Is There Still A Chance Of Cheaper Resale HDB Flats In 2021?

October 6, 2021

2021 has been one of the toughest years for first-time homebuyers; and for those who want resale flats, it gets worse. Take a deep breath, because as of Q3 2021…resale prices are now officially worse (higher) than they were even in the crazy days of 2013. The questions on everyone’s minds right now seem to be (1) how long will it last, and (2) are we going to see government intervention soon? Here’s our take:

What’s happening to resale flat prices in 2021?

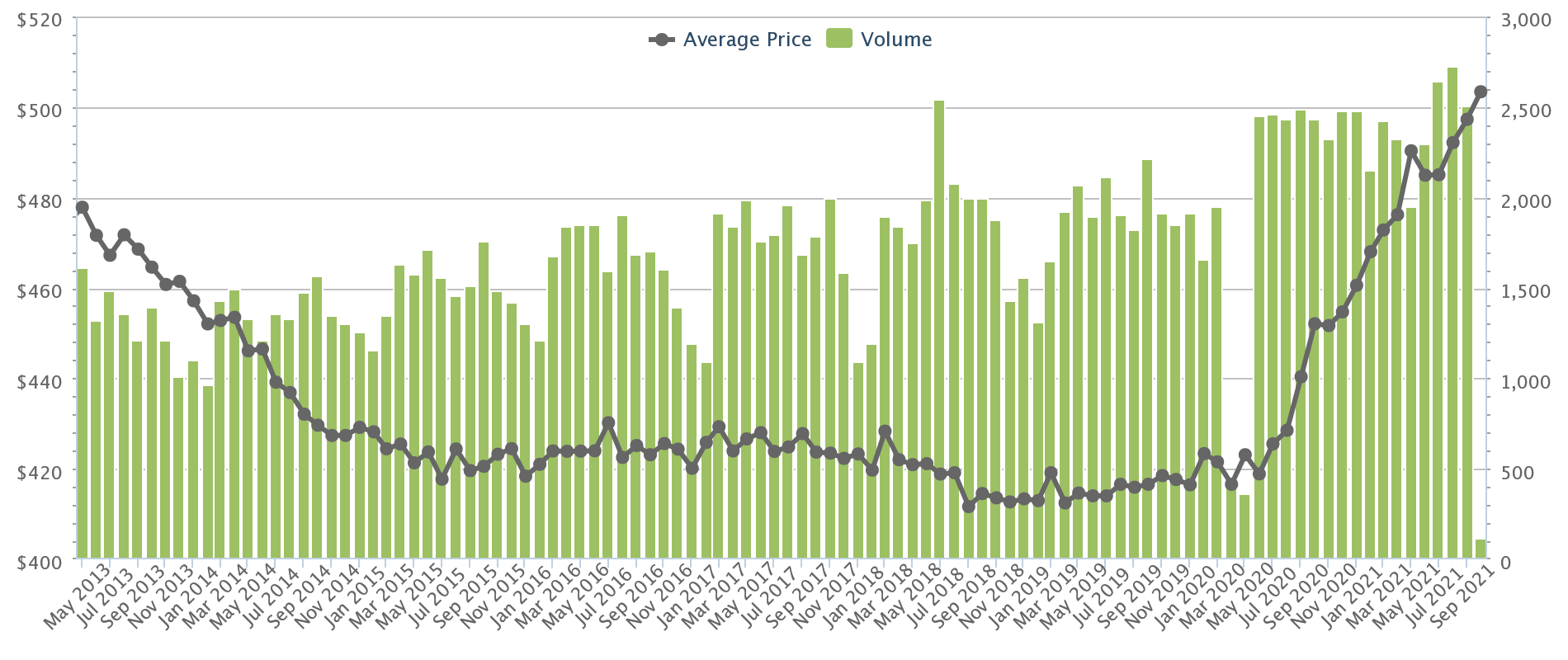

If we go by pure price per square foot, we can see the last peak was in May 2013. At the time, resale flat prices – island-wide – stood at around $478 psf. At the time, the government responded with tweaks to Cash Over Valuation (COV) rules and the Mortgage Servicing Ratio (MSR), which sent resale flat prices plummeting.

