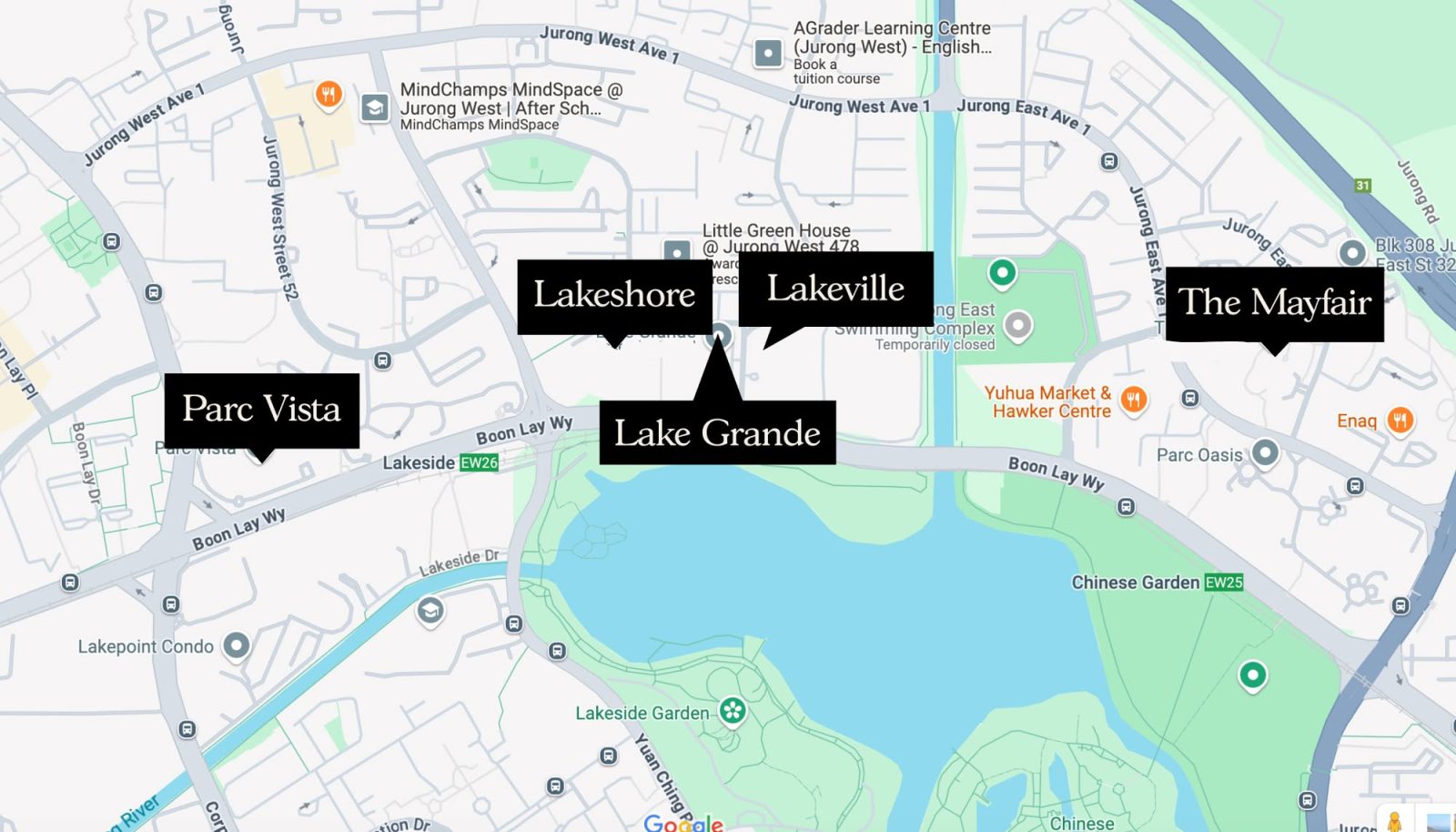

We curated a portfolio of properties that would help them experience the trade-offs in real time: This property shortlist included Lake Grande, Lakeville, Mayfair, Lakeshore, and Parc Vista.

The shortlist includes both newer developments with stronger investment prospects, and older properties with superior living space and amenities.

As we guided them through viewings, we encouraged them to express their reactions and feelings about each property. This process revealed that, while they initially emphasised investment potential in conversations, their actual emotional responses were much stronger toward spaciousness, maintenance levels, and overall ambience.

