What Is The Impact Of The Upgrades To Bayshore?

December 3, 2023

Well, there goes the seaview.

For decades, the residents in the Bayshore Road cluster (three condos: Costa Del Sol, Bayshore Road, and Bayshore Park) have tolerated poor public transport access, and limited amenities, in exchange for one of Singapore’s best sea views. But with the Long Island Plan underway, these residents are going to lose their beloved seafront views, with all the ships lining up along the coast.

To make it even worse, the Long Island project will likely close large swathes of East Coast Beach; so one of the main selling points of condos like Costa Del Sol (underground beach access) will be diminished; at least for a number of years. This is the loss of a major amenity, if it means that the BBQ pits, biking trails, fishing piers, and the nearby food village are all shut down.

But there’s some compensation: Bayshore is going to house a new HDB enclave, with MRT stations, shopping, and so forth. And the new MRT station, which should be running by next year, is already visible. These flats are even Plus model flats; and these developments will fix long standing issues of inaccessibility, and sparse amenities.

This has resulted in two conflicting views:

The first is that condos around Bayshore are going to fare badly: they’re losing their view, and the former peace and quiet will be shattered by dense housing blocks and bus malls.

The second is that condos around Bayshore should be celebrating, because the emergence of the MRT station – along with new amenities – will cause values to skyrocket.

Which is correct? I have to admit, it has me stumped. This is like downing sleeping pills with Red Bull; I don’t know which of the two forces are going to win out. But one thing’s for sure: the vibe of the entire Bayshore area is going to change. We may see a transition from the current “quiet resort” environment, to an emergent hub – perhaps comparable to Paya Lebar or Tampines, in the earlier stages of their upgrading.

Incidentally, if you’re wondering why I don’t just call up the price data and check, it’s because that’s of no real use right now. Practically every project saw good appreciation in the post-Covid period, especially older condos with bigger units; so while prices have gone up for all three Bayshore Road condos, there’s no way to tell how much of it is due (or not due) to the new enclave.

It also goes to show that, in the long run, even knowing the Master Plan has limited benefits

There were no large residential plots near the Bayshore condos at the time they were built; everything in the area was low-density, all the way up to the Bedok South area. The nearby Lucky Heights estate was – and still is – all landed housing.

More from Stacked

5 Property Types That May Be Most Affected By The New Cooling Measures

We previously looked at how various buyers and sellers are affected by cooling measures; but what about property types? Will…

Costa Del Sol and Bayshore Park were pushed right up against the coast; building anything else would require it to be underwater. So who could foresee that, at some point during the 99-year lease, Singapore would build an entire island to block the seaview? Or that an HDB enclave would literally spring up out of nowhere?

And as an interesting aside, some residents of Bayshore and Bayshore Park have gone through this before: when Costa Del Sol became the newest condo on the block, many decades back, some units at these two older properties also had their seaview impeded And in these cases, the owners also wouldn’t have seen it coming, as Costa Del Sol’s land parcel wasn’t visible on the Master Plan to them – at least not at the time.

In the end, we can study the Master Plan as much as we like; but over periods of five or more years, it’s still a case of “anything goes.”

Meanwhile, in other property news…

- The RTS link is bringing Johor properties back into the spotlight. Check out what’s going on.

- Three upcoming resale ECs to consider in 2024. Remember, there’s no upfront ABSD if you’re upgrading, and no more MOP.

- Leasehold condos on freehold land: a sneaky issue that will absolutely get you, when it comes to en-bloc prospects.

- Check out Lentor Green and Lentor Grove, one of the few landed enclaves where homes at $3.6 million or below are still possible.

Weekly Sales Roundup (20 November – 26 November)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| WATTEN HOUSE | $14,496,000 | 4080 | $3,545 | FH |

| MIDTOWN MODERN | $6,537,000 | 1808 | $3,615 | 99 yrs (2019) |

| THE CONTINUUM | $5,746,000 | 1905 | $3,016 | FH |

| 19 NASSIM | $4,939,050 | 1410 | $3,503 | 99 yrs (2019) |

| THE RESERVE RESIDENCES | $3,762,586 | 1625 | $2,315 | 99 yrs (2021) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE ARDEN | $1,220,000 | 657 | $1,858 | 99 yrs (2023) |

| ORCHARD SOPHIA | $1,285,000 | 463 | $2,776 | FH |

| PINETREE HILL | $1,316,700 | 538 | $2,446 | 99 yrs (2022) |

| THE LAKEGARDEN RESIDENCES | $1,328,000 | 592 | $2,243 | 99 yrs (2023) |

| GRAND DUNMAN | $1,385,000 | 549 | $2,523 | 99 yrs (2022) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| 8 NAPIER | $6,700,000 | 2013 | $3,329 | FH |