But in the span of just around two years, from 2020 to the present, resale flat prices shot up to average of $497 psf, as of end-September 2021.

In many such cases, we assume that it’s highly desirable, mature-estate flats that are seeing big gains. However, a quick check shows that even non-mature estates have seen a sharp pick-up in price.

For example:

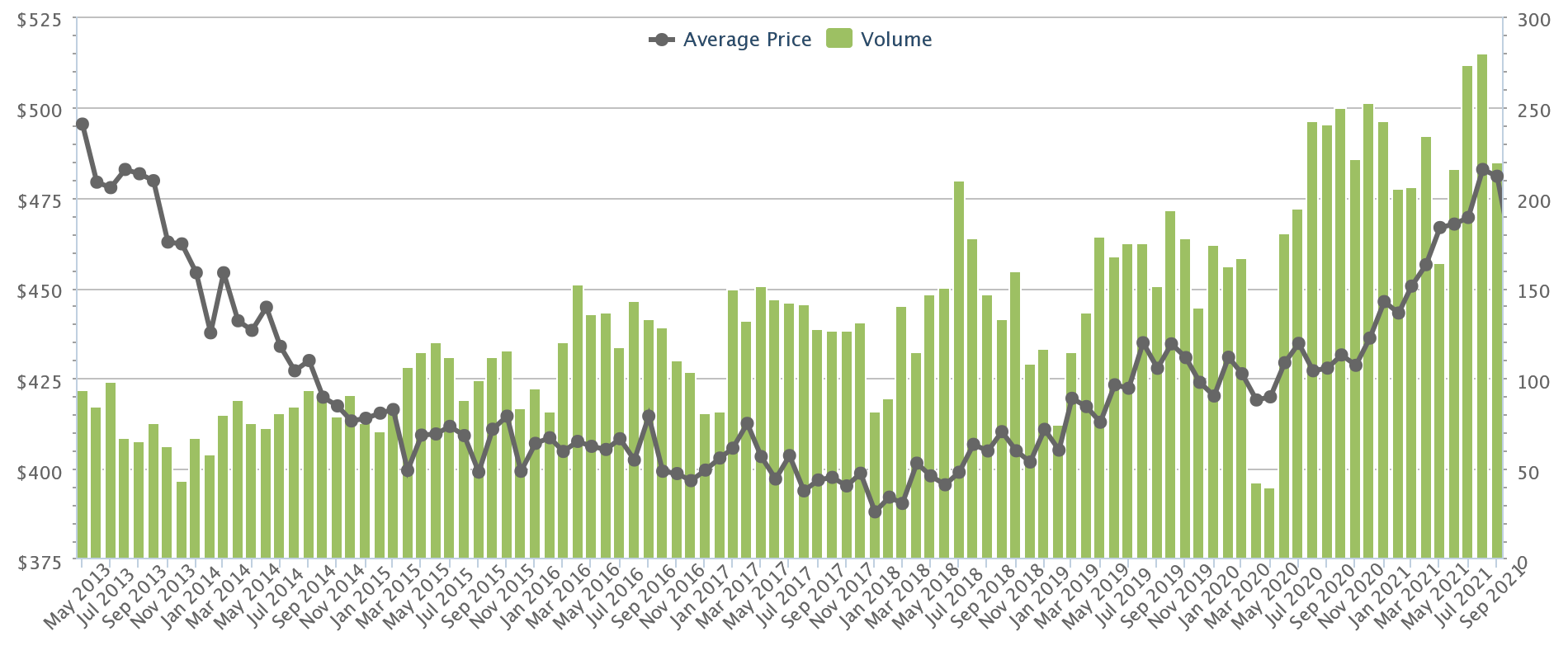

Sengkang is a non-mature area, and prices here have yet to reach peak 2013 levels ($495 psf). However, we can see that even in a supposedly “ulu” area, prices at end-September hit $481 psf, with prices and transaction volumes steadily rising.