We observed their disappointment with Lake Grande’s maintenance issues: the wooden boards showing signs of wear, and algae in the fountains. We also noted how they reacted to the tenant-heavy environment. They felt it diminished the sense of community they were seeking. These observations became valuable discussion points in our post-viewing consultations.

Refocusing the way our couple views property

When the couple expressed interest in Parc Oasis but found no available units, we guided them to consider Parc Vista, an older development that wouldn’t have made their initial shortlist if they had remained strictly investment-focused.

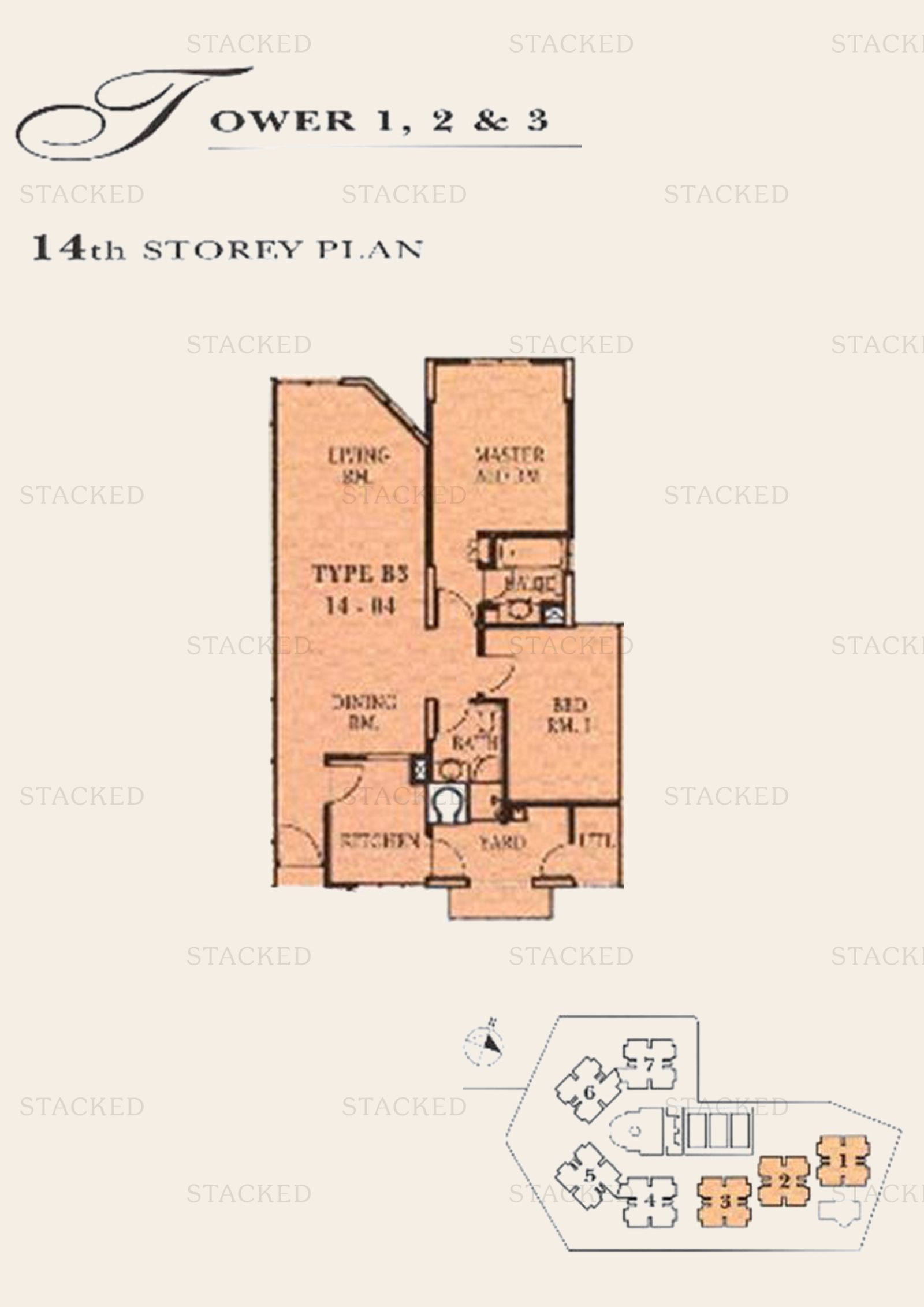

During this viewing, we drew their attention to specific quality-of-life factors they had previously overlooked: the dramatic difference in spaciousness. Their budget here could buy 1,076 sq. ft., versus approximately 650 sq. ft. in newer developments.