| THE SOVEREIGN | $6,500,000 | 2637 | $2,465 | FH |

| PEBBLE BAY | $5,100,000 | 2626 | $1,942 | 99 yrs (1994) |

| AALTO | $3,820,000 | 1528 | $2,499 | FH |

| DUET | $3,680,000 | 1744 | $2,110 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| SUITES@BRADDELL | $650,000 | 398 | $1,632 | FH |

| SUITES @ SIMS | $655,000 | 355 | $1,844 | FH |

| PARC ROSEWOOD | $662,672 | 431 | $1,539 | 99 yrs (2011) |

| JOOL SUITES | $725,000 | 409 | $1,772 | FH |

| LAVERNE’S LOFT | $740,000 | 474 | $1,562 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE SOVEREIGN | $6,500,000 | 2637 | $2,465 | $3,000,000 | 13 Years |

| DUET | $3,680,000 | 1744 | $2,110 | $2,319,000 | 19 Years |

| AMARANDA GARDENS | $2,508,000 | 1259 | $1,991 | $1,676,000 | 22 Years |

| ROBERTSON 100 | $2,638,888 | 1152 | $2,291 | $1,569,688 | 19 Years |

| HUME PARK II | $2,450,000 | 1475 | $1,661 | $1,560,000 | 25 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE VERMONT ON CAIRNHILL | $2,300,000 | 915 | $2,514 | -$200,000 | 11 Years |

| LUMIERE | $985,000 | 635 | $1,551 | -$175,000 | 13 Years |

| THE ROCHESTER RESIDENCES | $1,300,000 | 1023 | $1,271 | -$50,360 | 15 Years |

| D’LEEDON | $1,308,000 | 635 | $2,060 | $6,600 | 11 Years |

| SIXTEEN35 RESIDENCES | $1,000,000 | 667 | $1,498 | $12,000 | 5 Years |

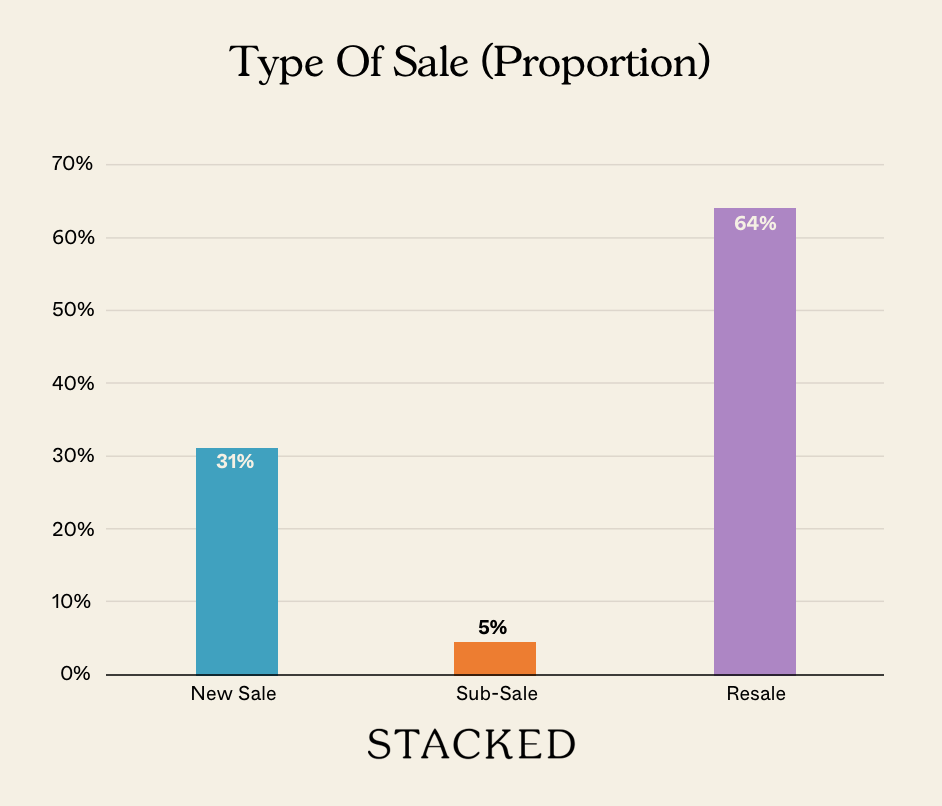

Transaction Breakdown

Follow us on Stacked for updates on the Singapore property market, as well as reviws of new and resale properties alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How will the Bayshore upgrades affect the sea view for residents?

What amenities are expected to change with the Bayshore upgrades?

Will property values in Bayshore increase or decrease after the upgrades?

What new developments are being introduced to Bayshore as part of the upgrade?

How might the Bayshore upgrades change the area's atmosphere?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Singapore Property News The Most Expensive Resale Flat Just Sold for $1.7M in Queenstown — Is There No Limit to What Buyers Will Pay?

Latest Posts

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

On The Market Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

0 Comments