This Singaporean Investor Owns 47 Properties Around The World: I Break Down 5 Of Them

April 27, 2022

In 2020, I met this fascinating lady when I was out socialising. Let’s call her Ms Dollar.

There were so many reasons why she left such a huge impression on me, but what truly took the cake was that she owns 47 properties around the world.

Yes, you read that right, 47.

And she was only 33 back then. Plus, she’s able to brew a mean cup of coffee (one of the best I ever had).

So Ms Dollar let me in on her portfolio after meeting up several times, with an interest in acquiring €7M worth of residential property in Portugal. She also wanted to get a friendly opinion on how she should hedge her real estate portfolio, what with the worsening condition of the pandemic at that time.

Of course, I was flattered – asking me? For advice? Completely made my year.

One part of her portfolio that really stood out to me was that she owned 28 residential properties around the world (the rest are a mixture of holiday, commercial, industrial and farmland properties) – and she explained that it was because she grew up in different countries her entire childhood and wanted every part of it with her.

I wish I could casually buy 28 residential units around the world just because I love those places too (no, I’m not envious, not at all).

As the popular saying goes:

“If you want to be the best, you have to learn from the best.”

And so, with her blessing, I will be going through 5 of her international properties with you, and also share my thoughts on which property would be best to invest in.

For those looking to invest in international properties, I hope you learn something insightful here.

Setting the Tone

To see if it’s worth it, I thought it would be important to set the rubrics right. I reckon that these variables would be great to peg the different countries & properties against each other:

- Price per SQFT

- Neighbourhood Amenities

- Location

- Payable Taxes

- Potential

- Rental Demand & Yield

- Initial Cash Outlay

- Risks

Introducing the 5 Properties I’ve picked

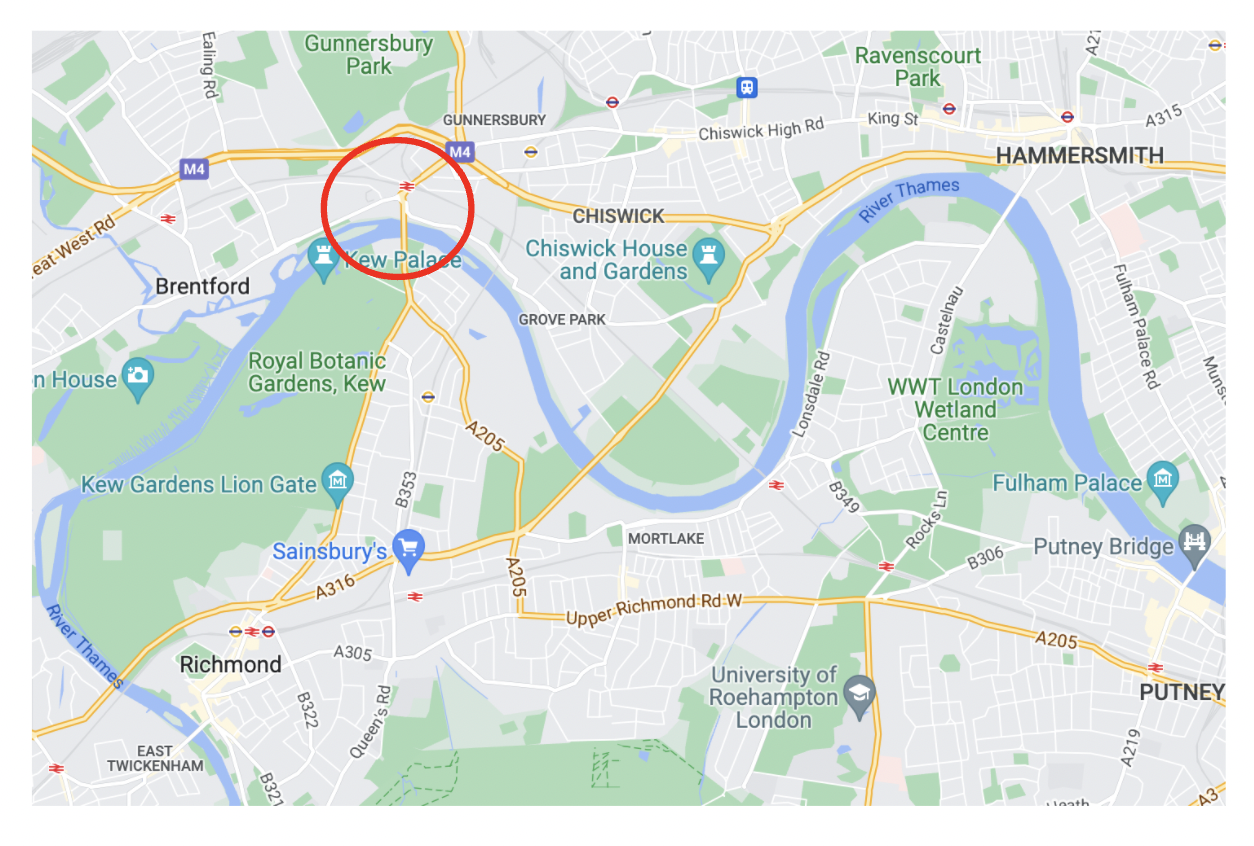

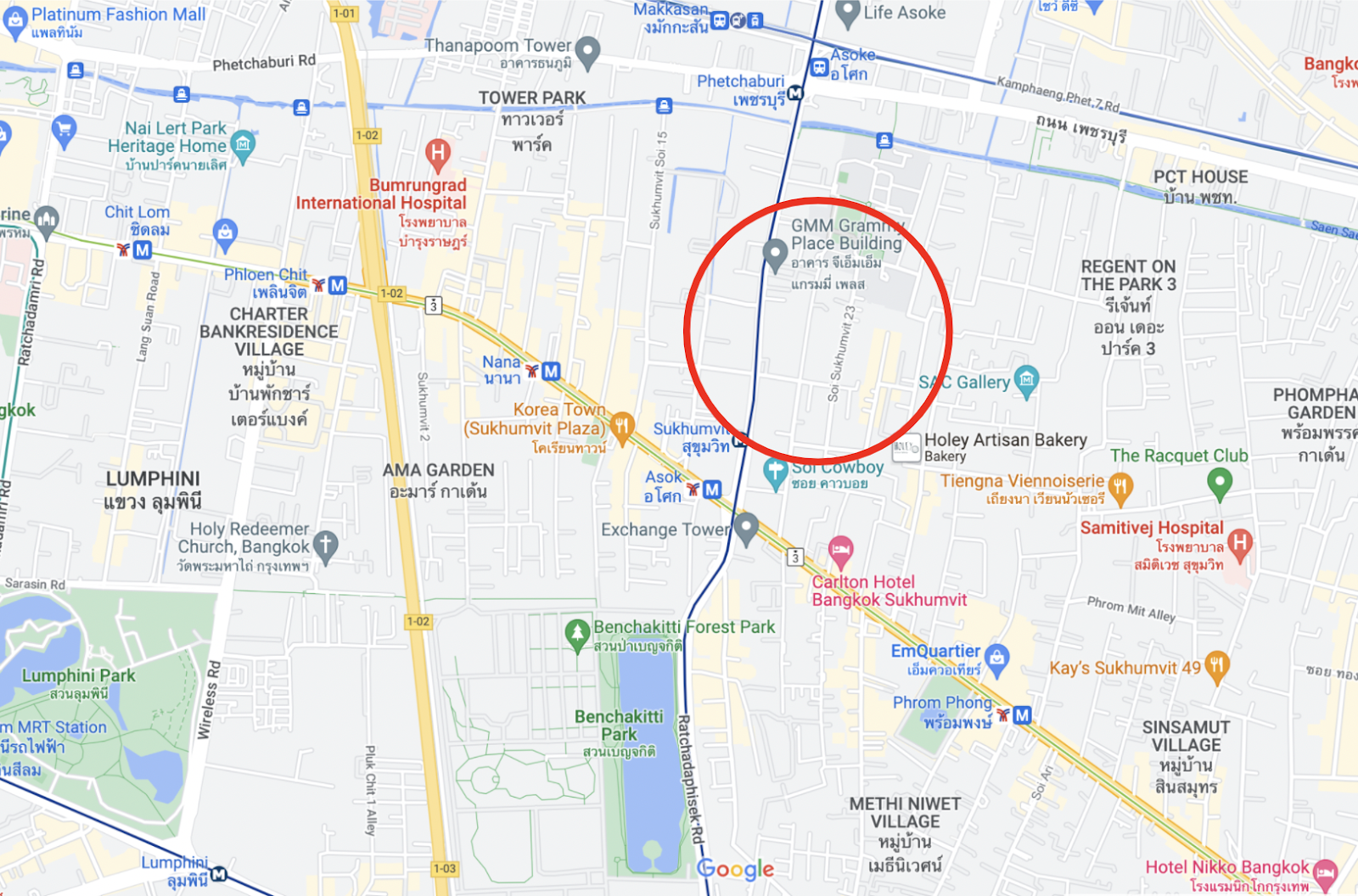

First things first, I want to say that all these locations are amazing. Really really nice neighbourhoods. To give you a better idea of her property locations, I’ve highlighted the location of her apartments with a red circle.

Property 1: Brentford, West London

1 Bedroom Condo Unit, 615 Sqft

Purchase Price: est. £260,000 (~S$463K)

Price Per Sqft: est. £422 / S$750

Price Point: $$

- Price per SQFT:

The estimated price per sqft she paid is about S$750. If you put that into SG’s context, that’s like getting a HDB at Labrador Park or Tanjong Pagar. Brentford or Tanjong Pagar, you choose.

- Neighbourhood Amenities

Maybe we Singaporeans take this for granted, but properties near green spaces or water bodies command a much higher premium, especially in gateway cities. Her unit’s location is situated just between River Thames and Kew Gardens so I guess she gets the best of both worlds.

Not just that, the tube station (Kew Bridge Station) can take her to the city centre in 40 minutes. Heathrow airport is also really convenient. Other than the tube, residents can take the national railway or bus. Love the variety. 8/10.

- Location

A piece of not-so-secret information that people who lived in London before would know is that West London generally retains its value much better than any other part of the city. It’s the more refined and posh side of town with heavy influences from arts and the monarchy. And although this is just hearsay from the ground, I get why people would say that.

It feels a little like living in Tanah Merah if you put it in Singapore’s context.

