I Regret My First HDB Purchase. What Should I Do Next?

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

Hi Stacked,

I discovered Stacked Homes in early 2024, and I’m writing in because I feel stuck about what my next housing move should be. I’m not sure if I should simply wait things out or start planning more actively, but lately I’ve been feeling increasingly overwhelmed and uncertain. I want to be better prepared when the time comes, understand my options clearly, and avoid repeating the mistakes I made with my first purchase.

I’m in my late 30s, single, and I currently own a two-room resale HDB flat at Canberra Walk, which I bought during the post-Covid peak for around $340,000 . At the time, I was earning about $9,000 a month and handled the entire purchase myself without engaging an agent. Looking back, I don’t think I was in the right headspace when I made this decision.

I took a private housing loan of about $120,000 for the purchase, most of which was funded through CPF. About $110,000 has already been drawn from my CPF OA, and the remaining balance will be fully settled by July 2025. I currently have about $90,000 in cash. My Minimum Occupation Period ends in February 2028, although realistically I may only be ready to sell around September 2028.

Since moving in, I’ve realised that this home doesn’t suit the way I live. Previously, I stayed for many years in the Bedok area, renting a room in a four-room flat. Bedok was always well connected to the places I frequented, such as Novena, Kallang, and the East Coast. The move to Sembawang has been a much bigger adjustment. Travel times are significantly longer, with journeys to Orchard taking around 30 minutes and close to 50 minutes to my workplace. Everything now feels further away.

The flat itself has also been an issue. A one-bedroom layout feels too restrictive, especially when I have guests over, as there is no privacy.

I will sell the unit once I reach my MOP, but I’m worried whether I can find a buyer given the relatively high price I paid, the limited buyer pool for two-room flats, and the supply of new BTO units.

Living in a block with many two-room units has been a very different experience from the larger flats I previously rented in Bedok and Toa Payoh. I also miss the everyday conveniences I had before, such as the wide variety of hawker centres and the general neighbourhood feel. In Canberra, food options are less accessible, bus connectivity is weaker, and even places like Chong Pang are not particularly convenient to get to.

I also have an active lifestyle. In Bedok I was just minutes from the stadium, Bedok Reservoir, and East Coast Park. Now, getting to places like Yishun Stadium or Yio Chu Kang takes much longer, and the parks nearby don’t offer the same experience. More than anything, I’ve realised I have a strong emotional attachment to my old neighbourhood, from its greenery and connectivity to the sense of familiarity and comfort it gave me.

Looking ahead, I’m unsure how to approach the sell-and-buy process.

Should I sell first so that the cash and CPF funds can be used for my next purchase, even if that means renting in between? Or should I try to buy and sell at the same time? How long might it take to sell my current flat, and how long might it take to find a suitable replacement? Ideally, I would love to move back to my previous area in Bedok, even the same block if possible, but there are only a handful of blocks there and listings are rare.

As of May 2025, I earn about $10,000 a month, with a bonus of roughly 1.2 to 1.5 months a year. I have about $60,000 in cash savings, a stock portfolio worth around $290,000, and about $57,000 in CPF OA, which will go towards clearing my outstanding loan. I currently save about 50 per cent of my take-home pay. Based on recent transactions, my flat is likely worth around $350,000 to $380,000.

For my next home, I’m certain I want at least a 4-room HDB flat for the extra space.

While I’ve considered a condominium, the kind of locations I like, especially in Bedok, would likely require a budget of over $2 million, which feels financially uncomfortable. Given my priorities for space and location, a resale HDB seems more suitable. If not in Bedok, I would prefer somewhere central and well connected, such as Havelock, Tanjong Pagar, or similar areas.

I want to get this next purchase right and settle into a home I can stay in for the long term. I’m also keen to start preparing financially now so that I can meet my eventual budget. I would appreciate any guidance on how to think about my options, how long I should be prepared to wait after selling if my ideal unit is not immediately available, and what I should be doing over the next two and a half years to get ready.

Hi and thanks for writing to us.

