Should You Buy The Orie? A Pricing Review Comparing Gem Residences And New Launches Today

January 6, 2025

We recently shared our review of The Orie, and now we’re diving deeper into its pricing. Here’s a detailed breakdown of the indicative prices for this new launch, along with an analysis of how it compares at its current price point.

As a recap, here’s the indicative starting price:

| Bedroom Type | Size From (Sq Ft) | Price | $PSF |

| 1 Bedroom + Study | 517 | $1,280,000 | $2,476 |

| 2 Bedroom | 592 | $1,480,000 | $2,500 |

| 3 Bedroom | 850 | $2,090,000 | $2,459 |

| 4 Bedroom | 1,216 | $2,920,000 | $2,401 |

| 5 Bedroom | 1,453 | $3,480,000 | $2,395 |

Conservatively, we could see prices climb to approximately $2,600 PSF as prices are progressively staged upward.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Hypothetical prices at $2,600 psf

If prices were to align with the $2,600 PSF average, here are the prices you might expect for each unit type:

| Bedroom Type | Size From (Sq Ft) | Price | $PSF |

| 1 Bedroom + Study | 517 | $1,344,200 | $2,600 |

| 2 Bedroom | 592 | $1,539,200 | $2,600 |

| 3 Bedroom | 850 | $2,210,000 | $2,600 |

| 4 Bedroom | 1,216 | $3,161,600 | $2,600 |

| 5 Bedroom | 1,453 | $3,777,800 | $2,600 |

It’s no longer surprising to see 3-bedroom units crossing the $2 million mark in today’s market. For example:

- At Norwood Grand, a new launch in Woodlands (OCR), the most recent 3-bedroom unit (1,011 sq ft) transacted for $2.142 million.

- Over at Chuan Park, a 3-bedroom unit (958 sq ft) sold for over $2.5 million.

Given these recent benchmarks, an estimated $PSF of $2,600 for The Orie appears in line with today’s market.

Context Matters

However, pricing doesn’t exist in a vacuum. The Orie is located in Toa Payoh, an estate primarily made up of HDBs. This could mean that buyers here are more price-sensitive, as HDB upgraders are likely to form the core audience.

To provide further context, let’s examine the land cost behind The Orie. Here’s a comparison of residential sites purchased in 2023/24:

| Location | Planning Area | Successful Tender Price | $PSF |

| Lorong 1 Toa Payoh | Toa Payoh | $968,000,000 | $1,360 |

| River Valley Green (Parcel A) | River Valley | $463,999,999 | $1,325 |

| Zion Road (Parcel B) | Bukit Merah | $730,088,888 | $1,304 |

| Holland Drive | Queenstown | $805,390,000 | $1,285 |

| Clementi Avenue 1 | Clementi | $633,447,945 | $1,250 |

| Pine Grove (Parcel B) | Bukit Timah | $692,388,000 | $1,223 |

| Margaret Drive | Queenstown | $497,000,000 | $1,154 |

| Jalan Tembusu | Marine Parade | $828,800,000 | $1,069 |

| Lentor Central | Ang Mo Kio | $435,166,426 | $982 |

| Upper Thomson Road (Parcel B) | Yishun | $779,555,000 | $905 |

| Champions Way | Woodlands | $294,889,000 | $904 |

| Faber Walk | Clementi | $349,857,988 | $900 |

| De Souza Avenue | Bukit Timah | $278,900,000 | $841 |

| Canberra Crescent | Sembawang | $279,000,800 | $793 |

The land for Lorong 1 Toa Payoh (The Orie) was acquired by the developers at $1,360 PSF, making it the most expensive site purchase among residential plots in 2023/24.

Notably, this price surpasses even prime locations such as River Valley, Zion Road, and Holland Drive, underscoring the premium placed on this site.

| Ranking | Name of Tenderer | Tendered Sale Price | Tendered Sale Price in $PSF |

| 1 | CDL Constellation Pte. Ltd., Frasers Property Phoenix Pte. Ltd. and Sekisui House, Ltd. | $968,000,000 | $1,360 |

| 2 | Tanglin Land Pte. Ltd. | $819,999,999 | $1,152 |

| 3 | GuocoLand (Singapore) Pte. Ltd., Intrepid Investments Pte. Ltd., Garden Estates (Pte.) Limited and TID Residential Pte. Ltd. | $775,781,823 | $1,090 |

The second-highest bid, submitted by Tanglin Land, was $1,152 PSF. If successful, this would have placed the land price somewhere between the Margaret Drive and Jalan Tembusu plots, which seems more aligned with market expectations.

However, the winning bid surpassing prices for plots in Bukit Merah and River Valley is a bold one. This raises questions about whether the resulting price point will resonate with HDB upgraders, who form a significant portion of buyers in Toa Payoh.

Let’s delve into a couple of key considerations:

Supply of private property in Toa Payoh is low

Similar to the recent new launch, Chuan Park, there are only a limited number of resale condos in the area. Among them, Gem Residences stands out as the only truly comparable development. The next youngest project is Trevista, followed by two significantly older condominiums.

| Project Name | Tenure | Completion | No of units |

| THE ORIE | 99 yrs | 2029 | 777 |

| Gem Residences | 99 yrs from 2015 | 2019 | 578 |

| TREVISTA | 99 yrs from 2008 | 2011 | 590 |

| TRELLIS TOWERS | Freehold | 2000 | 384 |

| OLEANDER TOWERS | 99 yrs from 1995 | 1998 | 318 |

Breakdown by bedroom type:

| Project Name | 1BR | 2BR | 3BR | 4BR | 5BR | PH | % 1 or 2 Bedders |

| THE ORIE | 78 | 310 | 195 | 117 | 77 | 49.9% | |

| GEM RESIDENCES | 109 | 221 | 172 | 37 | 37 | 2 | 57.1% |

| TREVISTA | 44 | 136 | 298 | 112 | 30.5% | ||

| TRELLIS TOWERS | 38 | 48 | 196 | 98 | 4 | 22.4% | |

| OLEANDER TOWERS | 88 | 168 | 60 | 2 | 27.7% | ||

| Total | 269 | 803 | 1,029 | 424 | 114 | 8 |

Excluding The Orie, there are just 4,517 private units in Toa Payoh.

| Project Name | 2021 | 2022 | 2023 | 2024 | Total | Average | % To Units |

| Gem Residences | 39 | 44 | 38 | 31 | 152 | 38 | 6.57% |

| OLEANDER TOWERS | 16 | 12 | 9 | 6 | 43 | 11 | 3.38% |

| TRELLIS TOWERS | 7 | 6 | 5 | 7 | 25 | 6 | 1.63% |

| TREVISTA | 37 | 32 | 20 | 32 | 121 | 30 | 5.13% |

| Total | 99 | 94 | 72 | 76 | 341 |

Over the past three years, only 341 units were sold in Toa Payoh, averaging just 114 units per year. For those looking to upgrade to private property or move within the area, this represents a relatively modest number, likely constrained by the limited supply.

Notably, the newer developments, Gem Residences and Trevista, account for a higher percentage of these sales, reflecting their appeal compared to older options in the area.

