How Do We Keep HDBs Affordable & Accessible? Singaporeans Share Their Opinions On PSP’s Public Housing Scheme

February 14, 2023

The recent debate on affordable housing has brought up several possible alternatives, but we don’t think all of them will go down well with everybody. It’s beginning to look a bit like a zero-sum game, where someone – be they young first-time buyers or older sellers of resale flats – is going to gain at the expense of another. This week we look at some of the proposed alternatives, as well as the proposal put forward by PSP: let’s see what you think of them.

Table Of Contents

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

A quick recap of the housing affordability debate

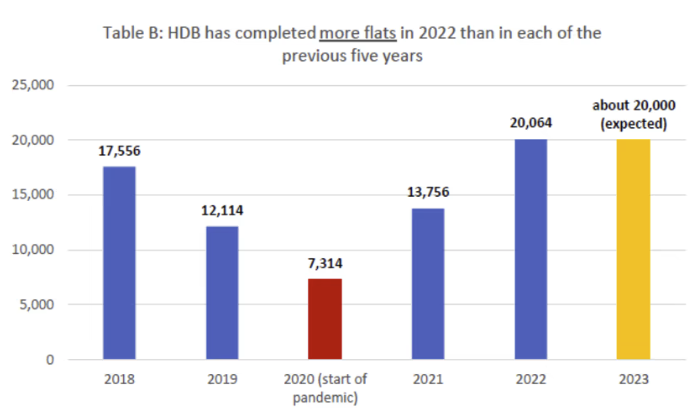

First, the Workers Party (WP) pointed out that the average of 20,000 flats per year (between 2021 and 2025) is higher than in the last five years; but it is still below the average of 23,000 in the years from 2011 to 2015.

They also pointed out that application rates have risen from 2.8 times in 2012 to 5.6 times in 2021; and suggested more proactive steps to address demand.

We also noticed that Ms. Denise Phua (Jalan Besar GRC) said the government should take a calculated risk and build in advance, rather than stick with the Built To Order (BTO) system. There was a response recalling the 1997 surplus of flats, however, which resulted in a brief period where later buyers could purchase surplus flats at a lower price than those who had queued.

We’ve weighed in on this at Stacked before, as we previously also suggested it may be time to drop the BTO system. As much as the Government has repeatedly pointed to the 1997 financial crisis oversupply of 31,000 unsold flats in response to building ahead of demand, we don’t think a drastic oversupply situation like 1997 is likely, as HDB has now had over two decades of data to calibrate production.

Besides, we are in a very different landscape today. There are measures like the ABSD and SSD helping to keep a lid on the growth of runaway property prices. And unlike in 1997 when you can freely buy a property and sell it the next day, you don’t have such freedom today. As such, you don’t have such irresponsibility in the market of people overleveraging to try to make a quick buck.

There could also be a hybrid approach, where HDB units in prime/mature areas get built without having to go through a BTO system. After all, it’s been shown time and time again over the last few years how quickly these get snapped up. As for locations that may be considered to be more challenging, having the BTO system could still be relevant.

Also, it’s no secret that the wait to get a BTO (in some cases it can be 6 to 7 years) has a detrimental effect on the low birth rates that Singapore is currently facing. Housing, or rather, the lack of housing, will definitely delay many couples’ family planning activities.

And it’s not just family planning that is affected, an increase in BTO supply would also naturally help with the rising resale HDB prices as demand has outstripped the supply over the last few years.

Ms. Phua also suggested there should be more incentives for buyers to move into non-mature towns.

There was also some debate on the use and depletion of CPF savings for housing. Associate Professor Jamus Lim (Sengkang GRC) highlighted the latent conflict between growing retirement savings and keeping public housing affordable.

To this there was a response that CPF monies are in separate buckets; e.g., the Special Account and Retirement Accounts are untouched for housing.

Mr. Xie Yao Quan (Jurong GRC) proposed expanding the PLH model to more than just the current model. One suggestion was that other tiers could be introduced, such as a six-year MOP and two per cent clawback; this would be less severe than the current MOP models, but still more restrictive than regular resales.

He also suggested an absolute cap on BTO prices, such as a cap of five times median income; this would cap a 4-room flat at $500,000 before grants.

Ms. Cheryl Chan (East Coast GRC) said that government intervention to make resale flats affordable would require a few bold moves; such as younger Singaporeans convincing their parents to settle for lower profits when selling flats, or being willing to live in the same property for longer periods.

