Should You Buy ELTA? A Pricing Review Against Clavon, Clement Canopy And Other New Launches

February 13, 2025

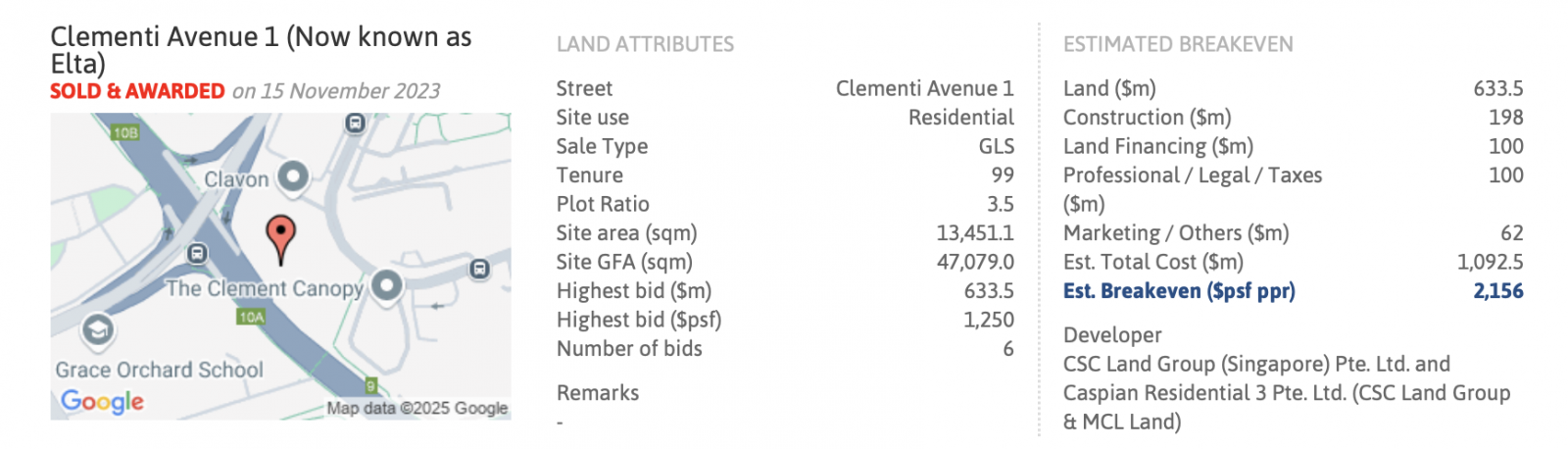

Welcome to our pricing review of ELTA, the newest (and final) Government Land Sales (GLS) site along Clementi Avenue 1. If you’ve been watching this neighbourhood, you’ll know it’s been four years since the last condominium launch here – so ELTA’s arrival is quite timely for those who are looking for something new. Jointly developed by MCL Land and CSC Land, ELTA was hotly contested, with six bidders aiming for a slice of Clementi’s prime real estate. Ultimately, MCL Land and CSC Land clinched the site at $1,250 psf ppr, edging out a formidable partnership of CDL, Frasers, and Sekisui House by a mere 4% margin.

Positioned between UOL’s Clavon (2020) and Clement Canopy (2017), ELTA brings 501 units to the table, ranging from 1+Study layouts to spacious 5-bedroom options. Land costs in this area have been climbing steeply over the years—from $614 psf ppr for Clement Canopy’s site in 2015 to $1,250 psf ppr for ELTA in 2023. Part of this jump can be traced back to ELTA’s GFA-harmonised plot, which changes how land efficiency is factored in. Still, the price difference is significant enough to spark questions about whether buyers will see commensurate value here.

In the following review, we’ll break down ELTA’s pricing structure, weigh it against past launches, and highlight key considerations that may tip the scales for prospective homeowners and investors alike.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Indicative starting prices

Here are the indicative starting prices for the various unit types in ELTA:

| Unit Type | Size (sqft) | Starting Price | $PSF |

| 1-bedroom | |||

| 1BR + Study | 506 | $1,158,000 | $2,289 |

| 2-bedroom | |||

| 2BR (1 Bath) | 614 | $1,338,000 | $2,261 |

| 2BR (2 Bath) | 700 | ||

| 2BR + Study | 807 | ||

| 3-bedroom | |||

| 3BR | 926 | $2,198,000 | $2,374 |

| 3BR Premium | 1023 | ||

| 4-bedroom | |||

| 4BR | 1184 – 1313 | $2,798,000 | $2,363 |

| 4BR + Study | 1,507 | ||

| 4BR Dual Key | 1,313 | ||

| 5-bedroom | |||

| 5BR | 1,776 | $3,880,000 | $2,189 |

Since these are starting prices, actual transaction prices will likely be higher depending on factors such as unit level, size, and facing. While the exact increase is uncertain, we can make a rough estimate by analysing other new developments launched in 2024. For comparison, we will focus on new launches within the western region of Singapore.

| Project | District | Year that land was purchased | Land size (sqm) | Highest bid $PSF | Estimated breakeven $PSF | Price range for new sale transactions | Median $PSF for new sale transactions | Average developer’s profit margin (based on median $PSF) |

| Novo Place (EC) | 24 | Sep 2023 | 16,441.20 | $703 | $1,292 | $1,506 – $1,754 | $1,630 | 26.16% |

| Hillhaven | 23 | Nov 2022 | 10395.2 | $1,024 | $1,849 | $1,858 – $2,365 | $2,112 | 14.20% |

| Lumina Grand (EC) | 23 | Sep 2022 | 16,623.70 | $626 | $1,187 | $1,326 – $1,590 | $1,458 | 22.83% |

| Sora | 22 | Jul 2022 | 17,835 | – | $1,847 | $1,851 – $2,502 | $2,177 | 17.84% |

| The Hill @ One North | 5 | Oct 2021 | 5936.6 | $1,210 | $1,941 | $2,272 – $2,708 | $2,490 | 28.28% |

The table above shows that the median transacted price per square foot ($PSF) reflects an average developer’s profit margin ranging from 14% to 28%.

Now, let’s examine the profit margins of past projects located near ELTA.

| Project | Year that land was purchased | Land size (sqm) | Highest bid $PSF | Estimated breakeven $PSF | Price range for new sale transactions | Median $PSF for new sale transactions | Average developer’s profit margin (based on median $PSF) |

| Clavon | Jul 2019 | 16,542.70 | $788 | $1,401 | $1,487 – $1,858 | $1,673 | 19.38% |

| Parc Clematis | Jan 2018 | 58,898.00 | $850 | $1,374 | $1,025 – $2,076 | $1,551 | 12.85% |

| The Clement Canopy | Dec 2015 | 13,037.90 | $615 | $1,093 | $1,187 – $1,735 | $1,461 | 33.67% |

These projects have a similar profit margin range of around 13% to 34%.

If we were to assume a 10% to 30% developer’s profit margin for ELTA, the following would be the estimated $PSF:

| Project | Year purchased | Land size (sqm) | Highest bid $PSF | Estimated breakeven $PSF |

| ELTA | Nov 2023 | 13,451.10 | $1,250 | $2,156 |

| Developer’s profit margin | Estimated $PSF |

| 10% | $2,372 |

| 20% | $2,587 |

| 30% | $2,803 |

Using the hypothetical $PSF above, here’s a look at the potential price matrix at the various profit margins.

| Unit Type | Size (sqft) | Price based on $PSF of $2,372 (10% profit) | Price based on $PSF of $2,587 (20% profit) | Price based on $PSF of $2,803 (30% profit) |

| 1BR + Study | 506 | $1,200,232 | $1,309,022 | $1,418,318 |

| 2BR (1 Bath) | 614 | $1,456,408 | $1,588,418 | $1,721,042 |

| 2BR (2 Bath) | 700 | $1,660,400 | $1,810,900 | $1,962,100 |

| 2BR + Study | 807 | $1,914,204 | $2,087,709 | $2,262,021 |

| 3BR | 926 | $2,196,472 | $2,395,562 | $2,595,578 |

| 3BR Premium | 1023 | $2,426,556 | $2,646,501 | $2,867,469 |

| 4BR | 1184 – 1313 | $2,808,448 | $3,063,008 | $3,318,752 |

| 4BR + Study | 1,507 | $3,574,604 | $3,898,609 | $4,224,121 |

| 4BR Dual Key | 1,313 | $3,114,436 | $3,396,731 | $3,680,339 |

| 5BR | 1,776 | $4,212,672 | $4,594,512 | $4,978,128 |

Upcoming development along Faber Walk

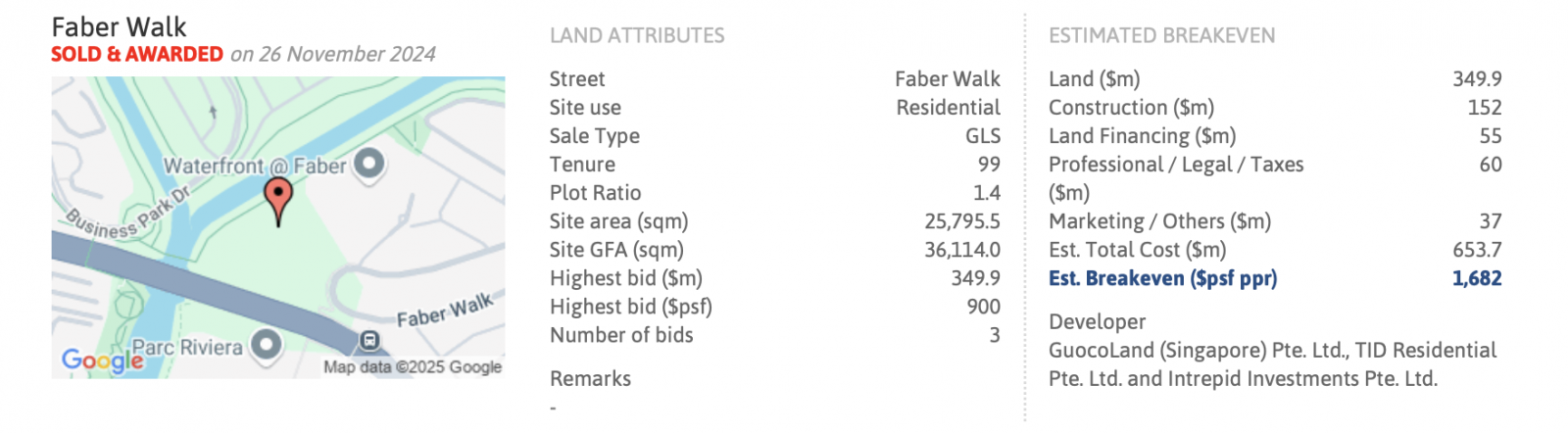

In November last year, the Faber Walk GLS site was sold for $349.858M, translating to $900 per square foot per plot ratio (psf ppr). The winning bid came from a joint venture between GuocoLand, TID Residential (a partnership between Hong Leong Holdings and Mitsui Fudosan), and Intrepid Investments, a wholly-owned subsidiary of Hong Leong Holdings.

| Address | Year purchased | Land size (sqm) | Highest bid $PSF | Estimated breakeven $PSF |

| ELTA | Nov 2023 | 13,451.10 | $1,250 | $2,156 |

| Faber Walk | Nov 2024 | 25,795.50 | $900 | $1,682 |

The Faber Walk GLS site and ELTA offer distinct advantages, catering to different buyer priorities.

1. Proximity to Nan Hua Primary

One of the standout advantages of the Faber Walk development is that it falls within 1km of the renowned Nan Hua Primary School. The school is a draw for families with kids and could potentially be a key purchase consideration. This proximity makes it a prime choice for parents looking to secure priority admission for their children. ELTA, on the other hand, does not have this advantage.

2. MRT Accessibility

In terms of public transport accessibility, ELTA has a slight edge, with a walking distance of approximately 13 minutes to Clementi MRT. Meanwhile, the Faber Walk site is further, with an estimated walk time of over 20 minutes. While this difference may not seem huge, it could be a deciding factor for those who rely heavily on public transport for daily commutes.

3. Land size, density, and development character

The Faber Walk site sits on a larger land plot but has a lower plot ratio, meaning it will be a low-rise development like its neighbours, Waterfront @ Faber and Faber Crest. This is in contrast to ELTA, which will be a high-rise project with a higher density. In comparison, the Faber Walk development may offer a more spacious and exclusive living environment. It is also situated along the Ulu Pandan River and the developers have mentioned the intention of building a waterfront project.

