We Own An EC In Punggol That Has Appreciated: Should We Sell To Buy A Resale Condo Or New Launch?

October 13, 2023

Hi There,

Been an avid reader of your condo reviews and condo analysis article. Love the No BS data driven, fact based approach. You guys have been my go-to source for knowledge on real estate investing.

Am in an interesting juncture for the property I am currently living in and am in a dilemma on what to do next. Greatly appreciate your advice.

Context:

- Currently own a 3 bedder unit over at Waterbay EC, with a family of 3 (wife and young child)

- Purchased the property at a decent entry price in 2020 and thankfully the property has appreciated over the last 3 years.

- As the property clears its Seller Stamp Duty holding period, I am considering what to do next.

Objective:

My key objective, would be the following

- find another property that could provide a better capital appreciation potential

- And ideally move closer to my son’s future primary school in the Bishan area (but this is not mandatory, first objective remain priority, have got logistic arrangement in place)

Options:

Am pondering over the following options

- Option 1: Stay status quo – hoping that the current property continue to appreciate further with the realization of Punggol digital district

- Option 2: Sell and purchase a resale property – ideally selecting a resale property with better capital appreciation potential in the next 3 to 5 years (family of 3)

- Option 3: Sell and purchase a new launch, and rent for 3 years – this options is conceived with the consideration of new launch providing better capital gain over 3 year holding period, with saving on interest expense, renovation expense, vs the option of buying resale in option 2. Noted that rental expense over (4,500 x 12 x 3) will be incurred over 3 years

Concerns:

- My concerns over option 2 would be purchasing a resale property with little growth, i.e price appreciation, or would require a long holding period of greater than 5 years to realize reasonable capital gain. This will result in me being stuck with a larger mortgage payment that eats into monthly cashflow while not achieving my objective of attaining greater capital gain

- My concern over option 3, would be the cost of paying rental for 3 years eats into the profit or worst case the new launch did not appreciate much, resulting in a sunk cost incurred for rental over 3 years

Be great to hear what you guys think ?

Appreciate if you can keep name anonymous as promised

Thanks !

Editor’s Note: Financial details and personal information were removed for privacy reasons.

Hi there,

Thanks for writing in and we’re glad our content has been useful for you.

Like many investments, accurately predicting its growth rate can be challenging. While we can analyse historical data as a reference point, the specific investment may not necessarily mirror the same trajectory. Plus given the shorter time frame that you have, it does make it harder to guarantee whether or not another property will offer superior returns. But before delving deeper into that topic, let’s begin by assessing your financial capacity and evaluating the performance of Waterbay.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Affordability

Selling

Here are some of the recent transactions in Waterbay.

| Date | Size (sqft) | Price | Level |

| Jul 2023 | 1,098 | $1,320,000 | #04 |

| Jun 2023 | 1,098 | $1,440,000 | #08 |

| Mar 2023 | 1,098 | $1,368,000 | #11 |

To be conservative, we will assume your unit is of a smaller size at 1,098 sq ft.

From January till date, there have been 3 transactions with an average price of $1,376,000. For our calculation, we will assume this to be the selling price.

| Description | Amount |

| Selling price | $1,376,000 |

| Outstanding loan | $533,424 |

| CPF used plus accrued interest | $221,796 |

| Estimated cash proceeds | $620,780 |

Buying

Since you’ve only provided your wife’s details, we are assuming that after selling this current property, the next one will also be bought solely under her name.

| Description | Amount |

| Maximum loan based on age of 35 with a fixed month income of $8K, at an interest rate of 4.6% | $858,295 |

| CPF funds | $221,796 |

| Cash ($118,298 + $620,780) | $739,078 |

| Total loan + CPF + cash | $1,819,169 |

| BSD based on $1,819,169 | $60,558 |

| Estimated affordability | $1,758,611 |

Now let’s look at how Waterbay has been performing.