First, we want to say you’re not actually behind, and you haven’t ruined your chances of making a good long-term decision. What you’re experiencing right now, the realisation that your first home doesn’t fit your lifestyle, is far more common than most homeowners admit.

It’s normal to only understand what truly matters after you’ve lived in a place for a while. Factors like the daily commute, how easy it is to get decent food, where you can run, etc. These are parts of a lived experience, and many first-time homebuyers don’t get what they expect.

From a financial standpoint, you’re in a relatively strong position. We sense the main issue is less about money, and more the growing sense that this home doesn’t support your lifestyle; and you don’t want to make the same mistake again when you move.

This clarity is useful. Rather than rushing or forcing a move just to “fix” the discomfort, you can use it to plan with greater intention.

Let’s think through your options for now:

What to do with your current flat, how to approach the sell-and-buy process, and how to get a replacement home you can stay in for the long term.

Before going into the numbers, let’s establish your lifestyle requirements.

Based on what you’ve told us, we’ll list them as:

- Strong preference for familiarity with areas in the East, like Bedok

- Walking distance to good food, parks, and public transport

- Easy access to stadiums and running routes

- Privacy and space (at least the equivalent of a 4-room HDB)

Besides this, timing is a factor. You still have about 2.5 years before your Minimum Occupation Period (MOP) ends and you are eligible to sell the flat. The property market can change significantly over that period, and what makes sense today may shift the closer we get to your MOP.

For that reason, consider the following a planning framework rather than a fixed strategy. We recommend revisiting these considerations three to six months before your MOP, to adapt to prevailing market conditions.