4. Notable difference in estimated breakeven $PSF

Financially, the estimated breakeven $PSF for ELTA is approximately 28% higher than that of the Faber Walk site. This significant price gap could potentially influence buyers’ purchase decisions.

Now, let’s take a look at some resale comparisons.

Resale landscape: How ELTA stacks up against nearby developments

ELTA’s location places it in direct competition with its immediate neighbours, Clavon and The Clement Canopy, as all three projects share similar proximity to key amenities in the Clementi area.

While Parc Clematis has a similar walking distance to Clementi MRT as ELTA, it differs significantly in size. Being a mega-development more than twice the size of ELTA, Parc Clematis offers a vastly different living experience, catering to those who prefer a larger community with more extensive facilities. Additionally, Parc Clematis benefits from being within 1km of Nan Hua Primary School, a key factor that appeals to families prioritising proximity to the school.

Given these factors, Parc Clematis may not serve as a direct benchmark for ELTA’s performance, but it is still useful to observe how Parc Clematis has performed in the market fora broader context.

While both Clavon and The Clement Canopy are near ELTA, Clavon is newer, with its lease starting in 2019 and completed in 2024. This makes it the youngest project in the area and stands out as the most relevant comparison.

Let’s examine how these three developments have performed compared to other condominiums launched around the same time. We will assess their performance from their launch to the present.

Projects that were launched around the same time as Clavon:

| Gains | Losses | |||||

| Project | Average quantum | Average annualised gains (%) | No. of tnx | Average quantum | Average % gains | No. of tnx |

| Penrose | $381,769 | 7.0 | 117 | – | ||

| Clavon | $366,490 | 6.5 | 85 | – | ||

| One North Eden | $375,658 | 5.3 | 18 | – | ||

| The Landmark | $219,250 | 4.4 | 4 | – | ||

| Midtown Modern | $264,928 | 4.3 | 6 | – | ||

| The Verdale | $206,225 | 4.2 | 12 | – | ||

| The Reef at King’s Dock | $211,777 | 2.9 | 12 | – | ||

| Irwell Hill Residences | $146,500 | 2.4 | 4 | – | ||

Projects that were launched around the same time as Parc Clematis:

| Gains | Losses | |||||

| Project | Average quantum | Average annualised gains (%) | No. of tnx | Average quantum | Average annualised losses (%) | No. of tnx |

| Parc Clematis | $358,398 | 6.3 | 219 | – | ||

| Treasure @ Tampines | $259,634 | 5.5 | 495 | -$238,000 | -8.6 | 1 |

| Normanton Park | $270,261 | 5.5 | 69 | – | ||

| Midwood | $203,386 | 5.1 | 24 | – | ||

| Sengkang Grand Residences | $238,278 | 4.4 | 82 | – | ||

| The Florence Residences | $220,505 | 4.4 | 281 | -$74,000 | -2 | 1 |

| Dairy Farm Residences | $256,509 | 4.4 | 19 | – | ||

| Avenue South Residence | $220,460 | 3.2 | 72 | – | ||

| One Pearl Bank | $163,361 | 2.4 | 18 | -$110,000 | -2.6 | 1 |

Projects that were launched around the same time as The Clement Canopy:

| Gains | Losses | |||||

| Project | Average quantum | Average annualised gains (%) | No. of tnx | Average quantum | Average annualised losses (%) | No. of tnx |

| The Clement Canopy | $319,082 | 4.2 | 128 | – | ||

| Grandeur Park Residences | $255,140 | 4.1 | 159 | – | ||

| Seaside Residences | $325,651 | 4.1 | 157 | -$92,500 | -5.7 | 2 |

| Artra | $390,495 | 4.0 | 62 | – | ||

| Parc Riviera | $202,519 | 3.8 | 298 | – | ||

| Le Quest | $169,335 | 3.5 | 78 | -63,800 | -3.8 | 1 |

| Martin Modern | $469,989 | 3.5 | 61 | -$103,668 | -1.2 | 11 |

| Park Place Residences at PLQ | $201,817 | 2.8 | 72 | -$20,333 | -0.6 | 2 |

Regardless of their respective launch dates, all three Clementi developments—Clavon, Parc Clematis, and The Clement Canopy—have consistently ranked among the top-performing projects in terms of average annualised gains when compared to other condominiums launched during the same periods.

This suggests that Clementi remains a resilient and desirable location for homebuyers and investors alike.

Let’s now take a look at the sub sale and resale prices of these developments in 2024 to see how they compare against ELTA (we will only be comparing similar unit types).

| Clavon | % difference compared to ELTA at varying developer’s profit margins | ||||

| Unit type and size (sqft) | Avg $PSF | Avg price | 10% | 20% | 30% |

| 1-bedroom + Study | |||||

| 527 | $1,991 | $1,049,876 | 14.32% | 24.68% | 35.09% |

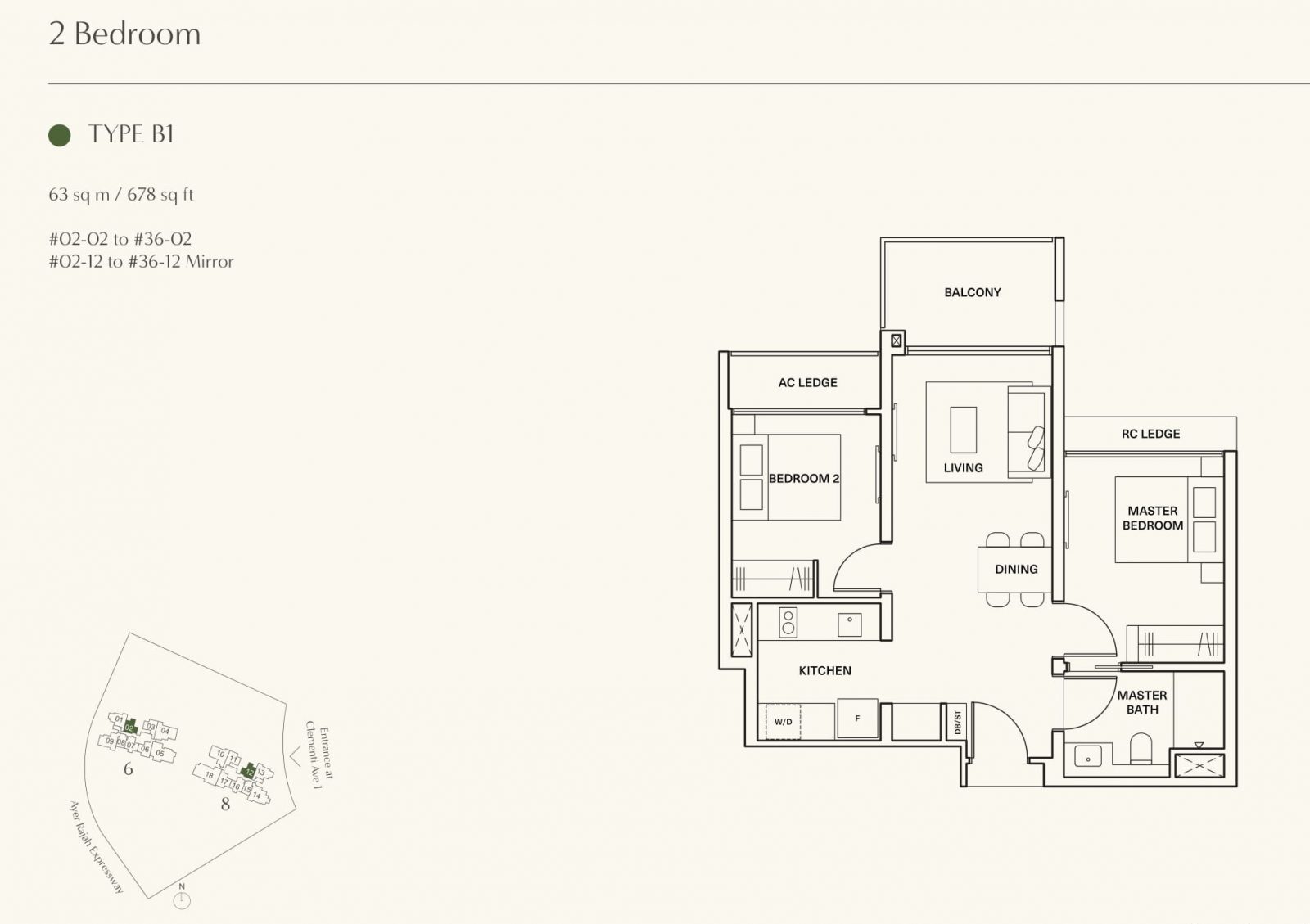

| 2-bedroom 1-bathroom | |||||

| 678 | $1,933 | $1,310,857 | 11.10% | 21.17% | 31.29% |

| 2-bedroom 2-bath | |||||

| 764 | $1,999 | $1,527,964 | 8.67% | 18.52% | 28.41% |

| 3-bedroom | |||||

| 958 | $2,119 | $2,029,514 | 8.23% | 18.04% | 27.89% |

| 4-bedroom | |||||

| 1281 | $2,021 | $2,588,000 | 8.52% | 18.35% | 28.24% |

| 4-bedroom + Study | |||||

| 1356 | $2,157 | $2,925,000 | 22.21% | 33.29% | 44.41% |

| Parc Clematis | % difference compared to ELTA at varying developer’s profit margins | ||||

| Unit type and size (sqft) | Avg $PSF | Avg price | 10% | 20% | 30% |

| 1-bedroom + Study | |||||

| 517 | $1,976 | $1,021,000 | 17.55% | 28.21% | 38.91% |

| 2-bedroom 2-bath | |||||

| 700 | $2,044 | $1,430,000 | 16.11% | 26.64% | 37.21% |

| 710 | $2,002 | $1,422,164 | 16.75% | 27.33% | 37.97% |

| 721 | $2,003 | $1,444,376 | 14.96% | 25.38% | 35.84% |

| 732 | $1,936 | $1,417,222 | 17.16% | 27.78% | 38.45% |

| 2-bedroom 2-bath + Study | |||||

| 743 | $2,114 | $1,570,250 | 21.90% | 32.95% | 44.05% |

| 3-bedroom | |||||

| 829 | $2,164 | $1,793,750 | 22.45% | 33.55% | 44.70% |

| 861 | $2,142 | $1,844,629 | 19.07% | 29.87% | 40.71% |

| 893 | $2,150 | $1,920,648 | 14.36% | 24.73% | 35.14% |

| 904 | $2,218 | $2,005,000 | 9.55% | 19.48% | 29.46% |

| 915 | $2,150 | $1,967,500 | 11.64% | 21.76% | 31.92% |

| 990 | $1,979 | $1,960,000 | 12.06% | 22.22% | 32.43% |

| 1044 | $2,199 | $2,295,889 | 5.69% | 15.27% | 24.90% |

| 1076 | $2,267 | $2,440,000 | -0.55% | 8.46% | 17.52% |

| 4-bedroom | |||||

| 1238 | $2,240 | $2,772,963 | 1.28% | 10.46% | 19.68% |

| 1292 | $2,219 | $2,866,200 | -2.01% | 6.87% | 15.79% |

| 5-bedroom | |||||

| 1668 | $2,104 | $3,510,000 | 20.02% | 30.90% | 41.83% |

| The Clement Canopy | % difference compared to ELTA at varying developer’s profit margins | ||||

| Unit type and size (sqft) | Avg $PSF | Avg price | 10% | 20% | 30% |

| 2-bedroom 1-bathroom | |||||

| 635 | $1,882 | $1,195,200 | 21.85% | 32.90% | 44.00% |

| 657 | $1,911 | $1,255,000 | 16.05% | 26.57% | 37.13% |

| 2-bedroom 2-bath | |||||

| 710 | $1,918 | $1,362,500 | 21.86% | 32.91% | 44.01% |

| 732 | $1,853 | $1,356,333 | 22.42% | 33.51% | 44.66% |

| 3-bedroom | |||||

| 990 | $1,922 | $1,903,413 | 15.40% | 25.86% | 36.36% |

| 4-bedroom | |||||

| 1346 | $1,895 | $2,550,000 | 10.14% | 20.12% | 30.15% |

**For 3-bedroom units, we compare resale units under 1,000 sq ft against ELTA’s 926 sq ft unit, and those above 1,000 sq ft against its 1,023 sq ft unit for a fairer comparison.