Here’s an overview of the HDB supply across Singapore, based on the total number of flats sold. Note that this data excludes HDB flats rented out directly by HDB.

| Town | 3 Room Flats Sold | 4 Room Flats Sold | 5 Room Flats Sold | Executive Flats Sold | Total Units |

| Tampines | 14,814 | 35,678 | 21,798 | 5,749 | 78,039 |

| Jurong West | 12,061 | 30,192 | 22,492 | 6,507 | 71,252 |

| Sengkang | 4,800 | 33,596 | 25,710 | 4,463 | 68,569 |

| Woodlands | 7,294 | 30,388 | 21,125 | 6,191 | 64,998 |

| Yishun | 16,288 | 32,639 | 11,194 | 2,567 | 62,688 |

| Bedok | 23,000 | 21,971 | 10,773 | 2,718 | 58,462 |

| Hougang | 10,944 | 27,306 | 11,210 | 4,311 | 53,771 |

| Punggol | 6,255 | 26,334 | 18,491 | 1,126 | 52,206 |

| Choa Chu Kang | 2,664 | 23,993 | 15,952 | 4,762 | 47,371 |

| Ang Mo Kio | 24,440 | 14,703 | 6,150 | 503 | 45,796 |

| Bukit Merah | 15,782 | 17,192 | 9,622 | 47 | 42,643 |

| Bukit Batok | 11,985 | 18,823 | 7,964 | 2,734 | 41,506 |

| Toa Payoh | 16,958 | 14,375 | 6,788 | 854 | 38,975 |

| Bukit Panjang | 3,867 | 17,224 | 10,628 | 3,381 | 35,100 |

| Kallang/Whampoa | 14,234 | 12,800 | 5,478 | 505 | 33,017 |

| Geylang | 12,092 | 12,525 | 3,626 | 832 | 29,075 |

| Pasir Ris | 490 | 11,641 | 9,379 | 7,460 | 28,970 |

| Queenstown | 13,646 | 10,431 | 4,338 | 356 | 28,771 |

| Clementi | 12,747 | 10,755 | 4,256 | 625 | 28,383 |

| Sembawang | 1,705 | 12,250 | 9,056 | 2,871 | 25,882 |

| Jurong East | 7,039 | 8,188 | 5,925 | 1,871 | 23,023 |

| Serangoon | 4,526 | 10,231 | 3,760 | 2,365 | 20,882 |

| Bishan | 2,352 | 9,359 | 5,716 | 1,567 | 18,994 |

| Central Area | 4,205 | 3,424 | 904 | 6 | 8,539 |

| Marine Parade | 3,026 | 1,798 | 1,682 | 0 | 6,506 |

| Tengah | 346 | 1,337 | 1,060 | 0 | 2,743 |

| Bukit Timah | 439 | 920 | 683 | 380 | 2,422 |

| Total | 247,999 | 450,073 | 255,760 | 64,751 |

While Toa Payoh is often perceived as an HDB town, it doesn’t rank among the largest estates like Tampines or Jurong due to its smaller size. The estate comprises 2,647 private condo units (including The Orie) and nearly 39,000 HDB units, meaning private condos make up only around 6% of the housing stock – significantly lower than the national HDB-to-condo ratio of approximately 80%/15%.

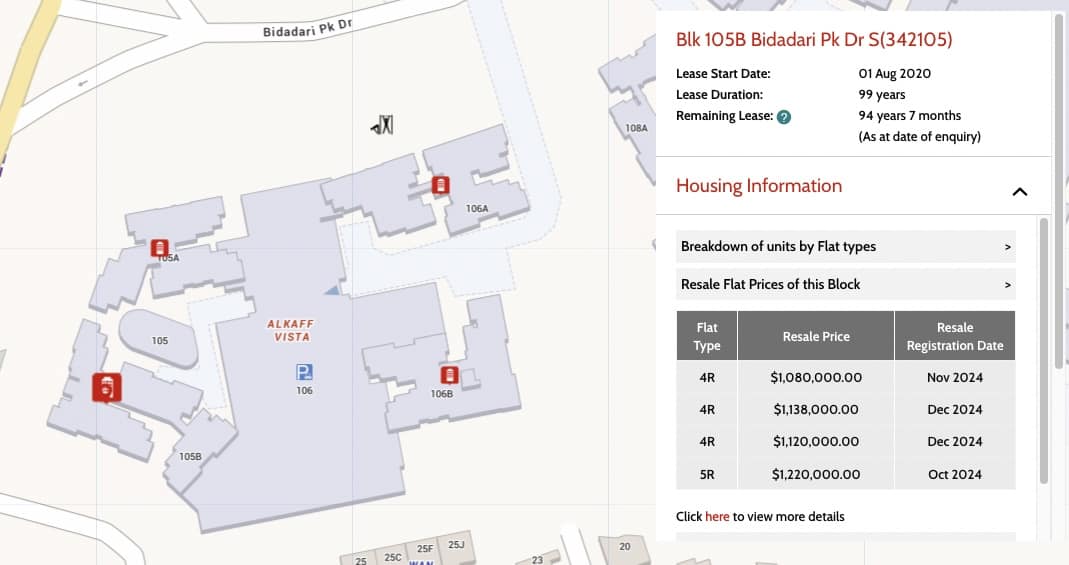

However, the recent Bidadari precinct presents an opportunity for future HDB upgraders, as many homeowners there are likely to profit from their BTO flats in the coming years. In total, 5,950 HDB units in Toa Payoh have leases starting from 2019, making up roughly 15% of the estate’s total HDB stock.

If 15% of these households choose to upgrade, we’re looking at approximately 893 potential upgraders. For those seeking newer private developments, the available options are limited to The Orie, Gem Residences, and possibly Trevista – though Trevista’s pricing tends to be on the higher side.

This presents a promising prospect. While Toa Payoh isn’t a massive estate, having a significant proportion of newer HDB flats reaching their Minimum Occupation Period (MOP) in the next few years is a positive indicator for the private property market.

Additionally, we can analyse the proportion of HDB upgraders across different parts of Singapore by examining purchaser address data based on planning areas:

| Planning Area | HDB | Unknown | Private | Grand Total | HDB Upgrader |

| Sengkang | 236 | 200 | 436 | 54.10% | |

| Sembawang | 30 | 26 | 56 | 53.60% | |

| Yishun | 139 | 129 | 268 | 51.90% | |

| Choa Chu Kang | 61 | 60 | 121 | 50.40% | |

| Mandai | 8 | 8 | 16 | 50.00% | |

| Punggol | 76 | 82 | 158 | 48.10% | |

| Hougang | 361 | 3 | 417 | 781 | 46.20% |

| Tampines | 285 | 353 | 638 | 44.70% | |

| Toa Payoh | 186 | 6 | 254 | 446 | 41.70% |

| Jurong West | 66 | 100 | 166 | 39.80% | |

| Pasir Ris | 302 | 73 | 418 | 793 | 38.10% |

| Clementi | 219 | 3 | 395 | 617 | 35.50% |

| Jurong East | 107 | 114 | 109 | 330 | 32.40% |

| Bukit Panjang | 159 | 85 | 249 | 493 | 32.30% |

| Kallang | 175 | 21 | 349 | 545 | 32.10% |

| Bukit Batok | 209 | 108 | 350 | 667 | 31.30% |

| Bishan | 94 | 222 | 316 | 29.70% | |

| Bukit Merah | 157 | 1 | 378 | 536 | 29.30% |

| Ang Mo Kio | 363 | 340 | 546 | 1249 | 29.10% |

| Geylang | 296 | 177 | 550 | 1023 | 28.90% |

| Woodlands | 115 | 175 | 108 | 398 | 28.90% |

| Queenstown | 168 | 38 | 380 | 586 | 28.70% |

| Bedok | 334 | 45 | 801 | 1180 | 28.30% |

| Novena | 132 | 8 | 336 | 476 | 27.70% |

| Outram | 28 | 11 | 65 | 104 | 26.90% |

| Downtown Core | 84 | 41 | 267 | 392 | 21.40% |

| Museum | 6 | 25 | 31 | 19.40% | |

| Serangoon | 237 | 609 | 384 | 1230 | 19.30% |

| Rochor | 26 | 61 | 74 | 161 | 16.10% |

| Bukit Timah | 209 | 544 | 668 | 1421 | 14.70% |

| River Valley | 40 | 10 | 225 | 275 | 14.50% |

| Newton | 33 | 16 | 180 | 229 | 14.40% |

| Singapore River | 29 | 100 | 79 | 208 | 13.90% |

| Tanglin | 46 | 23 | 327 | 396 | 11.60% |

| Orchard | 21 | 176 | 197 | 10.70% | |

| Southern Islands | 12 | 114 | 126 | 9.50% | |

| Marine Parade | 130 | 1047 | 492 | 1669 | 7.80% |

According to the data, approximately 41% of condo transactions in Toa Payoh were made by buyers with an HDB address. This figure is comparable to other estates with higher percentages, indicating a consistent demand from HDB upgraders.

