We Make 300k Per Annum. Should We Pay ABSD For A 2nd Property For Investment When We Own A 5-Room HDB?

September 9, 2022

Hi StackHomes,

Foremost, thank you for your insightful articles and unbiased views on residential matters provided to the community and I believe many had benefited from it.

Owning an investment property is an aspiration of many and to be honest, the thought of purchasing a 2nd property for investment has always been a frequent discussion topic with my spouse. We hope to seek your advice to help us assess our situation in a better perspective.

My spouse and I are in our late 30s. We are currently staying in a 5 room resale HDB flat bought in 2014 in the West which has 73 years lease remaining. We are unlikely to move out from where we are staying in the next 5 years as my children are studying in the nearby schools with my parents being the caregiver.

On the financial front, we have a combined income of $300k per annum, combined CPF OA balance of $300k and cash savings with liquidity at $500k. Our current HDB is still not fully paid but we had set aside cash savings for a full loan redemption to prepare ourselves should we decide to purchase a 2nd property as that will enable us to secure the maximum loan for the 2nd property. We are also fully aware on the ABSD that is slapped against us with that decision.

To share with you on our thoughts of purchasing a 2nd property:

Generate rental income (though it may take a few years to breakeven considering the ABSD payable) and potential upside in property value for investment

Sell off the HDB in view of the decaying lease and use the 2nd property as our retirement home

My main considerations of the 2nd property would be proximity to train stations and a healthy rental yield. We are looking at 2 bedroom properties so that we do not over leverage. Personally, a resale condo is more practical as it can be rented out immediately. Having said that, is there any merits for me to consider a new launch rather than a resale condo?

Apologies for the long email and truly appreciate your time in reading.

God Bless and Thank you!

(This is part of an ongoing series where we answer reader questions about the property market. If you have one of your own, send it to stories@stackedhomes.com.)

Hi there!

Appreciate the really kind words, and thank you for the support! Being able to own two properties is truly a Singaporean dream but perhaps with all the cooling measures, this may become less of a reality for many too. Let’s run through some of your considerations on purchasing a second property!

Affordability

First, let us work out your affordability based on the numbers that you have provided. We’re going to assume that the cash savings you have set aside is part of the $500,000 cash figure.

Here’s what your maximum loan amount would be:

Maximum loan (based on a fixed income of $12,500 each and ages of 39, with no other outstanding loan): $2,814,156 (26 year tenure)

Combined CPF OA: $300,000

Cash: $500,000

If we were to use $250,000 of cash (saving $250,000 as emergency funds) and full CPF for the 25% downpayment and taking a 75% loan of $1.65m, your estimated affordability will be approximately $2.2m. Note, this is not including BSD, ABSD and legal fees.

But as you’ve rightly written about not over-leveraging, let’s do a sample calculation with a more conservative amount of $1.2m:

CPF utilised: $300,000

Cash: $250,000

Loan: $650,000

Monthly loan repayment at 3.5% interest: $3,172

BSD: $32,600

ABSD: $204,000

Legal fees: $2,500

The BSD, ABSD and legal fees add up to $239,100. If you were to use the $250,000 that was set aside for emergencies to pay for this, you’ll be left with $10,900 which is stretching it real thin.

Even at a 3.5% rental yield, it will take approximately 4.85 years in order to breakeven on your ABSD plus legal fees of $239,100. We have not taken the loan and interest into consideration yet.

As such, buying a second property and paying the ABSD of 17% may not be the best option given the amount of cash on hand you have. Even though the rent will partially offset your monthly loan repayment while you wait for prices to appreciate, it is still quite a long time to wait just for you to breakeven based on rental income. Besides, this is in consideration that all things remain status quo. Understandably both of you are still relatively young, but if in the worst case scenario either of you lose your jobs or have to sell the property for liquidity – you’ll have to sell at $200k above your neighbours. Which if you’re buying a unit in the OCR or RCR where majority are home owners that did not have to pay BSD, it’s going to be a challenge.

Of course, we also have to add that this is not taking into account that the property does appreciate in that same period. Because of that, finding the right property becomes even more important with this “handicap” thrown in.

However, you are right on the point that there is potential upside when buying a private property.

