Anything Is Possible Until It Is Not – The Dangers of Procrastination

June 22, 2020

“Am I on track?” is a question you should ask yourself at regular intervals.

Knowing the money you have and where it is going is the core of a financial plan.

And by the time you reach your 40s and retirement is on the distant horizon, keeping your financial life on track is important to you and your family – more than ever.

The Slippery Slope to the Top of the Mountain

Trying to achieve a goal is like climbing up a mountain but it is muddy and slippery.

You struggle a little bit as you climb up and eventually you reach halfway up the mountain. The view is nice and we decide to just chill and relax.

But because of your weight and the mountain is so slippery – you slowly start to slide backwards. However, it happens so slowly and gradually that you don’t notice it at first.

And over time you start to slide back as you are not doing anything to improve yourself.

Years later, you look back up and say “I used to be up there.” But you are not anymore.

And that sliding back – it represents all the opportunities that you passed up that you didn’t take advantage of.

The Significance of the MOP Milestone

If you are an HDB owner – you will know about the requirement of the 5-year Minimum Occupation Period. It was a ruling that was put in place to prevent speculation from happening.

Now in 2020, I see an increasing number of HDB BTO owners reaching out to me – sometimes up to 6-12 months before their MOP date to start planning for their next property.

Make no mistake, this isn’t something I’m just conjuring up on the spot.