Performance of Waterbay EC

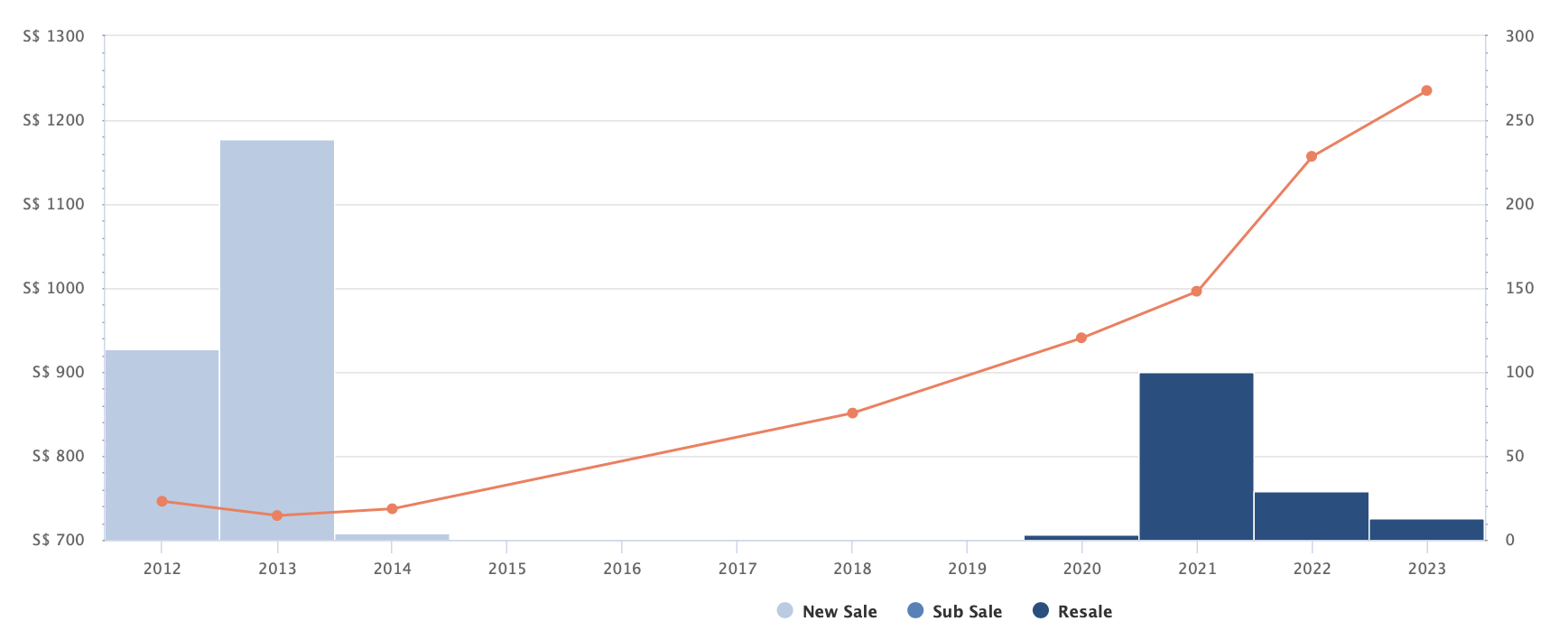

Given that the project was completed in 2016 and met its Minimum Occupation Period (MOP) in 2021, there isn’t a whole lot of data to reference from.

| Year | Avg PSF (resale) | YoY |

| 2021 | $996 | – |

| 2022 | $1,157 | 16.16% |

| 2023 | $1,235 | 6.74% |

| Annualised | – | 11.35% |

Regardless, the project was launched in 2012 with the majority of units sold in 2013, during a period when several rounds of cooling measures were introduced. As such, it’s possible that the developers adopted a more cautious pricing strategy.