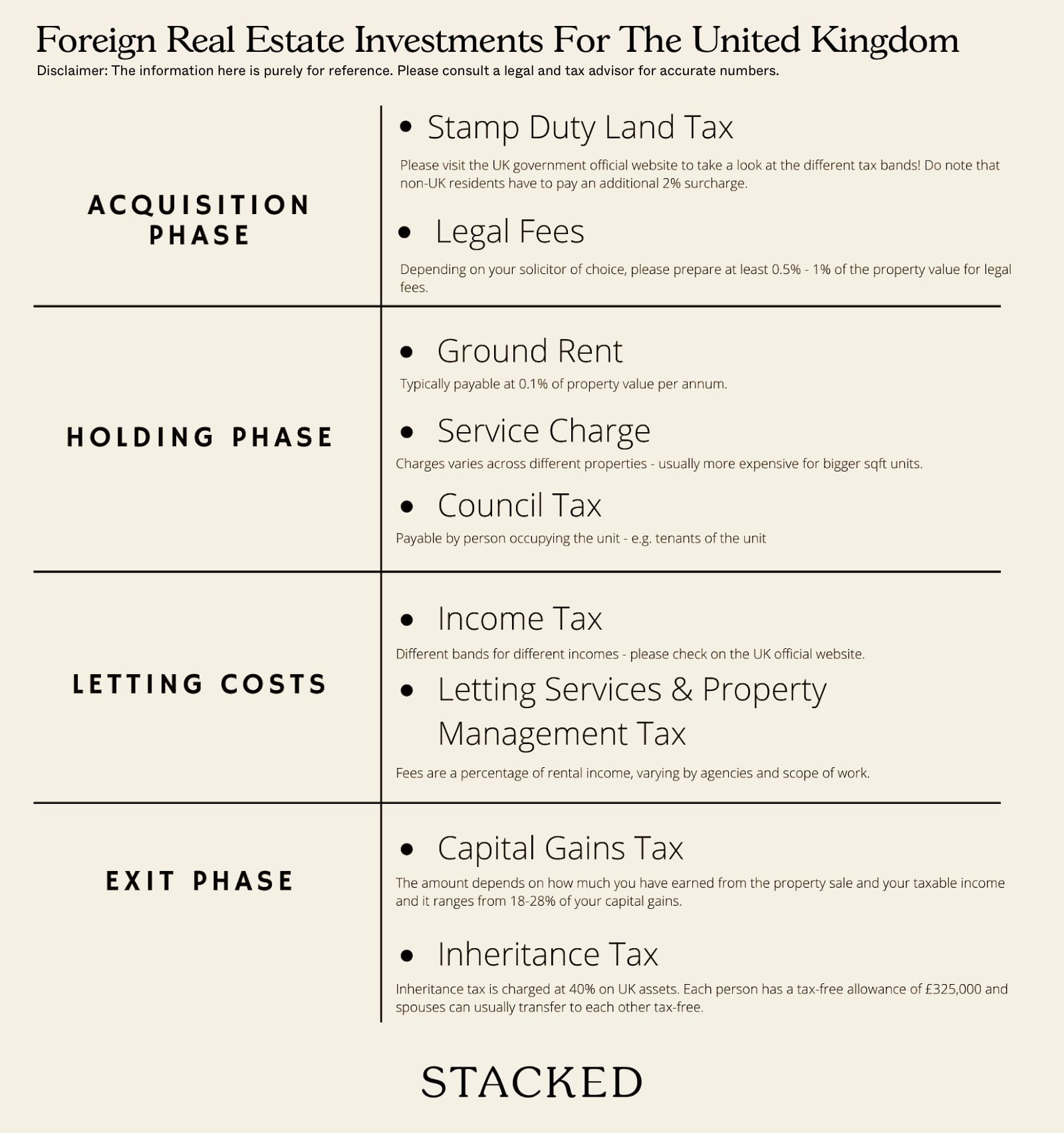

- Taxes Payable

If you compare London with our local options, I’d say that its tax structure is really much more appealing when acquiring your property #2.

I always tell everyone who asks me for opinions: ALWAYS categorize the different taxes & monthly payments through the property’s phases. Here’s a lil’ table that I’ve done up.

Do note that there are deductible payments that you can offset when calculating your income tax, like agent fees, legal fees, building insurance, property loan interest, maintenance fees, service charge and council tax.

It’s also not a secret that people who are committed to investing in multiple properties throughout the UK will set up a new business and buy it under the company to save up on taxes.

Do chat with an advisor to make sure your every dime is accounted for. It’s super important cause being informed is your responsibility!

- Potential

As I’ve previously mentioned, there’s a lot of noise and projects that are upcoming specifically to regenerate Brentford. This really means great news for Ms Dollar as it signals a capital appreciation and higher yield.

Especially when it comes to less-developed neighbourhoods like these, the risk is high if there’s a lack of demand. But when news like this is officially announced, you can definitely be more assured of the future potential. This might not be as big as the GSW regeneration in Singapore, everyone is still excited.

- Rental Demand & Yield

As with any investment, you have to know your numbers. Don’t just dream of buying promises of making gains on your unit, you need to be really clear of your calculations. Don’t be boo boo the fool.

When doing your research, it’s great to have a general idea of the average yield of your neighbourhood. You can compare with your neighbours or consult with the lettings agency to get a rough gauge. In Singapore, the average yield ranges from 2 – 3%.

For this Brentford unit, Ms Dollar yields an estimate of 8.2%, which is a really great number in terms of London’s context. Higher risk higher return, right?

- Initial Cash Outlay

When it comes to investing in UK property, you can either take a mortgage from our local banks or from the UK banks at 60 – 75%. This means that in her context, she needs to pay upfront 25 – 40% of her purchase value (= SGD $115,750 – $185,200). However, she didn’t take up any mortgage and decided to pay full cash.

Though I’d think that leveraging on the low-interest rates by taking up a mortgage could be a good idea now, she preferred to lower her debts at the expense of her equity.

- Risks

I can’t think of any major risks off the bat but I would be more cautious if I buy in other parts of Brentford that are less accessible or lack great amenities.

In her case, the vicinity of her apartment is great, so I can see that there’d be support from long-term rents. Perhaps, I might consider purchasing a 2 – 3 bedroom unit instead, since the demographics of the area are made up of mostly young families.

Property 2: Sukhumvit, Bangkok

2 Bedroom Condo Unit, 814 Sqft

Purchase Price: est. ฿13,500,000 (~S$543K)

Price Per Sqft: est. ฿16,600 / S$667

Price Point: $

- Price per SQFT

I love Bangkok and I also love that this unit is relatively affordable (our idealogy of affordability is increasingly warped, I know).

For those who aren’t familiar, Sukhumvit is a shopping and eating paradise for tourists and is well known for its nightlife. The price psf is an estimated S$667 which is comparable to HDBs in Tiong Bahru & Bugis.

- Neighbourhood Amenities

I may be biased as a city-loving girl, but I love the amenities here. It is near Terminal 21, all the other food markets around the area, love that the BTS (Skytrains, not the boy band) and MRT system (underground trains) are so near her apartment and just A-class type selections around the area. Retail and lifestyle options are endless here.

The nightlife is also some of the best. And also, it’s near to Bangkok’s core CBD – really great for office workers nearby. It truly reminds me of a Tanjong Pagar/Siglap. Westernised, dynamic and fun.

- Location

Bangkok needs no introduction, and neither does Sukhumvit.

For your property to not lose its value, it’s well-known that the core CBD & outer CBD areas have held their demand through time after time. If it was my first time buying in Thailand, I’d consider looking into these neighbourhoods to make sure that my foundations are laid right.

Ms Dollar definitely checks off all of these with this Sukhumvit unit. Nice.

