We Review 10 Of The October 2025 BTO Launch Sites – Which Is The Best Option For You?

September 17, 2025

The October 2025 HDB BTO exercise is one of the largest to date, offering about 9,100 new flats across 10 projects in eight towns. Notably, it includes the first-ever BTOs in the new Mount Pleasant estate and the Greater Southern Waterfront (GSW), signalling HDB’s push into prime central areas. There are 10 different sites from Ang Mo Kio to Yishun, so this launch provides a wider range of options: from city-fringe estates with potential sea views, or quiet heartland areas with a stronger family focus. Let’s look at what we have:

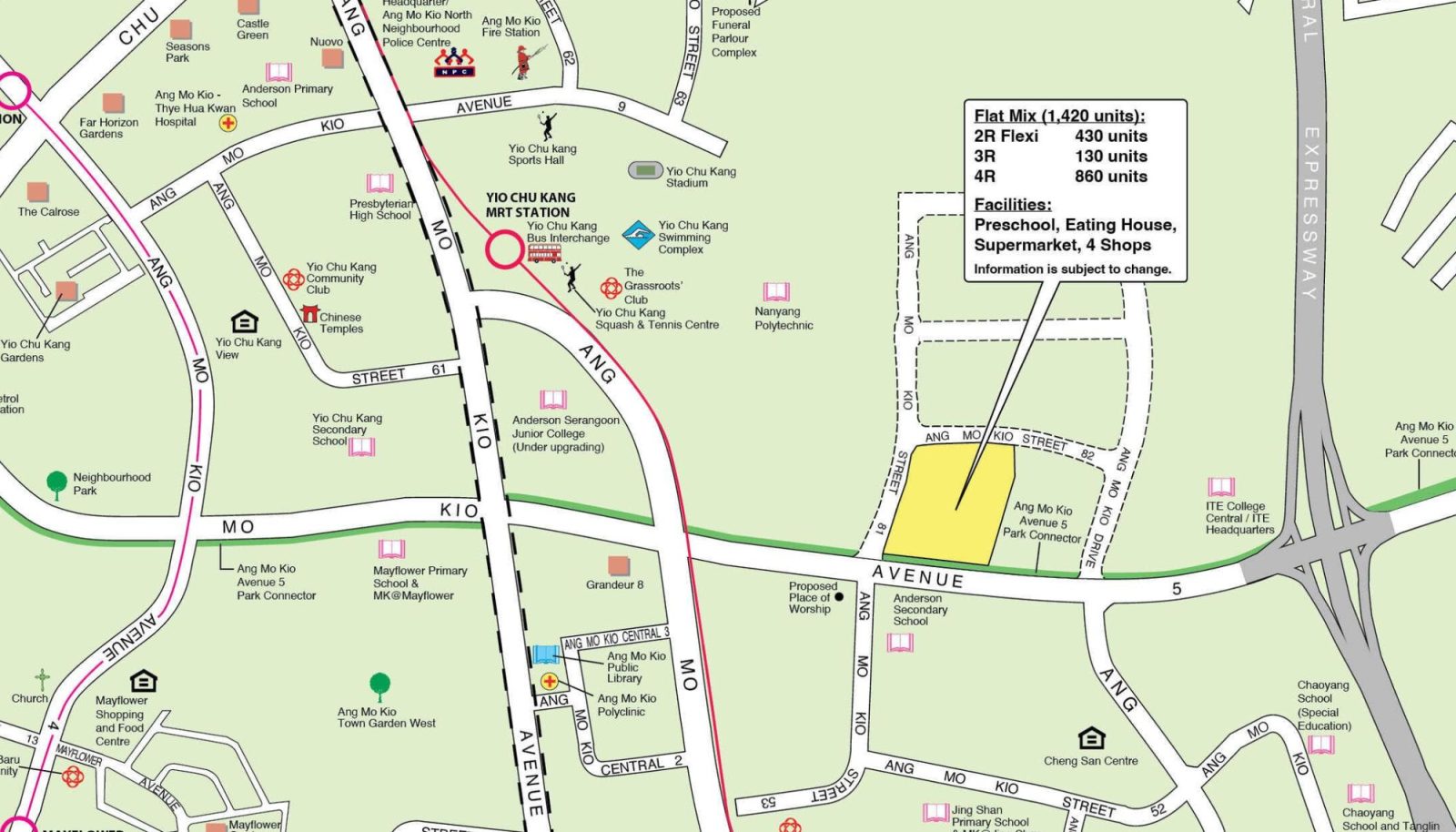

1. Ang Mo Kio

The launch site is at Ang Mo Kio Street 81, near Avenue 5. This is one of the largest launches with around 1,420 units. These will be available in 2, 3, and 4-room formats, but there are no 5-room options.

This site appears to be roughly equidistant to Ango Mo Kio and Yio Chu Kang MRT stations (NSL). It’s close to a kilometre though, so that may not be a comfortable walking distance; for now, we’ll say it’s probably a short bus ride.

AMK MRT station is also integrated with AMK hub, which is a major heartland mall; this has the usual supermarket, food court, pharmacies, and other day-to-day necessities. Otherwise, the existing HDB enclave here is already quite developed; you’ll also find Cheng San Centre – an HDB-run mall – within rough walking distance.

