We Are Planning For Retirement With Passive Rental Income In Mind: Should We Invest In A Newer Leasehold Condo Or Older Freehold One?

November 3, 2023

Hi Stacked Homes,

Thank you for all the great and insightful articles. My wife and I have been enjoying reading and watching contents from Stacked Homes, not to mention learning how to apply all the calculations.

We are currently contemplating between the 2-bedroom unit at Twin Regency (980 sqft) vs. 3-bedroom unit at Highline Residences (904 sqft) as our investment property. Both developments are situated next to each other with the former being freehold and the latter a leasehold, thus both share the same great location and amenities.

We are both planning for retirement hence passive income is our priority. We do not have any legacy planning in mind. If purely considering investment, we would think that Highline Residences is definitely the better option with higher rental yield and perhaps more competitive in the rental market due to its age and newer facilities. However, we still could not shake off the “freehold” mentally and unsure in the long run, how would Highline Residences fare as opposed to Twin Regency?

As for our own stay, would you think that selling our 2015 4-bedder 1200 sqft condo at Riversound Residences for a 2-bedder 1109 sqft at Seasons Park is a wise choice? We chose Seasons Park for its low quantum, close proximity to MRT and perhaps the upside potential of the upcoming Lentor township. However, we dread the risk of lease decay and maintenance/upkeep of the development. What are your thoughts assuming we do not have affordability issues for all the options mentioned above.

We would be very grateful for your advice and opinions. Looking forward to hearing from you.

Best Regards

(This is part of an ongoing series where we answer reader questions about the property market. If you have one of your own, send it to stories@stackedhomes.com.)

Hi there,

Thanks for writing in, and we are happy to know you’ve been enjoying the content we’ve put out!

Before we get fully into it, we have to caveat here that it’s quite hard to give thorough advice on this when we don’t know about your age and length of holding time till retirement. For example, if you are still in your 40s and planning to retire soon, Seasons Park could be sensible even if it may en bloc in the next 20 years (moving when you are in your 60s is still okay). But if you are in your 60s now, you may not want to have to move when you are older – even if it may be a sizeable windfall. The stress of moving from somewhere familiar and having to uproot and find another home may not be worth the money at that point.

Also, it is understandably hard to let go off the mentality that freehold is better than a leasehold property, but this is very much dependent on your own goals for the property. Again, it matters how long you are planning to keep the property. Especially when passive income is your primary consideration, the premium on a freehold property could potentially reduce the rental yield. (We have recently written a piece on this, which you can read here).

Since you’ve shortlisted some projects, let’s look at how they’ve been doing so far.