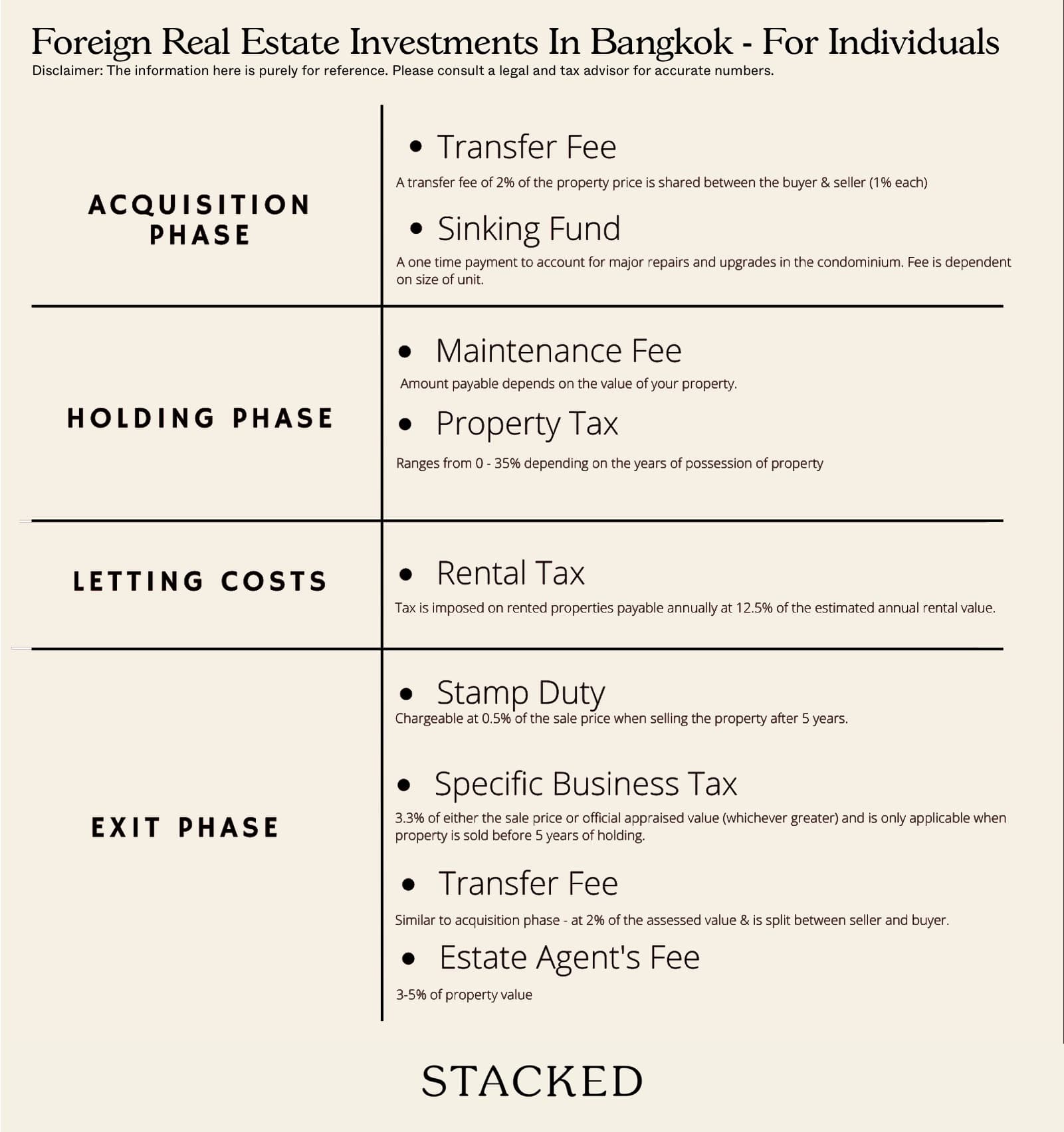

- Payable Taxes

Compared to other countries, its taxes are relatively lower. Love that there aren’t capital gains tax too.

- Potential

Thailand is really dependent on tourists for a healthy economy. Seeing that this property is specifically bought for Airbnb rentals, the pandemic really messed with the numbers. However, due to the strength of the location, she was able to rent out her apartment on a 3-year contract with a local. It’s not great, but it isn’t as dire as you might think.

Central Bangkok has a decrease in new condo launches, so I would presume that once borders open, the apartment will see an uptick in demand and potentially a capital increase. Although, it may still be hard to convince many to spend 40-70% more on rent just for the location.

- Rental Demand & Yield

Rental demand has been tricky over the past three years, though Ms Dollar shared that her Airbnb rentals have been booming pre-COVID. At that time, her rental yield for this apartment was around 7% from renting Airbnb. Now, she is bobbing along fine with a 5.2% (considered very good in Singapore). She’s just glad that it is not deadweight.

- Initial Cash Outlay

Like in the UK, investors can consider offshore or local Thai banks to finance the mortgage. LTV ranges from 50 to 70% depending on the bank you approach.

In Ms Dollar’s case, she took a 50% loan, which amounts to around SGD 271,500 of upfront payment for this property. It’s quite steep for first-timers, don’t you think?

- Risks

Since her unit is within an extremely famous tourist hotspot, her neighbours are also playing the Airbnb game – which translates to many short stays. It’s harder to sell off this kind of apartment to genuine home buyers, because who wants to see a different neighbour every day? Her exit strategy would definitely be a concern to me.

Property 3: Nakanoshima, Osaka

2DK Condo Unit, 690 Sqft / 39 Tatami

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Why This 24-Year-Old Condo Outperformed Its Newer Neighbours In Singapore

Rio Vista, a 99-year leasehold condominium along Upper Serangoon View in District 19, defied expectations to become a top performer…

Purchase Price: est. ¥185,000,000 (~S$1,999,000)

Price Per Sqft: est ¥268,116 / S$2,897

Price Point: $$$$

- Price per SQFT

It is hardly a surprise that real estate in Osaka is so grotesquely expensive. Costing almost SGD $2,900 psf, this Osaka apartment is almost comparable to a condo in Singapore’s golden District 10. In its defence, Osaka is highly coveted and its location is really near Namba – so you are paying for the premium to own real estate here.

- Neighbourhood Amenities

Nakanoshima is literally Osaka’s CBD, serving as its political, cultural and business epicentre. And what comes with that is world-class amenities like the Nakanoshima Park, museums and many grocery shops and convenience stores littered around the area.

