The Mystery Behind This Freehold Condo On Top Of A Mall: Why Katong Regency Isn’t As Profitable As You Might Think

December 24, 2024

Given the rise of Paya Lebar Quarter (PLQ) and the prominence of District 15 (RCR), any properties in the area should be doing well. And if there is anything that Singaporeans love in their condo developments: it is the trifecta of being freehold, close to the MRT, as well as being located on top of a mall.

This should be the case with Katong Regency, a freehold mixed-use project better known to most as the KINEX mall. But then why the mediocre performance? Is this an underrated property that’s waiting to be rediscovered? Or is it just an overpriced and risky buy? If you’re looking for a home near PLQ, you may want to check this out:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

An overview of Katong Regency

Katong Regency is the residential component of KINEX. It consists of 244 freehold units, situated atop the three-storey mall. It was completed in 2015, though note that the mall component (KINEX) was known as One Knowledge Mall (One KM) at the time. It was revamped as KINEX much later on in August 2018.

Katong Regency is along Haig Road (just across from the Market and Food Centre), and also next to the old City Plaza Mall. It’s possible to walk to the Paya Lebar MRT station (CCL, EWL) from here, and the nearby Paya Lebar Quarter (PLQ) provides a dense cluster of malls, offices, restaurants, etc. As an aside, this area is also famous for the regular Ramadan Bazaar, around the Geylang Serai market.

The project is also close to some notable schools, with Haig Girls’ and Kong Hwa School being within the priority enrolment range.