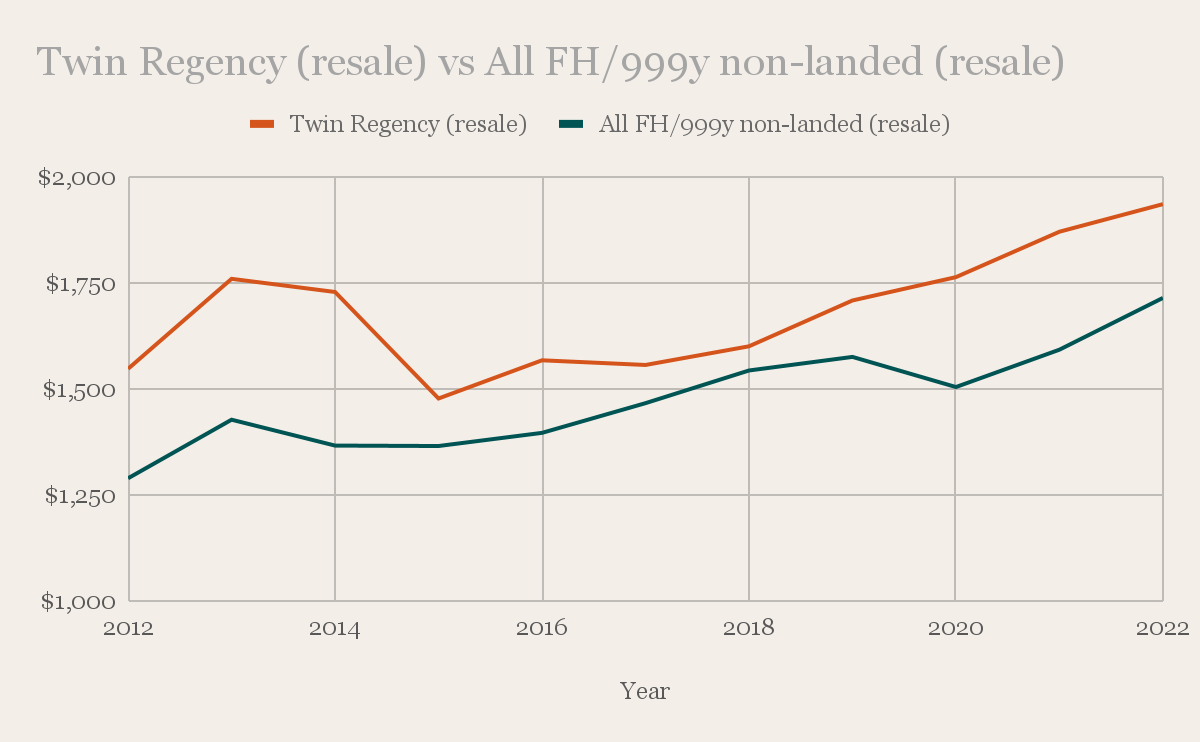

Performance of Twin Regency

| Year | Twin Regency (resale) | YoY | All FH/999y non-landed (resale) | YoY |

| 2012 | $1,547 | – | $1,289 | – |

| 2013 | $1,759 | 13.70% | $1,427 | 10.71% |

| 2014 | $1,728 | -1.76% | $1,366 | -4.27% |

| 2015 | $1,477 | -14.53% | $1,365 | -0.07% |

| 2016 | $1,567 | 6.09% | $1,396 | 2.27% |

| 2017 | $1,556 | -0.70% | $1,466 | 5.01% |

| 2018 | $1,600 | 2.83% | $1,543 | 5.25% |

| 2019 | $1,708 | 6.75% | $1,575 | 2.07% |

| 2020 | $1,763 | 3.22% | $1,504 | -4.51% |

| 2021 | $1,870 | 6.07% | $1,592 | 5.85% |

| 2022 | $1,935 | 3.48% | $1,714 | 7.66% |

| Annualised | – | 2.26% | – | 2.89% |

From the graph and table above, it’s evident that the price movement of Twin Regency is more or less aligned with the trend observed in all freehold and 999-year leasehold non-landed properties. However, its annualised growth rate over the past decade is slightly lower.

One notable observation with Twin Regency is its relatively low transaction volume, which is not entirely surprising given it has just 234 units. Another reason could be due to its freehold status, of which you don’t have very many condos of the same nature in Tiong Bahru – so you may have many owners here with the intention of a more long-term hold.

A lower transaction volume may also imply extended waiting periods for units to become available on the market. Over the past decade, the average number of units sold annually is 5. The most recent transaction was a 970 sq ft 2-bedroom unit sold in June last year for $1.95M.

Between June and August this year, 7 2-bedroom units were rented out at an average price of $5,486. Based on the last transaction price of $1.95M, this translates to a rental yield of 3.4%.

Given its freehold status, the property’s age is not a significant concern at this point. However, when it comes to attracting tenants, updated facilities may make a difference for some renters. The project obtained its TOP 16 years ago, which some would consider old, but it offers a full range of well-maintained condo facilities, as reflected in positive Google reviews.

Let’s now look at its neighbour, Highline Residences.