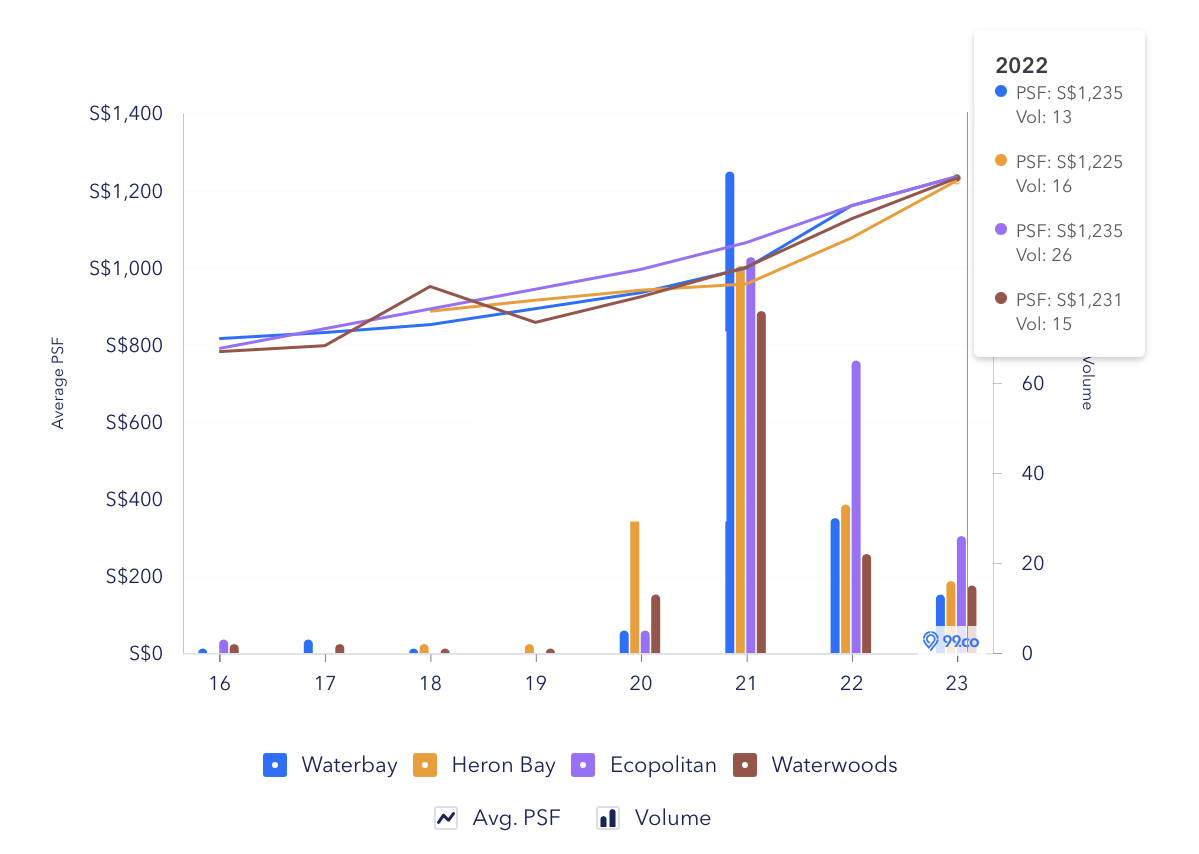

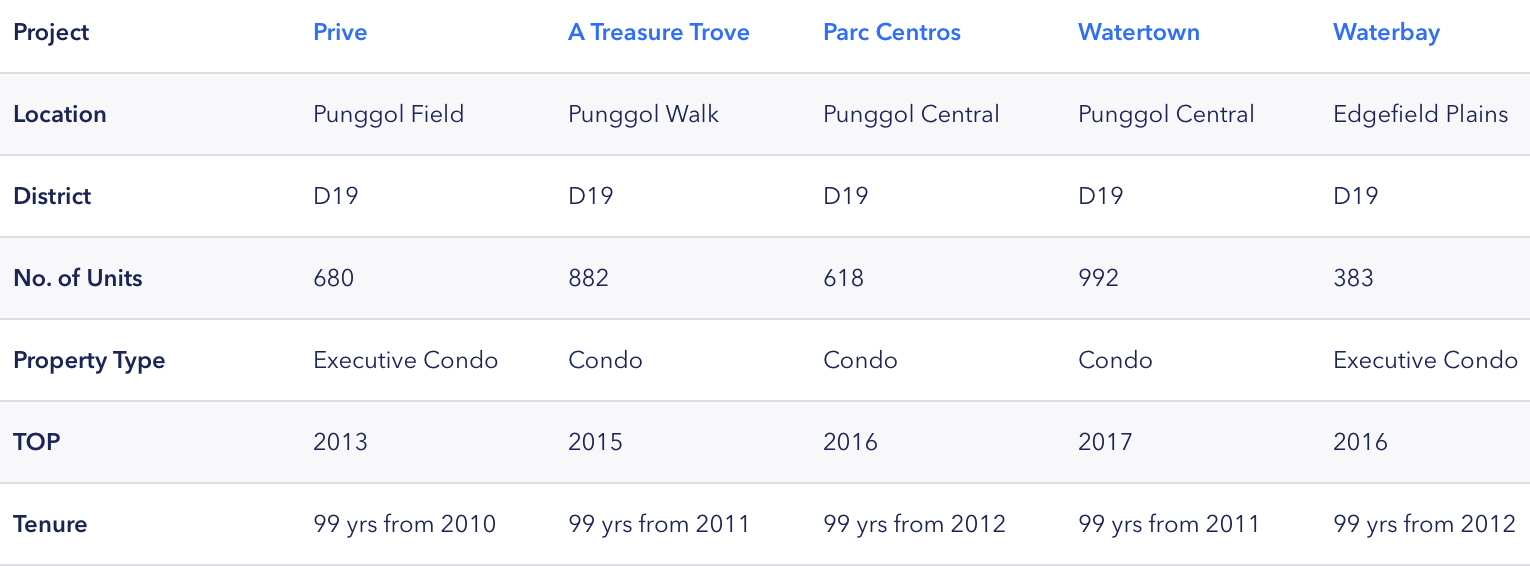

| Project Name | Tenure | Number of transactions in 2013 | Avg price (S$ psf) |

| Ecopolitan | 99y from 04/12/2012 | 293 | $791 |

| Waterbay | 99y from 02/07/2012 | 239 | $729 |

| Heron Bay | 99y from 04/06/2012 | 198 | $728 |

| Waterwoods | 99y from 11/03/2013 | 67 | $801 |

In comparison to other new Executive Condominiums (ECs) in District 19 that were sold in 2013 (with a minimum of 50 transactions), Waterbay stood out as one of the most affordable new projects during that period based on its average price PSF.

