Why I Look For Old Malls Before I Buy Property

February 25, 2024

I look for old, “run-down” malls when I shop around for property

The typical response I get to this is “siao ah, what’s so good about that.” But hear me out: old, strata-titled malls are a more valuable amenity than we give them credit for. I did point it out once in a previous article, but I don’t feel I’m overstating it: the older strata-titled malls are what makes some neighbourhoods work.

New malls, with land bought at today’s prices, are crazy expensive. They need a certain rental yield to justify their existence; and that means the businesses in a new mall need to generate a certain amount of revenue. Sure, the developers try to make provisions – usually something like a corner reserved for a small grocery store, or a food court to balance out the high-priced eateries; but it doesn’t last.

The food court usually ends up on Mothership for selling you cai png at $10 a plate, while the small shop spaces close up after a year or two, crushed under the weight of rental demands. And as for small boutiques or bespoke tailors, they either end up raising prices like crazy (which customers rarely accept), or they get replaced by a big chain.

Or look at the lifestyle stretch along Katong: Consider how The Flow (a relatively new construction) remained empty for so long, whilst Roxy Square nearby is an ageing but reliable venue for salons, enrichment schools, and an actually affordable and good coffee shop (complete with that wanton mee stall where the man will yell so loud, you can run out from the hair salon to get it when you hear it).

This isn’t just in the fringe areas as well. I know many of my friends living in the Orchard area, or nearby, who will tell you they frequent Lucky Plaza more often than some newer malls like Ion Orchard. Or Bras Basah Complex, home of the venerable Swee Lee Music and second-hand bookstores – amenities that might vanish if the Bras Basah/Bugis area were wholly replaced with newer malls.

*If you think tuition and enrichment mean big bucks by the way, I have to tell you the era of millionaire tutors is fading; and while some still exist, most are now condemned to miserably low margins and cutthroat bidding on GeBiz.

My point is, scout out the old malls, however run down they appear on the surface when surveying the amenities

If you set aside any prejudices, you may find that these old malls – which are often excluded from brochures or portals – actually provide some pretty viable and useful services. You may even find yourself going to these old malls more often than some newer ones.

Speaking of commercial properties, a shophouse is going up for sale at $38 million

Some of you may know this shophouse, which is famous for the Pig Organ Soup stall. It’s finally given up the ghost (the building, not the stall), with BCA deciding the kitchen wall might collapse.

More from Stacked

We Asked: Is The New PLH Model Fair? Here’s The Collated Response From 175 People

The PLH model is one of the biggest changes we’ve seen to the housing market, since the first cooling measures.

Along with the recent news of the $40.5 million coffee shop though, I wonder if our commercial property prices are strangling our food culture. I’m not sure, for instance, how much rental the new owner of this shophouse would expect; but at $38 million, it would certainly entail higher rental rates. I do hope we don’t end up losing another foodie joint though. But as a highlight of how crazy that coffee shop price is, consider this: the shophouse has THREE shop fronts and three storeys, and still sold for less than that coffee shop.

On the flip side, all these commercial property stories – coupled with rising ABSD rates on residential properties – might incline some investors to switch their sights to commercial (not as if that isn’t already happening). We’ll see as the year progresses.

Meanwhile in other property news…

- Check out Lentoria, a new launch within priority enrolment distance to CHIJ St. Nicholas

- Do you need a big freehold condo? Here are some of the cheaper options we could find as of 2024.

- On a similar note, here’s where you can find the cheapest 4-room flats right now, if you absolutely must go the resale route.

- We tried our best to resolve the question: Is a condo near a hospital good or not? And its impact on price.

Weekly Sales Roundup (05 February – 11 February)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| TERRA HILL | $8,050,000 | 3035 | $2,652 | FH |

| 19 NASSIM | $5,960,000 | 1733 | $3,439 | 99 yrs (2019) |

| THE RESERVE RESIDENCES | $4,047,263 | 1744 | $2,321 | 99 yrs (2021) |

| ONE BERNAM | $3,600,000 | 1421 | $2,534 | 99 yrs (2019) |

| ENCHANTE | $3,525,200 | 1281 | $2,752 | FH |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| HILLHAVEN | $1,399,950 | 678 | $2,064 | 99 yrs (2023) |

| THE MYST | $1,493,000 | 678 | $2,202 | 99 yrs (2023) |

| THE ARCADY AT BOON KENG | $1,809,000 | 667 | $2,711 | FH |

| THE CONTINUUM | $1,822,000 | 667 | $2,730 | FH |

| THE BOTANY AT DAIRY FARM | $1,880,000 | 926 | $2,031 | 99 yrs (2022) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE OCEANFRONT @ SENTOSA COVE | $8,100,000 | 4865 | $1,665 | 99 yrs (2005) |