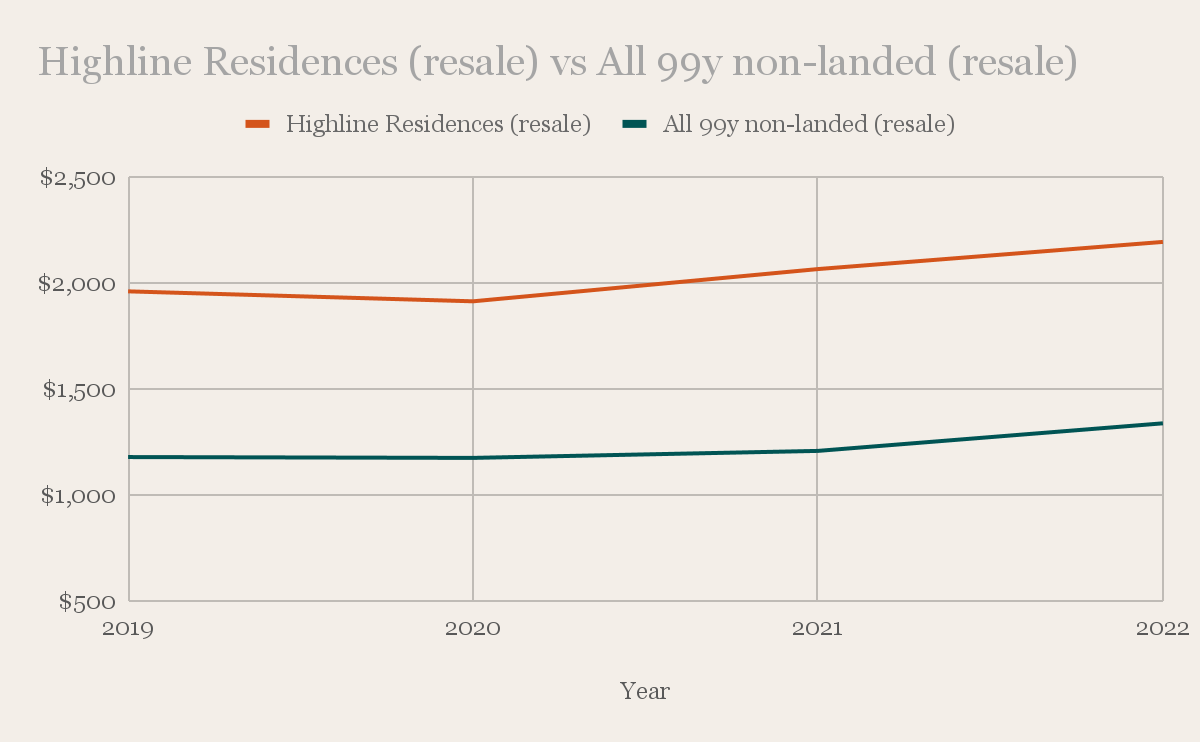

Performance of Highline Residences

| Year | Highline Residences (resale) | YoY | All 99y non-landed (resale) | YoY |

| 2019 | $1,959 | – | $1,178 | – |

| 2020 | $1,912 | -2.40% | $1,174 | -0.34% |

| 2021 | $2,064 | 7.95% | $1,207 | 2.81% |

| 2022 | $2,192 | 6.20% | $1,337 | 9.72% |

| Annualised | – | 3.82% | – | 4.31% |

As Highline Residences only obtained its TOP in 2018, frankly there isn’t a whole lot of data to analyse. It’s clear from the graph and table above that prices at Highline Residences are moving in line with the rest of the 99-year leasehold non-landed properties, albeit with a slightly lower annualised growth rate. However, it’s important to note that this data might not provide a truly accurate representation due to the unique market conditions we experienced in the past two years.

If we were to also look at the annualised growth rate of Twin Regency and all freehold non-landed properties during the same time period, it is at 4.25% and 2.86% respectively. The difference as compared to the 10-year growth rate is pretty substantial for Twin Regency and it did better compared to Highline Residences during this period.

There has only been one 904 sq ft 3-bedder transacted this year in July, at $2.08M. From June to August, there were 5 of such units rented out at an average price of $7,020 per month, which translates to a rental yield of 4.1%.

Since you’ve raised concerns over the long term performance of Highline Residences, in order to have a better idea of how the project may perform in the long run, let’s take a look at the two other 99-year leasehold projects in the vicinity.

Although they do have varying characteristics in terms of land size, number of units, unit mix, available facilities, etc. They do share the same advantages in terms of locality.

Central Green Condominium – currently 31 years old

| Year | Central Green Condominium (resale) | YoY | All 99y non-landed (resale) | YoY |

| 2012 | $1,252 | – | $986 | – |

| 2013 | $1,372 | 9.58% | $1,057 | 7.20% |

| 2014 | $1,273 | -7.22% | $1,029 | -2.65% |

| 2015 | $1,246 | -2.12% | $1,033 | 0.39% |

| 2016 | $1,246 | 0.00% | $1,129 | 9.29% |

| 2017 | $1,251 | 0.40% | $1,115 | -1.24% |

| 2018 | $1,412 | 12.87% | $1,153 | 3.41% |

| 2019 | $1,413 | 0.07% | $1,178 | 2.17% |

| 2020 | $1,412 | -0.07% | $1,174 | -0.34% |

| 2021 | $1,443 | 2.20% | $1,207 | 2.81% |

| 2022 | $1,479 | 2.49% | $1,337 | 10.77% |

| Annualised | – | 1.68% | – | 3.09% |

Meraprime – currently 20 years old

| Year | Meraprime (resale) | YoY | All 99y non-landed (resale) | YoY |

| 2012 | $1,414 | – | $986 | – |

| 2013 | $1,478 | 4.53% | $1,057 | 7.20% |

| 2014 | $1,429 | -3.32% | $1,029 | -2.65% |

| 2015 | $1,372 | -3.99% | $1,033 | 0.39% |

| 2016 | $1,329 | -3.13% | $1,129 | 9.29% |

| 2017 | $1,436 | 8.05% | $1,115 | -1.24% |

| 2018 | $1,520 | 5.85% | $1,153 | 3.41% |

| 2019 | $1,576 | 3.68% | $1,178 | 2.17% |

| 2020 | $1,464 | -7.11% | $1,174 | -0.34% |

| 2021 | $1,607 | 9.77% | $1,207 | 2.81% |

| 2022 | $1,766 | 9.89% | $1,337 | 10.77% |

| Annualised | – | 2.25% | – | 3.09% |

We can see that in the years preceding the pandemic, Central Green Condominium which is much older in age, mostly saw very little appreciation and even experienced negative growth rates in several years. It was only during periods of overall market uptick that its prices picked up (2012 – 2013, 2017 – 2018, 2020 – 2022).