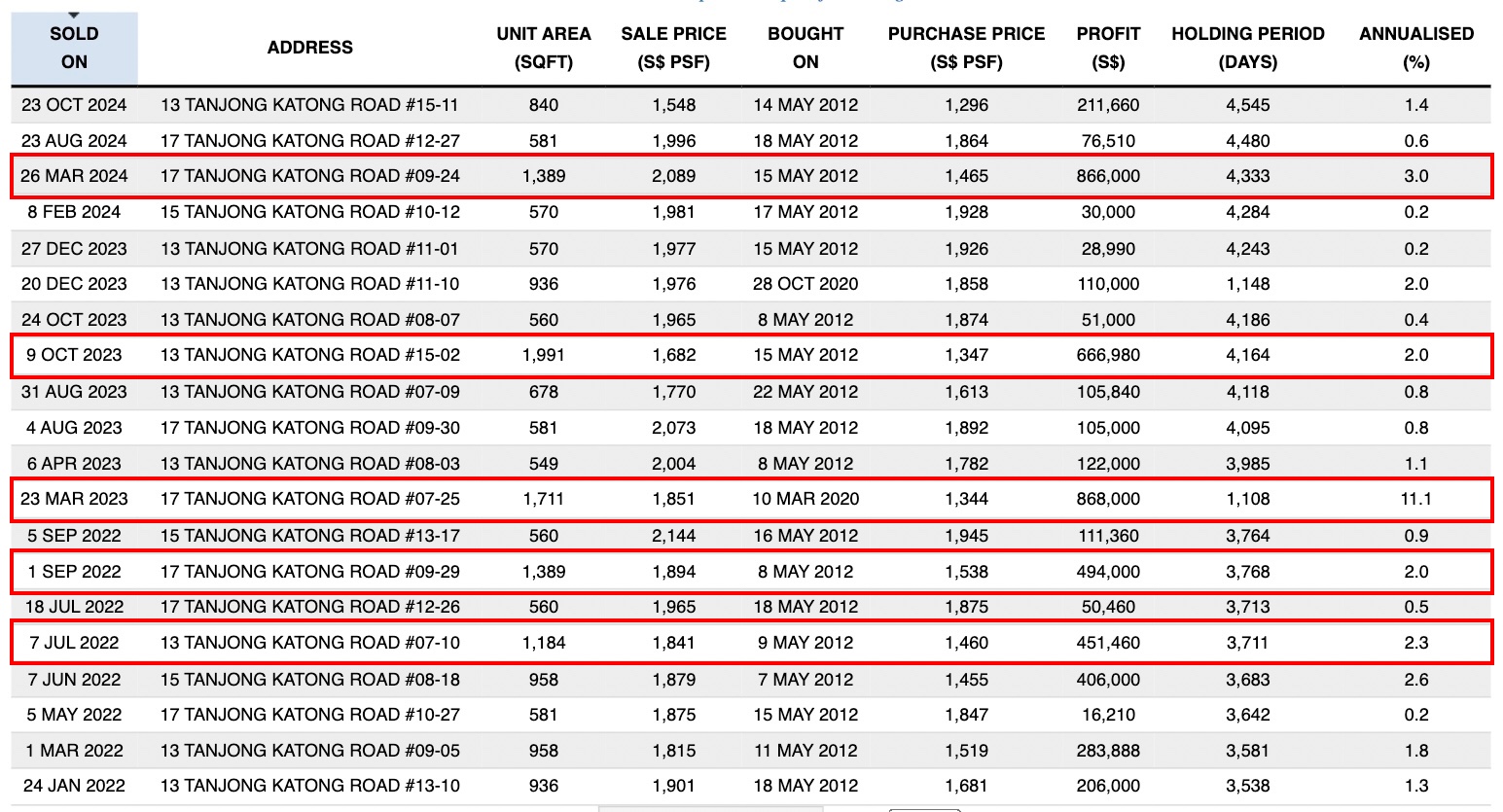

A Rest of Central Region (RCR) location, this close to PLQ, should be seeing strong appreciation. However, the performance of Katong Regency is quite shaky so far: there are currently 18 unprofitable transactions to 44 profitable ones; and gains tend to be slim. The last recorded transaction, on 23rd October 2024, saw marginal returns of 1.4 per cent. Another two transactions, in December 2023 and February 2024, saw gains of just 0.2 per cent. In fact, the average ROI is around one per cent (more on this below)

Overall price movement has also been volatile:

But given this is a smaller project (244 units counts as on the small side), the lower transaction volume is partly to blame for this.

An anecdote regarding the former One KM Mall component

As a coincidence, this writer was approached to rent a space in One KM for an education-related business, several years back (while it was still under construction). At the time, the sales pitch mentioned it was a good catchment area for enrichment or tuition centres, hence the name “One Knowledge Mall.”

It was evident even then that the developer targeted mainly families; and since the mall’s enrichment-hub concept was eventually dropped, we know this didn’t work out. Speculatively, an emphasis on working professionals or landlords may have been better, as PLQ is a hub with Grade A office spaces, and the area lacks the kind of green space that most families seem to prefer.

So why isn’t it doing well?

From the looks of it, there are some possible reasons:

1. It’s due to the high launch pricing

This may be the main reason we’re seeing such low returns. Check out the prices of Katong Regency at launch. Compared to other projects within a 500-metre radius, it was the most expensive project at an average of $1,673 psf. This was 53.4 per cent higher than surrounding resale options:

| Project Name | New Sale | Resale | Sub Sale |

| 38 I SUITES | $1,321 | ||

| ASTON MANSIONS | $812 | ||

| BELLA CASITA | $1,242 | $1,439 | |

| BUTTERWORTH 8 | $1,172 | ||

| BUTTERWORTH VIEW | $1,033 | ||

| CITY PLAZA | $1,012 | ||

| CRANE COURT | $960 | ||

| D’WEAVE | $1,238 | ||

| DAWN VILLE | $1,088 | ||

| EASTSIDE LOFT | $1,050 | ||

| EMERY POINT | $1,025 | ||

| ESTA RUBY | $1,274 | $1,304 | |

| ESTIQUE | $1,254 | ||

| FORTUNE JADE | $1,096 | ||

| GALAXY TOWERS | $901 | ||

| GRANDLINK SQUARE | $866 | ||

| GRAY MANSIONS | $808 | ||

| IMPERIAL HEIGHTS | $1,491 | ||

| KATONG REGENCY | $1,673 | ||

| MELROSE VILLE | $1,337 | ||

| ONE K GREENLANE | $1,143 | ||

| PALM LODGE | $801 | ||

| PAYA LEBAR RESIDENCES | $1,097 | ||

| RITZ REGENCY | $1,134 | ||

| SHEBA LODGE | $726 | ||

| SIGNATURE CREST | $1,106 | ||

| SIMS DORADO | $1,006 | $980 | |

| SIMS RESIDENCES | $728 | ||

| SUITES @ GUILLEMARD | $1,507 | ||

| SUNFLOWER GRANDEUR | $988 | ||

| TAIPAN JADE | $737 | ||

| THE AMARELLE | $1,261 | ||

| THE CARPMAELINA | $851 | ||

| THE SILVER FIR | $1,289 | ||

| THE WATERINA | $1,147 | ||

| VERSILIA ON HAIG | $1,217 | ||

| WORTHINGTON | $1,327 | ||

| Overall Average | $1,567 | $1,090 | $1,330 |

It seems that at the time Katong Regency went up, the pricing had already factored in the planned upgrades to the area. It was already known that Paya Lebar would be a new hub at the time, even though PLQ would only see completion in around 2019.

More from Stacked

Why The Interlace Condo Underperformed—Despite Its Massive Land Size And Large Units

In this Stacked Pro breakdown:

But what about price comparisons today?

Katong Regency is still priced higher than its neighbours (average of $1,678 psf). Looking at the same 500-metre distance, here’s how it compares:

| Project Name | New Sale | Resale |

| 38 I SUITES | $1,781 | |

| ASTON MANSIONS | $1,147 | |

| BELLA CASITA | $1,737 | |

| BUTTERWORTH 8 | $1,936 | |

| BUTTERWORTH VIEW | $1,532 | |

| CITY PLAZA | $1,530 | |

| D’WEAVE | $1,659 | |

| DAWN VILLE | $1,551 | |

| EMERY POINT | $1,824 | |

| ESTA RUBY | $1,669 | |

| ESTIQUE | $1,508 | |

| FORTUNE JADE | $1,658 | |

| GALAXY TOWERS | $1,464 | |

| GREENLANE APARTMENT | $1,465 | |

| IMPERIAL HEIGHTS | $1,749 | |

| KATONG REGENCY | $1,978 | |

| ONE K GREENLANE | $1,354 | |

| PAYA LEBAR RESIDENCES | $1,749 | |

| RITZ REGENCY | $1,783 | |

| SANDY EIGHT | $1,839 | |

| SIMS DORADO | $1,270 | |

| SIMS RESIDENCES | $1,109 | |

| SUITES @ GUILLEMARD | $1,600 | |

| SUNFLOWER GRANDEUR | $1,326 | |

| THE AMARELLE | $1,787 | |

| THE CONTINUUM | $2,812 | |

| THE SILVER FIR | $1,659 | |

| THE WATERINA | $1,865 | |

| VERSILIA ON HAIG | $1,770 |

This is a price premium of roughly 19.8 per cent, compared to its neighbours, even though the price gap has narrowed.

To be doubly sure, we also took a look at new-to-resale and resale-to-resale transactions. This would help to exclude sub-sale transactions. This is important because a transaction like sub-sale to sub-sale can result in rapidly dwindling profits, thus distorting the overall view of returns:

| Project | Returns (%) | Average of ROI | Volume | Avg. Holding Period |

| MELROSE VILLE | 1% | 0% | 4 | 7.7 |

| SANDY EIGHT | 6% | 1% | 4 | 5.5 |

| KATONG REGENCY | 9% | 1% | 53 | 8.6 |

| BELLA CASITA | 3% | 1% | 2 | 5.0 |

| THE AMARELLE | 10% | 1% | 10 | 6.2 |

| 38 I SUITES | 8% | 2% | 15 | 6.2 |

| SIMS DORADO | 12% | 2% | 4 | 6.3 |

| SHEBA LODGE | 13% | 2% | 1 | 5.9 |

| ESTA RUBY | 19% | 2% | 2 | 7.2 |

| IMPERIAL HEIGHTS | 11% | 2% | 16 | 5.4 |

| ASTON MANSIONS | 15% | 3% | 16 | 5.1 |

| THE CARPMAELINA | 24% | 3% | 4 | 6.1 |

| SUITES @ GUILLEMARD | 20% | 3% | 2 | 6.0 |

| VERSILIA ON HAIG | 20% | 3% | 9 | 5.6 |

| SIMS RESIDENCES | 27% | 3% | 5 | 7.5 |

| THE SILVER FIR | 16% | 3% | 3 | 4.6 |

| SIGNATURE CREST | 26% | 4% | 2 | 5.5 |

| EASTSIDE LOFT | 20% | 4% | 3 | 5.1 |

| THE WATERINA | 30% | 4% | 11 | 7.1 |

| CITY PLAZA | 57% | 4% | 1 | 11.3 |

| TAIPAN JADE | 47% | 4% | 1 | 9.2 |

| BUTTERWORTH VIEW | 38% | 4% | 3 | 7.8 |

| D’WEAVE | 22% | 4% | 6 | 5.6 |

| RITZ REGENCY | 15% | 4% | 2 | 4.0 |

| ESTIQUE | 32% | 4% | 1 | 6.4 |

| GRANDLINK SQUARE | 35% | 5% | 2 | 6.7 |

| DAWN VILLE | 33% | 5% | 1 | 5.5 |

| BUTTERWORTH 8 | 26% | 6% | 7 | 4.4 |

| PAYA LEBAR RESIDENCES | 43% | 7% | 1 | 5.5 |

| FORTUNE JADE | 37% | 7% | 6 | 5.5 |

| EMERY POINT | 41% | 12% | 6 | 5.5 |

As mentioned earlier, we see average returns of just around one per cent, which is bad; in fact it makes Katong Regency the third-worst performer in the area.

So despite the strong locational aspects, and the freehold status of the project, the price point may have been too high from the get-go. This limited the room for price growth, and it’s probably one of the main causes of the weak overall performance.

