“I Lost My $10K Deposit And A 300% Property Appreciation” 4 Readers Share Their Missed Property Opportunities

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

Hindsight is 20/20, but that doesn’t mean we can’t learn from it. From near-misses of bad investments to lost opportunities, we’ve asked people about their top “what if” investments. Here are some stories from investors who could have, or luckily didn’t, invest in some of their shortlisted projects:

1. Cavenagh House

One reader shares how they nearly bought Cavenagh House in the 1990s:

“We were looking to buy Cavenagh House to be close to our son’s Primary School,” they said. “We went to view it twice and made the decision quite quickly to buy it”.

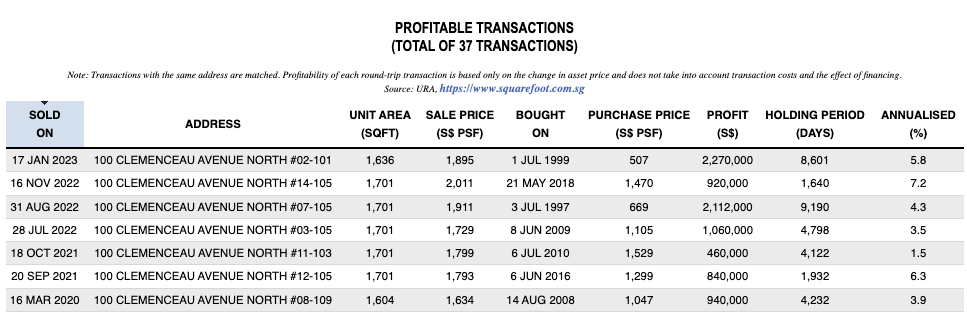

They remember putting down around $10,000 for the property, which was around $500 to $600 psf, with a quantum of around $1 million; a price that would be considered typical for the era.

However, a warning from the conveyancing lawyer raised a red flag:

“We heard from our lawyer that the deal was complicated as the property was under a trust. I can’t remember exactly why either but he said that it would be a long-drawn-out process.”

This is unusual for a condo, and we’ve almost never heard of it in the current market. Properties owned by a trust are usually commercial (e.g., a shopping mall owned by a REIT), so the conveyancing process for residential property would be complex even today.

In addition, there was a warning from a friend that future en-bloc opportunities would be slim, as they heard from a friend that there were MRT tracks running under the property. This would supposedly be off-putting to future developers, as it could cause construction issues.

“We started to get cold feet and decided to pull out of the deal and lost $10,000 in the process. I do remember feeling somewhat vindicated when the prices dropped in the early 2000s. But today it’s definitely a miss, as getting a unit of that size (1,600+ sq. ft.) at that price is unheard of. I know that the prices have about tripled, and even without an en bloc this would have been a good deal eventually.”

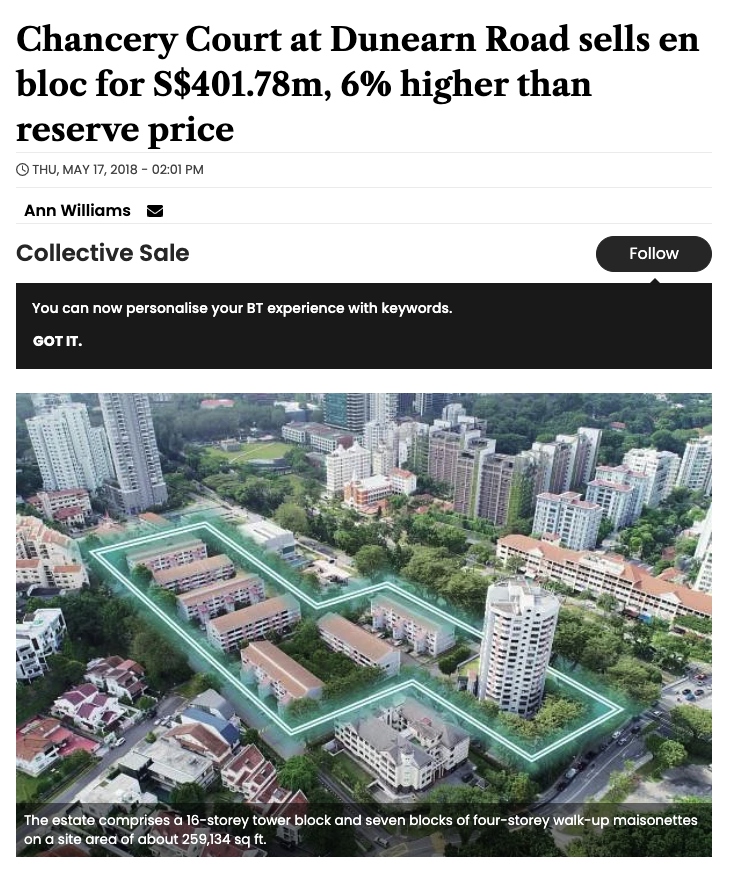

2. Chancery Court

Our next readers were looking at Chancery Court in the early 2000s, as a place to raise a family. Most condos were out of budget, so they had targeted former HUDC projects as their prices were more affordable. Plus given the age and size of these developments, they felt that they had stronger en bloc potential in the future. These are formerly public developments that have since been privatised (one of the more recent examples being Normanton Park).

