Landlord And Tenants Take Note: How Singapore’s Rental Market Has Changed In 2021

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

2020 and 2021 have been some of the most unusual years in Singapore’s history. The combination of Work From Home arrangements, to the impact of the Circuit Breaker, have sent many scrambling to find their own place as soon as possible. There are also, for some foreign workers, difficulties in going home, or returning if they do; these have prompted longer leases, and alternate arrangements. Here’s a look at how the rental market has changed as of 2021:

A seeming recovery from 1H 2020

Overall, the rental market appears to be doing better, instead of worse, under the pandemic.

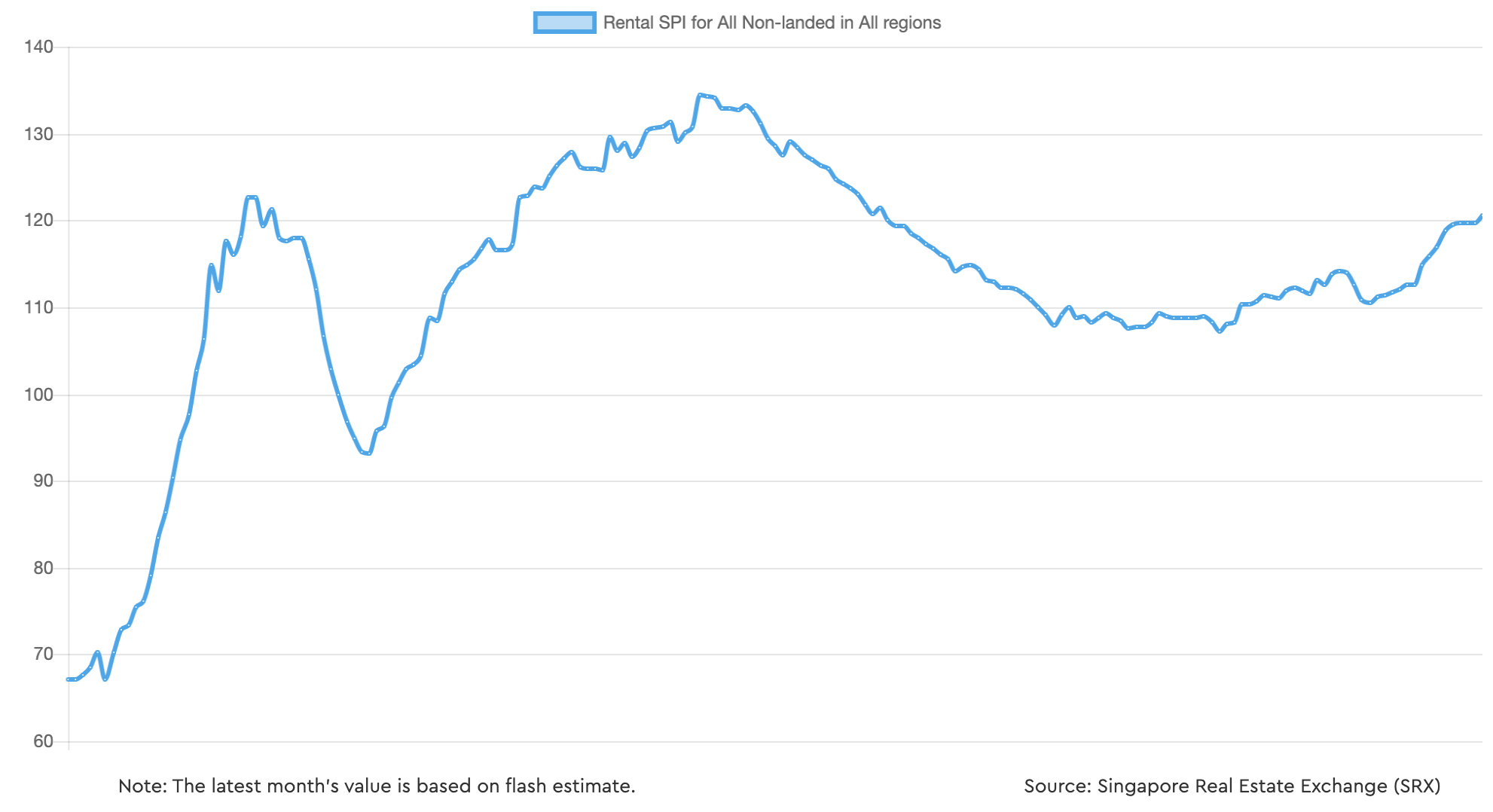

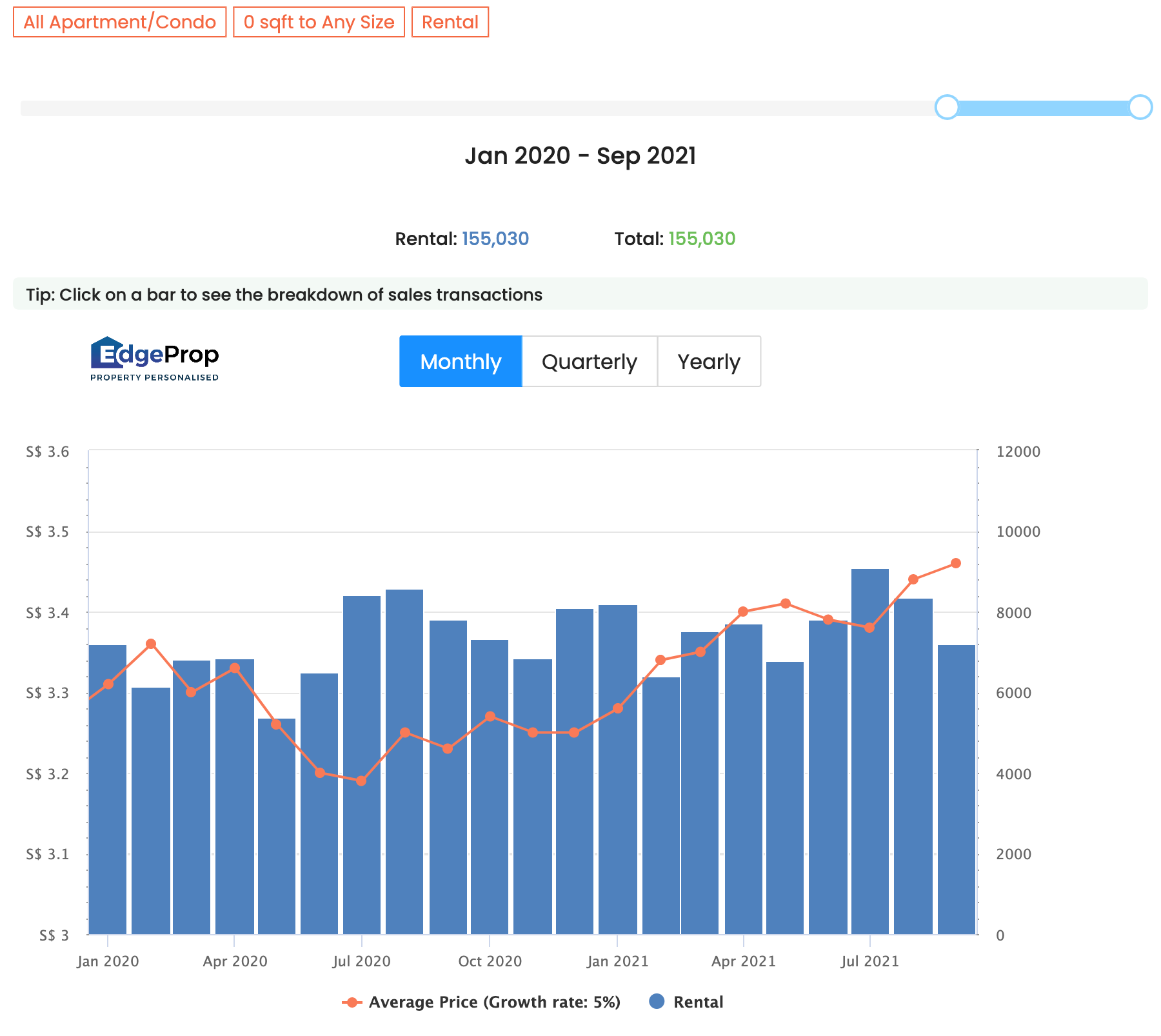

For example, flash data from SRX shows rising condo rents, as of end-September 2021. Rental rates are now up eight per cent from the same time last year. We’re still down about 10 per cent from the last rental peak (2013), but rates seem to be catching up.

HDB has also had a strong showing over Covid-19. Rental rates have risen for 15 straight months as of September, and HDB rental rates are up 8.8 per cent from the previous year. They are down by around seven per cent from the 2013 peak.

While condo leasing volumes have fallen compared to 2020, the dip is miniscule; from 4,593 to 4,454 (September 2020 to September 2021).

Meanwhile, the HDB rental market saw a pick-up in leasing volume instead, reaching 1,702 units in September this year. This is up from 1,654 units, at the same time last year.

This is good news for most landlords; events have run contrary to predictions at the start of the pandemic, when it was believed that travel and economic issues would worsen the already soft rental market.

Indeed, in the first half of 2020, we saw rental rates and volumes fall dramatically, as the pandemic took effect.

On the other hand, rising rental rates have become an issue for many Singaporeans as well as foreigners right now. Based on conversations with realtors, tenants, and landlords, we’ve put together some rental issues in 2021 to be aware of:

- Work From Home is pushing up demand for temporary accommodation

- The previous strategy of getting shorter leases may backfire

- More locals are cancelling overseas work arrangements

- More expatriates want to avoid travelling to and from home

- Rising property prices and the Home School Distance (HSD) have affected rental

- Further down the road, construction and renovation delays may keep rental demand high

1. Work From Home is pushing up demand for temporary accommodation

Many companies have shifted to indefinite Work From Home (WFH) arrangements, in light of the pandemic. For some, WFH will continue even after Covid-19, becoming their default work arrangement.

