Slowest Growth Of Property Prices In Nearly 2 Years: What You Need To Know

April 25, 2022

The numbers are in for Singapore’s property market in Q1 2022 – and while prices are up as expected, there’s seemingly a glimmer of hope for struggling first-time buyers as the rise in prices have been tampered, and transaction volumes are down. Does this mean you should wait to see what happens, or bite the bullet to purchase now? Here’s what you need to know:

Table Of Contents

- The private home market slowed its momentum in Q1

- Resale flat transactions also showed signs of a slowdown

- Overall, transaction volumes may continue to slide in the near term

- 1. The US aggressively raising interest rates

- 2. Uncertainty over the Russia – Ukraine conflict

- 3. Price resistance starting to set in

- Overall though, it’s still not clear cut that prices will be falling so soon

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

The private home market slowed its momentum in Q1

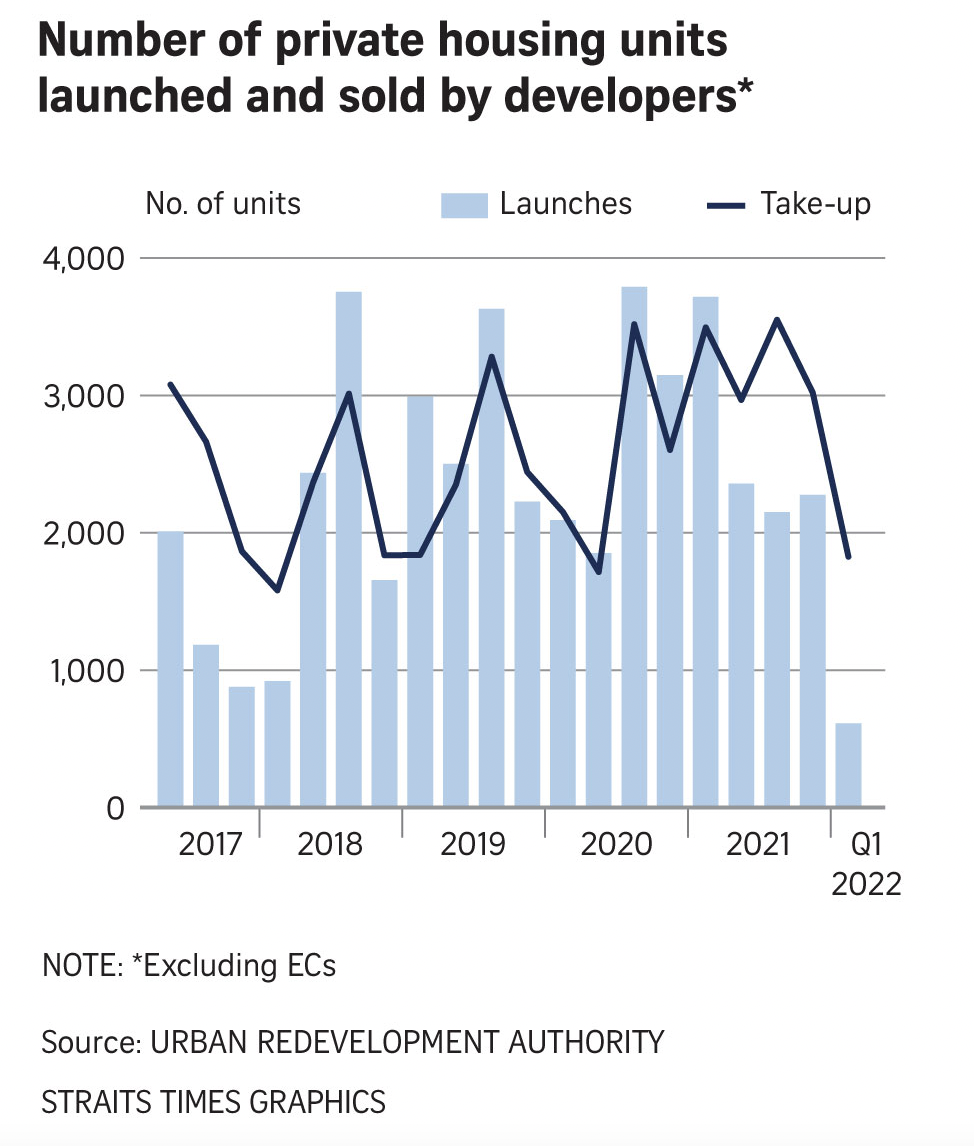

There were only 1,825 new condo transactions in Q1 2022 (excluding ECs), down from 3,018 transactions in Q4 last year. For resale condos, ERA calculated between 2,660 to 2,750 transactions, estimated to be over 40 per cent lower than the last quarter.

Overall, private non-landed home prices barely rose by 0.4 per cent for Q1 – a significant fall from the last quarter of 2021, which saw a rise of around five per cent.

Realtors and analysts said this was not completely unexpected, as new cooling measures were passed in December last year. In particular, a higher Additional Buyers Stamp Duty (ABSD) of 30 per cent for foreigners may have made properties less attractive, to affluent overseas investors.

Also learning from past rounds of cooling measures, realtors said a knee-jerk reaction is common, with many buyers taking a wait-and-see approach right after the measures take place. No one wants to feel like a fool, by buying and then seeing prices fall just months or even weeks later.

However, realtors also noted that – while demand seems to be tapering – diminishing supply may still keep prices propped up. We were told that the number of unsold homes in Q1 stood at just over 14,000 units, the lowest supply in around five years. It’s possible that, despite recent cooling measures, the dwindling housing supply may work to support existing prices (as opposed to the situation with HDB flats below).