Since Clavon is the newest project in the area, it will serve as the primary benchmark for our comparison with ELTA. We will analyse pricing and floor plans across various unit types to assess their relative value and appeal.

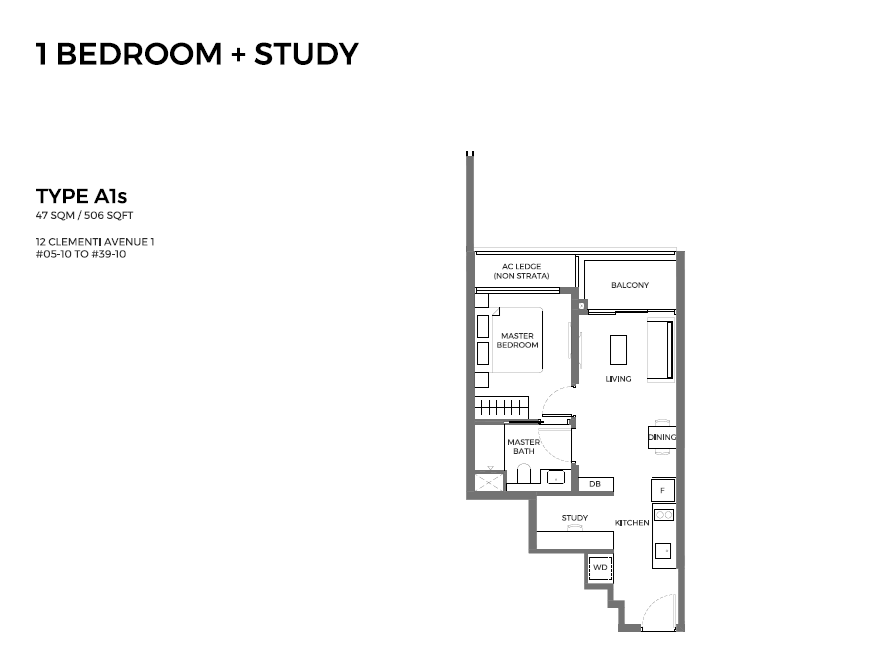

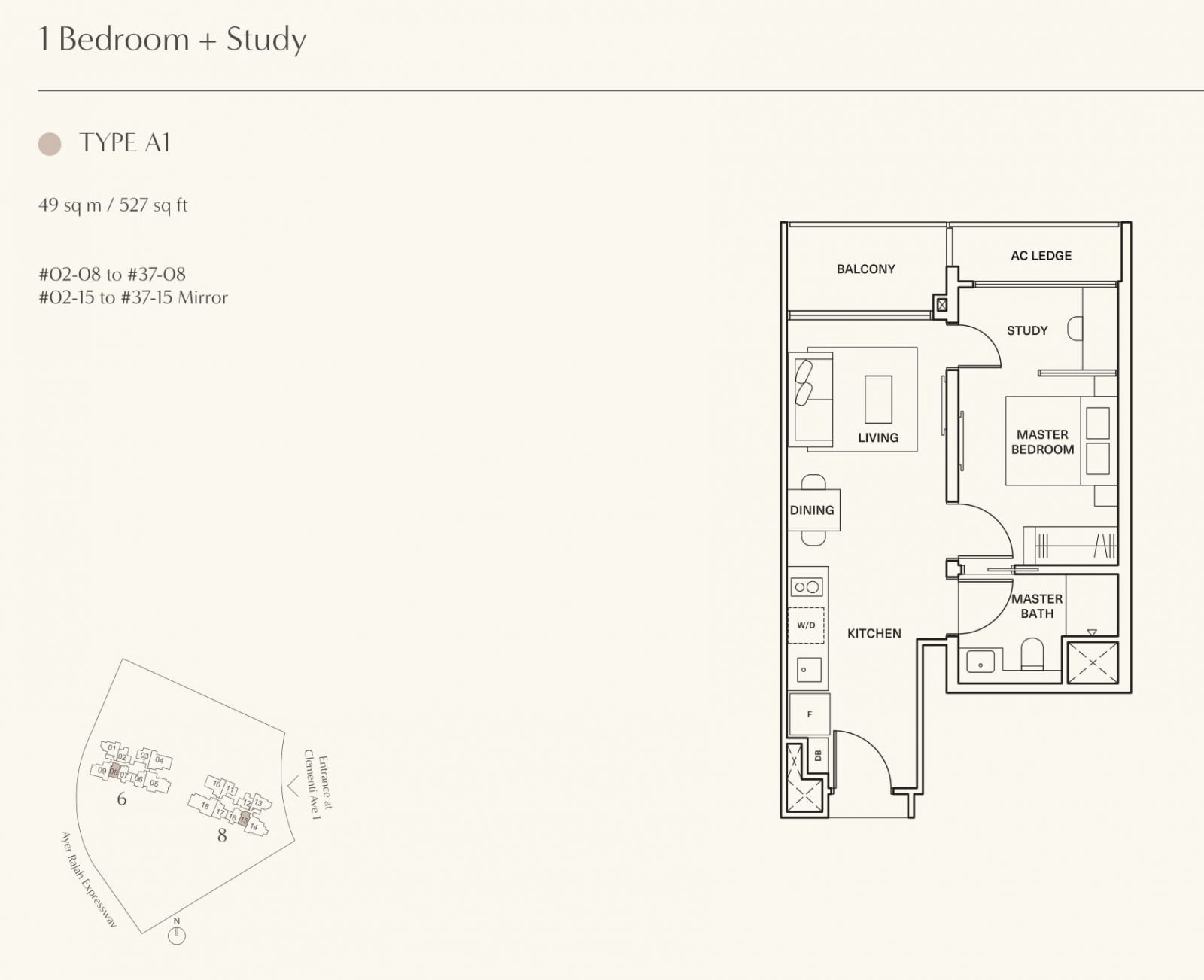

1-bedroom + Study

ELTA – 506 sqft

Clavon – 527 sq ft

Both Clavon and ELTA have fairly similar layouts, though Clavon’s units are slightly larger. However, much of this extra space comes from the AC ledge, meaning the actual liveable space may not differ significantly.

One key difference is the study area—in Clavon, it is accessible from the bedroom, offering added flexibility for use as an extended bedroom space or workspace. In contrast, ELTA’s layout does not have this feature.

Additionally, Clavon’s unit design is more efficient, with no awkward corners or wasted space. In comparison, ELTA has a small wall protrusion near the DB (distribution board), which slightly cuts into the walkway and may affect the overall flow of the unit.

Assuming a 10% developer’s profit for ELTA, the 1-Bedroom + Study in ELTA is estimated to be 14% more expensive than the same unit type in Clavon. In terms of overall quantum, this translates to a price difference of approximately $150,000.

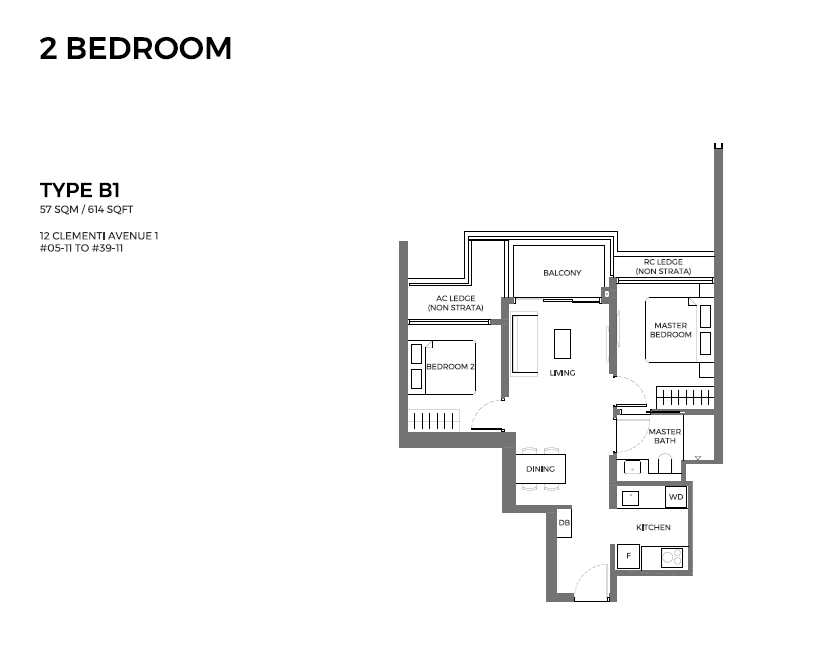

2-bedroom (1 Bath)

ELTA – 614 sq ft

Clavon – 678 sq ft

Both ELTA and Clavon feature a dumbbell layout for their 2 Bedroom, 1 Bath (2B1B) units, ensuring efficient use of space with minimal corridor wastage. Additionally, their kitchens are tucked into a corner, allowing for easy enclosure if preferred.

ELTA’s 2B1B unit is 6 sqm smaller than Clavon’s, but this difference includes AC and RC ledges, meaning the actual space may not be significantly different.

A key distinction lies in the living and dining area layouts. ELTA offers clear segregation between the living and dining spaces, creating better-defined functional areas. Clavon, in contrast, has a more open layout, where the living and dining spaces blend together.

More from Stacked

Why This 24-Year-Old Condo Outperformed Its Newer Neighbours In Singapore

Rio Vista, a 99-year leasehold condominium along Upper Serangoon View in District 19, defied expectations to become a top performer…

Another small difference is in the entryway design. ELTA’s units have minor wall protrusions, forming a tiny foyer area upon entry. Clavon’s units open directly into the dining area, providing a more immediate sense of space.

Assuming a 10% developer’s profit for ELTA, its 2B1B units are estimated to be 11% more expensive than Clavon’s. In absolute quantum, this translates to approximately $146,000.

