Why Waiting For Property Cooling Measures May Not Really Mean Cheaper Properties In Singapore

January 23, 2025

Cooling measures can cause one of two reactions: one group of home seekers rush to buy, because they’re afraid measures like loan curbs or higher ABSD will make a property less affordable. The second group do the opposite: they’d rather wait-and-see because they’re hoping the cooling measures will drive prices down. In this article, we’re going to address the concerns of the latter group, and explain why lower prices may not be the outcome:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

The theory of “wait-and-see” strategies

Cooling measures are specifically designed to apply downward pressure on home prices. As such, an intuitive response is to wait for the measures to cool the market, and buy when prices fall. In reality, it’s not that simple; but as we were trying to explain this to some readers, we ran into an interesting twist:

Some pointed to our own article on Urban Vista as proof of the “wait-and-see” theory.

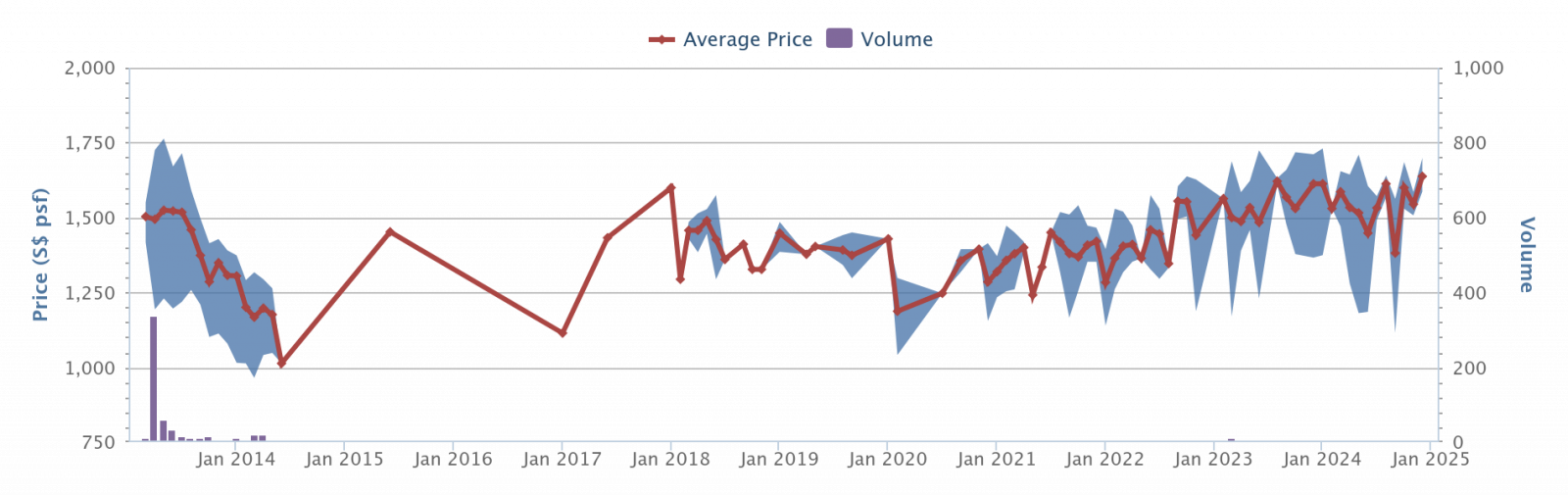

In the linked article, we mentioned that buyers of the underperforming Urban Vista may have bought at the peak of 2013. This was the last property peak, and that same year the government began to unleash cooling measures. This resulted in declining prices in subsequent years, and hence weaker gains.

Oops! Now, we need to qualify what we’ve said before, and clear up why “wait-and-see” isn’t a good idea all the time:

What can go wrong if you “wait-and-see?”