When we examine the current resale prices of these same projects, we observe that the difference in their average price PSF is almost negligible. Even though Waterbay was initially launched with a lower PSF, its resale value is on par with projects that had higher launch prices.

So regarding your purchase of the unit in 2020, it’s likely that the unit received approval for sale before the Minimum Occupation Period (MOP) or was among the first few units to complete the MOP requirement. This coincided with a period when property prices began to rise. As indicated in the first table, Waterbay demonstrated an annualised growth rate of 11.35% over the past two years.

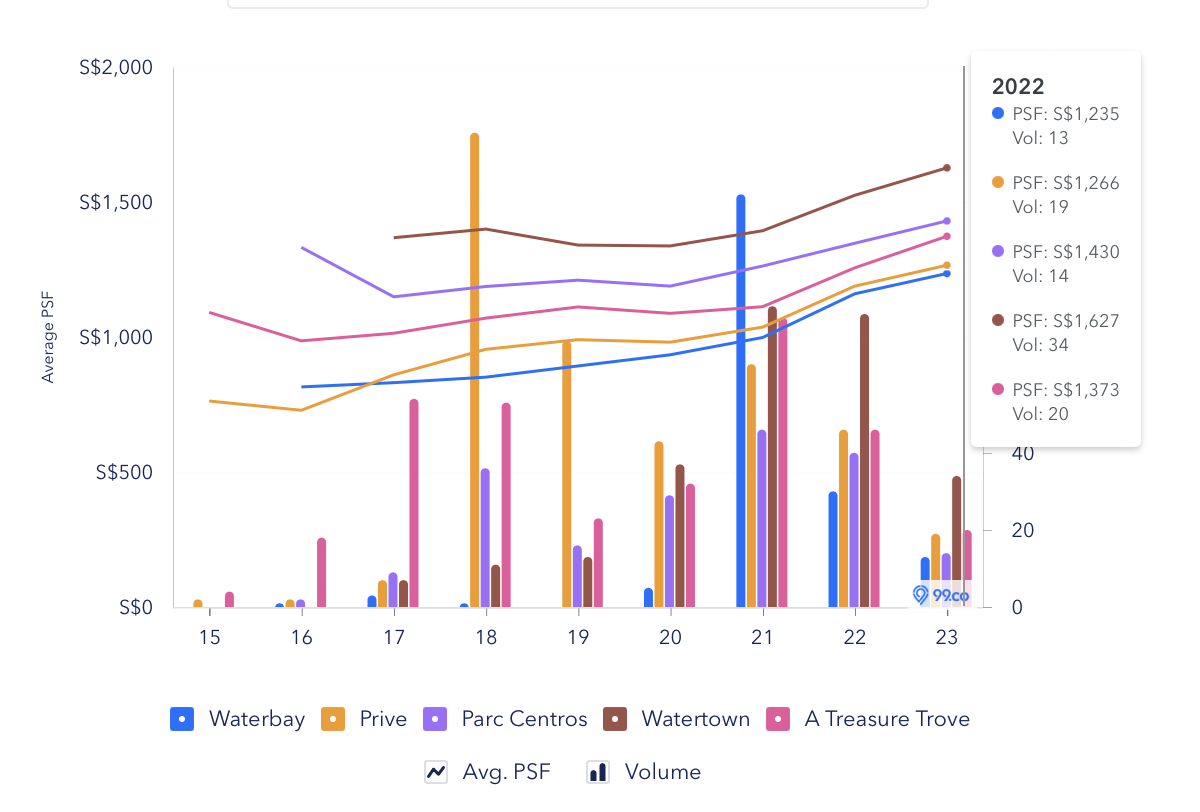

If we were to compare Waterbay’s prices to other developments in the vicinity, we find that it boasts the most competitive price PSF. Although some of these neighbouring developments hold condominium status, Waterbay offers full-fledged condo facilities and is just three years away from achieving full privatisation.

Given your favourable purchase price and the project’s standing as one of the youngest and most affordable in the area, it’s likely that strong demand for the project will persist in the near future.

Furthermore, with the forthcoming commencement of operations at the Punggol Digital District next year, there is a possible future uplift in the area. And given that the project is set to become fully privatised in just a couple of years, maintaining the current situation could indeed be a viable option.

