Will My HDB Flat Be Worth $0 When The Lease Expires, And Should We Change Things?

February 9, 2022

Probably one of the biggest questions most HDB buyers have is: what happens when the 99-year lease is up? Does it just go down to zero? Or will you have an option of extending the lease?

A recent discussion on Reddit focused on this very question and on some possible alternatives. It’s an especially pertinent question at this point in 2022, with resale flat prices at record highs, and no less than 259 flats selling for $1 million or more last year. Have Singaporeans truly processed the significance of the 99-year lease limit; and is there a better way?

The official stance is that, once the lease is up, it’s up

Let’s start with the official answer: the value of your flat would drop to zero. Everything gets returned to the state. While we haven’t yet seen this happen with an HDB flat, we have seen it happen with a batch of private properties in Geylang: and that should make it clear that the government is dead serious about it.

That said as Reddit user Paullesq has pointed out, it’s not as simple as just evicting people from their homes at the end of the lease – there is often a political slant to it. There have been numerous examples cited from China, Hong Kong, and Malaysia that the pressures from the public have resulted in the leases being renewed for a fee.

And in reality in Singapore too, we’ve seen many “interventions” that take place before a lease is up, leading some to speculate that the process can’t be so harsh. The two that we know can happen are:

1. Selective En-bloc Redevelopment Scheme (SERS)

This is the most ideal solution for most HDB owners. The government takes back the flats before the lease expires, gives out some compensation (as appropriate to the situation), and gives new homes with fresh leases to the owners.

However, SERS is only going to happen with a tiny number of HDB projects; only an estimated four to five per cent of HDB estates will see SERS. As such, it’s not a solution you should ever count on, when buying old flats (although if you are calculated enough, it could pay off).

SERS sites don’t always go toward future HDB flats by the way; they are often bought by developers for private housing. However, we speculate that, with HDB planning to have one Prime Location Housing (PLH) launch per year, more SERS sites in future will be redeveloped into PLH flats, instead of going toward more condos.

2. Voluntary En-bloc Redevelopment Scheme (VERS)

When an HDB development reaches 70 years or older, a VERS offer will be made. If enough flat owners’ consent to it, the flats will be bought back by HDB, with a payout based on the remaining lease.

We haven’t seen a VERS exercise in Singapore yet, so the exact details are still sketchy at this point. However, the government has made clear that VERS compensation will be “less generous” than SERS.