Whereas Meraprime, which is 11 years younger than Central Green, over the last 10 years was more or less moving in tandem with the overall market. Its annualised growth rate is only 0.01% lower than Twin Regency.

According to this study done by NUS, when a 99-year leasehold private property reaches the 21-year mark, its prices depreciate by more than 30%. Although this may vary from project to project, we can see in this case here that the growth rate of Central Green is considerably lower than that of Meraprime. As such, like we mentioned in the beginning, an important consideration would be your holding period.

Given that Highline Residences is currently 10 years old, there’s still some ways to go before it turns 21, but if your plan is to hold it for a longer period of time, perhaps buying a freehold property might be a more sensible option.

Going back to the rental yield, even though Highline Residences has a higher yield than Twin Regency, its purchase price is also higher. Assuming a 10-year holding period, let’s compare the potential costs and profits of both of these properties.

Buying Twin Regency

| Purchase price | $1,950,000 |

| BSD | $67,100 |

| 25% down payment | $487,000 |

| 75% loan | $1,462,500 |

As we do not have your age or financial details, we will assume you’ll take the full 75% loan with a 25-year tenure.

Cost incurred over 10 years

| BSD | $67,100 |

| Interest expense (Assuming 4.6% interest) | $589,347 |

| Property tax | $129,000 |

| Maintenance fees (Assuming $300/month) | $36,000 |

| Rental income (Assuming $5,486/month with no vacancy period) | $658,320 |

| Agency fee (Paid once every 2 years) | $29,625 |

| Total costs | $192,752 |

For the projection, we will use the annualised growth rate of all private properties over the last decade of 2.21%.

| Time period | Price | Gains |

| Starting point | $1,950,000 | $0 |

| Year 1 | $1,993,095 | $43,095 |

| Year 2 | $2,037,142 | $87,142 |

| Year 3 | $2,082,163 | $132,163 |

| Year 4 | $2,128,179 | $178,179 |

| Year 5 | $2,175,212 | $225,212 |

| Year 6 | $2,223,284 | $273,284 |

| Year 7 | $2,272,419 | $322,419 |

| Year 8 | $2,322,639 | $372,639 |

| Year 9 | $2,373,969 | $423,969 |

| Year 10 | $2,426,434 | $476,434 |

Estimated gains in 10 years: $476,434 – $192,752 = $283,682

Buying Highline Residences

| Purchase price | $2,080,000 |

| BSD | $73,600 |

| 25% down payment | $520,000 |

| 75% loan | $1,560,000 |

Cost incurred over 10 years

| BSD | $73,600 |

| Interest expense (Assuming 4.6% interest) | $628,637 |

| Property tax | $195,260 |

| Maintenance fees (Assuming $450/month) | $54,000 |

| Rental income (Assuming $7,020/month with no vacancy period) | $842,400 |

| Agency fee (Paid once every 2 years) | $37,910 |

| Total costs | $147,007 |

Similarly, we will use the annualised growth rate of all private properties over the last decade of 2.21% for the projection.

| Time period | Price | Gains |

| Starting point | $2,080,000 | $0 |

| Year 1 | $2,125,968 | $45,968 |

| Year 2 | $2,172,952 | $92,952 |

| Year 3 | $2,220,974 | $140,974 |

| Year 4 | $2,270,058 | $190,058 |

| Year 5 | $2,320,226 | $240,226 |

| Year 6 | $2,371,503 | $291,503 |

| Year 7 | $2,423,913 | $343,913 |

| Year 8 | $2,477,482 | $397,482 |

| Year 9 | $2,532,234 | $452,234 |

| Year 10 | $2,588,196 | $508,196 |

Estimated gains in 10 years: $508,196 – $147,007 = $361,189

We can see here that even though the costs incurred (BSD, interest expense, property tax, maintenance fees and agency fees) are all higher for Highline Residences, its rental income is substantially more than Twin Regency and thus helps to offset a huge bulk of these costs resulting in a higher potential gain.

