This New Condo Will Be The Biggest Project In One-North: Is Bloomsbury Residences Worth A Look?

March 20, 2025

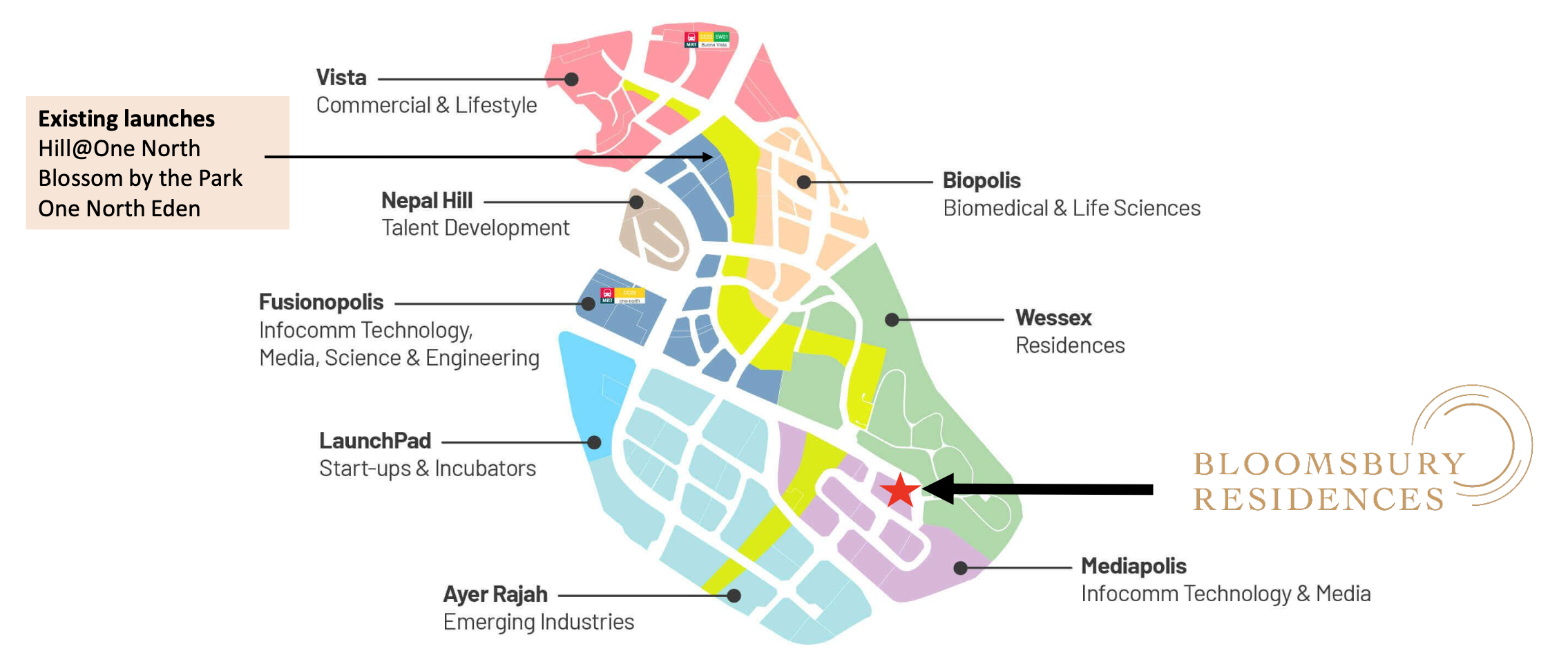

Bloomsbury Residences is the latest entrant to the One-North area, which has traditionally been better known as a hub for R&D, start-ups, and tech companies rather than a residential hotspot. But that’s starting to change.

With the URA’s push for a more balanced live-work-play environment—mirroring the transformation of the CBD—One-North is evolving.

So is Bloomsbury Residences one to look at? Here’s what we know so far.

Unlike its predecessors, it isn’t located in the thick of One-North’s main action. Instead, it’s nestled in Mediapolis, a quieter pocket of the district that overlooks the black-and-white bungalows of Wessex Estate.

But this relative tranquillity won’t last forever.