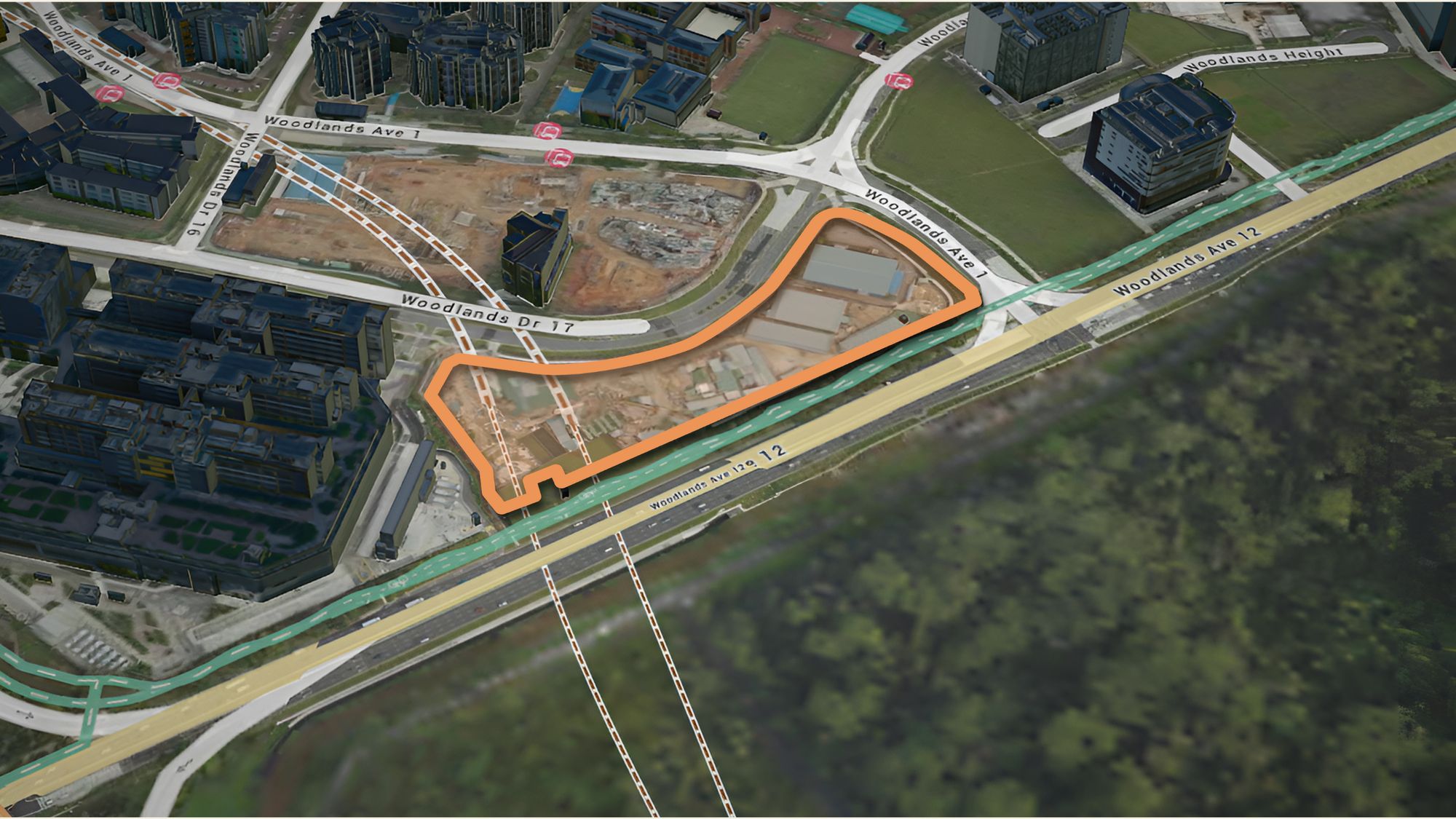

Now, before we explore your options, let’s look at recent transacted prices for two-room flats along Canberra Walk. This will give us a sense of what you might get from selling.

| Block | Storey | Floor Area (sqm) /Flat Model | Lease Commence Date | Remaining Lease | ResalePrice | ResaleRegistrationDate |

| 115A | 10 to 12 | 47.002-Room | 2018 | 91 years8 months | $370,000 | Dec 2025 |

| 115B | 07 to 09 | 47.00Model A | 2018 | 91 years11 months | $380,000 | Sep 2025 |

So far, there have only been two resale transactions for two-room flats along Canberra Walk. However, both were sold at prices slightly higher than what you paid. While this is a very small sample size, that’s still a positive early sign.

This is also a good time to address your concerns about selling, especially pertaining to two-room flats.

To be blunt, because of their smaller size, the buyer pool is naturally smaller compared to other flats. Most buyers of two-room flats tend to be singles or senior households who are right-sizing to a smaller unit, which makes for a more niche buyer demographic.

As a result, it’s harder to predict how quickly a two-room flat will take to find a buyer. It will depend heavily on prevailing market conditions when you list the flat, as well as how competitively you’re willing to price it.

Let’s now run through the options you are considering

Option 1: Sell first and buy later (rent in-between)

| Pros | Cons | On-the-ground insight |

| Clearer budget for a replacement, once your flat is sold and fully paid off | If there’s no other alternative accommodation, this often means having to rent | Sellers who rent after the sale are usually calmer and make better decisions |

| No pressure from holding two properties at once | Risk of limited supply if you are targeting one very specific block | Buyers who fixate on a single block tend to end up selling too early |

| Stronger negotiating position as both seller and buyer |

As you’re hoping to move back to the exact block / cluster you previously lived in, this does narrow your options somewhat.

There are only five blocks in that area, so there’s no way to predict when a suitable unit will come onto the market. You might have to be prepared for a longer and more uncertain waiting period.

To improve your chances, we suggest widening your search slightly. For example, consider neighbouring clusters within the same estate, or other areas that still meet your lifestyle and connectivity needs.

Don’t think of it as giving up on your ideal location, but rather giving yourself flexibility so you’re not forced into a decision because the available units is limited.

While renting in between does come with an added cost, it also buys you time.

A temporary home gives you the freedom to wait for a place you genuinely like, rather than pressuring you to buy the moment the opportunity arrives. Remember, even if an ideal unit comes on the market some sellers can be unrealistic about the price and you don’t want to be held hostage to that.