Additionally, we can gain further insights into buyers’ preferences by breaking down the data by individual condo projects:

| Project | HDB Address | Private Address | Total | HDB Upgrader % |

| Gem Residences | 18 | 13 | 31 | 58% |

| Oleander Towers | 2 | 4 | 6 | 33% |

| Trellis Towers | 3 | 3 | 6 | 50% |

| Trevista | 9 | 23 | 32 | 28% |

In 2024, nearly 60% of buyers at Gem Residences are HDB upgraders, highlighting that most of those seeking something new in the area likely come from HDB flats. Combined with the limited supply, this positions The Orie to capitalise on demand from HDB upgraders nearby.

However, pricing remains a crucial factor. While Trevista has a transaction volume similar to Gem Residences, only 30% of its buyers are upgraders. This is likely driven by Trevista’s higher price points, which we’ll explore further below.

How Did Gem Residences Perform?

One way to gauge the potential success or challenges for The Orie is by examining the performance of Gem Residences, given the similar supply dynamics at the time of its launch.

Gem Residences’ performance offers valuable insights into how The Orie might fare.

So, how did Gem Residences perform compared to other developments that launched around the same time?

| Projects | Gain | Loss | ||||

| Average of quantum | Average of % | No. of Tnx | Average of quantum | Average of % | No. of Tnx | |

| FOREST WOODS | $313,638 | 26.8% | 105 | |||

| THE ALPS RESIDENCES | $215,563 | 26.1% | 167 | |||

| LAKE GRANDE | $226,540 | 22.7% | 111 | |||

| STURDEE RESIDENCES | $219,467 | 21.2% | 64 | -$39,300 | -4% | 1 |

| QUEENS PEAK | $232,528 | 21.1% | 167 | |||

| PARC RIVIERA | $200,614 | 20.9% | 284 | |||

| STARS OF KOVAN | $218,489 | 20.6% | 102 | |||

| Gem Residences | $240,766 | 20.5% | 158 | -$139,000 | -7% | 1 |

| THE WISTERIA | $137,973 | 16.8% | 80 | |||

| GRAMERCY PARK | $985,083 | 15.4% | 10 | |||

| VIIO @ BALESTIER | $126,558 | 12.1% | 10 | |||

| STRAITS MANSIONS | $224,000 | 11.1% | 2 | |||

| 183 LONGHAUS | $140,165 | 10.7% | 9 | -$125,200 | -8% | 1 |

| CAIRNHILL NINE | $257,361 | 8.4% | 18 | -$166,000 | -6% | 5 |

| THE ASANA | $68,662 | 4.5% | 7 | -$135,753 | -9% | 7 |

| 38 JERVOIS | $40,899 | 3.5% | 1 | |||

| Average | $342,957 | 37% | 1,954 | -$138,918 | -7% | 15 |

Gem Residences performed quite well, delivering an average return of 20.5% for those who made a profit. Only one person recorded a loss, while 158 buyers saw gains.

While this performance isn’t exceptional, given that anyone who bought in 2016/17 benefitted from the market’s low point, it’s still noteworthy that Gem Residences ranks in the top half of developments launched that year – just 2.2% behind third-place Lake Grande.

The developments that underperformed were mostly boutique projects, except for Wisteria.

On the surface, this all looks positive. However, buyers won’t be comparing The Orie solely to Gem Residences. With the price point now higher, it raises the question: Should you be concerned?

Here’s a look at resale prices in the area by bedroom type:

| Project | Tenure | 1BR | 2BR | 3BR | 4BR | 5BR | PH |

| The Orie (assuming $2,600 psf) | 99 yrs | $1,344,200 | $1,539,200 | $2,210,000 | $3,161,600 | $3,777,800 | |

| Gem Residences | 99 yrs from 2015 | $1,212,794 | $1,903,000 | $2,406,667 | $2,584,444 | $2,988,888 | |

| Oleander Towers | 99 yrs from 1995 | $1,708,333 | |||||

| Trellis Towers | Freehold | $1,522,500 | $2,196,250 | ||||

| Trevista | 99 yrs from 2008 | $1,167,500 | $1,678,753 | $2,224,135 | $3,065,000 |

Immediately, it’s clear that while Trevista is older than Gem Residences, it commands a higher price due to its larger unit sizes. Earlier, we examined the proportion of HDB upgraders in the estate and found that Trevista attracted fewer buyers with HDB addresses, likely due to its higher prices. For instance, a 2-bedroom unit at Trevista costs on average about $400k more than Gem Residences in 2024, despite having 7 fewer years on its lease.

More from Stacked

Where HDB Flats Continue to Hold Value Despite Ageing Leases

The “99-year time bomb” has been a topic of public discussion as far back as the 1990s. We all know…

When comparing The Orie to Gem Residences, the price gap becomes even more apparent. The Orie is priced over $300k higher for both 2- and 3-bedroom units, and a staggering $700k more for the 4-bedroom. The price difference climbs to $1.2 million for a 5-bedroom unit.

We’ve also compared Gem Residences to The Orie’s smallest unit for each bedroom type, meaning the price differences could be even greater.

This raises concerns for The Orie. If the target market is primarily HDB upgraders, the higher price point could make it less appealing compared to Gem Residences, which offers a more competitive price point.

Another concern is the lack of 1-bedroom transactions at Gem Residences in 2024

Despite having 109 1-bedder units, it’s surprising that not a single unit has been sold this year. We checked PropertyGuru, where there are currently 12 active listings, though some are duplicates of the same unit. Looking at the listing history, some of these units have been on the market since early 2024, meaning they’ve been selling for nearly a year with no success.

One of the listings is for a 484 sq ft unit priced at around $928k, which is significantly lower than the prices at The Orie. While the size difference is notable (as Gem Residences includes the AC ledge as part of its space, being a pre-harmonisation development), the price is still about $400k less than the starting prices at The Orie.

This reflects a common trend: HDB upgraders typically prefer to move into 2-bedroom or larger units. A 3-room HDB has 2 bedrooms, so upgrading to a 1-bedroom unit doesn’t align with their needs.

That’s why we believe The Orie’s decision to offer fewer 1-bedder units, compared to Gem Residences, is a wise one. For those considering buying a 1-bedder, be aware that the exit could be challenging, as evidenced by Gem Residences. The primary target market (HDB upgraders) is unlikely to consider a 1-bedroom as an option.