In addition, it’s estimated that the number of new units launched in Q1 2022 was less than 1,000. This is much lower than Q1 last year, when there were over 3,700 new units launched.

That said, do note that Q1 is usually a quiet time for new launches. This is due to the Chinese New Year period, which often sees a lull in sales; developers tend to time launches to avoid this. 2022 has definitely been a slow start, as compared to 2021, as Jan 2021 started with a bang with the launch of mega-developments like Normanton Park, and smaller ones such as The Reef at King’s Dock. That said, with the launch of North Gaia, Piccadilly Grand, and Liv @ MB taking place, it may still help to sustain the numbers going into Q2.

New Launch Condo ReviewsThe Reef At King’s Dock Review: Singapore’s First Condo With A Floating Deck

by Matthew KwanResale flat transactions also showed signs of a slowdown

There were 6,934 resale flat transactions in Q1 this year, down about 12.7 per cent from Q4. Year-on-year, transaction volumes are down 8.5 per cent.

Unfortunately for first-time buyers, prices have continued to climb, ending up 2.4 per cent for Q1. But you can take some consolation from the fact that this is the lowest quarterly growth we’ve seen since around 2020.

This may be due to the growing awareness of resale flat supply. Over 31,000 flats are expected to reach their Minimum Occupancy Period (MOP) by end 2022; and buyers may be waiting for the surge to lower prices, while also providing more options.

This is, in effect, the opposite of what we’re seeing in the private housing market. While the supply of condos is starting to dwindle, we’re expecting a deluge of resale flats across the coming year.

We’ve also heard opinions that ramped up production of new flats (a 35 per increase for 2022 and 2023) could have soaked up some of the demand. This opinion is not universally shared.

Some realtors have pointed out that a significant demographic of buyers – such as those who need an immediate place due to Work From Home arrangements – still have to buy resale, regardless of how many new flats are built. From this perspective, the ramped-up supply of BTO flats can only take effect many years down the road; after their construction and MOP is also up.