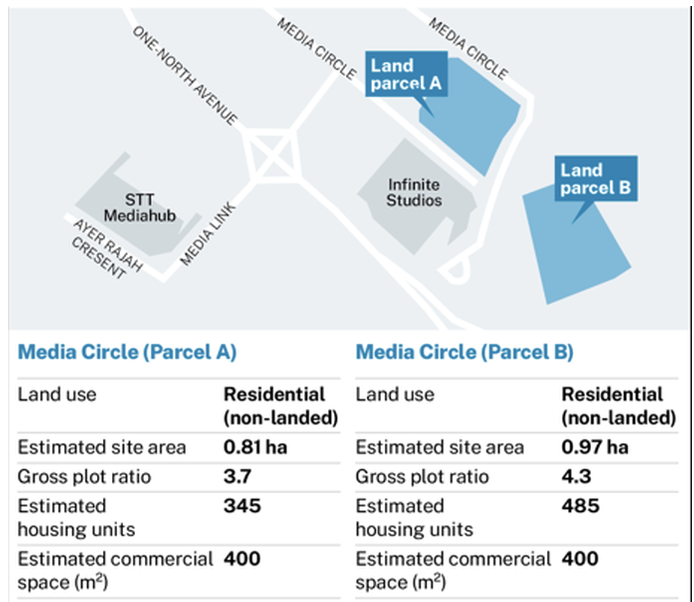

In addition to Bloomsbury Residences, URA has launched two other GLS sites in Media Circle (Parcels A & B). With more supply on the horizon, some might see Bloomsbury as a first-mover opportunity in this still-untapped part of One-North.

Whether or not you agree, one thing’s for sure—residential supply here is tight.

Normanton Park is long sold out, and Blossoms by the Park is 93 per cent taken up (with only a handful of larger units left). The only option that buyers have is The Hill @ One-North, which has been slower-moving at around 41 per cent sold, but that is a boutique project that offers only 142 units.

In any case, here’s a quick overview of Bloomsbury Residences:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Overview of Bloomsbury Residences

| Project Name | Bloomsbury Residences |

| Location | 61, 63, and 65 Media Circle |

| Developer | JV between Qingjian Realty Group, Forsea Holdings Pte Ltd, ZACD & Jianan Capital |

| Tenure | 99-year Leasehold |

| Site area | 10,632 sqm (est. 114,442 sq ft) |

| GFA Harmonised | Yes |

| No. of Units | 358 Residential units 400 sqm of retail space |

| Est. TOP | Est. Feb 2029 |

Bloomsbury Residences is a 358-unit leasehold condominium that includes a 400 sqm retail component, dubbed Bloomsbury Shoppes.

Mixed-use developments are becoming a staple in One-North—projects like Blossoms by the Park and One-North Eden have already integrated retail elements, and both upcoming GLS sites will follow suit.

The project is helmed by a consortium of Qingjian Realty, Foresea Holdings, ZACD, and SXT. Among them, Qingjian is probably the most recognisable, with Bloomsbury Residences marking their 17th project in Singapore. Their portfolio includes The Arden, Altura (EC), Tenet (EC), Le Quest (a mixed-use project), and the mega-development Jadescape.

Foresea Holdings, on the other hand, is a subsidiary of China Communications Construction Company (CCCC). While their residential track record here is still in its early days—their only other project so far being Hillock Green in the Lentor enclave—they’ve played a major role in some of Singapore’s infrastructure projects, including the RTS link between Johor Bahru and Singapore.

