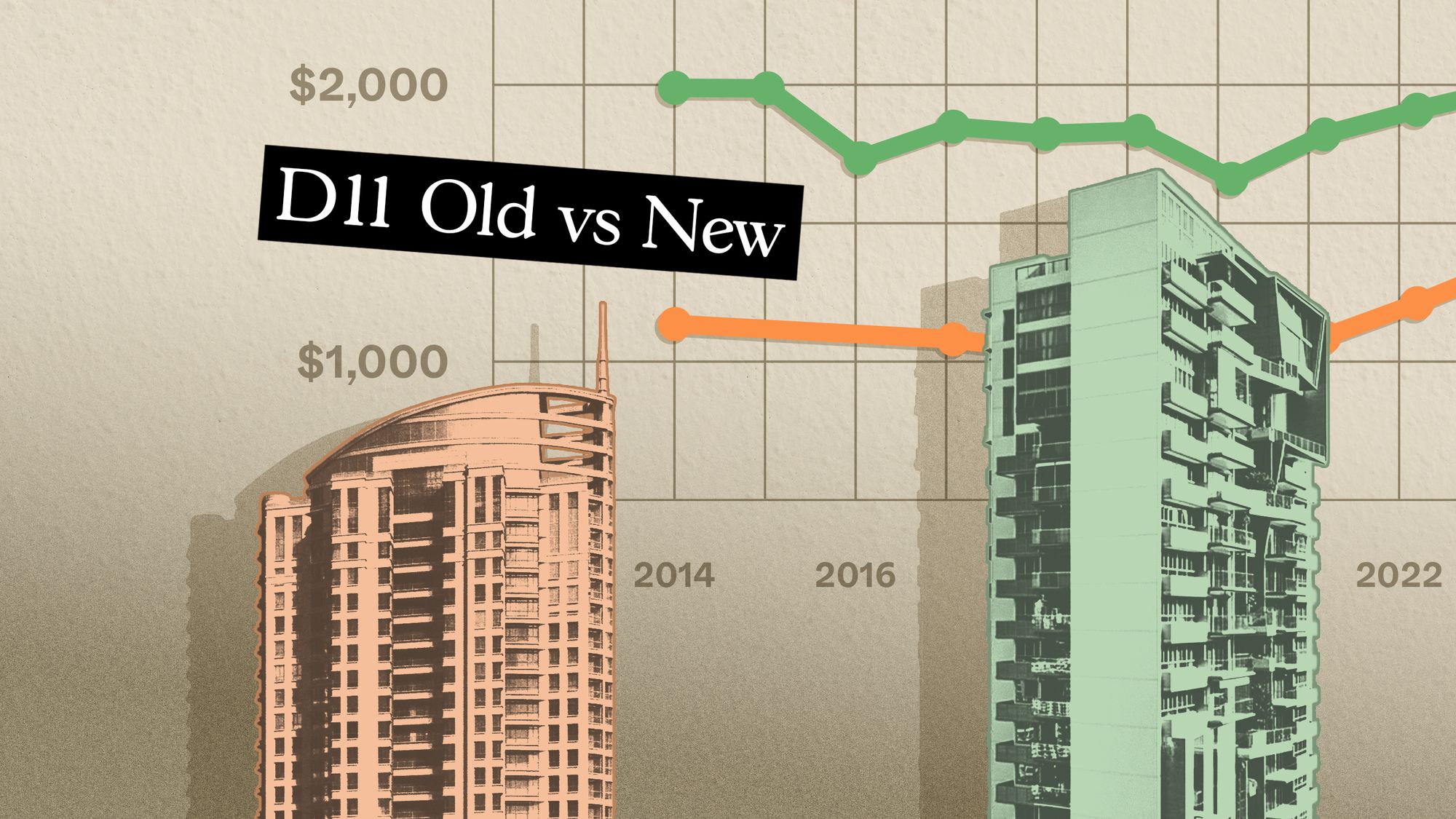

We Compared Old vs New Condos in One of Singapore’s Priciest Neighbourhoods — Here’s What We Found for Smaller Units

October 30, 2025

District 11 (D11) has some of the most famous high-end residential enclaves: think Newton, Novena, Watten Estate and Thomson. Here, the condo landscape has a wide-ranging mix of old and new projects alike; but thanks to its central location, even the oldest condos here can still fetch a premium. D11 is also one of the districts that draw both owner-occupiers as well as landlords, as proximity to the CBD ensures near-constant tenant demand. In light of that, does condo age matter in D11, and how much? Demand seems strong across the board anyway; so does it make sense to go for a lower $PSF, even in an ageing unit? Let’s take a closer look:

Quick Summary:

- Older condos in D11 have held their own, with many showing stronger growth than newer counterparts. Their larger unit sizes and lower entry prices continue to attract both home buyers and investors despite their age.

- One-bedders show weaker overall performance, but projects like Hillcrest Arcadia show that size and value can offset age. Its nearly 1,000 sq ft one-bedder unit at under $1 million was quite a find.

- Two-bedders remain the most balanced segment, with newer units leading in $PSF but older ones keeping pace in overall appreciation. Rental yields are strong on both ends, showing that age has limited impact on returns in D11.

So many readers write in because they're unsure what to do next, and don't know who to trust.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

Property Investment Insights This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Property Investment Insights Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Latest Posts

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

0 Comments