Having said that, it is important to note that this is contingent on the rental prices staying at the current rates or going higher.

Which project should you invest in?

This firstly comes down to your intended holding period. As we have seen with the performance of older 99-year leasehold condominiums in the area, even though they share the same locality, Central Green which is 31 years old is experiencing a much slower growth rate than Meraprime which is 20 years old. The former mostly saw notable growth in the years where the entire market picked up.

Considering this, if you’re planning to hold the property for over 10 years, buying Twin Regency might be a better option.

Looking at our calculations based on a 10-year horizon,

| Twin Regency | Highline Residences | |

| 25% down payment | $487,000 | $520,000 |

| Total costs (excluding rental income) | $851,072 | $989,407 |

| Total | $1,338,072 | $1,509,407 |

We can see here that the initial investment as well as the total outgoings of Highline Residences is considerably higher than Twin Regency, with a difference of $171,335. These costs are more or less predictable.

| Twin Regency | Highline Residences | |

| Rental income | $658,320 | $842,400 |

| Estimated gains | $476,434 | $508,196 |

| Total | $1,134,754 | $1,350,596 |

The rental income and potential gains on the other hand, will vary depending on market conditions.

Based on the above tables, to potentially make an extra $215,842 (with no guarantee) by investing in Highline Residences, you’d need to invest an additional $171,335. In essence, this would result in a profit margin of just $44,507 more compared to purchasing Twin Regency over a 10-year period.

However, in this scenario, we are comparing a 2-bedder and a 3-bedder. Let’s instead compare the 2-bedder at Twin Regency to a 2-bedder (2b2b) at Highline Residences, which could be an alternative option.

From January till date, there were just two 2b2b transactions in Highline Residences with an average price of $1,705,000, and the average rent from June to August was $6,000. This translates to a rental yield of 4.2%.

Assuming the same 10-year holding period:

| Purchase price | $1,705,000 |

| BSD | $54,850 |

| 25% down payment | $426,250 |

| 75% loan | $1,278,750 |

Cost incurred over 10 years

| BSD | $54,850 |

| Interest expense (Assuming 4.6% interest) | $515,301 |

| Property tax | $151,200 |

| Maintenance fees (Assuming $300/month) | $36,000 |

| Rental income (Assuming $6,000/month with no vacancy period) | $720,000 |

| Agency fee (Paid once every 2 years) | $32,400 |

| Total costs | $69,751 |

Similarly, we will use the annualised growth rate of all private properties over the last decade of 2.21% for the projection.

| Time period | Price | Gains |

| Starting point | $1,705,000 | |

| Year 1 | $1,742,681 | $37,681 |

| Year 2 | $1,781,194 | $76,194 |

| Year 3 | $1,820,558 | $115,558 |

| Year 4 | $1,860,792 | $155,792 |

| Year 5 | $1,901,916 | $196,916 |

| Year 6 | $1,943,948 | $238,948 |

| Year 7 | $1,986,910 | $281,910 |

| Year 8 | $2,030,820 | $325,820 |

| Year 9 | $2,075,701 | $370,701 |

| Year 10 | $2,121,574 | $416,574 |

Estimated gains after 10 years: $416,574 – $69,751 = $346,823

Let’s now re-look at the outgoings:

| Twin Regency (2b2b) | Highline Residences (2b2b) | |

| 25% down payment | $487,000 | $426,250 |

| Total costs (excluding rental income) | $851,072 | $789,751 |

| Total | $1,338,072 | $1,216,001 |

And potential gains:

| Twin Regency | Highline Residences | |

| Rental income | $658,320 | $720,000 |

| Estimated gains | $476,434 | $416,574 |

| Total | $1,134,754 | $1,136,574 |

We can see here that when comparing the same unit type, while the difference in potential gains is negligible, the outgoings are reduced by $122,071 if you were to invest in Highline Residences.

Given its higher rental yield, lower costs incurred, and seeing as the property is still relatively young, if your intention is to hold the property for less than a period of 10 years, you could possibly consider this alternative of purchasing a 2-bedder at Highline Residences instead.

Finally, do remember that these were all worked out based on the gross rental numbers. The final cash flow that you take home could be very different depending on the monthly maintenance of each development as well.

Now let’s discuss your own stay property.

