We Are In Our 50s With $5m Assets & Earn $480k Per Year. Should We Keep Our Condo And Decouple Or Sell It To Purchase A Landed Home?

September 30, 2022

Hi Ryan,

We have been avid readers of your Stacked Home articles, thank you for writing and sharing your knowledge with all.

We are in a dilemma with some of our property decisions and would like to seek your advice. We really hope to hear back from you with your thoughts.

Our situation

My wife is (turning 55 in 12 months) and myself (turning 55 in 6 months), we have 2 kids. Eldest has just started working and son is currently finishing NS. We both anticipate to continue working for another 10 years, barring unforeseen circumstances. I have my own business consultancy whereas my wife holds a full time job.

Our existing home

We bought a freehold 3-bedroom condo in District 10 in 2006 in our joint names (no TDSR, ABSD etc in those days) and hold 50% each. In 2018, we rented out the condo and in turn we started renting a landed house. We have really liked living in a landed home since and hence are strongly considering buying our own landed home.

The condo unit is an excellent facing unit, great spacious layout, close to good schools and now close to the MRT also. It is valued at $2.8m and outstanding bank loan is $950K. We used our CPF to purchase the house as well as pay the monthly installments.

Currently, my CPF utilised including accrued interest is $318K whereas my wife’s CPF utilised including accrued interest is $598K. Our net rental income from the condo is approximately $30k p.a.

Our finances

My wife earns S$360K p.a and I earn S$120K p.a. My CPF ordinary account + special account balance is currently $449K. So upon age 55, $198,800 will be transferred to the retirement account. Balance $251K will be available for withdrawal, which I plan to withdraw and use it to repay my CPF utilised for home balance.

For the shortfall, I will pay it from my other savings, so that the CPF utilised is completely refunded.

My wife’s CPF ordinary account + special account balance is currently $414K. So upon age 55 next year, $198,800 will be transferred to her retirement account. Balance $215K will be available for withdrawal, which she plans to withdraw and use it to repay her CPF utilised for home balance.

For the shortfall, she will pay it from our savings, so that the CPF utilised is completely refunded. This cash will then again be eligible for withdrawal.

We have fairly liquid assets of around $5m which earns upto 8% p.a. We expect this to continue for another 5 years, thereafter assuming we are not actively managing this portfolio, the returns would drop to around 2% p.a.

The returns are typically reinvested and hence that does not form part of our monthly living expenses. We would also prefer not to use this money for buying a new property and instead let it continue compounding the returns.

Question:

We want to buy a landed home of around 4,000 sq ft land area. Preferably not wanting to rebuild it, but move into a fairly well done-up home which we only need to spend on some repairs/interiors. Our budget is $4m for this, stretching it to a maximum of $5m if we find something that we really like. We are open to exploring D26/27/28 or other similar locations for purchasing the landed home in order to fit into our budget. We are leaning towards purchasing a freehold compared to a leasehold, but would love to hear your views on this.

Should we keep our current condo and just decouple? Thought is to decouple to my name as the single owner, leaving my wife’s name free to buy the landed home. However, due to the TDSR requirements based on my income, I will not be able to re-finance any additional equity loan even after repaying the outstanding CPF used loans. Hence, for the downpayment for the landed home, we will need to draw down from our liquid assets which are earning us a decent return. We would also like to understand the cash outlay involved in decoupling, as I will need to buy over my wife’s 50% share.

Should we sell our current condo and use the excess cash from sale towards downpayment for the landed home? As my wife will be past 55 when we do buy the landed home, the loan tenure will be shorter. However, we understand that whilst on the initial purchase, the loan tenure will be up to age 65, upon repricing the loan, it can then be extended to age 75. With this option, we don’t need to withdraw a significant amount from our other liquid assets to fund the downpayment, except for the monthly loan installment payment to bank for which we may need to draw down from the investment returns earned.

Thanks for your advice and look forward to hearing from you soon.

(This is part of an ongoing series where we answer reader questions about the property market. If you have one of your own, send it to stories@stackedhomes.com.)

Hi there,

Thanks for your support so far, and we’re glad that our content has helped!

This was a long one, but thanks for all the detail that you’ve put into it. It’s an interesting dilemma that you are in, to say the least.

We certainly see the appeal of staying in a landed property given its abundance of space and privacy but we also understand the other side of the equation since your existing property is centrally located with good amenities.

Let’s run through your options and hopefully you’ll get a clearer idea by the end of this!

First, let’s answer your question on tenure.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Should you get a freehold or leasehold landed?