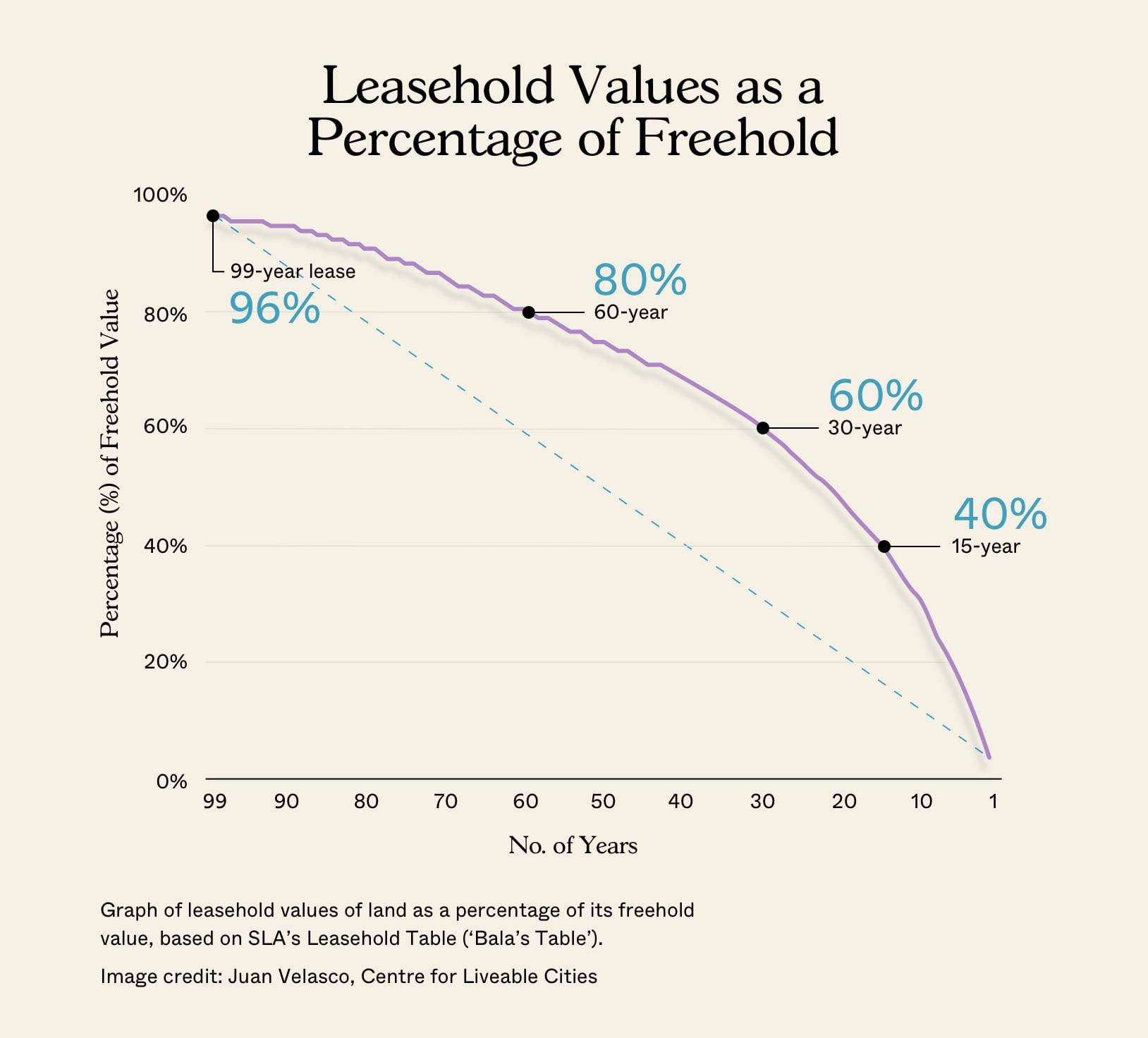

We suspect the compensation will be based on Bala’s Curve, where leasehold land value is pegged to a percentage of freehold land (we’ve written more about it here). The Singapore Land Authority (SLA), when pricing the top-up of leases, seems to follow pricing that’s broadly similar; so it’s reasonable to expect that the value of the remaining lease would be priced the same way.

What would worry us, however, is the process of getting consent. If anything like the requirement for a condo’s en-bloc sale, the nature of many HDB projects makes a common consensus difficult. This is because:

- More HDB owners are pure home owners rather than investors. They may not be moved by the allure of more money; however fair the offer may be.

- HDB projects often have a higher and more varied population density; this makes shared consensus tougher to acquire (compared to, say, a boutique condo where all 50+ unit owners are of the same socioeconomic background and intent).

- If it’s an old development with lots of old folks, we can’t imagine their being happy to move in their late 60s, 70s, etc. Especially not for the (seemingly) small amount of compensation they’re getting. We shouldn’t assume all of them have sufficient savings to afford a new, equally comfortable home, let alone want to deal with the hassle of moving.

Property Investment InsightsFreehold vs Leasehold: Can You Really Prove Which Is Better? (Part 1)

by Sean GohBut can’t you just sell the flat before the lease decay is too advanced?

On a societal level, this isn’t really a solution as it just kicks the proverbial can down the road. But for those who are immediately facing the issue of having an ageing flat… it might work depending on where you live.

There are real obstacles to selling older flats. For example, once your flat is nearing the final stages of its life, financing can be tougher to acquire. You can’t use your CPF to buy a flat with 20 or fewer years left on the lease, for instance, and banks won’t finance flats with 30 or fewer years on the lease. This should logically make it quite tough to sell an old flat.

However, as we’ve seen from some million-dollar flats, location can make a significant difference. Notice that, in the linked article, most of the locations mentioned are among the oldest and most developed HDB towns (hence their continued appeal).

For flats in less prime locations, depreciation and difficulty selling are going to be serious obstacles. But we’d add the caveat that, quite often, the speed of depreciation is exaggerated (it has been helped by the pandemic, of course).

More from Stacked

Many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

How a 57% Rent Spike Drove Flor Patisserie Out — And What It Says About Singapore’s Retail Scene

In 2001, Singapore abolished the Control of Rent Act—a move that changed the landscape for commercial tenants.

Singaporeans really should avoid buying flats that won’t last till they’re at least 90. Not every HDB town is going to be like Tiong Bahru, Queenstown, Bishan, etc. And even in those desirable locations, we should be careful not to make assumptions about SERS prospects.

What are some possible solutions or effects we’ll see, when leases start running out?

- Build back denser (already happening)

- Involvement of private developers

- Changes to lease renewal methods

- An even-more-sandwiched generation

1. Build back denser (already happening)

It’s widely known that older HDB flats are bigger; and this is a trend that’s likely to continue, if the population keeps increasing.

Old HDB developments are bought over, demolished, and rebuilt into projects (private or public) that can house more people. E.g., a 20-storey block is demolished, and in its place is a 30-storey block with more units.

