We Bought A $1.6m Braddell View Unit Hoping For En Bloc: Should We Convert It To A Dual Key For Rental Or Rightsize To A BTO Instead?

November 18, 2023

Hi Ryan

Good Day! Recently started to c ur U tube. Would like some advice. We currently hold a sizeable unit at Braddell View (BV). Bought a couple of years ago hoping for the enbloc, which of course did not materialise. It was bought at around $1.6 mil, a price I truly regret.

Outstanding loan $786,709.

Currently tenanted at $4800.

My hubby is now 55 yo and I’ll be 53 yo this year. We have a son, 21 yo and attending local university. First year now and scheduled to complete I think in 2027. Using cpf to fund his studies.

We hv been thinking to sell BV cos of I) our age, ii) the large cpf amount plus accured interest used – close to $700k between 2 of us 3) the decaying lease 4) the large outstanding loan amount 5) the possibility of stopping full time work in the next 4 years after our son graduates from uni

We do not own any Hdb property. Owned a resale hdb and sold off many years ago. Currently staying at my mum’s bishan unit n renting from her at $2100.

Was thinking of taking the opportunity to apply for bto… After the 30 mths wait (nvr apply bto b4)

Or

Purchase a resale hdb with a healthy remaining lease.

Oso thinking if shd continue to keep BV, renovate n convert part of it to bcom dual key for rental (possibly 2 rooms) while we eventually stay there in the future.

But still think not a really good idea cos would need to pour in quite a bit for reno n oso the need to still service the loan n the reasons ive stated above.

We r definitely out of the race to purchase another private property.

Our combined income is only close to $14k.

Would like to seek your advice. Hope to hear from you soon.

Thx you very much!

Editor’s Note: Some financial information were retracted for privacy reasons.

(This is part of an ongoing series where we answer reader questions about the property market. If you have one of your own, send it to stories@stackedhomes.com.)

Hi there,

Thank you for writing in.

We’ve always maintained that investing in a property with the anticipation of an en bloc sale will require you to have a flexible holding period. Over the years, we’ve heard of many people who bought thinking it would en bloc, but were forced to sell ultimately because they couldn’t hold on.

And while there are identifiable characteristics shared by properties that have undergone successful en bloc sales, it’s important to note that possessing these traits doesn’t guarantee a similar outcome for every property. The process of en bloc sales is inherently unpredictable, and there’s no assurance that the collective sale will come to fruition in the time frame that you want. Perhaps even more so for a development like Braddell View, where that extraordinarily large land size probably works against rather than for it.

Let’s start by looking at your affordability before we run through the options you’re considering.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Affordability

From January till date, there were seven 1,701 sqft units that changed hands in Braddell View. Here are the transactions:

| Date | PSF | Price | Level |

| Oct 2023 | $1,110 | $1,888,000 | #25 |

| Jun 2023 | $1,091 | $1,855,000 | #22 |

| Jun 2023 | $1,140 | $1,938,000 | #09 |

| May 2023 | $1,003 | $1,705,000 | #06 |

| Apr 2023 | $1,000 | $1,700,000 | #23 |

| Jan 2023 | $953 | $1,620,000 | #03 |

These units were sold at an average price of $1,784,333. We will round this to $1,784,000 and assume this as the selling price in our calculation.

Selling

| Description | Amount |

| Selling price | $1,784,000 |

| Outstanding loan | $786,709 |

| CPF funds to be refunded into OA | $700,000 |

| Cash proceeds | $297,291 |

Although your husband is currently 55 years old, he has already fulfilled the Basic Retirement Sum as well as the Full Retirement Sum, so any CPF funds refunded from the sale can be put into the next property.

For the calculations, we will assume you put all the sales proceeds of $997,291 into your next home without utilising any of the existing CPF funds or cash that you have on hand.

Buying (HDB)

| Maximum loan based on ages of 53 and 55, combined monthly income of $14k and interest rate of 2.6% | $481,717 (11 year tenure) |

| CPF + cash | $997,291 |

| Total loan + CPF + cash | $1,479,008 |

| BSD based on $1,479,008 | $43,760 |

| Estimated affordability | $1,435,248 |

*For the loan calculation, we are assuming your incomes to be $7k each

If you stick with your plan of buying an HDB, you may not even have to take up a loan considering the amount of CPF funds and cash you have after selling Braddell View. This is especially helpful if you intend to retire in 4 years.

We will also include your affordability to buy a private property as an alternative option to explore.