Mayflower Primary and Jing Shan Primary appear to be within one kilometre of the site; and it’s reasonably close to AMK Hub. It’s also worth noting that ITE College Central and Nanyang Polytechnic both flank the site.

As this is the largest launch, buyers who urgently need their ballot win should look here. This is where you’re most likely to secure a unit, even though there’s no 5-room flat option. It’s also probable that these will be standard flats with no added requirements; this is a definite boon, since it means being reasonably close to the heart of AMK (perhaps one short bus ride), without the 10-year MOP.

2. Bedok (Chai Chee)

The launch site is in Chai Chee, and has around 850 units in the full range of sizes – that means 2,3,4, and 5-room flats, including 3-Gen flats. It’s quite rare to see new 5-room and 3-Gen flats in mature estates, so we do foresee a lot of demand for the larger units.

Transport-wise, it falls short of the former Kembangan Wave launch last year. There’s no MRT station within easy walking distance, so you’ll need a bus connection; Bedok and Kembangan MRT stations are roughly equidistant and provide access to the EWL. If you need access to the DTL, there’s also the Bedok North MRT station, but it’s some distance away. Nonetheless, once you make the short bus trip to Bedok, you’ll have access to Bedok Mall, along with the town centre’s hawker centre, library, sports centre, etc. We’d also consider Simpang Bedok and its supermarket/eateries a possible source of amenities, if you’re okay to take the bus there.

Coupled with the provision for 5-room flats (which never show up in Plus or Prime estates), we can be confident these are standard flats.

The main highlight here will be relatively good balloting chances (850 units) and a shot at a larger new flat; it may also be a second shot at a mature east-side location if you missed Kembangan Wave last year, and subscription rates will be less frenzied than its Plus-status counterpart.

Opera Estate Primary and St. Stephen’s Primary are likely within the one-kilometre distance.

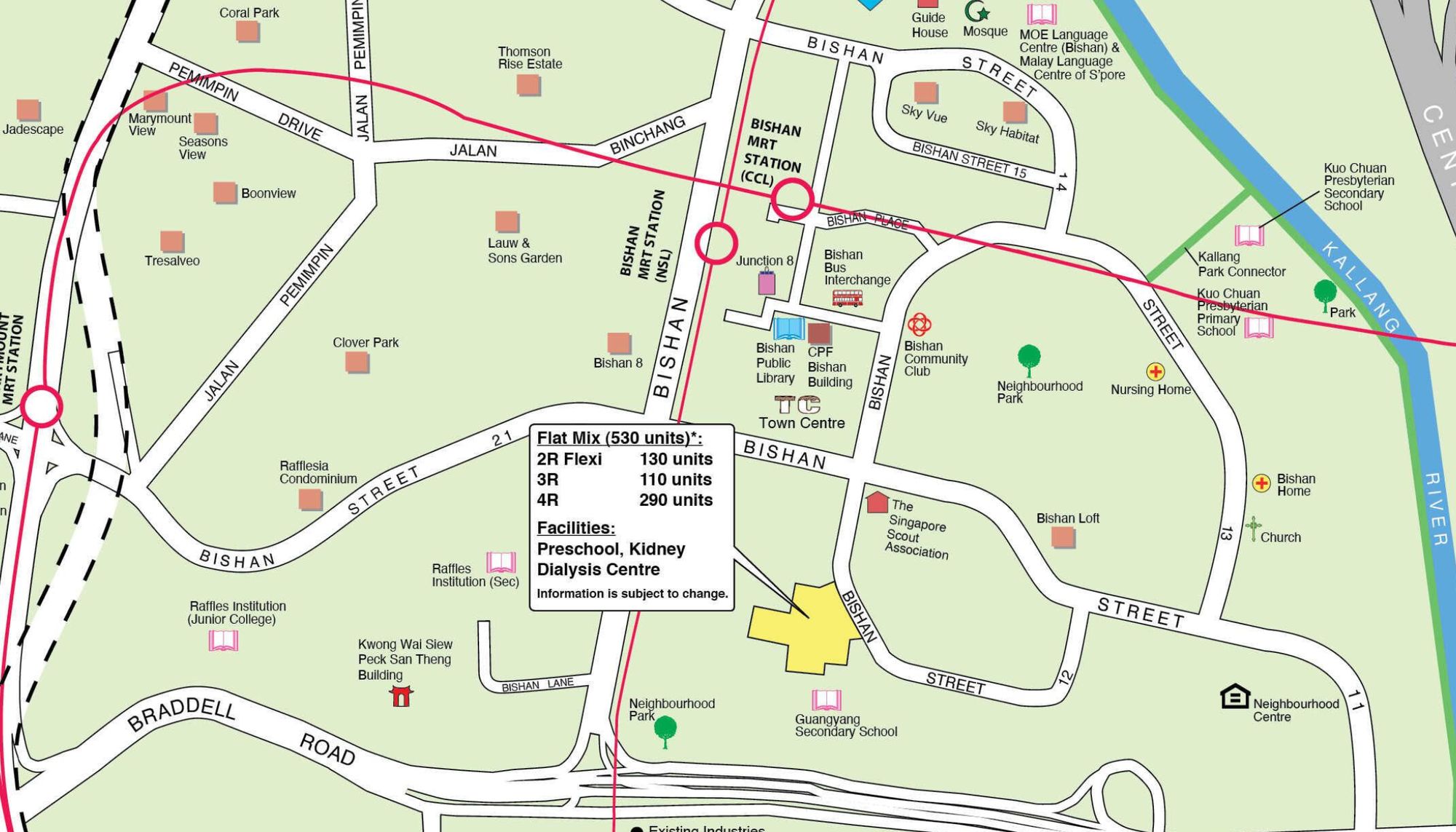

3. Bishan (Street 12)

Bishan more or less sells itself – so with just 530 units, expect a tough fight for this one. There are only 2, 3, and 4-room flats available; and because of the Bishan location – also within rough walking distance to Bishan MRT (NSL, CCL), these are likely to be Plus or even Prime category flats.