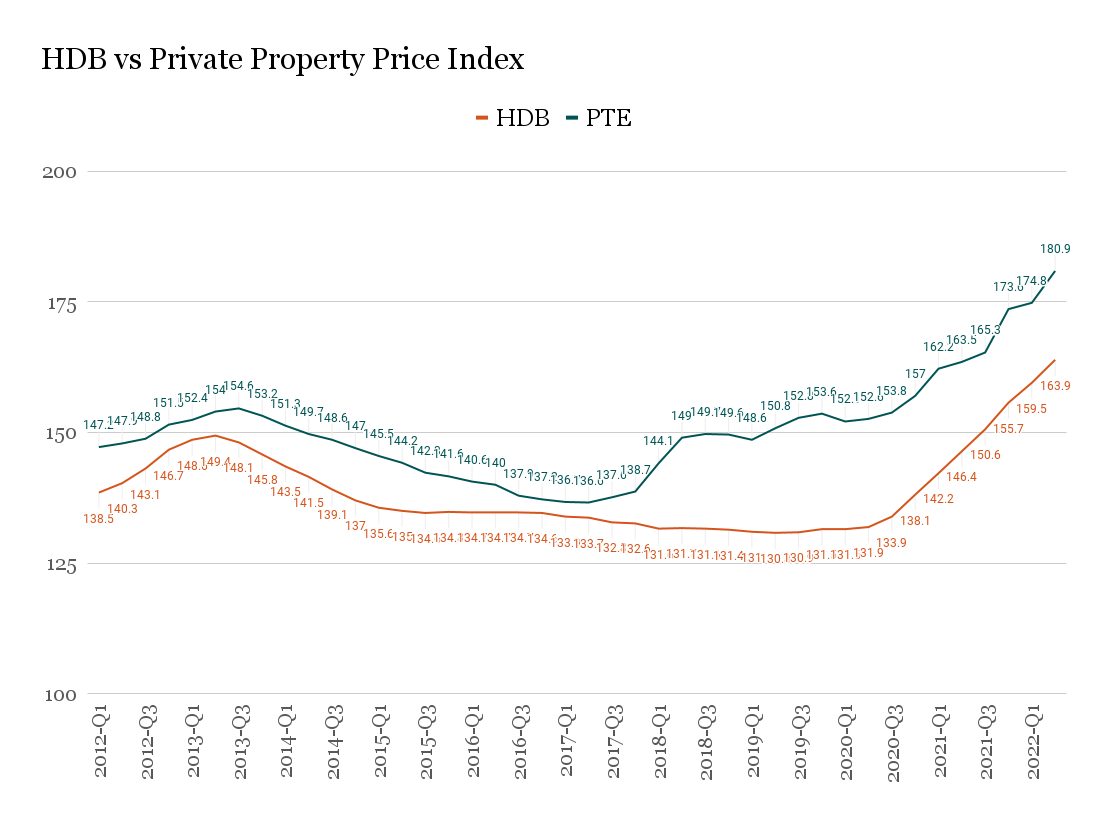

From this chart above, you can see that the price disparity between HDBs and private properties has been growing over the past 3 years. With land and construction prices on the rise, it’s unlikely that private property prices will go back to pre-covid times. As much as HDB prices are also on the rise, it is after all public housing that is regulated by the government and prices will be kept under control so that citizens will still be able to afford them. We have recently written about this price gap, you can read more about it here.

Let’s say you were to bite the bullet and buy this second property. Should you continue to hold on to the HDB, sell it closer to your retirement years and then move into your investment property?