Since your MOP is still some time away, we would suggest taking the time to explore neighbourhoods that might suit you.

Pay attention to how walkable they are, how close they are to food options, parks, transport networks, and how conveniently they accommodate your daily commute and regular activities. Doing the groundwork now will make it much easier to narrow your options later. You may discover areas outside your old Bedok neighbourhood that offer a similar lifestyle.

Next, let’s do some simple calculations on the finances

As mentioned earlier, your MOP is still about 2.5 years away, so these numbers should be treated as rough planning figures rather than precise forecasts.

For now we’ll assume your flat sells at around today’s average price of $375,000, and that you have used $125,000 of CPF for the purchase, including accrued interest based on a 2.6% over roughly three years.

Note: We use 2.6% because the HDB loan rate is pegged at 0.1% above the prevailing CPF interest rate of 2.5%, hence 2.6%

For selling

| Selling price | $375,000 |

| CPF principal + interest to be refunded into OA (estimated) | $141,426 |

| Cash proceeds | $233,574 |

Your rental cost will depend on whether you rent a room or an entire unit. For now, we’ll assume you rent a three-room HDB flat in Bedok at about $2,800 per month, which was the average rent as of Q2 2025 based on HDB data.

| Rental cost estimation | $33,600 |

We’ll deduct this rental cost from the sale proceeds of your flat later.

For buying

| Maximum loan for HDB based on monthly income of $10K and age 40 at 2.6% interest (HDB loan) | $661,274 |

| CPF OA (estimated) | $191,826 |

| Cash | $199,974 |

| Total funds | $1,053,074 |

The CPF OA figure includes the refund from the sale of your current flat, and your projected monthly CPF contributions of about $1,680 over the next 2.5 years, based on a $10,000 income.

The cash figure is your estimated sale proceeds after deducting one year of rental, but this can be adjusted if you choose to add more of your personal savings to reduce the loan amount.

Based on this budget, you would be comfortably within the price range of a typical four-room HDB flat.

For context, here are the average four-room HDB resale prices in 2025. These will probably change a bit over the next 2.5 years, so consider them a benchmark.

| HDB town | Average 4-room resale prices |

| JURONG WEST | $555,601 |

| CHOA CHU KANG | $559,030 |

| JURONG EAST | $560,543 |

| WOODLANDS | $564,718 |

| YISHUN | $566,367 |

| BUKIT PANJANG | $588,016 |

| BUKIT BATOK | $619,945 |

| SEMBAWANG | $628,064 |

| HOUGANG | $630,117 |

| PASIR RIS | $651,424 |

| BEDOK | $653,330 |

| MARINE PARADE | $653,619 |

| SENGKANG | $658,813 |

| SERANGOON | $681,721 |

| PUNGGOL | $684,660 |

| TAMPINES | $685,290 |

| ANG MO KIO | $693,846 |

| GEYLANG | $763,428 |

| BISHAN | $785,275 |

| CLEMENTI | $826,815 |

| BUKIT TIMAH | $837,098 |

| KALLANG/WHAMPOA | $867,625 |

| BUKIT MERAH | $889,717 |

| TOA PAYOH | $912,963 |

| QUEENSTOWN | $971,262 |

| CENTRAL AREA | $1,078,795 |

Now let’s look at your second option, which is to buy first and sell later

Option 2: Buy first and sell later

| Pros | Cons | On-the-ground insight |

| No need to rent | ou may have to compromise on the sale price to meet tight timelines | This approach works best when your budget buffer is conservative, and if the seller is flexible on the transaction dates |

| You can wait patiently for the right unit | You must qualify for a home loan while still owning your current flat |

(One extra bonus is that you skip having to move twice – a first time to your rental unit, and then again to your replacement home.)

Buying first has its advantages. But if you absolutely need the sale proceeds from your current flat to fund your next home, it contribute to a more stressful process.

In such a situation, the completion of your sale must take place before the completion of your purchase. Specifically, the seller of your replacement flat must be willing to be flexible when it comes to the completion date of the sale.