Walking distance to the MRT station also means, by default, walking access to Junction 8 Mall and the general hub of the neighbourhood. Under Master Plan 2025, the existing Bishan Town Centre is also going to be rejuvenated with shops, offices, and other commercial upgrades. These will be accompanied by a new polyclinic and a new bus interchange.

Guangyang Primary and Catholic High Primary may also fall within enrolment range.

Overall, this is one of the better launch sites; but with so few units, buyers may not want to get their hopes up. We’d suggest you hedge by also applying to the larger projects like Ang Mo Kio as well, if it’s very urgent that you lock down a flat.

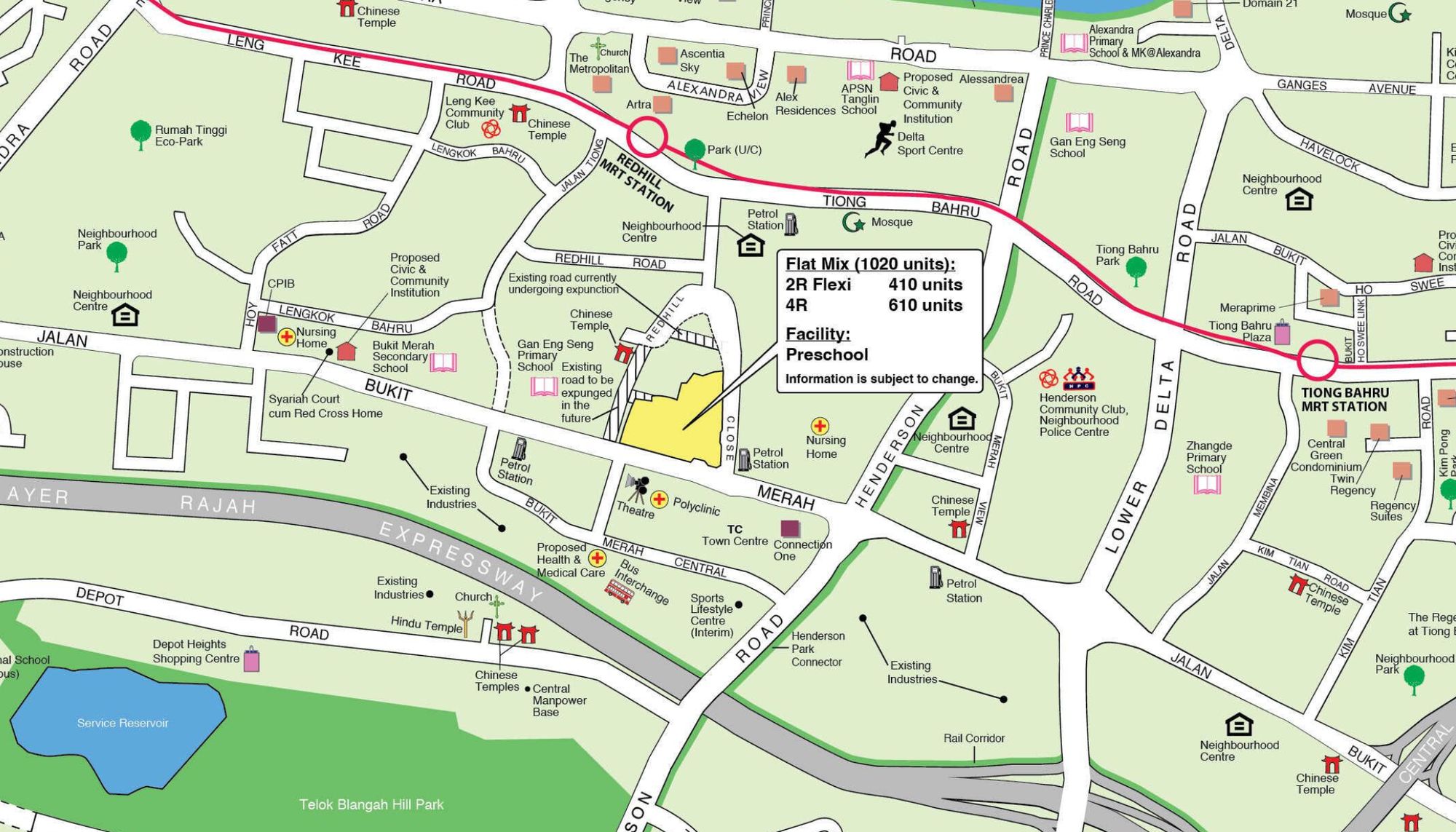

4. Bukit Merah (Jalan Bukit Merah/Redhill)

This is one of two Bukit Merah launches, and this one is within the Redhill/Alexandra area. There is a large number of units (1,020 units), but strangely, these are only offered in 2-room and 4-room sizes; nothing else.