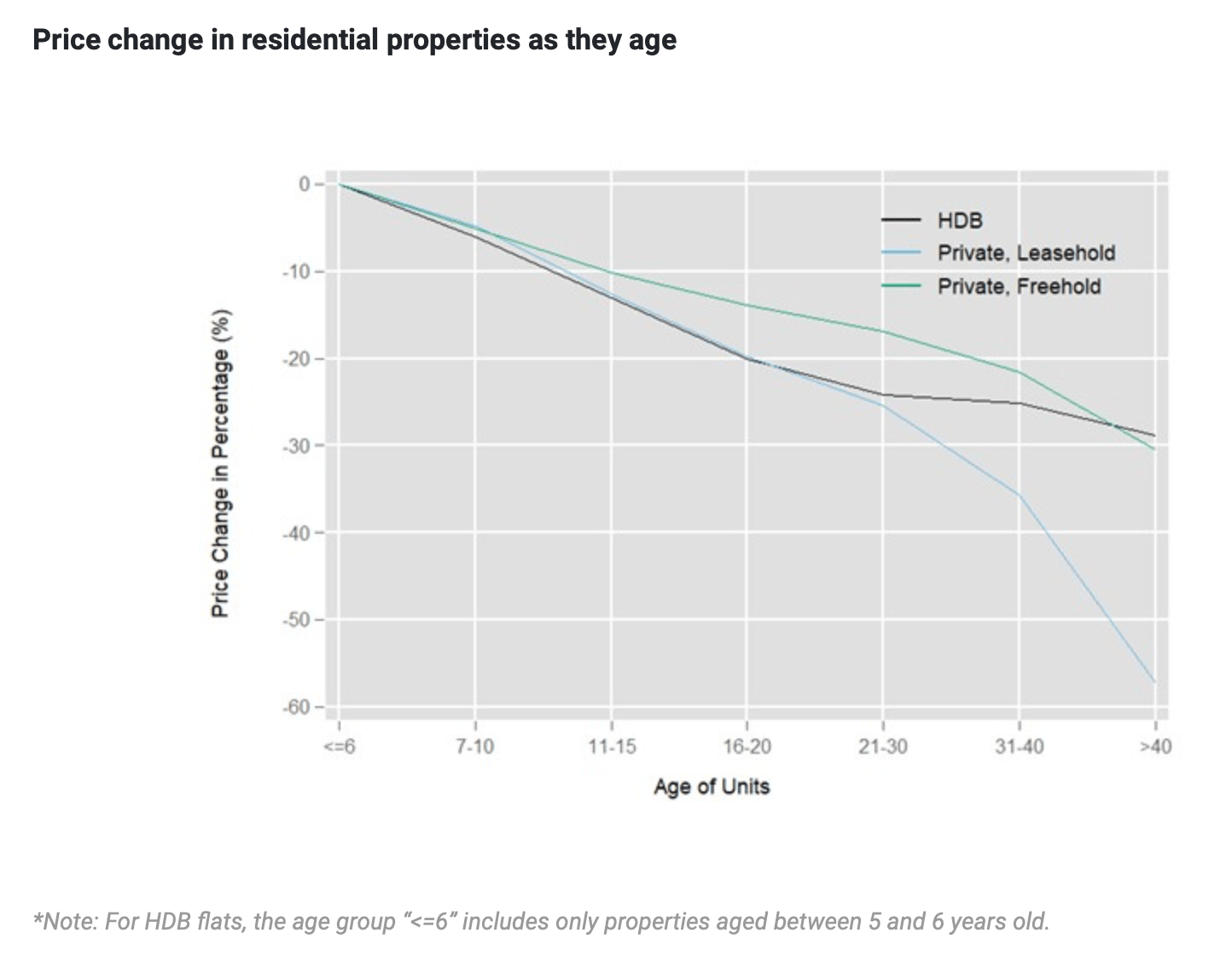

An NUS study found that the steepest drop in prices was generally between the 5th to 20th year for HDBs. The price decrease from the 21st year onwards was significantly slower, almost plateauing until the 40th year before it starts declining again. (Do note that this study took transactions from 1997 – 2017. While it’s a broad enough dataset, the recent changes in market conditions were not accounted for in the study and may have an impact on the conclusion).

Presuming you are now 39 and will retire at 60. Your flat will be 47 years old by then. Besides the gradual drop in prices as the lease decays, the buyer pool will also become smaller as younger buyers will not be eligible to take the full loan and grants, or fully utilise their CPF funds if the age of the youngest buyer plus the remaining lease does not add up to 95 years.

When you bought the flat 8 years ago when it was 18 years old, it would have almost been at the end of the steep decline and now at 26 years prices are likely to become stagnant or drop minimally until it hits 40 years. The current market situation is unique as there is a greater demand than supply for resale flats, so even older HDBs are selling at high prices. But should the market revert, you should see a wider gap in prices between younger and older flats.

As such, holding on to the HDB until its closer to your retirement years may not be the best option as the difference in price from 18 to 47 years would be rather substantial. However, if this is the route you decide to take, perhaps moving into the investment property and renting the HDB out instead could be something to consider given a HDB’s higher rental yield and it will give you a constant stream of passive income as well.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Should you consider a new launch?