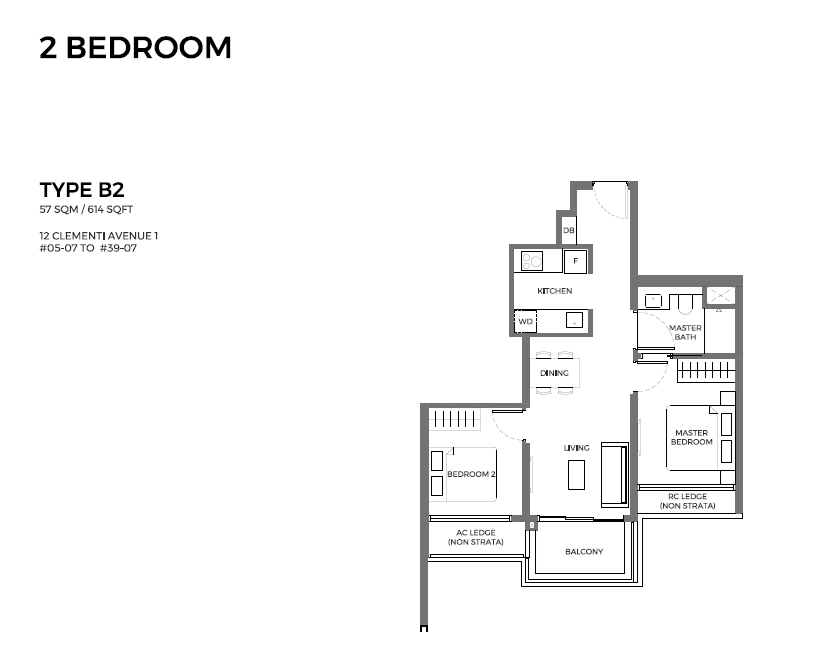

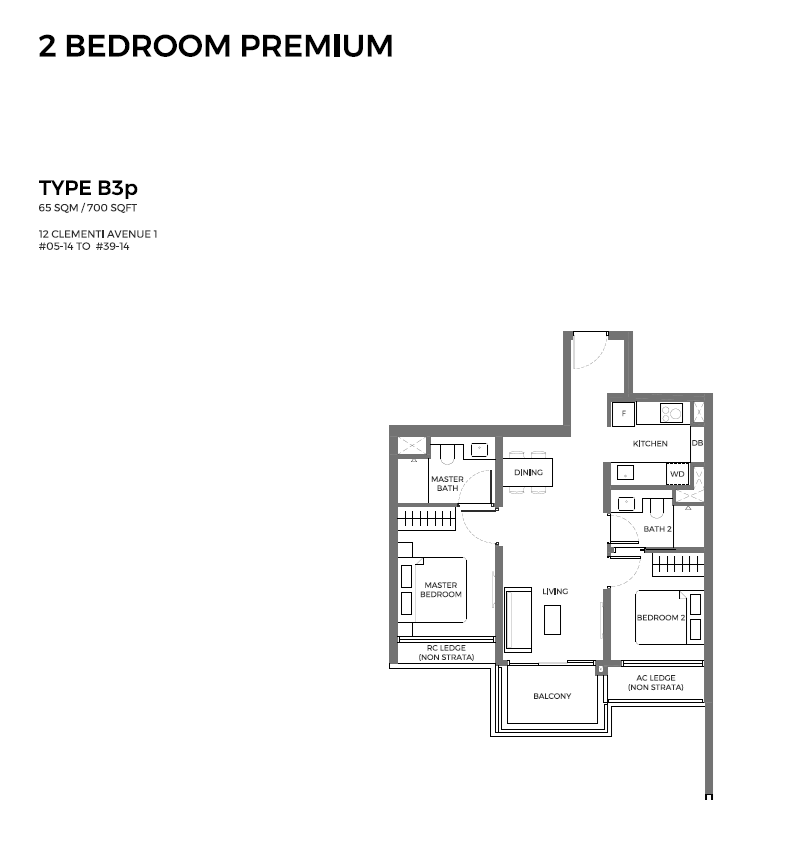

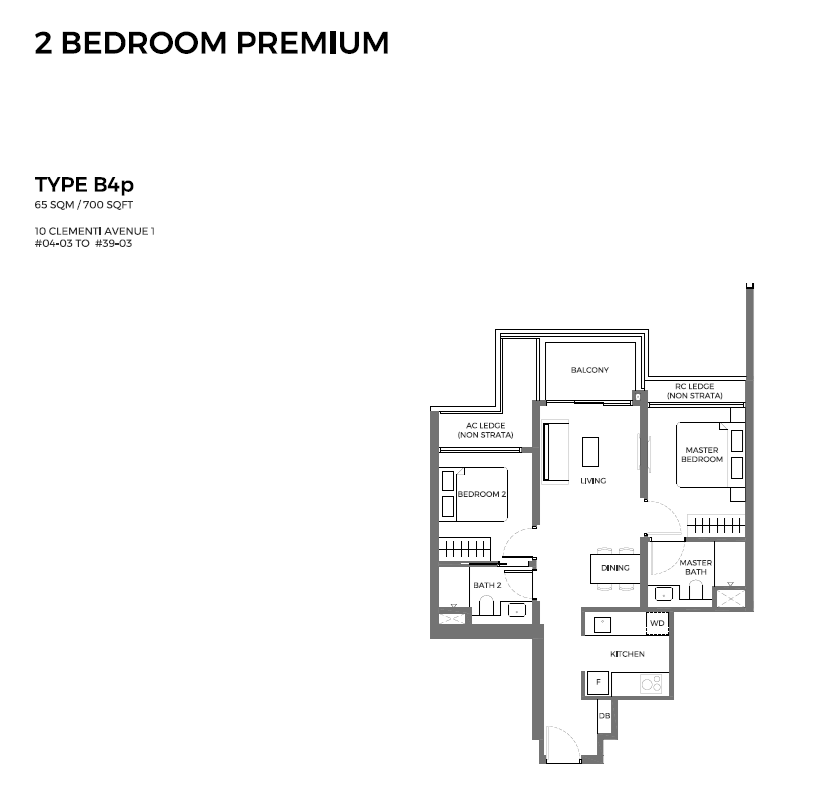

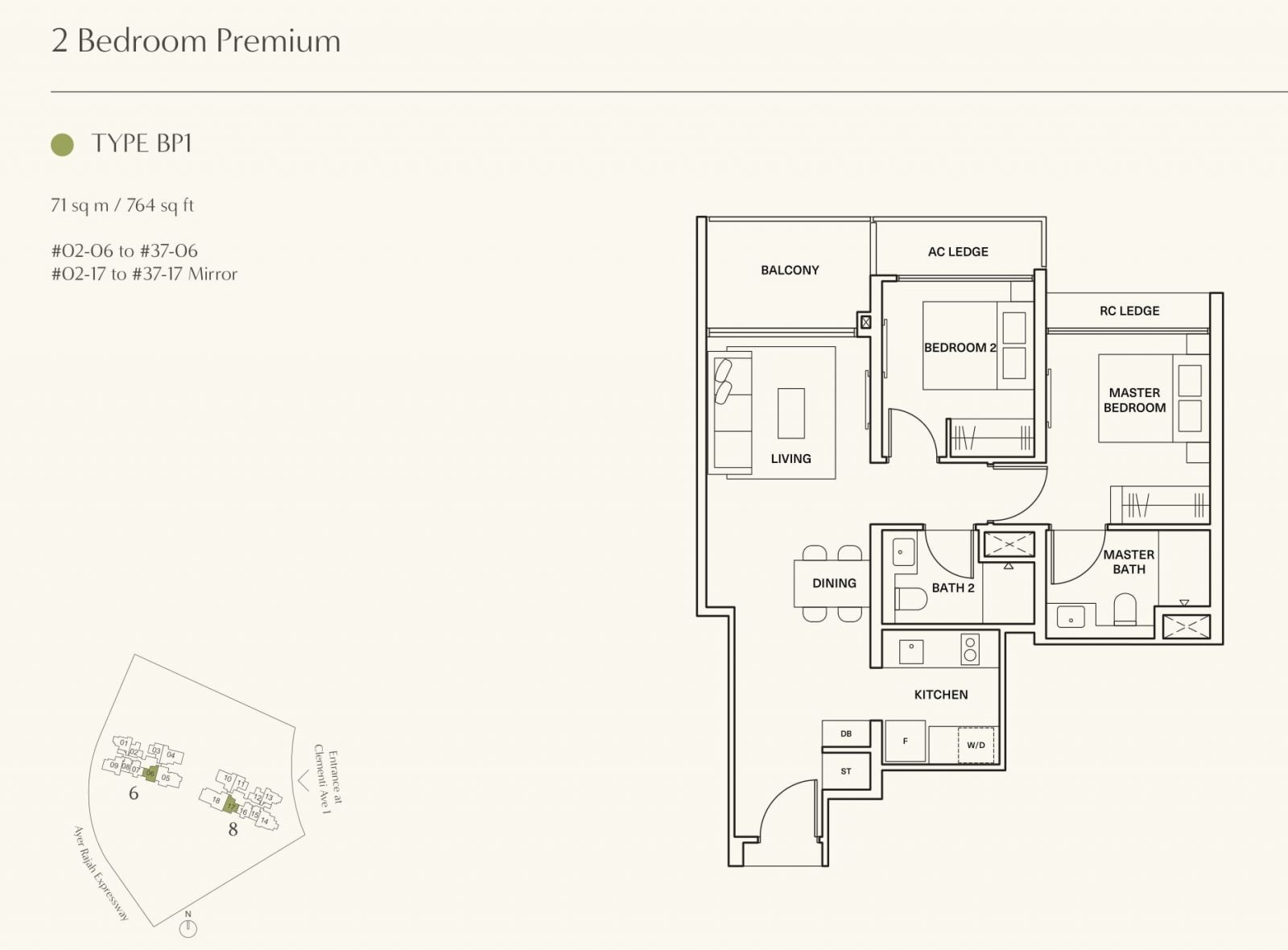

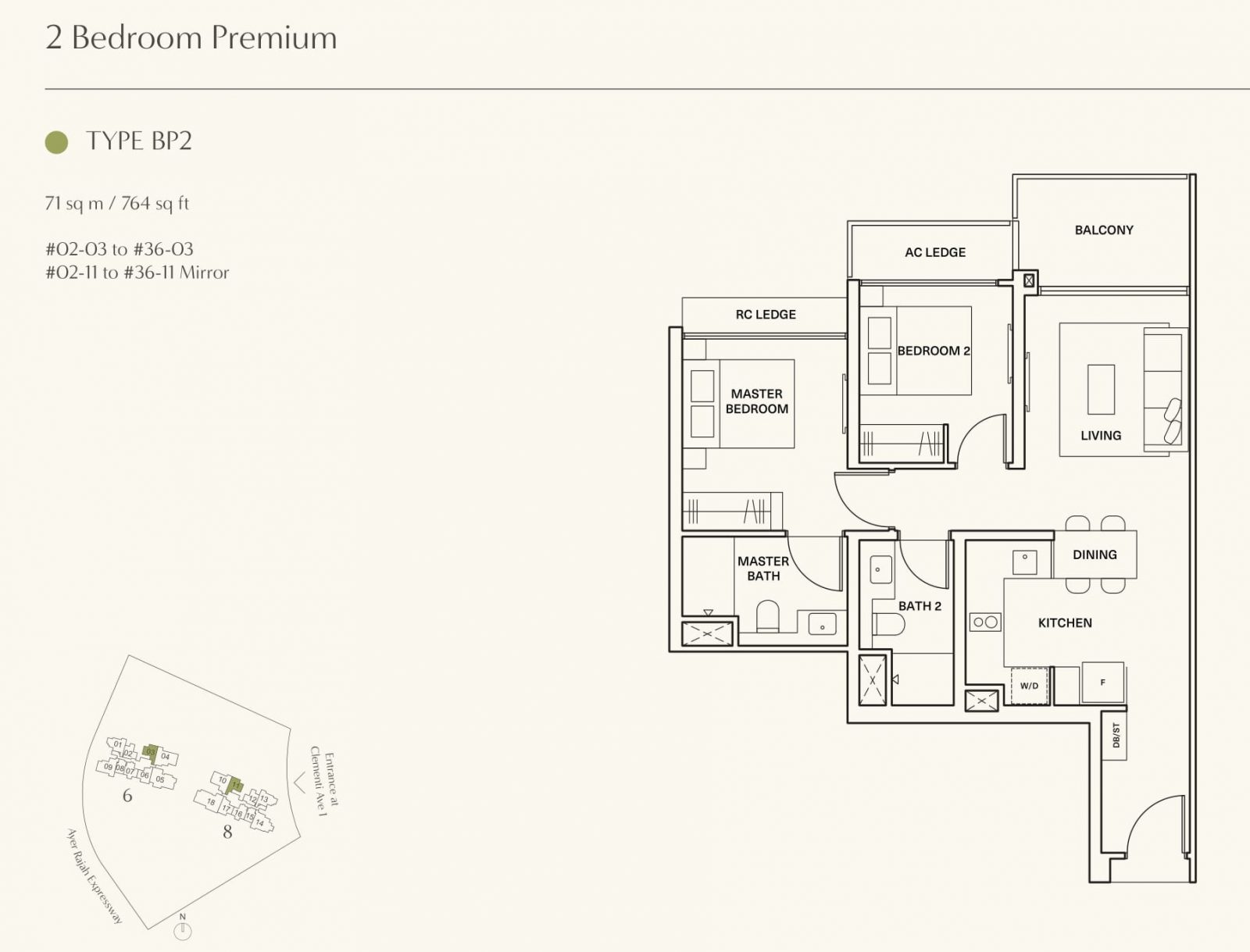

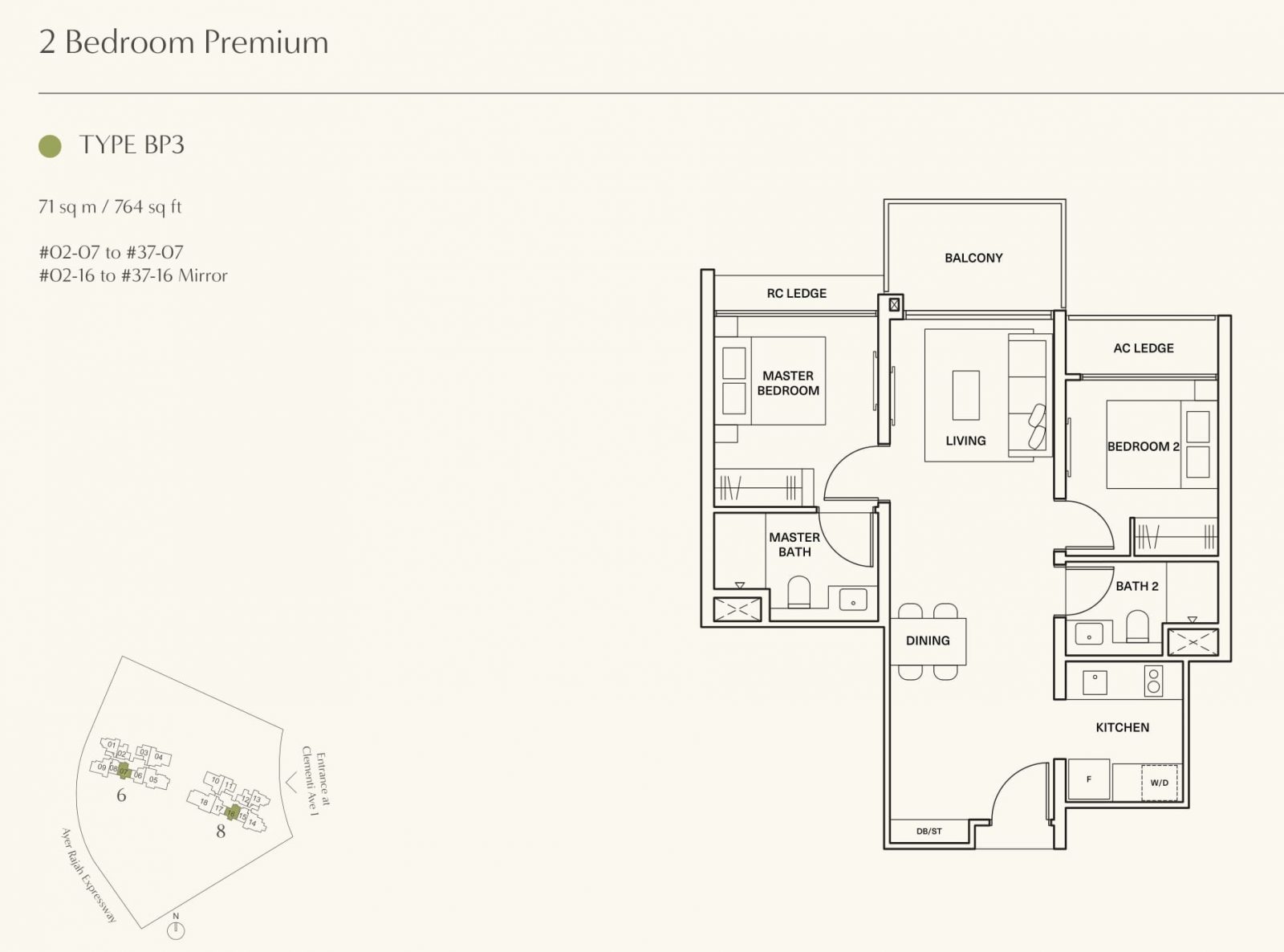

2-bedroom (2 Bath)

ELTA – 700 sqft

Clavon – 764 sq ft

ELTA’s 2 Bedroom, 2 Bath (2B2B) units feature a dumbbell layout, which is known for its efficient use of space since it eliminates walkways to the bedrooms. Clavon, on the other hand, offers three layout variations, including a dumbbell design, giving buyers more options.

For both developments, the kitchens are tucked in a corner, allowing the possibility of enclosing the space if desired.

In terms of overall size, Clavon’s 2B2B unit is 6 sqm larger than ELTA’s, but this difference includes the AC and RC ledge. When factoring out these spaces, the actual interior size difference is minimal.

Both developments provide well-defined living and dining areas. In ELTA’s units, wall protrusions create a small foyer space upon entry, adding a sense of separation between the entrance and the living/dining space.

In comparison, Clavon’s dumbbell layout feels more open as the main door directly leads into the living and dining areas, without any interruptions. This may create a more spacious feel.

Assuming a 10% developer’s profit for ELTA, its 2B2B units are estimated to cost close to 9% more than Clavon’s. In terms of overall quantum, this price difference translates to approximately $133,000 more.