Buying (Private)

| Maximum loan based on ages of 53 and 55, combined monthly income of $14k and interest rate of 4.6% | $796,476 (11 year tenure) |

| CPF + cash | $997,291 |

| Total loan + CPF + cash | $1,793,767 |

| BSD based on $1,793,767 | $59,288 |

| Estimated affordability | $1,734,479 |

*For the loan calculation, we are assuming your incomes to be $7k each

Let’s now look at how Braddell View has been performing.

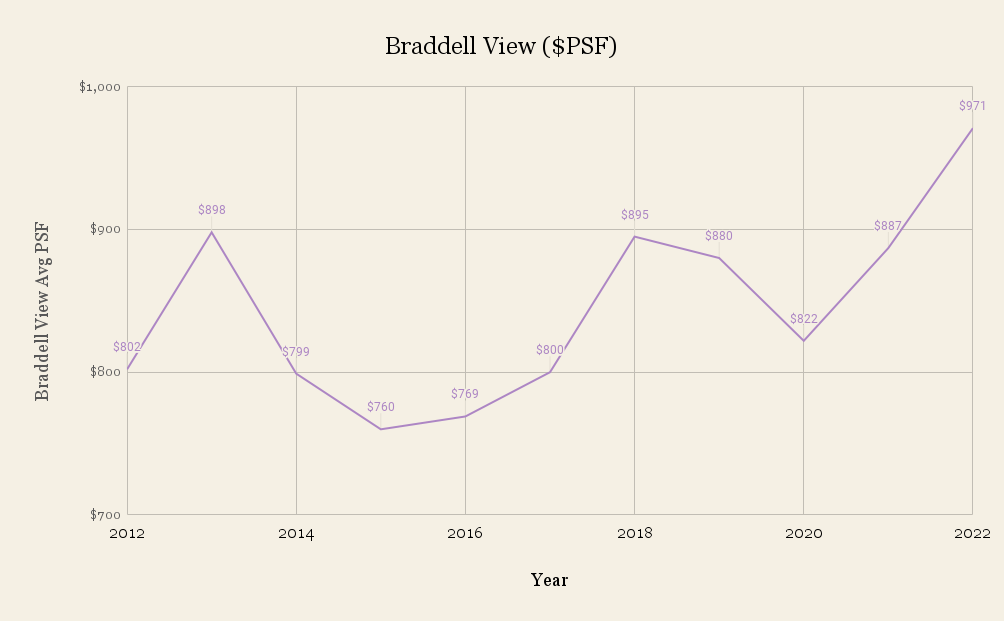

Performance of Braddell View

| Year | Braddell View Avg PSF | YoY | Property Price Index of Private Residential Properties (PPI) | YoY |

| 2012 | $802 | – | 151.5 | – |

| 2013 | $898 | 11.97% | 153.2 | 1.12% |

| 2014 | $799 | -11.02% | 147 | -4.05% |

| 2015 | $760 | -4.88% | 141.6 | -3.67% |

| 2016 | $769 | 1.18% | 137.2 | -3.11% |

| 2017 | $800 | 4.03% | 138.7 | 1.09% |

| 2018 | $895 | 11.88% | 149.6 | 7.86% |

| 2019 | $880 | -1.68% | 153.6 | 2.67% |

| 2020 | $822 | -6.59% | 157 | 2.21% |

| 2021 | $887 | 7.91% | 173.6 | 10.57% |

| 2022 | $971 | 9.47% | 188.6 | 8.64% |

| Annualised | – | 1.93% | – | 2.21% |

From the graph above, it becomes evident that the price fluctuations of Braddell View over the past decade have displayed a rather unpredictable pattern. A closer examination of the accompanying table reveals that while property prices at Braddell View rebounded in tandem with the overall market between 2016 and 2018, they failed to sustain this upward trend, and a decline ensued until the onset of the pandemic.

Given that Braddell View is now 45 years old, concerns about lease decay are valid, as are apprehensions regarding its resale potential. Younger buyers might find themselves needing to allocate a larger portion of their financial resources to the purchase if the remaining lease does not extend until they reach the age of 95. Nonetheless, the development’s favourable central location (and large format units) may sustain demand, despite its age.

At the time of writing, the average price per square foot (PSF) stands at a decade-high of $1,028. If you are contemplating selling the property, the current market conditions could yet present an opportune moment to do so.

Let’s now run through the options you’re considering.

Potential pathways

Before continuing, we must preface that our pathway here considers your potential financial outcome at the end of a certain period. As you plan for this to be your last property, we would simply look at the outcome in 10 years. Ultimately, the pathway you decide to take may have little to do with the financial outcome, but this is still something worth noting.

Option 1. Sell Braddell View and apply for a BTO

Due to the 30-month wait-out period and 3-4 years wait for the BTO to be completed, the main issue here is that additional costs may be incurred.