Not to mention, it’s just 19 minutes away from Namba, where you can find the best street foods, shopping and lifestyle options there. I’m starting to see a pattern to the properties that Ms Dollar buys, don’t you agree?

- Location

It serves as a “centre” for smaller cities like Kyoto, Kobe and Nara which lacks the urbanisation that Osaka has experienced. Many people are choosing to move over to Japan’s 2nd largest city which is more vibrant and expressive as compared to more developed Tokyo.

Those of you who’ve travelled to Osaka before will definitely know how easy it is to do day trips from smaller towns back to this big metropolitan city. More transportation links are being formed across Osaka and its neighbours. With the convenience and its strategic location, I’m sure that “all roads (will eventually) lead to Rome”.

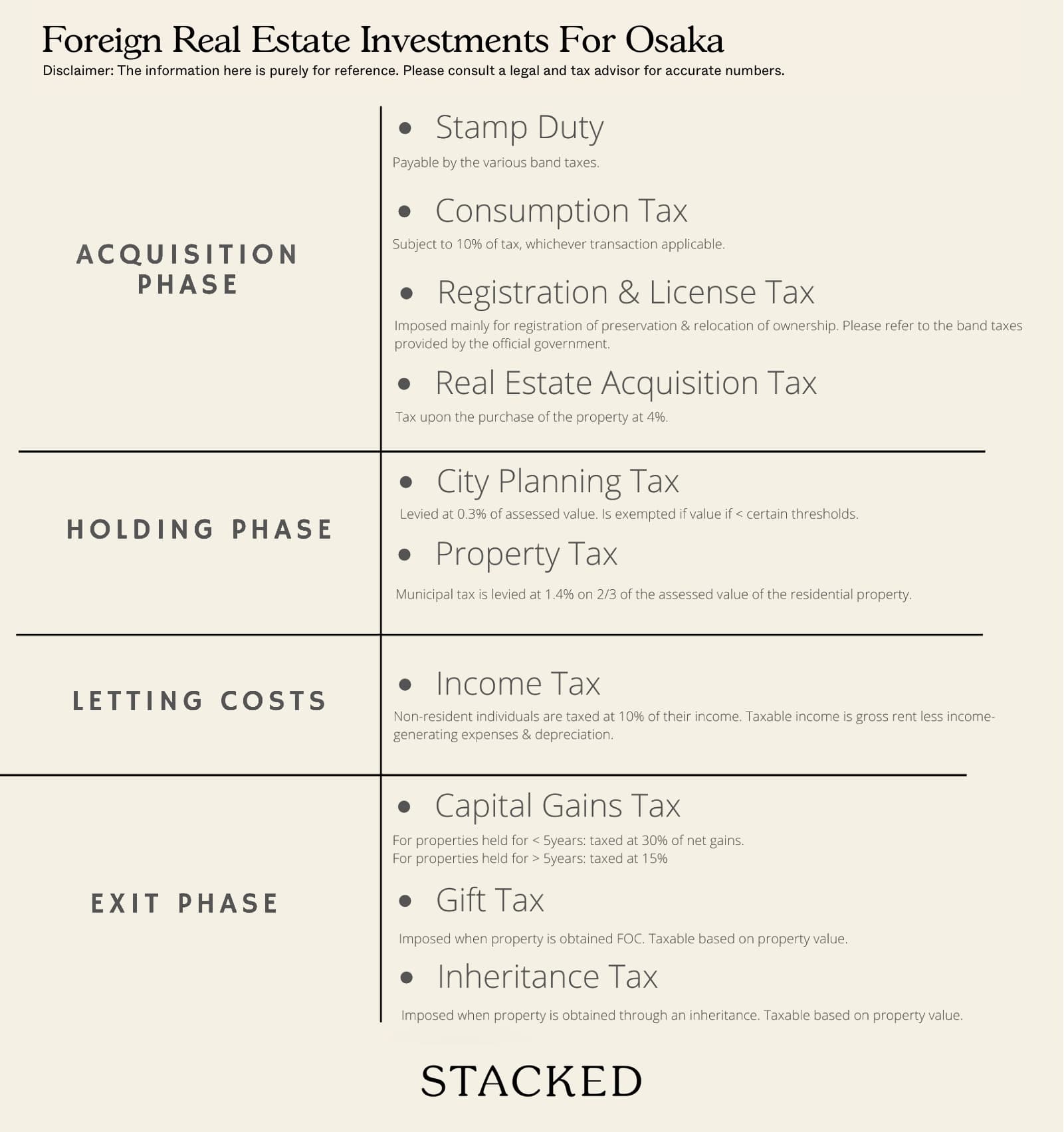

- Payable Taxes

Note that brokerage commissions to estate agents are usually paid half upon signing of the contract, and the remaining half upon property completion.

- Potential

One major concern, at least to me, is Japan’s demographic issue where there are more elderly than younger people. Yet, it also seems like there is a domestic migration where younger people prefer to work in bigger cities which nets out the population issue in Osaka.

The government is also bulldozing through Osaka’s urban revitalisation plans, especially in Central Osaka. That’s great news for Nakanoshima.

As a foreigner, I also love that Japan allows land ownership – which means that it’s much safer than other countries that only allow leases, maybe except Hokkaido probably.

- Rental Demand & Yield

The COVID-19 outbreak really took a toll on the demand in the city centre of Osaka. Everyone is WFH and Ms Dollar had a really hard time finding a tenant for her unit. Previously, it was rented to a Canadian expatriate but he left for home, leaving the unit empty for a good 8 months.

However, the rental yield prior to the pandemic was pretty solid – she got about 5.7% off her unit till 2020 and is receiving a 4.3% as of now. That’s the risk of a landlord – the cycle isn’t always consistent.

- Initial Cash Outlay

Japan’s banks aren’t too keen on providing mortgages for foreigners, that’s a sad but true fact. But if you do succeed in applying for a loan, they’d probably offer you 70-80% of the purchase price. Consider looking for offshore banks – a 60% loan is better than nothing.

For this, Ms Dollar only took a 20% loan – but if you are average like me, the downpayment will result in something like SGD $800,000 for her apartment. That’s steep for sure.