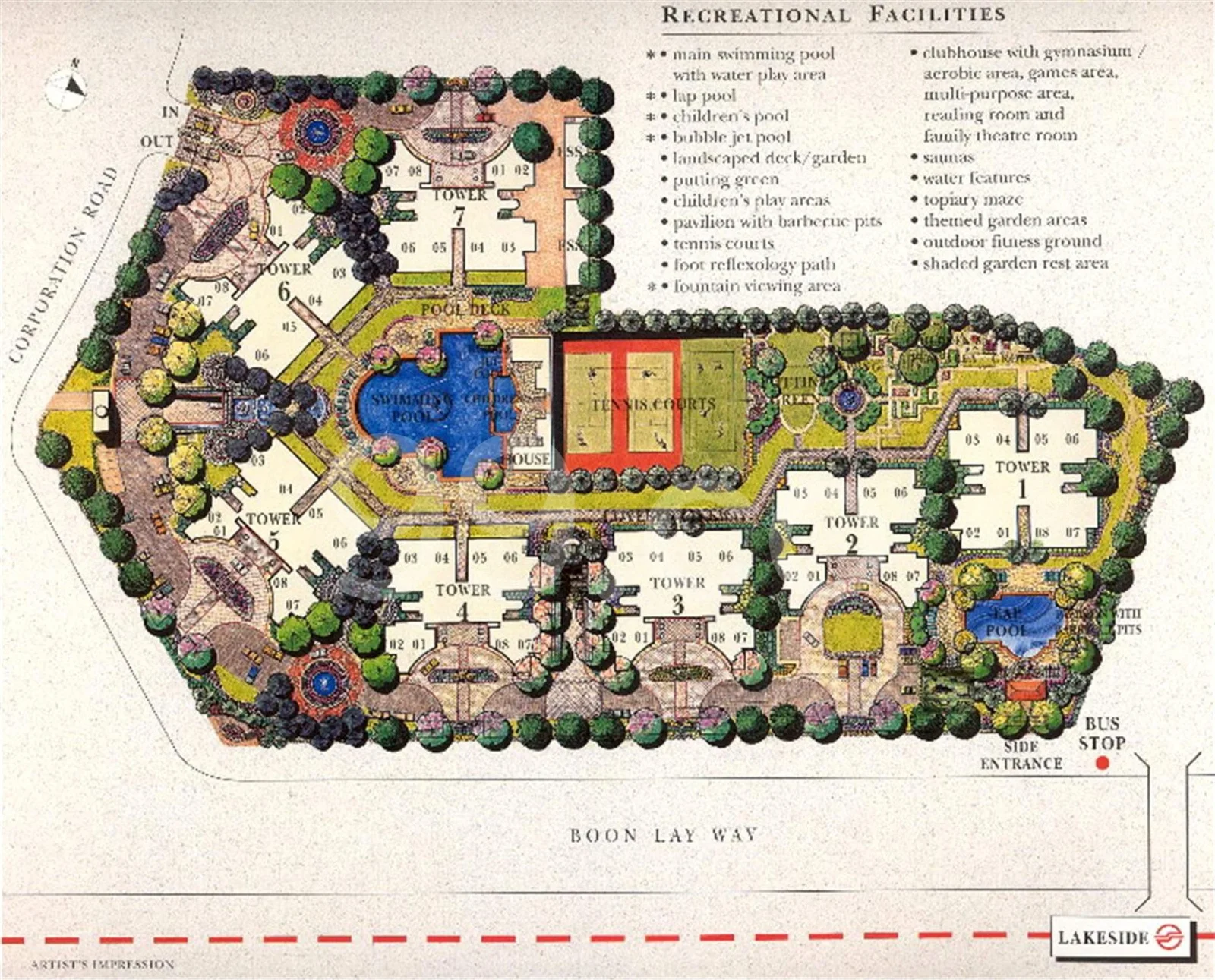

The couple also noticed the well-maintained landscaping and premium amenities like three tennis courts.

(Tennis courts tend to be the most overcrowded facilities in many condos.)

We walked the buyers through a comparison exercise, helping them contrast the actual living experience at Parc Vista with what they had seen at newer developments like Lake Grande. This helped them recognise that newer doesn’t always mean better, and that sometimes the “feeling” of a place can outweigh its age on paper.