Another option is the HDB Contra Facility, where the sale and purchase are completed on the same day. However, only one party in the transaction can use the contra arrangement, and timelines can still be tight.

In both scenarios, timing becomes critical.

A valuation is only valid for 90 days, which means you need to submit your purchase to HDB within that window. In essence, this only gives you three months to secure a buyer for your current flat.

If you urgently need the sale proceeds in this situation, it could force your hand into accepting a lower offer just because you have a deadline to meet.

As such, buying first is best if you don’t need to rely on the funds from your existing flat.

Since your current home will be fully paid off by the time it reaches MOP, the maximum loan amount for your next flat will not be affected. In this situation, you would have up to six months after completing your purchase to sell your current flat.

One additional point to note is that, if you take a second HDB loan, at least half of the cash proceeds from the sale of your existing flat must go toward your next flat purchase.

Let’s run some simple calculations, to see whether you can afford to buy your replacement flat without the sale proceeds from your current one.

For buying

| Maximum loan for HDB based on monthly income of $10K and age 40 at 2.6% interest (HDB loan) | $661,274 |

| CPF OA (estimated) | $50,400 |

| Cash | $186,000 |

| Total funds | $897,674 |

For the CPF OA figure, we only use your projected monthly contributions of about $1,680 over the next 2.5 years, based on a $10,000 income.

For cash, we assume you still save half of your take-home pay, or about $8,400 a month, over the same period; but this can be adjusted as required.

Based on this budget, you would still be able to purchase a four-room HDB flat without having to sell your existing property first. So as it appears right now, you might be in a viable position to buy first and sell later.

Now let’s look at whether a condominium would be a viable option.

Below are the average prices for resale two- and three-bedder units, across various districts in 2025.

| District | 2-bedder average price | 3-bedder average price |

| 1 | $2,025,207 | $2,570,028 |

| 2 | $1,747,509 | $2,555,258 |

| 3 | $1,707,620 | $2,488,266 |

| 4 | $1,881,729 | $2,902,893 |

| 5 | $1,420,565 | $2,155,069 |

| 6 | $2,738,333 | $3,853,333 |

| 7 | $1,708,383 | $2,889,167 |

| 8 | $1,504,475 | $2,033,680 |

| 9 | $2,220,094 | $3,433,938 |

| 10 | $2,277,197 | $3,731,148 |

| 11 | $2,049,672 | $2,930,963 |

| 12 | $1,394,624 | $2,042,901 |

| 13 | $1,500,576 | $2,206,640 |

| 14 | $1,413,692 | $1,917,448 |

| 15 | $1,762,502 | $2,539,969 |

| 16 | $1,340,124 | $1,947,848 |

| 17 | $1,127,905 | $1,516,821 |

| 18 | $1,167,224 | $1,578,464 |

| 19 | $1,298,560 | $1,725,041 |

| 20 | $1,605,272 | $2,208,102 |

| 21 | $1,646,061 | $2,334,391 |

| 22 | $1,351,708 | $1,621,090 |

| 23 | $1,243,882 | $1,603,159 |

| 25 | $945,814 | $1,316,931 |

| 26 | $1,449,539 | $2,104,373 |

| 27 | $1,103,681 | $1,413,205 |

| 28 | $1,106,076 | $1,573,540 |

Bedok is in District 16. Here, the average price of a resale two-bedder is about $1,340,124, while a three-bedder averages around $1,947,848.

Let’s see if this is affordable for you, assuming you sell your flat first

For buying

| Maximum loan for HDB based on monthly income of $10K and age 40 at 4% interest (MAS medium term interest rate floor) | $1,041,989 |

| CPF OA (estimated) | $191,826 |

| Cash | $419,574 |

| Total funds | $1,653,389 |

The CPF OA figure includes the refund from the sale of your current flat and your projected monthly contributions of about $1,680 over the next 2.5 years.

As before, we assume you save about half your take-home pay (roughly $8,400 a month) over the same period, adjustable as you see fit.

Based on this budget, you would be able to afford a two-bedroom condo in District 16. Buying a three-bedder, however, would likely require you to sell a substantial portion of your investments.