This will result in smaller homes, and increased demand for infrastructure (particularly transport). We probably don’t need to go too much into this right? You can already see it happening around you today.

The real issue is whether we’ll still find our homes liveable, as square footage shrinks. Smaller homes also tend to dissuade large families.

2. Involvement of private developers

If SERS is rare, and VERS gives too little compensation, we can think of certain land-starved entities who would be happy to buy over all those old flats.

Private developers are already eager to make en-bloc attempts for existing properties. But currently, they can’t do so with HDB flats – only private homes.

This actually deepens the wealth divide, as it gives private homeowners a massive advantage over HDB dwellers.

Consider that many leasehold condos are bought at good prices, even before they’re past their 40th year. This makes the 99-year lease almost irrelevant in the eyes of some, and most (though not all) sellers are happy with the deal they get. It’s quite different from HDB owners, who can only look to VERS or an improbable SERS as the endgame.

It might make sense to have some involvement from the private market, in clearing and renewing the stock of older flats.

3. Changes to lease renewal methods

In many other countries with leasehold properties, the owners are given the opportunity to renew the lease (at a cost). Perhaps, instead of forcibly evicting everyone, HDB could impose a charge to top up the lease.

We don’t think this will be less politically ugly, however.

Town Councils would have to be heavily involved in any such policies, and things can get politically charged (e.g., what if a town held by political opposition parties face a higher cost to renew the lease?)

It’s hard to tell which would create an uglier political situation: disputes and inevitable conspiracy theories over the costs to renew the lease, or the eviction of the flat owners. So if the intent is simply to avoid conflict, just allowing for lease renewal is not the magic bullet – not unless everyone agrees that the costing method is fair (an improbable scenario).

These problems may be even more pronounced in years such as 1984, when a bumper crop of 67,017 HDB flats was constructed.

What lease renewal can do, however, is mitigate the need for older residents, or families with children in nearby schools, from having to move. This may be worth more than the cost of the disputes.

4. An even-more-sandwiched generation

If your elderly parents run out of home, they’ll need help with housing; and the government prefers to have family members help first, before any government aid.

As such, this is a concern that some Singaporeans will face in future: as more flats near the end of their lease, we’ll also have to pay attention to the age of our parents’ homes.

Our financial planning may need to be more extensive, as not all retirees are in a position to sell and move to a newer place. So we do hope there will be schemes and subsidies to help Singaporeans, who also have to house their parents.

For example, bigger subsidies on a 3-Gen flat, for Singaporeans whose parents are in danger of outliving their lease.

For current flat owners, there’s a bigger issue to think about than 99-year leases