The location appears to be a long-ish walk from Redhill MRT (EWL), which is just around three stops from Raffles Place. Also nearby are the Bukit Merah View Market & Food Centre, and the Redhill Hawker Centre, which cover most daily needs. There are even NTUC supermarkets at Dawson and Redhill Close, and Gang Eng Seng Primary and Alexandra Primary appear to be within priority enrolment range.

Some buyers may also appreciate the short distance to Tiong Bahru nearby.

The strong accessibility, the lack of flats larger than a 4-room, and the fact that Alexandra Peaks/Vista BTOs (launched in July this year) were prime projects, suggest that these flats will be the same.

If you’re okay to accept the 10-year MOP and other restrictions though, this is a good shot at city fringe living. The higher unit count also means you could stand a decent chance, especially as a first-timer.

5. Bukit Merah (Telok Blangah – Greater Southern Waterfront)

This is the second half of the Bukit Merah BTO launch sites. This is also arguably the headline of the 2025 launch sites, because it’s the first BTO to be launched in the former Keppel Club area. It’s spearheading a new waterfront township in the much talked-about Greater Southern Waterfront (GSW).

It goes without saying that this is going to be a Prime offering, and the biggest trophy of the launch exercise.

We’re seeing 870 units here, in the 2, 3, and 4-room sizes common to Plus and Prime projects. Connectivity is excellent, with Telok Blangah MRT ( CCL) within walking distance. From here it’s just one stop to HarbourFront, with the huge VivoCity Mall.

More locally, the land plot is right next to the established Telok Blangah housing estate. Existing amenities across the road include Telok Blangah Market, food centres, clinics, etc.

So simply put, this new estate will have a waterfront view and launch with a running start, without any of the slow, gradual build-up of amenities needed. In spite of that, we can say it has a first-mover advantage anyway, as it’s the first of a massive 6,000 flat development pipeline; this will eventually form the new Pasir Panjang/Keppel precinct over the coming years.

This is a once-in-a-generation type chance, so expect subscription rates to be through the roof.

As a side effect, applicants who might otherwise aim for the Queenstown or Bukit Merah launches may instead turn toward this launch, and take some of the heat off those other locations.

We should also add that the location is not perfect: Blangah Rise Primary School appears to be the only school within one kilometre for now. So if your children are school-aged, bear in mind school access is a bit limited here; and the 10-year MOP means your children might be past Primary school age by the time you have the means to sell and move.

