New Central Condos Cheaper Than City Fringe Ones In 2022? Here Are 4 Simple Reasons Why

October 4, 2022

The CCR has long maintained a reputation as Singapore’s prime region, where one finds the most luxurious – and pricey properties. But in 2022, prices of new RCR condos have started to rise further, and are rapidly narrowing the gap with their CCR counterparts; at least in terms of new launches. Here are some reasons it may be happening:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

What’s happening to new condos in the RCR and CCR?

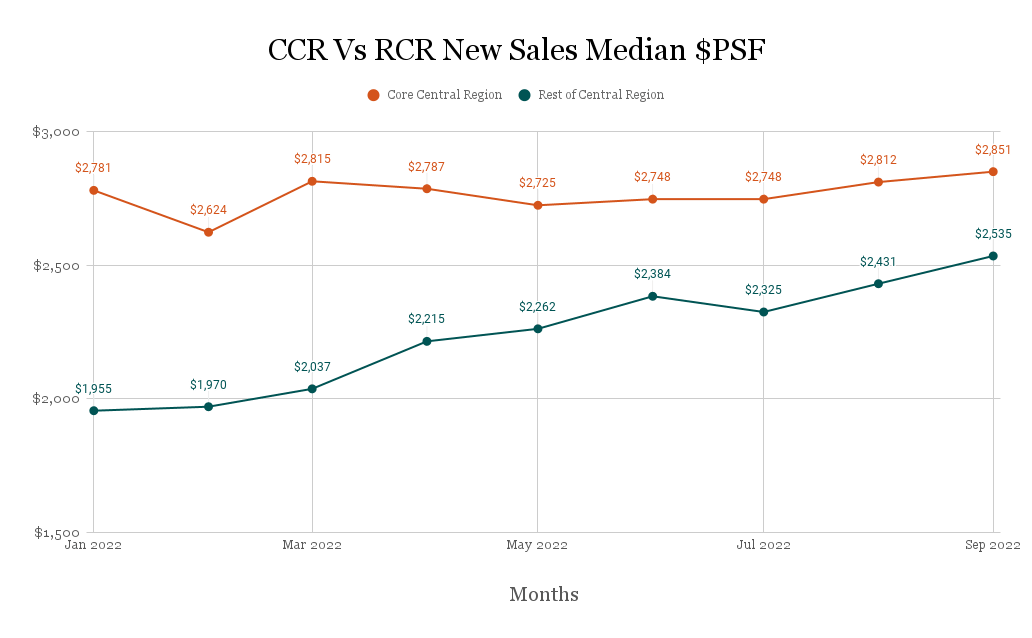

Huttons Asia recently reported that condos in the RCR have significantly narrowed the price gap with their CCR counterparts:

As a 10-year average (2012 to 2021), the price gap between new launches in the CCR and RCR, on a price PSF basis, is about 42.7 per cent. But as you can see from above, that’s far off from the numbers this year.

The price gap between RCR and OCR narrowed significantly to 25.7 per cent in April, and to around 14.9 per cent as of August.

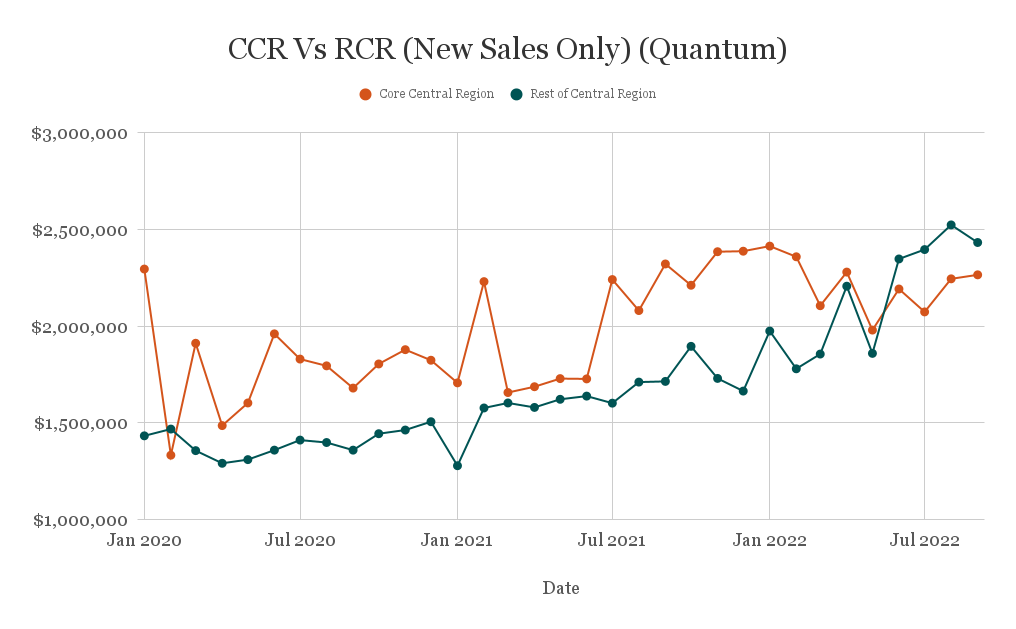

In terms of quantum, the numbers are even more surprising: the median price of RCR new launches actually overtook their CCR counterparts.