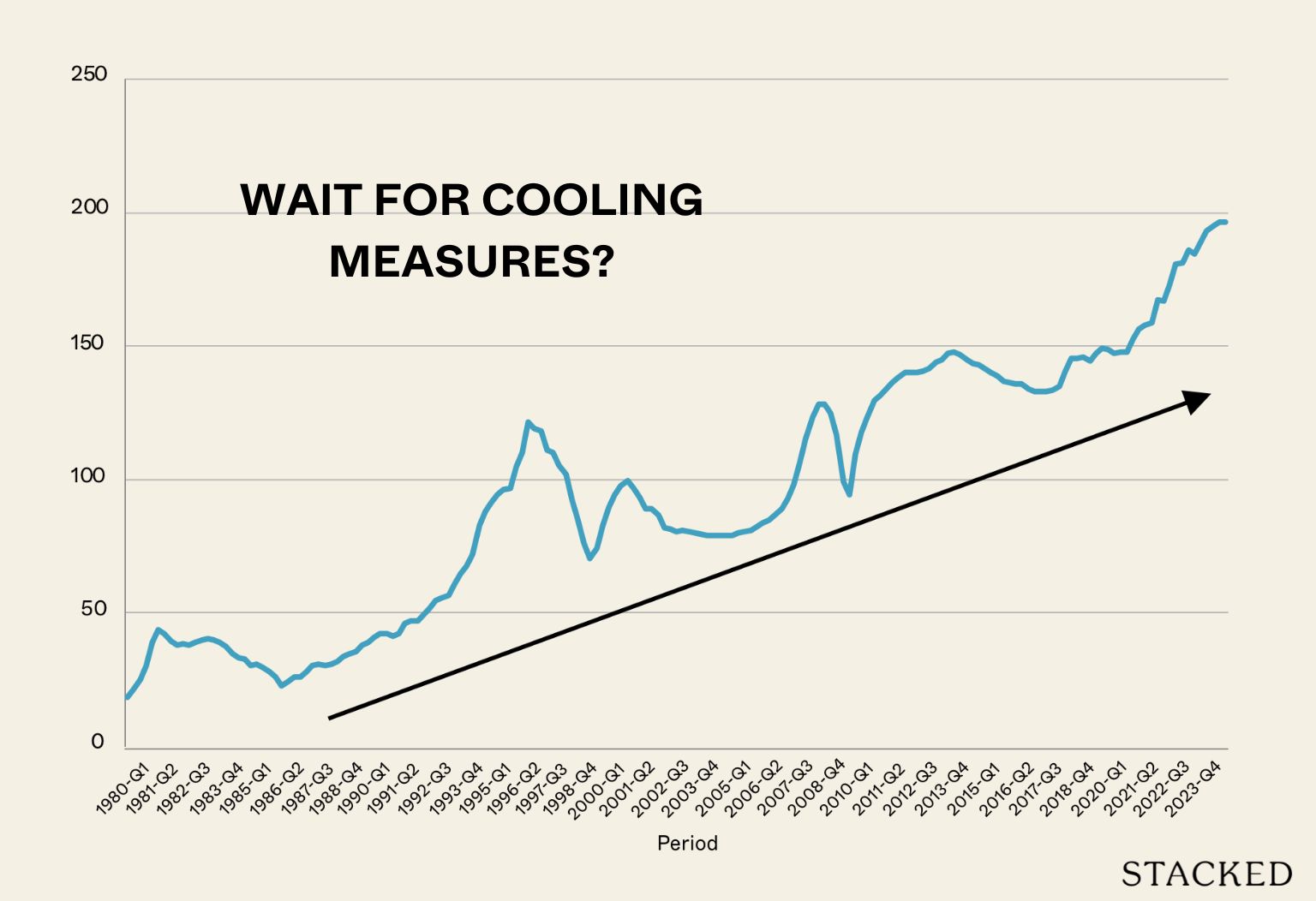

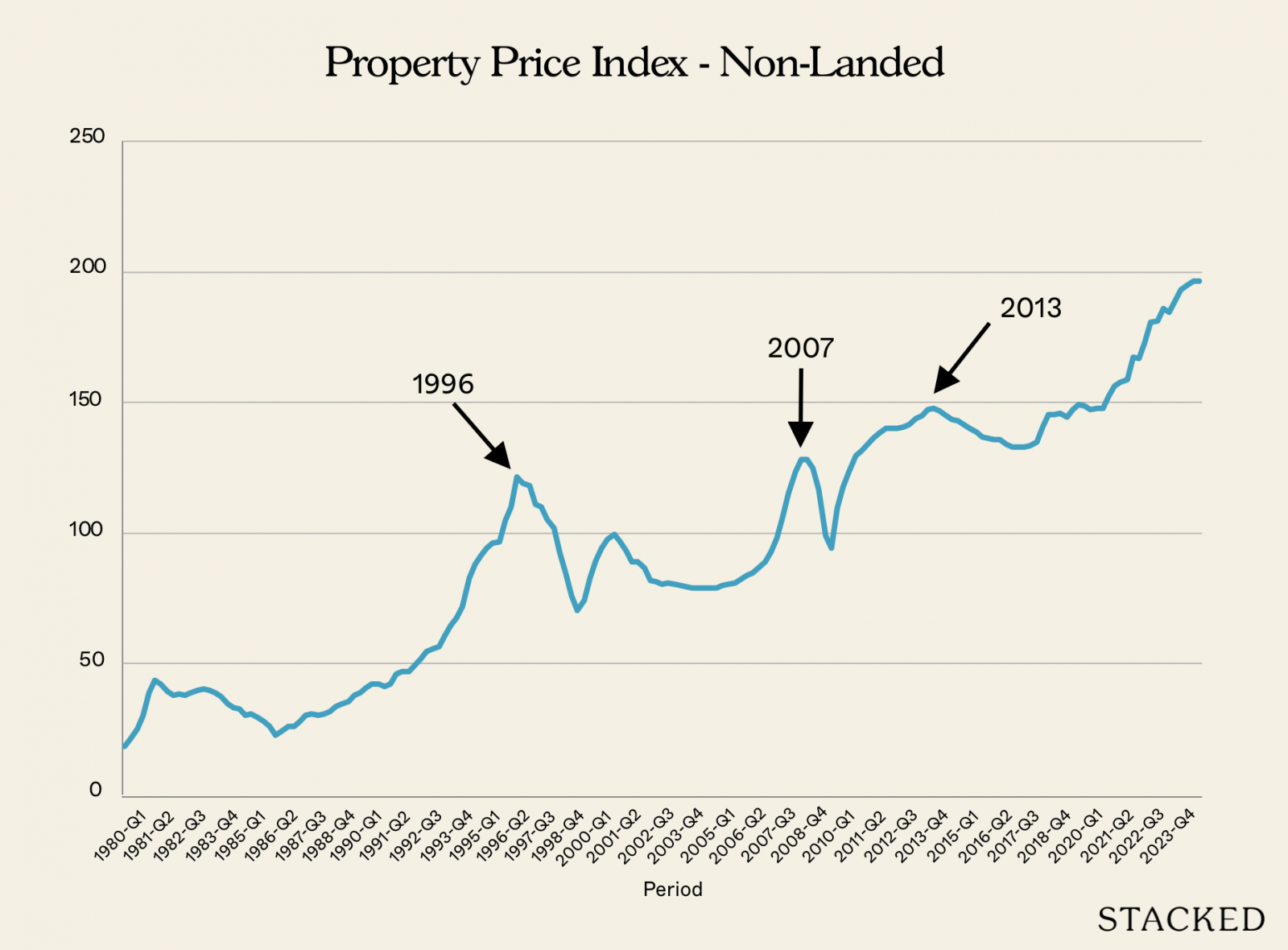

1. If you wait too long, prices can rise even higher than before

Historical trends show that each property peak in the Singapore market – most recently in 1996, 2007 and 2013 – tends to end higher than the last:

This means that when you wait-and-see, you’re engaging in a tricky attempt to time the market. Even if prices do dip after a new cooling measure, you don’t know where the bottom is. It can be quite painful to buy after a price dip, and then see it plummet even further; as would be the case with someone who bought Urban Vista in October 2013, only to see it decline even further by June 2014:

(Ps. It’s not that we’re trying to pick on Urban Vista, we’re just using this as an example because it was brought up!)

