Your Monthly Interest Payments Are Set To Spike In 2022: Here’s What You Need To Know

March 23, 2022

Since around 2008/9, bank home loans have been significantly cheaper than HDB Concessionary Loans. Homebuyers have been warned repeatedly that bank loans could one day be pricier than HDB loans again – but that concern has been diminished, after being repeated for more than a decade. This year, however, a surprisingly sharp interest rate hike, over a short period, has made the warning tangible again:

Table Of Contents

- What’s happening with US interest rates?

- The rise in interest rates is sharper than expected

- How does this matter to Singapore homeowners?

- 1. Higher-income buyers of BTO flats may still be affected

- 2. Reconsider refinancing your HDB loan to a bank loan

- 3. EC buyers will have to deal with the rising rates

- 4. Tighter TDSR limits, plus rising home loan rates, may make borrowing tougher

- 5. Internal board rates are not necessarily proof against rising rates

- 6. If you have just a little left to go, you may want to consider prepayment

- How will this affect rental?

What’s happening with US interest rates?

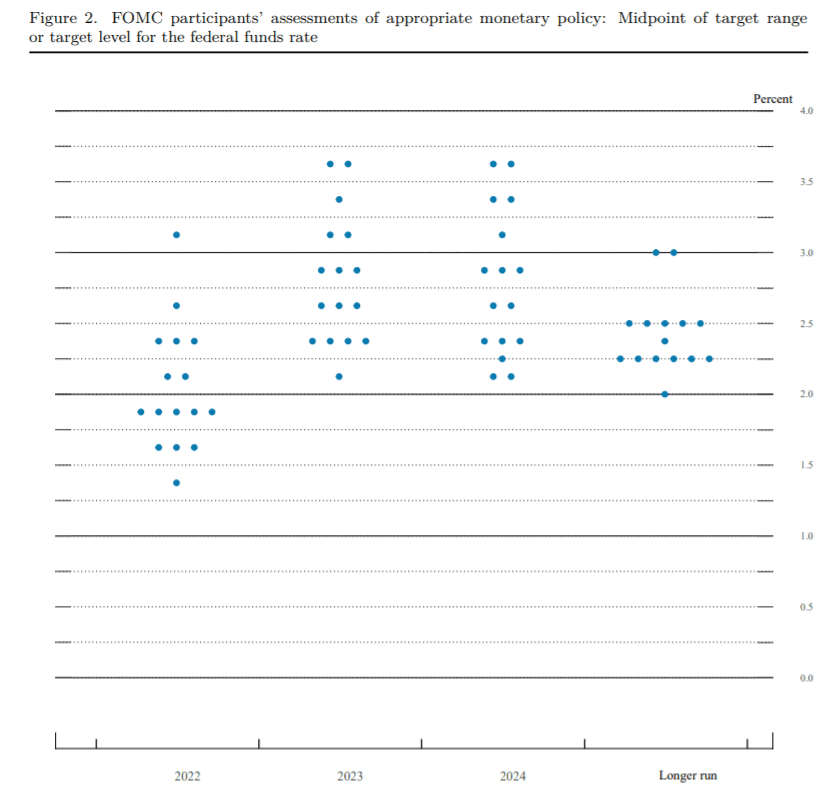

The US Federal Reserve may raise interest rates to about 2.25 to 2.5 per cent this year, much higher than the predicted 1.9 per cent we heard about in 2021. This is to combat rising inflation in the US, which has continued despite the pandemic and the war in Ukraine.

This has an indirect effect on interest rates in Singapore as well. When the Fed raises interest rates, many loans – in particular home loans – tend to rise in tandem (although not necessarily at the same pace).

Some mortgage brokers have said that interest rates of 2.5 per cent in the US could mean home loan rates of above three per cent in Singapore, depending on how banks respond.

This would once again raise private bank rates above the HDB loan rate, which is set at 0.1 per cent above the prevailing CPF rate (2.6 per cent).

The US previously dropped to zero or near-zero during the Global Financial Crisis in 2008/9, to stimulate the economy. Efforts were then made to normalise over the next decade, but the Covid-19 pandemic saw rates plummet to near zero again.

As such, we saw an unusually long period in which Singapore home loans were able to stay below two per cent on average.

The rise in interest rates is sharper than expected

Back in 2020, mortgage brokers pointed out that, even if interest rates rise, it would be in small increments of about 0.25 per cent, over a long period.

So it’s a surprise that the Fed has planned no less than six rate hikes in the span of just this year. Current Fed Chair Jerome Powell also said he was willing to consider increments of larger than 0.25 per cent, if they felt it necessary.

The move also ran contrary to expectations, given rising geopolitical tensions. Some mortgage brokers told us that they previously expected rate hikes to be delayed, to cope with rising fuel costs in the event of Russian sanctions.

The reasons may go beyond economics. Interest rate hikes are a factor in increasingly divisive US politics: former US President Donald Trump often criticised the Fed for trying to implement rate hikes, whilst current US President Joe Biden is supportive of them.

How does this matter to Singapore homeowners?

This isn’t a concern to those using HDB loans, which are likely to remain at the current 2.6 per cent.

Other homeowners, however, need to know the following:

- Higher-income buyers of BTO flats may still be affected

- Reconsider refinancing your HDB loan to a bank loan

- EC buyers will have to deal with the rising rates

- Tighter TDSR limits, plus rising home loan rates, may make borrowing tougher

- Internal board rates are not necessarily proof against rising rates

- If you have just a little left to go, you may want to consider prepayment

Besides this, there may be some impact on the rental market, as landlords face rising costs.

1. Higher-income buyers of BTO flats may still be affected

Under some circumstances, such as if your income is on the high-end, HDB may tell you to use a private bank loan, instead of an HDB loan. This means you’re at the mercy of rising interest rates, even if you’re just trying to buy a regular BTO flat at a launch.

