Why Older Freehold Condos Are Struggling to Go En-Bloc in 2025

October 22, 2025

“It wasn’t meant to be like this.” That’s a common sentiment I’ve come across in 2025, and based on what industry experts used to say prior to COVID, I’m inclined to agree. Older freehold properties are supposed to have better en-bloc prospects: a developer buying over freehold land doesn’t need to top up the lease to 99 years again. Further, it’s been argued that residents can drive a harder bargain, as there’s no urgent lease expiry that pressures them to accept a bad deal. To some homeowners, this was a major contributing reason as to why they paid the freehold premium.

But as I write this in October 2025, there is a trend that older and larger freehold projects are finding it increasingly difficult to secure collective sales.

Here’s why:

1. With the number of Government Land Sales (GLS) sites ramping up, en-bloc sales are less necessary, and developers tend to seek smaller sites

Developers are gravitating toward GLS and smaller sites, and this has hurt the prospects of older freehold en-blocs, especially projects that sit on large land parcels.

The government has been deliberately ramping up GLS supply: as of 2H 2025, the Confirmed List yielded around 4,725 private housing units, with the total annual pipeline nudging past 9,200 units once Reserve List sites are included. This was higher than in 2024, when the supply was already at the highest point since 2013.

For developers, GLS tenders are attractive because they come with clear planning parameters, transparent bidding, and a fixed launch timeline of about 15 months. Compared to the uncertainty of wrangling 80 per cent owner consent in an en-bloc, the GLS route is simply quicker and more reliable. So whenever GLS sites are available, we can expect major developers to focus on bidding for those, rather than tie themselves up with en-bloc efforts.

(Note: An exception to this is small, boutique sites, such as freehold projects with a double-digit unit count. These are usually bought by smaller developers, who don’t have the capital needed to bid for GLS sites; so in a sense, it’s a different industry segment that deals with these.

Smaller plots and compact freehold sites can still draw attention, as seen with River Valley Apartments: 48 units, sold for $56 million, where the modest price tag and prime location saw success. But large-scale freehold projects, with many more owners and inflated reserve prices, tend to stall.)

Developers always need land to build on

In the event there’s a lack of GLS sites, developers have no choice but to turn to en-bloc attempts, but so long as the government continues to provide land, that’s the first choice developers will turn to. There’s also an opportunity cost to consider: if a developer has committed to an en-bloc, they always worry they’ll miss out on the next great GLS plot: if the government is releasing land plots in prime areas (which has been the case in 2025), is it a good idea for them to commit to a land plot that can be fraught with more complications?

Pricing is another factor here. From word on the ground, I’ve been told that GLS plots in 2024–2025 transacted at roughly $1,223 to $1,318 psf per plot ratio, while some en-bloc sites like Pine Grove pushed for around $1,335 psf.

The GLS/en-bloc price gap is compounded by higher interest rates and construction costs in 2025; there’s a bit more detail on that here. So for many developers, going for cheaper GLS land is the proverbial “no brainer.”

2. Regarding the price gap, it’s not fair to say that the owners of ageing freehold properties are “greedy”

A lot of it comes down to the cost of a replacement property, and how much that price has gone up over the decade.

One good example of this is from District 9, which is something of an icon for prime freehold projects. In 2024, new freehold or 999-year three-bedroom units in D9 averaged about $4.68 million, while resale freehold three-bedders averaged just $3.33 million. That’s a 40.6 per cent premium for the newer projects.

(More details are available here, if you have a Stacked Pro account.)

For an owner in an ageing D9 condo, the reality is simple: if they cash out today, a like-for-like replacement in the same area could cost them over 40 per cent more. Seen from this angle, it’s not really “greed” when owners are trying to ask for higher sale proceeds. It’s simply a rational response to the current replacement gap.

Unless some miraculous confluence of factors forces down the price of replacement homes, this isn’t going to change anytime soon.

As a related aside, a small percentage of these property owners may be foreigners

This is more probable in prime region freehold properties, which were once the stomping ground of affluent foreigners. Whilst they’re not a huge majority, consider that some of them may have bought when ABSD was much lower or nonexistent. Should they sell the property in an en-bloc, their replacement today would come with a 60 per cent ABSD.

So even if they’re a minority, we can expect some of them to fight tooth-and-nail against any collective sale attempt; especially if the unit is their only foothold in Singapore.

More from Stacked

Will euHabitat, Villa Marina, Or The Bayshore Be A Better Choice For A 3 Bedroom Unit?

Hi Stacked Homes,

3. Sellers can see transactions that seem to support their asking prices

Since COVID, demand for larger homes has surged. Families want bigger living spaces for hybrid work, home offices, sometimes multi-generational living, etc.

As newer condo units are more compact, buyers seeking bigger homes will turn to the resale market. As a result, resale values in some of these projects have risen substantially, often outpacing what a developer might offer in a collective sale.