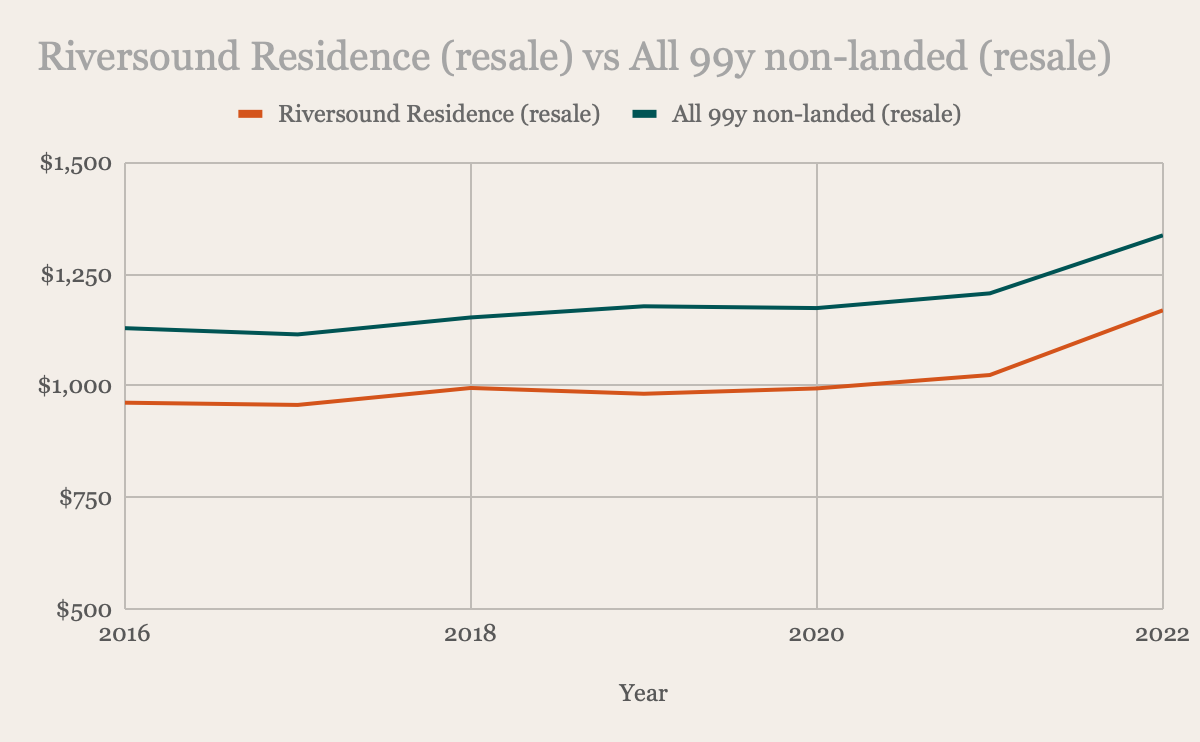

Performance of Riversound Residence

| Year | Riversound Residence (resale) | YoY | All 99y non-landed (resale) | YoY |

| 2016 | $962 | – | $1,129 | – |

| 2017 | $957 | -0.52% | $1,115 | -1.24% |

| 2018 | $995 | 3.97% | $1,153 | 3.41% |

| 2019 | $982 | -1.31% | $1,178 | 2.17% |

| 2020 | $994 | 1.22% | $1,174 | -0.34% |

| 2021 | $1,024 | 3.02% | $1,207 | 2.81% |

| 2022 | $1,169 | 14.16% | $1,337 | 10.77% |

| Annualised | – | 3.3% | – | 2.86% |

Since Riversound Residence obtained its TOP in 2015, we have just 6 years of data to look at. From the above, we can see that the price movement of Riversound Residence is pretty much parallel to that of all 99-year leasehold properties. In fact, over the last 6 years it is performing better than the overall market.

Now let’s look at your competitors.

When we examine the neighbouring developments which are situated side by side, we find that Riversound Residence stands as the youngest property and the sole condominium among them. The remaining three are Executive Condominiums (ECs), but Park Green and The Rivervale have already surpassed the 10-year milestone and are now fully privatised. Given that Park Green and The Rivervale have both exceeded 20 years in age, your primary competitor in this context is Austville Residences, which is just one year older than Riversound Residence.

From the graph above, we can see that prices at Austville are gradually catching up with Riversound but there is still some disparity. Let’s zoom into the 4-bedders specifically.