In other words, you have made more than others who bought during this period, and there’s a good chance that your condo will continue to appreciate at least in line with real estate inflation.

Now, let’s focus on your main question – what should you do now?

Since your priority is capital appreciation, it’s natural to start thinking of ways to find a better-performing property that you could live in.

Perhaps instead of thinking about the profits, let’s look at it from a risk perspective.

Why? Because capital gains are very hard to predict, unlike costs.

By understanding the additional cost incurred, you’ll have a better sense of the risk you’ll be taking which frames this question better.

With that, let’s move on to your options.

Option 1. Stay status quo

Let’s now take a look at the costs and potential gains should you decide to stay put. We will assume a holding period of 3 years.

Costs incurred

| Description | Amount |

| Interest expense (Assuming 4.6% interest and 27 years remaining tenure on a $533,424 loan) | $71,510 |

| Property tax | $5,823 |

| Maintenance fee (Assuming $350/month) | $12,600 |

| Total costs | $89,933 |

Potential gains

To be conservative, we will utilise the annualised growth rate of private properties over the last 10 years of 2.21% for our calculation.

| Time period | Price | Gains |

| Starting point | $1,487,000 | $0 |

| Year 1 | $1,519,863 | $32,863 |

| Year 2 | $1,553,452 | $66,452 |

| Year 3 | $1,587,783 | $100,783 |

Potential gains if you were to remain status quo: $100,783 – $89,933 = $10,850

However, if you do have a loan package with a lower interest rate, then the total costs will be reduced and potential gains will be higher.

Option 2. Sell and purchase a resale property

The difficulty here lies in providing an absolute assurance regarding whether another property will outperform in terms of capital appreciation, as numerous factors can influence this outcome – especially over such a short period.

| Year | Property Price Index of Residential Properties (PPI) | YoY |

| 2021 | 173.6 | – |

| 2022 | 188.6 | 8.64% |

| Q2 2023 | 195.4 | 3.61% |

| Annualised | – | 6.09% |

If we were to compare Waterbay’s annualised growth rate over the past two years to the broader private property market, we can clearly observe that Waterbay has significantly outperformed the overall market. However, it’s important to note that the past two years were marked by unique circumstances due to the pandemic, which led to shifts in market dynamics. As the market stabilises, the growth rate may not be as pronounced.

Since you’ve mentioned looking for a place in Bishan, although it’s not a priority, let’s take a look at how properties in the area have been performing.

| Year | Avg PSF (D20 non-landed resale) | YoY |

| 2021 | $1,411 | – |

| 2022 | $1,530 | 8.43% |

| 2023 | $1,581 | 3.33% |

| Annualised | – | 5.85% |

We can see that the growth rate of non-landed private properties in D20 is not too far off from the growth rate of the overall market over the last two years.

Let’s zoom in on some of the younger projects in the area to see how they’ve fared.

| Year | Sky Vue | YoY | Sky Habitat | YoY |

| 2021 | $1,766 | – | $1,599 | – |

| 2022 | $1,874 | 6.12% | $1,658 | 3.69% |

| 2023 | $1,972 | 5.23% | $1,732 | 4.46% |

| Annualised | – | 5.67% | – | 4.08% |

These are the two youngest developments in Bishan, with Sky Vue at 10 years old and Sky Habitat at 12.

Comparing these growth rates to Waterbay, it is evident that Waterbay is head and shoulders above. Although as we have said, as the market corrects itself, the growth rate may not be as significant but prices are likely to still hold up.

Let’s look at the costs and potential gains should you sell Waterbay and purchase a unit at Sky Vue. With a budget of $1.75M, you will most likely be looking at a 2-bedder which is still sufficient for a family of 3. From January till date, there have been 14 2-bedroom transactions with an average price of $1.47M. We will assume this to be the purchase price for our calculation. Similarly, we will use a 3-year holding period.

| Description | Amount |

| Purchase price | $1,470,000 |

| BSD | $43,400 |

| CPF + cash | $960,874 |

| Loan required | $552,526 |

Cost incurred

| Description | Amount |

| BSD | $43,400 |

| Interest expense (Assuming 4.6% interest and 30 year tenure) | $74,446 |

| Property tax | $5,670 |

| Maintenance fee (Assuming $320/month) | $11,520 |

| Renovation costs* | $30,000 |

| Total costs | $165,036 |

*We have included a conservative renovation cost assuming you will do some simple renovation since your objective is to only hold for the short-term.