In addition, some realtors have mentioned encountering renters who lost their previous jobs, and have now turned to the digital economy; many of these have joined the remote work force.

One realtor said that:

“I notice there were a lot more enquiries for HDB rental listings, about two or three months after the Circuit Breaker last year, and so far the volume of inquiries hasn’t dropped.

Many people find Work From Home is not very conducive when parents and siblings are around, and the younger ones are having online tuition, the parents are also trying to work from home with Zoom calls, and so on.

But many of them are also too young to buy their own flat, or don’t yet have the financial means to buy their own place. So many of them have taken the plunge to move out and rent their own home.”

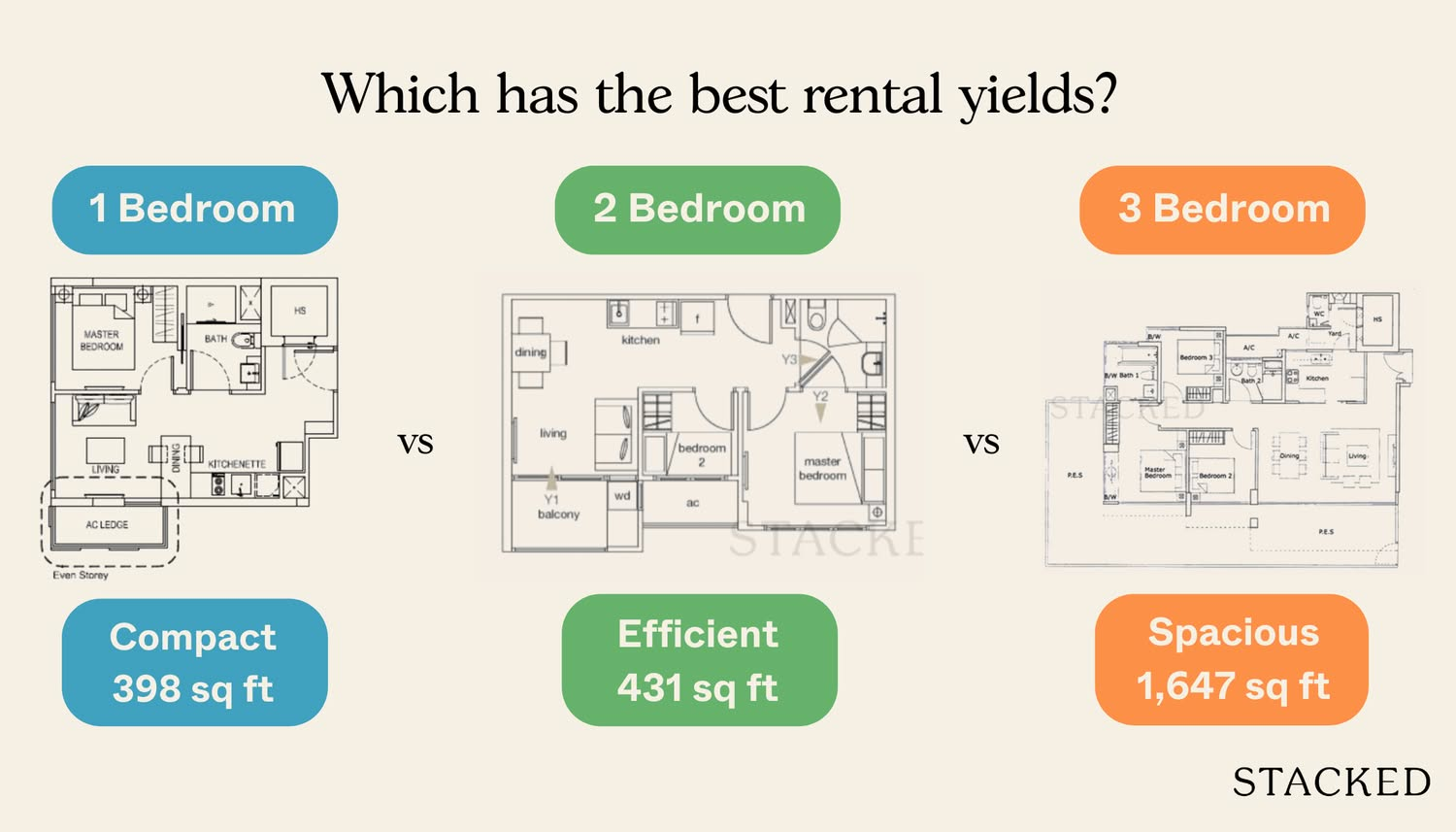

This has resulted in increased demand, even small units that are usually hard to rent out.

“Usually one-bedders in non-central areas are quite hard to rent out, but this lot are on a budget, and they’re just happy to find a place of their own. If there is a pool or such facilities, they like it even more as it’s something they don’t get back home.”