“After a couple of months of viewings, we finally narrowed it down to Chancery Court and another ex-HUDC development. The prices were actually very similar overall, even though Chancery Court was in a more prime location.”

The unit was huge by today’s standards, at 2,000+ sq. ft., and with a quantum of just around $700,000. The choice came to a toss-up, and they ultimately decided to pick the other development instead because it had more facilities that would have been better for their children.

Today, they regret the decision as Chancery Court had already gone en-bloc in 2018. Their own project has seen several similar en-bloc attempts but failed each time.

In addition:

“2018 was a great time to acquire another property too, as compared to today. Even if we were to get a collective sale today, prices have gone up so much more for us to acquire another property as compared to back then.”

As such, those who managed to en bloc in 2017/18 and acquire another home/investment before prices ran away in 2021/22 would be in a great spot by now.

Finally, the biggest pain for the couple now would be the sunk cost fallacy.

“It’s tough to wait for a collective sale. You are stuck waiting in limbo as you would never know when it would happen. You want to sell to move on, but if an en bloc sale does happen in the near future you would be just kicking yourself!”

More from Stacked

Buying a New Launch Condo Has Changed in 2025 — Here Are the Key Details Most Buyers Overlook

From launch weekend sellouts to changing methods of balloting, you may have noticed some differences in new launch methods these…

3. Paya Lebar Residences

Our readers were recently married in the early 2000s. Both were not intending to have children, so schools and parks were not a priority; they would rather have had malls, a train station, and other entertainment nearby.

One of the newer launches at the time was Paya Lebar Residences, which was practically next to the Paya Lebar MRT station.

“We were considering a 1,300 sq. ft. unit, which I think at the time was around $1,000 psf. But at the time Paya Lebar was not as attractive as two or three other shortlisted projects; we acknowledged it was near the MRT station, but there was a sense that there lacked any real amenities.”

At first, during the Global Financial Crisis in 2008/9, they felt they had made the right decision; they had expected the property market would see a big crash. In reality, the opposite occurred: low-interest rates caused prices to skyrocket soon after the crisis, enough to bring measures like the ABSD.

On top of this, they realised they had missed the transformation of the Paya Lebar Quarter (PLQ). From a handful of low-grade office spaces, the area is now a major commercial hub. Even the SingPost building has been transformed into a third mall for the area.

“Last time I checked the prices were already around $1,600 psf. And to really rub it in, one of us now works in Paya Lebar. If we had picked a unit there – which I think we can’t afford now – she would just be a five-minute walk from the office.

I especially regret that we didn’t buy at the old price because it’s a freehold condo.”