- Risks

Japan is well-prepared for natural disasters like earthquakes or typhoons – even their structural designs account for it. But I’m a Singaporean and I’m kiasu – I definitely would recommend extra insurance on your Osaka properties.

Overseas Property InvestingMaking Your First Overseas Real Estate Purchase: 8 Tips By An Ex-International Property Marketer

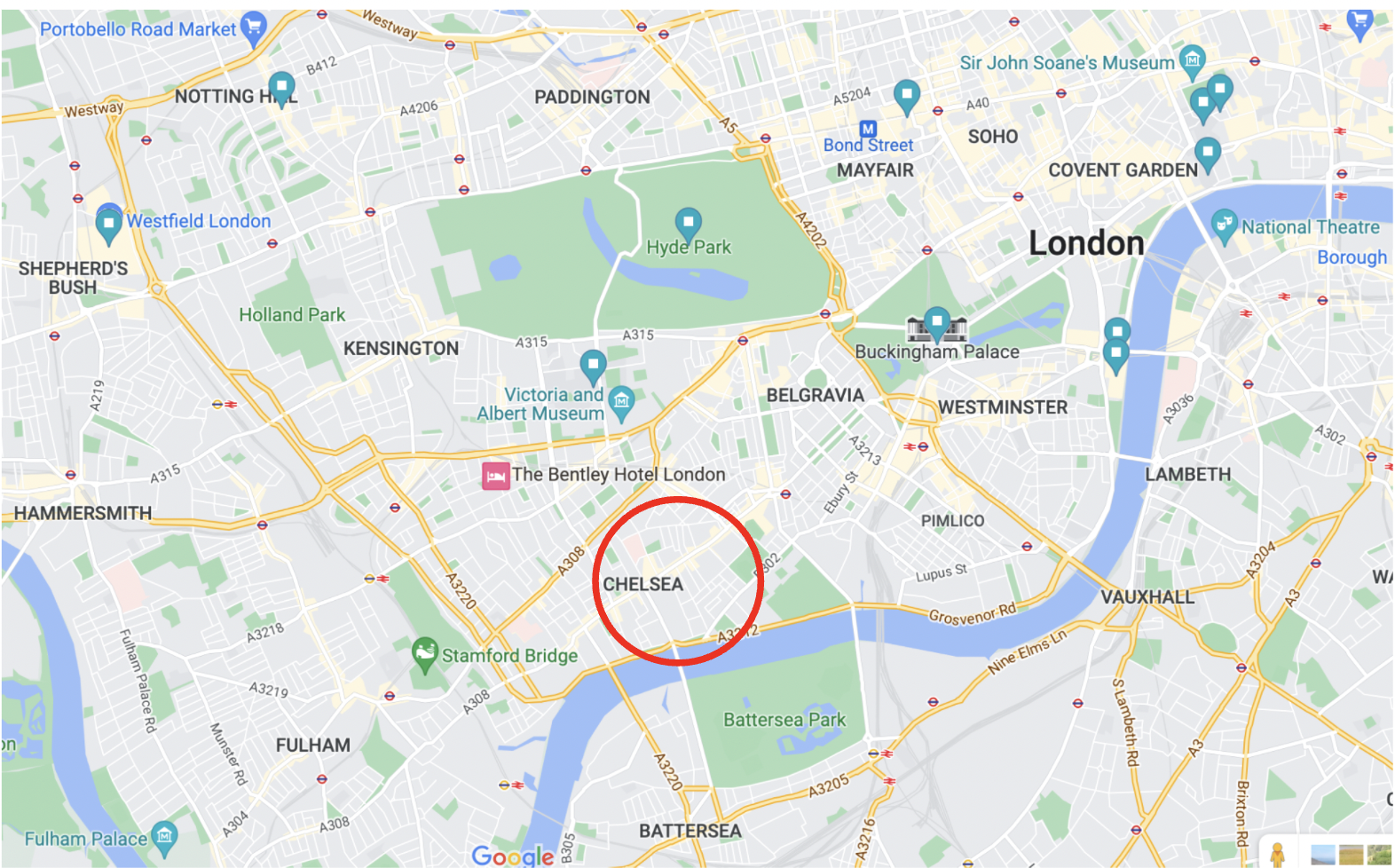

by Cheryl TeoProperty 4: Chelsea, West London

1BR Condo Unit, 550 Sqft

Purchase Price: est. £750,000 (~S$1,334,000)

Price Per Sqft: est. £1,364 / S$2,426

Price Point: $$$$

- Price per SQFT

Chelsea is such a lovely place and this lovely place is going for almost SGD $2,500 psf.

It’s surrounded by places that are literally fit for royals and is within Zone 1 of West London, so no wonder the price. Belgravia is also known to be London’s most expensive postal code, so don’t be too taken aback by the prices here.

- Neighbourhood Amenities

Ms Dollar was really drawn in by its architecture and the aesthetics of the architecture. It’s known to be one of the best neighbourhoods in London to shop and to eat – I don’t think you’ll lack options in London’s very own fashion capital.

The nearest tube station is Sloan Square tube station which can take you to London’s CBD, Canary Wharf in about 20 minutes.

- Location

As I’ve previously mentioned, Chelsea is in West London which is known for its wealth preservation. However, Chelsea is much more central compared to Brentford – giving you more luxurious offerings, architecture and people.

- Potential

I must say, Chelsea is lacklustre in terms of potential for capital appreciation. To me, it’s more of buying into the prestigious name rather than financials. Though its yields have seen a mini uptick as the world is progressing from the effects of COVID, it’s a more long term hold than a short term stint.

Ms Dollar bought it purely due to her love for the neighbourhood she grew up in – definitely not a first purchase kinda thing.

- Rental Demand & Yield

Central London continues to be a desirable place to live, especially for international students. It has great universities and job opportunities around the city – I do suppose that rental demand will continue to grow stronger as more people return to the city.

Ms Dollar said that she has yielded a 4.1% rental over the past 2 years but she doesn’t feel too optimistic, especially seeing the rate of inflation (yeah, inflation is giving me nightmares).

- Initial Cash Outlay

Her 1 bedroom investment in Chelsea cost her a cool SGD $1,344,000. She took a 50% bank loan on this with a Singapore bank, which leaves her with an upfront payment of SGD $672,000.