Huttons Asia noted that the median price for a new, non-landed residential unit in the RCR was around $2.472 million, whilst the median price for a new CCR counterpart was $2,231,548.

The prices may account for the higher proportion of CCR sales this year

Home buyers aren’t blind to the price differences, and some have realised that – with the prices being charged for RCR properties – they may as well go for the prime region.

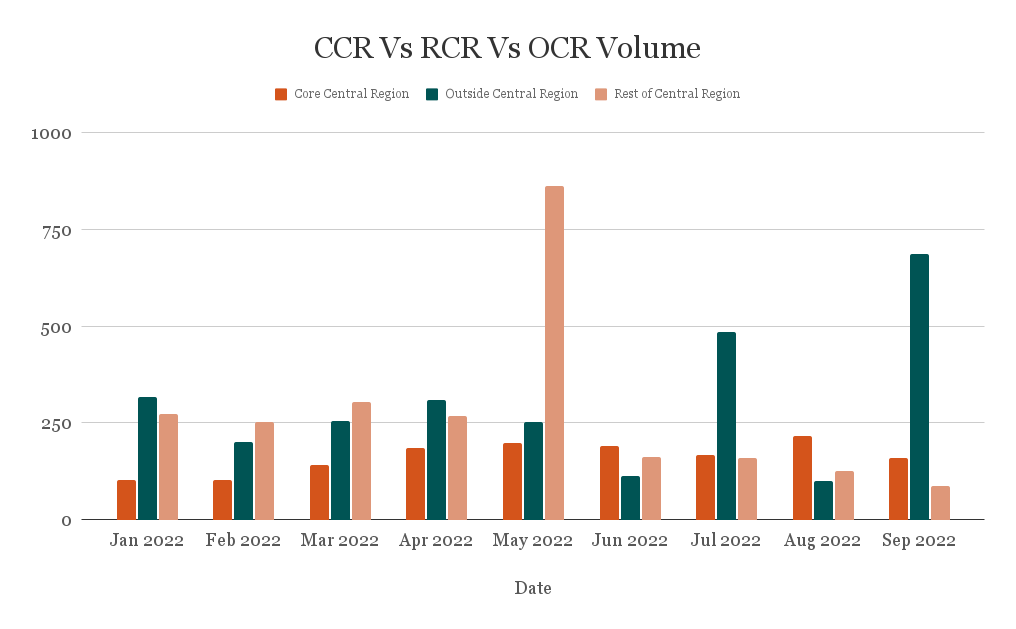

This may explain why, for the month of August, the CCR managed to account for nearly half of all new home sales; a phenomenal result, since the CCR typically sees the least volume of transactions. The last time the CCR managed to account for such a high proportion of sales was way back in 2017, prior to two rounds of cooling measures.

Nevertheless when we talk about the narrowing price gap, the general consensus came down to:

- A few condos swaying the data

- December cooling measures disproportionately affect the CCR

- Price movements in some CCR properties

- Changing perspectives on the notion of “central”

Table Of Contents

1. A few condos swaying the data

One of the first things to note when you look at such data points is to see if there are any peculiar transactions that may have a strong effect on the outcome.

When we look at the transactions from the CCR from the last few months, the bulk of the transactions was from new launches like Leedon Green and Perfect 10 (you can see our expansion on this in point 3). But in short, some (not all) of these launches are trending at lower prices than their launch prices.