There were four 4-bedders transacted in Riversound Residence from January till date with an average price of $1,535,500.

| Date | Size (sqft) | PSF | Price | Level |

| Jul 2023 | 1,259 | $1,199 | $1,510,000 | #09 |

| Jul 2023 | 1,292 | $1,200 | $1,550,000 | #13 |

| May 2023 | 1,259 | $1,216 | $1,532,000 | #14 |

| Mar 2023 | 1,259 | $1,231 | $1,550,000 | #06 |

For a similarly sized 4-bedder in Austville Residences, there were 3 transactions done this year with an average price of $1,451,000.

| Date | Size (sqft) | PSF | Price | Level |

| Jul 2023 | 1,227 | $1,257 | $1,543,000 | #15 |

| May 2023 | 1,227 | $1,157 | $1,420,000 | #07 |

| Jan 2023 | 1,227 | $1,133 | $1,390,000 | #09 |

Although there is a noticeable difference in average prices, it’s worth noting that the prices of 4-bedroom units at Austville Residences appear to be trending upwards. The lower price tag at Austville Residences may have offered it a competitive edge but if the prices are similar and Austville Residences achieves privatisation next year, the competition would be on a level playing field.

Let’s now look at how Seasons Park is doing.

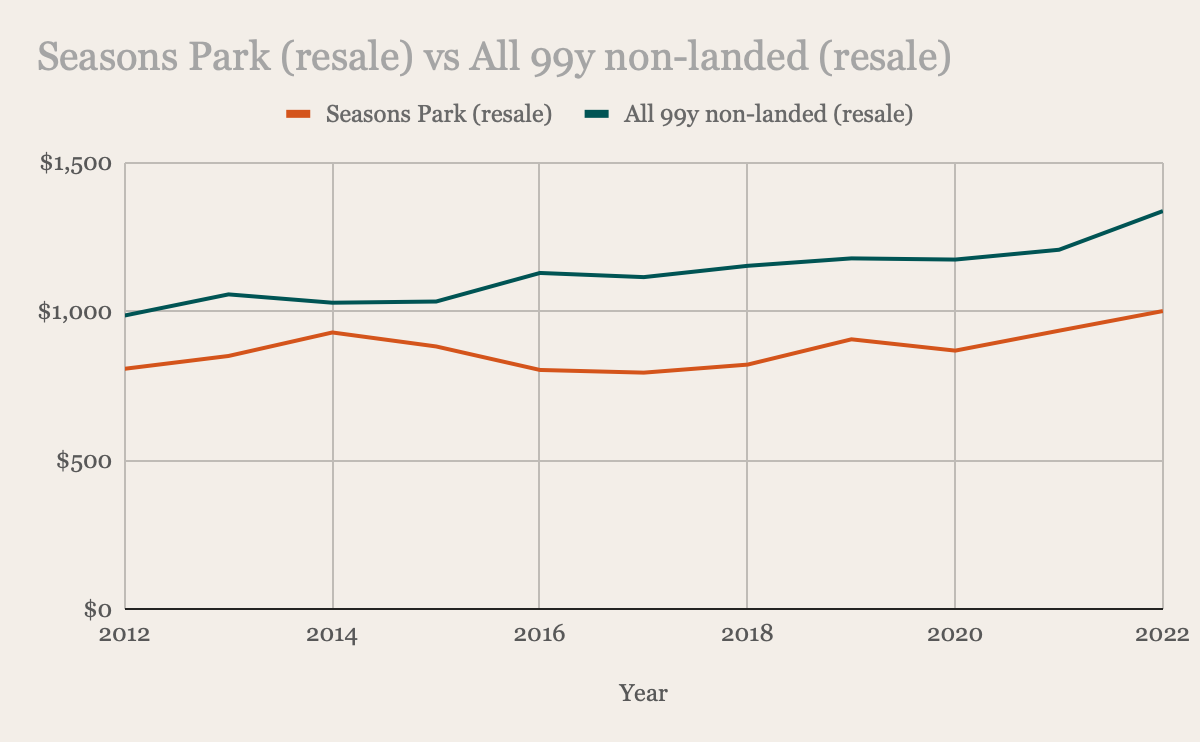

Performance of Seasons Park

| Year | Seasons Park (resale) | YoY | All 99y non-landed (resale) | YoY |

| 2012 | $807 | – | $986 | – |

| 2013 | $850 | 5.33% | $1,057 | 7.20% |

| 2014 | $929 | 9.29% | $1,029 | -2.65% |

| 2015 | $882 | -5.06% | $1,033 | 0.39% |

| 2016 | $803 | -8.96% | $1,129 | 9.29% |

| 2017 | $794 | -1.12% | $1,115 | -1.24% |

| 2018 | $821 | 3.40% | $1,153 | 3.41% |

| 2019 | $906 | 10.35% | $1,178 | 2.17% |

| 2020 | $868 | -4.19% | $1,174 | -0.34% |

| 2021 | $935 | 7.72% | $1,207 | 2.81% |

| 2022 | $1,001 | 7.06% | $1,337 | 10.77% |

| Annualised | – | 2.18% | – | 3.09% |

Examining the data in the provided table, it’s apparent that Seasons Park experienced substantial year-on-year (YoY) growth during market upswings, but it also witnessed notable price declines during market downturns.