As such, tenants may find a surprising amount of competition; even for one-bedders in the OCR, and further from MRT stations.

2. The previous strategy of getting shorter leases may backfire

We enquired as to why leasing volumes of condos seem to be dipping, and if that indicates rental rates will follow.

However, many numbers said this isn’t always the case; in fact, a dip in leasing volume can reflect tenants trying to lock-in rates, before they rise further. One realtor explained that:

“When a soft rental market is expected, as was the case in early 2020, it’s common for leasing volumes to actually go up. This is because tenants expect rental rates to go down – so they will sign shorter leases, in the expectation that they can quickly move to a cheaper place nearby, or even in the same development if they’re lucky, when the rates drop.”

However, this strategy may backfire, in a rental market where rates are steadily rising. In such a situation, the landlord may push for a higher price, when it comes time to renew the lease.

As such, the dip in leasing volume may just be from tenants who previously signed three-month or six-month leases, now deciding to go for a longer term to “lock in” the rates.

Realtors also expressed the opinion that, in general, trying to capture discounts with shorter leases is a risky move. It’s better to focus on finding an affordable and convenient place, and not gamble on possibly cheaper rent later.

More from Stacked

An Overview Of The Bedok Property Market In 2024: HDB Price Trends And Key Developments

Bedok is one of the most transformed parts of Singapore, between the post-independence generation and today. This area used to…

You could end up finding no nearby alternatives when the lease expires, and be forced to move somewhere inconvenient or even more expensive.

Rental MarketHow Are Singapore Property Rental Rates Rising Despite Covid-19?

by Ryan J3. More locals are cancelling overseas work arrangements

Realtors pointed out that more Singaporeans are coming home, due to the pandemic.

Among these are locals that may not have expected to come home so abruptly, and who have yet to purchase a property locally. Many are also uncertain of their future arrangements – if they do fly back after the pandemic, for example, they may not want to be saddled with a local property.

As such, this creates a rare situation, with locals joining foreigners in the competition for good rental units.

One realtor noted that:

“Even if they decide they are going to move home permanently, buying still involves time. Renovation takes longer because of Covid, looking for houses takes longer because of viewing restrictions. And of course, if they buy new, they have to wait for construction. So, in any case, they are stuck and have to find a rental unit in the meantime.”

4. More expatriates want to avoid travelling to and from home

One example of this was the Movement Control Order (MCO), which left many Malaysian workers stuck on our side of the causeway. Forced into finding quick accommodation, many of them were denied the time to scout out better locations, or secure more reasonable rates.

However, Malaysian workers were not the only ones affected. Realtors have heard worries from many expats, about the difficulties of returning if they go back home. Mandatory Stay Home Notices (from either side of the border) can affect them; as well as increased costs (like having to pay for test kits) every time they move between countries.

As such, more expatriates are settling for longer leases, and digging in until the pandemic is over.

Realtors noted that this may be the reason why leasing volumes seem to be dropping; and that we may see this continue further into the pandemic.

5. Rising property prices and the Home School Distance (HSD) have affected rental

Home School Distance (HSD) of one-kilometre gives a child priority enrolment in a school (you can read about it in this earlier article). This does apply to rental as well – so you can indeed get priority by renting a unit close to a desired school.

According to some realtors, the desire to be near top schools – coupled with high private property prices – is driving some families to rent. As one realtor points out:

“Besides the cost of buying, some families may not want to stay in an area after the child’s schooling. For example, if your child is going to Secondary School for four years, you need to consider if you still want to be living in the area after that.

Some are also of the belief that high prices are due to a ‘Covid ripple’, coming from effects like low interest rates; and they believe it’s more sensible to buy a few years on, when prices are lower.

So they rent near their child’s school for now, and buy at a desired location later. Hopefully at lower prices.”

Realtors also noted that HSD has been revamped of late, putting more properties (on average) within the one-km mark, this could better distribute demand among available rental units.

