Why I Sold My 40-Year-Old Jurong Flat For A Newer Bukit Panjang One: A Buyer’s Case Study

October 1, 2025

Project: 5-room Bukit Panjang HDB flat

Buyer profile

- 47 years old

- Living with her son

- Owns a 5-room HDB flat in Jurong East

- Works in the finance sector

Buyer brief

- Wants to sell her 40-year-old home

- Wants to buy a home that can be passed on to her son

Buyer challenges

- Concerned about the lease decay of her current home

- Didn’t want to worry about the mortgage payment on her new home

Lease decay is a growing concern for many HDB owners, especially those hoping their homes will serve as a legacy for their children. Without careful planning, the value of a home may not always keep pace with what families hope to pass on. This case study looks at how we helped one homeowner restructure her housing situation: trading an older flat in Jurong East for a newer one in Bukit Panjang, ensuring her housing decision could support both her needs today and her son’s future.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

How it all started

By late 2024, P owned a fully paid 5-room flat in Pandan Gardens. The flat was already 40 years old, and while it had served her family well, she was beginning to think about the future. Having transferred much of her CPF OA savings into her SA for retirement, her available funds for a new purchase were limited.

When P and her husband first bought the flat, it was close to three decades old, but with enough lease remaining to feel secure. Over time, circumstances changed: she became the sole owner, and her priorities shifted toward retirement planning. With her son starting his studies soon, she began to consider what she could eventually pass on to him. The age of the flat, coupled with her reduced OA balance, made her realise that staying put might not be the best option.

P came to us with a straightforward objective: sell the ageing flat before further depreciation, and secure a newer HDB that would work for her lifestyle today while giving her son more certainty for the future.

Planning beyond a flat’s lease for her son’s future

As an agent with over 15 years of experience, I’ve met many clients in P’s position. After decades of monthly mortgage bills, paying off a flat can feel like a giant relief. It’s natural to assume the home will always serve its purpose, whether as a place to live or something to pass on to the next generation. The difficulty comes later, when the reality of an ageing property sets in. Selling can feel like undoing years of chasing certainty, and the thought of becoming a buyer again can seem like starting all over.

That’s why our first consultation was important. P voiced a concern that I hear often from owners of ageing flats: that buyers would see the shorter lease as a bargaining chip to push prices down. We unpacked this together. Historically, her worry was valid. After the 2013 changes to CPF usage and HDB loan limits for flats over 40 years old, demand for such units fell sharply between 2014 and 2018.

But we also looked at how the landscape had shifted since 2019. With CPF and HDB rules revised, and COVID-19 delays reducing new supply, resale demand for older flats had rebounded. This gave P confidence that her flat was still marketable in the near term.

Even so, we agreed that the current surge in HDB prices might not last indefinitely. Past cycles have shown that cooling measures are usually introduced once the market overheats. Together, we concluded it was the right time to sell, making the most of the strong demand rather than risk steeper depreciation later.

Selling her unit within one week, amid the busy CNY

Although we first met in November 2024, we agreed to list the property in the third week of Chinese New Year 2025.

When we discussed the right time to list her home, I shared with P that some owners avoid putting their units on the market during Chinese New Year. It’s typically one of the quieter periods in the property cycle, as many buyers are occupied with family visits and celebrations.

Even so, I was confident her flat could stand out. Located in Pandan Gardens, where every block consists of 5-room layouts, her 129 sqm corner unit offered something extra, a recessed area that added both privacy and usable space. These features gave it a strong appeal in a familiar estate.

The results spoke for themselves. Despite the timing, we secured a sale within a week, achieving a record price in the cluster to an upgrader from within Pandan Gardens.

To ensure a smooth transition, we negotiated not only the standard 60-day grace period but also an additional three-month extension. This gave P the breathing room to complete her next purchase without the stress or cost of temporary accommodation.

Working out her financials

Since she had transferred some savings from her CPF OA to SA, we had to reassess her budget for her new home. For HDB flats, buyers can use their CPF OA to make the full 25% down payment. However, CPF SA funds can’t be transferred back to OA; she would have to fork out more cash savings if she decided on a more expensive unit. Considering her age, we were also mindful about the maximum HDB loan tenure she’d be able to get (i.e. 65 – 48 = 17 years).