Considering that there were only a few projects in the Lentor area prior to the development of the Lentor Hills Estate, and with freehold property prices in the vicinity being considerably higher, potential buyers seeking private properties in the area have limited options. This scarcity of choices could account for the demand for Seasons Park, even though it’s an older development.

Let’s now look at Seasons Park’s competitors.

Of the projects in the area, these are the only 99-year leasehold properties. We’ve excluded Nuovo since it only has 3 and 4 bedroom units and you are looking at a 2-bedder.

Out of the 3 developments, Seasons Park at 28 years old is the youngest but currently has the lowest average PSF. Castle Green is 2 years older and would be the closest competitor since Far Horizon Garden is alot older at 41 years old. Let’s zoom into the 2-bedders in particular.

From January till date, there have been 7 2-bedders sold in Seasons Park at an average price of $1,194,286.

| Date | Size (sqft) | PSF | Price | Level |

| Oct 2023 | 1,109 | $1,155 | $1,280,000 | #06 |

| Sep 2023 | 1,066 | $1,145 | $1,220,000 | #12 |

| Mar 2023 | 1,066 | $1,060 | $1,130,000 | #11 |

| Mar 2023 | 1,066 | $1,042 | $1,110,000 | #09 |

| Mar 2023 | 1,109 | $1,073 | $1,190,000 | #03 |

| Mar 2023 | 1,109 | $1,173 | $1,300,000 | #08 |

| Mar 2023 | 1,109 | $1,019 | $1,130,000 | #02 |

While at Castle Green, there were 2 transactions with an average price of $1,113,000.

| Date | Size (sqft) | PSF | Price | Level |

| Aug 2023 | 947 | $1,180 | $1,118,000 | #05 |

| Feb 2023 | 947 | $1,170 | $1,108,000 | #08 |

Given that the 2-bedroom units at Seasons Park offer more space, it’s logical that their prices are slightly higher. In this context, there appears to be a fair competition between the two projects.

Of course, the area will also be set for an uplift in the near future with the development of the Lentor precinct.

We have previously written an article touching on the topic of whether a new launch will help boost prices of the surrounding projects. In summary, this is not guaranteed and there are alot of factors that influence whether or not prices of projects in the vicinity of a new launch will go up or remain unaffected.

In the case of Lentor, with Lentor Modern being a mixed-use development, it will definitely bring more convenience to the neighbourhood. However, the redevelopment of the area will also bring a greater supply of private properties.

If we were to look at the 2 bedders (excluding 2 + Study units) in the latest launch in the area, Lentor Hills Residences, they’re transacting at an average price of $1,480,870, which although is notably higher than the average price of $1,194,286 at Seasons Park, but it has the advantage of a brand new lease. Whilst the unit sizes are no doubt more compact (678 – 721 sqft), many buyers are now used to such sizes since it has been the norm for a while.

At this point it’s hard to say which way the pendulum would swing. There may be more competition in the future, and the gulf between the modern developments and the older ones maybe even more apparent. But it could also mean more interest and activity in the area, where buyers are attracted to live but want bigger spaces.

What should you do?

In terms of the investment property, we are in greater favour of purchasing Highline Residences if you do not plan to hold it for the long-term (more than 10 years). Also, keeping in mind that your main objective here is for rental income. However, if you intend to hold onto an investment property purely for investment income indefinitely, buying Twin Regency would make more sense especially if you find the need to sell the development decades down the road to unlock a large amount of cash for whatsoever reason in your retirement years.

In terms of own stay, you mentioned there was no legacy planning in mind. It seems that the existing 4 bedroom may not be the most optimal for you since you’re willing to move into a 2-bedder (albeit almost the same size).

Like we mentioned at the beginning, it’s hard to really give advice on if Seasons Park would make sense without knowing your age and how long is the planned stay. As you rightly have concerns about, the age of Seasons Park means that the maintenance and upkeep in the long run is something that will still have question marks.

Since this is an own-stay retirement property and you have no intention for legacy planning, perhaps you might want to think about something more elderly-proof. Older condos such as Seasons Park may not be the best if you are less mobile in the future (no shelter between blocks, wheelchair access, etc), and you may even want to have even more convenient access to amenities. That’s not to say Seasons Park isn’t good, but it may not be the most ideal.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Latest Posts

Pro Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

On The Market A Rare Pair Of Conserved Shophouses In Chinatown Just Hit The Market For $32.5M

Singapore Property News Some Units At This Freehold Riverfront Condo Could Lose Their Views — But Here’s How Prices Have Actually Moved

0 Comments