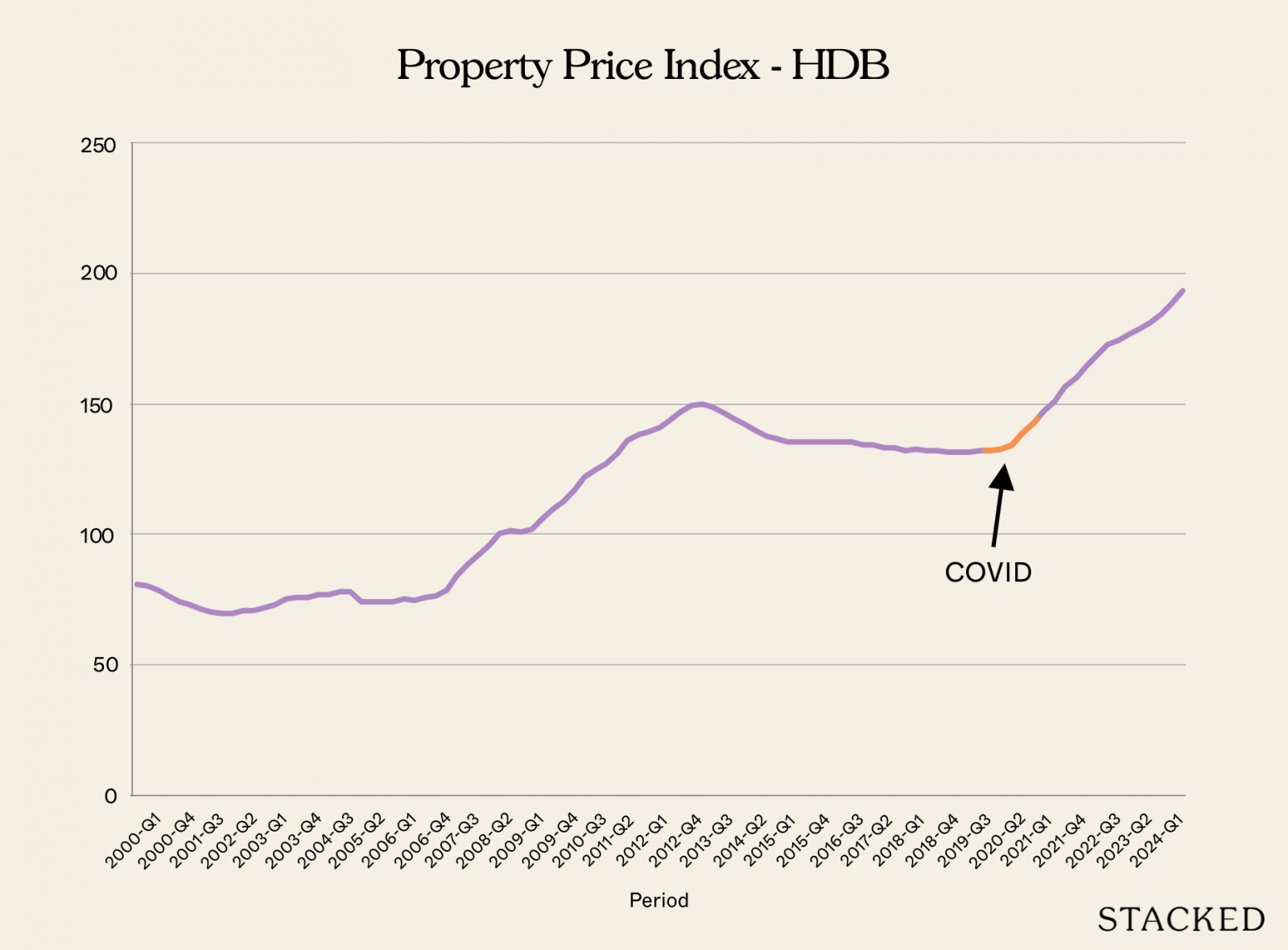

If you play a guessing game and try to find the bottom, you may miss it as the property market suddenly rushes to its next peak. To demonstrate how fast this can happen, consider the HDB resale market. After the implementation of the Mortgage Servicing Ratio (MSR) in 2013, HDB resale prices went into a tailspin until around the Covid era. Right after the pandemic, prices soared past even the 2013 peak, in the space of just around three years.