6. Further down the road, construction and renovation delays may keep rental demand high

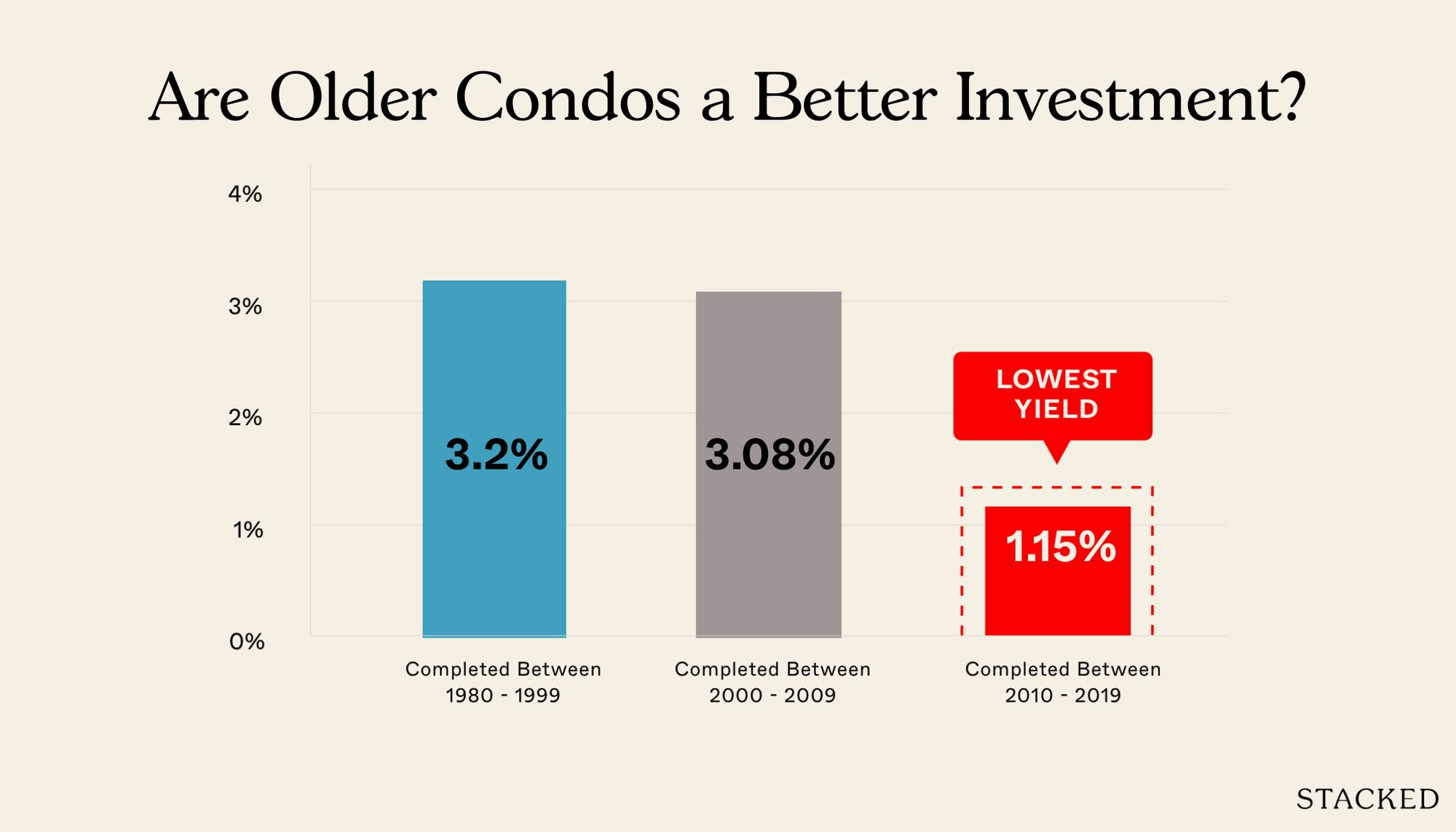

When we asked if rental rates were likely to drop, the consensus was “not in the near to mid-term”. This is due to a combination of factors right now. Some, such as higher property prices and increased demand, have been mentioned above.

However, we should also consider the manpower crunch, and disrupted supply chains that accompany Covid-19. HDB has already seen delays in flat construction, and the private property sector is subject to the same issues. There are a number of people that have sold their homes to take advantage of the strong demand and record prices, and have put those gains towards buying a new launch instead.

This leads to an unusually high number of locals seeking rental units, in a market where – up till the pandemic – it’s been almost entirely foreigners who made up the tenant demographic.

Finally, don’t forget that more HDB upgraders can mean more tenants too!

Depending on how well your property agent can time your upgrade, you might end up having to rent for a while. This is especially true if you intend to sell your flat first and buy your condo afterwards.

With over 50,000 flats reaching MOP, and HDB upgraders being the main buyer demographic, there’s a good number of Singaporeans who will end up needing an interim home.

Do reach out to us if you want to upgrade, but also don’t want to pay the rising rent. We have experts who may just find a way (no promises though!) In the meantime, you can follow us on Stacked for any potential changes to the situation, and check out reviews of new and resale properties alike.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Rental Market

Rental Market Is Singapore’s Rental Market Really Softening? We Break Down The 2024 Numbers By Unit Size

Editor's Pick The Cheapest Condos For Rent In 2024: Where To Find 1/2 Bedders For Rent From $1,700 Per Month

Rental Market Where To Find The Cheapest Landed Homes To Rent In 2024 (From $3,000 Per Month)