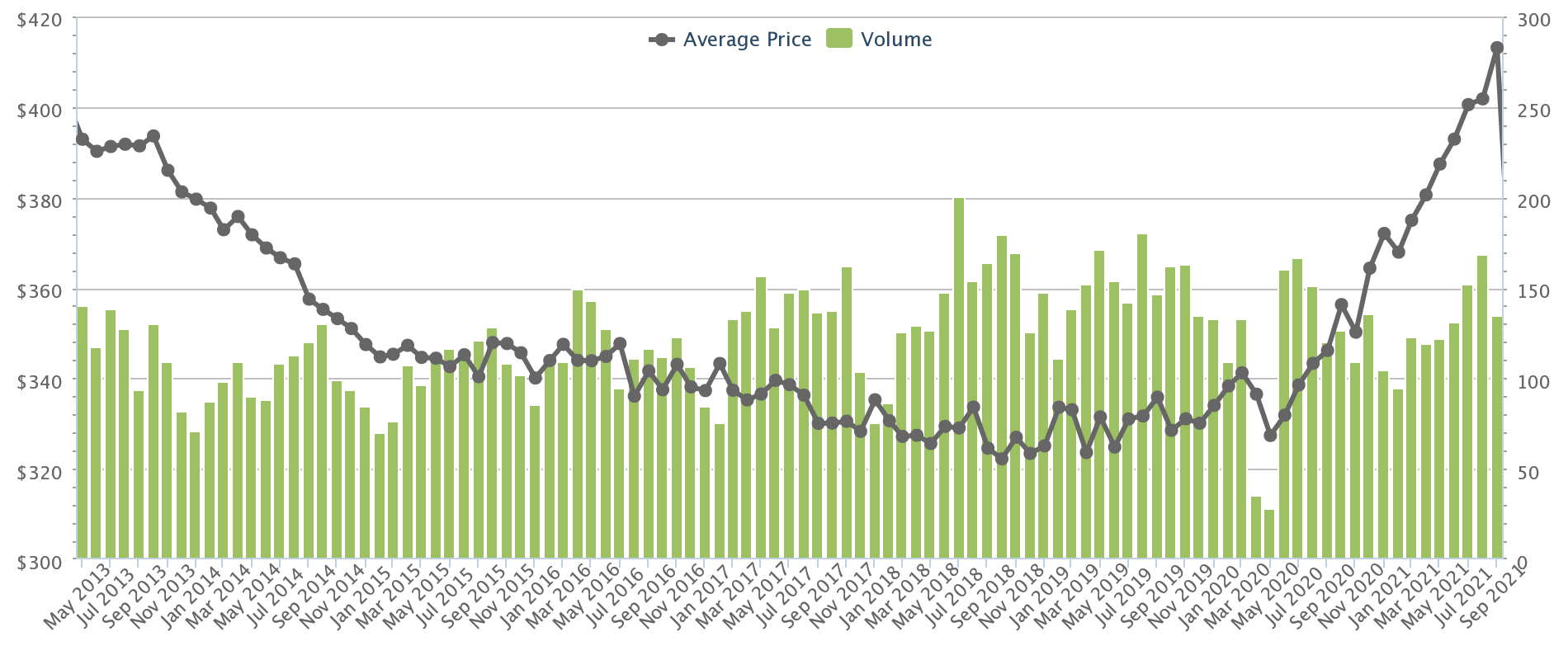

In Woodlands, once considered a bastion of affordability, prices now average $413 psf; much higher than $401 psf during the town’s last peak (April 2013). Although we should add, transformations from the Woodlands North Corridor is adding a lot of upward pressure to prices here.