| THE INTERLACE | $5,315,000 | 3972 | $1,338 | 99 yrs (2009) |

| AALTO | $5,000,000 | 1959 | $2,552 | FH |

| THE ARCADIA | $4,630,000 | 3714 | $1,247 | 99 yrs (1979) |

| THE LINCOLN RESIDENCES | $4,200,000 | 1981 | $2,121 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| LE REGAL | $572,000 | 366 | $1,563 | FH |

| STRATUM | $635,000 | 452 | $1,405 | 99 yrs (2012) |

| SUITES @ EUNOS | $670,000 | 366 | $1,831 | FH |

| THE LENOX | $706,000 | 431 | $1,640 | FH |

| VIBES @ EAST COAST | $728,000 | 420 | $1,734 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| BOONVIEW | $3,830,000 | 2368 | $1,617 | $2,570,000 | 20 Years |

| TIARA | $3,280,000 | 1346 | $2,438 | $2,080,000 | 23 Years |

| PEBBLE BAY | $3,750,000 | 2336 | $1,605 | $1,939,000 | 28 Years |

| THE OCEANFRONT @ SENTOSA COVE | $8,100,000 | 4865 | $1,665 | $1,700,000 | 7 Years |

| CLOVER BY THE PARK | $2,800,000 | 1733 | $1,616 | $1,605,260 | 15 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE ROCHESTER RESIDENCES | $1,545,000 | 1281 | $1,206 | -$274,020 | 16 Years |

| ROBIN SUITES | $1,030,000 | 441 | $2,334 | -$180,000 | 10 Years |

| EON SHENTON | $1,650,000 | 1195 | $1,381 | -$104,200 | 12 Years |

| SKYSUITES@ANSON | $1,500,000 | 700 | $2,144 | -$84,000 | 12 Years |

| ROBIN SUITES | $1,060,000 | 463 | $2,290 | -$40,000 | 8 Years |

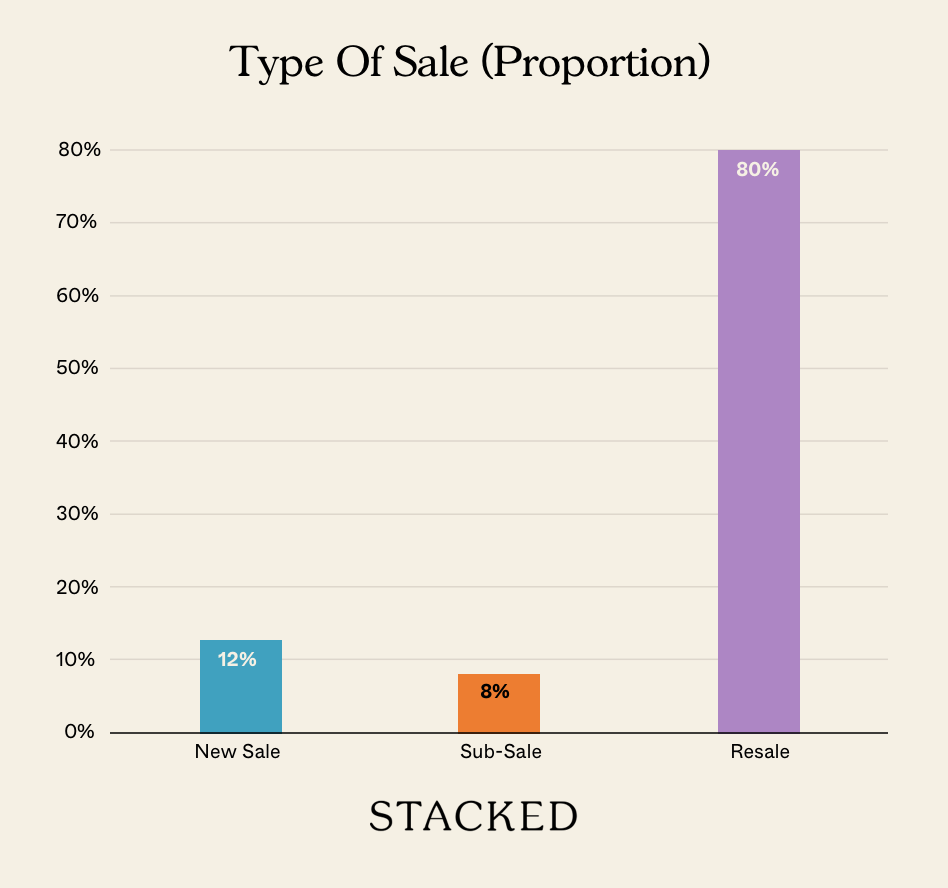

Transaction Breakdown

For more on the Singapore property market, and reviews of new and resale condos, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why should I consider old malls when looking for property investments?

Are older malls still useful despite appearing run-down?

How do old malls compare to new malls in terms of community value?

What is the significance of old malls in the context of property and commercial development?

Should I avoid investing in new malls due to high costs and rental pressures?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

Latest Posts

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

0 Comments