When Should You Consider Using A Home Equity Loan? Here Are 6 Reasons To Do So

April 13, 2021

You’ve seen the ads, or maybe had it suggested by a mortgage banker or two: take out a home equity loan, and you could be sitting on a six-digit pile of cash a few months later. Sounds too good to be true? It depends – home equity loans are one of the main advantages of owning a private property; but there are cases where it may not be entirely appropriate. Here’s how to decide whether it’s worth taking one:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Caveat:

In all matters of personal finance, always consult a professional – such as a wealth manager or financial planner – before deciding to take on significant loans. The following is meant to inform you of home equity loans as a financing tool only; get expert advice for the final word on whether it’s right for you.

What’s a home equity loan?

Sometimes called a cash-out, this is when you take out a loan that uses your property as collateral. The interest rate, just like a mortgage, tends to be lower as it’s a secured loan. But also like a mortgage, it does mean the bank can and will foreclose on your property, if you’re unable to make repayments.

The total amount you can borrow is usually up to 80 per cent of your current property value, minus any outstanding loan amount or CPF monies used.

For example, say you have a fully paid-up property worth $1.2 million, and you’ve used $500,000 from CPF. You might then be able to get a loan for up to $560,000; way more than you could from typical home loans, business loans, etc.

(The exact terms and conditions differ between each bank).

Note that you do have to meet the usual loan restrictions, such as the Total Debt Servicing Ratio (TDSR), to qualify. In addition, this sort of loan can only ever be used for private properties, never HDB properties.

In addition, home equity loans tend to have high administrative costs; these can go all the way up to $3,000.

Home equity loans versus other regular loans

| Home equity loans | Other unsecured loans | |

| Risk of foreclosure | Property can be taken by the lender if loan isn’t repaid | Usually no |

| Interest rates | Usually lower, can fall to as low as 1.3 per cent | Often six to nine per cent |

| Administrative costs | High, $2,000 to $3,000 | Usually a few hundred dollars |

| Application process | Complex and requires two to three months, as well as valuations of the property | Same-day approval for most personal loans |

| Loan quantum | Often up to 80 per cent of property value, minus outstanding loan amounts and CPF used | Total credit (across all unsecured loans) is currently capped at 12 months of income |

| Restrictions on use | Cannot be used to buy a second property | Usually none |

That’s a lot of money for very low interest; but when should you consider this?

Because a home equity loan uses your property as collateral, you should treat it as seriously as you would a regular mortgage. Some factors in which it could help are:

- You need to monetise your property in a bad market

- The property cannot be rented out for some reason

- Conversely, the rental income would more than cover loan repayments

- There’s been significant appreciation, but selling isn’t viable

- It provides a way to pay off other, higher interest loans

- The loan priority is not urgent

1. You need to monetise your property in a bad market

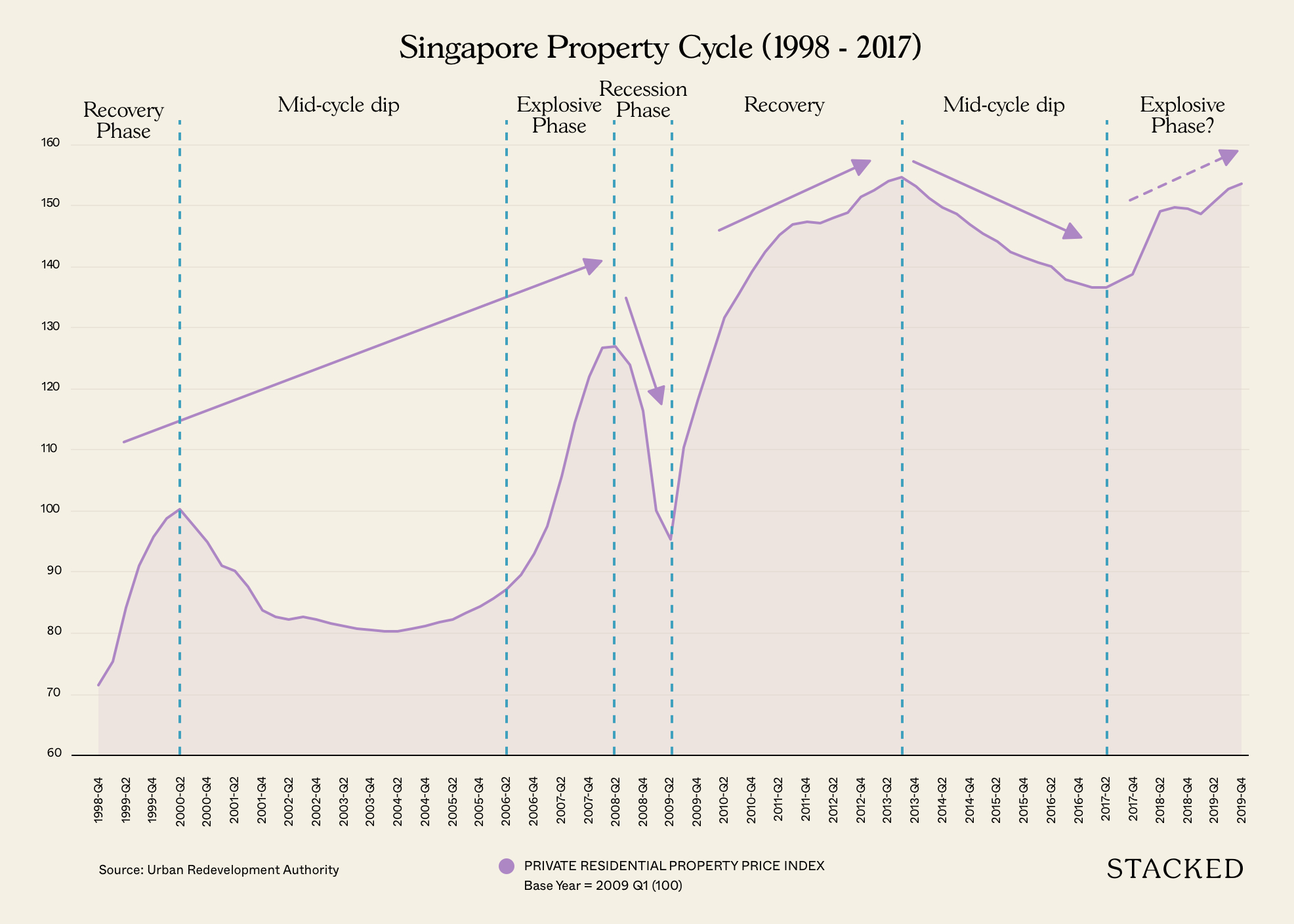

The property market goes through constant up and down cycles, be it from wider economic circumstances or government policy. Sometimes, you could be in a situation where you need money from the property, but a down-cycle means selling at a loss.

For example, if you had bought a home during the property peak in 2013, the next five years would have been a bad time to sell:

It could have been only until July 2018, before home prices recovered to 2013 levels. If you had needed cash during this five-year period, and sold at the time, it might have been at a loss.

So as an alternative, some homeowners took out home equity loans. This allowed them to unlock the value of the property, without having to sell it during the downturn. It also spared them the need to use higher interest loans, such as personal loans.

2. The property cannot be rented out for some reason

The common example of this is when the property is also your primary residence. It may be too small, or your family is too uncomfortable, to rent out rooms to strangers. Even if the property is a second home, there are cases where other family members use it as a residence (e.g., you have elderly parents who need to live there).

This can sometimes turn a property into a liability – it locks up capital, requires tax and maintenance payments, and cannot be monetised. A home equity loan can provide a workaround: you can continue to use the property, while still getting a lump sum out of it.

For some investors, the opposite scenario also applies:

3. Conversely, the rental income would more than cover loan repayments

Consider a home equity loan at one per cent interest, for just 50 per cent of the value of a $1 million condo. Over a 15-year loan tenure, at two per cent per annum, this would come to a monthly repayment of around $3,200.

If you’re already getting $3,400 a month from rental income, this would cover the home equity loan repayments while still giving you $500,000 to re-invest elsewhere. Depending on how your portfolio is structured, this may be more beneficial than just collecting rental income alone.

However, be careful not to assume the rental income will always cover the loan; there may be vacancies, and the rental market can experience down periods too. Consult with a financial planner to determine if this is an appropriate risk.