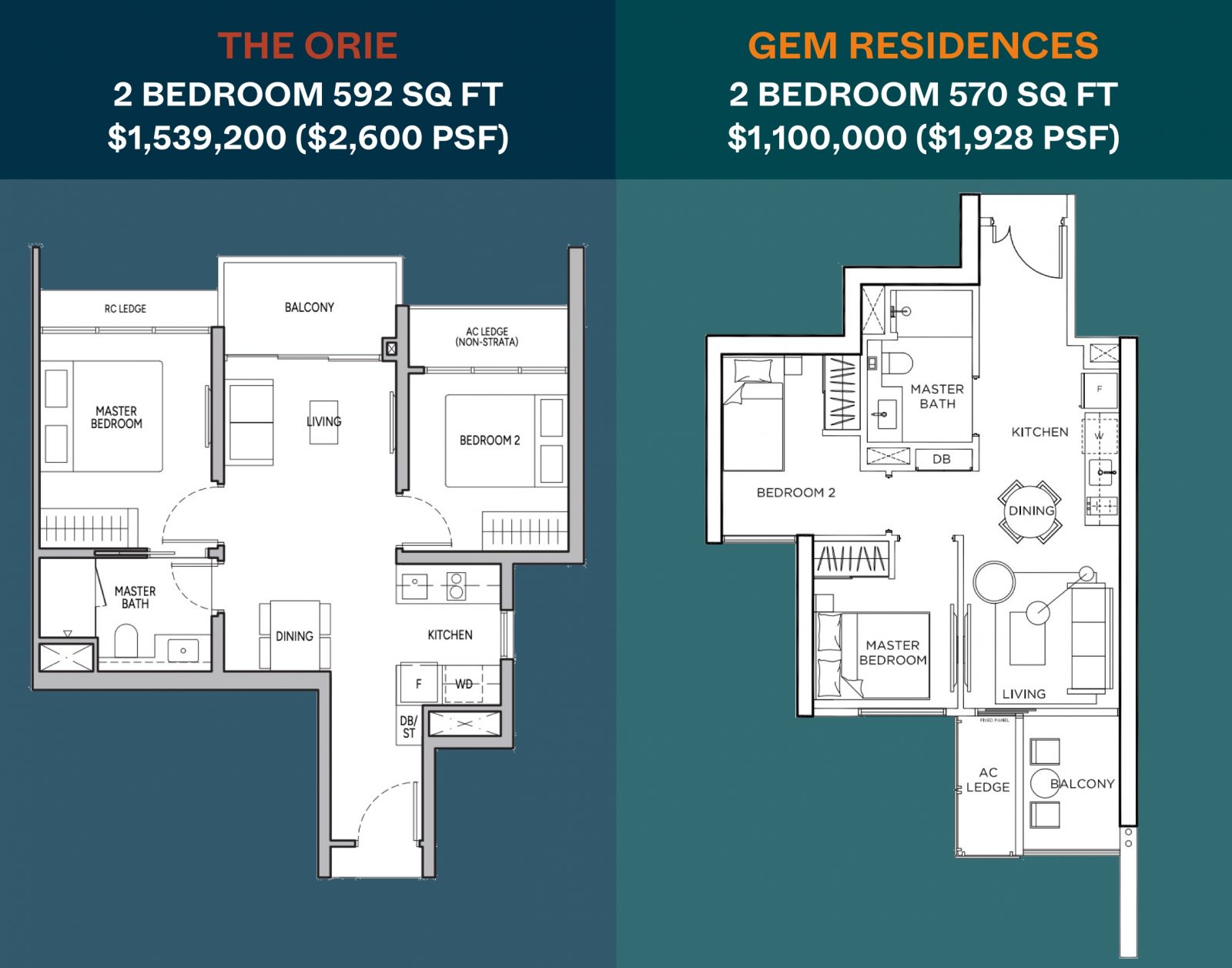

2-Bedroom comparison – The Orie vs Gem Residences

2-bedroom units make up 310 units out of the 777 units at Gem Residences, accounting for the majority (about 40%) of the development. In 2024, there were 20 transactions for 2-bedroom units, representing 9% of the total 2-bedders, which is a healthy sales rate.

On average, 2-bedroom units at Gem have sold for around $1.2 million. At $2,600 psf, the smallest 2-bedroom unit at The Orie would be priced around $1.539 million, which is about $300k more than its counterparts at Gem Residences.

Let’s look at the 570 sq ft 2-bedder at Gem Residences. In December 2024, a unit on the 26th floor sold for $1.1 million, which is approximately $439k less than what you’d expect to pay for a comparable unit at The Orie.

Layout-wise, The Orie offers a more efficient design with its dumbbell layout, providing better space utilization. Additionally, it offers a larger size (even excluding the AC ledge), meaning more usable space compared to older developments. The living and dining areas are more separated and spacious, unlike in Gem Residences, where the layout can feel more cramped. The kitchen in The Orie also comes with its own window, enhancing the overall functionality and ventilation.

Both bedrooms in The Orie are generously sized, unlike some units at Gem Residences, where the second bedroom is small enough only to fit a single bed. While The Orie has a $400k price difference, the added space and functional design could justify the premium, especially for young couples or small families.

Moreover, The Orie will be around 10 years newer by the time it’s completed, which could also make it more appealing for buyers seeking a modern living experience.

Can 3-room flat BTO buyers in the Bidadari area afford The Orie?

The launch prices of 3-room BTO flats in the latest Bidadari projects that recently MOP ranged from $297k to $385k. Recently, a high-floor unit in the area sold for an impressive $900k, though this is likely an exception due to its prime location, with likely park views.

That said, prices are unlikely to deviate significantly from the typical range, with most 3-room flats likely going for around $750k. If that’s the case, BTO buyers could see a profit of around $409k, which could easily cover the downpayment for a 2-bedroom unit at The Orie.

While this makes it feasible for HDB upgraders to consider The Orie, the real question is whether they will allocate most of their profit to a condo purchase. This is something that will depend on the financial priorities and lifestyle choices of the buyer.

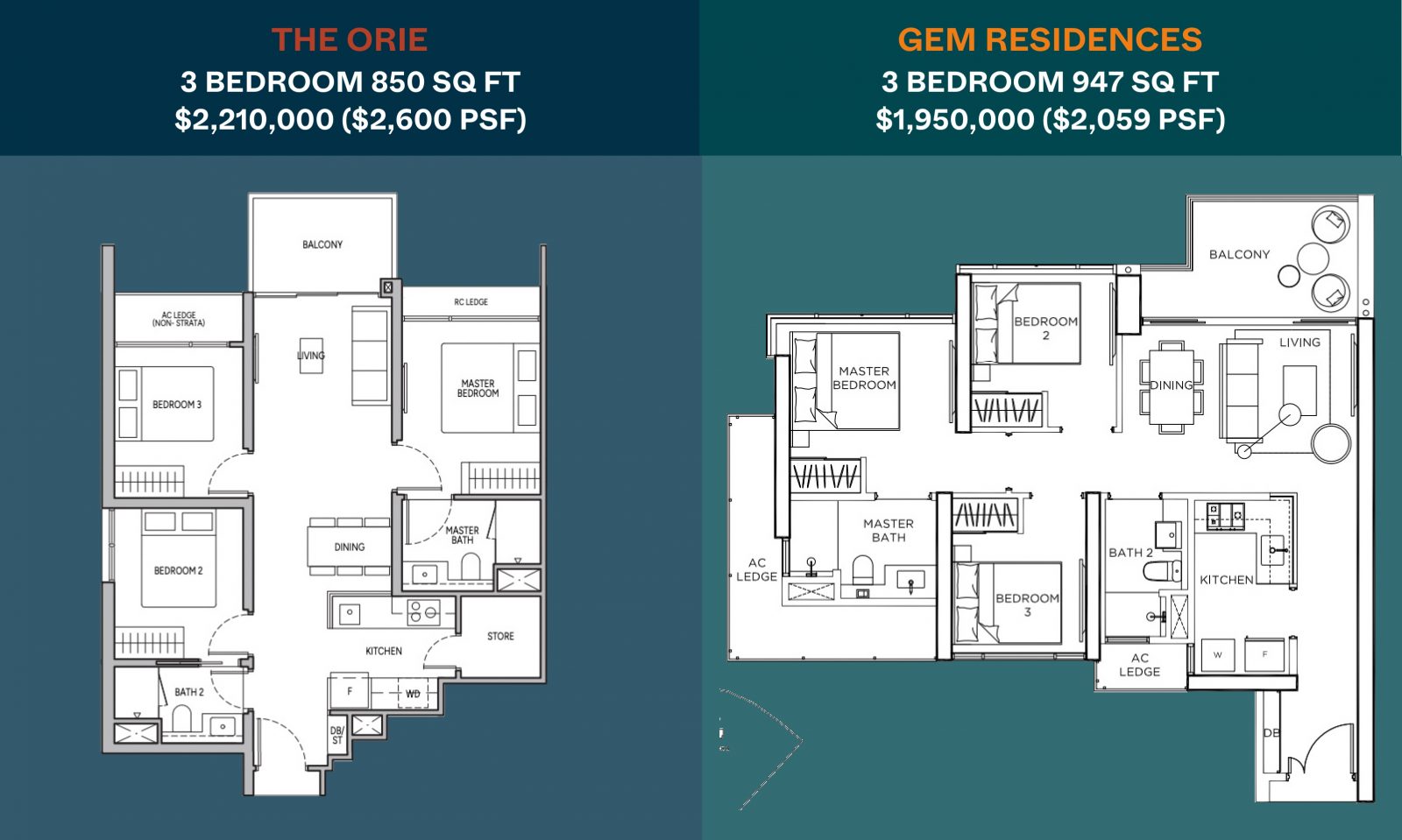

3-Bedroom comparison – The Orie vs Gem Residences

The Orie stands out with its efficient dumbbell layout, making it the clear winner when compared to Gem Residences, which suffers from a less functional design.