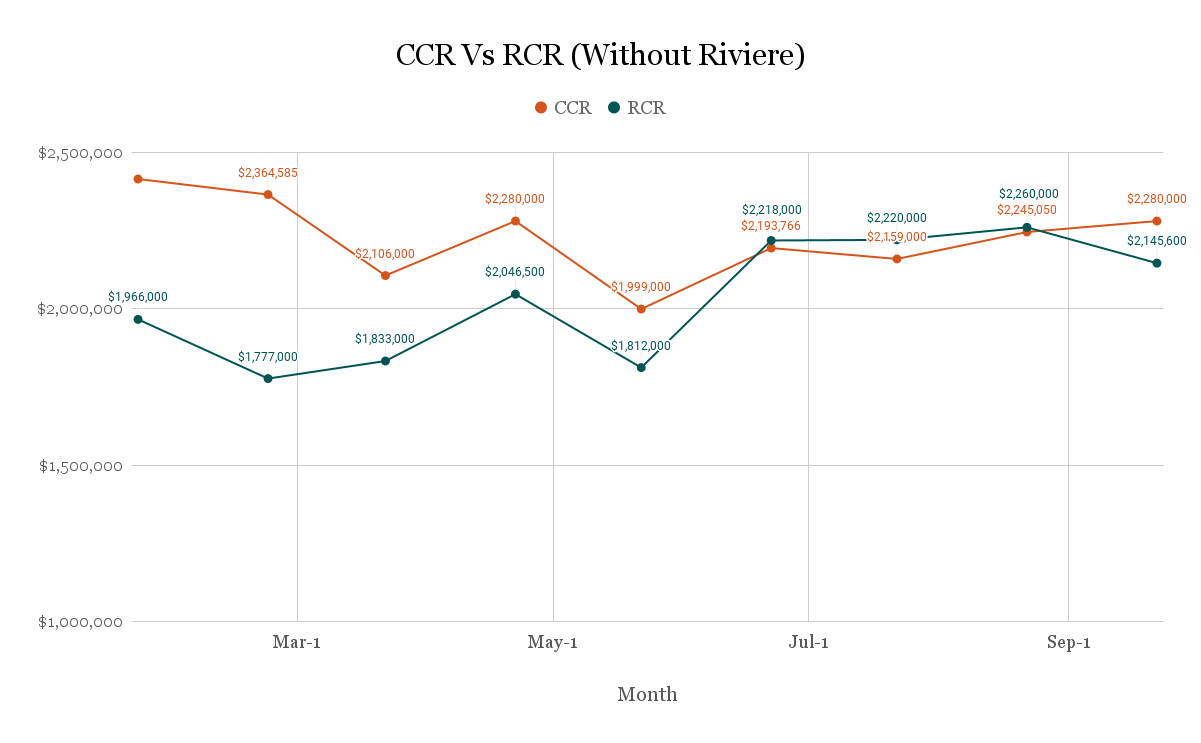

But when you look at the transactions from the RCR, there’s one condo that clearly stands out – and that’s Riviere. It’s been the top-selling condo in the RCR for the past few months since June, and prices and transactions have picked up, with recent prices climbing back on par during its launch of nearly $3,000 psf.

Now, some of you may actually be surprised that Riviere is classified as an RCR condo given its location. You would be forgiven for thinking that Riviere was a CCR condo instead, as its immediate next-door neighbour Tribeca by the Waterfront is in District 9, as compared to the District 3 of Riviere. It’s fine margins indeed, but we suppose the line does have to be drawn somewhere.

So just going by that, if we were to remove Riviere from the equation, this is how it would have played out instead.

As you can see, the gap has still narrowed but it doesn’t quite look as bad as before.

2. December cooling measures disproportionately affect the CCR

One of the December 2021 cooling measu16 Dec 2021 New Property Cooling Measures Kick In: Here’s How It May Affect Youres was an upward revision of the Additional Buyers Stamp Duty (ABSD). As such, one of the most affected groups was foreign buyers, who now face an ABSD of 30 per cent on any residential property purchased in Singapore.

Singapore Property News16 Dec 2021 New Property Cooling Measures Kick In: Here’s How It May Affect You

by Ryan J. OngIt goes without saying that measures targeting foreigners tend to impact the CCR first, as this is the favoured region for wealthy overseas buyers. Most foreigners would know the Orchard Road shopping belt, so it’s much easier for them to understand the location where they are buying in. Contrast this to something like Lentor, which the average foreign buyer would probably know nothing about. The added 30 per cent tax, coupled with the fact that borders are only just re-opening, may be slowing sales in the CCR.

More from Stacked

9 Cost-Cutting Ways To Keep Renovation Costs Lower For Resale Homes In 2021

In the current Covid-19 environment, buyers are opting for resale units in a bid to be able to move into…

Some realtors also pointed out that geopolitical instabilities, from issues like the Russia-Ukraine war, may be causing foreign investors to hold back for the time being.

One realtor singled out Chinese buyers, as being one of the most important demographics for the CCR. She noted that recently, a single Chinese buyer purchased 20 units at Canninghill Piers for over $85 million and that Chinese buyers alone accounted for around 391 transactions last quarter, most of it in the CCR.

However, China is currently undergoing a real estate crisis, that has recently also spilt into Hong Kong. This may affect confidence in the real estate market, and render Chinese property investors to be more cautious*.

The RCR and OCR, however, are less affected by these issues; these two regions still see comparatively few foreign buyers.

*Some realtors disagree with this and feel that problems with local developers in China will spur Chinese buyers to re-invest in Singapore property.