Progress Singapore Party (PSP) has some proposed alternatives

Among the issues referenced were PSP’s Affordable Homes Scheme proposal and the Millennial Apartments Scheme.

The Affordable Home Scheme would require buyers to pay only the “user price” of a flat, which excludes land costs (you pay the construction costs and a notional location premium). So long as they continue to reside in the flat, they will never pay anything beyond the user price (i.e., if you live there for life, you will never end up paying for land).

More from Stacked

An Ultimate Guide To Using Your CPF To Buy Property: How Much Can You Really Use?

Most Singaporeans will use their CPF in some form, to purchase their property. This has resulted in some debates over…

This will increase affordability while reducing CPF consumption.

However, if you should choose to sell the flat, you would then pay the land cost upon resale, including interest based on accrued historical mortgage rates. This money would go into the Reserves, thus allowing the government to avoid “raiding the reserves” for the sake of housing.

The other proposal is a Millennial Apartments Scheme, which aims to set aside some flat units near prime CBD locations for young families, or groups of singles. These apartments would be available on affordable leases from two to five-year.

This is in line with the current demand from the younger generation to have more housing options, as they seek independent living earlier.

Would the schemes work?

The counter-argument to the Affordable Home Scheme was made in Parliament, which you can read about here. From readers we’ve spoken to, there have been replies both in favour of it and against the Affordable Homes Scheme.

One reader, J, springs this question:

“What if the husband pays the whole user price on his own, because it’s so cheap, then can his wife go out and separately buy another property under her own name? Because that would give an unfair advantage compared to buyers of yesteryear.”

We had another reader, who remarked that whether the schemes would be well-received would be dependent on which side of the fence you are on.

“Everyone wants to buy a cheaper home, but for those who’ve already bought at higher prices, how would the affordable home scheme be fair? It seems that it would impact my current flat prices, and not in a good way. Likewise the millennial rental scheme, where seems to make sense for the young generation who want a more flexible lifestyle. But what if you own a unit in those places? Seems like it would depress the rental rates there as well.”

Another reader, who is a former realtor, says she would need to understand how the lump-sum payment of the land cost is calculated:

“At first glance, I feel it’s worse than the CPF refund that we have now because at least with a CPF refund I pay back to myself. In this version my money goes to the reserves, but what does that do to help me buy my next house?”

She also asks if the accrued interest would be based on “a fixed rate like the HDB loan, or floating rate like bank loans,” as the latter would make the land cost much less predictable.

Another reader, EK, says he is supportive of the scheme provided it is applied flexibly:

“What happens if someone has financial difficulty and needs to downgrade? Then is it really fair to force them to pay the land costs still? If so I would not be very happy. But if we can apply flexibility I think it’s a big improvement over what we have now.”

Finally, reader KC feels the PSP alternative isn’t going far enough on the land issue. He says:

“We don’t own the land, so we should not be paying the land costs. We are only renting for 99 years. If your tenant wants to cancel the lease, then you can charge him for the land? This scheme is still unfair to us.”

What are your opinions on some of these ideas?

- Affordable Housing Scheme

- Millennial Apartments Scheme

- Absolute price cap on BTO flats

- Take a risk and go beyond the BTO model

- Expanded PLH scheme with different tiers

- Incentives to get people to move to non-mature areas

- Convince your parents to accept lower profits for flats, and stay in the same place for longer

Let us know which of them you agree with or disagree with, and why. Also let us know how you would tweak the housing system if you had it your way.

Follow us on Stacked as we update you on the situation, and the latest market happenings. We’ll update you on trends in the Singapore property market, as well as provide in-depth reviews of new and resale properties alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are the main proposals by PSP to make housing more affordable in Singapore?

How does the Affordable Homes Scheme aim to reduce housing costs?

What are some concerns about the proposed housing schemes in Singapore?

Would relaxing the BTO system help with housing affordability in Singapore?

What other strategies are discussed for improving housing affordability besides PSP's proposals?

What are some opinions from the public about the proposed housing schemes?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

2 Comments

A few years ago, SDP comes up with a policy for housing. I spent some time to go through it. I find it logical and reasonable, just take out HDB from open market, sell at the cost, but they cannot earn from it. They can only sell back to government, therefore the supply will always be there. If you want to sell at open market, you need to be willing to buy at open market price. Resident should be fair, if you just want profiteering, do it at open market. If you seriously just need an affordable house to stay, make sense that you cannot profit from it. https://yoursdp.org/2019/04/06/sdp_proposes_non_open_market_flats_to_address_hdb_39_s_99_year_lease_crisis/ . More people need to be aware of it.