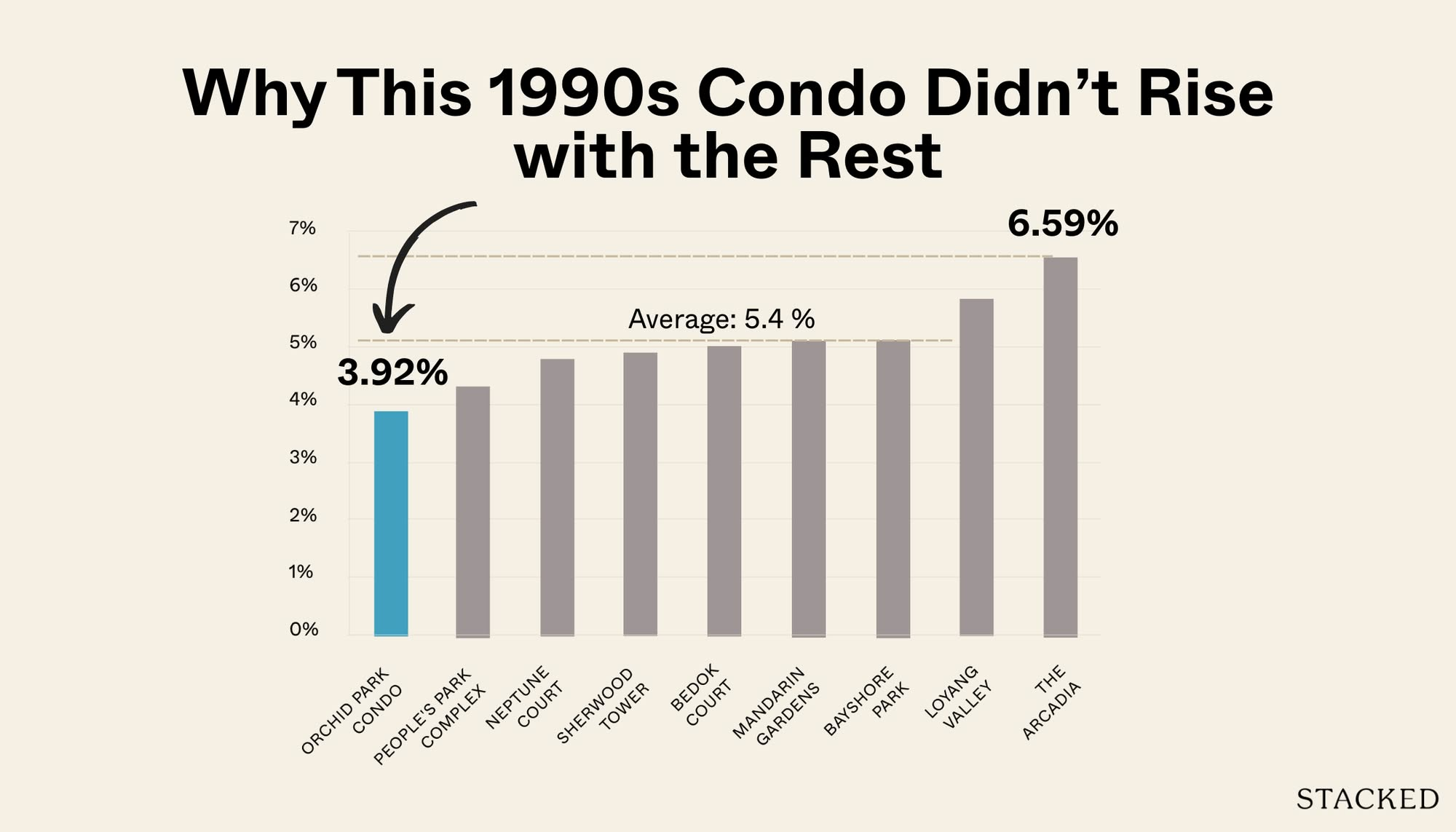

Rental Market Where To Find High Rental Yield Condos From 5.3% (In Actual Condos And Not Apartments)

Latest Posts

Overseas Property Investing I’m A Singaporean House-Hunting In Mexico City: Here’s What 2 Weeks On The Ground Taught Me

Homeowner Stories I’ve Lived In Braddell View For 14 Years: What It’s Like To Live In Singapore’s Largest Residential Site

Singapore Property News Rare Mixed-Use Site At Hougang MRT And New Sembawang EC Plot Just Launched: What You Need To Know

Property Investment Insights Why Some 30-Year-Old Leasehold Condos Are Still Outperforming New Ones

Pro How Do Old Leasehold Condos Hold Up Against Newer Projects? A Case Study Of Orchid Park

On The Market 5 Cheapest 4 Room HDB Flats In Central Singapore (From $495K)

Homeowner Stories Why These Buyers Chose Older Leasehold Condos—And Have No Regrets

Singapore Property News $1.16M For A 4-Room HDB In Clementi? Why This Integrated Development Commands Premium Prices

Editor's Pick Arina East Residences Review: First Condo Launch in Tanjong Rhu in 13 Years, Near MRT Station