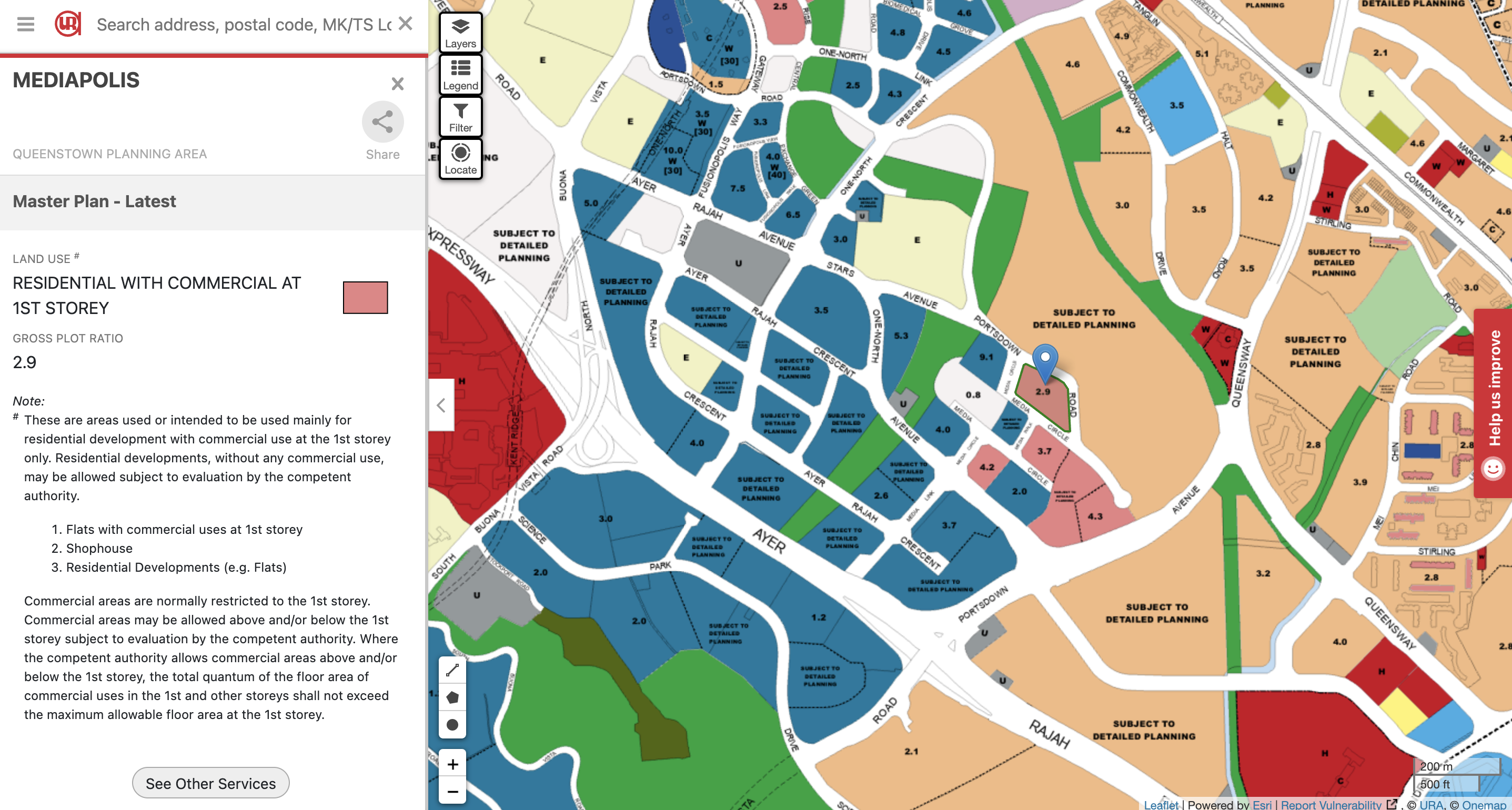

Bloomsbury Residences comprises three residential towers, standing 15 to 24 storeys high. The development sits on a 114,442 sq ft site with a GPR of 2.9.

The consortium secured the site with a winning bid of $395 million ($1,191 psf ppr), just 2.6 per cent above the second-highest bidder. However, with only three bidders for this site, it does indicate that developers are taking a more measured approach toward this part of One-North.

For context, this is the lowest psf ppr among recent launches in One-North, despite its post-GFA harmonisation status:

- 4.4 per cent lower than Blossoms by the Park ($1,246 psf ppr)

- 1.6 per cent lower than The Hill @ One-North ($1,210 psf ppr)

Of course, some might argue that this lower land cost reflects Bloomsbury Residences’ less central location, as it isn’t as close to the MRT or One-North’s main commercial cluster.