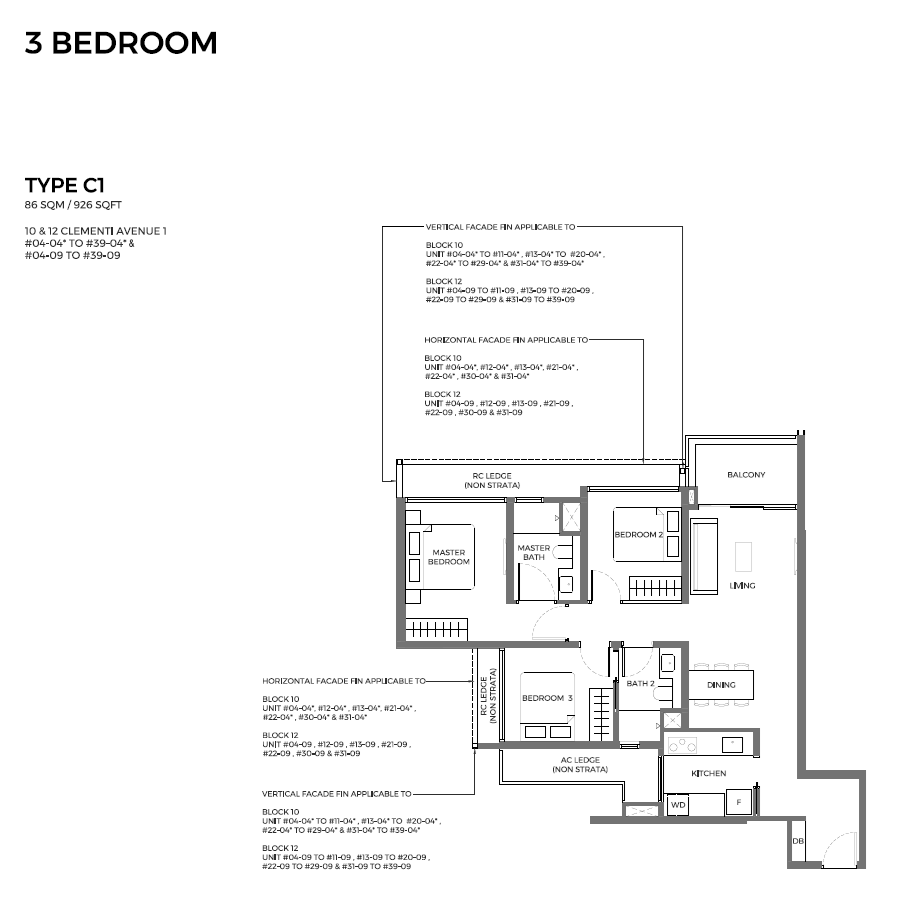

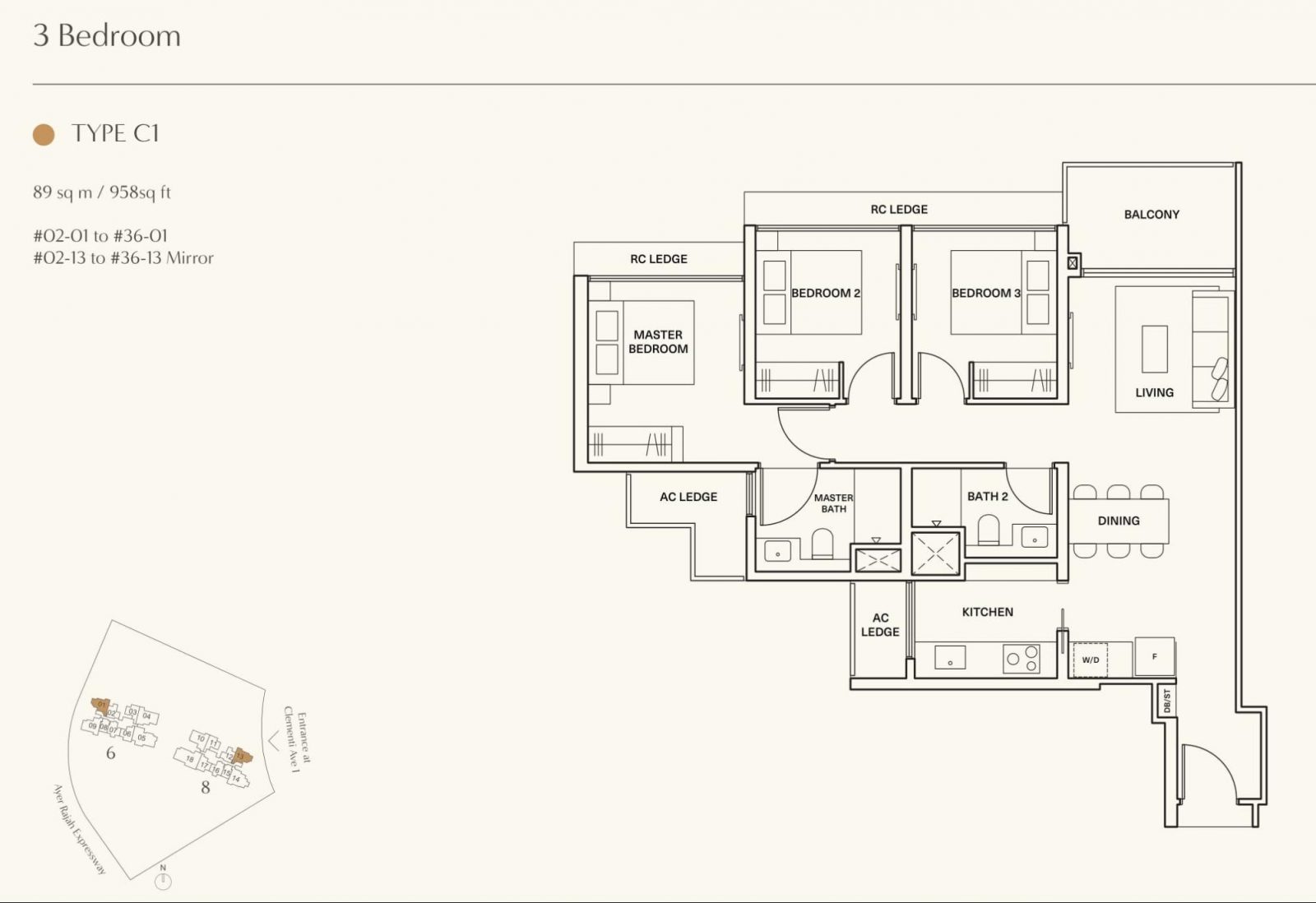

3-bedroom

ELTA – 926 sq ft

Clavon – 958 sq ft

Clavon’s 3-bedroom unit is approximately 3 sqm larger than ELTA’s, but this includes AC and RC ledges, of which there are four in total. As a result, the actual space between the two may not differ significantly.

At first glance, both layouts may seem quite similar, but certain small design differences can have a notable impact on the living experience.

ELTA’s layout provides a bit more privacy for those who prefer to keep their doors open. This is because the layout opens up into a foyer area that is sectioned off from the main living space. In Clavon, while there is also a foyer, it is aligned with the dining and living areas, offering a more open flow from the entryway.

Both developments feature well-segregated living and dining spaces, but Clavon’s layout may feel more spacious due to its kitchen being tucked into a corner, which creates more open space on both sides of the living and dining areas. In contrast, ELTA’s kitchen juts out, creating a nook where the dining area sits, which may slightly limit the perception of space.

Assuming a 10% developer’s profit for ELTA, its 3-bedroom unit is estimated to be 8% more expensive than Clavon’s. In terms of overall quantum, this difference amounts to approximately $167,000 more.

