We Own A $1.1 Million HDB And Make $22k Per Month: Is It Feasible To Upgrade To A Condo Without Additional Cash?

April 19, 2024

Hi Stacked Homes,

I wanted to check in with you regarding the possibility to upgrade to a condo in terms of financial stability and suitability.

Currently owning a 4 room HDB flat at Saint George Towers. It has recently MOP in January 2024. The past recent transaction in the BTO project has hit 1.12 million.

- I’m 35 and my husband is 40.

- My HDB remaining loan is 321,286.80.

- Both of our current OA CPF is about 100k.

- Both total monthly salary income is SGD 22,250.

Given that I do not wish to fork out any spare cash to purchase my next apartment, would it be possible to advise what suits the best for us to move on next? And what’s the affordability?

Thank you so much. Do let me know if you need any further information.

(This is part of an ongoing series where we answer reader questions about the property market. If you have one of your own, send it to stories@stackedhomes.com.)

Hi there, thanks for writing in!

Let me first briefly introduce myself. My name is Joshua and I’m a data/tech fanatic who has been in the industry for 4 years now. During this time I’ve assisted numerous HDB owners like yourself, thus I understand the apprehensions you may harbour. It is great that you are first looking at your financials/feasibility first before doing anything else, so let me try to help with that.

There are a few questions highlighted in your email to us which I’d be very happy to answer, so here’s what we’ll be going through:

- Affordability

- Things to note

- Possible options

Let’s start by assessing your affordability.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Affordability

Before we begin, I would like to highlight that I would have to make certain assumptions to fill in the gaps in the calculations.

The following assumptions are made for this scenario:

- You would like to remain in the same area

- The condo should have 3 bedrooms and be the same size or bigger as your current home

- You both earn the same income

- You both have no other debt obligations contributing to your TDSR

Since the objective is to avoid any cash top-up, I will begin by calculating the potential sales proceeds. This amount can then be utilised to offset the expenses associated with purchasing your next property.

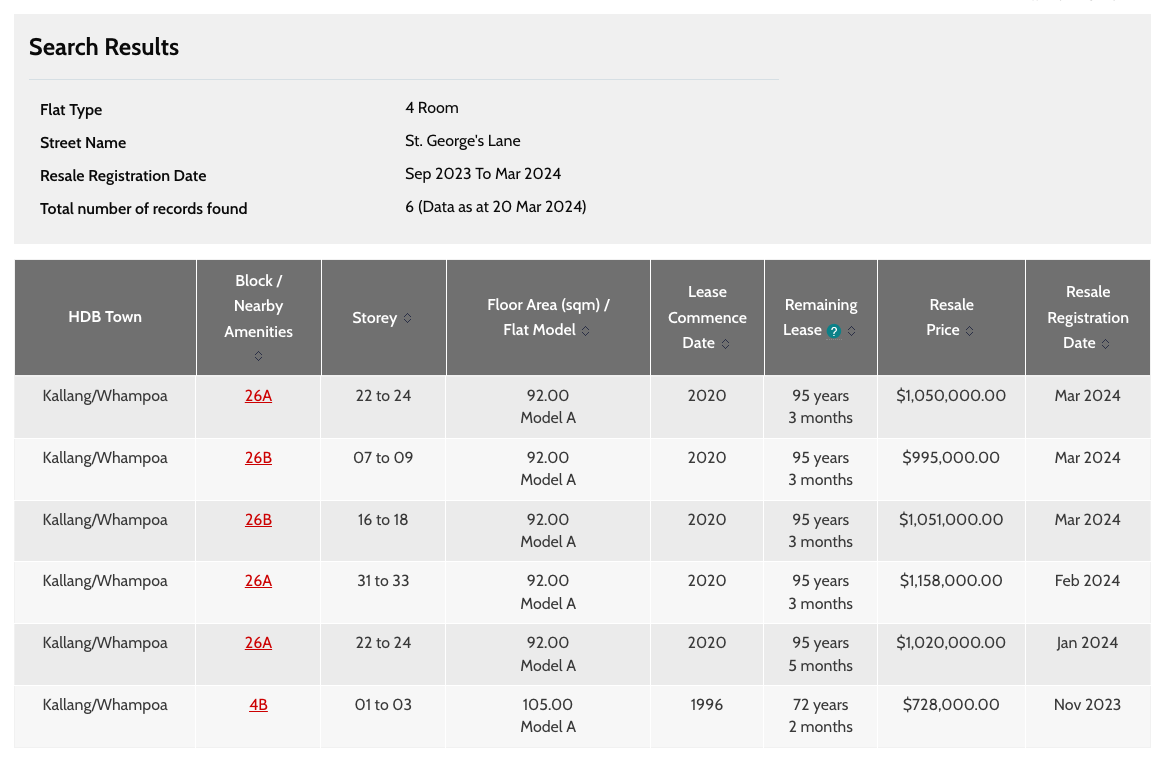

Recent transactions for 4-room flats in St. George’s Towers have ranged between $995K to $1.158M. Assuming your unit is situated on a mid-floor, I will take the $1,051,000 transaction as a benchmark for the selling price.