3. Price movements in some CCR properties

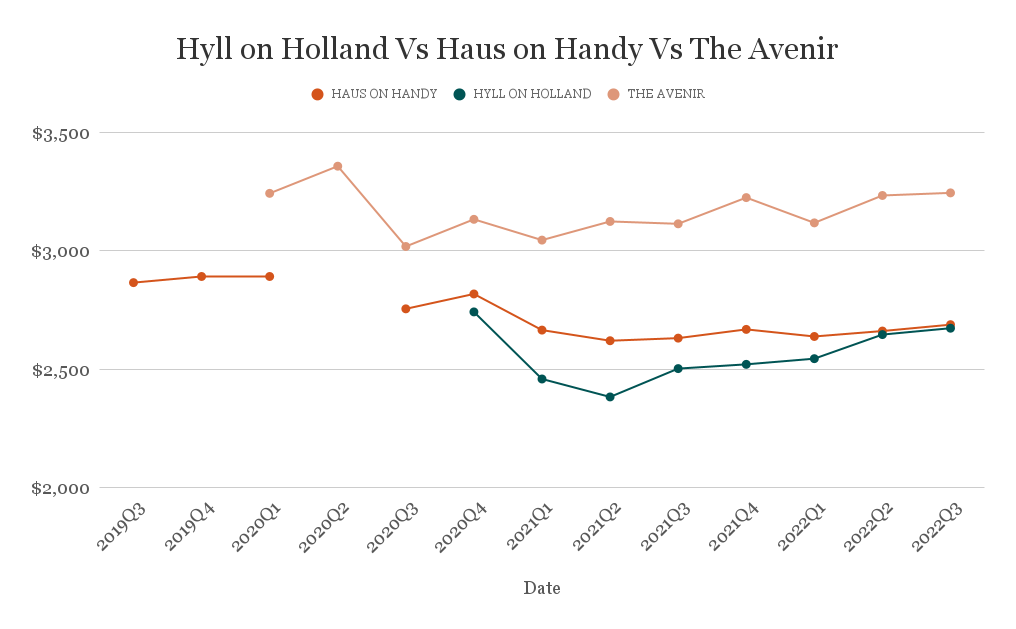

One anonymous realtor noted that the CCR’s top sellers in August include names such as Hyll on Holland, Haus on Handy, and The Avenir; and hinted at the reason being in the apparent price movements.

Hyll on Holland, for instance, was the best-selling CCR project as of August 2022, moving 111 units.

However, Square Foot Research shows Hyll on Holland’s earliest recorded transaction – in October 2020 – had a median price of around $2,729 psf. In fact, units moved very slowly, with only four transactions over its launch weekend.

Towards July 2022 however, we note that the median quantum was just around $2,448 psf; lower over time. It’s

Haus on Handy, which moved 77 units (also among the top 10) had median transactions at $2,874 psf in 2019; but median price had dropped to $2,654 psf. The Avenir, which moved 73 units, had a median price of about $3,245 psf, but this is now down to about $3,183 psf.

Developers behind these CCR projects may be wary of the impact of cooling measures, as well as the rising interest rate environment. This might spur them to sell off the remaining units at a lower cost (remember they have a five-year time limit). If so, it could explain the higher transaction volume in the CCR of late.

4. Changing perspectives on the notion of “central”

A few decades ago, being “central” was the height of convenience. But as Singapore decentralises, and each neighbourhood becomes its own enclave, buyers will start to question the real value of being on, say, Orchard Road.

We have, for instance, met buyers who feel projects like Lentor Modern are more convenient than some CCR condos (which also have to contend will less parking). We’ve also heard from buyers who believe projects like One Pearl Bank, or Avenue South Residence, have more convenient locations than CCR projects such as Hyll on Holland.

What constitutes “central” is increasingly subjective, as Singapore develops, and the market seems willing to accept that some RCR projects are every bit as well-located as CCR Counterparts.

2022 is shaping up to be an interesting year, and it’s hard to say if the price gap will narrow even further. Right now, with prices being so high, we believe the OCR will start looking more attractive than either of its pricier counterparts. But it will take time to see the impact of rising interest rates, and inflation.

For more on the news as it unfolds, follow us on Stacked. We’ll also provide you with in-depth reviews of new an resale properties alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why are new condos in the Rest of Central Region (RCR) becoming more affordable compared to city fringe condos in 2022?

How have recent cooling measures impacted property sales in the CCR and RCR?

What role do specific condo projects play in the changing property price trends in Singapore?

How is the perception of 'central' location evolving in Singapore's property market?

What factors contributed to the narrowing price gap between CCR and RCR new launches in 2022?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

1 Comments

Imagine thinking Lentor Modern is more conveniently located than a CCR condo. I’d like to have some of whatever these people are smoking!