Backing up emotional choices with hard data

To ensure they weren’t making a decision based purely on emotion, we conducted a financial analysis of buying at Parc Vista.

Their rent was about to increase from the low $2,000 range to $2,800 per month. Over the next three years, that would amount to $100,800 in rental costs. We compared this to the upfront costs of buying, factoring in both Buyer’s Stamp Duty (BSD) and Additional Buyer’s Stamp Duty (ABSD). In their case (a Singapore PR and a Malaysian citizen), the ABSD was based on the higher applicable rate. The estimated BSD came up to about $30,000, and ABSD around $60,000, bringing the total to roughly $90,000, which is almost on par with what they’d spend on renting.

More from Stacked

This Affordable Condo Enclave Is Priced From $867 Psf In 2024: Is It Worth A Closer Look?

As we approach the end of 2024, private property prices remain stubbornly high, pushing homebuyers to explore less conventional areas…

We also discussed the HDB route. From a cost perspective, an HDB flat would’ve offered a larger space and lower long-term maintenance, and we actually encouraged them to consider that option. But in the end, they were clear:

They no longer wanted to be tenants.

As PRs, they didn’t want to risk being forced to sell if they eventually returned to Malaysia — something required if they owned an HDB. A private property, on the other hand, could be kept and rented out.

So while their initial interest in Parc Vista came from an emotional place, the numbers and their long-term plans confirmed it was a rational, well-grounded choice.

A guided journey to clarity

After approximately one month of guided viewings and consultations, the couple decided to go with a mid-floor, 2-bedroom, 2-bathroom unit at Parc Vista for $1.23 million. This represented not simply a purchase, but a fundamental shift in their property criteria: from one primarily driven by investment metrics, to one centred on owner-occupancy and lifestyle.

Throughout their deliberation process, we provided detailed comparisons of layouts, neighbourhood amenities, and maintenance quality across their options. When they experienced moments of doubt – a common occurrence of “buyer’s cold feet” – we helped them revisit their priorities and the reasoned framework.

Key insights from this case study

This case highlights the importance of helping clients balance between theoretical preferences, and actual emotional responses during the viewing process. While many buyers begin with investment-focused criteria on paper, our experience shows that direct exposure to properties often reveals different priorities.

Our approach of constant communication during viewings, followed by structured post-viewing analysis, helped this couple recognise what truly mattered to them. The space premium proved more valuable than they initially realised, with the dramatic downsizing in newer developments requiring more sacrifices than they were comfortable with.

We also validated their emotional responses with practical considerations. The excellent upkeep of older developments like Parc Vista suggested responsible management committees, and potential for capital retention despite building age. This is a factor often overlooked by buyers fixated on property age alone.

Facilitating authentic property decisions

Most property advisors in Singapore fall into two categories: those who focus exclusively on investors, and those who simply show whatever properties fall within budget. Our approach differs: we guide clients through a structured discovery process that reveals their authentic needs, then validate those priorities with data-backed analysis.

Our role in this case study was not simply to find properties matching stated criteria, but to guide buyers to discover what truly matters to them, and benefits them. The resulting decision balanced practical considerations with emotional resonance, leading to a home that genuinely matched their lifestyle needs.

If you’re navigating similar constraints between budget and aspirations, our team can help you find your optimal balance between investment potential and daily happiness. The journey begins not with property listings, but with understanding what truly matters to you. Reach out to us at Stacked for a similar walkthrough.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Joshua Ho

With lifelong roots in Bukit Batok, Joshua knows the west inside out and this provides him with a clear advantage in guiding clients through property transactions in the area. His personal experience of purchasing his own home in 2022 unveiled the emotional depth of the process, allowing him to bring a distinctive perspective for first-time buyers and connect with his clients on a personal level.

With a commitment to being well-informed before making decisions, he extends this diligence to his clients, ensuring they are equipped with the knowledge necessary for confident choices. By fostering genuine connections built on transparency and integrity, he is devoted to serving as a trusted partner for clients, whether they are buying, selling, or investing in property.

Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Latest Posts

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

Singapore Property News Executive Condo Prices Have Doubled In A Decade — Raising New Questions About Affordability In 2026

Singapore Property News River Modern Sells Over 90% Of Units At Launch — Here’s What Buyers Paid

1 Comments

Very informative and understanding of some doubts about “old” condo. Keep it up. Thanks for all the hardwork