When Is The Best Time To Sell Your House In Singapore?

December 27, 2023

This is one of the most common questions we get asked; and often one of the most impossible to answer accurately. That’s because everyone’s home ownership or investment situation is unique, outside market conditions. But since everyone asks all the time, let’s try to cover the general principles on when it’s “best” to sell, in any kind of property market situation:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Getting some vague general answers out of the way

Every property agent, since around the 1990s, has been saying the best time to sell is during the middle of the year (second and third quarter). We don’t know when, during the past 30 years, this became an accepted truth – nor can we vouch for its accuracy. It is, however, the answer many realtors have been trained or taught to deliver.

On the surface it makes sense: this is because most people don’t like to move during the festive season, which begins at year-end. They also don’t like to move house until after Chinese New Year. These are observable patterns, and hence the general advice is to sell sometime in the middle of the year (and not during the Hungry Ghost Season).

But again, these are just accepted truths that have been around for decades, rather than the subject of any actual (recent) studies. It’s entirely plausible that some, or perhaps even many, sellers have realised solid gains despite selling near Christmas or New Year.

Now that’s said, we can move on to answers with a bit more clarity:

First, you need a specific definition of what “best time” means

What does one mean by “the best time” to sell a house? Answers like “when it makes more money” are too vague to be useful. Rather, most property investors define very specific targets, such as:

- Once the property has appreciated to a certain amount (e.g., planning to sell once you realise returns of X percentage, or a net profit of $X)

- Selling for a specific amount at a specific time (e.g., aiming to sell within a 10-year period, for a given return)

- Liquidating a property once rental yields or vacancies have reached a predetermined point, to cut further losses

Coming up with the above numbers requires holistic financial planning. For example, when determining how much the property must appreciate before selling, the target amount may be influenced by other financial concerns like retirement goals, estate planning, selling to reinvest in another asset or business, etc.

This could mean sitting down with a financial professional of your choice, to work out the numbers. If you don’t have quantifiable goals for your property asset, it’s impossible to determine the “best time” to sell.

(Unless you want to go on gut instinct and sell when you “feel” the market is at a peak, but that’s really closer to playing Jackpot than it is investing).

With that in mind, here are the other considerations for timing your sale:

1. Selling considerations, if targeted gains can be realised

This applies to both resale and sub-sale sales, if you are looking from an investment standpoint.

This is somewhat easier for resale condos, as you have your rental income to consider, as well as the potential appreciation based on recent transactions (if you have enough relevant, frequent transactions).

By mapping out the trend in appreciation, you can make an informed decision about whether the project has reached its maximum value. If the appreciation rate has slowed down or is lagging behind other developments, it’s important to evaluate whether there’s potential for further growth. If not, it might be more beneficial to consider investing in a different development.

As for sub-sales, these are transactions which occur before your property is built (prior to the Temporary Occupancy Permit, or TOP). It could make sense to agree to a sub-sale offer, if the returns realised would already reach the targeted returns (or perhaps come very close to the targeted returns, in a much quicker time).

For example, say you’re aiming for a return of around 20 per cent on your condo, over the next five years. You bought a unit at Treasure at Tampines, in its earliest phase:

You bought at $1,335 psf in 2019, but by 2022, the price has risen to $1,584 psf. Someone offers to buy your unit at this price.

This is up 18 per cent, close to your predetermined target of 20 per cent. Given that this has happened in three short years, instead of five, it may be viable to recognise your gains and do the sub-sale.

Also bear in mind that, because of the Progressive Payment Scheme (PPS), you may not have been paying the full loan repayment yet, which may improve your net returns.

Mind you, agreeing to a sub-sale does mean another long wait for a condo, so certain other logistics factor into it. For example, if you’re renting and the rate is increasing, it may not be wise to make the sale.

2. Ability to bridge the gap to another desired property

Let’s say your goal is to upgrade from a 4-room flat to a condo. It’s often wise to sell and make the move, while you’re certain you have enough.