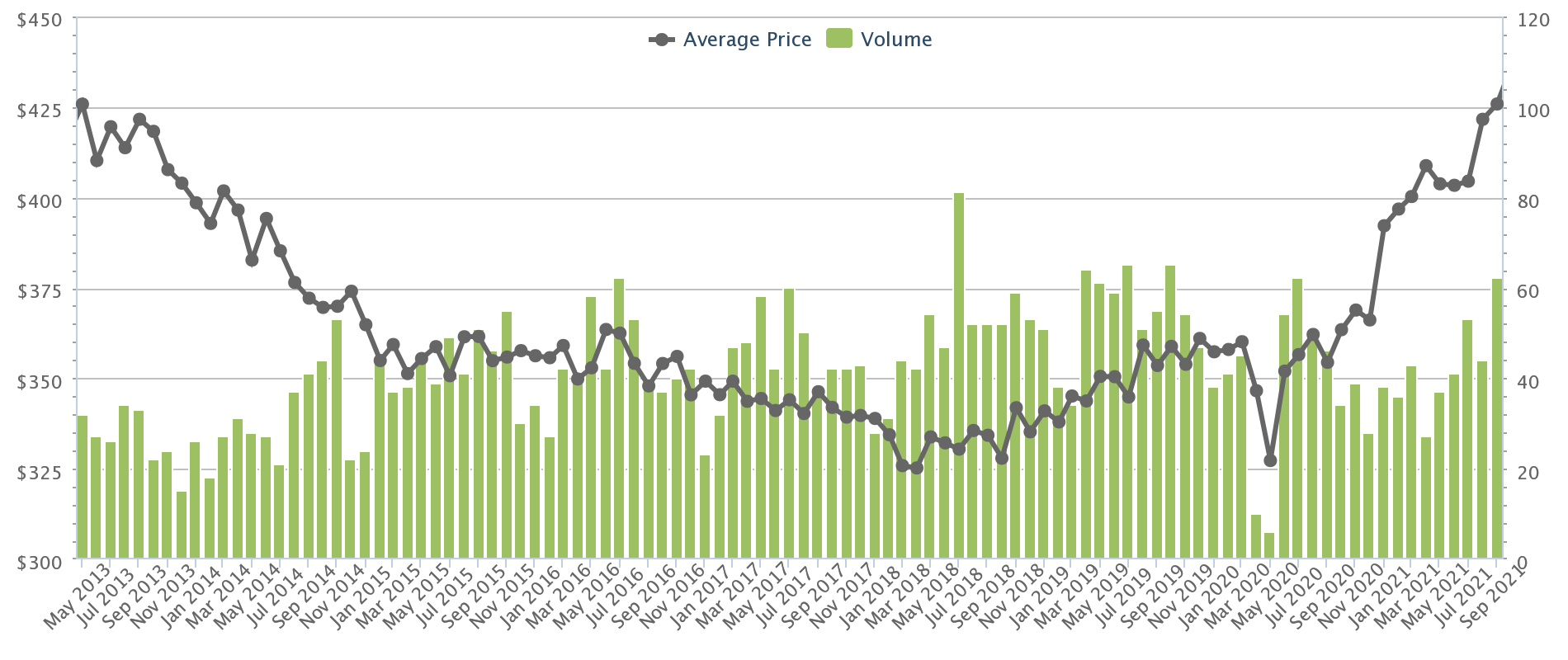

In Sembawang, resale flat buyers in September 2013 were often derided for paying $422 psf, for an area with few amenities, and no real plans for upgrading. As of September this year, average prices here have climbed back to $426 psf.

Mature areas and scarce flats have also hit peak prices

87 resale flats transacted at over $1 million, and that was just between January to May. This surpasses 2020, where we saw 82 such transactions for the entire year (and 2020 itself was already a record-breaker, surpassing 71 transactions in 2018).

Most of these flats are not typical flats though, but include maisonettes and DBSS flats. The current record is now $1.295 million for a unit at Natura Loft, in Bishan.

Is there any chance of flat prices coming back down?

- HDB’s response to construction delays will play a major role

- If private housing prices come down, it could sap some demand for resale flats

- The OCR condo market has become a contributing factor

- Prices could dip as the crop of “new” resale flats get bought out

1. HDB’s response to construction delays will play a major role

The worries about construction delays have gotten more intense; from initial six to nine-month delays in around 85 per cent of projects, to news of contractor Greatearth going bust.

Note that the fear isn’t specific to Greatearth projects. Covid-19 is raising manpower and material costs to potentially unsustainable levels; as high as 20 to 50 per cent. The danger is that, when contractors feel margins are too slim (or even non-existent), they’re more likely to pack up and close than carry on.

