What You Need To Know About En-bloc Sales In 2021

January 19, 2021

For those who remember the en-bloc fever of 2016/17, the current Singapore property market may look a little depressing. Back then, a certain Stirling Road plot (today Stirling Residences) made history by selling for $1 billion; and Shunfu Ville (today JadeScape) raked in an impressive $638 million.

Ever since however, a combination of cooling measures and rising development charges have put out the fire. That’s why it’s surprising that – in these Covid-19 days – that en-bloc movements may be seeing a revival. And while we don’t think it will be as overheated as 2017, it might be a relief to owners of older condos who have been waiting.

Here’s what you need to know about en-bloc sales in 2021:

Notable changes to the en-bloc scene

- Limited supply of land in limited places

- Most developments from the last en-bloc cycle are finished and sold

- There’s growing developer confidence despite Covid-19

- New rules on proxy votes can make a big difference

- Bigger developments still face slimmer prospects

1. Limited supply of land in limited places

For 1H 2021, there are only three confirmed residential sites (one of which is an Executive Condominium or EC site), which can yield about 1,605 new homes, including 590 EC units.

What’s significant is that this follows a supply cut in 2H 2020. At the time, the government had reduced residential supply by close to a quarter (23 per cent) from 1H 2020. This meant 2H 2020 saw the lowest supply in close to 11 years.

As such, it was expected that – with the Covid-19 situation improving – the government would significantly ramp up supply in 1H 2021 to make up for it.

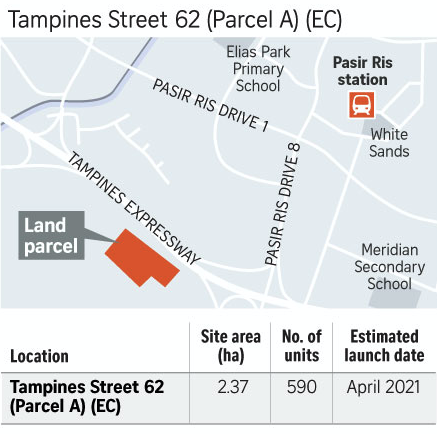

That hasn’t happened though, and developers may be worrying about their land banks. This is compounded by the limited number of locations: two of the confirmed sites (Slim Barracks Rise, Parcels A and B) are more or less across from each other in One North. The other site is at Tampines Street 62, which is an EC site.

While One-North is a current hot spot, there’s just a lack of options elsewhere. Developers who want to tap on the momentum of District 7 properties, seafront properties in District 16, etc. are stuck with considering en-bloc sales.

So coupled with the healthy uptick in transaction volumes (see below), we do expect more collective sale interest in the coming year.

2. Most developments from the last en-bloc cycle are finished and sold

These were the top few collective sales in 2017, during the last en-bloc rush:

- Tampines Court ($970 million)

- Amber Park ($906 million)

- Normanton Park ($830 million)

- Eunosville ($765 million)

- Florence Regency ($629 million)

- Rio Casa ($575 million)

| Old Project | New Project | Units | Take-up Rate |

| Tampines Court | Treasure at Tampines | 2,203 | 77.3% |

| Amber Park | Amber Park | 592 | 41.2% |

| Normanton Park | Normanton Park | 1,862 | 32.3% |

| Eunosville | Parc Esta | 1,399 | 99.6% |

| Florence Regency | Florence Residences | 1,410 | 68% |

| Rio Casa | Riverfront Residences | 1,451 | 93.6% |

Former Serangoon Ville (now Affinity at Serangoon), and Royalville (now RoyalGreen) have also launched (although RoyalGreen isn’t doing so well on the sales front). As such, we have a situation where many of the 2016/17 en-bloc sales are done with, and developers will be looking for a new slate.

This, coupled with a distinct lack of options from GLS (see above), could push many into the first en-bloc discussions.