So it’s just a dicey proposition, to try and find the market bottom. If you miss the brief window of the downturn, you could end up paying even more than the last peak.

2. Cooling measures aren’t always the same and have different effects

The problem with waiting for potential cooling measures is that you don’t actually know what those measures are. Take, for instance, the April 2023 cooling measures. Those cooling measures imposed a substantial 60 per cent ABSD on foreigners.

But unless your intended purchase was a luxury condo in Orchard or some other prime area, you would likely have seen no benefit from this. Hiking taxes on foreigners has no real effect on, say, condos in Bedok or Jurong East.

August 2024 also saw a cooling measure, but this cooling measure reduced the maximum loan amounts of HDB loans. This move has no bearing on condos and doesn’t even affect those who have to use private bank loans anyway (bank loans already had a lower loan quantum.)

If you’re a regular Singaporean buyer looking at mass-market condos, you would likely regret having waited for these measures to hit. They did very little to lower mass-market condo prices, and you could even be paying more if you’ve been waiting since 2023.

More from Stacked

Will 1 Canberra, The Warren, Or A Small Freehold Condo In Potong Pasir Be A Better Choice For A Family Of 4?

Hi stacked homes,

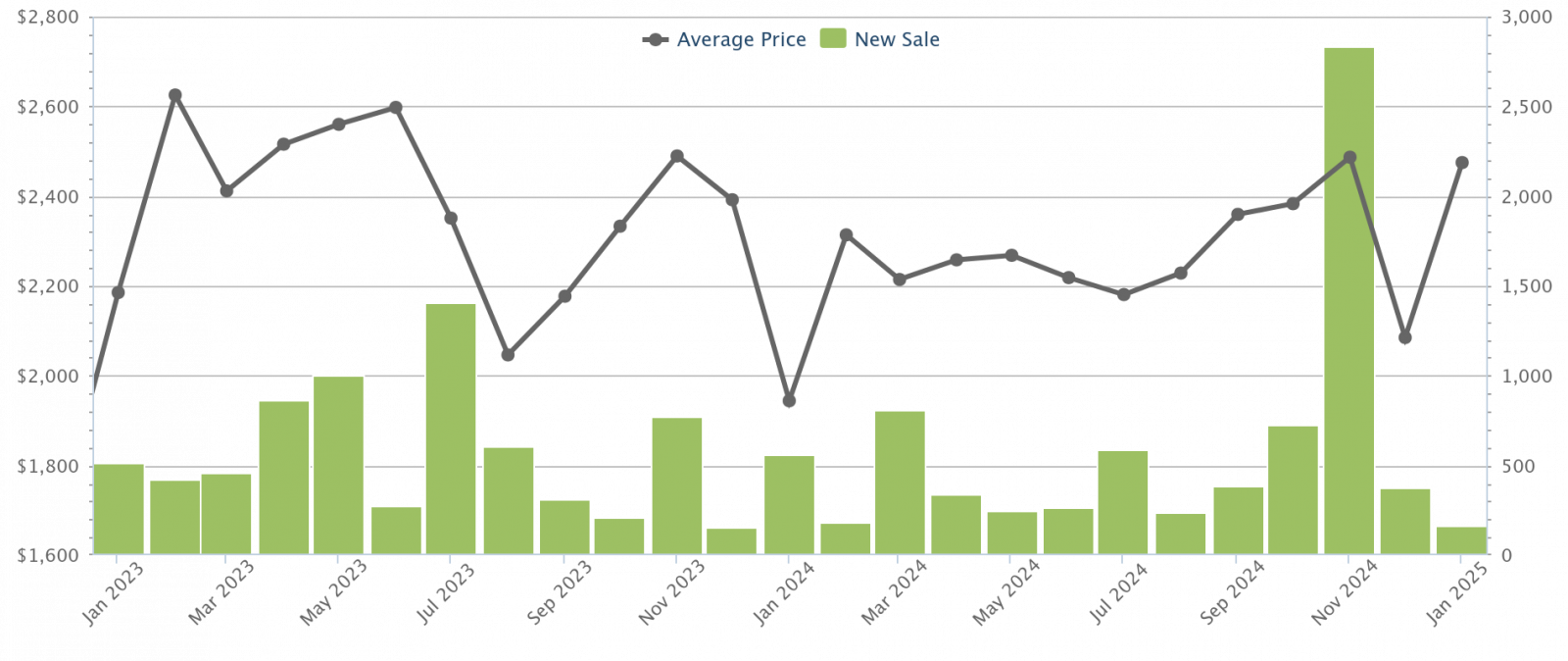

Average new launch prices were at $2,185 psf in January 2023, and are now at $2,475 psf in January 2025. So much for the last two cooling measures helping out the average buyer!

We’d also add that, even if a cooling measure exerts downward pressure on the market, that doesn’t necessarily mean prices will fall. It might just mean prices won’t rise as quickly. This may be especially true in the resale market, where measures like debt-servicing ratios and loan limitations have created patient and well-capitalised buyers. Few Singaporean property owners are truly in desperate need to sell, cooling measures or not.

3. Developers may not have room to go lower anyway

Developers have been tightly squeezed in the past few years, to the point where even GLS sites have seen lower competition. Consider that the land sold during the last en-bloc craze, which ended back in 2017, has all been redeveloped and sold now – and yet there’s still only lukewarm interest in replenishing land banks.

This already left us wondering about developer sustainability back in 2021, and our views haven’t changed much.

Whether or not cooling measures hit, we have little confidence that developers can lower prices further; the prices that you’re seeing now can’t get much lower given the land prices. This is compounded by the new GFA harmonisation rules, which prevent developers from charging for spaces such as air-con ledges. This further eats into developer margins, so they may not budge that much on price even with cooling measures.