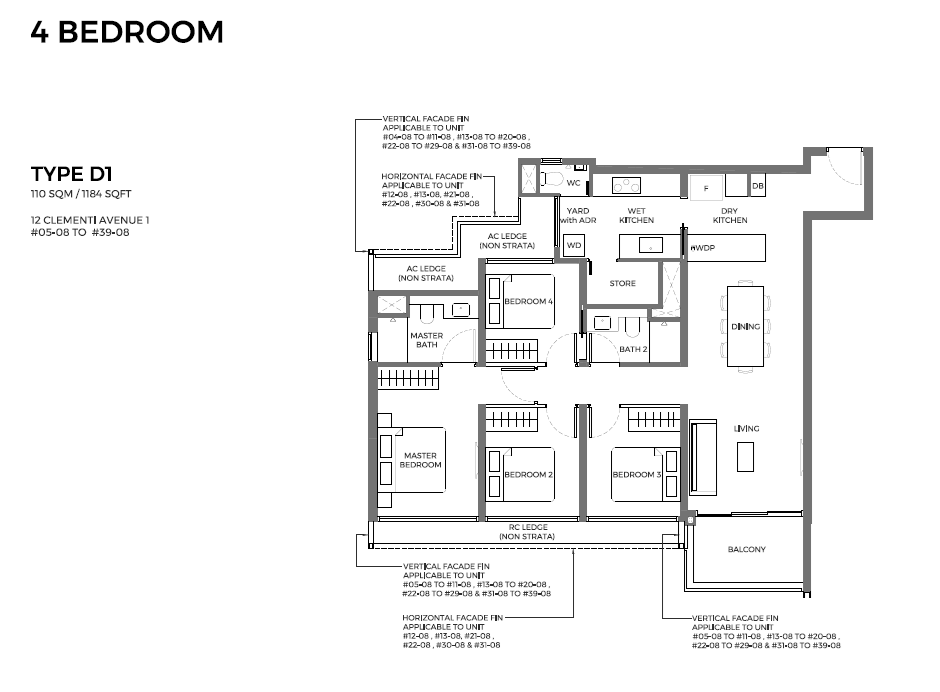

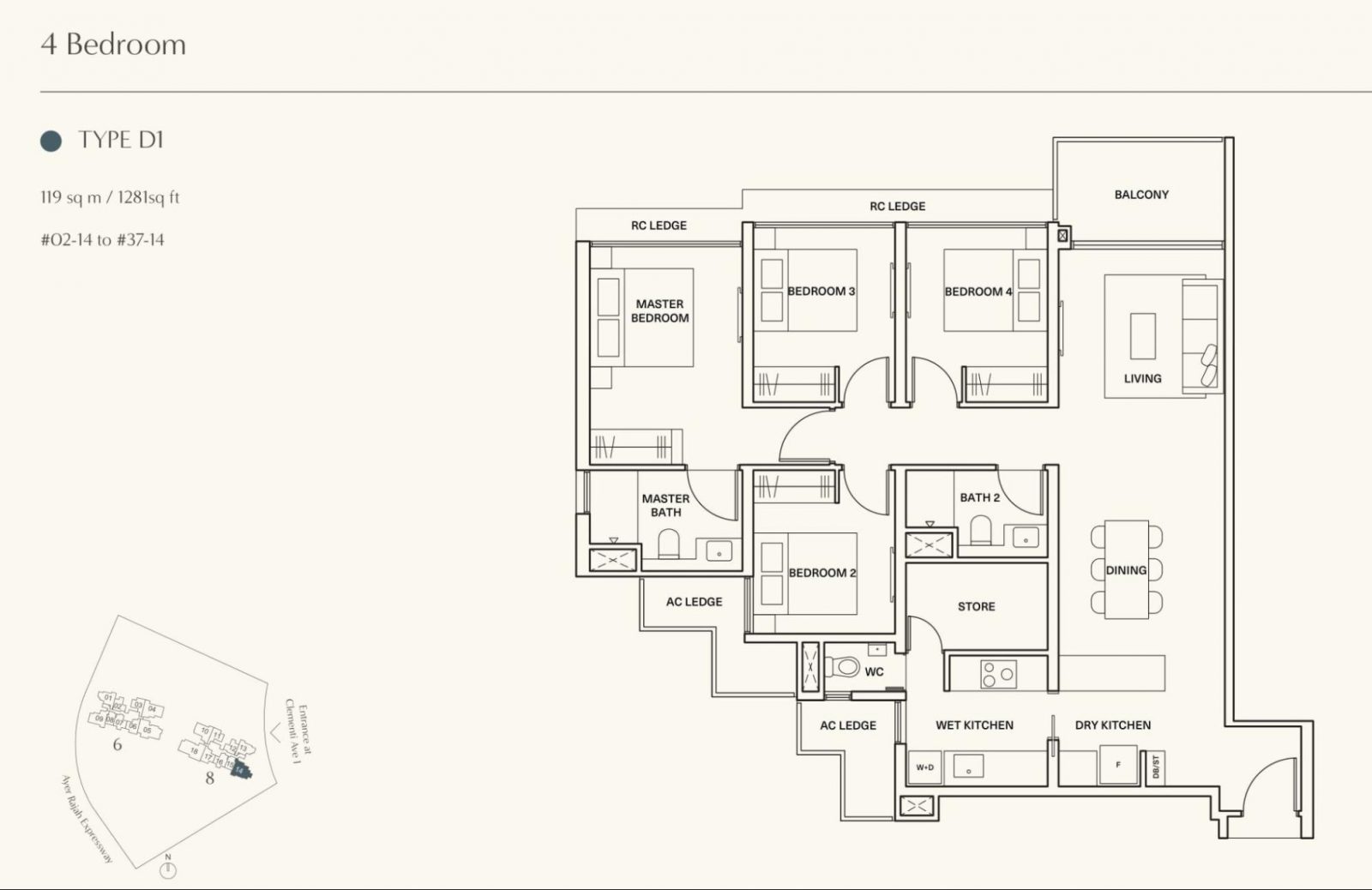

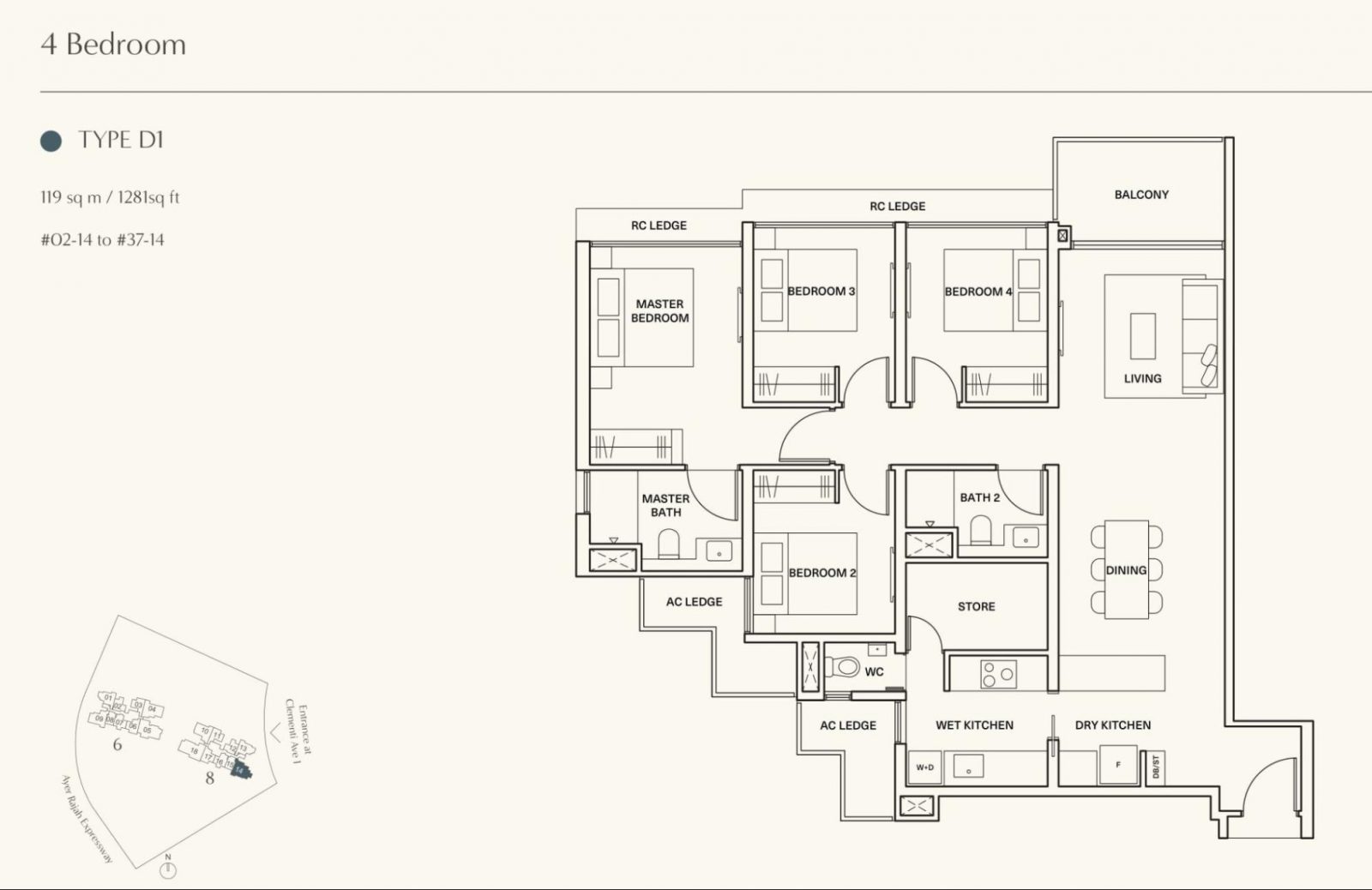

4-bedroom

ELTA – 1184/1313 sqft

Clavon – 1281 sq ft

ELTA’s smaller 4-bedroom unit (1,184 sq ft) comes in 2 layouts and is 9 sqm smaller than Clavon’s. However, when considering the AC and RC ledges at Clavon, the actual interior space of the two units may be comparable.

The two layouts are nearly identical, with a few key differences.

ELTA’s unit has a small yard space in the kitchen, which includes an automated drying rack, adding convenience for homeowners. Additionally, ELTA’s common bathroom is equipped with Jack-and-Jill doors, providing access from Bedroom 4, effectively making it a second en-suite bedroom.

Both units feature 4 well-sized bedrooms, a generously sized dining area that is separated from the living area, wet and dry kitchens, a store room and WC, and also a foyer space that is sectioned off from the living area, enhancing privacy.

Assuming a 10% developer’s profit margin for ELTA, the 1,184 sq ft 4-bedroom unit in ELTA will cost around 8.5% more than the unit at Clavon, which equates to approximately $220,000 more in overall quantum.

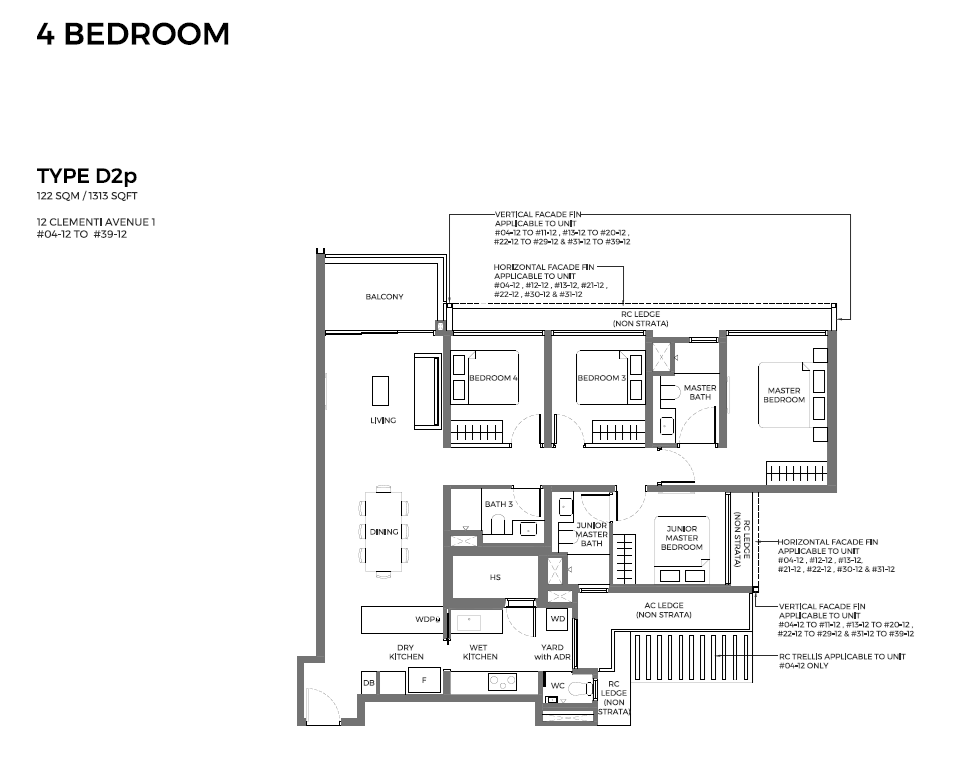

As for ELTA’s larger 4-bedroom unit (1313 sqft), it is 3 sqm bigger than Clavon’s. It’s important to note that Clavon’s unit size includes the AC and RC ledges, so ELTA’s interior space will be substantially larger.

Most of the layout is similar to the smaller one, but this layout features a master bedroom and junior master bedroom, and a third common bathroom. Additionally, the store in the kitchen is replaced by a home shelter.