3. There’s growing developer confidence despite Covid-19

To date, the pandemic has given developers only theoretical reasons to slow down. Buyers should be cautious, the economy is rocky, etc. However, those theories ring hollow next to the numbers we’ve seen:

Private homes sales are at their highest point in almost eight years, with last December seeing a 57 per cent rise in transactions from November. Notably, the sales were driven by new launch condos, with Clavon and Ki Residences accounting for over half the transactions in December.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Selling Your Home On Your Own? We Breakdown An Ex-FBI Negotiator’s Book Into 5 Key Takeaways (Part 1)

Call it manipulation, call it persuasion.

Overall, private home sales ended 2020 up 126.2 per cent from the previous year.

Despite Covid-19, there’s a slew of flats reaching their Minimum Occupation Period (MOP), and clear signals that buyers are willing to take the plunge. It’s unlikely that developers are going to sit on their thumbs and play cautious, while the market roars ahead.

Property Market CommentaryWhy HDB And Private Home Prices Are Still Projected To Rise In 2021

by Ryan J. Ong4. New rules on proxy votes can make a big difference

In a move that’s been expected since 2016/17, the government has passed laws restricting proxy votes at condo general meetings.

The cap for proxy holders is now two per cent of the total number of lots in a strata development (or just two lots, if that would be higher). The Ministry of Law also said that:

“We will also improve the form of instrument to appoint a proxy, to allow the proxy giver to explicitly direct his proxy to vote as he intended.”

According to real estate agents on the ground, this fixes a longstanding issue of abuse. Here’s how it works:

Say a group of people have an interest in pushing for an en-bloc sale. A long time before such any en-bloc meetings, they go around asking owners for the right to vote on their behalf (getting a proxy vote). This may be under the guise of helping them vote on issues like parking fines, changing the cleaners’ routines, etc.

After a while, these people would have amassed a significant number of proxy votes this way. Later during an en-bloc meeting, they use all those votes to push for a collective sale; and it’s not always clear if some of the owners actually gave their consent for such a vote.

There have also been complaints that some owners, such as elderly homeowners, may not understand the significance of giving away their vote.

While the changes are fair and reasonable, there is an issue going forward: there’s a risk of insufficient attendance, which may slow the en-bloc process even if everyone really does agree. This is because more owners now need to be physically present and take the time to vote.

5. Bigger developments still face slimmer prospects

We mentioned this last year, and it still applies this year: developers are more likely to eye smaller developments (those with 300 units or less), when it comes to en-bloc sales.

This is because the five-year Additional Buyers Stamp Duty (ABSD) time limit applies regardless of the development’s size. Whether it’s 20 units or 2,000 units, the developer must finish and sell the project within five years (or pay 30 per cent tax on the land price).

There is some “give” with regard to the deadlines, such as last year’s four-month extension due to Covid-19. Nonetheless, we feel developers will be cautious in this regard, as there’s no telling how the pandemic will affect supply chains and manpower. Malaysia, for instance, announced a second Movement Control Order (MCO) last week; and the closure of factories in places like Johor can affect construction timetables here.

So while rising sales may be encouraging to developers, we feel they’ll still show a preference toward smaller projects; these are likely to be completed and sold before any unfortunate whims of fate.

Follow us on Stacked so we can keep you updated on the news, as well as on new and resale developments alike. We’ll be looking at some of the former HUDC estates next, and how they’ve fared since their redevelopment.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is the current state of en-bloc sales in Singapore in 2021?

How has the supply of land for en-bloc developments changed recently?

What recent changes have been made to voting rules in condo en-bloc sales?

Are larger developments still likely to be sold en-bloc in 2021?

Why are developers cautious about en-bloc sales despite rising transaction volumes?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Singapore Property News Executive Condo Prices Have Doubled In A Decade — Raising New Questions About Affordability In 2026

Singapore Property News River Modern Sells Over 90% Of Units At Launch — Here’s What Buyers Paid

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

1 Comments

Hi Ryan, thank you so much for this great article, may I please know what about Spring Grove at Grange Road, your thoughts on that, do you believe there is any potential for en block the next couple years?

Thank you very much!