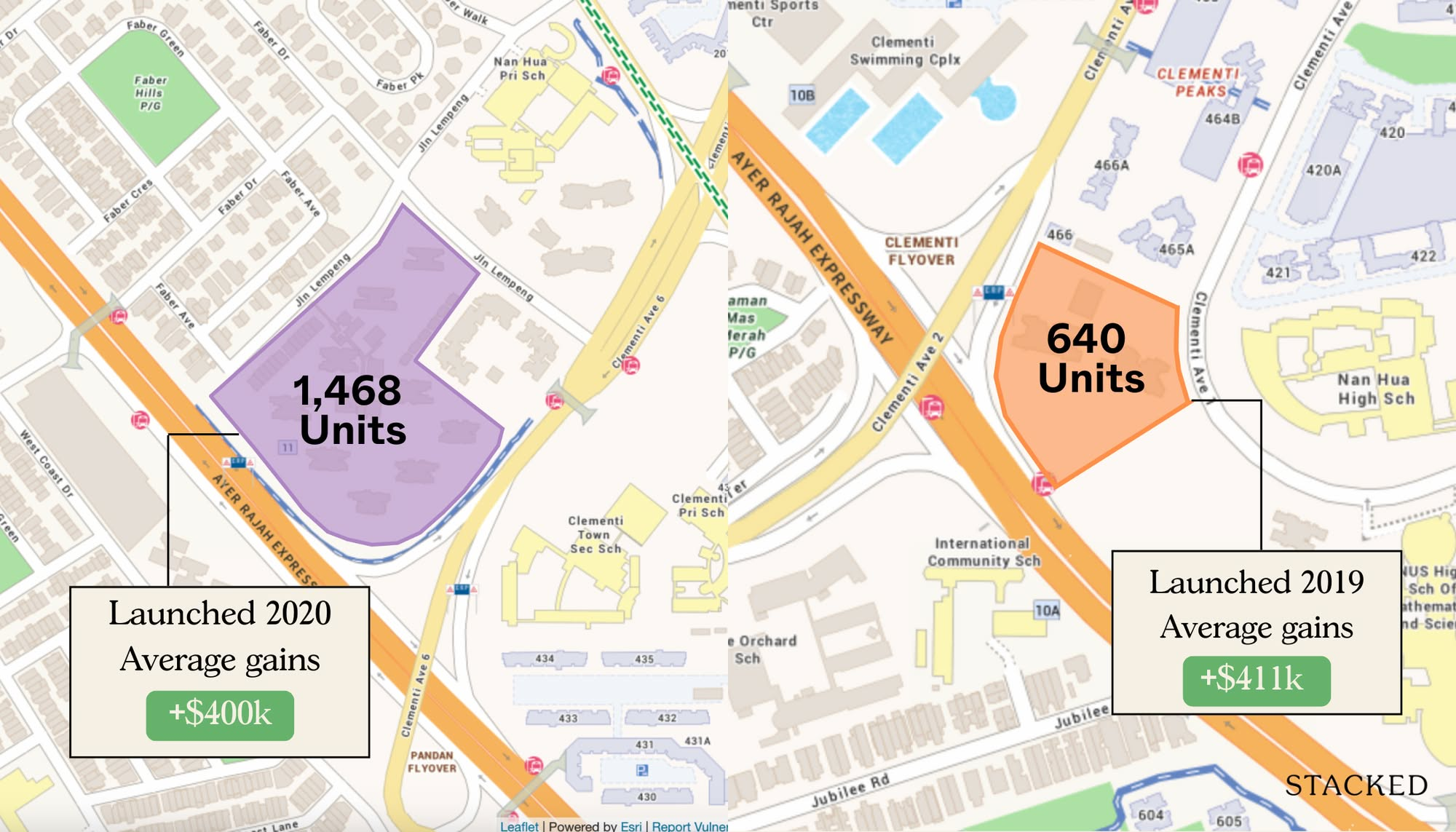

Pro Do Mega-Developments Really Outperform Regular Condos? A Parc Clematis Vs Clavon Case Study

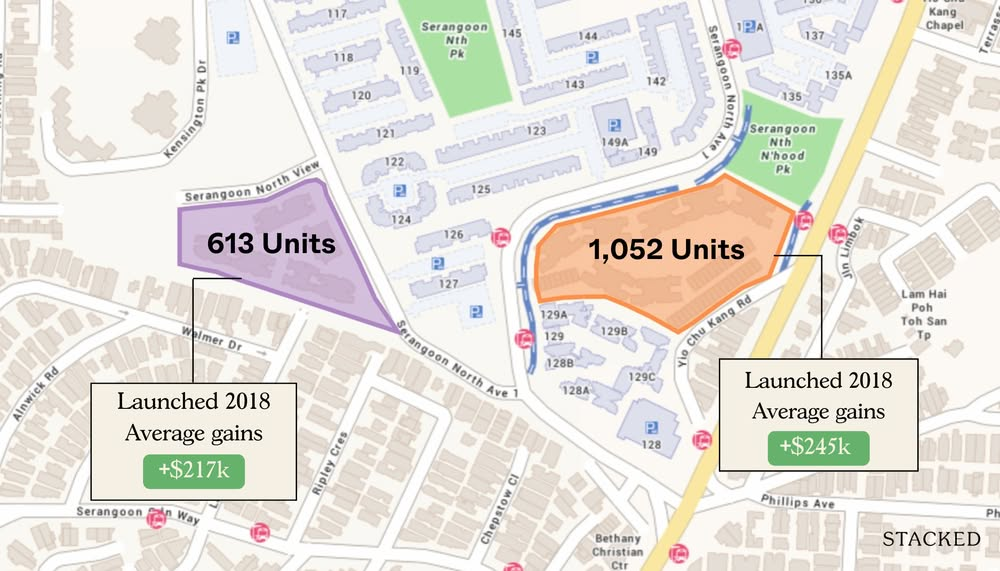

Pro Affinity at Serangoon vs The Garden Residences: Same Launch Year, Same Location — But Which Gave Better Capital Gains?

