Understanding SIBOR, Board Rate, And Fixed Deposit Home Loans

June 4, 2020

This is Part 5 of our 18-part first-time home buyer series. You may refer to the full table below:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

First Time Home Buyer Guide

Financing

- Approval-in-Principle: Why It’s Your First Step for a Home Loan/Mortgage

- How Much Can You Borrow For A Home Loan / Mortgage?

- How Much Income Do You Need To Get A Home Loan / Mortgage?

- How To Read Your Credit Report For Your Home Loan / Mortgage

- Understanding SIBOR, Board Rate, And Fixed Deposit Home Loans

- How You Can Compare Home Loans And Get The Best Deal

Choosing The Right Condo

- Executive Condo Versus Private Condo

- Freehold Versus Leasehold Condos

- New Versus Resale Condos

- Large Versus Small Condo Developments

Choosing The Best Condo Unit In A Development

- How To Pick The Best Stack In A Development

- Key Questions To Ask About Condo Facilities

- Key Factors To Note About A Condo’s Location

- How To Read And Compare Floor Plans

- What To Look For In Condo Shoebox Units

- When Should You Consider A Dual-Key Unit?

- Key Questions To Ask At A Showflat

- Condo Purchase Timeline

If you feel like you’ve listened to the mortgage banker for 20 minutes and understood nothing, you’ve done well. Most people find that the more they hear, the less they actually understand. Because with SIBOR, Board Rates, and Fixed Deposit loans all working differently, it’s not surprising that confusion abounds.

Here’s a simple, straightforward take on what this all means:

| SIBOR loans | Board Rate loans | Fixed Deposit-pegged loans | |

| Interest rate decided by: | The median interest rate between local banks | The bank | The interest rate of some of the bank’s fixed deposit products |

| Volatility: | Rate typically changes every one month or three months | Depends on how your bank wants to behave | Relatively low, as banks don’t change their fixed deposit rates too often |

| Biggest risk: | SIBOR rates are affected by many variables, such as the US economy | The bank can do anything it wants to the interest rate | This is ultimately still a type of board rate, the bank can still do what it likes (see below) |

SIBOR Loans

The Singapore Interbank Offered Rate (SIBOR) is the median interest rate among local banks. This rate is overseen by the Monetary Authority of Singapore (MAS), and you can check it on the Association of Banks in Singapore (ABS) website. For this reason, no individual bank can control the SIBOR rate (although they can control the spread applied to SIBOR).

A SIBOR loan is usually expressed as a time period, plus the bank’s spread. For example:

3M SIBOR + 0.3%

This would mean the bank uses the three-month SIBOR rate, and adds 0.3 per cent to it as their spread (fees). So if SIBOR is 0.7 per cent, you would have an interest rate of one per cent.

The time period in the front is the number of months before the SIBOR rate is revised to match the prevailing rate. So 1M SIBOR means your interest rate changes each month, while 3M SIBOR means it changes every quarter.

Rates of 6M SIBOR, 9M SIBOR, or even 12M SIBOR do exist, but by and large, most home loans are either 1M SIBOR or 3M SIBOR.

Banks have no say over how SIBOR moves; all they can do to raise your interest rate is to raise their spread (e.g. raise your spread from 3M SIBOR +0.3% to 3M SIBOR + 0.9%).

(Most banks will raise the spread significantly in the fourth year and thereafter of a home loan).