Assuming a 10% developer’s profit margin for ELTA, the larger 4-bedroom unit will cost around 20.34% more than a unit at Clavon, translating to approximately $526,000 more in overall quantum.

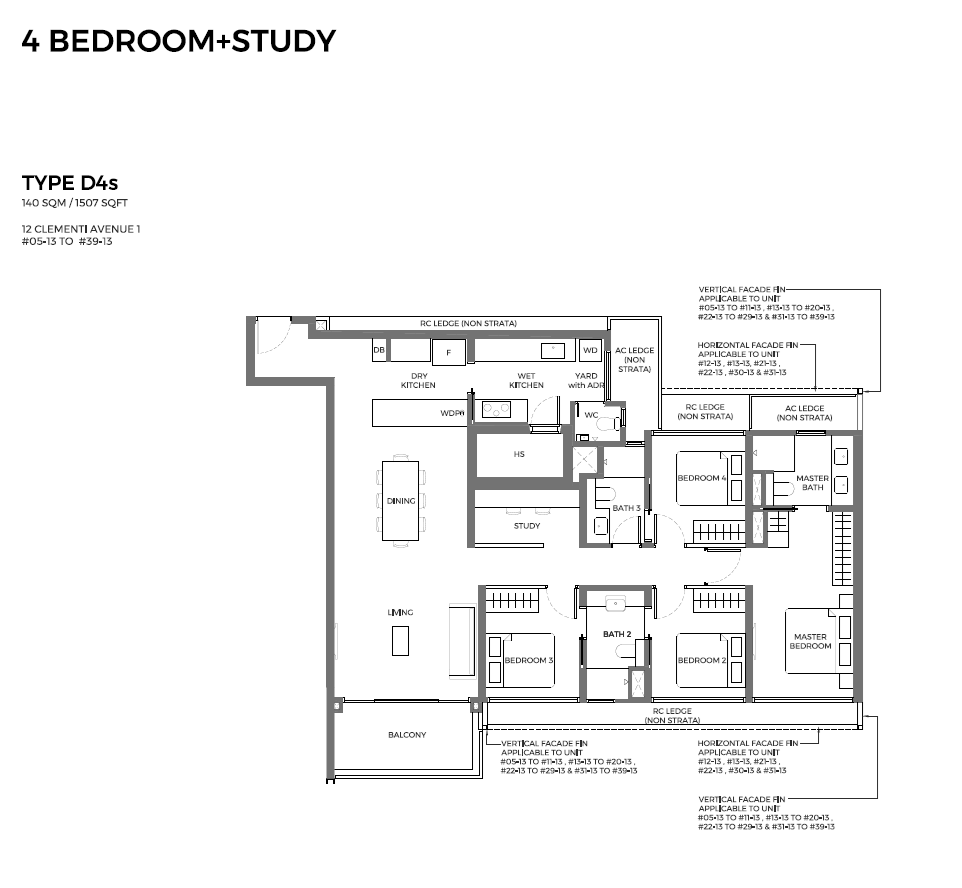

4-bedroom + Study

ELTA – 1,507 sq ft

Clavon – 1,356 sq ft

ELTA’s 4-bedroom + Study unit is 14 sqm larger than Clavon’s, and this difference includes Clavon’s AC and RC ledges. As a result, the actual interior space of Clavon is significantly smaller than ELTA’s.

There are several notable differences in the layouts.

ELTA’s layout provides more privacy as it opens up into a foyer space that is sectioned off from the living area. In contrast, Clavon’s main door opens directly into the dining and living areas, creating a more open-flow layout.

ELTA’s unit has 3 bathrooms (2 common and 1 master), and both common bathrooms feature Jack-and-Jill doors, effectively making all 3 common bedrooms ensuite. Clavon’s unit, on the other hand, only has 2 bathrooms (1 common and 1 master), with no Jack-and-Jill access, meaning none of the common bedrooms have direct access to a bathroom.

ELTA’s master bedroom is designed with space to create a walk-in closet, and its bathroom features a double vanity. Its kitchen is equipped with a small yard space that includes an automated drying rack, adding functionality.

Clavon’s store is accessible from the walkway leading to the bedrooms and is connected to the WC in the kitchen. This space could potentially serve as a helper’s room. In ELTA, instead of a store, there is a home shelter in the kitchen area, which could serve different purposes, such as storage for the household.

Assuming a 10% developer’s profit margin for ELTA, the 4-bedroom + Study unit would cost around 22% more than Clavon, which equates to approximately $650,000 in overall quantum.

While ELTA’s layout offers additional features such as an extra bathroom, all ensuite bedrooms, and more privacy, the difference of over half a million in quantum may be a significant consideration for potential buyers.

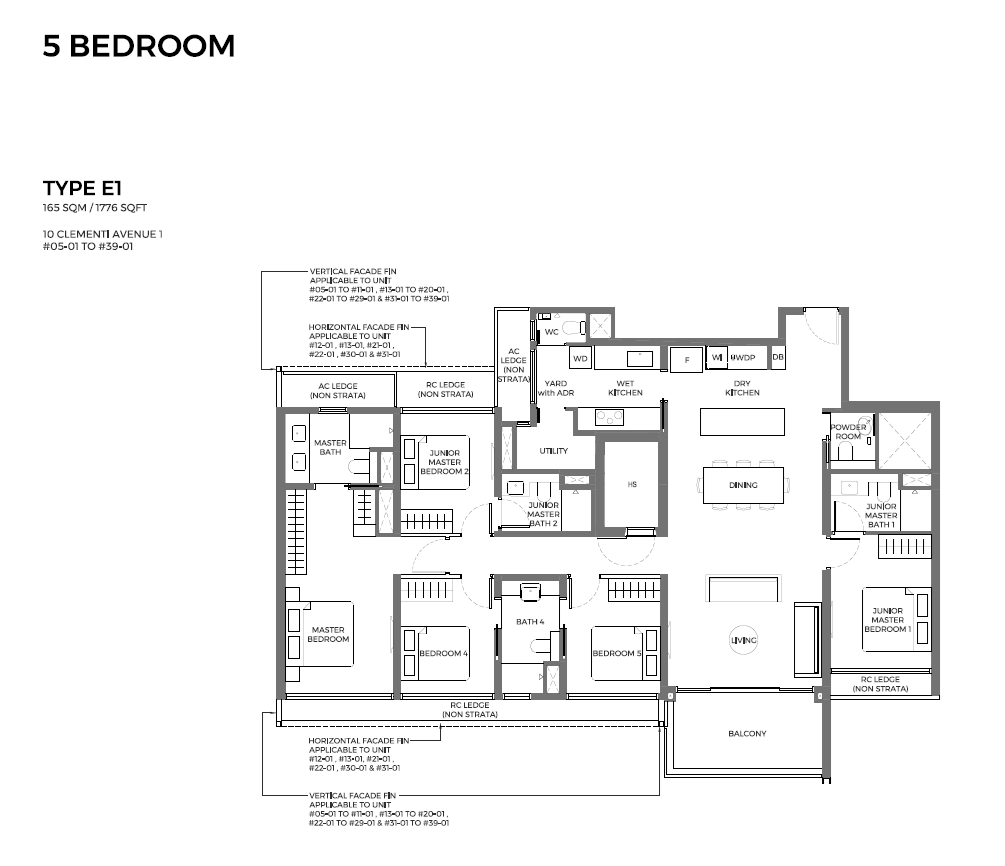

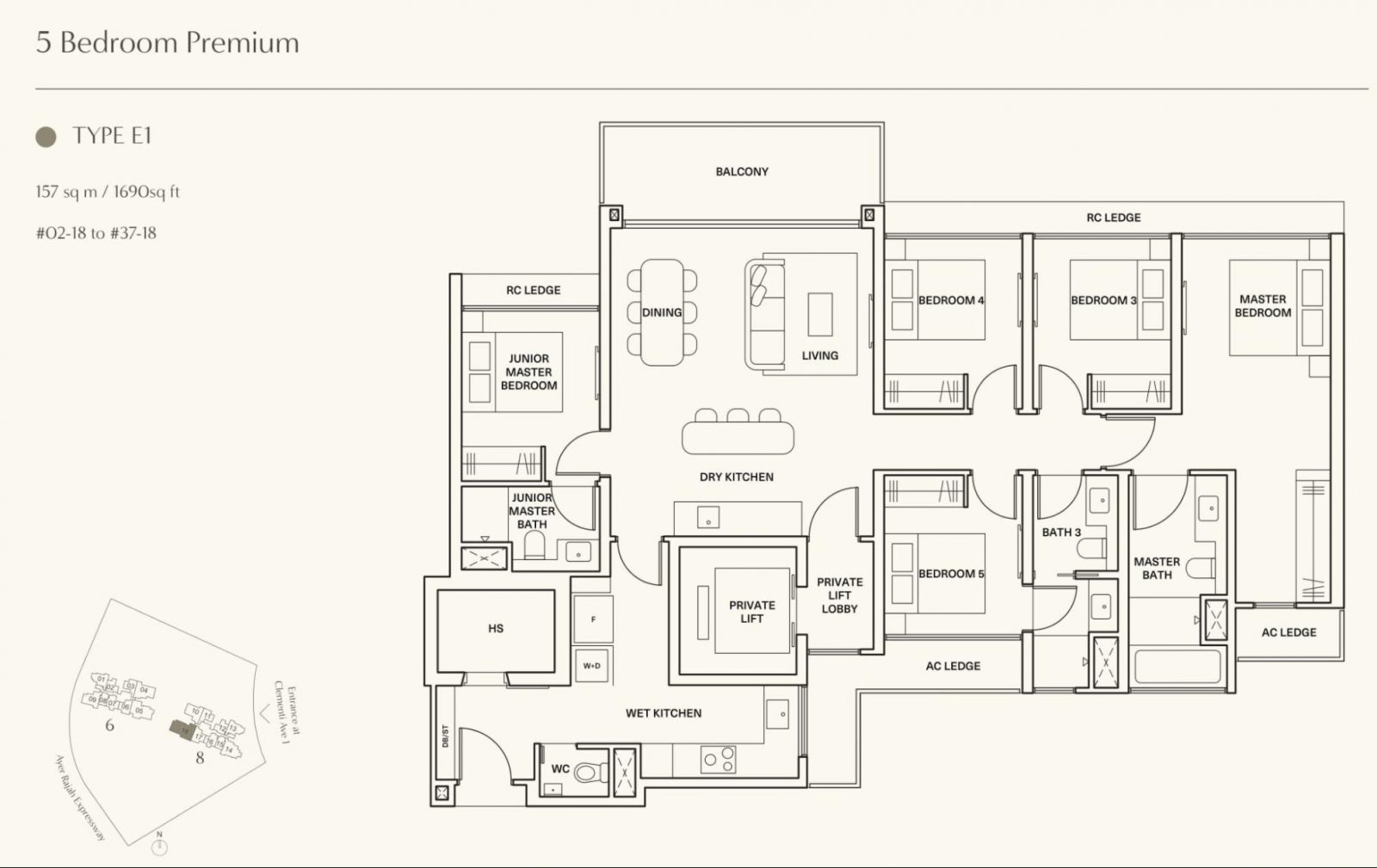

5-bedroom

ELTA – 1,776 sq ft

Clavon – 1,690 sq ft

ELTA’s 5-bedroom units are 8 sqm larger than Clavon’s, and Clavon’s square footage includes its AC and RC ledges. This means that ELTA’s units offer substantially more interior space.

Here’s a breakdown of the key differences between the two floorplans.

All 5 bedrooms in ELTA are en-suite, providing greater convenience and privacy. The layout features a master bedroom, 2 junior master bedrooms, and 2 common bedrooms, both with Jack-and-Jill entries for direct access to a shared bathroom. Elta also has a powder room, which is perfect when having guests over.

The living and dining areas are generously sized and nicely segregated.

The kitchen is split into wet and dry areas for better functionality and also includes a yard, WC, and a ventilated utility room that could be used as a helper’s room. There’s a home shelter located along the walkway to the bedrooms, adding extra storage or utility space.

The master bedroom is spacious enough to accommodate a walk-in closet, and the master bath comes with a double vanity.

Clavon’s 5-bedroom unit comes with a private lift that provides additional privacy and exclusivity.

Of the 5 bedrooms, 3 are en-suite, and the master bathroom is spacious enough to fit a bathtub for added comfort. Like ELTA, the master bedroom layout also allows for a walk-in closet.

The living and dining areas share the same space, but the large balcony provides the potential for an alfresco dining area, freeing up more interior space for the living room.