Handing over construction projects is not a simple task, with delays of up to a year being quite common. As such, some buyers are worried that BTO flats – the most affordable option right now – are going to take an unfeasibly long time to complete.

For owner-investors, who are focused on asset progression, the delays make BTO flats especially unpalatable. The Minimum Occupancy Period (MOP) of five years starts from the point of key collection – so if their flat takes five years to build, it will be a decade before they can upgrade.

By then, there’s a risk that private home prices – which are also rising – would be out of reach.

This contributes to the roaring demand for resale flats right now, also buoying up Cash Over Valuation (COV).

More from Stacked

14,000 Homes In Kranji And A Transformed Woodlands — Will The North Become Singapore’s Next Hotspot?

Now that the NDP Rally 2025 speech is done, there are some interesting details to ponder. There are, for instance,…

2. If private housing prices come down, it could sap some demand for resale flats

If resale flat prices are soaring, why aren’t resale flat owners cashing out and upgrading? The answer is simple: private home prices are soaring, right alongside resale flat prices (we have a list of districts that have seen the biggest increases/decreases in prices heWhich Districts Have The Highest Increase/Decrease In Prices Over Covid-19re).

Property TrendsWhich Districts Have The Highest Increase/Decrease In Prices Over Covid-19

by Ryan J. OngBesides this, an uncertain economy – plus high home prices – has prompted more home buyers to consider resale flats instead. One of the realtors we spoke to opined that this is related to the number of million-dollar flats:

“To me, if you spend an amount like $1.29 million on a flat, that is not an investment purchase, that is an own-stay purchase. Many of these are potential buyers who had been saving up for a condo, but have now ‘switched tactic’ and gone for a resale flat instead.

For the price of a fringe region condo, they get a better location, more space, and they take on less debt. If there were more availability in the OCR, or more desirable condos within this $1.3 million price point, I think there would be fewer million-dollar flats.”

3. The OCR condo market has become a contributing factor

Since around April this year, it’s been noted that demand for OCR condos has exceeded supply. This was one of the reasons behind the popularity of Pasir Ris 8, and the reason why the OCR has been dominant for most of 2021.

For HDB upgraders, who make up the majority of the market, OCR condos are at the acceptable price point of about $1.5 million. Multiple launches in the RCR and CCR don’t really soak up demand from this important buyer group, as condos in those regions are typically beyond their budget.

As such, buyers who cannot find a suitable OCR condo – and who are priced out of other regions – instead turn toward bigger, or better-located flats as a compromise (see above).

We do think, however, that increased supply in the OCR could entice some resale flat buyers back into the private market.

4. Prices could dip as the crop of “new” resale flats get bought out

We’ve pointed out that five-year old flats see the highest demand, and often sell at a premium. These flats have no risk of construction delay, the renovations are so new that many buyers can live with them (and renovate after Covid-19), and lease decay is negligible.

These “new” resale flats usually sell out quite fast; while we have no way to tell how soon it will happen, it’s like price increases will slow down afterward.

In a wider sense, we don’t see resale flat prices coming down in 2021; but there are individual exceptions

We have a list of places where you have better odds of finding a reasonably priced flat. In general, you can still get a lower price by:

- Avoiding a “new” resale flat (five-year flats), and getting a cheaper but older option in the same area

- Stick with regular HDB flats, and don’t be lured in by DBSS status (unless you’re sure that’s the end point of your property journey)

- Focus on older listings, where sellers have had more time for realism to sink in

- Get property agents who have transacted in the same block or neighbourhood; the shorter the time period the better. CEA now provides this information publicly. You want to be aware of factors not seen on property portal sites, such as Ethnic Quotas being reached.

For more on property news and updates, follow us on Stacked. We’ll also keep you up to date with in-depth reviews of new and resale properties alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Are resale flat prices in Singapore expected to decrease in 2021?

What factors are influencing the high resale flat prices in Singapore?

Can government intervention help lower resale flat prices in Singapore?

Is it possible to find cheaper resale flats in Singapore right now?

How do construction delays affect the resale flat market in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

0 Comments