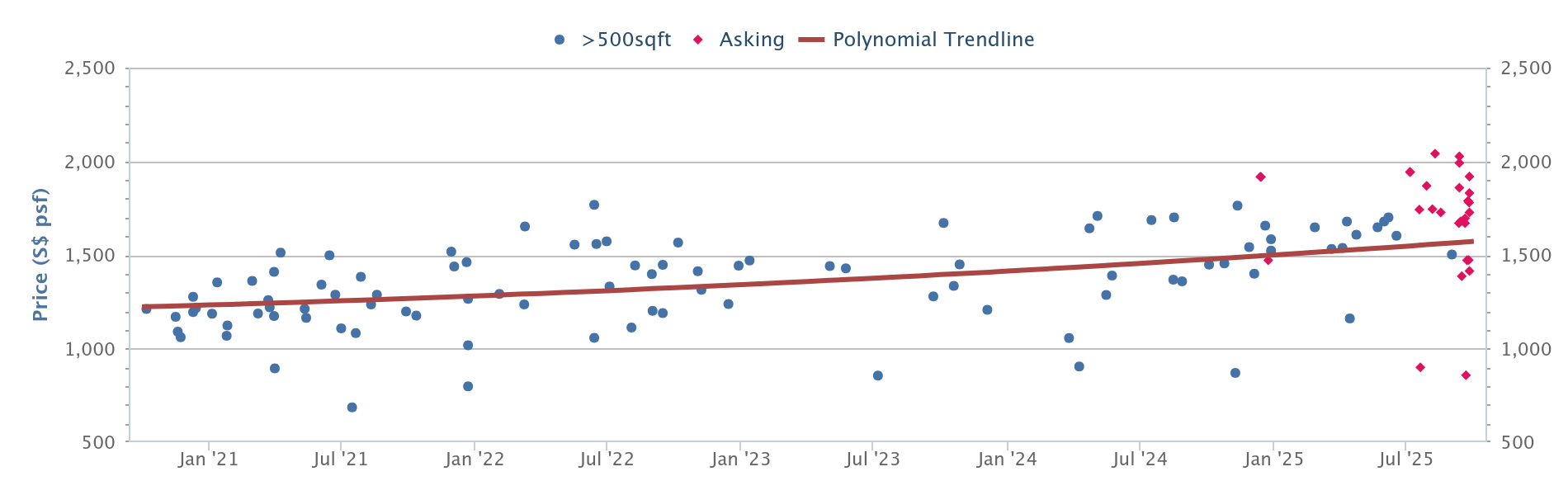

Take Pandan Valley as an example. Back in 2020, prices here averaged about $1,113 psf. As of September this year, it had risen to about $1,572 psf.

Now, if a nearby unit can transact for that price, sellers expect a developer to do better. This is especially incentivised by high replacement costs (see above), so this causes en-bloc negotiations to stall.

Simply put, developers can’t pay above their own redevelopment thresholds, while owners insist on benchmarking against recent resale transactions – many of which exceed the developer’s tolerance.

4. Gross Floor Area (GFA) harmonisation also cuts into sale proceeds

URA’s move to harmonise Gross Floor Area (GFA) definitions took effect in 2023. Previously, developers could treat certain spaces – such as air-conditioning ledges, planter boxes, large void areas, and even some bay windows – as “bonus space” outside of chargeable GFA. They could still sell these areas to you, even though they weren’t being charged for them.

With harmonisation, this sort of “min-maxing” tactic is officially over. Only the liveable areas count; so the saleable floor area a developer can monetise is smaller. From word on the ground, subtracting features like air-con ledges shaves around six per cent off the total square footage; multiplied across a few hundred units, this is a substantial cost to the developer.

This matters to collective sale hopefuls because it translates into lower potential sale proceeds. Developers can squeeze out less from the same plot, thus their land bids naturally fall; and it narrows the en-bloc premium owners can expect.

This harmonisation has hit older freehold estates especially hard. Many of these older projects relied on…let’s politely call it “bonus space” to justify their initial prices. The result is a widening mismatch: owners continue to base their desired sale proceeds on pre-harmonisation expectations, while developers need to contend with today’s measurement methods.

This also has the added effect of longer and more complex negotiations within the condo itself, as the pro-sale committee struggles to explain why the reserve price has to be lowered.

5. Freehold matters a lot less to developers than we might think

Earlier, I mentioned that freehold was supposed to have a built-in edge for en-bloc. That the developer doesn’t have to pay to top up the lease is one advantage. But the other is the prior Singaporean obsession with freehold properties – there was a time when freehold status itself could go a long way toward selling a project.

But in 2025, the landscape looks very different.

GLS sites are abundant, and leasehold launches are not only accepted by buyers, but selling better than expected. Many of 2024–2025’s most successful launches – such as River Green, Promenade Peak, and Emerald of Katong– are on 99-year sites. The neighbourhoods surrounding these projects are characterised by a good number of freehold properties, and in theory, a leasehold property with freehold neighbours should “look bad” in contrast.

But clearly, sales numbers show the market disagrees. Buyers today are focused more on price quantum, layouts, and amenities than on tenure. If the unit is liveable and affordable, few baulk at 99 years.

Accordingly, for developers, as long as a redevelopment yields sufficient margins – after factoring in GFA limits, construction costs, marketing, and so forth – they may not care whether it’s leasehold or freehold. In fact, a freehold site zoned with a lower plot ratio, or one hemmed in by setback requirements, conservation rules, etc., can be much less attractive than a 99-year plot with a higher GFA.

Today, the en‑bloc landscape for older freehold condos is characterised by caution and hesitation.

Replacement property issues, competing GLS sites, and shifting market mindsets are weighing on their collective sale prospects. As such, sellers looking to liquidate their older freehold units may have to go the traditional route (i.e., get an agent and sell the hard way) rather than banking on an en-bloc.

There are, however, some owners of ageing freehold properties who benefit from this. If you’re a non-citizen and your replacement property would come with high ABSD, or if you simply enjoy your home and loathe the thought of a forced departure, all of this will likely come as a relief to you.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Latest Posts

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

On The Market Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

0 Comments