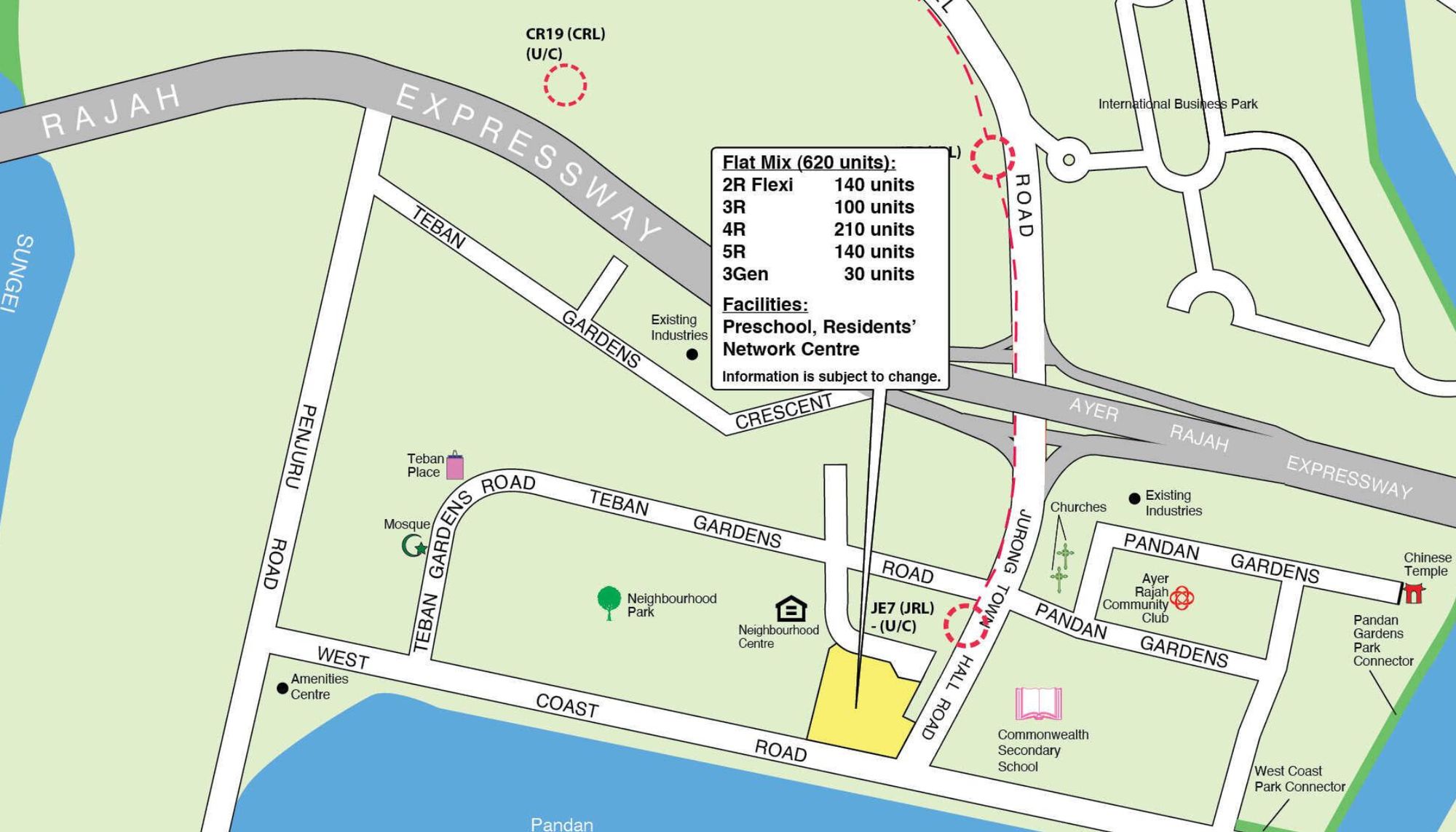

6. Jurong East (Teban Gardens)

This is not the part of Jurong East where you’ll find all the malls and offices. The Teban Gardens site is near the Pandan Reservoir, which is a quiet enclave that’s quite far from the hub of Jurong East. There are only 620 units here, but you do get the full range: 2,3,4, and 5-room and 3-Gen flats. As such, we’re looking at a standard project here.

This area needs quite a bit of development to grow, but the plans are definitely in the works. In the future, a Jurong Region Line (JRL) station – Teban MRT – will be located here. That’s upcoming in 2028/29, and when that happens, it will connect to Jurong East. In the meantime, it’s mainly down to bus connections, with a few routes here running to Clementi MRT (and hence Clementi Mall) or to Jurong East.

The immediate Teban Gardens estate has its own market, food centre, and neighbourhood shops (Teban Gardens Market & Food Centre, supermarkets, etc.), which cater to daily needs. But otherwise, residents will probably rely on the bus connection to Jurong East for most of their recreation or major retail needs.

More from Stacked

10 Stunning Profitable Condo Transactions Bought And Sold In The Past 5 Years

Despite the big losses that we wrote about from those who bought in 2017, the reality is that the majority…

As for schools, Pandan Primary used to be in Teban but got merged with Fuhua; the nearest primary schools now would be in Jurong/Clementi (e.g. Fuhua Primary, Yuhua Primary, Qifa Primary – all within a few kilometres). But we don’t see anything in the priority enrollment range yet.

A positive is the environment: being near Pandan Reservoir, some units might enjoy greenery and waterfront views; and there’s a park connector along the reservoir that’s great for jogging or cycling.

While it’s not the most convenient site for now, it does offer larger units in a greener setting; and it may appeal to those who can’t secure units in the increasingly pricey Jurong East – you’re at least a short bus ride to the same amenities, and will save quite a bit.