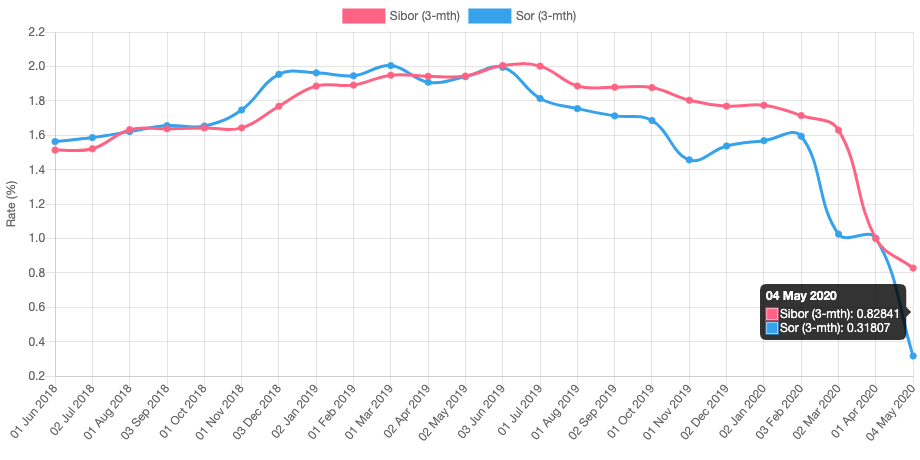

Note that, despite being pegged to the interest rates of local banks, SIBOR is still affected by wider economic factors. For example, the recent Federal Rate cut in the United States has lowered the SIBOR rates to new lows, as it did after the financial crisis in 2008.

But as the US economy recovers and their interest rate rises, so too will SIBOR.

Board Rate Loans

A Board Rate (BR) or Internal Board Rate (IBR) means the bank puts together a home loan for you, and you accept whatever terms and interest rate they charge. Usually, banks will try to make this attractive, such as by pointing out their loan rates haven’t changed in a decade, or that what they charge is cheaper than other loan packages.

Most banks will keep their promises, so as to protect their reputation. But it’s up to you to decide how much you trust them.

In practice, these types of loans are more common among affluent home buyers who have access to small private banks, or certain “prestige” tiers of private banking. The assumption is that banks will be reluctant to give anything but favourable treatment to such important clients.

Fixed-deposit Pegged Loans

These are sometimes loosely referred to as Fixed Deposits Home Rate or “FHR loans”, but note that FHR loans are unique to DBS. Other banks now have similar products with different names, but they’re erroneously called FHR due to familiarity.

This is because DBS was the first bank to introduce the concept. The bank noticed that a lot of home buyers didn’t trust BR loans, so came up with a variation – a home loan that was pegged to the bank’s fixed deposit rates.

That way, if DBS wanted to raise interest rates, it would also have to raise the payouts on fixed deposits in a particular tranche, thus creating a disincentive to raise rates quickly. This proved popular, and other banks began to do it, thus creating the fixed-deposit pegged loan.

Over time, borrowers began to realise that – although these types of loans ultimately moved in tandem with SIBOR – they tend to rise or fall in smaller increments, as banks don’t change fixed deposit rates as quickly as SIBOR fluctuates. As such, volatility can be lower than SIBOR loans.

All this being said, note that banks can still control the spread on a fixed-deposit pegged loan and raise the rate. Likewise, banks still have the power to raise fixed deposit rates if they find it’s profitable (the bank may earn far more from the interest on the loans than they have to pay out in fixed deposits). So keep in mind that, ultimately, you face some similar risks as BR loans.

Fixed-deposit pegged loans will often indicate the particular tranche of deposits they’re pegged to. For example, FHR 8 is pegged to DBS’ eight-month fixed deposit rates. The total interest rate consists of the bank’s spread, plus the interest rate on the fixed deposit.

Which of these is better?

In general, SIBOR loans tend to perform better in an environment of falling interest rates (as the rates adjust downward a lot quicker). Some home buyers also believe it’s fairer to let the market regulate their interest rate, rather than leave everything in the hands of their bank.

However, a fixed-deposit pegged loan is better for conservative home buyers, who want a less volatile loan package. While the bank can raise fixed deposits, they’re less inclined to do so than if it was a pure board rate (not only do they have to pay out more, any sharp spikes in interest rates may also draw the scrutiny of MAS).

BR loans are usually a tough call. They may look cheaper and more attractive than other offerings on the market, and sometimes they really are. But you have to trust your bank not to suddenly raise their rates.

Property Market CommentaryHDB vs. SIBOR vs. Fixed Deposit: Which Home Loan is Best Right Now?

by Ryan J. OngEven within a specific type of loan, there can be hundreds of offerings on the market

Even if you narrow your choice down to, say, SIBOR loans, there might still be 50 or 100 SIBOR loan packages on the market. You still need to compare between them to find the cheapest mortgage. Contact us on Facebook, and we can help you source for the lowest possible rate.

For more details on home ownership, check out the rest of this ultimate guide on Stacked Homes. You can also follow us for in-depth reviews on Singapore’s top properties.

This is Part 5 of our Ultimate Guide to buying your first home. If you haven’t read Part 4, you can do so at the link!

Next up: Part 6 – How to compare home loans and get the best deal

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Editor's Pick New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

0 Comments