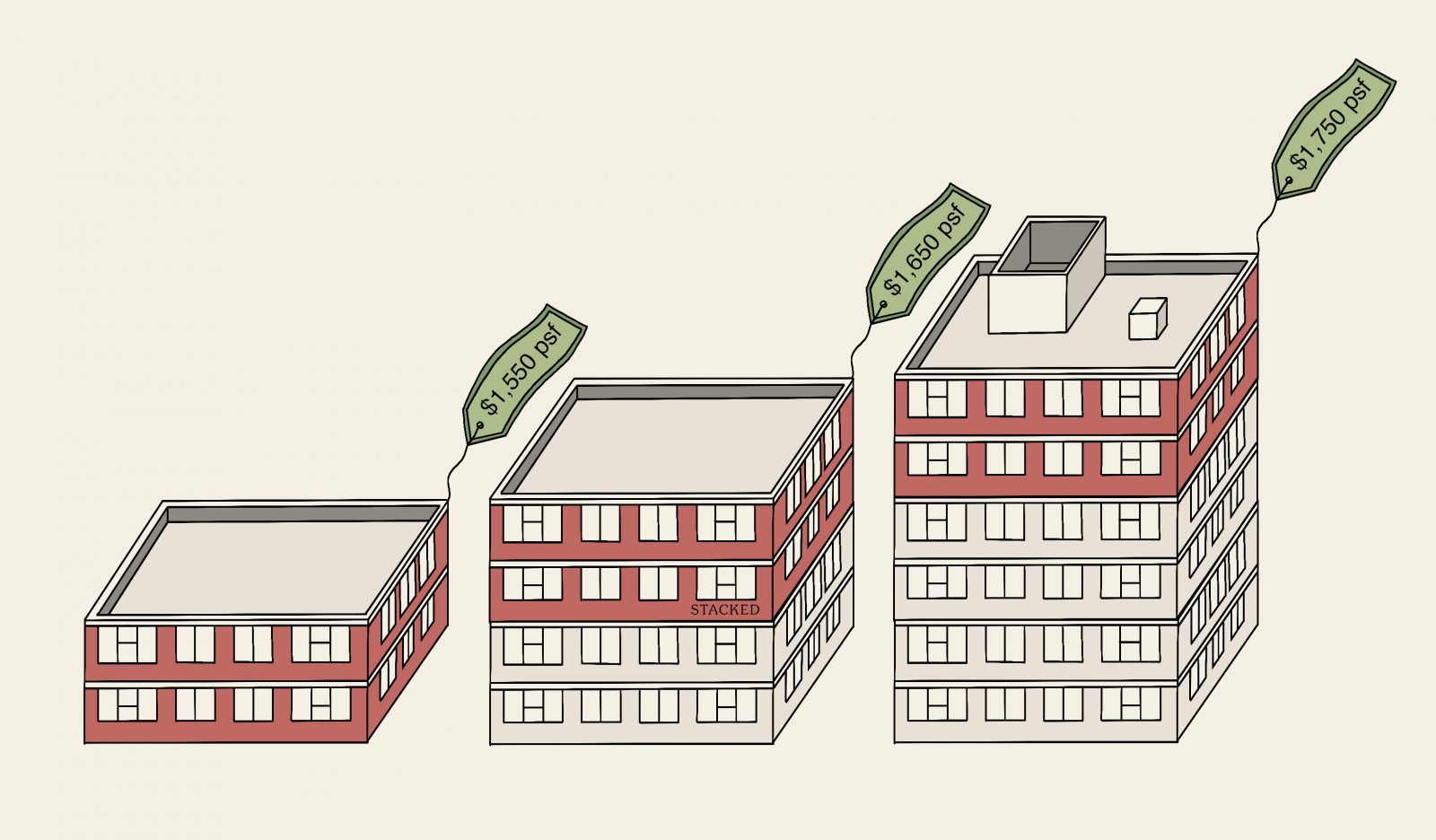

4. There’s been significant appreciation, but selling isn’t viable

Remember that a home equity loan amount is based on the current valuation of your property, not its initial purchase price.

For example, say you bought a property for $600,000 back in the late 1980’s. Today, it has appreciated to $1.2 million. A home equity loan of 80 per cent would come to $960,000 – way more than even the original purchase price.

However, it may not be viable to sell the property. This can result in a frustrating situation, where you have accumulated value that can’t go toward retirement funds, paying off existing debts, etc.

Home equity loans might be a viable tool in these scenarios. Again though, consult a financial expert on whether it works for your overall investment strategy.

5. It provides a way to pay off other, higher interest loans

Say you have a fully paid-off property, but you still have outstanding personal loans, credit card debt, business loans, etc.

You cannot sell the property to pay off these debts, and almost all the rental income is absorbed by them (personal loans often range from six to nine per cent interest, credit cards reach around 25 per cent).

One potential avenue is to take a home equity loan to pay off all the high-interest debts, leaving you with just a single loan at one to 1.3 per cent. This can save you a significant amount in interest repayments, over the long term.

Do note that this method is not appropriate to everyone. You run the risk of losing your home as it’s being used as collateral; so it may be worth bearing with the higher interest rates. This is a personal finance issue that you should discuss with a professional.

6. The loan priority is not urgent

Home equity loans will never work for urgent cases. It can take two to three months from application to disbursement. Application is also an involved process, and requires a valuation of your property (which you may have to pay for, it’s about $500 to $700).

In addition, home equity loans don’t have widely advertised interest rates, so it’s hard to know whether you’re getting the cheapest deal. Couple that with the fact that different banks will accept different valuations, and you have a time-consuming process on your hands.

So if you intend to use a home equity loan for a big move, such as funding overseas education, starting your own business, etc., we suggest you start making enquiries far ahead of time.

Can you use a home equity loan to buy more properties?

You’re not supposed to, and the lender will usually make this clear to you.

We’re aware there are investors who attempt to circumvent this – such as by using the home equity loan to buy stocks, and then liquidating the stocks to purchase a property. As we’re not legal experts, we can’t offer advice on the finer points of this; but do note that such borrowers can get into serious trouble, and lenders can take legal action.

Whether or not someone gets away with this, it is a dangerous and inadvisable move: it’s effectively taking on two property loans.

Finally, it’s best to take a home equity loan only on a second property, or paid-off property.

If the property is your only home, it’s better not to risk it with this form of financing. A slightly higher interest rate (from other loan options) is not as bad as running the risk of losing your property.

A home equity loan is also best for a property that’s already fully paid-off. You can only take a home equity loan from the same bank that gave you the mortgage, and this can prevent you from refinancing later – even if the interest rate from this particular bank rises.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

0 Comments