One of the key drawbacks of Gem Residences is its huge AC ledge, which means the layout isn’t as large as the size may suggest. In particular, the 947 sq ft unit feels tight as the living and dining areas almost spill into the hallway, and the large balcony further eats into the space.

In contrast, The Orie maximises its 850 sq ft with a more efficient layout, including a sizeable store – a rare feature for this size. Most stores in units of this size would only fit one shelving rack, but here, buyers can fit up to three racks, resembling the storage capacity of a typical 3-bedroom unit. This thoughtful design is a huge plus for those needing extra storage space.

At an average price of $2,600 psf, The Orie offers a more functional layout for around $200k more than Gem Residences, making it a compelling option. However, a downside is the lack of natural ventilation, something Gem Residences offers, though this is often the case with more compact layouts.

Turning to 4-room flats in Bidadari, we see these properties going for around $1 million. With launch prices between $433k – $550k, owners stand to make a profit of about $500k, which could cover the downpayment for a 3-bedroom unit.

Given these price points, The Orie is certainly a strong contender, especially for HDB upgraders looking for more space and a better layout at a competitive price.

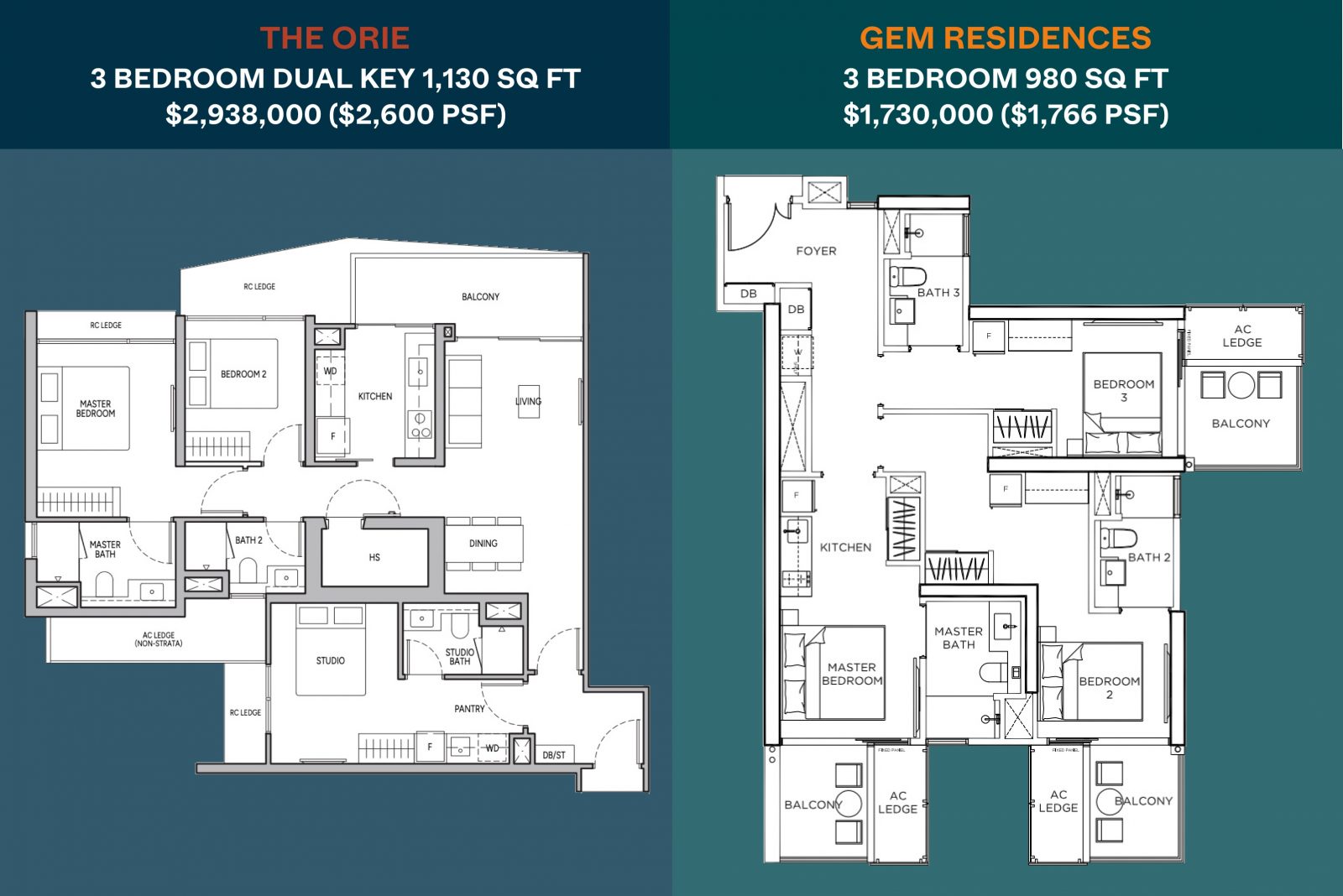

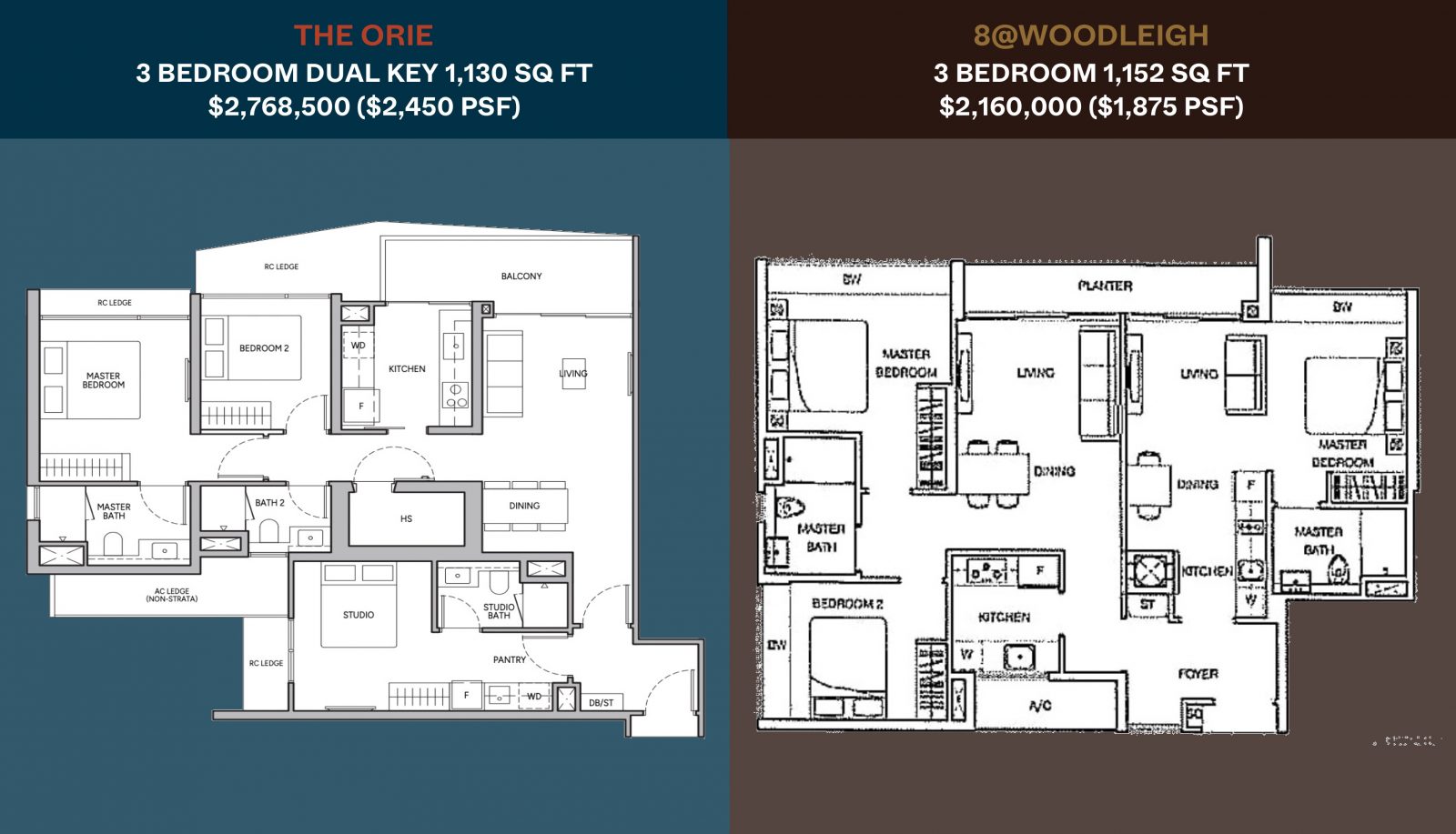

A Quick Note on the Dual Key Units at The Orie

The 3-bedroom dual key units at The Orie offer great flexibility, making them ideal for multi-generation living, where privacy is key, or for those looking to live in one unit and rent out the other.

However, the layout may not appeal to regular families who don’t require such arrangements. The dual key design can result in inefficient use of space, especially in areas like the foyer, which serves as a separator between the two units but doesn’t add much functionality. Additionally, having two pantries instead of a single well-designed kitchen with a yard and household shelter can make the layout less optimised.

It’s important to note that Gem Residences does not offer a dual-key layout but rather a triple-key design, which is a different concept altogether and not directly comparable.

In Gem Residences, the triple key layout offers no pantry space between the rooms. This makes it feel more like room rentals than a proper studio unit. The main occupant, likely residing in the master bedroom, has no dedicated living or dining area. As a result, the space functions more like a regular 3-bedroom layout, but without a proper living/dining space, which limits its appeal.