I love the place. Hate the price.

- Risks

I think one main risk is how people will respond after the pandemic clears up. Would people be returning back to the city? Or would they rather continue their new way of life?

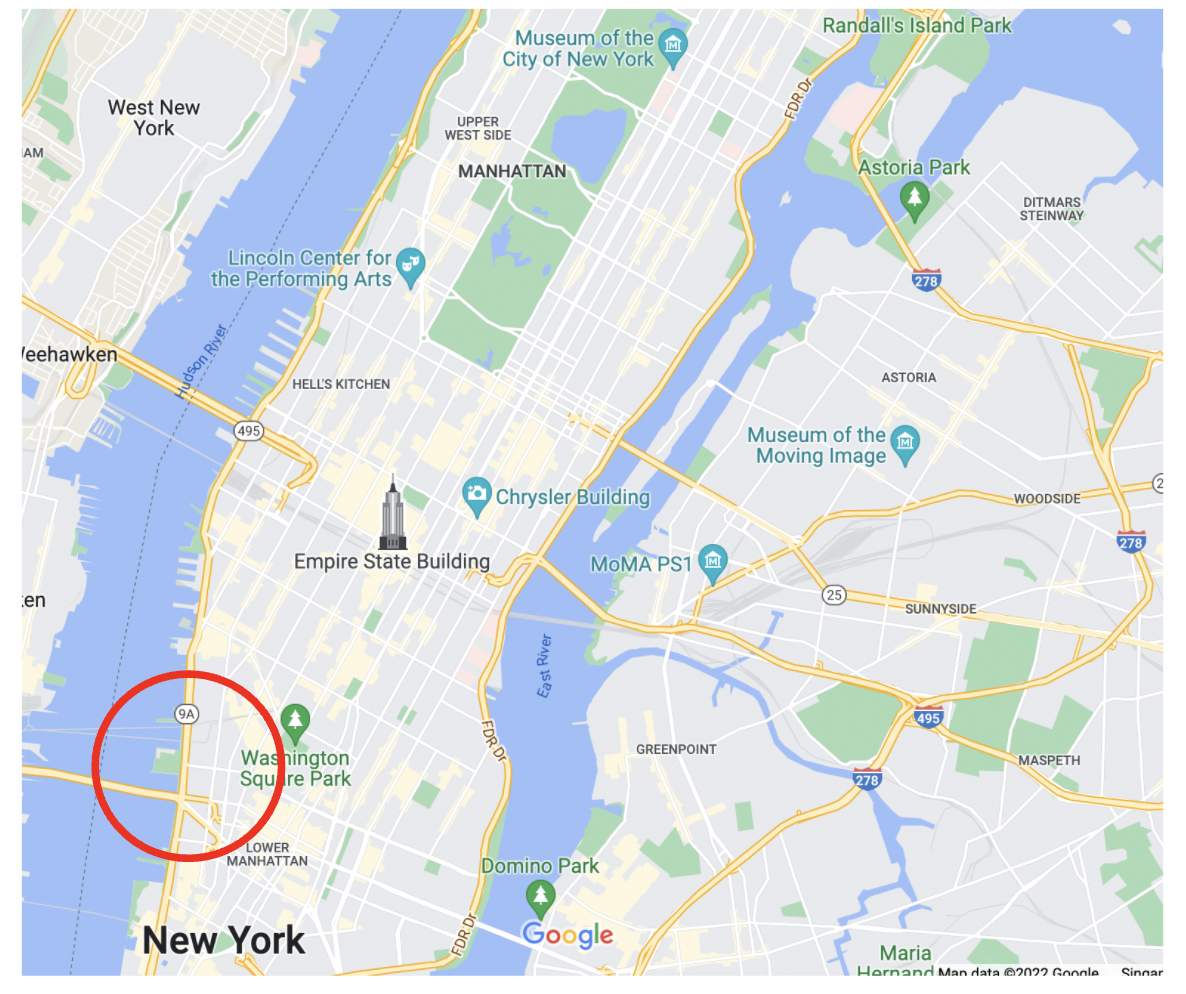

Property 5: Lower Manhattan, New York City

Studio Unit, 570 Sqft

Purchase Price: est. US$750,000 (~S$1,015,600)

Price Per Sqft: est. US$1,315 / S$1,782

Price Point: $$$

- Price per SQFT

Personally, I absolutely love lower Manhattan. I spent a lot of time there when I was exploring NYC and I can say that the area is perfect for young working adults.

Ms Dollar paid about S$1,782 psf for a studio unit in West Village and she loves the place.

- Neighbourhood Amenities

It isn’t an amenity, but her unit offers unblocked views of the Hudson River. New York University is also just around the corner, complemented with quaint cafes and pubs to spend your days in. SoHo for shopping is also just 10 – 15 minutes away.

The nearest tube station from her unit is 14St/8Av station – really convenient!

Just a few blocks away, Washington Park is great to hang out while enjoying some street cart food. Yum.

- Location

Other than Lower Manhattan being a place investors love to buy property, the Upper East Side is also really popular. Billionaire’s Row, Financial District and Fifth Avenue are some really famous examples.

What makes West Village stand out is the character of the area – really beautiful tree-lined streets and low-rise building architecture. There is also a lack of supply but always a high demand. That being said, many residents commented that it is one of the safest places to live in NYC.