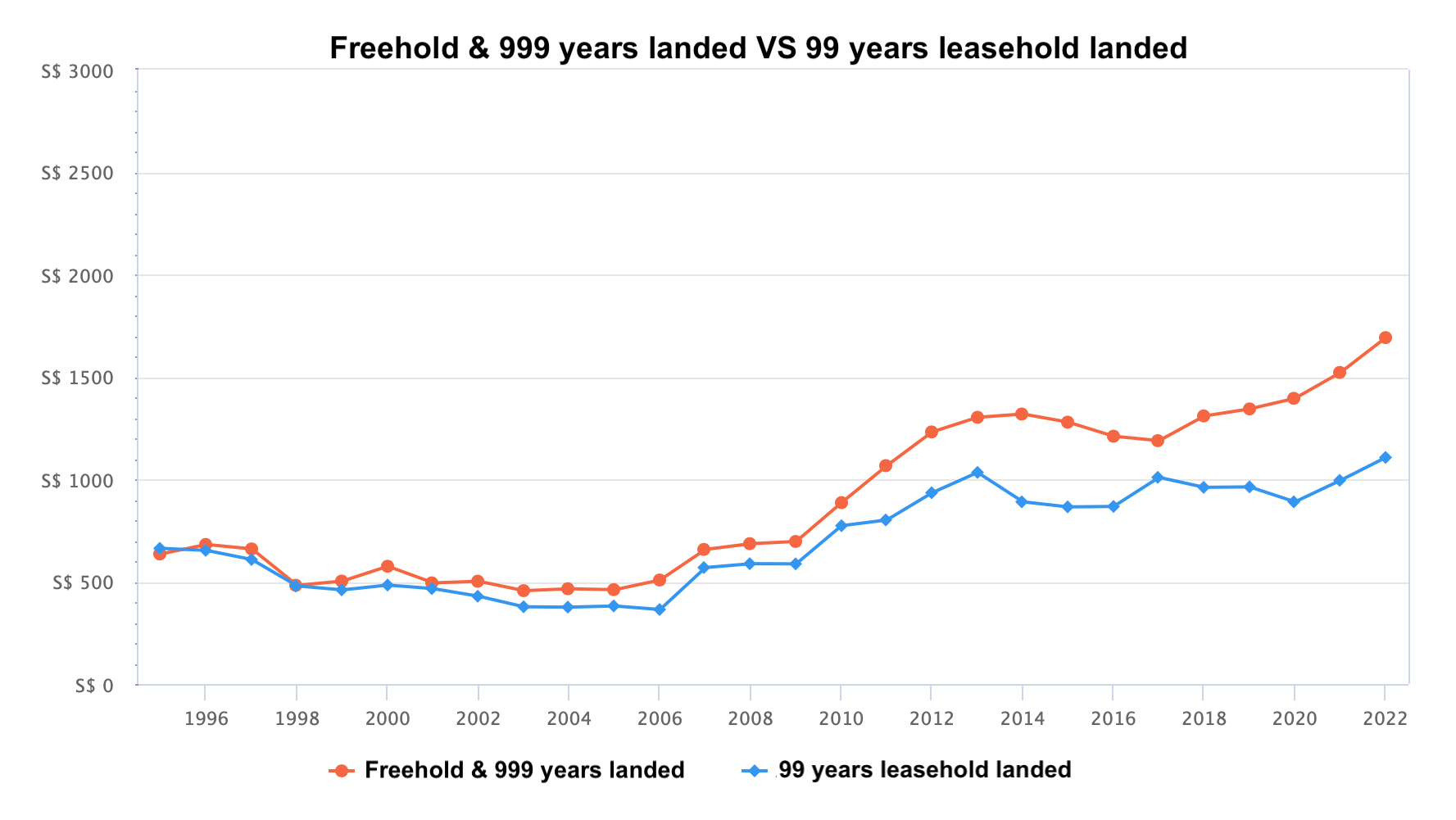

From the above graph you’ll notice that from 1995 to 2009, the difference in prices between freehold/999 years landed and 99 years leasehold landed is very marginal, almost on par for certain years. This could be due to world events that impacted the economy during said period such as:

- 1997 – 1998: Asian financial crisis

- 2000: Dotcom bubble burst

- 2001: 9/11

- 2002 – 2004: SARS outbreak

- 2007 – 2009: Great recession

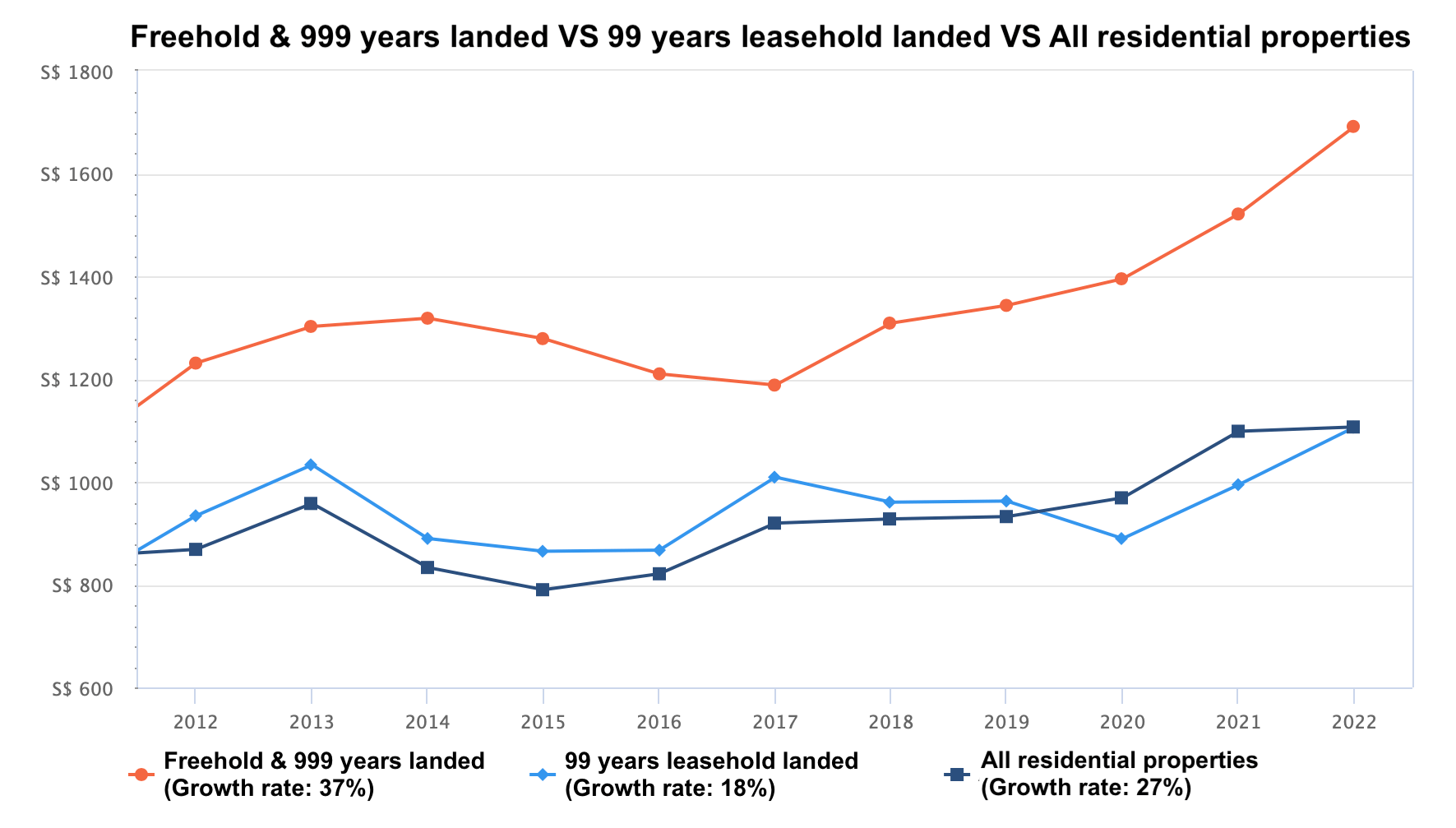

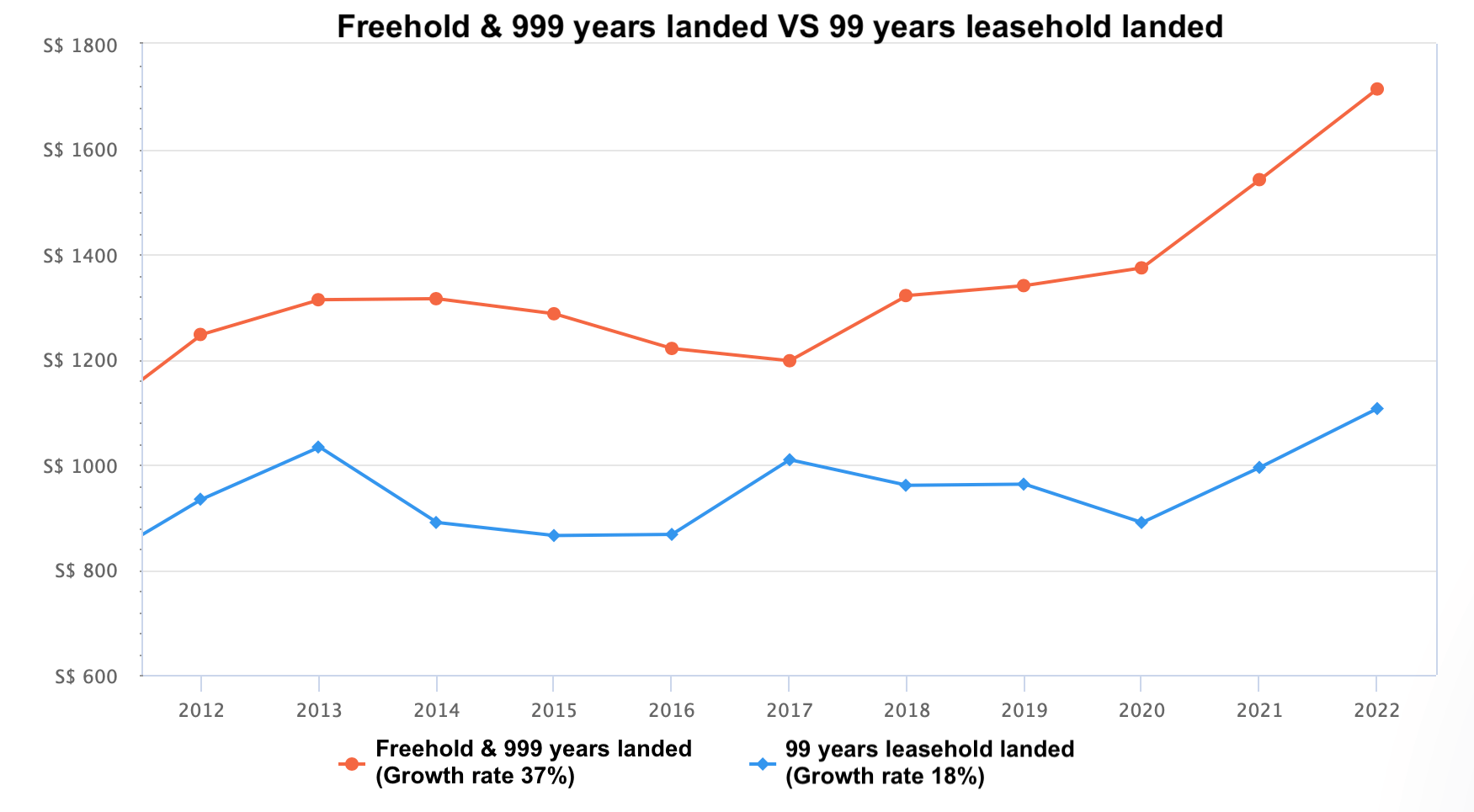

However, if we were to look at the price trend for the last 10 years, we can see there is a clear price disparity between a freehold/999 years landed property as compared to a 99 years leasehold landed property. The growth rate for freehold/999 years in the last 10 years is double that of the 99 years leasehold. This is probably due to the fact that prices of freehold/999 years properties continue to appreciate even as they age, whereas for 99 year leasehold properties, prices gradually stagnant and decline as their leases decay. For this reason, buyers who are looking for landed properties tend to lean towards a freehold/999 years development. If anything, perhaps the notion of you actually owning the land that the house sits on makes the distinction between a leasehold and freehold all the more apparent as compared to condos/apartments.