Unit Mix & Configurations

The development offers 2- to 6-bedroom layouts, providing options for both investors and own-stay buyers. Here’s a quick breakdown:

| Unit Type | Size (sq ft) | Total Units | Unit Breakdown |

| 2 Bedroom | 568 | 38 | 53% |

| 2 Bedroom Premium | 639 – 675 | 76 | |

| 2 Bedroom + Flexi | 687 | 76 | |

| 3 Bedroom + Study | 900 | 38 | 26% |

| 3 Bedroom Premium | 974 | 19 | |

| 3 Bedroom Premium + Study | 977 – 986 | 23 | |

| 3 Bedroom Premium + Flexi | 1,095 | 12 | |

| 4 Bedroom Premium + Study | 1,175 – 1,201 | 30 | 19% |

| 4 Bedroom Premium + Flexi | 1,418 | 38 | |

| Penthouse 4 Bedroom | 1,341 | 2 | 2% |

| Penthouse 5 Bedroom + Flexi | 1,671 – 1,915 | 4 | |

| Penthouse 6 Bedroom + Flexi | 2,125 | 2 | |

| 358 | 100% | ||

At first glance, Bloomsbury Residences looks like it’s trying to strike a balance between investors and own-stay buyers. 2-bedders make up 53 per cent of the unit mix, while 3-bedders and above take up 47 per cent—a relatively even split.

But here’s what’s interesting: unlike its peers, Bloomsbury Residences doesn’t have any 1-bedders. That’s an unusual omission for a project in One-North, where rental demand is strong, and smaller units usually get snapped up by investors looking for a lower entry price. Instead, the inclusion of 5- and 6-bedroom penthouses—rare for this area—suggests a stronger push towards own-stay buyers who prioritise space over affordability.

This unit mix is quite similar to what we saw at Blossoms by the Park, The Hill @ One-North, and One-North Eden, but here’s the key difference—Bloomsbury Residences is the only project under the new GFA harmonisation guidelines (for now).

With aircon ledges no longer counted in the total square footage, layouts should be more space-efficient than past One-North launches. That’s a plus, especially in an area where compact unit layouts are the norm.

Larger Units: More Space, But Less Affordability?

For families considering larger units, there’s one key detail—the 3-bedders and above at Bloomsbury Residences only come in “premium” configurations.

This means spacious layouts, which is great for those who prioritise liveability. But it also means there’s no entry-level 3-bedder option for budget-conscious buyers looking for a more compact (and lower quantum) alternative.

For comparison, here’s how Bloomsbury Residences’ potential 3-bedroom sizes stack up against recent RCR new launches under GFA harmonisation:

- Emerald of Katong – 883 sq ft

- The Orie – 850 sq ft

- Chuan Park* – 915 sq ft

(While Chuan Park technically sits in the OCR, its fringe location means some may still consider it part of the RCR market.)

Lack of Condo Amenities: A Common Downside Noted in Projects in One-North

One of the common gripes about One-North condos is their lack of full-fledged facilities—a trade-off that comes with smaller land plots and lower-density developments.

From what we’ve heard, Bloomsbury Residences aims to buck that trend, offering one of the strongest facility line-ups in the district:

- 50m lap pool + two smaller pools

- Tennis court

- Two function rooms & a smart gym

- Library & co-working space

What’s also worth noting is that some of these facilities will be spread across the rooftop, allowing even lower-floor residents to enjoy unblocked Wessex Estate views. It’s a clever move, though one that likely comes with higher construction costs.

Beyond the facilities, Bloomsbury Residences will also have an on-site retail component (coined Bloomsbury Shoppes). While there’s no confirmed tenant list yet, we’ve heard that the developers will be managing the curation themselves—which could mean a more thoughtful tenant mix, rather than just a random selection of stores.

From what we understand, the focus will be on a grocer and F&B outlets, though nothing has been finalised. If done right, this could add a much-needed layer of convenience to the area—something that’s still lacking in this part of One-North’s residential scene.

Bloomsbury Residences is also estimated to TOP in 2029.

Car-Lite, But Is It Too Light?

Bloomsbury Residences follows the car-lite model, with a 40% carpark ratio (~143 lots).

While that’s in line with the urban planning trend in One-North, it’s less than ideal for a project that isn’t within walking distance to the nearest MRT station. Most would find that they would need a short bus ride or drive to get to One-North MRT Station (CCL)— so this is a factor that might not sit well with some buyers.

For context, Blossoms by the Park offers 110 car park lots for 275 units (40% carpark ratio), but Buona Vista MRT Station (EWL, CCL) is located just across the site.

One-North’s First Robot-Run Condo?