We’ve done numerous pieces on this, and the conclusion is always the same. It’s not so much of new launch vs resale that is the question, it’s which is the right property that will suit your timeline or investment horizon.

There are new launches that are priced right, or if the developer has staged the pricing well and you have selected a good unit which has significant buffer against the rest of the units – typically that will stand you in good stead. As much as it seems inconceivable sometimes that people are willing to pay for such a premium in psf for a new launch when it’s completed, most people just like things new and shiny. It’s hard to explain, but it’s why buying a home can be such an emotional decision.

For resale condos, even if you’ve identified a good development, it can differ a lot because of what is available at the moment. Seller’s pricing their homes can be irrational, and you are very limited by what is on sale at that point in time.

Let’s look at some of the pros and cons of buying a new launch and a resale condominium.

| Pros | Cons | |

| New Launch | – Progressive payment plan where loan is disbursed in smaller amounts throughout the course of construction until CSC – No property tax payable – No maintenance fee payable – More control over unit choice (if you get a good queue number) – Everything is brand new – Majority of owners are buying in at a similar price range | – Can’t rent out immediately – Unable to physically see unit and its surroundings/neighbours |

| Resale | – Can rent out immediately – Able to physically see unit and have a feel of the surroundings | – Full loan is disbursed once transaction is completed – Property tax is payable – Maintenance fee is payable – Restricted to whatever unit is on the market – May require renovation – Likely buying in at a higher price than other first owners |

We do understand the appeal of being able to earn on rental income (particularly given the rental highs right now). For simple calculation this is how it would play out if you were to purchase a $1m property.

| Costs | New Launch | Resale |

| Interest for monthly repayment (at 3.5%) | Avg $631.50 (before TOP) | Avg $2,125 (for 3 years) |

| Property tax | $0 | $200 |

| Maintenance fees | $0 | $300 |

| Total (monthly) | $631.50 | $2,625 |

| Total (for 3 years) | $22,734 | $94,500 |

Based on a 3.5% rental yield on a $1m property, the monthly rental will be approximately $2,917.

$2,917 – $2,625 = $292 (profits per month)

$292 x 11 months (assuming its vacant for a month each year) x 3 years = $9,636

$9,636 – $5,119 (3 years of agent fees + GST) = $4,517

Assuming you were to sell the property at the 3 year mark and the cash proceeds for both new launch and resale are the same, buying a resale will net you give or take $4,517 more, which is rather negligible in the grand scheme of things.

As an aside, there are other considerations as well, such as future integration in the area which will affect potential capital appreciation, demand and supply, holding period, the price you’re buying in at, etc. We have previously shared 6 actionable steps you can take to compare between a new launch and resale condo which you can read here.

Perhaps another possible option is to sell the HDB now (or after 5 years) as the market is still high and purchase 1 private property each, saving a significant amount from the avoidance of ABSD.

Affordability

Maximum loan (based on a fixed income of $12,500 and age of 44, with no other outstanding loan): $1,225,670 (21 year tenure)

CPF OA (assuming it’s half of $300K): $150,000

Cash (half of $500K): $250,000

Using $200,000 of cash (saving $50,000 as emergency funds), your estimated affordability will be approximately $1.4m each. This is not including BSD and legal fees and we also have not taken the CPF refund and sales proceeds from your HDB into consideration.

With $1.4m today, these are some available 3 bedders on the market (for own stay):

| Project | District | Tenure | TOP date | Size (sqft) | Asking price | PSF |

| Bellewoods | 25 | 99 years | 2017 | 1,066 | $1,288,000 | $1,208.26 |

| The Brownstone | 27 | 99 years | 2017 | 915 | $1,250,000 | $1,366.12 |

| Kingsford Waterbay | 19 | 99 years | 2018 | 850 | $1,180,000 | $1,388.24 |

| Symphony Suites | 27 | 99 years | 2019 | 893 | $1,080,000 | $1,209.41 |

These are some 3 bedders in the West under $1.4m if you prefer to still live closer to your parents:

| Project | District | Tenure | TOP date | Size (sqft) | Asking price | PSF |

| The Rainforest | 23 | 99 years | 2015 | 958 | $1,260,000 | $1,315.24 |

| Westwood Residences | 22 | 99 years | 2018 | 947 | $1,250,000 | $1,319.96 |

| Parc Riviera | 5 | 99 years | 2020 | 904 | $1,380,000 | $1,526.55 |

| Le Quest | 23 | 99 years | 2021 | 818 | $1,248,000 | $1,525.67 |

With $1.4m today, these are some available resale 2 bedders on the market with decent rental yields if that’s what you are still looking for. Of course, further analysis would have to be done on the appreciation potential here.