You’ll also notice that the freehold/999 years landed have a delayed reaction to the price dip in 2013 as compared to 99 years leasehold landed as well as the overall market. It took 3 years to recover and has been on the uptrend ever since, whereas on the other hand, 99 years leasehold landed and the overall market is moving much slower in comparison.

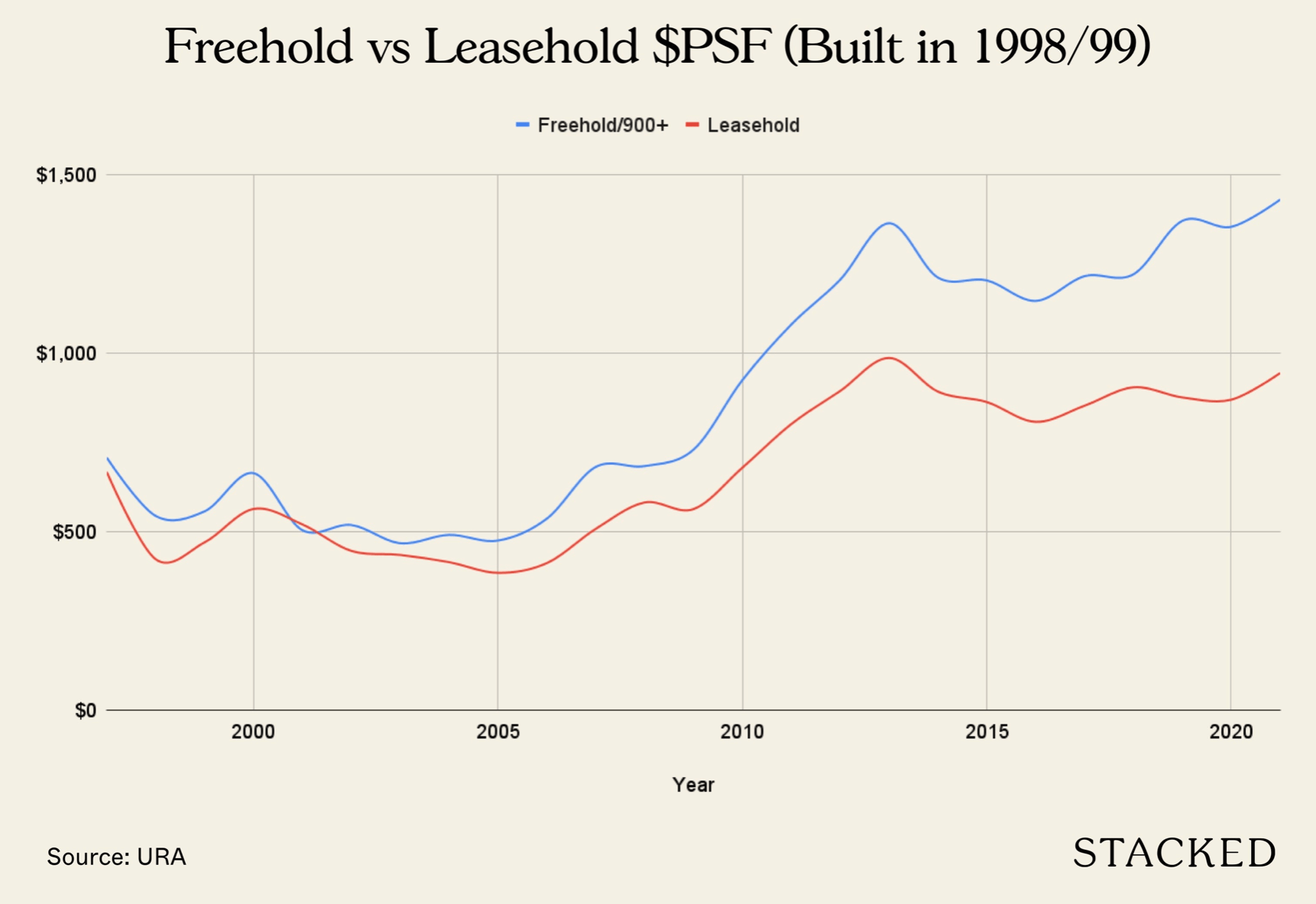

The above graph represents all landed properties across Singapore which means different developments of all different ages are included. Let’s now look at the price trend of landed properties built between 1998 – 1999 for a fairer comparison.

You’ll notice from this graph that while the properties may be similar in age, the price gap starts to widen as their ages increase. Prices for the 99-year leasehold properties are already starting to show signs of stagnation at 20 years old.