Qingjian has been one of the more tech-forward developers, being the first to bring smart ECs to Singapore. At Bloomsbury Residences, they’re pushing further with robot-assisted maintenance, which would be the first of its kind in Singapore.

So far, we’ve heard about:

- Autonomous cleaning robots for common areas

- Contactless delivery robots

- Automated pool-cleaning robots

- Tennis ball-picking robots

While it’s a futuristic touch that fits the innovation-driven One-North theme, it remains to be seen how this will affect maintenance fees and day-to-day practicality for residents. That said, if it helps lower costs while maintaining a higher standard of cleanliness and upkeep, it could be an underrated perk—and maybe even a trend we’ll see in more condos down the line.

More from Stacked

Touring Clementi Park Condo: A Giant Development With Its Own Hill And Park + Freehold

When I first saw a unit listed at Clementi Park, a condo development built in 1986 by CDL and located…

The Location of Bloomsbury Residences

The main ingress of Bloomsbury Residences would be located along Media Circle, which connects to Portsdown Road, a cul-de-sac.

Here’s a look at the estate in early 2024—a scene that’s quite unlike what you’d typically expect from One-North. Instead of futuristic high-rises and a dense urban landscape, this part of the district feels quieter, more open, and far less built-up than its more commercialised counterparts.

Another key drawback is that Media Circle lacks direct MRT access. Future residents of Bloomsbury Residences will need a short bus ride or drive to One-North MRT (CCL). While this might be a deal-breaker for some, Normanton Park’s success—despite similar limitations—shows that strong demand can persist with good bus connectivity.

Ultimately, it depends on how much you value walkable amenities. Bloomsbury Residences does have Bloomsbury Shoppes on-site, which could help bridge the gap.

A Unique Selling Point: Unblocked Views of Wessex Estate

This is where Bloomsbury Residences sets itself apart. From what we’ve heard, unblocked views of Wessex Estate are a key selling point, with the developers designing 60–70% of the units to maximise the panoramic views. It’s a rare proposition in a district that’s more commonly known for high-rise, commercial-driven developments.

Do keep in mind that the unblocked views might not be a permanent feature.

In Singapore, unblocked views are never guaranteed.

While Wessex Estate has been zoned residential since the 2003 Master Plan, it remains subject to future detailed planning. With the Draft Master Plan 2025 on the horizon, any changes to zoning or land use could affect the long-term outlook of the area.

For now, though, Bloomsbury Residences arguably enjoys the best vantage point among the three GLS sites here—being the only project that directly borders a low-rise landed zone.

Meanwhile, units facing Media Circle will also have some unblocked views, at least until the neighbouring GLS sites are developed.

Schools: A Consideration for Families

For families, One-North’s proximity to schools could be a potential draw. The Buona Vista and Holland Village areas have long been favoured by families due to their accessibility to well-regarded institutions, so for those priced out of these mature estates, One-North may serve as an alternative.

Bloomsbury Residences is located next to Tanglin Trust School, a British international school—similar to how Le Quest (another Qingjian project) is situated near Dulwich College in Bukit Batok.

For those considering Fairfield Methodist Primary School, the 1km radius remains unclear. While Bloomsbury Residences appears to be within the range, OneMap does not confirm this, so parents relying on priority admission should verify this separately.

Other schools in the wider vicinity include:

- National University of Singapore (NUS)

- Ngee Ann Polytechnic

- Anglo-Chinese School (Independent)

- Anglo-Chinese Junior College (ACJC)

With educational institutions nearby, the area sees a mix of students and families, which could contribute to rental demand.

Upcoming GLS Sites: More Supply, But Also More Amenities

As mentioned earlier, two GLS sites in Media Circle have been released for tender, bringing more supply—and potentially more conveniences—to this part of One-North.

The tender for Parcel A closed in March 2025, with Qingjian Realty and Foresea Holdings (the same developers behind Bloomsbury Residences) securing the top bid at $1,037 psf ppr—13 per cent lower than what they paid for Bloomsbury Residences.

In terms of competition, Parcel A drew three bidders, with Qingjian & Foresea outbidding EL Development (the developer behind Blossoms by the Park) by a marginal 5.7 per cent.

While not an aggressive premium, this suggests steady but measured interest in the area. Meanwhile, Parcel B’s tender closes on April 29, 2025, so its outcome remains to be seen.