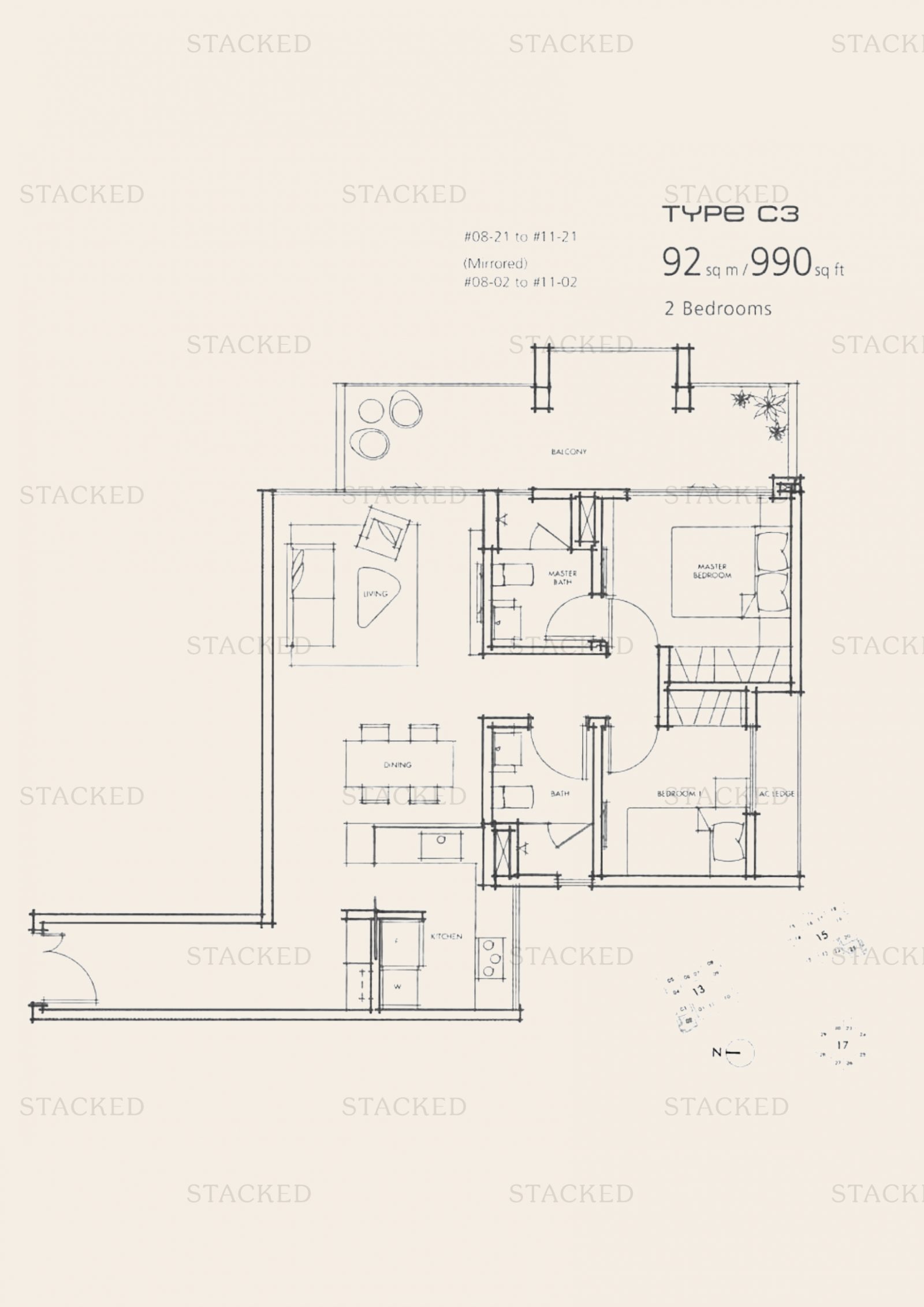

2. Unit mix and floor plans

One look at the recent profits, and you can quite easily see that those who’ve made a good amount from Katong Regency were those who bought the larger units at a lower psf during launch.

This has paid off as recent trends have shown strong demand for bigger, family-sized units, as opposed to smaller bedroom types.

You can also see that the pricing strategy back then was to price the small units at a much higher psf compared to the bigger units, which is why the smaller units more than 10 years on have barely appreciated. This is something that is changing today, where we’ve seen new launches like Sora price their 3-bedders at a higher psf than the 1-bedders (which reflects the changing demand).

Another possible reason would be the size and floor plans of the units at Katong Regency. While the 1-bedders are within the average, the 2-bedroom + study units here at 936 to 990 sq. ft. are larger than average (which are the sizes of a new launch 3-bedder today). As such, the quantum may be unpalatable to buyers today – who may rather pay for a 3-bedroom unit elsewhere, even if the location may not be as convenient.

Also, the balconies in the 2-bedroom units are overly large, which may not be necessary for a development located above a mall.

3. Too urban and too close to busy roads

We spoke to an agent who specialises in District 15, and he remarked that – despite the proximity to PLQ – the immediate surroundings of Katong Regency look much older than its upscale neighbour. The area around City Plaza to Grandlink Square is much more reminiscent of Geylang than of PLQ (long stretches of older shophouses, with coffee shops, KTVs, lighting fixture stores, etc.)

This is a rather subjective judgment, but if you’re interested in the area we’d suggest you take a quick look on Google Maps or swing by. We do think there’s a big difference in aesthetics and overall vibe, despite PLQ being so close.

There’s a distinct lack of green space in the immediate surroundings, and traffic here can get very heavy. It’s very much a location for urbanites, and not for the sort who like park connectors, cycling, etc.

4. Weaker commercial elements

Despite the rebranding, word on the ground is that KINEX is okay as far as the tenant mix goes (you can check out the directory here). While it’s sufficient for most day-to-day needs, it definitely suffers in contrast, with the PLQ being within walking distance. With so many large retail malls also close by, buyers may disregard the added amenity of the “downstairs shops.”

City Plaza and Grandlink are also ageing and very limited in what they provide; such that buyers may not even count them as amenities.

Still, Katong Regency has potential, given the location

Almost wasted potential, we feel, given the recent developments in Paya Lebar. This property could represent a more affordable way to live near PLQ. Consider, for instance, the sellout success of projects like Parc Esta, where the main selling point was being one train stop away from Paya Lebar.

If the commercial element could be improved (perhaps concessions on rent for a strong anchor tenant), and it was marketed to urban professionals, there’s still a chance that prices can climb.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why is Katong Regency not performing well despite its location?

How does the price of Katong Regency compare to nearby projects?

What impact does unit size and layout have on the property's performance?

Does the location of Katong Regency affect its value?

What are the potential opportunities for improving Katong Regency’s value?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Property Investment Insights Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Property Investment Insights This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Editor's Pick New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

0 Comments