We have previously written an in-depth article on the price gap between a freehold and a leasehold landed which you can read here.

Since you’re buying this for own stay purposes, we presume that your plan is to stay for the long term for at least the next 10-15 years. Given your age and stage of life, it’s unlikely you’d like to move again when you’re older. If that is the case, there’s no doubt that buying a freehold will have a greater potential for capital appreciation. That’s unless you’re open to buying a brand new 99 year leasehold development and hold it for a short term.

Before we move on to your question on decoupling, let’s take a look at what prices of landed homes look like today.

Brand new landed property:

| Project | District | Tenure | Type | Size(sqft) | PSF | Price |

| Parkwood Collection | 19 | 99 years | Semi-D | 4,865 | $843 | $4,100,000 |

| Parkwood Collection | 19 | 99 years | Semi-D | 6,211 | $806 | $5,008,000 |

| Belgravia Ace | 28 | Freehold | Semi-D | 3,929 | $1,121.15 | $4,405,000 |

| Belgravia Ace | 28 | Freehold | Semi-D | 4,370 | $1,053.55 | $4,604,000 |

This is just for your knowledge, these developments may or may not be suitable for you, and it is best to consult an agent for further analysis.

Here are some of the average prices for Districts 26, 27 and 28 over the last 2 years (new and resale):

| District | Freehold/999 years (Land) | 99 years leasehold (Land) | ||||

| Avg Price | Avg PSF | Avg Size (sqft) | Avg Price | Avg PSF | Avg Size (sqft) | |

| D26 | $3,673,496 | $1376.59 | 2,837 | – | – | – |

| D27 | $3,560,323 | $1187.15 | 3,293 | $2,375,175 | $1,086 | 2,295 |

| D28 | $3,873,129 | $1413.67 | 3,014 | $2,381,101 | $980 | 2,642 |

Next, let’s tackle your question on decoupling.

Should you decouple your existing property?

You mentioned that you plan to withdraw from your CPF OA to repay your CPF utilised for the home balance so far (AKA voluntary housing refund). This means that you plan to decouple after doing the voluntary housing refund.

Decouple AFTER the voluntary housing refund

| Wife (Seller) | Husband (Buyer) | |

| Existing details | ||

| Shares | 50% | 50% |

| Valuation (a) | $1,400,000 | $1,400,000 |

| Outstanding loan (b) | $475,000 | $475,000 |

| CPF usage | $598,000 | – |

| Payments required | ||

| Legal | $3,000 | $3,000 |

| Buyer stamp duty | – | $40,600 |

| Option fees (5%) | $70,000 (Received) | $70,000 (Paid) |

| 20% downpayment | – | $280,000 |

| Proceeds from sale (cash) (a – b) | $925,000 | |

| Husband new loan amount after decoupling | – | $1,525,000 |

| Total cash + CPF payable (Buyer) | – | $396,600 |

Now let’s look at your new financing situation:

| Description | Amount |

| Husband’s maximum loan based on a fixed monthly income of $10,000 and age 56 | $508,910 (9 year tenure) |

| Monthly loan repayment at 3.5% interest | $5,500 |

| Loan shortfall (To be paid in cash or CPF) ($1,525,000 – $508,910) | $1,016,090 |

| Loan shortfall + total cash & CPF payable | $1,412,690 |

56 years of age is used for your age as you plan to withdraw from both your CPF, as such, you’ll need to wait for your wife to turn 55.

In this scenario, you could utilise the cash proceeds of $925,000 that your wife will be receiving to cover the loan shortfall + total cash & CPF payable.

Additionally, you’ll also have $318,000 that you can choose to withdraw from your CPF after the voluntary housing refund. If you were utilise those funds, you will still have a shortfall of $169,690 ($1,412,690 – $925,000 – $318,000).

Wife’s affordability

Maximum loan based on a fixed monthly income of $30,000 and age 55: $1,668,590 (10 year tenure)

At this point though, you would have utilised the cash proceeds from the decoupling and also the cash withdrawn from your CPF refund to facilitate the decoupling. To purchase a property at $4M, you’ll have to fork out $2,331,410 plus $144,600 for stamp fees, which unless you’ve other cash savings, you will have to draw down from your liquid assets.

We should also take into consideration whether or not it’s worth holding onto the current property seeing that the net rental income a year is at $30,000, which merely covers half of the annual loan repayment of $66,000.

What does a 10-year projection of your assets look like then?

There are 3 areas to consider:

- Your liquid asset’s growth

- Your wife’s landed housing gains

- Your current condo gains

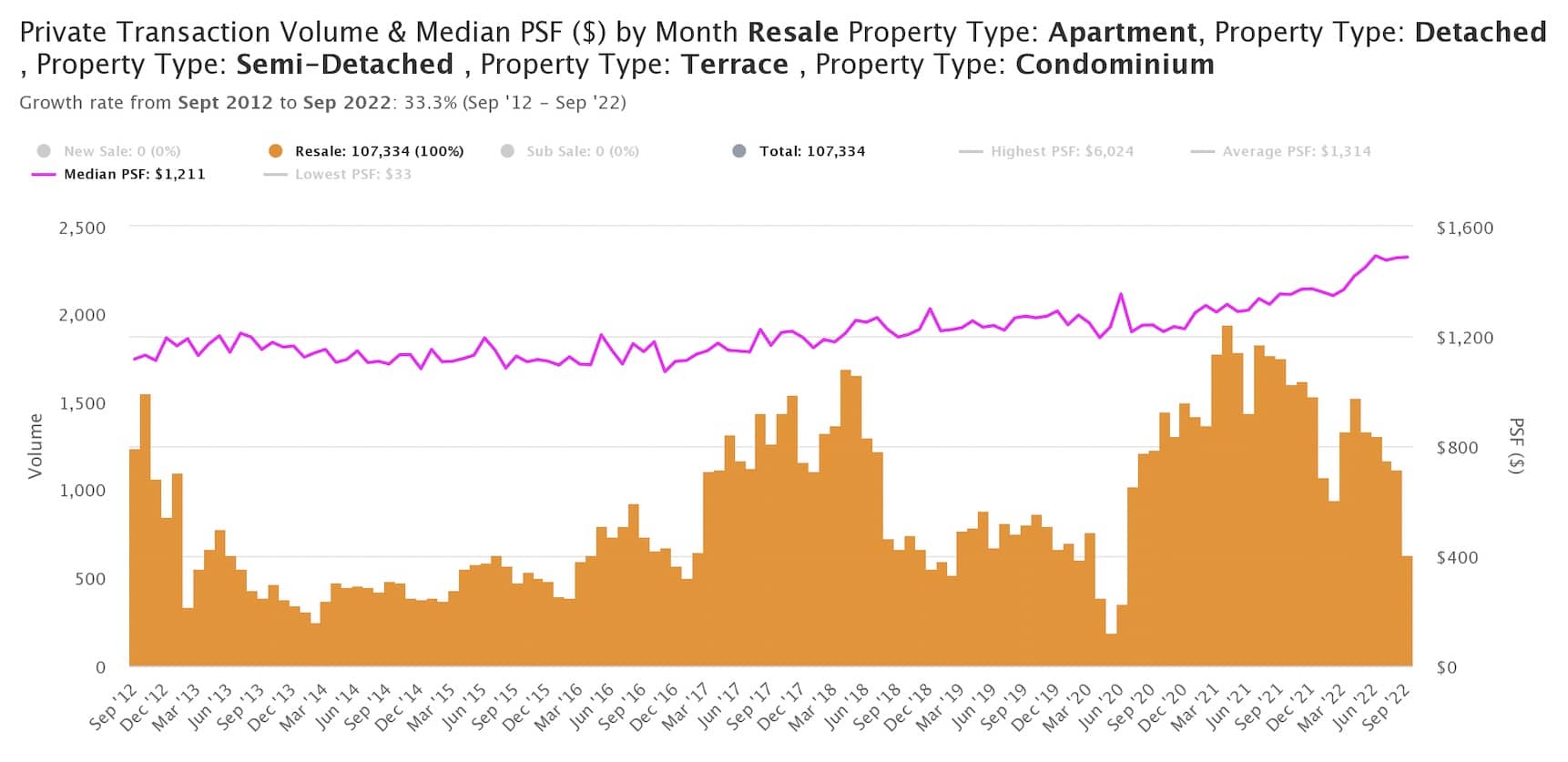

In considering housing gains, we’ll assume a yearly growth rate of 3.3%. This is taken by looking at resale property prices in the past 10 years:

Editor’s Note (04 Nov 2022): We’ve adopted the use of the Property Price Index (10-year horizon) in our calculations to project prices into the future. This figure is a moving target over the quarters and will be reflected in our advice article at the point of writing. As of 2022Q3, the PPI stands at 187.1. Compared to 2012Q4 (151.5), this is a 23.5% jump in 10 years. As such, the previous assumption will no longer be used.

Liquid asset growth

You mentioned you had $5 million in liquid assets. If you were to use half of this to fund the landed property, here’s what the other half would look like in 10 years according to your projections:

50% Liquid assets projected growth

| Year | Balance Start | % Gains | Quantum Gains | Balance End |

| 1 | $2,500,000 | 8% | $200,000 | $2,700,000 |

| 2 | $2,700,000 | 8% | $216,000 | $2,916,000 |

| 3 | $2,916,000 | 8% | $233,280 | $3,149,280 |

| 4 | $3,149,280 | 8% | $251,942 | $3,401,222 |

| 5 | $3,401,222 | 8% | $272,098 | $3,673,320 |

| 6 | $3,673,320 | 2% | $73,466 | $3,746,787 |

| 7 | $3,746,787 | 2% | $74,936 | $3,821,722 |

| 8 | $3,821,722 | 2% | $76,434 | $3,898,157 |

| 9 | $3,898,157 | 2% | $77,963 | $3,976,120 |

| 10 | $3,976,120 | 2% | $79,522 | $4,055,642 |

Landed property under wife’s name

| Description | Amount |

| Assuming a | $4,940,000 |

| Original purchase price | $4,000,000 |

| Interest costs (Assuming $1,668,590 loan at 3.5% interest) | $311,410 |

| Estimated gains | $628,590 |

Your current condo gains

| Description | Amount |

| Assuming a | $3,458,000 |

| Current valuation | $2,800,000 |

| Interest costs (Assuming $508,910 loan at 3.5% interest) | $85,090 |

| $30K net rental income per year | $300,000 |

| Estimated gains | $872,910 |

Estimated paper gains from liquid assets and keeping both properties after 10 years: $3,723,542 $3,057,142

Should you sell your existing property?