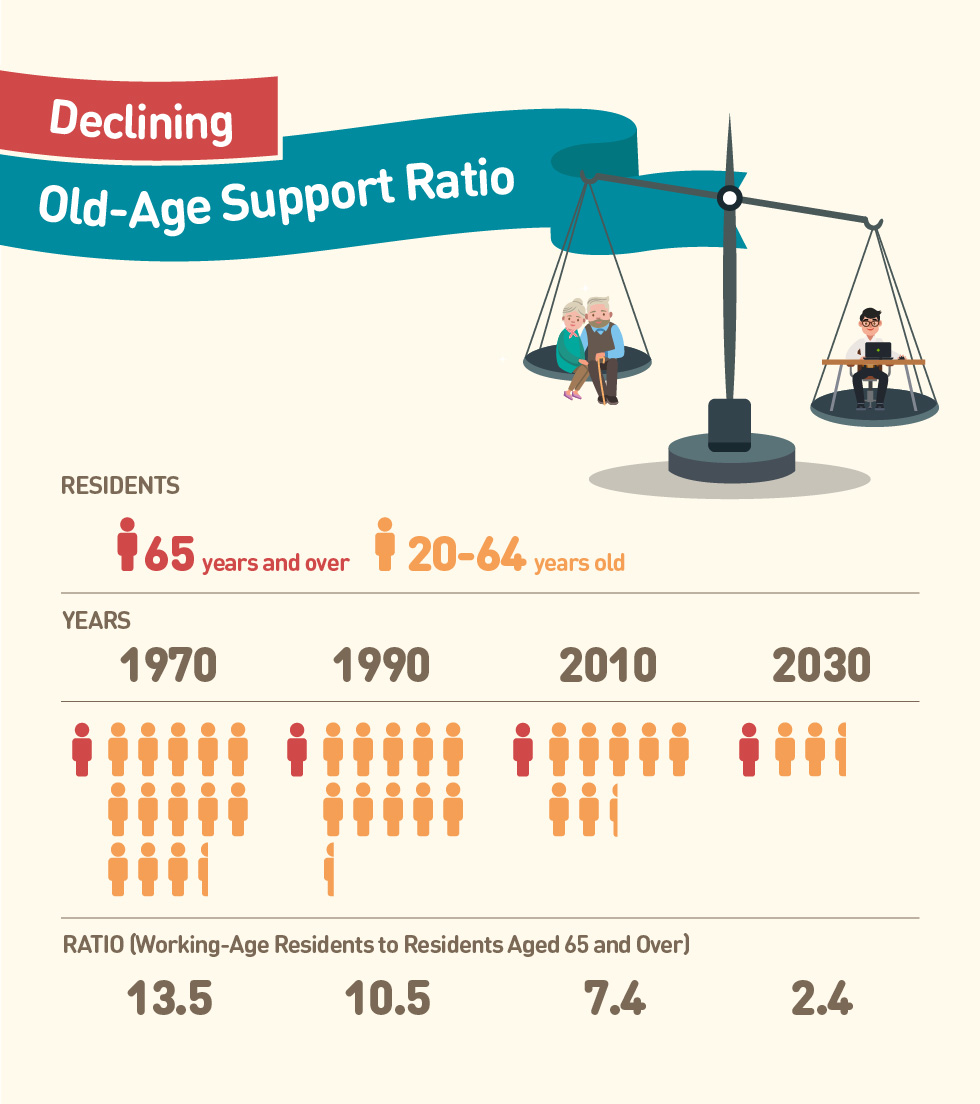

That’s the age of our citizens, not our flats.

Singapore is a rapidly ageing country. At some point, the older generation will pass on, and they will hand down their flats to their children. But given that Singapore already has a 90 per cent homeownership rate, chances are most of their children already have their own flats, condos, etc.

So they’ll probably be unable to inherit the flats anyway, which could lead to a deluge of vacant resale flats on the market (unless the rules change by then). We understand that’s hard to visualise in 2022, when demand is through the roof and everyone is complaining about insufficient housing – but we should remain conscious of how serious our ageing problem is.

But then again, some might say a deluge of vacant flats – and much lower prices – isn’t a bad thing for our future generation.

For more on the topic as it unfolds, follow us on Stacked. We also provide in-depth reviews of new and resale condos alike, to help you make informed housing purchases.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What happens to HDB flats when the 99-year lease expires?

Are there any schemes that allow for lease renewal or redevelopment of old HDB flats?

Can I sell my old HDB flat before the lease runs out?

What changes might happen as HDB leases start to run out?

How does Singapore plan to address the issue of aging flats and an aging population?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

9 Comments

Hi Stacked team, thanks for the great articles and research.

How do these points affect private condos? I’m wondering about the investment potential of purchasing a middle-age leasehold property in D10. Let’s say, Draycott 8. It is a 26-year old lease, with low density (139 units in 150000sqft area), but for some reason the price has come down quite a bit since it was launched 15 years ago and I’m wondering if the price will continue to drop as the lease gets shorter. On the other hand, such large plots are not common in D10. Thoughts?

https://singapore2b.blogspot.com/2019/01/lease-decay-solutions.html

1) Allow HDB flats with less than 20 years of lease left, to be rented out by the owner without MOP or other conditions, even on short term rental (i.e. AirBnB)

2) This will raise the market value of the flats.

3) Owner-occupiers who do not want to rent, can sell to “entrepreneurs” who would rent out the flats (AirBnB) or to sub-tenants. Most of the lease decaying flats would be older flats with larger space and can be divided to rent to young tenants (undergrads, etc).

Good article and good info. I am just pessimistic about having a painless solution. That’s why I will never buy an HDB flat even if I am eligible (I am not as a foreigner).

Robert, thank you for the detailed analysis. Would like to check your view of the old HDB flats around Beo Crescent Market? Any potential for SERS ? Thank you.

Thank you for the detailed analysis. Would like to check your view of the old HDB flats around Beo Crescent Market? Any potential for SERS ? Thank you.

Hi Cindy, Beo Cres is an old estate with mainly low rise HDBs and it is sandwiched between taller HDBs at Havelock Road and Boon Tiong Road. Land here is quite under utilised especially with the open carpark at Havelock Food Centre. From an urban planning perspective, It makes sense to increase the plot ratio to match the neighbour’s high rise characteristics.

Enjoy reading the articles from Stacked – informative and insightful!

I happen to find out actually there are some HDB which are built earlier than their lease start dates (while looking at resale flats in central region).

– one example is 050032 refer to: https://www.roots.gov.sg/Collection-Landing/listing/1481749 for built year – the lease start is 1983 (refer HDB map services) however the built year is 1968.

– I am really curious if HDB will note to these interesting ‘restart lease’ blocks when considering SERS or maybe test the durability of the construction done in the early days (1960s).