Potential gains

We will also utilise the annualised growth rate of private properties over the last 10 years of 2.21% for our calculation. We do this to better compare strategies first so we can get a better grasp of costs.

| Time period | Price | Gains |

| Starting point | $1,470,000 | $0 |

| Year 1 | $1,502,487 | $32,487 |

| Year 2 | $1,535,692 | $65,692 |

| Year 3 | $1,569,631 | $99,631 |

Potential gains if you were to sell Waterbay and purchase a resale property: $99,631 – $165,036 = -$65,405

We can see here that even though the loan quantum is low, with the current elevated interest rates, the potential gains are diluted.

Option 3. Sell and purchase a new launch while renting for 3 years

As with Option 2, it’s not possible to guarantee that a new launch property will experience higher appreciation than your current property.

In the following table, we tracked how prices of new sales of 99-year leasehold private properties in 2015 have moved to date.

| Year | 99y leasehold (new sales done in 2015) | YoY |

| 2015 | $1,211 | – |

| 2016 | $1,330 | 9.81% |

| 2017 | $1,390 | 4.54% |

| 2018 | $1,332 | -4.20% |

| 2019 | $1,384 | 3.93% |

| 2020 | $1,415 | 2.18% |

| 2021 | $1,491 | 5.43% |

| 2022 | $1,597 | 7.06% |

| 2023 | $1,638 | 2.58% |

| Annualised | – | 3.84% |

| Time period | Annualised growth rate |

| Year 3 | 3.22% |

| Year 5 | 3.15% |

| Year 7 | 4.03% |

Here, we observe that the annualised growth rate over the various years remains below that of Waterbay. However, it’s important to note that this is calculated based on the average price PSF and provides a broad perspective. The actual growth rates for specific projects may vary.

These are some new launches that fall within your affordability:

| Project | Tenure | Completion year | District | Unit type | Size (sqft) | Price |

| The Continuum | Freehold | 2027 | 15 | 2b2b | 667 | $1,742,000 |

| Grand Dunman | 99-years | 2028 | 15 | 2b1b | 667 | $1,718,000 |

| Lentor Hills Residences | 99-years | 2028 | 26 | 2b2b | 721 | $1,592,000 |

Let’s say you were to purchase the unit at The Continuum.

| Description | Amount |

| Purchase price | $1,742,000 |

| BSD | $56,700 |

| CPF + cash | $960,874 |

| Loan required | $837,826 |

Cost incurred

Here we are assuming that you will put all the available CPF funds and cash into the purchase so your Loan to Value (LTV) is roughly around 43%. The following is the progressive payment scheme.

| Stage | % of purchase price | Disbursement amount | Monthly estimated payment | Monthly estimated interest | Monthly estimated principal | Duration |

| Completion of foundation | 0% | – | – | – | – | 6-9 months (from launch) |

| Completion of reinforced concrete | 0% | – | – | – | – | 6-9 months |

| Completion of brick wall | 0% | – | – | – | – | 3-6 months |

| Completion of ceiling/roofing | 0% | – | – | – | – | 3-6 months |

| Completion of electrical wiring/plumbing | 3% | $54,002 | $70 | $207 | $277 | 3-6 months |

| Completion of roads/car parks/drainage | 5% | $87,100 | $182 | $541 | $723 | 3-6 months |

| Issuance of TOP | 25% | $435,500 | $746 | $2,210 | $2,956 | Usually a year before CSC |

| Certificate of Statutory Completion (CSC) | 15% | $261,300 | $1,084 | $3,212 | $4,295 | Monthly repayment until property is sold |

We will presume that you sell the property after meeting the 3-year SSD period which in this case, will be at the stage where the electrical wiring and plumbing works are completed.

| Description | Amount |

| BSD | $56,700 |

| Interest expense (Assuming 4.6% interest and 30 year tenure) | $1,242 |

| Rental expense (Assuming $4,500 as you’ve mentioned) | $162,000 |

| Total costs | $219,942 |

Potential gains

For a fair comparison of the options, we will also utilise the annualised growth rate of private properties over the last 10 years of 2.21%.

| Time period | Price | Gains |

| Starting point | $1,742,000 | $0 |

| Year 1 | $1,780,498 | $38,498 |

| Year 2 | $1,819,847 | $77,847 |

| Year 3 | $1,860,066 | $118,066 |

Potential gains if you were to purchase a new launch while renting: $118,066 – $219,942 = -$101,876

What should you do?

| Option | Total costs incurred | Potential gains |

| Stay status quo | $89,933 | $10,850 |

| Sell and purchase a resale property | $165,036 | -$65,405 |

| Sell and purchase a new launch while renting | $219,942 | -$101,876 |

Option 1 presents the most cost-effective choice, potentially even more so if your current loan package offers a lower interest rate. Given Waterbay’s relatively young age and strong performance over the past two years, doing nothing could be your best option.