Do also note that if you took the CPF housing grants when buying your previous resale HDB, that counts as a subsidised flat and a resale levy will be payable. You will also be considered a second-timer and may stand a lower chance of successfully getting a BTO.

Since you’ve been staying in Bishan, we will also assume that you would prefer to continue residing in the central area. As there haven’t been any BTO launched in Bishan recently (although there will be one in Dec 2023), we’ll look at some of the starting prices of units under the Prime Location Public Housing (PLH) model from the latest BTO launch in October.

| HDB estate | Unit type | Price (excluding grants) | Price (including grants) |

| Kallang / Whampoa | 3-room | From $368,000 | From $308,000 |

| 4-room | From $535,000 | From $490,000 | |

| Queenstown | 3-room | From $364,000 | From $304,000 |

| 4-room | From $537,000 | From $492,000 |

For calculation purposes, let’s say you were to buy a 4-room flat at $550k and pay for it in full with your CPF funds. Since you have plans to retire in 4 years, after your son has completed his studies, we presume that this next property is likely to be your last. However, for our calculations, we will look at a 10-year timeframe just for comparison purposes.

| Description | Amount |

| Purchase price | $550,000 |

| BSD | $11,100 |

The cost incurred in 10 years

| Description | Amount |

| BSD | $11,100 |

| Rental cost (Assuming it remains at $2,100/month for 6.5 years – 30 months wait out and 4 years wait for BTO to complete) | $163,800 |

| Town council service and conservancy fees (Assuming $71/month during 6.5 years of rental and $79/month for 3.5 years after BTO is complete) | $8,856 |

| Property tax (For 3.5 years) | $1,190 |

| Total outcome | -$184,946 |

When it comes to any BTO, the biggest gain is in its capital appreciation. Although you will likely not be selling the property, we will still look at the potential paper gains, just as a comparison with the other options.

We looked at close to 200 BTOs that were sold upon obtaining their MOP, and the average gain was about 90%. As such, we will use this same appreciation to make a simple projection.

Potential gains in 3.5 years

| Time period | Price | Gains |

| Starting point | $550,000 | $0 |

| Year 3 | $1,045,000 | $495,000 |

Total gains in 10 years: $495,000 – $184,946 = $310,054

Cash remaining: $297,291 (cash proceeds from the sale of Braddell View)

We have also factored in the remaining cash amount from the sale of Braddell View, which could potentially serve as part of your retirement funds in addition to your CPF savings, current cash reserves, and investments.

In this scenario, as you won’t be taking out any loans, you will not be subjected to any interest expenses. However, it’s important to note that the wait for the completion of the BTO is quite lengthy, and this is with the consideration that you manage to secure a unit on your initial attempts.

Unfortunately, this remains an uncertain variable, as it hinges on an element of luck. With the 6.5-year waiting period, the incurred rental costs are already substantial. Considering that we cannot guarantee you’ll secure a unit on your first or even second application, these costs could potentially be even higher.

Option 2. Sell Braddell View and buy a resale HDB

If you intend to purchase a property for your permanent residence, and profit generation is not a priority, then this approach may be more suitable than Option 1 because it eliminates the extended waiting time and its associated expenses (which are realised, unlike paper gains!).

For individuals who own private properties and are 55 years old or older and are looking to rightsize to an HDB, the 15-month waiting period is waived when purchasing a 4-room flat or smaller. Since your family consists of three members, we can assume here that you are considering a 4-room or smaller unit.

Additionally, if you have not utilised any of the CPF housing grants for your previous HDB purchase, you remain eligible to apply for them now. The first-timer grant is notably substantial, amounting to $80,000.

When examining HDBs in Bishan, the youngest blocks are at the Natura Loft DBSS, which was completed in 2011. In the past six months, 4-room units were sold at an average price of $1,011,750. The next youngest cluster, Bishan Heights, located adjacent to Natura Loft and completed in 1998, had an average transaction price of $740,378 over the same period.

The latter option, Bishan Heights, maybe a more prudent choice, especially if you consider this property to be your final home purchase. With a remaining lease of 74 years, it provides ample coverage for you and your partner throughout your retirement years. Therefore, opting for a more cost-effective option like Bishan Heights ensures that you preserve your financial resources and avoid over-committing to a more expensive flat, which may not be necessary if you plan to hold onto the property rather than sell it.