| Project | District | Tenure | TOP date | Size (sqft) | Asking price | Average rent | Rental yield |

| Midtown Residences | 19 | 99 years | 2016 | 635 | $900,000 | $2,700 | 3.6% |

| D’Nest | 18 | 99 years | 2017 | 753 | $959,000 | $2,874 | 3.6% |

| The Trilinq | 17 | 99 years | 2017 | 752 | $1,380,000 | $3,550 | 3.09% |

| Kingsford Waterbay | 19 | 99 years | 2018 | 689 | $950,000 | $2,835 | 3.58% |

| Parc Riviera | 5 | 99 years | 2020 | 710 | $1,099,999 | $3,200 | 3.49% |

| Parc Botannia | 28 | 99 years | 2022 | 667 | $1,088,888 | $3,347 | 3.69% |

With $1.4M today, these are some available new launch 1 and 2 bedders on the market:

| Project | District | Tenure | Type | Size (sqft) | Price | PSF |

| Mori | 14 | Freehold | 1+S | 592 | $1,237,000 | $2,089.53 |

| Zyanya | 14 | Freehold | 2b2b | 614 | $1,237,296 | $2,015.14 |

| Fourth Avenue Residences | 10 | 99 years | 1 bedder | 474 | $1,295,3210 | $2,732.74 |

| The Landmark | 3 | 99 years | 1 bedder | 495 | $1,313,280 | $2,653.09 |

| One Bernam | 2 | 99 years | 1 bedder | 441 | $1,348,000 | $3,056.69 |

| Ikigai | 11 | Freehold | 1+S | 603 | $1,381,280 | $2,290.68 |

Conclusion

To conclude, paying off your HDB in order to take the full loan for the second property and paying the ABSD will set your cash savings back quite significantly. It will also take quite a long time to breakeven and start profiting from the investment property due to the hefty ABSD.

Holding on to the HDB for a long term may not be the best course of action given the lease decay and reduced buyer pool in the future. Although you could rent out the HDB in the later years and move into your investment property, this is a rigid option as in the event you wish to cash out on the investment property (or if it’s not doing well) and buy another one with better potential, you will have to pay for the ABSD again which may deter you from doing so.

Ultimately, it seems to be too many hoops to jump through, or that you will have to get right, to really profit from this. Of course the best case scenario is that you find a really good property. But you will also have to consider scenarios in the event of losing your jobs, the property doesn’t appreciate as hoped, the rental yield gets worse due to unforeseen circumstances, or it goes through a collective sale (if you bought a resale) in a few years which may barely cover your ABSD still.

If you are really bent on owning 2 properties, selling the HDB to purchase two properties will take ABSD out of the equation and also give you more flexibility in the sense that you can always choose to sell the investment property when its profitable without incurring any more ABSD.

Given that you are in your late 30s, it is still a relatively young age which you can leverage on before you retire. As always, it is important to be prudent and not over-leverage so do get your finances checked before committing.

Have a question to ask? Shoot us an email at stories@stackedhomes.com – and don’t worry, we will keep your details anonymous.

For more news and information on the Singapore private property market or an in-depth look at new and resale properties, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Pro Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

On The Market A Rare Pair Of Conserved Shophouses In Chinatown Just Hit The Market For $32.5M

Singapore Property News Some Units At This Freehold Riverfront Condo Could Lose Their Views — But Here’s How Prices Have Actually Moved

7 Comments

300k? Of course

It appears that readers of this website tend to be amongst the higher income earners and wealthier people in Singapore, like me. Am a landlord who lives in a freehold landed property and owns a three-bedroom condominium which is rented out for easy income every month. Me and my wife easily earn more than $300k a year.

By the way, my three-bedroom condominium is freehold too.

In addition, my landed property is fully paid up.

That’s the way bro, earn easy money from foreigners on expat packages!

Come lim kopi with me while we laugh at bagholding HDB owners, lol!

Thank you Bro! Have also contributed to nation building as we paid ABSD (at 12%) for the freehold condo.