Moreover, Waterbay stands out as one of the newest and most affordable projects in the area, suggesting sustained demand in the near future, especially with the impending opening of the Punggol Digital District next year. This choice also eliminates the need for relocation.

Options 2 and 3 entail extra expenses when compared to maintaining the status quo, including the BSD, rental expenses, and renovation costs, all of which eat into potential profits.

We will evaluate the disparity in potential gains between Options 2 and 3 in contrast to Option 1, and assess the property appreciation needed in these two options to achieve returns equivalent to those of Waterbay within the 3-year holding period.

| Stay status quo | Sell and purchase a resale property | Sell and purchase a new launch while renting | |

| Difference in potential gains compared to staying status quo | – | $76,255 | $112,726 |

| Purchase price | – | $1,470,000 | $1,742,000 |

| Required sell price after 3 years | $1,587,783 | $1,646,186 | $1,972,792 |

| ROI over 3 years | 6.8% | 12% | 13.2% |

| Increased ROI needed to match the option of staying status quo | – | 12% – 6.8% = 5.2% | 13.2% – 6.8% = 6.4% |

| Annualised growth rate | 2.21% | 3.8% | 4.2% |

From the above table, we can see that not only will it demand a significantly higher level of appreciation to offset the added costs associated with Option 2, as discussed earlier, there’s no guarantee that a resale property will appreciate more rapidly than Waterbay.

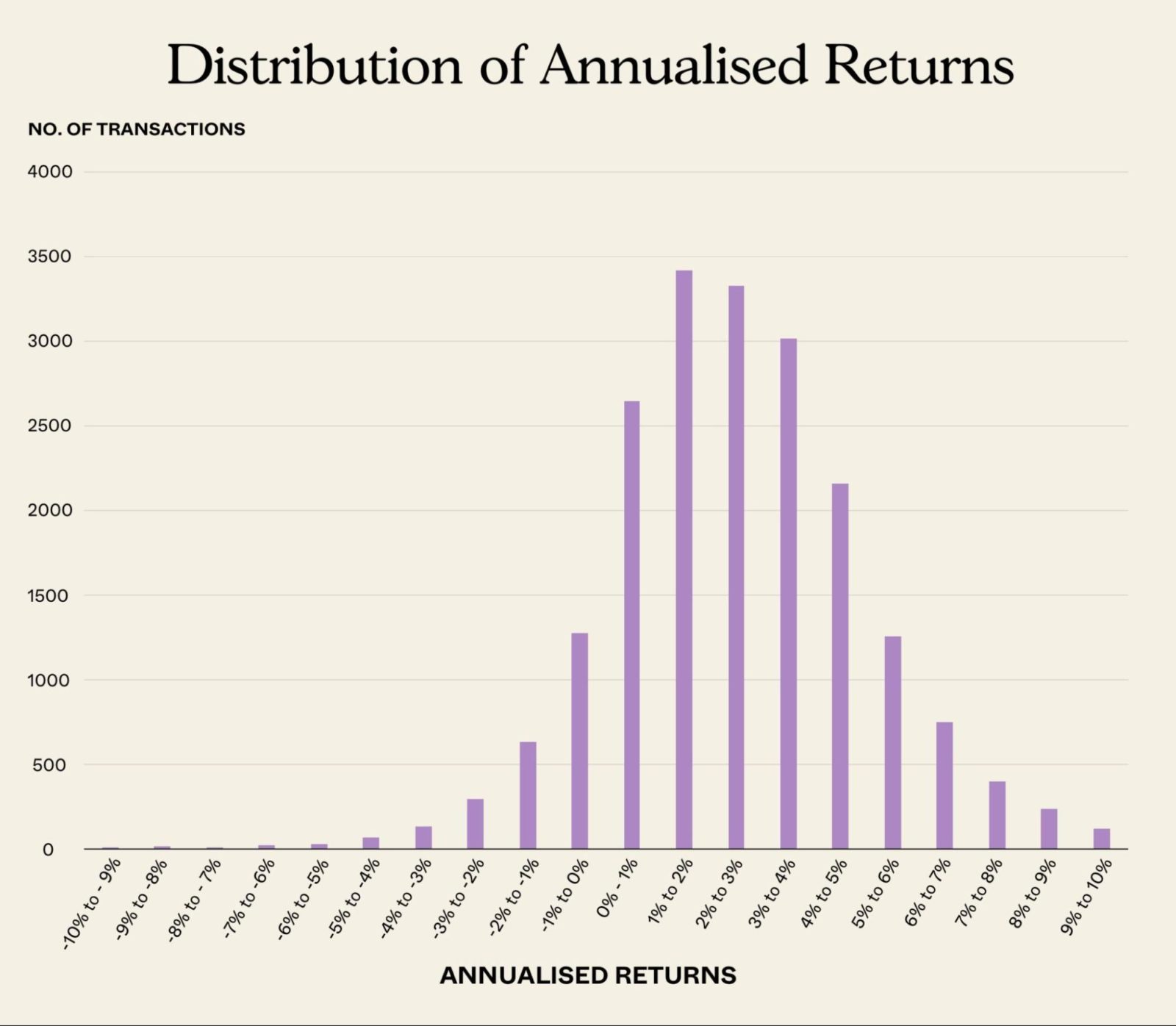

Here’s a look at the distribution of annualised returns for those who bought and sold over the past 10 years:

As you can see, most transactions fall within the 1-2% returns annually, followed by 2-3%. Here’s a look at it from a proportions perspective:

| Annualised Range | No. of Tnx | Proportion |

| -10% to – 9% | 9 | 0.05% |

| -9% to -8% | 16 | 0.08% |

| -8% to – 7% | 14 | 0.07% |

| -7% to -6% | 22 | 0.11% |

| -6% to -5% | 34 | 0.17% |

| -5% to -4% | 73 | 0.37% |

| -4% to -3% | 136 | 0.69% |

| -3% to -2% | 297 | 1.50% |

| -2% to -1% | 634 | 3.19% |

| -1% to 0% | 1,277 | 6.43% |

| 0% – 1% | 2,644 | 13.32% |

| 1% to 2% | 3,420 | 17.23% |

| 2% to 3% | 3,329 | 16.77% |

| 3% to 4% | 3,015 | 15.19% |

| 4% to 5% | 2,162 | 10.89% |

| 5% to 6% | 1,260 | 6.35% |

| 6% to 7% | 751 | 3.78% |

| 7% to 8% | 402 | 2.03% |

| 8% to 9% | 237 | 1.19% |

| 9% to 10% | 119 | 0.60% |

Summing up the proportions from those who made below 3% annualised returns, you’ll find that 60% of the number of transactions fall within this range. 75% of transactions fell below the 4% annualised return range.

This means there’s a greater chance that you’ll lose money doing options 2 and 3 compared to just staying put.

Aside from the data, we have to recognise the position we’re in now. Given the prevailing high interest rates, a substantial portion of the profits would be eroded.

As you’re considering a relatively brief holding period, it’s unlikely that interest rates will drastically decrease within this timeframe to turn the tide in your favour. It’s also significant in this case because you’d be taking a bigger loan, so the interest expense would be higher than if you had held onto Waterbay.

The only reason we’d go with option 2 is if you desire a change in location. But from what you’ve written, this isn’t a priority.

New launches may then make sense since you can leverage on the loan and reduce interest expense during the construction phase. You would not have to worry about property tax or maintenance fees.

However, these savings would be offset by the substantial costs associated with renting. While choosing a place with a lower rent could reduce expenses, your mention of $4,500 suggests you may already have a particular property in mind.

Similar to Option 2, there is no certainty that a new launch project would appreciate more rapidly than Waterbay and a much higher appreciation rate of 4.2% annually is required just to match the potential gains of staying status quo. If the project does not prove profitable upon TOP, you do have the option of moving in while waiting for prices to rise, but this would indefinitely extend your holding period.

On that note, you’d also be facing the prospect of having to buy another home after going through options 2 and 3 – especially if this investment property you purchase doesn’t meet your own-stay criteria. This only further increases your cost which increases your risk.

Both Options 2 and 3 come with the inconvenience of moving, and there’s also an element of luck and skill involved in identifying an undervalued property that may or may not outperform Waterbay.

To merely match the potential gains from staying put (as we have seen in the table above), would require the properties to appreciate at a much higher rate annually than the overall market – a move that isn’t in your favour.

Given that you do not have a pressing need to relocate and considering the factors mentioned, Option 1, which involves maintaining the status quo, appears to be the most sensible short-term course of action.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Property Advice We’re In Our 50s And Own An Ageing Leasehold Condo And HDB Flat: Is Keeping Both A Mistake?

Latest Posts

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

2 Comments

Haha.. Find this is funny. So Author assumes this water bay price will sustain despite the Bubble there?. Are you sure there is no bubble in punggol?. How come prices In 2013 went down record level that area, compare to rest of Sg. Any last time EC will sure gives profit at any point in resale, but question is when it gives the best returns? Now. So take the profit. And Bishan home This author suggested Three condos, Instead of the ones Which i would suggest, and lot more chance of appreciation. Any market When buying resale, need proper analysis, and if Waterbay can hold current prices, Bishan anything will appreciate more. Remember Any real estate investment in Sg is depends on hdb and prices of Hdb. Cash out now and Buy best Resale which can still.grow well