Let’s say you were to buy a unit at Bishan Heights at $740,000. Similarly, we will presume you pay the property in full with your CPF funds.

| Description | Amount |

| Purchase price | $740,000 |

| BSD | $16,800 |

The cost incurred in 10 years

| Description | Amount |

| BSD | $16,800 |

| Town council service and conservancy fees (Assuming $79/month) | $9,480 |

| Property tax | $5,680 |

| Total outcome | -$31,960 |

As before, we will use the annualised growth rate of HDBs over the past 10 years of 1.42% to do a simple projection.

Potential gains in 10 years

| Time period | Price | Gains |

| Starting point | $740,000 | $0 |

| Year 1 | $750,508 | $10,508 |

| Year 2 | $761,165 | $21,165 |

| Year 3 | $771,974 | $31,974 |

| Year 4 | $782,936 | $42,936 |

| Year 5 | $794,053 | $54,053 |

| Year 6 | $805,329 | $65,329 |

| Year 7 | $816,765 | $76,765 |

| Year 8 | $828,363 | $88,363 |

| Year 9 | $840,126 | $100,126 |

| Year 10 | $852,055 | $112,055 |

Total gains in 10 years: $112,055 – $31,960 = $80,095

Cash remaining: $297,291

It’s clear from the calculations that by eliminating the need for rental expenses during the extended BTO waiting period, the overall cost is significantly reduced, and you won’t need to dip into the cash proceeds from the sale of BV.

Option 3. Renovate Braddell View into a dual-key unit

Considering the performance of Braddell View before the pandemic, along with its age, it might not be the most suitable option for a long-term hold, especially when you still have a significant outstanding loan and are aiming to retire in a couple of years. As you’ve mentioned, the expenses for renovating the house into a dual-key unit can be quite substantial and may not yield a worthwhile return on investment. Also, let’s not forget that if Braddell View ends up in a collective sale earlier than expected (or even at a price lower than what you want), your returns may end up being lower.

If you’re interested in generating passive income for your retirement but still retain your privacy, an alternative approach would be to purchase a dual-key unit instead of converting Braddell View into one. With your financial capacity, you have the means to acquire a resale 3-bedroom dual-key condo, although it might not be situated in a central location.

These are some of the available 3-bedroom dual-key units on the market:

| Project | District | Tenure | TOP | Size (sqft) | Asking price |

| Skies Miltonia | 27 | 99 years | 2016 | 1,173 | >$1,399,000 |

| 1 Canberra | 27 | 99 years | 2015 | 1,259 | >$1,499,888 |

| Riversound Residence | 19 | 99 years | 2015 | 1,184 | $1,688,000 |

Nevertheless, considering that retirement is approaching, you might prefer not to commit to a substantial loan, which is one of the motivations behind your inclination to sell Braddell View. Therefore, an alternative worth exploring could be the acquisition of an adjoined HDB flat. As the name implies, this involves two separate units merged into one. This combination can consist of two adjoining 3-room units or a combination of a 3-room and a 4-room unit.

Given your financial capacity, you can secure a centrally located unit without the necessity of a significant loan, and for some units, you may not even need a loan at all. These are some of the recent transactions over the last 3 months, for adjoined flats in the central region:

| Date | Street | Level | Size (sqm) | Completion year | Price |

| Aug 2023 | Ang Mo Kio Ave 10 | 04 to 06 | 176 | 1979 | $1,200,000 |

| Aug 2023 | Tg Pagar Plaza | 13 to 15 | 118 | 1977 | $928,000 |

| Sep 2023 | Ang Mo Kio Ave 4 | 10 to 12 | 134 | 1985 | $830,000 |

| Sep 2023 | Ang Mo Kio Ave 10 | 13 to 15 | 176 | 1980 | $1,180,000 |

| Sep 2023 | C’wealth Cres | 04 to 06 | 132 | 1970 | $780,000 |

| Sep 2023 | Lor 8 Toa Payoh | 07 to 09 | 130 | 1976 | $720,000 |

| Oct 2023 | Ang Mo Kio Ave 10 | 07 to 09 | 164 | 1980 | $996,000 |

| Oct 2023 | Ang Mo Kio Ave 10 | 10 to 12 | 163 | 1980 | $995,000 |

| Oct 2023 | Ang Mo Kio Ave 3 | 10 to 12 | 149 | 1979 | $960,000 |

| Oct 2023 | Jln Kukoh | 16 to 18 | 106 | 1971 | $560,000 |

If you were to purchase a smaller unit, you would be able to pay off the property in full with your CPF funds and some cash proceeds from the sale of BV. However, since this is not a 4-room or smaller unit, you will have to adhere to the 15-month wait-out period.