P wanted to cap her loan at $200,000, using the cash proceeds from her sale to fund the new purchase. At one point, she even thought about taking a smaller loan, but that would have required a larger upfront cash outlay. In the end, she decided to keep some savings aside for minor renovations.

Finances were understandably top of mind. Her first thought was to apply for a Sale of Balance Flat (SBF), which occasionally offers unsold BTO units and older flats still held by HDB. While these can sometimes provide move-in-ready options, supply is limited. Not to mention as a second-time applicant, P’s chances were even lower. After a month of trying, she shifted her focus to the resale market, where the options were broader and the timeline more predictable.

Making a move on her purchase

Once the sale was concluded and her finances worked out, we turned our attention to finding her next home. P’s requirements were clear:

- New enough to be passed on to her son

- Lower monthly mortgage

- 5-room flat

- Accessible to son’s school

- Accessible to the DTL for her commute to work

- Fully furnished, move-in ready

With these in mind, we shortlisted locations and units that came closest to her needs. Because we had secured some leeway from the sale timeline, I prioritised getting her as many viewings as possible upfront so she could move in smoothly without needing temporary accommodation.

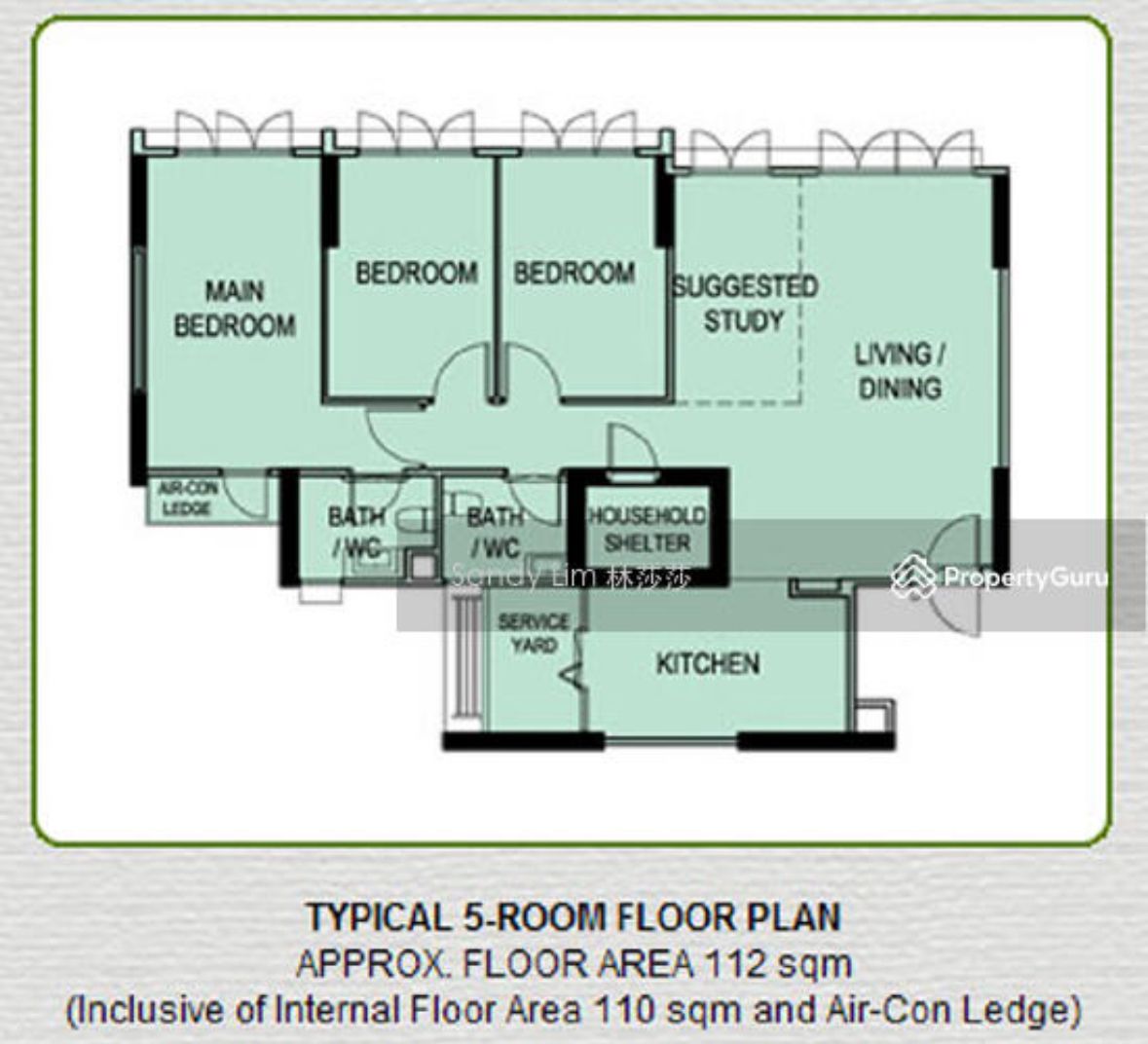

Week one: We viewed two units that were around 20 years old. Both were well-kept, though not fully furnished and in need of significant renovation. What P liked, however, was the layout. These units had common bathrooms placed along the bedroom hallway, a feature more common in condos today. In contrast, older HDB flats usually place the common bathroom at the end of the kitchen, which means occupants of common bedrooms walk further to access it.

One of the units caught P’s eye. We considered making an offer, but the seller’s agent mentioned more viewings were lined up. To avoid our offer being used as leverage to drive up the price, I advised P to hold back until we saw how things unfolded, but unfortunately, the owner ended up transacting with another buyer.

Ultimately, missing out turned out to be a blessing in disguise. That seller needed an extension to stay on, and while P could have stayed temporarily with her parents, she was not fully comfortable doing so.