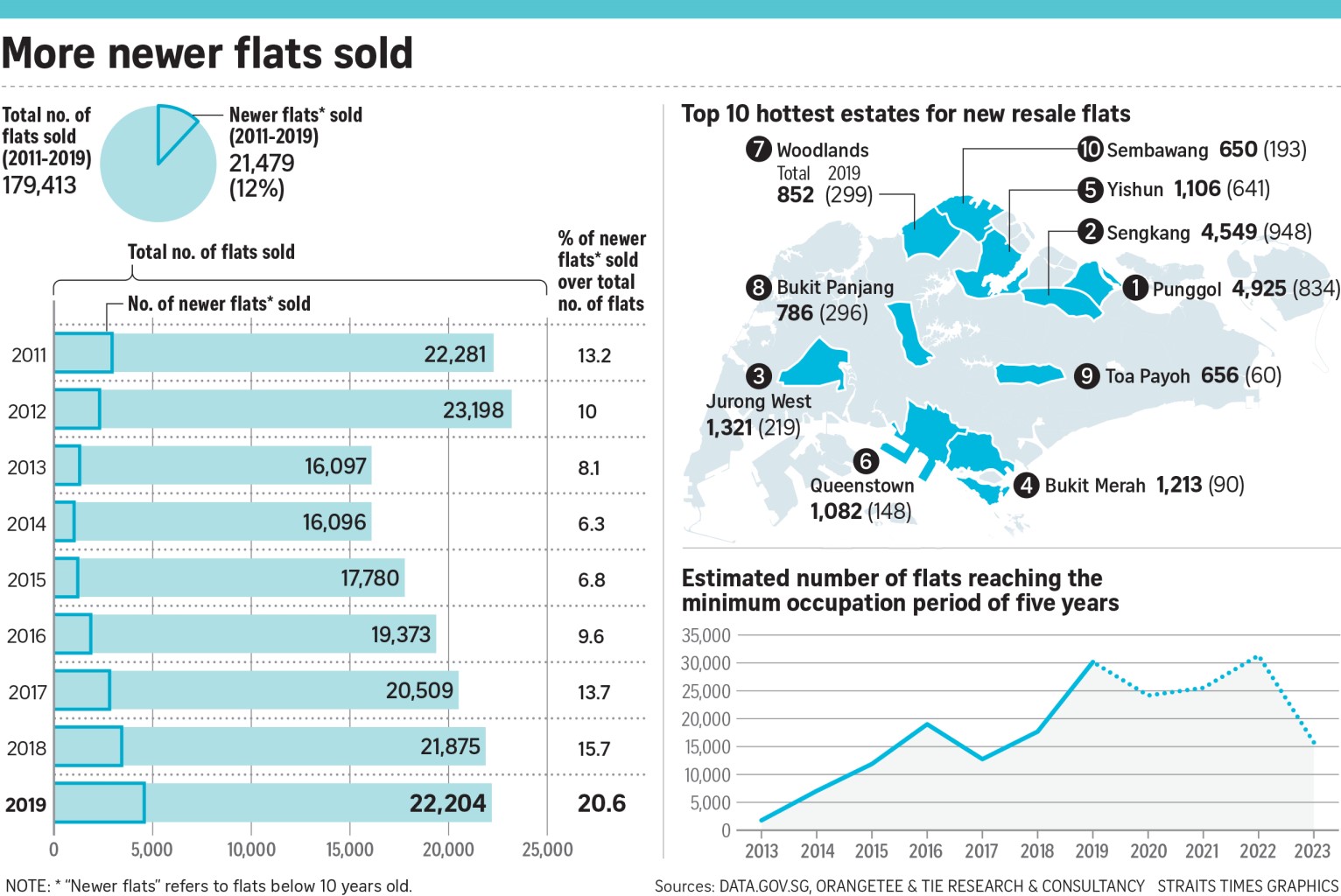

Sales of HDB flats less than 10 years old have hit a nine-year high in 2019, when 4,578 units were sold – this is 33.4 per cent higher than 2018.

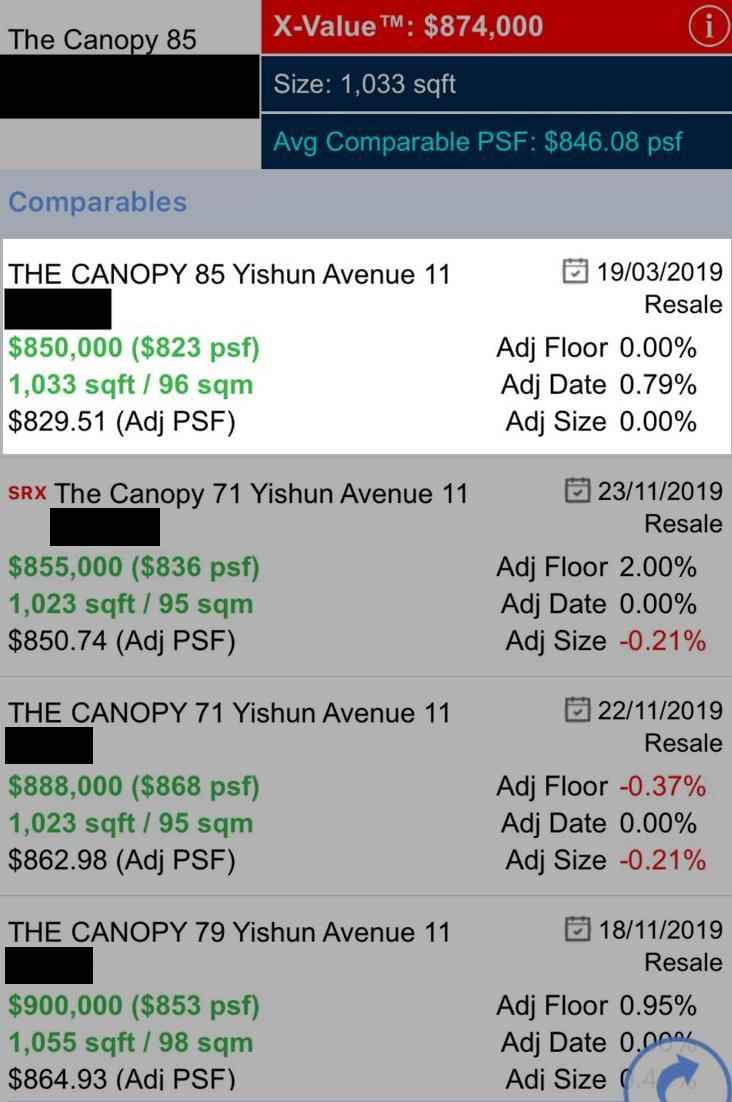

It’s a trend that I see will continue to happen as the younger generation have rising levels of affordability and lifestyle desires.