Let’s say you were to purchase a unit at $830,000 in Ang Mo Kio and rent out one side at $2,700/month (average rent for a 3-room flat in Ang Mo Kio in Q3 2023). Although you are renting out a proper sized 3-room flat, that is just a portion of the house and not the entire flat so you need not wait for the 5-year MOP to be up.

| Description | Amount |

| Purchase price | $830,000 |

| BSD | $19,500 |

| CPF funds refunded from the sale of BV | $700,000 |

| Cash required | $149,500 |

The cost incurred in 10 years

| Description | Amount |

| BSD | $19,500 |

| Rental expense for 15-month wait out | $31,500 |

| Town council service and conservancy fees (Assuming $71/month for 15 months and $90/month for 8 years and 9 months) | $10,515 |

| Property tax | $36,720 |

| Rental income (For 8 years and 9 months) | $283,500 |

| Agency fee (Payable once every 2 years) | $11,664 |

| Total outcome | $173,601 |

Similarly, we will use the annualised growth rate of HDBs over the past 10 years of 1.42% to do a simple projection.

Potential gains in 10 years

| Time period | Price | Gains |

| Starting point | $830,000 | $0 |

| Year 1 | $841,786 | $11,786 |

| Year 2 | $853,739 | $23,739 |

| Year 3 | $865,862 | $35,862 |

| Year 4 | $878,158 | $48,158 |

| Year 5 | $890,628 | $60,628 |

| Year 6 | $903,274 | $73,274 |

| Year 7 | $916,101 | $86,101 |

| Year 8 | $929,110 | $99,110 |

| Year 9 | $942,303 | $112,303 |

| Year 10 | $955,684 | $125,684 |

Total gains in 10 years: $125,684 + $173,601 = $299,285

Cash remaining: $297,291 – $149,500 = $147,791

In the previous two pathways, the profits achieved within a decade represented paper gains that will not materialise unless you decide to sell the property. However, in this alternative, you stand to realise tangible gains of $173,601 over 10 years through the rental income from one side of the unit. This is a useful avenue for generating passive income to support your retirement years.

What should you do?

Let’s do a quick comparison of the costs incurred and potential gains of the 3 pathways.

| Option 1. Sell BV and apply for a BTO | Option 2. Sell BV and buy a resale flat | Option 3. Sell BV and buy an adjoined HDB | |

| Costs incurred | $184,946 | $31,960 | $173,601 (Gains) |

| Cash remaining from sales proceeds of BV | $297,291 | $297,291 | $147,791 |

| Paper gains | $310,054 | $80,095 | $125,684 |

| Actual gains | – | – | $173,601 |

Considering the likelihood of not selling the property, we can disregard the potential paper gains, as they only become relevant if you decide to sell the house or leave it behind for your son.

Looking at the table, it’s evident that although Option 1 will make the highest paper gain, it will also incur the highest cost due to the need to rent for an extended period while waiting for the BTO flat, making it the least favourable choice if preserving your existing wealth is important, which should be the case given you’re looking forward to retirement.

In the case of Option 2, given that your husband is now 55 years old, the 15-month wait-out period is waived when purchasing a 4-room or smaller HDB, which reduces the overall expenses. Moreover, since you can pay for the flat using your CPF funds, there’s no necessity to dip into the cash proceeds from the sale of Braddell View, which can contribute to your retirement funds.

Option 3 introduces a source of passive income, but due to the larger unit size, the property is likely to come with a higher price tag, potentially requiring you to use some of your cash proceeds.

Upon closer examination, the available cash for Options 2 and 3 is relatively similar. While Option 2 doesn’t provide rental income, it keeps your cash proceeds of $297,291 untouched. On the other hand, Option 3, although generating rental income, may entail using a portion of your cash proceeds for the purchase.

With these considerations in mind, Option 2 appears to be a more practical choice. You can also look to invest the available cash in other avenues. For example, if you were to invest the $297,291 in stocks and shares or deposit it into your husband’s RA account, which yields a 4% annual interest, after four years, you could accumulate $440,063. This amount surpasses the cash you’d have in Option 3, including the rental income.

Additionally, this approach eliminates the hassle of managing a tenant and provides you with more options compared to Option 3, given the limited availability of adjoined units. Furthermore, option 3 ultimately leaves you with an old HDB flat which puts you in a similar spot of owning Braddell View.

If your goal is to purchase a flat with a healthy lease for legacy planning, then we are in favour of options 1 or 2.

Finally, you could also consider option 1 first, then selling after its MOP and then buying a resale flat. However, this boils down to whether or not the BTO you purchase falls under the Prime Location Housing Model (PLH) since this would affect your MOP period and the profits you could make from it. You’ll also have to deal with the hassle of moving again which can be cumbersome in your 60s.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Latest Posts

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

0 Comments