Editor's Pick 4 Potential Residential En Bloc Sites That Could Be Worth Watching In 2025

Property Market Commentary Can Singapore’s Housing Market Handle A Rapidly Ageing Population?

Editor's Pick We Tour Freehold Landed Homes Within 1km Of Tao Nan & CHIJ Katong (From $3.88M In 2021)

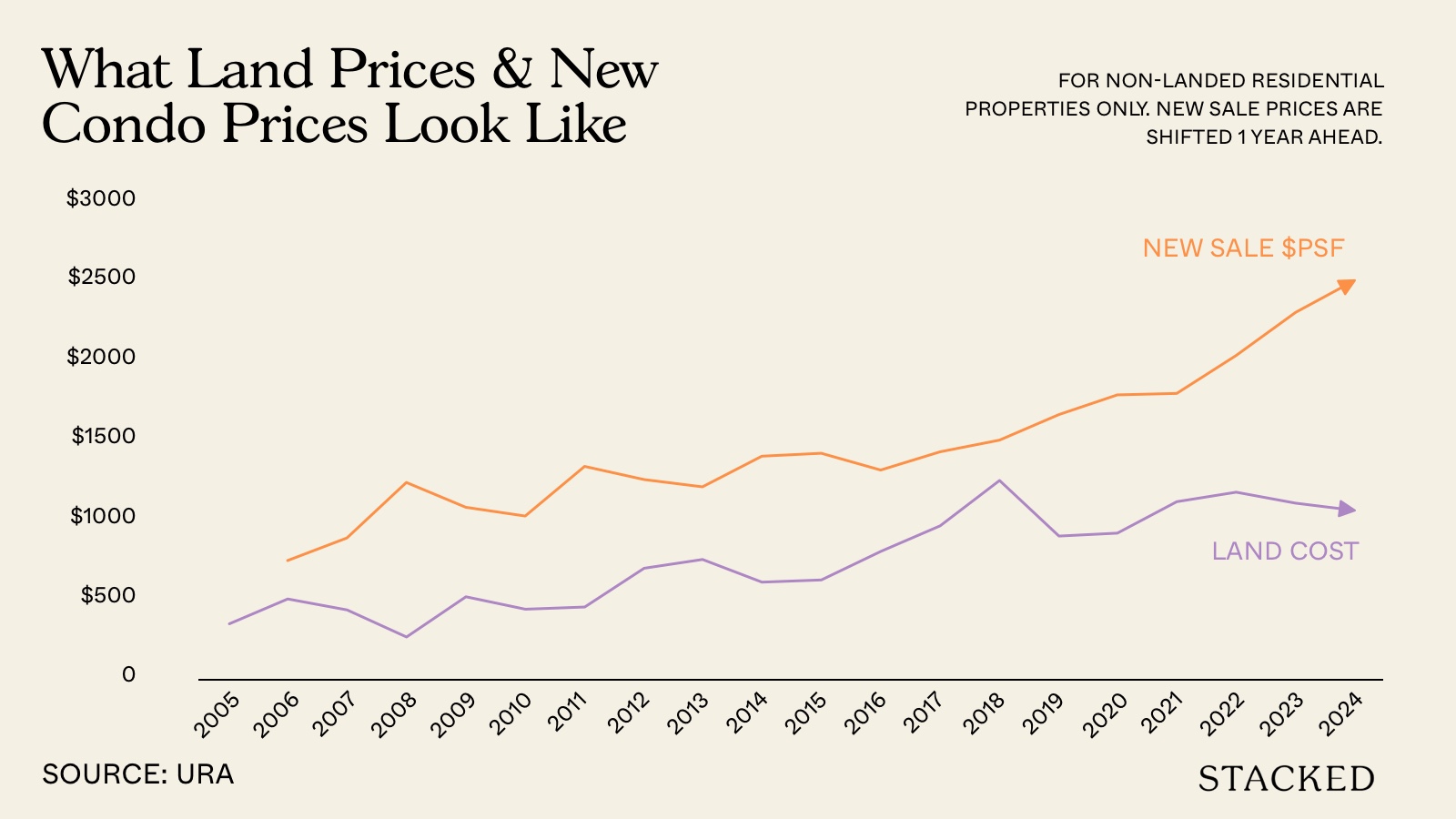

Singapore Property News Why Lower Land Prices In Singapore Don’t Mean Cheaper New Condos