The triple-key design seems more suited to investors or singles who plan to rent out two of the rooms. However, the layout doesn’t optimize the space for these needs. The unit lacks the necessary features of a typical triple key, and its overall configuration isn’t practical for most families. It may explain why it’s priced considerably lower—up to $1 million less than other similar properties.

Given these differences in layout, Gem Residences’ “Trio” design doesn’t offer much insight into how The Orie will perform. It’s not directly comparable, and its design constraints make it less likely to appeal to the same demographic.

A more relevant comparison might be 8@Woodleigh, a condo located right next to the Bidadari precinct, which could offer better insights into how properties near this area perform.

In November 2024, a 3rd-floor dual key unit at 8@Woodleigh (1,152 sq ft) was sold for $2.16 million. While this price is relatively lower due to its position on a low floor, it’s still noteworthy when comparing it to The Orie.

Assuming The Orie’s dual key starts at $2,450 psf, the total price would be around $2.768 million, a considerable premium. However, this price difference must be viewed in context: 8@Woodleigh was completed in 2012, and by the time The Orie is ready, it will be 18 years newer, offering advantages in terms of condition and features.

Key Differences:

- Layout: The Orie boasts a household shelter and a decent-sized balcony, allowing plenty of sunlight and ventilation into the kitchen, which adds to its practicality. In contrast, 8@Woodleigh has large planter spaces and bay windows, which are less efficient in terms of usable space.

- Dual Key Design: The dual key unit at 8@Woodleigh is highly pragmatic. Both sections have their own living and dining areas, which makes the studio section feel like a home rather than just a bedroom. The larger section functions as a compact 3-bedroom unit, with two queen-sized beds fitting comfortably.

- Age and Condition: The Orie’s newer age would naturally result in more modern amenities and construction standards. 8@Woodleigh, being older, will have ageing facilities and potentially less efficient space planning, making the premium for The Orie more justified for some buyers.

- Location: Both developments are near MRT stations, but 8@Woodleigh benefits from its proximity to The Woodleigh Mall, providing air-conditioned shopping and more immediate amenities. While The Orie is surrounded by other amenities, it lacks this specific convenience.

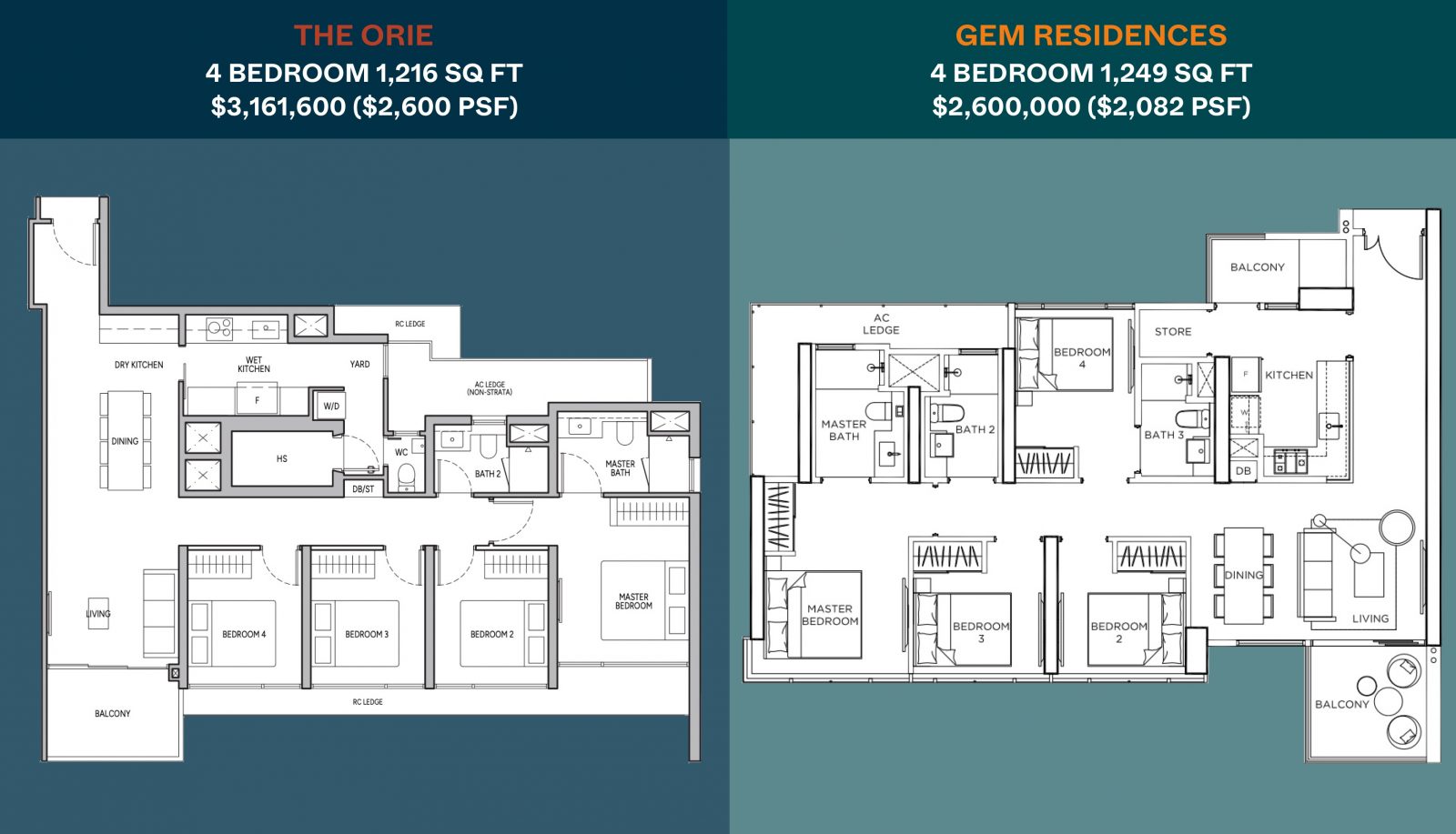

4 Bedroom The Orie vs Gem Residences Comparison

Here’s a look at the differences between them, and some considerations to make.