Source: HDB

| Description | Amount |

| Selling price | $1,051,000 |

| Less: Agency fee (2% of property price + 9% GST) | $22,911 |

| Less: Conveyancing fee | $3,500 |

| Outstanding loan | $321,286 |

| Sales proceeds (Cash + CPF) | $703,303 |

Now, let’s calculate your affordability.

Combined affordability

| Description | Amount |

| Maximum loan based on ages of 35 and 40 with a combined monthly income of $22,250 at a 4.85% interest | $2,220,089 (27-year tenure) |

| Sales proceeds | $703,303 |

| Current CPF OA | $100,000 |

| Total loan + cash + cpf | $3,023,392 |

| BSD based on $3,023,392 | $121,003 |

| Estimated affordability | $2,902,389 |

Things to note

Considering your available funds and current income, your combined affordability places you in a comfortable position to upgrade to a condominium. However, should you opt to maximise your loan, there would be a significant difference in loan quantum compared to your current HDB. The financial implications of managing the monthly mortgage amidst elevated interest rates, property tax, and maintenance fees might mean adjustments to your lifestyle.

Bearing the burden of increased expenses also exposes you to risk in the event of major life changes, such as taking a sabbatical or incurring new expenses like purchasing a car or welcoming a newborn.

Buyer Stamp Duty

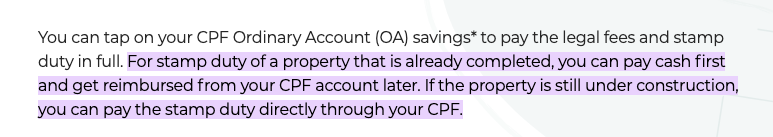

It’s important to remember that during the process of selling your current residence and purchasing your next property, there will be expenses such as the payment of the option fee for the condominium, conveyancing fees, and Buyer Stamp Duty (BSD). Depending on the purchase price, the BSD could amount to a significant amount.

For resale properties, the BSD must be paid in cash first. However, you can subsequently apply for reimbursement from your CPF accounts.

For the calculations below, I will assume that both of you have sufficient funds to pay for the necessary expenses first.

Resale Timeline

Another aspect to consider is the management of timelines for selling and purchasing your home. To unlock the funds tied up in your current property for use in your next purchase, the completion of selling your HDB should precede the completion of buying the condominium. If this is not feasible, an alternative is to take a bridging loan. It is important to note that you can only apply for this after the HDB approval letter is out, and the interest on the loan may be higher than a conventional mortgage loan.

For HDBs, both buyers and sellers may agree to an extension of stay of up to 3 months after the completion date. However, since you aim to use only the funds from the sales proceeds without contributing additional cash, complications may arise if the seller of the property you intend to buy also requires an extension of stay. Additionally, if you need time for renovation works, it may further delay your ability to move into your new home. Hence, it is crucial to clarify these details in advance.

In the event that the seller requires an extension stay, you may need to relocate to a temporary accommodation to facilitate the transition from your current home to the next one. This could involve moving your belongings into storage while residing in an apartment or serviced residence for a period of 3-6 months.

To accurately assess whether this move aligns with your goals, let’s take a look at the financial commitments associated with owning a 3-bedroom condominium that is of a similar size to your current home.

Financials

Let’s examine two developments located near Boon Keng MRT and Potong Pasir MRT for illustration purposes: Eight Riversuites and The Poiz Residences.