For some HDB owners, their first flat has the opportunity to provide the funds to upgrade to their next property.

And the best chance to extract those gains is by selling their flat immediately after the MOP date.

While there is a high level of awareness about the 5-year MOP – not many will take the opportunity to extract on those gains.

Those gains are achievable because you bought your BTO flat at an affordable price back then and there is high enough demand from buyers who are unwilling to wait for a new flat.

But if you were to think about it – those gains had an initial cost that you put in. You actually borrowed from your future.

If you are paying for your HDB flat via CPF, remember that you are essentially borrowing your future retirement monies at a cost of 2.5% per annum.

That CPF monies if were to be left in your OA – will earn a guaranteed 2.5% courtesy of the CPF Board.

But because it is locked into your current HDB flat – you are unable to access those funds. Now if your HDB flat is able to grow and appreciate in value – at a rate of more than 2.5% per annum – then it is worth it to borrow from your retirement funds.

If it grows at 2.5% per annum – then you just broke even. But if it is lesser than that – then you are on the start of the depreciation slope and you start slipping downwards.

At the end of the 5th year – you have the permission to release the funds locked in that flat and place it in another property that can perform better.

Still – there are people who do not take the time to check and find out if indeed their current HDB is performing up to mark and whether they should extract those gains if any.

(Do take note I have not even taken into consideration about the cost of the 2.6% HDB loan)