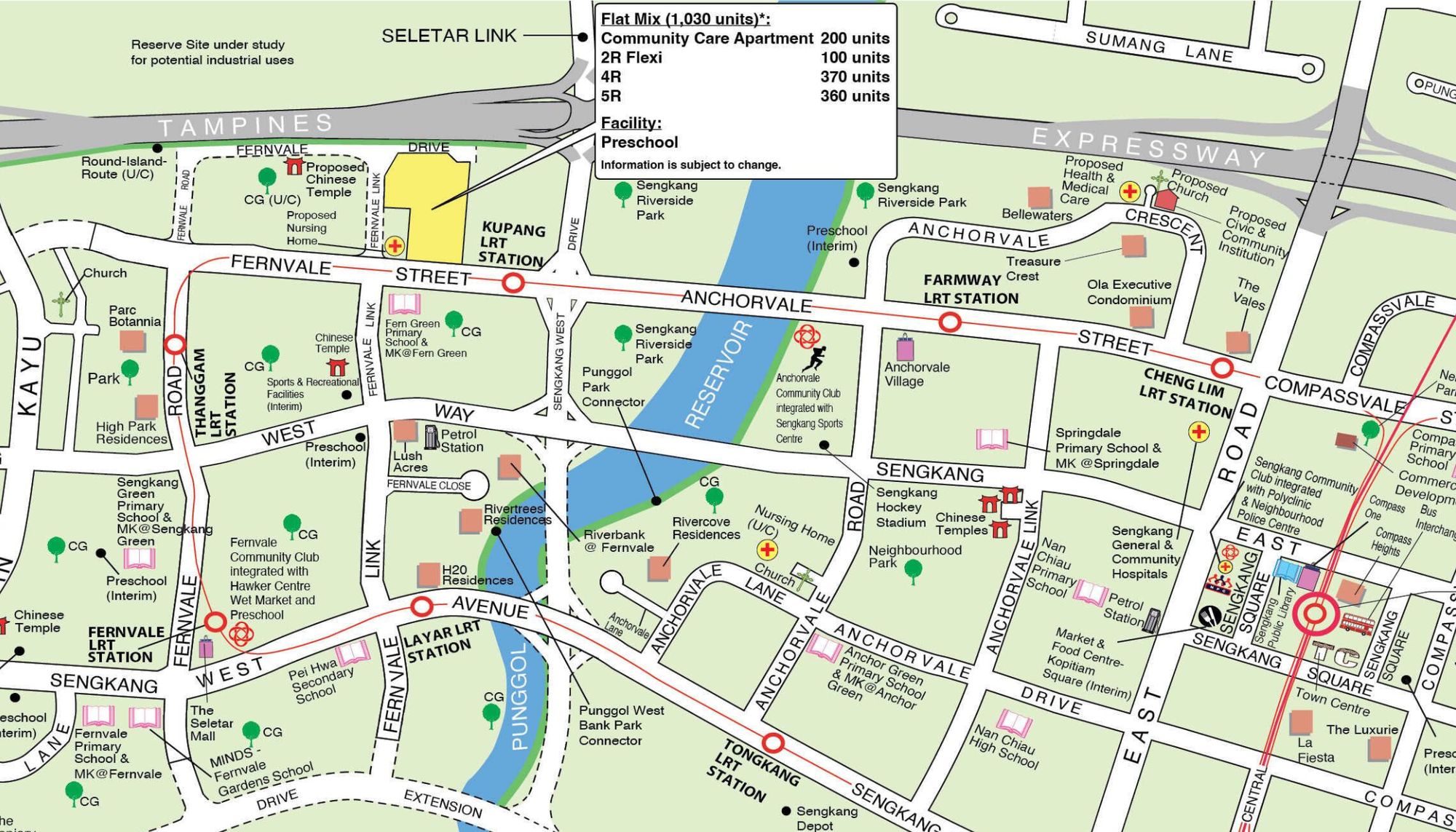

7. Sengkang (Fernvale)

This launch site is in Fernvale (Sengkang West), and is a large offering at 1,030 units. These are offered as 2,4, 5-room and 3-Gen flats (there’s no 3-room option.) There are also Community Care Apartments (CCA) here; this is the only batch of CCAs we’ve seen offered in 2025. This site seems targeted at older demographics to us: having CCAs as well as 3-Gen living makes it good for seniors.

The unit mix, coupled with the fringe location, means this is going to be a standard project.

The connectivity is decent if you’re the sort who’s okay with using the LRT. Kupang LRT is on Sengkang’s west loop and ends at Sengkang MRT station (NEL). This provides good access to Compass One mall. Also, in case you drive, this is not a car-lite estate, unlike many newer BTO launches, so there’s likely to be more parking lots. This could help, given that there’s no MRT within walking distance.

While Sengkang is not a mature neighbourhood, Fernvale itself is quite self-sufficient. Seletar Mall seems within walking distance of here, and has a supermarket. It’s also a short bus ride to alternatives like Greenwich V. It’s not a big range of options, but it’s enough for most.

Fernvale Primary and Sengkang Green Primary appear to be within one kilometre. Overall, not the most flashy offering, but a very strong choice for those living with parents, and who want to keep costs manageable.