When compared to neighbouring projects, Eight Riversuites stands out as the only mid-sized development in close proximity to Boon Keng MRT station, offering a similar level of convenience to your current home. In contrast, the other nearby projects lack this level of convenience and proximity to the MRT, and predominantly consist of small-sized units.

| Project | Tenure | Lease start year | TOP | Average 3-bedder price (2023) |

| The Poiz Residences | 99 years | 2014 | 2018 | $2,137,500 |

| Eight Riversuites | 99 years | 2011 | 2016 | $1,790,500 |

The price disparity provides us with a good case study to analyse the financial commitment at two different price points.

| Eight Riversuites | ||

| Year | Avg PSF | YoY Growth |

| 2018 | $1,519 | – |

| 2019 | $1,401 | -7.70% |

| 2020 | $1,481 | 5.70% |

| 2021 | $1,446 | -2.40% |

| 2022 | $1,549 | 7.10% |

| 2023 | $1,722 | 11.20% |

| 2024 | $1,830 | 6.20% |

| Average growth rate | – | 3.35% |

| The Poiz Residences | ||

| Year | Avg PSF | YoY Growth |

| 2018 | $1,324 | – |

| 2019 | $1,535 | 16.00% |

| 2020 | $1,684 | 9.70% |

| 2021 | $1,699 | 0.90% |

| 2022 | $1,784 | 5.00% |

| 2023 | $1,887 | 5.70% |

| 2024 | $1,982 | 5.00% |

| Average growth rate | – | 7.05% |

Despite Eight Riversuites’ average growth rate being lower compared to its Potong Pasir counterpart, its average growth is still higher than the 10-year non-landed private property performance at 2.9%.

Financial Breakdown

Option 1: 3BR at The Poiz Residences ($2,137,500)

Since the priority is to not fork out any extra cash, I will first use the sales proceeds to deduct any cash deductibles.

Purchasing costs

| Description | Amount |

| Sales proceeds | $703,303 |

| Less: BSD (based on $2,137,500) | $76,475 |

| Less: Conveyancing fees | $3,500 |

| Remaining Cash + CPF | $623,328 |

Loan required

| Description | Amount |

| Purchase price | $2,137,500 |

| Remaining Cash + CPF | $623,328 |

| CPF OA | $100,000 |

| Loan required | $1,414,172 |

| Monthly mortgage for a 27-year tenure at 4% interest | $7,145 |

If you utilise your CPF funds to pay for your monthly mortgage:

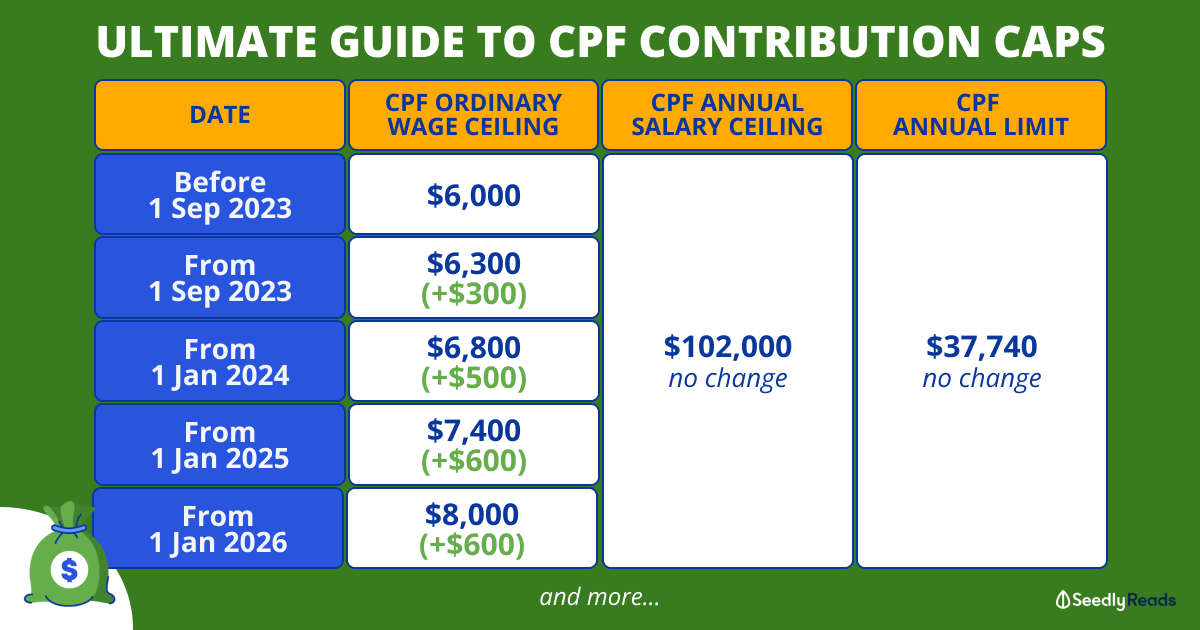

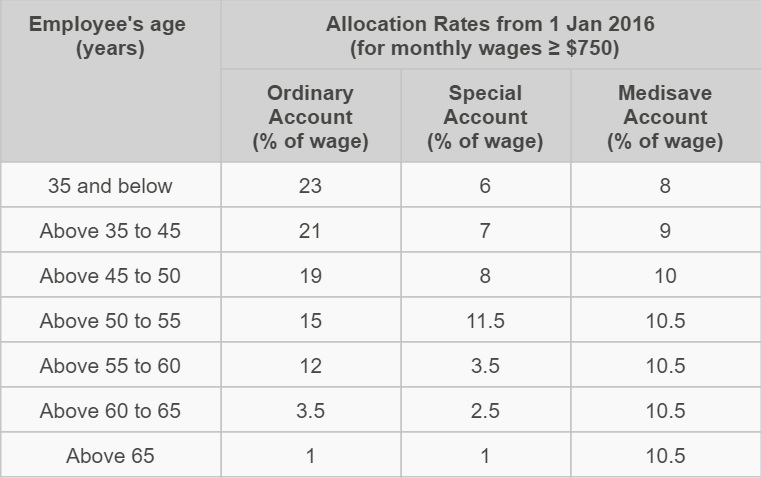

Husband & Wife CPF OA contribution: $2,856 (Based on new CPF OA Contribution Changes from 01 Jan 2024 using age 35 to 45 bracket as reference)

Your monthly cash required to service this property (excluding maintenance fees and utilities) would come up to be approximately $4,289.

Since you did not mention a potential holding period, I will assume a 5-year horizon for calculation purposes.

Cost incurred

| Description | Amount |

| BSD | $76,475 |

| Interest expense (Assuming 27-year tenure and 4% interest) | $267,524 |

| Maintenance fees (Assuming $400/month) | $24,000 |

| Property tax | $21,290 |

| Total costs | $389,289 |

Option 2: 3BR at Eight Riversuites ($1,790,500)

Purchasing costs

| Description | Amount |

| Sales proceeds | $703,303 |

| Less: BSD (based on $1,790,500) | $59,125 |

| Less: Conveyancing fees | $3,500 |

| Remaining Cash + CPF | $640,678 |

Loan required

| Description | Amount |

| Purchase price | $1,790,500 |

| Remaining Cash + CPF | $640,678 |

| CPF OA | $100,000 |

| Loan required | $1,049,822 |

| Monthly mortgage for a 27-year tenure at 4% interest | $5,304 |

If you utilise your CPF funds to pay for your monthly mortgage:

Husband & Wife CPF OA contribution: $2,856 (Based on new CPF OA Contribution Changes from 01 Jan 2024 using age 35 to 45 bracket as reference)

Your monthly cash required to service this property (excluding maintenance fees and utilities) would come up to be approximately $2,448.

Similarly, I will assume a 5-year holding period.

Cost incurred

| Description | Amount |

| BSD | $59,125 |

| Interest expense (Assuming 27-year tenure and 4% interest) | $198,599 |

| Maintenance fees (Assuming $400/month) | $24,000 |

| Property tax | $14,260 |

| Total costs | $295,984 |

To conclude..

Given your financial situation, upgrading to a condominium without additional cash outlay is certainly feasible. This presents an opportunity to capitalise on the significant gains from your HDB. However, transitioning to a condo entails more financial management and possible lifestyle changes. I’ve demonstrated this by showcasing 2 different condominiums at different price points to highlight its feasibility and the potential costs involved.

I’ve also shared some of the pitfalls you should be wary of when upgrading – specifically on transaction timelines and the Buyers Stamp Duty.

Beyond this, the rest is down to selecting the right project of which there are various factors to consider. Selecting the ideal project requires a deeper understanding of your specific needs and preferences. While these examples offer insight into ownership costs, personalised recommendations tailored to your circumstances would provide a more accurate guidance.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Joshua Ho

With lifelong roots in Bukit Batok, Joshua knows the west inside out and this provides him with a clear advantage in guiding clients through property transactions in the area. His personal experience of purchasing his own home in 2022 unveiled the emotional depth of the process, allowing him to bring a distinctive perspective for first-time buyers and connect with his clients on a personal level.

With a commitment to being well-informed before making decisions, he extends this diligence to his clients, ensuring they are equipped with the knowledge necessary for confident choices. By fostering genuine connections built on transparency and integrity, he is devoted to serving as a trusted partner for clients, whether they are buying, selling, or investing in property.

Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Latest Posts

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

0 Comments