Overall, transaction volumes may continue to slide in the near term

New launch condos, later in the year, may raise transaction volumes briefly; but in general, a number of factors are in place to make buyers more cautious. Besides the new cooling measures above, buyers also face the following:

- The US aggressively raising interest rates

- Uncertainty over the Russia – Ukraine conflict

- Price resistance starting to set in

1. The US aggressively raising interest rates

The United States Federal Reserve is pushing for interest rate hikes, which will have a knock-on effect on Singapore home loans.

Private home buyers, and those who use bank loans for their flats, have grown used to seeing low rates for over a decade. Since about 2009, home loan interest rates have stayed below two per cent, below the HDB loan rate of 2.6 per cent. Now, however, mortgage rates are likely to go up by at least 0.75 per cent, or more if the Fed deems it necessary to lower inflation.

The threat of higher interest rates may deter some HDB upgraders, some of whom are already unused to the idea of variable rates. For investors, a higher interest rate, coupled with higher stamp duties, could make other financial alternatives seem preferable (e.g., bond markets).

Rising rates also eat into rental yields and cash-on-cash returns, and investors may not feel sufficiently rewarded for the risk right now.

Although, it must be said, this could also mean genuine homebuyers plunging in right now before interest rates rise yet again.

2. Uncertainty over the Russia – Ukraine conflict

We found sharply divided opinions on how the ongoing conflict will impact the Singapore property market.

