With $700k In Cash, Should Our First Condo Be New Launch Or Resale?

January 17, 2025

Hi Ryan / Stacked,

I’ve been a long time reader of Stacked and have enjoyed the many wonderful analysis pieces by Ryan. I have been giving some thought to my situation and was wondering if it was possible to get Ryan’s analysis on it. My details are below and many thanks in advance.

Dual (middle) income family with two young kids (5,7). Both my spouse and I are in our late 30s. Our HHI probably exceeds the EC salary ceiling cap by a little.

Staying with parents currently. Both our names are unencumbered i.e. do not have a property to either of our names. We are not looking to move for the next 8-10 years or so. Have about $700k in liquid assets. How should we go about assessing and considering our options for investing in property/equity?

1. Buy new launch since monthly payments are in tiers / staggered, lower capital outlay, at least in the first few years. However new launches prices are so high now, capital appreciation is going to be slow/difficult.

2. Buy resale for immediate rental yield and look to sell in future if time/price is right. I am ok if the rental is unlikely to cover mortgage payments. Resale condo might also present opportunities for lower PSF.

As a side note, both our names are unencumbered, would we be overstretching if we bought 2 smaller (2 bedder) units?

3. Do not invest in property and invest in dividend stocks like Singapore bank stocks, can get around 5% div yearly. I’m aware equities prices/dividends may fall, no leverage effect. This approach is the least hassle, but at the same time, I’m unsure if it’s wise to not have a stake in Singapore’s property market as it has always been a solid store of value.

Many thanks for your analysis and always looking forward to your articles. Thank you.

Hi there,

Thank you for reaching out, and we truly appreciate your support over the years.

The options you’re considering each have their own merits and we’ll dive into the specifics of these pathways later in the article and hopefully help you make a more informed decision.

As usual, let’s begin by assessing your affordability.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Affordability

Since we do not have your exact numbers, the following calculation will just be an estimate based on these assumptions:

- Both of your ages are 38

- Your combined household income is $17,000, split equally between the two of you

- You do not have any other financial obligations

- You have sufficient CPF needed for the 20% down payment

Combined affordability

| Maximum loan based on ages of 38 with a combined monthly income of $17K, at a 4.15% interest | $1,820,215 (27-year tenure) |

| CPF (Assuming that the maximum loan is 75% of the purchase price, and the CPF will cover the 20% down payment) | $485,391 |

| Cash | $700,000 |

| Total loan + CPF + cash | $3,005,606 |

| BSD based on $3,005,606 | $119,936 |

| Estimated affordability | $2,885,670 |

Individual affordability

| Maximum loan based on the age of 38 with a monthly income of $8.5K, at a 4.15% interest | $910,107 (27-year tenure) |

| CPF (Assuming that the maximum loan is 75% of the purchase price, and the CPF will cover the 20% down payment) | $242,695 |

| Cash | $350,000 |

| Total loan + CPF + cash | $1,502,802 |

| BSD based on $1,502,802 | $44,740 |

| Estimated affordability | $1,458,062 |

With your liquid assets, you have the flexibility to adjust your individual affordability by reallocating funds as needed.

However, without specific details on your CPF balances, it’s challenging to determine whether purchasing two properties is feasible in your case.

Let’s now delve into the performance trends of new launch developments.