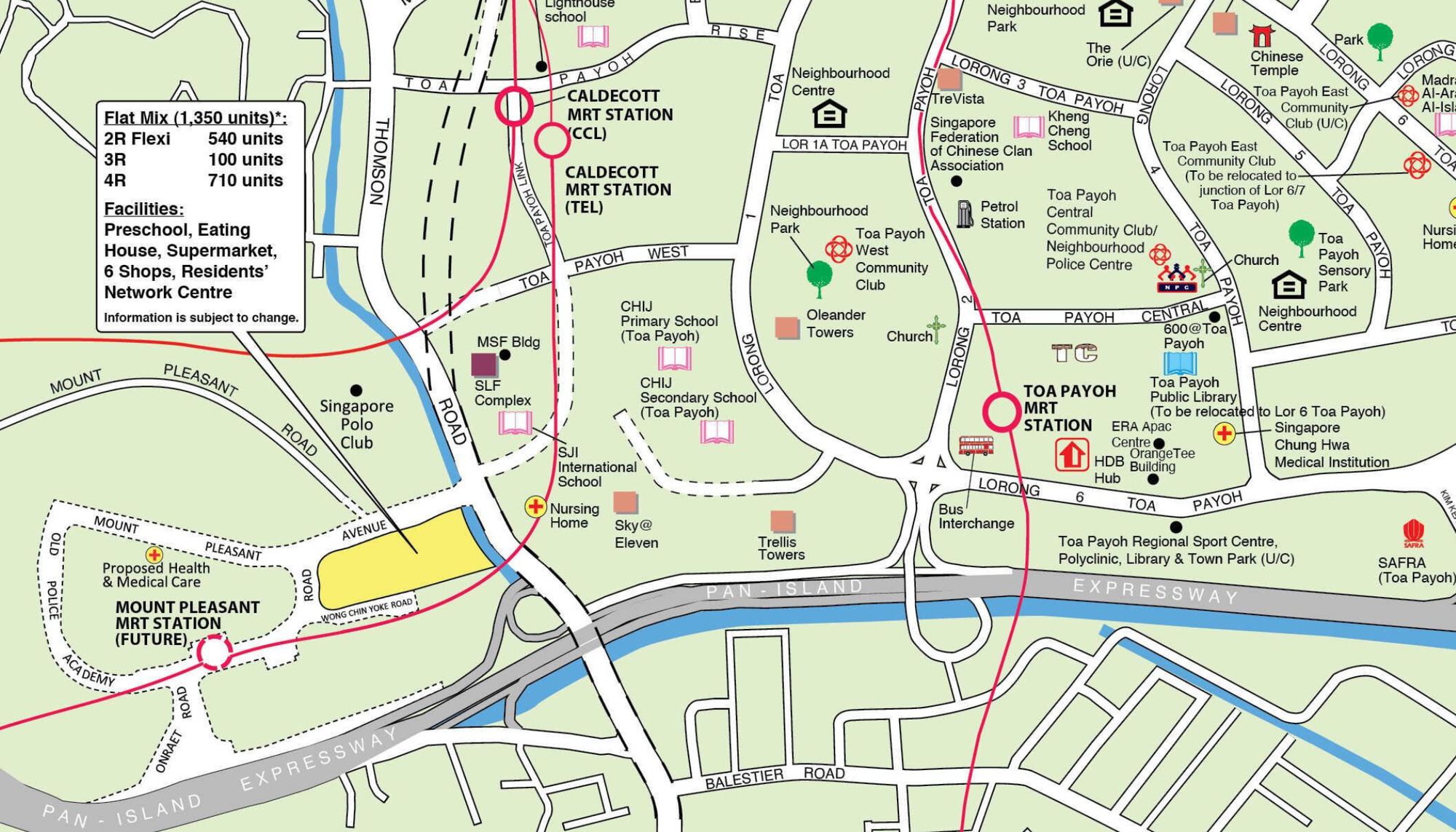

8. Toa Payoh (Mount Pleasant Crest)

This is probably the second most attention-grabbing launch, next to the Greater Southern Waterfront launch. This site is the first project to spearhead a new estate, Mount Pleasant, and sits on part of the former police academy on Thomson Road. This is a large project with 1,350 units, in 2, 3, and 4-room formats. There are also 270 rental flats included in the mix.

The flats here will use the open concept “white flat” layout for some of the units – this was initially debuted at Crawford Heights; these open floor plans mean the flats will be more versatile.

This site is likely to be at least Plus, given the Toa Payoh location, and the fact that it’s within walking distance to the future Mt. Pleasant MRT station (TEL). This will provide a direct train line to Orchard, Marina Bay, and East Coast areas like Marine Parade. The train station is likely to open upon completion of these flats.

CHIJ Primary looks to be within one kilometre of here, and even though the estate is new, HDB has said it will include a hawker centre and supermarket within the development. Additionally, this site is about five minutes from Toa Payoh Central (by bus or a couple of MRT stops), which has banks, clinics, a library, and a full town centre’s offerings. Novena is also just down Thomson Road. for malls like Velocity and Square 2, and medical facilities (Novena Medical Hub, TTSH hospital). So even though it’s a “new” estate, there’s little to no waiting period for amenities to ramp up – they’re mostly already here.

One advantage here is the relatively large number of units (over 1,300), which slightly improves your chances versus super-small, high-demand launches like Bishan. Still, competition per flat will be high.