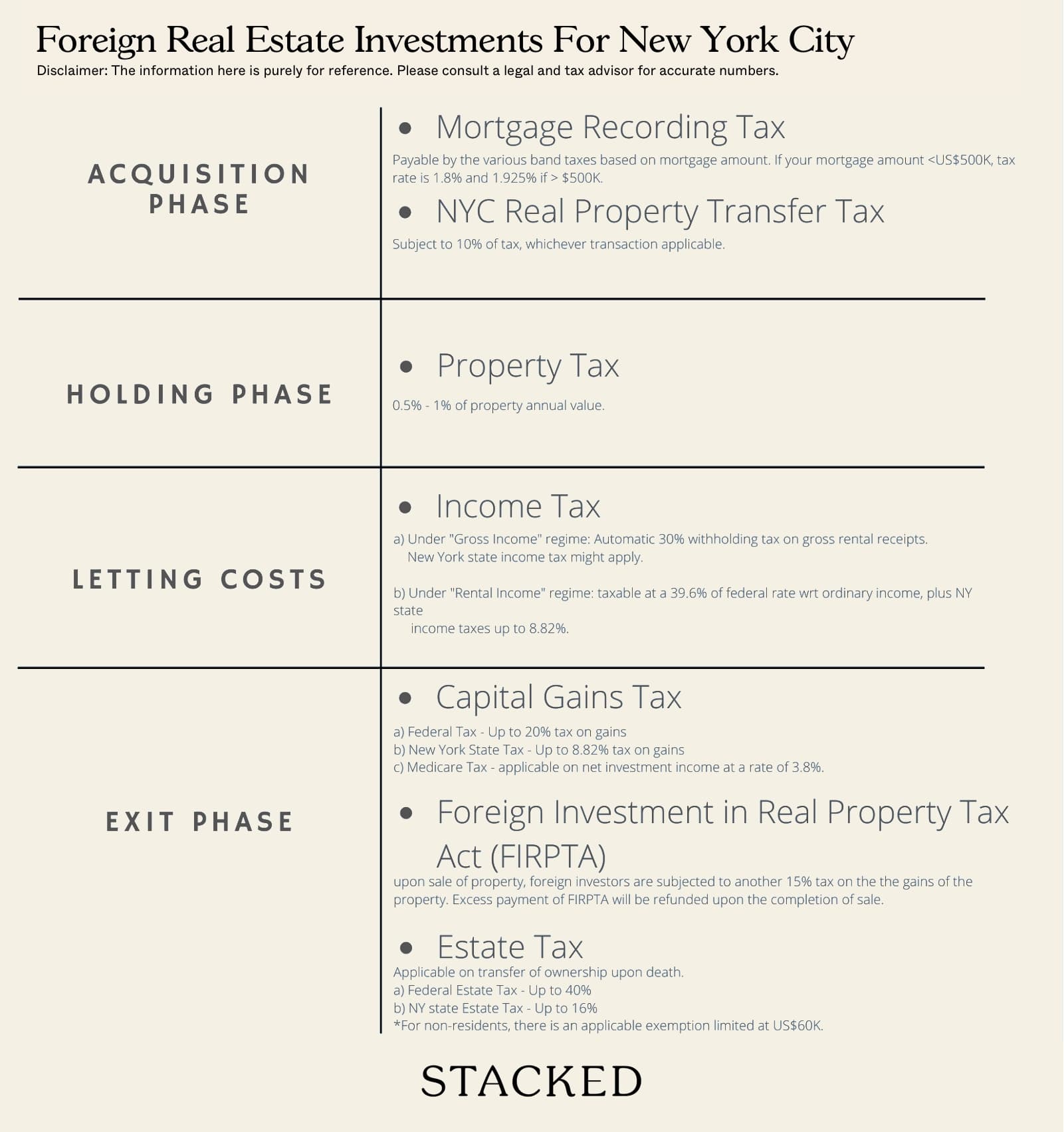

- Payable Taxes

Taxes upon purchasing is easy. It’s exiting the market that is the hard part. Still, it doesn’t stop investors all over the world to put money in the US property market.

- Potential

Just from demand and lack of supply alone, the home prices in West Village went up 20.4% just from last year. Ms Dollar bought this when she was 25 which was about 9 – 10 years ago, so she definitely saw a lot of capital appreciation.

Median prices are going at US$1.7M, with a 1 bedder renting on average from US$5K – US$8K. The average rent in Manhattan is about US$3.5K.

- Rental Demand & Yield

Median prices are going at US$1.7M, with a 1 bedder renting on average from US$5K – US$8K. The average rent in Manhattan is about US$3.5K. That’s about a 5% yield – not too bad.

Ms Dollar yields a 7.6% for renting her studio unit which is an insane number (to me at least).

- Initial Cash Outlay

Ms Dollar took up a 40% loan for this particular unit, with a whooping SGD $609,360 as a downpayment.

She also told me that her advisor recommended that she should not take up too much of a loan for properties in NYC as missing 3 monthly mortgage payments will put your unit up for sale on the market. It’s a very valid point to remember, so do take note.

- Risks

Since Manhattan is a renter-dominant town (about 75% of its resident’s rent!), the legal system tends to favour them over landlords. In that case, if your tenant is unable to pay their mortgage, they have a 6 to 9 months period to be evicted, which is really problematic. It’s important to choose your tenant wisely, if not it’s your own problem.

Final Thoughts

My brain says Brentford but my heart says West Village.

Thinking from a first-time investor’s perspective, Brentford seems like a good choice because of its lower quantum, the potential for a capital uptick and I like how it’s governed by the common law. It’s also a gateway city that is constantly evolving & growing. I love West Village with all my heart because of its tenant profile in the area, and the ability for wealth preservation. And its history is really one-of-a-kind.

Let me know what you’d choose in the comments!

(Shoutout to Ms Dollar for agreeing to share your experiences with me, thank you for your time and thoughts!)

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How much does Ms Dollar's property in Brentford, London cost per square foot?

What are the main amenities near Ms Dollar's Sukhumvit property in Bangkok?

Why is the Osaka property considered expensive, and what is its approximate price per square foot?

What are the typical risks associated with Ms Dollar's Bangkok Airbnb rental property?

What is the rental yield for Ms Dollar's Osaka property before and during the pandemic?

Cheryl Teo

Cheryl has been writing about international property investments for the past two years since she has graduated from NUS with a bachelors in Real Estate. As an avid investor herself, she mainly invests in cryptocurrency and stocks, with goals to include real estate, virtual and physical, into her portfolio in the future. Her aim as a writer at Stacked is to guide readers when it comes to real estate investments through her insights.Need help with a property decision?

Speak to our team →Read next from Overseas Property Investing

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Overseas Property Investing What Under $200K Buys In Malaysia Today — From Freehold Apartments to Beachfront Suites

Overseas Property Investing A London Landmark Is Turning Into 975-Year Lease Homes — And The Entry Price May Surprise Singapore Buyers

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

0 Comments