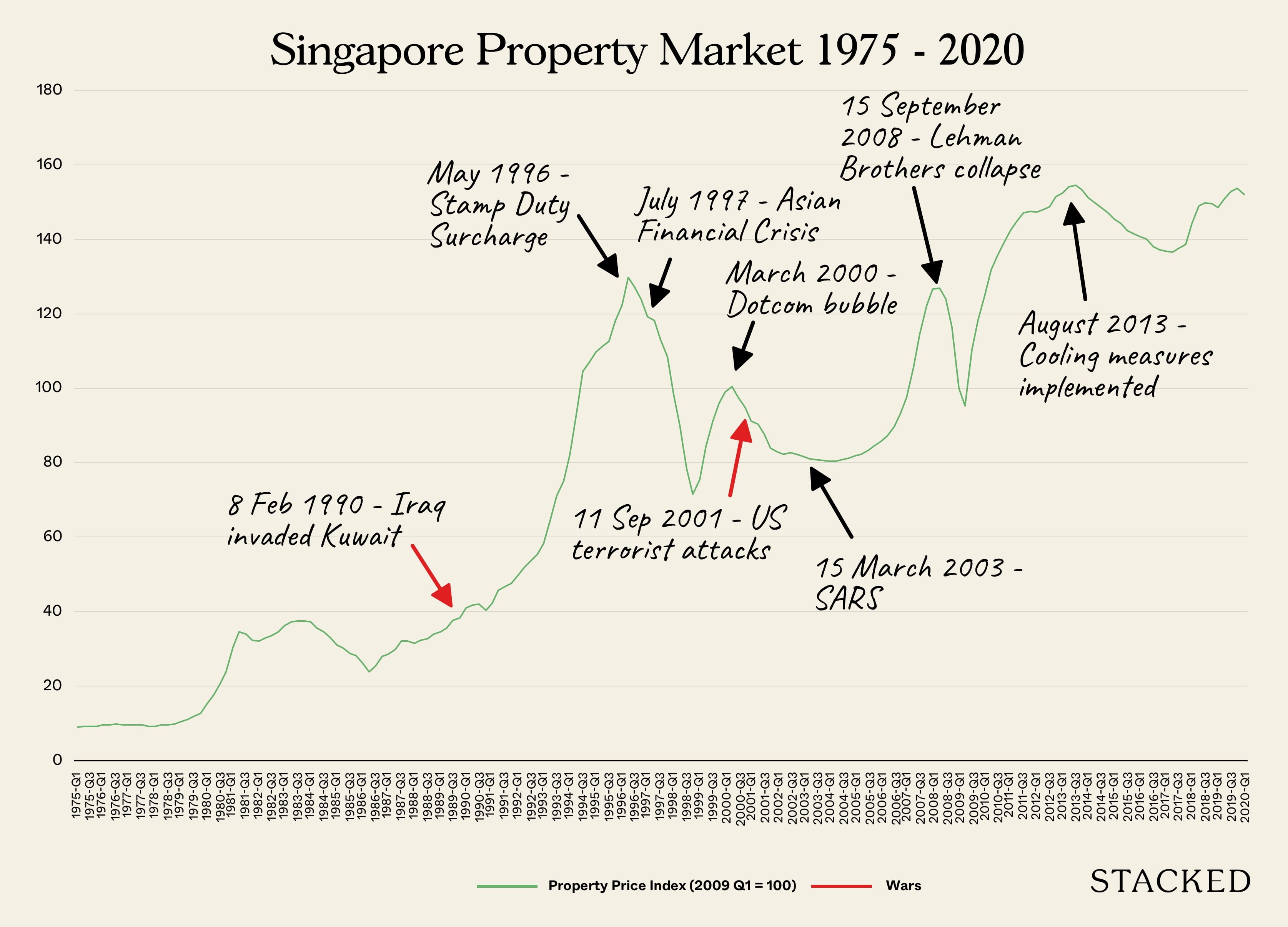

Some realtors and analysts look to previous downturns, such as Covid and the last Global Financial Crisis, when Singapore real estate saw an upturn. This was due to Singapore properties being seen as safe haven assets. They feel a repeat performance is likely, as conventional equity markets turn volatile.

On the other hand, there’s also an opinion that buyers will turn cautious. As jobs are affected and costs rise, buyers may rethink their commitment to a mortgage at this time.

It’s also plausible that buyers may opt for resale flats rather than condos, in these unpredictable times; that could shift demand toward the HDB market.

3. Price resistance starting to set in

Both HDB and private home prices are at record highs. As of Q1, average HDB prices were at $519 psf.

However, new private home prices averaged $2,129 psf, while resale condos averaged $1,413 psf. Realtors explained that, despite the recent rise in HDB prices, private home prices are increasingly out of reach for upgraders.

Many HDB upgraders have calculated that, after refunding their CPF and discharging the flat loan, they would still be priced out of the private market (especially if they insist on a new condo).

The comfortable price for most HDB upgraders is between $1.4 million to $1.6 million; but among newer condos, this amount commonly gets you a unit that’s under 1,000 sq. ft. This is smaller than a 5-room flat, and it may not be palatable to family buyers.

Overall though, it’s still not clear cut that prices will be falling so soon

With borders opening up all over the world, Singapore axing pre-departure tests for fully vaccinated travellers arriving in Singapore, Hong Kong expats fleeing the stricter Covid-19 rules, and the low supply of unsold inventory – it could mean buyers should tamper expectations of a significant price drop in the coming months barring another black swan event.

That said, though the above are factors, it is one also counterbalanced by the higher ABSD (for both developers and buyers), as well as what the HDB upgraders can manage; even with the lower supply, it’s getting quite tough for many of the upgraders to meet the TDSR or initial down payment.

For more on the situation as it unfolds, follow us on Stacked. We’ll also provide you with in-depth reviews of new and resale condos alike, so you can make a better-informed decision.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why did property prices in Singapore slow down in Q1 2022?

Are resale flat prices in Singapore still rising despite the slowdown?

How might rising US interest rates affect Singapore property buyers?

What impact could the Russia-Ukraine conflict have on Singapore’s property market?

Is there a chance that property prices in Singapore will fall soon?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Trends

Property Trends The Room That Changed the Most in Singapore Homes: What Happened to Our Kitchens?

Property Trends Condo vs HDB: The Estates With the Smallest (and Widest) Price Gaps

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

Property Trends Should You Wait For The Property Market To Dip? Here’s What Past Price Crashes In Singapore Show

Latest Posts

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

0 Comments