Performance of new launch condominiums

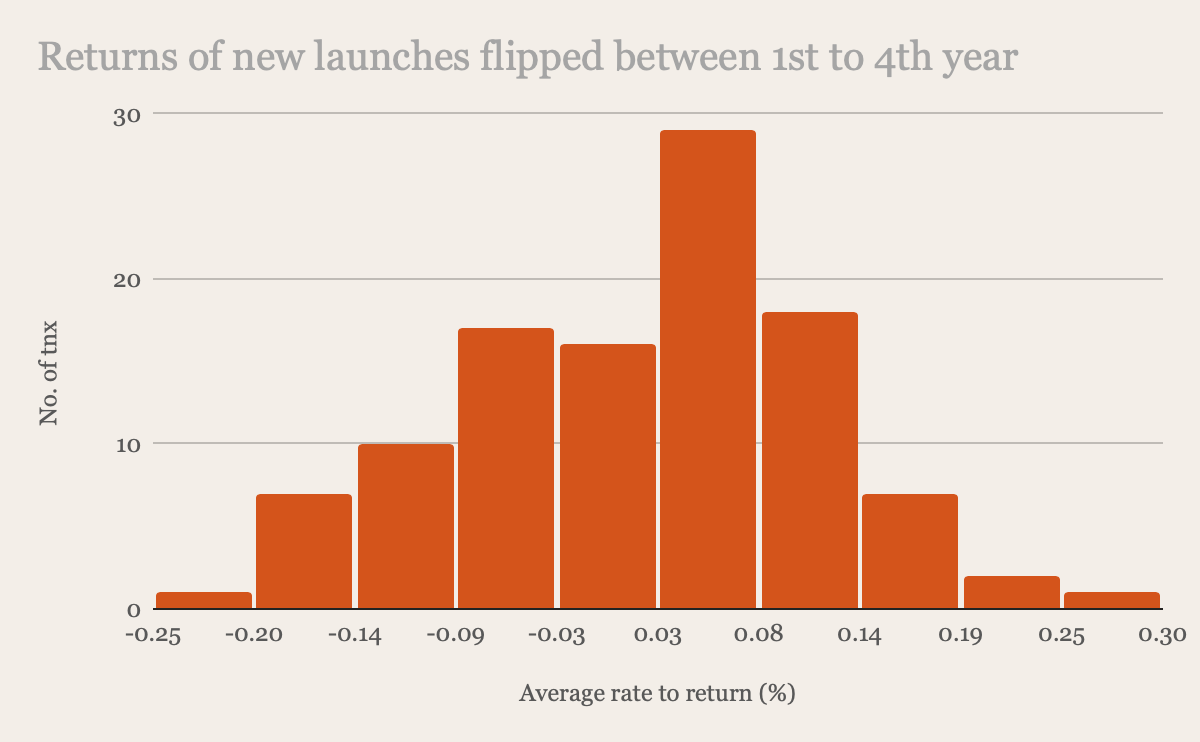

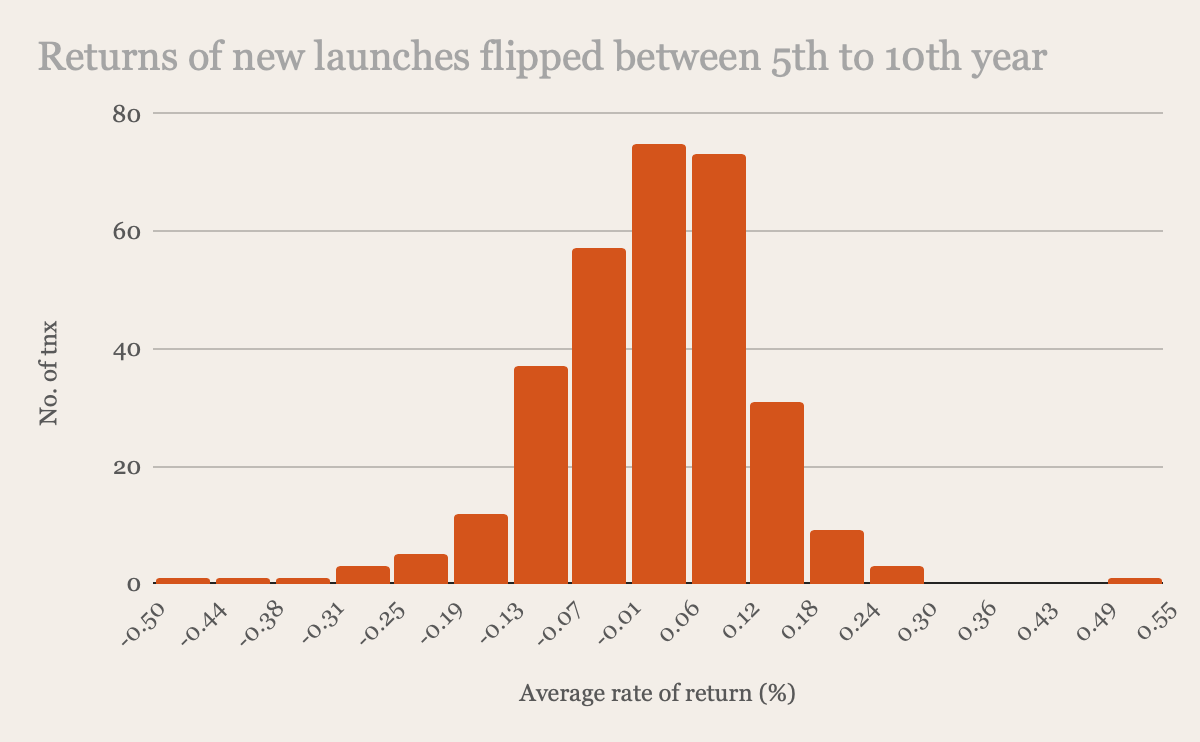

Here, we have analysed new sale transactions from 2012 and 2013, matching them to their respective sub-sale or resale transactions over the past decade.

| Highest gain | Highest loss | Average rate of return |

| 26.9% | -33.7% | 1.20% |

| Average gains | No. of profitable transactions | % of total transactions | Average losses | No. of unprofitable transactions | % of total transactions |

| 9% | 1087 | 82.66% | -8.40% | 228 | 17.34% |

| Highest gain | Highest loss | Average rate of return |

| 52.6% | -47.8% | 1.50% |

| Average gains | No. of profitable transactions | % of total transactions | Average losses | No. of unprofitable transactions | % of total transactions |

| 8.90% | 6345 | 82.10% | -7.70% | 1383 | 17.90% |

The data reveals a wide range of profits and losses, with the average rate of return being quite similar regardless of whether the property was sold within the first four years or between the fifth and tenth year. However, properties sold within the first four years tend to have a narrower range of gains and losses compared to those held for a longer period. Notably, the highest recorded gain for properties held between the fifth and tenth year was 52.6%, although this is an outlier. The next highest transaction at 25.7% is much closer to the top gain recorded for those sold within the first four years.

Average gains for profitable transactions show minimal variation across both holding periods, while average losses for longer-held properties are slightly lower than those for properties sold earlier.

It’s important to note that these findings represent general trends, and individual developments may perform differently based on demand and supply dynamics.

Next, let’s examine how resale properties fared during the same period.

Performance of resale properties

Here, we are looking at resale transactions done in 2012 and 2013 and matching them to their subsequent resale transaction up to date.

| Highest gain | Highest loss | Average rate of return | Average holding period (Years) |

| 100.30% | -39.03% | 11.43% | 7.4 |

| Average gains | No. of profitable transactions | % of total transactions | Average losses | No. of unprofitable transactions | % of total transactions |

| 17.44% | 4274 | 71.72% | -7.53% | 1685 | 28.28% |

The data reveals that the average rate of return for resale properties is significantly higher compared to new launches. When we consider the average holding period of 7.4 years for these resale properties and compare them to new launches sold between the fifth and tenth year, the average gains of resale properties remain considerably higher, while both their average losses are comparable.

One possible reason for this difference is that a portion of resale properties sold in 2012 and 2013 were likely priced lower than their new launch counterparts at the time. This lower entry price may have provided more room for appreciation, especially during and after the pandemic when property values experienced a significant uptick.

Now that we have a better idea of how new launches and resale properties compare to each other, let’s take a look at the pathways you’re considering.