Overall, it appears that a condo unit which meets your space and location preferences would stretch your finances close to the limit. It may not be the most comfortable or sustainable position for a long-term home.

What should you do?

With 2.5 years before crunch time, you have the advantage of scouting around extensively. Lay the groundwork by exploring neighbourhoods that appeal to you and see how well they support your lifestyle.

We understand Bedok is ideal for you and is a known area – but it doesn’t hurt to widen your options, since limiting yourself to just those five blocks could end up being expensive or disappointing. Sometimes, you’ll be surprised how much prices and opportunities change if you explore three or four bus stops away.

You can also use this time to study current listings in order to check out typical layouts and floor plans available in an area.

It also helps that you’ve defined your non-negotiables. These include proximity to transport, access to food options, parks and sports facilities, desirable unit size, and the overall feel of the neighbourhood. Having this clarity makes it much easier to narrow your search when the time comes.

From a financial perspective, you are in a strong position. You save around half of your take-home income, and at the time of this writing, chances are that your current flat has been fully paid, Additionally you have a sizeable stock portfolio that gives you an additional financial buffer. For now, there doesn’t seem to be any immediate need to liquidate these investments, unless you decide to reduce your loan exposure.

As you approach your MOP – ideally around three to six months before – it’s important to recheck your financial planning. This includes reassessing your affordability and the benchmark property prices of the locations you’re considering.

With more up-to-date data, you can then decide whether to sell first and buy later, or vice versa.

Very few buyers get everything right the first time: what matters is recognising what did not work, and adjusting course so you don’t repeat the pattern. At this stage, the goal is not to rush into the next purchase, but to make a decision you can live with comfortably – by that, we mean both financially and emotionally.

Overall, given your financial position and 2.5 year runway to prepare, you’re well placed to plan your next move without pressure.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Advice

Property Advice We’re In Our 50s And Own An Ageing Leasehold Condo And HDB Flat: Is Keeping Both A Mistake?

Property Advice Should We Buy An Old 99-Year Leasehold Condo To Live In: Will It’s Value Fall When The Lease Runs Out?

Property Advice We Own A $800K 1-Bedder And A $1.1M 3-Bedder: Is It Possible To Upgrade To A 4-Bedder Condo?

Property Advice I Own A 55-Year-Old HDB Flat, But May Have To Sell — Can I Realistically Buy A Freehold Condo With $700K?

Latest Posts

On The Market Here Are The Rarest HDB Flats With Unblocked Views Yet Still Near An MRT Station

Singapore Property News New Condo Sales Hit a Four-Year High in 2025 — But Here’s Why 2026 Will Be Different For Buyers

Pro How a 1,715-Unit Mega Development Outperformed Its Freehold Neighbours

Overseas Property Investing Why ‘Cheap’ Johor Property Can Get Expensive Very Quickly For Singaporeans

Pro Why This Old 99-Year Leasehold Condo Outperformed Newer Projects in Bukit Timah

Singapore Property News This New Woodlands EC May Launch at $1,850 PSF: Here’s Why

New Launch Condo Analysis This Freehold New Launch Condo In The CBD Is Launching From Just $1.29M

Property Market Commentary How Much You Need to Earn to Afford a One or Two-Bedder Condo In 2026 (As a Single)

Property Market Commentary This HDB Town Sold the Most Flats in 2025 — Despite Not Being the Cheapest

Singapore Property News This Former School Site May Shape A New Kind Of Lifestyle Node In Serangoon Gardens

Singapore Property News I Learned This Too Late After Buying My First Home

Overseas Property Investing I’m A Singaporean Property Agent In New York — And Most Buyers Start In The Wrong Neighbourhood

Property Market Commentary How To Decide Between A High Or Low Floor Condo Unit — And Why Most Buyers Get It Wrong

Overseas Property Investing What A $6.99 Cup of Matcha Tells Us About Liveability in Singapore

Singapore Property News This 4-Room HDB Just Crossed $1.3M — Outside the Usual Prime Hotspots