Week two: We turned to two newer options, which were 5-room flats about 10 years old along Segar Road in Bukit Panjang. They were a short bus ride to her son’s school and within walking distance of Bukit Panjang MRT. Both were simply furnished, making them easier to imagine moving into immediately.

In the end, P secured the unit with the better view, an open outlook across to another HDB block set at a comfortable distance, offering both light and privacy.

Spoiler alert: the unit she eventually bought was $755,000 – our first offer!

| Total cost (including stamp duty, legal fee, agent fee) | $778,885 |

| Upfront cash payment from HDB sale proceeds | $588,888 |

| Bank loan amount | $200,000 |

| Monthly cash payment | $1,204 |

| Monthly OA payment | $1,406 |

Older homes may drop in property value faster in the coming years

P chose to act when her flat turned 40, rather than wait another decade or two. It’s a decision many owners struggle with. Flats past the 50-year mark raise growing concerns around lease decay, loan eligibility, and the difficulty of uprooting after decades in the same community.

Those concerns have only been heightened by recent announcements that SERS will be fully replaced by the Voluntary Early Redevelopment Scheme (VERS).

P’s situation is far from unique. Many homeowners assume that once a flat is fully paid off, the hard decisions are behind them. In reality, choices around when to sell, how to finance the next purchase, and how to plan CPF balances all continue to matter. Even small moves, such as transferring OA funds into the SA, can complicate things later if circumstances change.

The key takeaway isn’t that there’s a single “right” choice. For some, acting earlier provides clarity and peace of mind; for others, staying put and enjoying a fully paid-off home may suit their needs best. What matters is timing: knowing the implications of each option, and planning with clarity. So your decision, whether to move or to stay, supports both your present lifestyle and your long-term goals.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Joe Quek

Since embarking on his real estate journey in 2009, Joe has brought a distinct perspective shaped by his background in engineering. Grounded in a commitment to minimizing risks and maximizing opportunities, he employs thorough research and analysis in his approach to real estate. Specializing in guiding first-time buyers and upgraders, Joe offers his knowledgeable assistance throughout their property journey to help clients plan for their long-term financial security through real estate.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

0 Comments