Potential pathways

Buy a new launch

As you mentioned, purchasing a new launch comes with several advantages. One key benefit is the progressive payment plan, which allows you to manage your finances more effectively by spreading out payments over time. Additionally, during the construction phase, there are no property taxes or maintenance fees, reducing your financial burden in the initial period.

Another advantage is the potential for paper gains through the developer’s pricing strategy. Developers often increase prices as the project nears completion, allowing early buyers to benefit from price appreciation. However, this varies across developments and is not guaranteed.

Buying a new launch also allows you to identify value buys more easily since the prices for all units are made transparent at launch. That said, in a way a lot of luck is involved, as your ballot number determines when you can select your preferred unit.

In terms of pricing, recent launches suggest that 2-bedroom units typically range between $1.4M and $2M, depending on location and size. For calculation purposes, let’s use your maximum budget of $2.8M.

Assuming you hold the property for ten years—3.5 years during the construction phase followed by renting it out for 6.5 years at a 3% yield—let’s evaluate the financial implications.

| Purchase price | $2,800,000 |

| BSD | $109,600 |

| Maximum loan | $1,820,215 |

| CPF and cash required | $1,089,385 |

Progressive payment scheme

- Assuming a $1,820,215 loan at 4% interest with a 27-year tenure

- Since your maximum loan does not cover up to 75% of the purchase price, for the first two stages (completion of foundation and reinforced concrete), the payments will be made with CPF or cash.

| Stage | % of purchase price | Disbursement amount | Monthly estimated interest | Monthly estimated principal | Monthly estimated repayment | Duration | Total interest cost |

| Completion of foundation | 10% | $0 | $0 | $0 | $0 | 6-9 months (from launch) | $0 |

| Completion of reinforced concrete | 10% | $140,215 (5%) | $467 | $241 | $708 | 6-9 months | $2,169 |

| Completion of brick wall | 5% | $280,215 | $934 | $482 | $1,416 | 3-6 months | $5,604 |

| Completion of ceiling/roofing | 5% | $420,215 | $1,401 | $722 | $2,123 | 3-6 months | $8,406 |

| Completion of electrical wiring/plumbing | 5% | $560,215 | $1,867 | $963 | $2,830 | 3-6 months | $11,202 |

| Completion of roads/car parks/drainage | 5% | $700,215 | $2,334 | $1,203 | $3,537 | 3-6 months | $14,004 |

| Issuance of TOP | 25% | $1,400,215 | $4,667 | $2,407 | $7,074 | Usually a year before CSC | $56,004 |

| Certificate of Statutory Completion (CSC) | 15% | $1,820,215 | $6,067 | $3,128 | $9,195 | Monthly repayment until the property is sold | $400,422 |

| Total interest paid in 10 years | $497,811 |

Costs incurred

| BSD | $109,600 |

| Interest expense | $497,811 |

| Property tax | $126,360 |

| Maintenance fee (Assuming $250/month) | $19,500 |

| Agency fee (Assuming it’s paid once every 2 years) | $22,890 |

| Rental income | $546,000 |

| Total costs | $230,161 |

Buy a resale

As you rightly pointed out, resale properties also offer their own set of advantages, such as the immediate potential for rental income to partially offset your expenses. This can alleviate financial strain during the holding period, giving you the flexibility to observe market trends before deciding on your next move.

Another advantage is being able to physically inspect the unit and its surroundings before making a purchase, which can provide greater assurance about the property’s condition and location.

As seen earlier, resale properties can offer significant growth potential, provided the right property is chosen. This makes them a viable investment option depending on your strategy and goals.

Since your available CPF funds are unclear, we’ll explore calculations for two scenarios: one where you purchase a single property and another where each of you buys a property individually.