For now, Indicative Pricing Still Unreleased

As of now, indicative pricing for Bloomsbury Residences has yet to be released, which is something buyers will want to keep an eye on as it could also give a hint at the pricing strategy for Media Circle Parcel A.

In many ways, Bloomsbury Residences finds itself in a similar position to Normanton Park at launch.

Both projects aren’t within immediate reach of major amenities and sit on the fringe of a less-established part of One-North. As such, demand will likely depend on how competitively it is priced—buyers will need enough incentive to take a bet on the location.

With that in mind, here’s a look at how resale transactions have played out for Normanton Park:

| Contract Date | Address | Unit Area (SQFT) | Price ($ PSF) | Price ($) |

| 6 Feb 2025 | 51 Normanton Park #21-XX | 936 | 2,176 | 2,038,000 |

| 23 Jan 2025 | 55 Normanton Park #06-XX | 581 | 2,064 | 1,200,000 |

| 17 Jan 2025 | 45 Normanton Park #18-XX | 657 | 2,056 | 1,350,000 |

| 3 Jan 2025 | 57 Normanton Park #12-XX | 667 | 2,128 | 1,420,000 |

| 24 Dec 2024 | 53 Normanton Park #07-XX | 560 | 2,055 | 1,150,000 |

| 18 Dec 2024 | 59 Normanton Park #21-XX | 635 | 2,075 | 1,318,000 |

| 17 Dec 2024 | 59 Normanton Park #12-XX | 635 | 1,913 | 1,215,000 |

| 17 Dec 2024 | 59 Normanton Park #15-XX | 915 | 2,098 | 1,920,000 |

| 16 Dec 2024 | 51 Normanton Park #14-XX | 1,098 | 2,176 | 2,388,888 |

| 21 Nov 2024 | 59 Normanton Park #07-XX | 635 | 1,968 | 1,250,000 |

| 18 Nov 2024 | 59 Normanton Park #18-XX | 904 | 2,212 | 2,000,000 |

| 5 Nov 2024 | 53 Normanton Park #06-XX | 570 | 2,051 | 1,170,000 |

| 4 Nov 2024 | 51 Normanton Park #07-XX | 969 | 2,157 | 2,090,000 |

| 30 Oct 2024 | 55 Normanton Park #07-XX | 732 | 2,094 | 1,533,000 |

| 29 Oct 2024 | 55 Normanton Park #18-XX | 1,615 | 2,261 | 3,650,000 |

Here’s a look at how One-North Eden has performed in the resale market:

| Contract Date | Address | Unit Area (SQFT) | Price ($ PSF) | Price ($) |

| 12 Feb 2025 | 8 Slim Barracks Rise #09-XX | 786 | 2,354 | 1,850,000 |

| 24 Jan 2025 | 10 Slim Barracks Rise #10-XX | 1,119 | 2,331 | 2,610,000 |

| 17 Jan 2025 | 10 Slim Barracks Rise #08-XX | 947 | 2,375 | 2,250,000 |

| 6 Dec 2024 | 8 Slim Barracks Rise #06-XX | 689 | 2,395 | 1,650,000 |

| 3 Dec 2024 | 8 Slim Barracks Rise #04-XX | 1,259 | 2,223 | 2,800,000 |

| 21 Nov 2024 | 8 Slim Barracks Rise #07-XX | 689 | 2,344 | 1,615,000 |

| 18 Nov 2024 | 8 Slim Barracks Rise #08-XX | 689 | 2,381 | 1,640,000 |

| 13 Nov 2024 | 10 Slim Barracks Rise #09-XX | 1,119 | 2,287 | 2,560,000 |

| 11 Nov 2024 | 8 Slim Barracks Rise #11-XX | 689 | 2,468 | 1,700,000 |

| 8 Nov 2024 | 10 Slim Barracks Rise #11-XX | 1,119 | 2,323 | 2,600,000 |

| 7 Nov 2024 | 10 Slim Barracks Rise #11-XX | 1,119 | 2,269 | 2,540,000 |

| 24 Oct 2024 | 10 Slim Barracks Rise #08-XX | 517 | 2,477 | 1,280,000 |

| 24 Oct 2024 | 8 Slim Barracks Rise #07-XX | 786 | 2,342 | 1,840,000 |

| 21 Oct 2024 | 8 Slim Barracks Rise #04-XX | 1,410 | 2,348 | 3,310,800 |

| 9 Oct 2024 | 10 Slim Barracks Rise #09-XX | 517 | 2,406 | 1,243,000 |

And here’s how Blossoms by the Park has performed in the resale market:

| Contract Date | Address | Unit Area (SQFT) | Price ($PSF) | Price ($) |

| 19 Feb 2025 | 9 Slim Barracks Rise #15-XX | 1,507 | 2,362 | 3,560,000 |

| 3 Feb 2025 | 9 Slim Barracks Rise #18-XX | 1,507 | 2,415 | 3,639,000 |

| 21 Jan 2025 | 9 Slim Barracks Rise #17-XX | 1,507 | 2,394 | 3,608,000 |

| 5 Oct 2024 | 9 Slim Barracks Rise #26-XX | 915 | 2,662 | 2,436,000 |

| 9 Sep 2024 | 9 Slim Barracks Rise #14-XX | 1,302 | 2,448 | 3,188,000 |

Looking at recent transactions, it seems the market has largely accepted the pricing trajectory in One-North, with prices in the area appearing to have stabilised.

For projects in Slim Barracks—which are closer to daily amenities—the $2,300–$2,400 psf range has become the norm, as seen in the steady demand for launches like Blossoms by the Park and One-North Eden.

Meanwhile, for Normanton Park, which lacks direct walkability to key amenities, prices have shown a wider range, hovering between $1,900–$2,200 psf. This isn’t too surprising when we consider the launch prices:

- Blossoms by the Park had an indicative price of $2,183–$2,352 psf

- Normanton Park launched at $1,517–$2,363 psf

In a way, pricing reflects accessibility—projects near amenities command a premium, while those further away are priced lower to compensate.

But given Normanton Park’s price appreciation over time, it suggests that the market has become increasingly comfortable with One-North’s pricing, regardless of location.

Media Circle: A Promising Yet Untested Bet

At the end of the day, the true measure of Bloomsbury Residences’ appeal will come down to its pricing.

If positioned competitively, it has the potential to attract both own-stay buyers and investors who see value in One-North’s ongoing evolution.

Its location offers a compelling mix of access to top schools, proximity to a highly skilled talent pool in Singapore’s R&D hub, and strong rental potential. While One-North has yet to establish itself as a full-fledged residential enclave, it sits just minutes from Holland Village and within easy reach of the city—offering a mix of connectivity and relative exclusivity.

However, it should be noted that One-North is a JTC-planned district, prioritising office infrastructure over everyday conveniences. There are no HDB clusters, hawker centres, or major amenities—just cafés, business-centric retail, and corporate-friendly F&B.

So, this part of One-North is still a work in progress. Buyers will need to weigh the trade-offs of fewer immediate amenities and MRT connectivity against the long-term potential of being an early mover in an area that’s set to grow.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is the location and main features of Bloomsbury Residences?

How does Bloomsbury Residences compare to other projects in One-North in terms of pricing and land cost?

What types of units are available at Bloomsbury Residences, and who are they aimed at?

What amenities and facilities are included in Bloomsbury Residences?

What are the potential drawbacks of Bloomsbury Residences' location and access?

What is unique about Bloomsbury Residences' design and future outlook?

Cheryl Teo

Cheryl has been writing about international property investments for the past two years since she has graduated from NUS with a bachelors in Real Estate. As an avid investor herself, she mainly invests in cryptocurrency and stocks, with goals to include real estate, virtual and physical, into her portfolio in the future. Her aim as a writer at Stacked is to guide readers when it comes to real estate investments through her insights.Need help with a property decision?

Speak to our team →Read next from New Launch Condo Analysis

New Launch Condo Analysis This New Dairy Farm Condo Starts From $998K — How the Pricing Compares

New Launch Condo Analysis This New Freehold CBD Condo Starts From $1.29M — Here’s How the Pricing Compares

New Launch Condo Analysis This Freehold New Launch Condo In The CBD Is Launching From Just $1.29M

New Launch Condo Analysis I Reviewed A New Launch 4-Bedroom Penthouse At Beauty World

Latest Posts

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

0 Comments