Layout Differences:

- Bathrooms

- Gem Residences offers 3 bathrooms, with 2 ensuite (for the master and one other bedroom). This means only 2 common bedrooms share a single toilet.

- The Orie, on the other hand, has 2 bathrooms, with 3 bedrooms sharing one common toilet. This could be a consideration for families who prioritise bathroom convenience.

- Kitchen and Utility Spaces

- Gem Residences has a balcony that’s likely used for hanging clothes, and a store space, but lacks a WC.

- The Orie follows a more traditional layout with a yard (with a window) and a WC. It also includes a household shelter, which is beneficial for storage and extra space.

- Dining and Living Areas

- The Orie provides a dedicated section for dining, comfortably fitting 8 people.

- Gem Residences combines the dining and living areas, offering more flexibility in the use of space

- Common Bedrooms

- The common bedrooms in The Orie are slightly larger, allowing for a queen-sized bed comfortably. In Gem Residences, while you can fit a queen-sized bed, the space is more tight without as much flexibility.

There is no clear winner in terms of layout. Some buyers may prioritize the extra bathroom and ensuite facilities in Gem Residences, while others may prefer the larger common bedrooms and more traditional layout in The Orie.

The price difference of $500k+ might seem significant, but for buyers who value a newer development and larger bedrooms, The Orie may offer enough value to justify the higher price.

However, for price-sensitive HDB upgraders, Gem Residences offers practicality and efficiency, with its extra bathroom and flexible living spaces. The difference in price for a 25% downpayment is around $140,400, which could be seen as a decent premium for a newer development.

While the upfront cost of Gem Residences is lower, the long-term cost (including interest expenses) should be factored in. Many HDB upgraders will likely gravitate toward Gem Residences due to the lower initial price and practical layout, especially for those with a tighter budget.

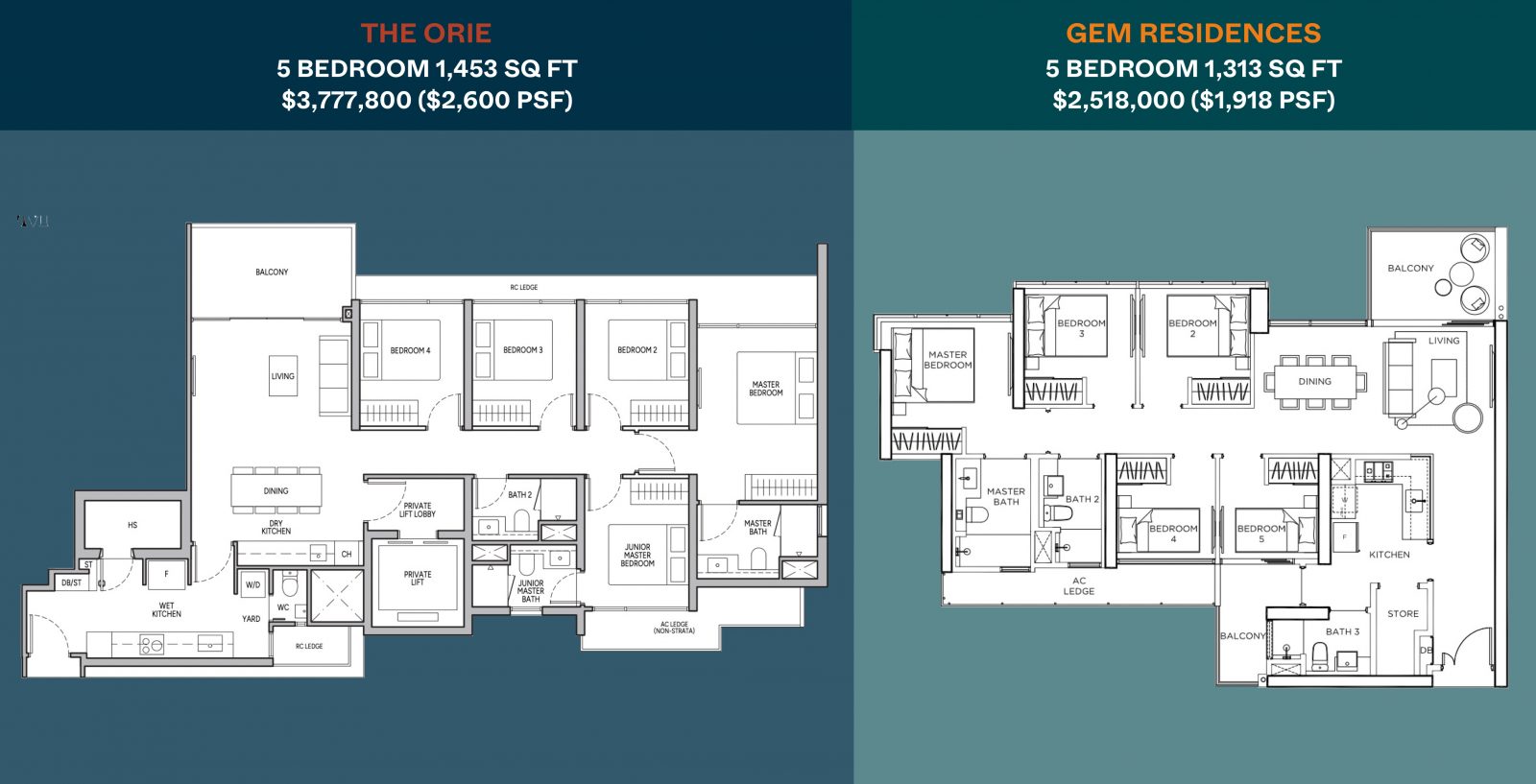

5 Bedroom The Orie vs Gem Residences Comparison

Here are the main differences between both:

Gem Residences:

The most recent 5-bedroom unit at Gem Residences was a 1,313 sq ft sub-sale in July 2024, which went for $2,518,000. At this price, Gem Residences offers affordable value, especially for HDB upgraders with larger families.

The unit includes 1 common bathroom shared with 4 bedrooms, which could be inconvenient for larger families. It also features a balcony, a yard, and a store room, which adds practicality to the space. The kitchen is compact but still functional.

As such, this is ideal for buyers on a budget who need a 5-bedroom unit and are looking for a more affordable option within the area.

The Orie:

The 5-bedroom unit at The Orie is priced at $3.777 million, reflecting a luxurious and premium offering.

Unlike Gem Residences, The Orie features a private lift for added exclusivity and convenience.

It includes a Junior Master Bedroom with its own ensuite, catering to families who require extra space and privacy.

Master Bedroom is compact, as the focus here is on affordability while still providing ample space in all rooms.

This is best suited for buyers looking for a new, higher-end 5-bedroom unit, with decently-sized rooms and modern amenities.