4. The cooling measures might make you pay more

We don’t need to explain this one too much, right? If the cooling measures impose, say, a tax on all properties at $1 million or more (as a certain Business Times writer has mentioned), you’re going to end up paying more! We’ve never ever seen ABSD being lowered, so any such tax may end up being permanent.

Even non-tax-related moves, such as tighter loan curbs, could impact your ability to afford your desired property. That’s bound to make anyone regret having waited.

This said, we’re not suggesting you rush to buy because of cooling measures either

It’s best not to try and time the market at all.

Your decision whether to buy now or later should be based, first, on your financial situation. That is: your readiness to put down the initial payment, your ability to cope with the mortgage rates, your job security, etc. If your income isn’t stable, or the mortgage repayments would be a struggle, then it’s not a good time to buy: cooling measures don’t even factor into it.

These financial concerns should be the primary determinants of when you buy, not guesses over cooling measures.

In addition, when buying for home ownership, factors such as location, layout, amenities, and your personal connection to the area can’t always be replicated (that may be why people who grew up in the East never want to leave the East!) In the case of resale properties, each unit often has its distinct characteristics (e.g. orientation, view, renovations done by previous owners), and the chance of finding that exact match again may be slim. If you’ve already come across a property that checks all your boxes, holding out for potential market changes or waiting for further government measures could mean losing the opportunity altogether. We wouldn’t suggest risking the loss of all that, just in the hopes that government policies turn out in your favour.

If you have specific questions or want help scouting for property options that align with your situation, feel free to reach out to us at Stacked. We’re here to offer tailored advice, so you can make the best choice for you and your family.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why might waiting for property cooling measures in Singapore not lead to cheaper prices?

Can cooling measures in Singapore actually cause property prices to stay the same or increase?

Why is it risky to wait for property prices to fall after government cooling measures in Singapore?

How do different cooling measures in Singapore affect various types of property buyers?

Why might developers be unable to lower property prices even after cooling measures are introduced?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Pro This Popular 520-Unit Condo Sold 85% At Launch — Here’s What Happened To Prices After

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

0 Comments