| Description | Amount |

| Sale price | $2,800,000 |

| Outstanding loan | $950,000 |

| CPF principal + accrued interest (Husband & Wife) | $916,000 |

| Estimated cash proceeds | $934,000 |

Scenario 1: Purchase $4M landed under both names

| Description | Amount |

| (a) Maximum loan based on husband aged 56 with a fixed monthly income of $10,000 & wife aged 55 with a fixed monthly income of $30,000 | $2,035,640 (9 year tenure) |

| Monthly repayment at 3.5% interest | $22,000 |

| (b) Combined CPF funds from sale of property | $916,000 |

| (c) Combined CPF funds that can be withdrawn from CPF OA after meeting the Full Retirement Sum | $466,000 |

| (d) Cash proceeds | $934,000 |

| (e) Total loan + cash & CPF (a + b + c + d) | $4,351,640 |

| (f) Buyer stamp duty (Based on $4M) | $144,600 |

| Surplus ($4M + f – e) | $207,040 |

Since you asked for other alternatives, let’s consider selling your condo and buying 2 properties in both your names separately.

Scenario 2: Purchase landed under wife’s name and another investment property under husband’s

Wife to purchase landed at $4M

| Description | Amount |

| (a) Maximum loan based on a fixed monthly income of $30,000 and age 55 | $1,668,590 (10 year tenure) |

| Monthly repayment at 3.5% interest | $16,500 |

| (b) CPF funds from sale of property | $598,000 |

| (c) CPF funds that can be withdrawn after meeting the Full Retirement Sum | $215,000 |

| (d) Half of cash proceeds | $467,000 |

| (e) Total loan + cash & CPF | $2,948,590 |

| (f) Buyer stamp duty | $144,600 |

| Shortfall ($4M + f – e) | $1,196,010 |

Husband to purchase an investment property at $1.5M

| Description | Amount |

| (a) Maximum loan based on a fixed monthly income of $10,000 and age 56 | $508,910 (9-year tenure) |

| Monthly repayment at 3.5% interest | $5,500 |

| (b) CPF funds from sale of property | $318,000 |

| (c) CPF funds that can be withdrawn | $251,000 |

| (d) Half of the cash proceeds | $467,000 |

| (e) Total loan + cash & CPF | $1,544,910 |

| (f) Buyer stamp duty | $44,600 |

| Shortfall ($1.5M + f – e) | -$310 |

In both scenarios, your monthly repayment amount is actually the same at $22,000. The only difference is in the shortfall. With scenario 1, you’ll need to top up $259,960 whereas in scenario 2, you’ll need to top up $1,195,700 which is a considerable amount.

Scenario 2 definitely offers more flexibility as you have 2 properties, so in the event your investment property becomes profitable, you can always choose to sell it without affecting your living situation.

Let’s also do a 10 year projection for these 2 scenarios:

Scenario 1: Purchase $4M landed under both names – withdrawing $260,000 from liquid assets

Liquid assets

| Year | Balance Start | Interest earned | Balance End |

| 1 | $4,740,000 ($5m – $260K shortfall) | $379,200 | $5,119,200 |

| 2 | $5,119,200 | $409,536 | $5,528,736 |

| 3 | $5,528,736 | $442,299 | $5,971,035 |

| 4 | $5,971,035 | $477,683 | $6,448,718 |

| 5 | $6,448,718 | $515,897 | $6,964,615 |

| 6 | $6,964,615 | $139,292 | $7,103,907 |

| 7 | $7,103,907 | $142,078 | $7,245,986 |

| 8 | $7,245,986 | $144,920 | $7,390,905 |

| 9 | $7,390,905 | $147,818 | $7,538,723 |

| 10 | $7,538,723 | $150,774 | $7,689,498 |

Landed under both names

| Assuming a | $4,940,000 |

| Original purchase price | $4,000,000 |

| Interest costs (Assuming $2,035,640 loan at 3.5% interest) | $340,361 |

| Estimated gains | $599,639 |

Total paper gains from both liquid assets and landed home after 10 years: $3,941,137 $3,549,137

Scenario 2: Purchase landed under wife’s name and another investment property under husband’s – withdrawing $1,196,000 from liquid assets

Liquid assets

| Year | Balance Start | Interest earned | Balance End |

| 1 | $3,804,000 ($5M – $1.196M) | $304,320 | $4,108,320 |

| 2 | $4,108,320 | $328,666 | $4,436,986 |

| 3 | $4,436,986 | $354,959 | $4,791,944 |

| 4 | $4,791,944 | $383,356 | $5,175,300 |

| 5 | $5,175,300 | $414,024 | $5,589,324 |

| 6 | $5,589,324 | $111,786 | $5,701,110 |

| 7 | $5,701,110 | $114,022 | $5,815,133 |

| 8 | $5,815,133 | $116,303 | $5,931,435 |

| 9 | $5,931,435 | $118,629 | $6,050,064 |

| 10 | $6,050,064 | $121,001 | $6,171,065 |

Landed under wife’s name

| Assuming a | $4,940,000 |

| Original purchase price | $4,000,000 |

| Interest costs (Assuming $1,668,590 loan at 3.5% interest) | $311,410 |

| Estimated gains | $628,590 |

Investment property under the husband’s name

| Assuming a | $1,852,500 |

| Original purchase price | $1,500,000 |

| Interest costs (Assuming $508,910 loan at 3.5% interest) | $85,090 |

| Rental at $3750/month for 11 months each year (Assuming 3% yield) | $412,500 |

| Agency fees if you engage an agent | $21,938 |

| Cost of repairs/replacements (Assuming $1000/year) | $10,000 |

| MCST (Assuming $350/month) | $42,000 |

| Property tax (Assuming $3000/year) | $30,000 |

| Estimated gains | $575,921 |

Total paper gains from both liquid assets and 2 properties after 10 years: $4,110,627 $3,571,576

We can see from the above projections that in both scenarios the paper gains are pretty similar (~4.3% 1% difference). In a conventional situation, owning 2 properties should give you a significantly higher return. In your situation, however, you’re not able to leverage more due to the short loan tenure and also the large amount you’ll need to withdraw from your liquid assets in order to fund the purchase of 2 properties which could potentially be earning more (at your 8%/2% projection) if left untouched.