Here’s a quick comparison to see how The Orie measures up against other new launches on the market today

| Project | Tenure | 1BR | 2BR | 3BR | 4BR | 5BR |

| North Gaia | 99 yrs | $1,258,000 | $1,729,000 | |||

| Lumina Grand | 99 yrs | $1,364,000 | $1,846,000 | $2,130,000 | ||

| The Shorefront | 999 yrs | $1,471,000 | $1,739,000 | $2,797,000 | ||

| The Arden | 99 yrs | $1,837,000 | $2,193,000 | |||

| Kassia | Freehold | $1,160,000 | $1,545,000 | $1,838,000 | $2,522,000 | |

| The Myst | 99 yrs | $1,342,000 | $1,573,000 | $1,918,000 | $2,746,000 | $3,180,000 |

| Jansen House | 999 yrs | $1,511,000 | $1,988,000 | $2,430,000 | ||

| Hillhaven | 99 yrs | $1,610,576 | $2,008,917 | $2,730,234 | ||

| The Orie | 99 yrs | $1,280,000 | $1,480,000 | $2,090,000 | $2,920,000 | $3,480,000 |

| SORA | 99 yrs | $1,406,000 | $1,559,000 | $2,094,000 | $3,225,000 | $3,542,000 |

| Lentoria | 99 yrs | $1,308,000 | $1,689,000 | $2,112,000 | $2,700,000 | |

| Bartley Vue | 99 yrs | $2,163,000 | ||||

| The Botany at Dairy Farm | 99 yrs | $2,248,000 | ||||

| Hill House | Freehold | $1,398,000 | $1,937,000 | $2,258,000 | ||

| The LakeGarden Residences | 99 yrs | $1,387,900 | $1,616,500 | $2,358,300 | $2,870,300 | $3,426,600 |

| Hillock Green | 99 yrs | $1,498,000 | $1,553,000 | $2,364,000 | $2,648,000 | |

| Sceneca Residence | 99 yrs | $2,368,000 | $3,000,000 | |||

| Terra Hill | Freehold | $1,884,000 | $2,376,000 | $3,469,000 | $5,511,000 | |

| Koon Seng House | Freehold | $1,807,000 | $2,387,000 | $2,780,000 | ||

| The Arcady at Boon Keng | Freehold | $1,785,000 | $2,390,000 | $3,701,000 | ||

| Nava Grove | 99 yrs | $1,892,400 | $2,432,700 | $3,180,200 | $4,329,100 | |

| Grand Dunman | 99 yrs | $1,428,000 | $1,964,000 | $2,458,000 | $3,311,000 | $4,034,000 |

| Claydence | Freehold | $1,412,200 | $1,807,800 | $2,474,800 | $4,977,200 | |

| The Hill @ One-North | 99 yrs | $1,918,000 | $2,499,000 | $3,137,000 | ||

| Pinetree Hill | 99 yrs | $2,006,000 | $2,561,000 | $3,214,000 | $4,364,000 | |

| The Hillshore | Freehold | $1,788,000 | $2,588,000 | $3,880,000 | ||

| Chuan Park | 99 yrs | $1,908,469 | $2,625,550 | $3,522,508 | ||

| The Continuum | Freehold | $1,502,000 | $1,886,000 | $2,670,000 | $3,388,000 | $5,567,000 |

| Lentor Hills Residences | 99 yrs | $1,334,000 | $2,733,000 | $2,787,000 | ||

| Atlassia | Freehold | $3,059,028 | $2,804,578 | |||

| 8@BT | 99 yrs | $1,565,000 | $1,881,000 | $2,813,000 | $3,613,000 | |

| Union Square Residences | 99 yrs | $1,404,000 | $2,023,000 | $2,820,000 | $4,620,000 | |

| J’den | 99 yrs | $2,970,000 | $3,312,000 | |||

| Tembusu Grand | 99 yrs | $1,409,000 | $3,042,000 | $3,385,000 | $4,028,000 | |

| Enchante | Freehold | $3,398,700 | $3,748,300 | |||

| 10 Evelyn | Freehold | $1,431,500 | $3,416,000 | |||

| Ikigai | Freehold | $3,465,280 | ||||

| One Bernam | 99 yrs | $1,508,000 | $2,019,000 | $3,829,000 | $16,446,000 | |

| Cuscaden Reserve | 99 yrs | $2,086,000 | $2,919,000 | $3,848,000 | ||

| Midtown Bay | 99 yrs | $1,588,000 | $2,308,000 | $4,714,000 | ||

| Watten House | Freehold | $5,038,000 | $4,956,000 | $7,958,000 | ||

| The Giverny Residences | Freehold | $5,497,000 | $9,566,000 | |||

| 32 Gilstead | Freehold | $14,474,000 | ||||

| Altura | 99 yrs | $2,210,000 | ||||

| Blossoms By The Park | 99 yrs | $3,336,000 | ||||

| Boulevard 88 | Freehold | $4,785,000 | ||||

| Canninghill Piers | 99 yrs | $1,712,000 | $8,904,000 | |||

| Grange 1866 | Freehold | $1,595,000 | $2,285,000 | |||

| Irwell Hill Residences | 99 yrs | $9,452,000 | $11,080,000 | |||

| Lentor Mansion | 99 yrs | $2,717,000 | $3,223,000 | |||

| Norwood Grand | 99 yrs | $2,590,000 | ||||

| Orchard Sophia | Freehold | $1,694,300 | ||||

| Straits at Joo Chiat | Freehold | $2,196,520 | $3,022,240 | |||

| TMW Maxwell | 99 yrs | $1,420,000 | $2,404,000 |

This table should be viewed with some caution, as the lowest prices for other projects are likely based on larger units that are yet to be sold, on higher floors, or a combination of both. However, if you’re in the market for a new launch right now, here’s a snapshot of what’s available.

Currently, The Orie ranks lower on the list. Considering its proximity to the MRT, nearby amenities, and its central location, the price is quite attractive. However, this could change as the prices are staged upwards.

For instance, if we estimate $2,600 psf for the 850 sq ft 3-bedder, it would price around $2.21 million. At this price point, alternatives like Lentoria, The Botany at Dairy Farm, and The LakeGarden Residences come into play. While these developments are in different locations, The Orie stands out for its central location, excellent amenities, and walking distance to the MRT.

The launch of EOK and Chuan Park offers valuable insights into how The Orie might perform in the market.

EOK achieved an average price of $2,637 psf in the first 3 days, while Chuan Park averaged $2,582 psf in its first 2 days. The lowest price psf for EOK was $2,387, while Chuan Park saw a lower minimum of $2,269.

For The Orie, the lowest price psf is $2,395, but this is for the 5-bedroom units. The 3-bedroom units start at around $2,459 psf. Based on transaction data, it seems that the success of Chuan Park and Emerald of Katong has given confidence to the developers.

While The Orie isn’t directly comparable to either of these two projects, it does share similar features, such as being a full-fledged condo, part of the mass-market segment, and located near the MRT and key amenities. Given this, if average prices remain in the $2,500+ to $2,600+ psf range, it seems likely that units at The Orie will be popular, based on the performance of similar developments.

However, if prices rise significantly beyond this range, The Orie might face challenges, especially since it’s located within an HDB town. In contrast, Chuan Park benefits from being surrounded by landed enclaves, and EOK is situated in the prestigious District 15 (plus the landed enclaves around), which attracts potential buyers from nearby landed properties or those considering downgrading.

Conclusion

Overall, The Orie stands out in the compact 3-bedroom category, offering an attractive layout and location. However, the price premium for other bedroom types, particularly the 5-bedroom units and 1 bedders, warrants more careful consideration.

It’s clear that the developers are positioning The Orie as a more upmarket project, which is evident in features like the private lift and higher price for the 5-bedroom unit. This strategy assumes there will be sufficient demand from buyers beyond HDB upgraders to support these prices.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are the starting prices for different unit types at The Orie?

How does the land cost for The Orie compare to other recent residential site purchases?

What is the potential market for buyers of The Orie in Toa Payoh?

How did Gem Residences perform compared to other projects launched around the same time?

What are the concerns regarding the pricing of The Orie compared to similar developments like Gem Residences?

Matthew Kwan

Matt read Law in university but has since traded legal statutes for the world of high finance on weekdays. On weekends, he delves into his keen interest in real estate, which has taken him to more 150 new and resale developments since the age of 16. Since first writing for Stacked, Matt has made his first home purchase and continues to appreciate the evolving trends of today's market. In his free time, Matt goes on walks and writes about (more) real estate on his personal Instagram page @propertyzaikiaNeed help with a property decision?

Speak to our team →Read next from New Launch Condo Analysis

New Launch Condo Analysis This New Dairy Farm Condo Starts From $998K — How the Pricing Compares

New Launch Condo Analysis This New Freehold CBD Condo Starts From $1.29M — Here’s How the Pricing Compares

New Launch Condo Analysis This Freehold New Launch Condo In The CBD Is Launching From Just $1.29M

New Launch Condo Analysis I Reviewed A New Launch 4-Bedroom Penthouse At Beauty World

Latest Posts

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

1 Comments

Why There is no Mention of Two Popular Schools within 1 Km?