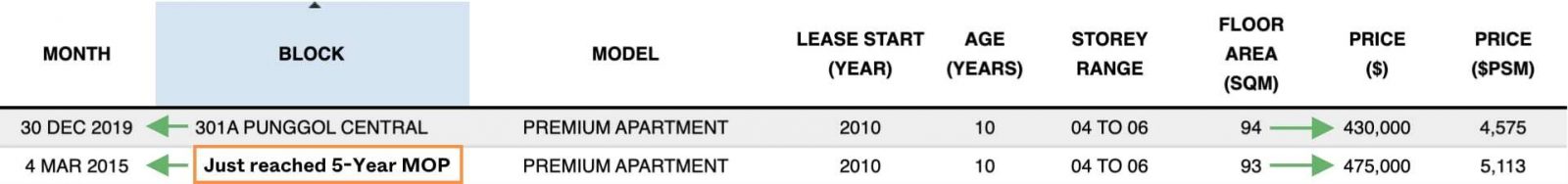

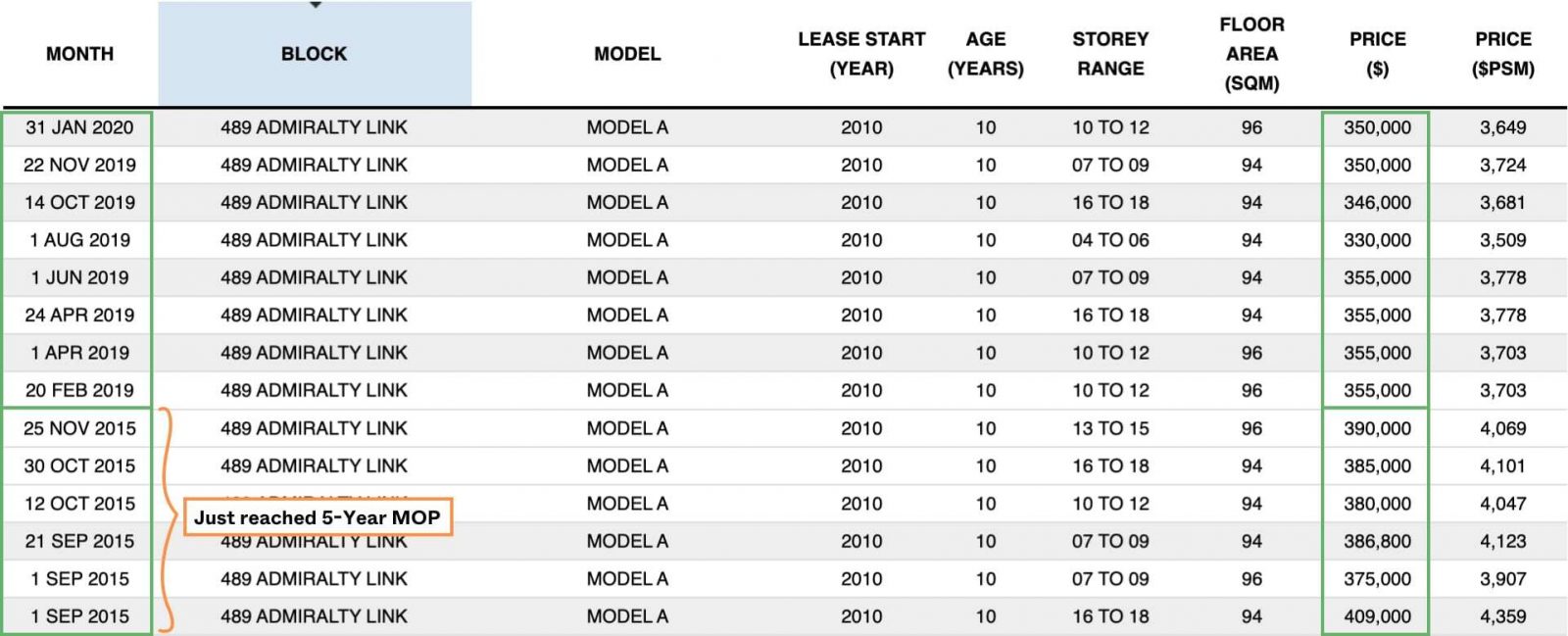

Look at this 4 room HDB unit at Compassvale Lane. It’s at the same storey range (1 to 3), one sold upon MOP, the other sold 4 years later. Of course, we could chalk this down to an isolated incident, so let’s take a look at other places to compare.

Over in neighbouring Punggol, same storey range (4 to 6), quite similar length of time apart – and it’s the same situation.

You could say the same for Sembawang, when you look at the transactions just after the 5-year MOP versus prices 4-5 years after.

Of course, that’s not to say this is a widespread matter – but it is a situation that some people will definitely be facing.

The Inevitability of Depreciation & Stagnant Prices

One of my cases I handled recently was the sale of a DBSS flat. I had earlier forewarned them about the potential MOP supply that would soften prices for their flat. Hence, we started preparing more than 6 months before their MOP, so that we could get it sold ASAP before the rest of the units came on market.

Thank God we did and we set a benchmark price in the estate. Fast forward, their unit price has corrected by 5% or $20K from a year earlier.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Why More Young Families Are Moving to Pasir Ris (Hint: It’s Not Just About the New EC)

This is actually a continuation from last week, when I mentioned Pasir Ris Northshore. While that’s one interesting part of…

As it was a HDB upgrading process, I also negotiated their purchase of a newly MOP EC at $30K before valuation, one of best priced deals since the EC obtained MOP. It took us nearly a month of negotiations back and forth but the price we closed at surprised my client who was willing to pay up to another $30K more.

In another 5 years time – that EC will be a full-fledged private property – eligible to be sold to a much larger pool of buyers. Whether they sell or not is really up to them – but that is another option that is open to them.

From 1 HDB to 3 Private Properties

So many people neglect to see the importance of owning a property that can grow with returns that can beat at least the 2.5% cost of borrowing your CPF monies.