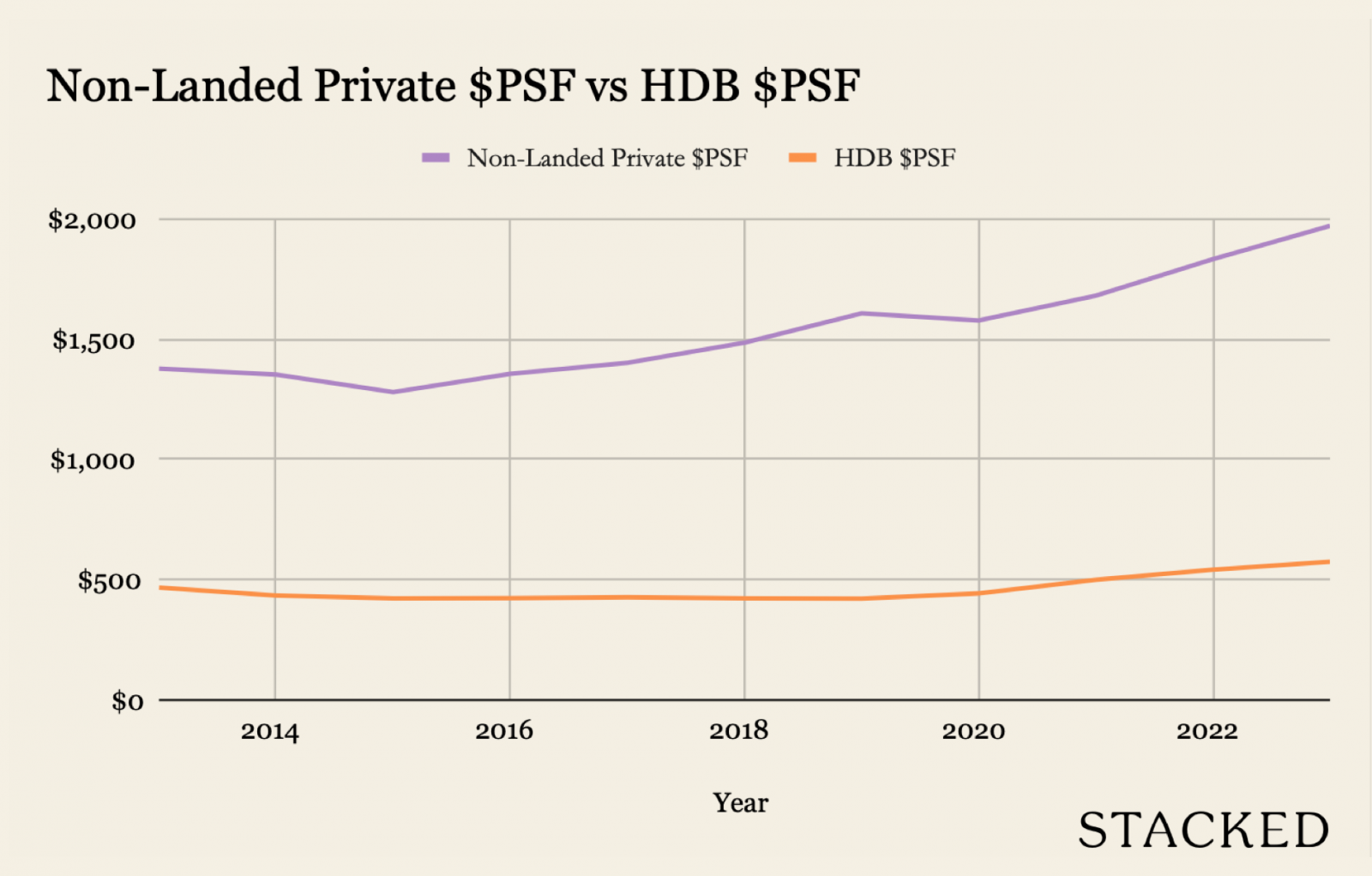

Property prices tend to go up over time, and private property prices often appreciate faster than HDB prices:

Because of this, waiting longer to “make more money” could result in the opposite happening.