For the scenario involving the purchase of a single property, let’s assume you acquire a unit priced at $2.8M (for a fair comparison with the earlier pathway) and rent it out at a 3% yield. Here’s how the financials could play out.

| Purchase price | $2,800,000 |

| BSD | $109,600 |

| Maximum loan | $1,820,215 |

| CPF and cash required | $1,089,385 |

Costs incurred

| BSD | $109,600 |

| Interest expense (Assuming a 27-year tenure at 4% interest) | $642,835 |

| Property tax | $194,400 |

| Maintenance fee (Assuming $250/month) | $30,000 |

| Agency fee (Assuming it’s paid once every 2 years) | $38,150 |

| Rental income | $840,000 |

| Total costs | $174,985 |

For the purchase of two properties, let’s assume that they each cost $1.4M and are also rented out at a 3% yield.

| Purchase price | $1,400,000 |

| BSD | $40,600 |

| Maximum loan | $910,107 |

| CPF and cash required | $530,493 |

Costs incurred

| BSD | $81,200 |

| Interest expense (Assuming a 27-year tenure at 4% interest) | $642,834 |

| Property tax | $120,000 |

| Maintenance fee (Assuming $250/month) | $60,000 |

| Agency fee (Assuming it’s paid once every 2 years) | $38,150 |

| Rental income | $840,000 |

| Total costs | $102,184 |

Invest in stocks

Let’s assume you invest the full $700,000 in stocks. We’ll project potential returns over ten years based on different Return on Investment (ROI) scenarios.

| ROI | Gains |

| 3% | $240,741 |

| 4% | $336,171 |

| 5% | $440,226 |

| 6% | $553,593 |

| 7% | $677,006 |

To provide a clearer comparison, we will also calculate the potential gains from a property purchase using the 10-year average growth rate of 2.9% for non-landed private properties. This will give a better perspective on the relative merits of each investment option.

For the purchase of a new launch/resale at $2.8M or 2 resale at $1.4M each

| Time period | Property value | Gains |

| Starting point | $2,800,000 | $0 |

| Year 1 | $2,881,200 | $81,200 |

| Year 2 | $2,964,755 | $164,755 |

| Year 3 | $3,050,733 | $250,733 |

| Year 4 | $3,139,204 | $339,204 |

| Year 5 | $3,230,241 | $430,241 |

| Year 6 | $3,323,918 | $523,918 |

| Year 7 | $3,420,311 | $620,311 |

| Year 8 | $3,519,500 | $719,500 |

| Year 9 | $3,621,566 | $821,566 |

| Year 10 | $3,726,591 | $926,591 |

Potential gains for a new launch: $926,591 – $230,161 (costs incurred) = $696,430

Potential gains for a resale: $926,591 – $174,985 (costs incurred) = $751,606

Potential gains for 2 resale condos at $1.4M each: $926,591 – $102,184 (costs incurred) = $824,407

What should you do?

Investing in property and stocks each comes with distinct advantages and drawbacks, making them complementary rather than mutually exclusive. Ideally, diversifying your portfolio by including both asset classes can provide a balanced approach to risk and returns.

From the calculations, if stocks consistently generate a 7% annual ROI, the gains are comparable to purchasing a property that appreciates at the 10-year average growth rate of 2.9%. However, both scenarios are subject to fluctuations—stock market returns can vary widely, while property appreciation depends on factors like market trends and demand. The advantage of hard assets like property especially in the context of a highly regulated landscape like Singapore’s is that price is more stable. Stocks, on the other hand, have wider swings.

The most advantageous scenario, as shown in the calculations, would be acquiring two properties and renting them out. This approach has the potential to generate the highest returns, particularly if property values appreciate as expected and rental income offsets holding costs. However, given that we do not have your full financial details, we cannot advise whether or not this pathway is feasible.

Ultimately, the decision should align with your financial goals, risk tolerance, and the level of involvement you are comfortable with in managing your investments. While stocks offer liquidity and minimal management, properties provide tangible assets with the potential for leveraged growth and rental income. Balancing these two can help maximise long-term gains while minimising risks so it might make sense to allocate a good mix between equities and property.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Latest Posts

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

0 Comments