You may want to try and appeal this, but if HDB is insistent you go to a bank, we suggest you quickly find a mortgage broker and try to lock in a good rate – before they start climbing later in the year.

2. Reconsider refinancing your HDB loan to a bank loan

Over the past few years, many homeowners with HDB loans have refinanced into bank loans – this lowered their interest rate from 2.6 per cent to an average of just 1.3 per cent.

But while you can refinance from an HDB loan to a bank loan, you cannot reverse the process. Once you do it, you’re stuck with using bank loans in the open market. Given that home loan rates could go past HDB’s 2.6 per cent, possibly in as little as a year, now is probably not the best time to switch.

More from Stacked

4 Key Trends Reshaping Singapore’s New Launch Condo Market In 2026

As 2025 draws to a close, the new launch market can look forward to a bit of a breather -…

3. EC buyers will have to deal with the rising rates

Lest you forget, there are no HDB loans for Executive Condominiums (ECs). This is regardless of whether or not they’ve been privatised.

As such, buyers looking to upgrade or purchase an EC have no choice but to use bank loans. If you’re an owner-investor or concerned about the bottom line, talk to a mortgage broker about the likely interest rates you’ll be paying.

A $1 million loan at 1.3 per cent, for 25 years, would cost total interest repayments of about $171,800+. Raising this by a single percentage point would raise total interest repayments to over $315,800, over the same loan tenure.

4. Tighter TDSR limits, plus rising home loan rates, may make borrowing tougher

During the December 2021 cooling measures, the Total Debt Servicing Ratio (TDSR) was tightened from 60 to 55 per cent. This means your monthly home loan rate, coupled with other debt obligations, cannot exceed 55 per cent of your monthly income.

Singapore Property News16 Dec 2021 New Property Cooling Measures Kick In: Here’s How It May Affect You

by Ryan J. Ong| Cooling Measure | Old Measure | 16 December 2021 New Measure |

|---|---|---|

| Loan To Value Ratio | 90% for HDB loans 75% for bank loans | 85% for HDB loans 75% for bank loans |

| Total Debt Servicing Ratio | 60% of monthly income | 55% of monthly income |

| Additional Buyers Stamp Duty | Singapore Citizens None for first property 12% on second property 15% on subsequent property Permanent Residents 5% on first property 15% on subsequent property Foreigners 20% Entities 25% +5% non-remissible for property developers | Singapore Citizens None for first property 17% on second property 25% on subsequent property Permanent Residents 5% on first property 25% on second property 30% on subsequent property Foreigners 30% Entities 35% +5% non-remissible for property developers |

For HDB properties (regardless of whether you use bank or HDB loans), the monthly loan repayment cannot exceed 30 per cent of your monthly income; this is called the Mortgage Servicing Ratio (MSR).

Depending on how much your interest rate pushes up your monthly repayments, you may find you now bust the TDSR, despite qualifying before. This will mean you either need to drag out the loan tenure (if possible) or make a bigger down payment.

5. Internal board rates are not necessarily proof against rising rates

When interest rates threaten to rise, many loan packages will start to boast of a board rate (i.e., an interest rate set by the bank) that hasn’t changed in a long time.

One variant of an internal board rate is a fixed deposit rate, in which the home loan interest rate is pegged to a particular tranche of fixed deposits.

While this might help to keep rates low, mortgage brokers have warned us not to oversimplify the issue. Some bank loans specify that the lender can raise rates at any time, without having to justify it to borrowers. Likewise, rising interest rates could mean later fixed deposit-pegged loan packages are pricey, as interest rates on fixed deposits are likely to rise as well.

6. If you have just a little left to go, you may want to consider prepayment

If you have just a little bit left of your home loan outstanding, this may be the year to consider prepayment (i.e., pay off the whole remainder, instead of continuing to pay monthly).

This could spare you future losses from a rising interest rate.

However, consult a qualified financial planner, or other experts of your choice, to review your finances before doing this. It is imprudent to accelerate loan repayments if it would leave you without savings, as you cannot easily liquidate your home in an emergency (and doing so may cause losses).

A mortgage broker can help go over the terms of your loan, to check if you would face penalties for doing this. It’s usually best to wait out the lock-in period of home loans, and make your lump-sum payment only when you’re past the lock-in.

Otherwise, you may be charged around 1.5 per cent of the undisbursed loan amount, when prepaying the loan.

How will this affect rental?

Realtors we spoke to said that, if interest rates rise substantially, landlords might also raise rental rates to match. This is especially true for higher-end properties, where realtors noted that rental rates are rising anyway (initially due to higher property taxes announced this year, but rising interest provides yet another justification).

However, not all landlords will be worried. Apart from those who have already paid off their property, realtors reminded us that landlords can claim mortgage interest rates as tax deductions (but only the interest portion). As such, the impact on landlords should stay manageable.

For more on the situation as it unfolds, follow us on Stacked. We also provide in-depth reviews of new and resale properties to alike, to help you make an informed decision.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How do US interest rate hikes affect home loan rates in Singapore?

Why are bank home loans becoming more expensive in 2022?

Should I refinance my HDB loan now due to rising interest rates?

How will rising interest rates impact EC buyers in Singapore?

What should homeowners consider if they have a small remaining mortgage balance?

How might rising interest rates affect rental prices in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News A Rare Freehold CBD Office Unit Is Up For Sale At $20.5M — And Foreigners Can Buy It

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

Latest Posts

Property Advice Should I Pay $500K More For A New Launch — Or Buy A Resale Condo Instead?

Pro This Popular 520-Unit Condo Sold 85% At Launch — Here’s What Happened To Prices After

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

0 Comments