It’s best to:

- Work out your remaining sale proceeds after settling the outstanding loan, and refunding your CPF

- Ensure you have sufficient funds for the down payment (the first five per cent is in cash, and don’t forget stamp duties)

- Keep to a loan repayment that’s 30 per cent of your combined income or under, at a floor rate of four per cent

If you can’t meet those levels, it’s not the best time to sell; regardless of market conditions.

We’ve met many people who have sold their property because prices were good, only to realise that they have sold high, but have to buy high as well. So do your homework, before deciding to take that offer.

3. Response to government policy changes

Cooling measures can cause buyers to back off, and take a wait-and-see approach. This can mean the occasional downturn in prices, which manifests over the next few months. We last saw this with the April 2023 cooling measures:

Overall private home prices dipped from an average of $1,991 psf in April to $1,802 psf in December (but note that December is still two weeks from ending, at the time we write this).

The market does eventually pick up again, and even tends to surpass the last peak before the previous set of cooling measures; but there tends to be a lull period in between. For some sellers, they may see this dip as an opportunity to swap out to another property. Otherwise, the next best time to sell may be after the market adapts to cooling measures.

While you don’t know when cooling measures may happen, you can still plan your response to it. For example, some investors make contingency plans, such as being ready to stretch their holding period by another two to three years, if cooling measures happen.

A realtor can help you to plan ahead this way, so you don’t succumb to stressful emotional reactions when the hammer lands.

4. Amount of competing listings and surroundings

This is where a property agent’s advice really comes in handy. There may be brief periods when your particular project is swamped with listings – such as an EC in the fifth year (when it first comes out of the Minimum Occupancy Period).

Paradoxically, that can be both the best and worst time to sell. It’s the best because demand for five-year old ECs is high, but it’s the worst because every other owner has the same plan to sell.

This will come down to detailed timing: you want to be slightly ahead or behind the rush of listings; and you especially don’t want to be in the very thick of it, listing when the unit right next to you (or one floor up or down) is currently on the market.

You’d also want to know early on if a unit has been sold (that hasn’t appeared on the URA records yet). Especially for new launches, the first recorded price for the unit will affect the rest. As such, sometimes it may make sense to put your unit up for sale only after the first few have sold (assuming that they achieve good prices).

Likewise, you’d want to be aware of the competition surrounding you that a buyer would typically be looking at. For example, if a new launch has just recently been completed next door – this could be a positive or negative point depending on the pricing. If priced well, agents would want to swing their buyers over, which may not be the best time for you to sell.

This is an issue that needs a sit-down planning session with a qualified agent; especially if your listing is on a major portal site, where you’re not able to control it anyway.

(The two biggest portal sites in Singapore require you to have a CEA license to list on them.)

The ultimate principle boils down to this:

The best time to sell depends on your quantified investment goals, and your personal financial situation. These factors, more so than market fluctuations, govern when the “best time” to sell would be. Even if you believe in the sorcerous powers of technical analysis and chart-gazing, this fact remains pertinent.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is the best time of year to sell a house in Singapore?

How do I determine the right time to sell my property in Singapore?

Should I sell my property before or after government cooling measures in Singapore?

Is it better to sell my property when there are many listings around me?

What factors should I consider before selling my property in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Trends

Property Trends The Room That Changed the Most in Singapore Homes: What Happened to Our Kitchens?

Property Trends Condo vs HDB: The Estates With the Smallest (and Widest) Price Gaps

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

Property Trends Should You Wait For The Property Market To Dip? Here’s What Past Price Crashes In Singapore Show

Latest Posts

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Pro Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

On The Market A Rare Pair Of Conserved Shophouses In Chinatown Just Hit The Market For $32.5M

0 Comments