A friend of mine related this story. She has a cousin who took the time to educate himself on property and investments. He knew the hidden gift that lay inside his very first HDB flat.

He wanted to trade up and upgrade to a private property but he wasn’t sure if he should proceed. He actually went up and asked his boss – will you be retrenching me anytime soon? The boss laughed and replied – “I might retrench others but I won’t be retrenching you soon.”

That actually gave him the confidence to proceed with his purchase. This was about 16 years ago.

He still has his job, has been promoted and moved on to work at other companies. But it was very interesting to hear such a story – my friend’s cousin understood the risks and wanted to simply get clarity before proceeding.

Granted, not everyone has the luxury of knowing whether their job is secure. This is really dependent on the nature of your job, the economy or even just the relationship with your direct superior!

Guess how he is doing now? He continued persevering upwards on the slippery slope of the mountain.

He now owns 3 properties – his wife has retired from teaching and he collects a significant rental income from 2 of those properties. His 3 children are currently in their teens.

Anything Is Possible Until It Is Not

Buying multiple properties is possible until it is not. Now ABSD has made it virtually impossible.

Properties appreciate upwards until it does not. The prices of older properties will start to stagnate eventually.

Working from home is not possible until it becomes possible. The pandemic has mandated all to work from home.

Anything is possible until it is not.

In life, it is too easy to dismiss others and stay in our own bubble. It is completely normal to stay in a comfort zone that will not damage our ego, our self-worth – any situation that will not put us at any risk mentally.

Unfortunately this also means – we just get complacent and don’t grow as a person.

So we stagnate. We become too scared to do it but we don’t realise it – until years later. And we see all the regrets that you had and the opportunities we should have taken.

Weighing the Risks and Rewards

Many people are motivated to feel secure and there are certainly plenty of things that may make us feel secure.

But feeling secure and being secure are not exactly the same thing. In this increasingly insecure world, feeling secure is often an illusion.

We should weigh risk as a long-term measure. If you were to ask me – there is a real risk of the chance that

(1) you won’t achieve your financial goals and the dreams associated with those goals and

(2) that you won’t be able to support yourself (and your loved ones) comfortably later in life…

if you do not take the time to do a financial check and where you stand currently in your property portfolio.

For investing success – it really depends on the quality of our decisions. We mentally put money in categories or accounts in order to simplify problems.

But simplify too much and it becomes a problem!

In investing, common categories, or mental accounts, that we create for ourselves include ‘money I can’t afford to lose’ versus ‘money I can afford to lose’ and ‘my money’ versus ‘the market’s money’.

But successful investors take ownership equally of all the money that they put in ALL investments, including unrealised profits.

Keen to check your financial blindspots?

Weigh the risks and make a decision based on the context of my 14 years of experience.

Drop me a message via this form so we can arrange for a no-obligation discussion on your needs.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Stuart

Stuart is a partner at Stacked and a co-founder of Navis Living Group where he leads and mentors more than 1800 agents in their training, growth and development as leaders and property wealth planners. Professionally, he is known for his interest and ability to connect with people and coaching both his agents and investors on obtaining better results in their lives and investments. Privately, he enjoys quiet time by himself, playing the guitar and acting all childish around his wife and 2 kids.Need help with a property decision?

Speak to our team →Read next from Homeowner Stories

Homeowner Stories We Could Walk Away With $460,000 In Cash From Our EC. Here’s Why We Didn’t Upgrade.

Homeowner Stories What I Only Learned After My First Year Of Homeownership In Singapore

Homeowner Stories I Gave My Parents My Condo and Moved Into Their HDB — Here’s Why It Made Sense.

Homeowner Stories “I Thought I Could Wait for a Better New Launch Condo” How One Buyer’s Fear Ended Up Costing Him $358K

Latest Posts

Singapore Property News Two New Prime Land Sites Could Add 485 Homes — But One Could Be Especially Interesting For Buyers

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

0 Comments