Of course, this is based on the projection of 3.3% 23.5% growth over 10 years. Your returns between both strategies would be different depending on whether the property market does extraordinarily well or dismal during that time.

If we were to compare selling the property to buy either one or two properties versus decoupling and buying a landed, there is a difference of approximately $217,595 – $387,085 $491,995 – $514,434. Based on this, we would deem selling the property as a better option, with the sell 1 buy 2 providing better-projected returns.

However, deciding between scenario 1 or 2 really boils down to your purpose and intentions. For scenario 1, you’ll be earning from your liquid assets which could go towards funding your retirement but in order to realise the gains from the property, you’ll have to sell it. For scenario 2, after 9 years when you’ve fully paid off the loan for your investment property, you’ll be receiving monthly passive income from the rental which could also help with your retirement on top of the interest from your liquid assets. Seeing as you’ve two children, legacy planning might also be something to think about.

Now that we’ve tackled both situations, let’s answer your final question on the repricing of the loan.

Repricing of loan

As you’ve rightly mentioned, for the initial purchase the age limit for the loan tenure is up to 65 but when you do a repricing it can be extended up to 75 years old depending on the bank. However, this will not change the loan amount or downpayment required for the purchase. The thing that will be different is the monthly repayment after repricing.

Let’s say you were to purchase the landed under both names:

| Description | Amount |

| Maximum loan based on husband aged 56 with a fixed monthly income of $10,000 & wife aged 55 with a fixed monthly income of $30,000 | $2,035,640 (9 year tenure) |

| Monthly repayment at 3.5% interest | $22,000 |

Repricing of loan after 3 years at 3%:

| Description | Amount |

| Outstanding loan after 3 years | $1,426,867 (16 year tenure – up to 75y/o) |

| Monthly repayment at 3% interest | $9,366 |

As the monthly repayment is cut by more than half, it will definitely lessen the financial burden. Having said that, you will also be paying more interest and you will have to continue paying even in your retirement years. If the interest from your liquid assets are able to cover the monthly repayments at $22,000, it will be advisable to stick with the existing loan tenure instead of extending it.

Sticking to the 9 year loan tenure:

| Description | Amount |

| Maximum loan based on husband aged 56 with a fixed monthly income of $10,000 & wife aged 55 with a fixed monthly income of $30,000 | $2,035,640 (9 year tenure) |

| Interest costs in 9 years at 3.5% interest | $340,361 |

Extending the loan tenure up to 75 years old:

| Description | Amount |

| Maximum loan based on husband aged 56 with a fixed monthly income of $10,000 & wife aged 55 with a fixed monthly income of $30,000 | $2,035,640 (9 year tenure) |

| Interest costs for the first 3 years at 3.5% interest | $183,227.38 |

| Outstanding loan after 3 years | $1,426,867.20 (16 year tenure – up to 75y/o) |

| Interest costs for the subsequent 16 years at 3% interest | $371,488.40 |

| Total interest costs | $554,715.78 |

Additional interest paid if you were to extend the loan tenure: $214,356

Conclusion

With your budget of $4M, it is definitely possible to get a landed property in Districts 26/27/28. If your plan is to stay for the long term, a freehold/999 years leasehold development will be a better option as it has a greater potential for value retention and even capital appreciation.

Decoupling the existing property and buying the landed under your wife’s name will mean drawing down half of your liquid assets to fund this and the projected returns after 10 years isn’t as good as compared to selling the property and either buying 1 or 2 properties afterwards so the latter might be a wiser choice.

As to whether you should purchase the landed under both names or to purchase 1 property each, it’ll depend on what your plans are for the future since both scenarios will likely give you similar returns. We would think perhaps buying 1 property under both names and leaving more liquid assets to earn the 8% interest in the first 5 years might be a better option. We have to caveat that the projections are not unerring and are just an approximation. A 2% growth rate is a conservative estimate, the actual numbers may differ.

With regards to extending the loan tenure, we would suggest sticking to the original tenure of 9 years if possible so you won’t have to pay an additional $200,000 of interest. Extending the loan tenure would make sense if you are short on cash, but considering your situation, it would seem rather unnecessary.

Have a question to ask? Shoot us an email at stories@stackedhomes.com – and don’t worry, we will keep your details anonymous.

For more news and information on the Singapore private property market or an in-depth look at new and resale properties, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Pro Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

On The Market A Rare Pair Of Conserved Shophouses In Chinatown Just Hit The Market For $32.5M

Singapore Property News Some Units At This Freehold Riverfront Condo Could Lose Their Views — But Here’s How Prices Have Actually Moved

1 Comments

he has another way to get loan is to pledge his investment