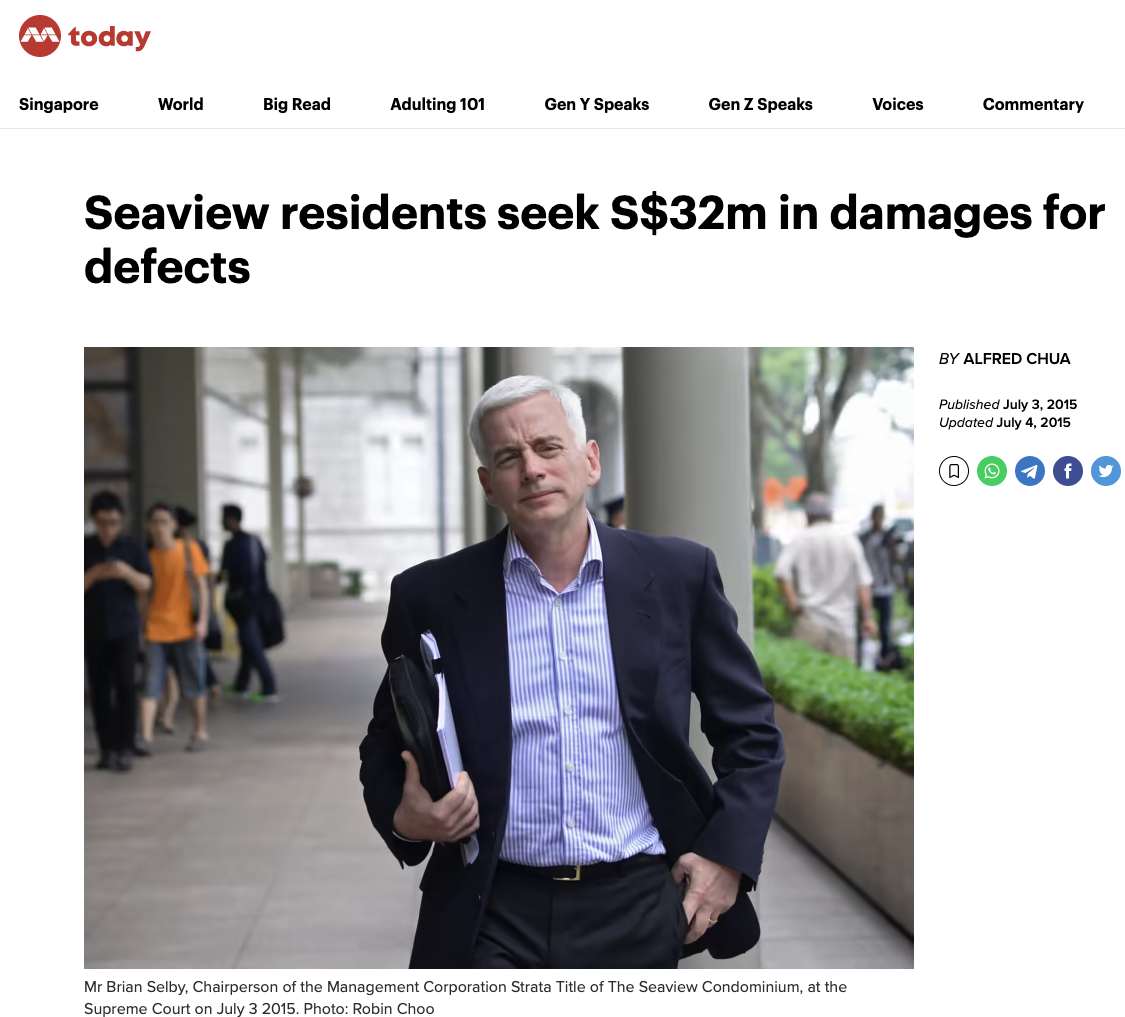

4. The Seaview

In this next scenario, the readers were relieved at having missed out. They were about to buy a 1,400+ sq. ft. unit, sometime in the 2000’s. They said that:

“We both grew up in the Katong area, so we wanted to stay somewhere nearby. We were lucky to have some help from my parents, which would have made the down payment possible. I don’t recall the exact price now, but I recall it was a bit of a stretch for us.”

The Seaview would have placed our readers close to areas like Parkway Parade and East Coast Road, which today is an ex-pat enclave. But while it’s a desirable area, there were issues with the Seaview itself.

In 2011, a civil suit was filed against the developer for serious defects; and it wasn’t until 2016 that the $32 million suit was settled. The Seaview was plagued by a number of issues in its early days, such as choked plumbing.

Our readers narrowly dodged this bullet:

“Literally hours before I was getting ready to sign anything, my wife called me and said she didn’t feel good about spending so much. She wanted a different project which wouldn’t have stretched our means so much, especially since my parents were putting down money to help.

If we had gone ahead, we would have been caught up in the same issues as the other buyers.”

As of 2023, the Seaview seems to have overcome its initial issues; and we notice units can transact for over $2,100 psf. Perhaps buyers who bought just after the issues were settled were the luckiest ones.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Homeowner Stories

Homeowner Stories What I Only Learned After My First Year Of Homeownership In Singapore

Homeowner Stories I Gave My Parents My Condo and Moved Into Their HDB — Here’s Why It Made Sense.

Homeowner Stories “I Thought I Could Wait for a Better New Launch Condo” How One Buyer’s Fear Ended Up Costing Him $358K

Homeowner Stories How We Saved $300K And Got Our 4-Room Toa Payoh Flat in Just 7 Months

Latest Posts

Singapore Property News Why Buying Or Refinancing Your Home Makes More Sense In 2026

New Launch Condo Reviews Narra Residences Review: A New Condo in Dairy Farm Priced Close To An EC From $1,930 PSF

Property Market Commentary Why Looking at Average HDB Prices No Longer Tells the Full Story: A New Series

On The Market This Latest $962 PSF Land Bid May Push Dairy Farm Homes Past $2,300 PSF — Here’s Why

On The Market Orchard Road’s Most Unlikely $250 Million Property Is Finally Up for Sale — After 20 Years

Editor's Pick We Analyse “Safer” Resale Condos in Singapore to See If They’re Actually Worth Buying: A New Series

Editor's Pick Why 2026 May Be a Good Year to Buy an EC — With an Important Caveat

Overseas Property Investing What $940,000 Buys You in Penang Today — Inside a New Freehold Landed Estate

Singapore Property News One of Singapore’s Biggest Property Agencies Just Got Censured

New Launch Condo Analysis This New Freehold CBD Condo Starts From $1.29M — Here’s How the Pricing Compares

Singapore Property News Over 3,500 People Visit Narra Residences During First Preview Weekend

Editor's Pick 66% of Units at Coastal Cabana Sold at End of First Sales Day, Prices Average $1,734 psf

Editor's Pick Newport Residences Review: Rare Freehold Development in the CBD with Panoramic Sea Views from $3,012 psf

On The Market Here Are The Rarest HDB Flats With Unblocked Views Yet Still Near An MRT Station

Singapore Property News New Condo Sales Hit a Four-Year High in 2025 — But Here’s Why 2026 Will Be Different For Buyers

The point is?

Hi, ive a story about my intention to buy a Condo I’m 2004. But my wife rejected it, now we felt super regret, the property En bloc for 9X its original selling price 5 years back.