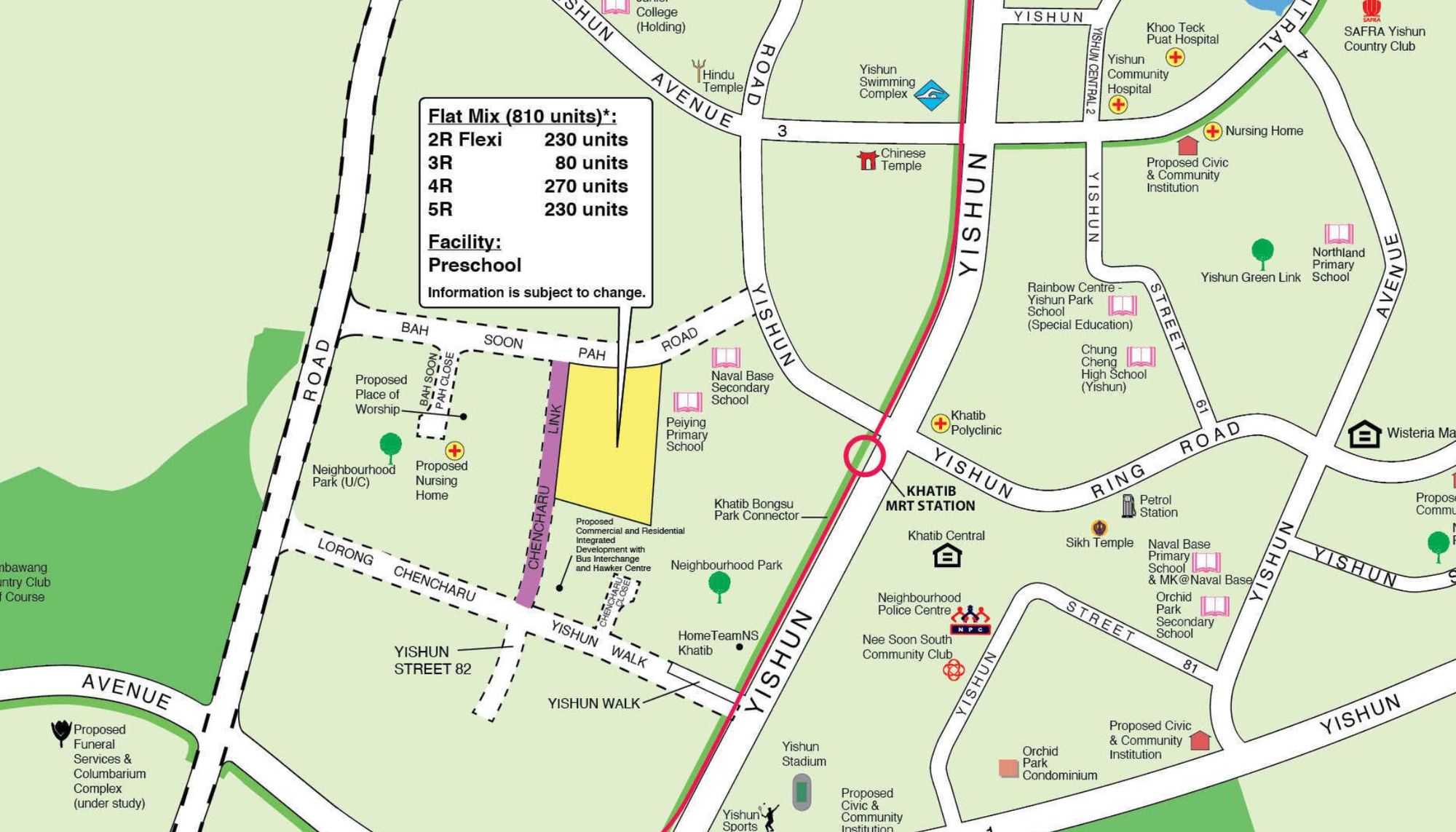

9. Yishun (Chencharu)

Yishun has two sites for this launch. This Chencharu site is the larger one, situated near Khatib MRT (NSL) in the north of Yishun. It offers 810 units with a full range of 2, 3, 4, and 5-room flats.

The site is notable for being right next to Peiying Primary School and very close to the former ORTO leisure park (which is being redeveloped). Given the presence of 5-room flats, we can be sure this is a standard project.

Walkable MRT access will make this quite popular among the standard offerings; and we note that this is one of only three launches that have 5-room flats in this exercise (the other two are Bedok and Jurong East, see above). That said, it’s tempered by the fact that the commute from Khatib MRT to more central areas is still rather long – a train ride of around half an hour or more to Orchard and Raffles. Nonetheless, a direct line to town is nothing to be dismissed.

For amenities, Khatib has its own heartland centre – Khatib Central – with a wet market and food centre. There are also supermarkets (there’s an NTUC FairPrice at Khatib MRT), and the usual heartland offerings like convenience stores, hair salons, etc. Recreationally, the site is near the former ORTO leisure park, and once this is redeveloped, it might bring more amenities to the area. Ultimately though, this is still a developing, non-mature area, so you might need to venture out for more serious retail therapy or other recreation.

Less mature, fringe areas like Yishun tend to have high application rates for 5-room flats. That’s because this is where larger homes are most affordable. First-timers who want a bigger flat, but don’t want the restrictions or high prices of more central areas, may zero in here. So despite not being a headliner, we would brace for surprisingly strong competition for the 5-room units.

One other advantage: as a first mover around the ORTO redevelopment, you might see the neighbourhood evolve – possibly new facilities or parks could come up on that land, benefitting future residents.

10. Yishun (Yishun Ave. 6)

This is the smaller Yishun launch, at 560 units in an unusual mix: you only get 2-room and 4-room flats here. The site is also an interesting mixed bag, for what’s likely to be a standard offering.

While there’s no MRT station nearby, this site is very strong in terms of amenities. The site is embedded in a residential area, and within one kilometre of three primary schools: Xishan Primary, North View Primary, and Huamin Primary. Yishun Park (with a large playground) is not too far, offering outdoor space. You also have several small malls nearby, like Junction 9 and Wisteria Mall, each with supermarkets, and it’s just a short bus ride from here to Northpoint City. So even though there’s no MRT station nearby, it may not be as big a downside.

The surrounding neighbourhood, especially near the community club, is also the definition of heartland comfort. So overall, we’d say this more than compensates for needing one quick bus to the MRT station.

This site might fly under the radar, especially for those who don’t know Yishun well and don’t recognise the true strength of the area. This might mean that, despite the smaller flat numbers, first-timers have a very good chance of securing a 4-room here.

Overall, this October launch is a bit of a “something for everyone” exercise.

If you’re gunning for centrality, Bishan, Mount Pleasant, or Bukit Merah are obvious choices; just be ready for Prime/Plus restrictions and crazy competition.

If you need space and flexibility, Bedok, Jurong East, or Yishun (Chencharu) are where the 5-room supply is hiding.

For those who just want to win a ballot and move on, Ang Mo Kio and Sengkang offer the largest pools of flats. And for more follow-ups or news on the Singapore property market, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

1 Comments

Very Very Good