The kitchen is split into wet and dry areas, with the wet kitchen being larger compared to ELTA’s. The home shelter is positioned in the kitchen area, and there is also a WC and back door.

Currently, no 5-bedroom units have been sold on the secondary market in Clavon. However, based on the average $PSF of the 4-bedroom + Study at $2,157 and a size of 1,690 sq ft, the estimated price of the 5-bedroom unit in Clavon could be around $3,645,000.

If this is the case, the 5-bedroom unit at ELTA would cost around 16% more, which translates to approximately $568,000.

While both units offer substantial living space and luxury features, ELTA’s layout may offer more functionality considering that all 5 bedrooms are en-suite, and there is an additional powder room and ventilated utility room. However, as with the 4-bedroom + Study, the difference of over half a million in quantum may be a significant consideration for potential buyers.

Now that we have a better idea of the differences in layouts and pricing compared to its competitors, let’s move on to the next point on potential HDB upgraders in the area.

HDB upgraders

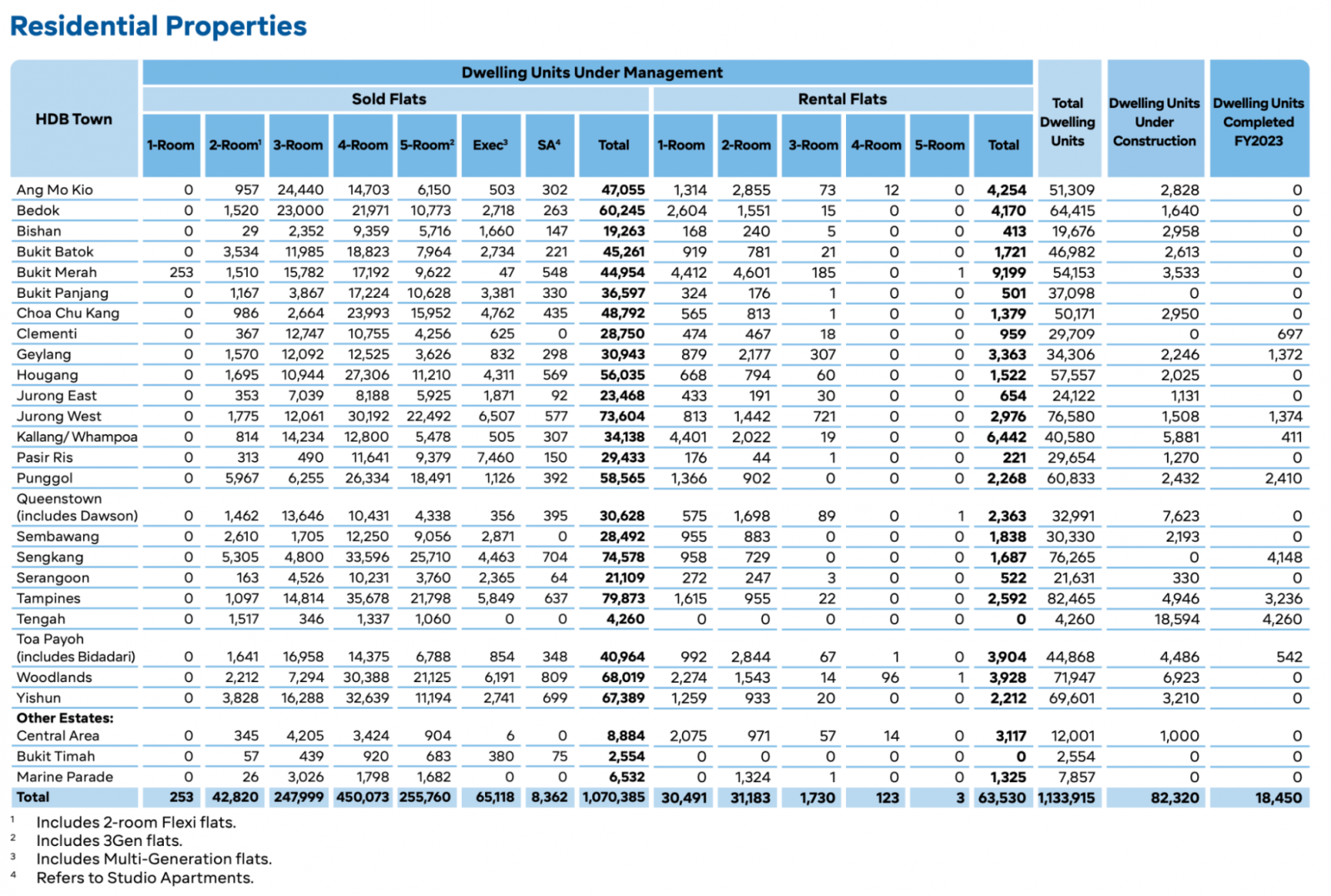

This is the supply of HDB flats in the various HDB towns based on HDB’s annual report for the FY 2023/2024:

While Clementi may not be the largest HDB town, its position as a mature estate with well-established amenities, schools, and transport links makes it a highly sought-after location for both owner-occupiers and investors.

The area benefits from proximity to reputable schools (e.g., Nan Hua Primary School, NUS High, Pei Tong Primary School), tertiary institutions (Ngee Ann Polytechnic, NUS, SIM, SUSS), and employment hubs such as One-North and Science Park.

Beyond that, Clementi is well-served by a range of amenities and recreational facilities, with good transport connectivity via public transportation or major expressways.

While some estates see sharper fluctuations in price performance depending on investor sentiment, Clementi has a healthy mix of families, upgraders, and investors, providing stability to the market. The rental demand from students and professionals working in nearby business hubs also supports property values.

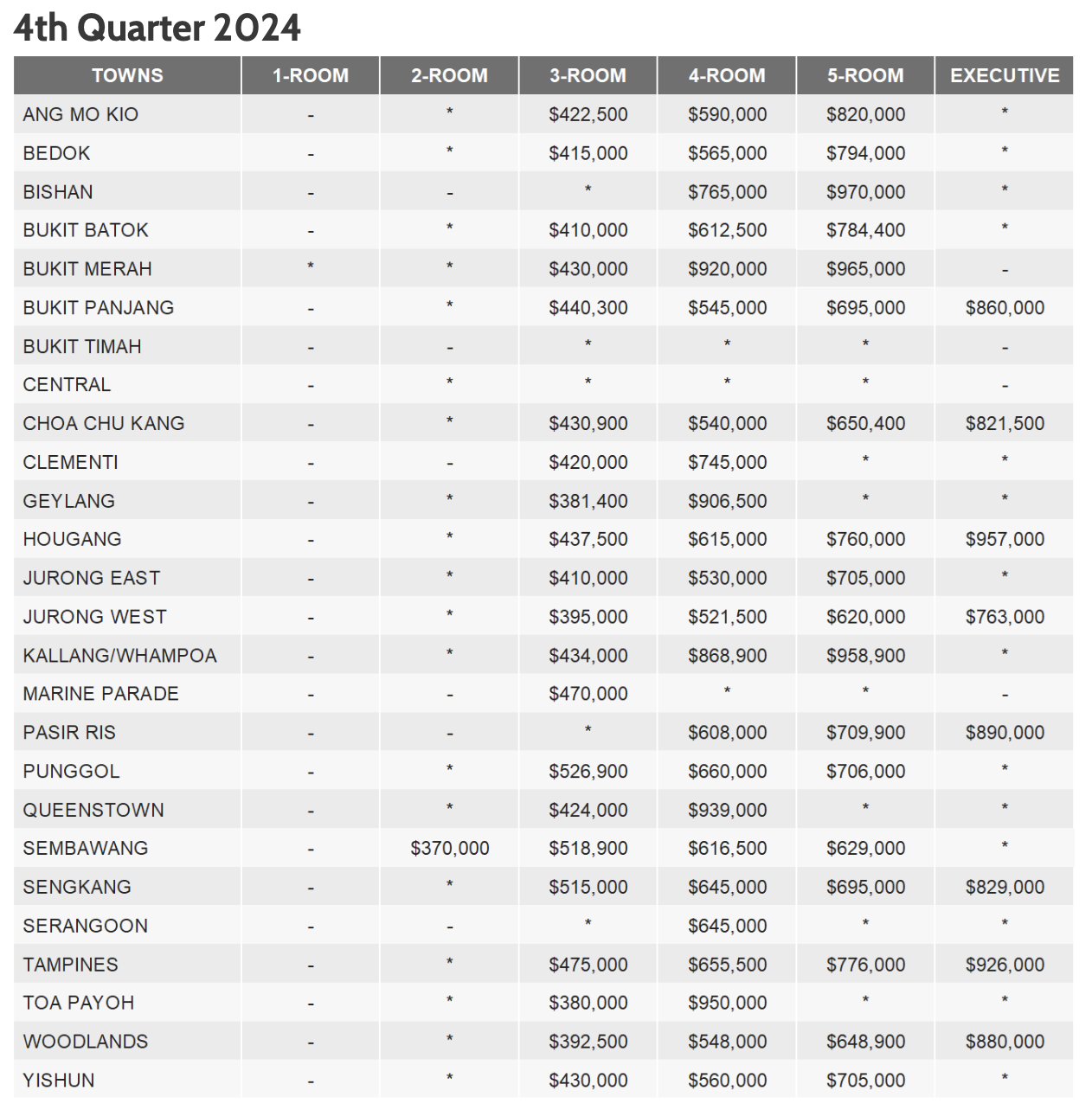

Based on HDB’s Q3 and Q4 2024 resale statistics, Clementi stands out as the HDB town in the western region with the highest median resale prices across all unit types.

In the following table, we will look at the buyer profiles in District 05 based on private property transactions done over the last five years.

| Previous address before purchase | |||||

| Project | HDB | Unknown | Private | Grand Total | % Of HDB Upgraders |

| Blue Horizon | 59 | 1 | 72 | 132 | 44.70% |

| Botannia | 33 | 66 | 99 | 33.33% | |

| Carabelle | 27 | 1 | 41 | 69 | 39.13% |

| Clavon | 281 | 138 | 295 | 714 | 39.36% |

| Clementi Park | 16 | 75 | 91 | 17.58% | |

| Clementiwoods Condominium | 19 | 45 | 64 | 29.69% | |

| Faber Crest | 22 | 46 | 68 | 32.35% | |

| Faber Hills | 7 | 1 | 34 | 42 | 16.67% |

| Freesia Woods | 4 | 11 | 15 | 26.67% | |

| Hundred Trees | 27 | 1 | 43 | 71 | 38.03% |

| Ki Residences At Brookvale | 177 | 177 | 330 | 684 | 25.88% |

| Monterey Park Condominium | 13 | 26 | 39 | 33.33% | |

| Newest | 10 | 26 | 36 | 27.78% | |

| Parc Clematis | 723 | 234 | 701 | 1658 | 43.61% |

| Parc Riviera | 157 | 2 | 129 | 288 | 54.51% |

| Pasir Panjang Gardens | 4 | 9 | 13 | 30.77% | |

| Regent Park | 25 | 2 | 34 | 61 | 40.98% |

| Seahill | 51 | 74 | 125 | 40.80% | |

| The Clement Canopy | 65 | 63 | 128 | 50.78% | |

| The Clementvale | 1 | 10 | 11 | 9.09% | |

| The Infiniti | 24 | 38 | 62 | 38.71% | |

| The Parc Condominium | 38 | 74 | 112 | 33.93% | |

| The Sorrento | 7 | 20 | 27 | 25.93% | |

| The Stellar | 7 | 22 | 29 | 24.14% | |

| The Trilinq | 114 | 109 | 223 | 51.12% | |

| The Vision | 35 | 46 | 81 | 43.21% | |

| Twin Vew | 75 | 14 | 87 | 176 | 42.61% |

| Varsity Park Condominium | 11 | 75 | 86 | 12.79% | |

| Waterfront @ Faber | 14 | 41 | 55 | 25.45% | |

| West Bay Condominium | 25 | 1 | 45 | 71 | 35.21% |

| West Coast Gardens | 6 | 48 | 54 | 11.11% | |

| Westcove Condominium | 14 | 32 | 46 | 30.43% | |

| Whistler Grand | 315 | 74 | 252 | 641 | 49.14% |

| Total | 2406 | 646 | 3019 | 6071 | 33.30% |

Over the 5 years, around 33% of private property buyers in District 05 were HDB upgraders. For the three projects previously compared to ELTA, the proportion of HDB upgraders ranged from 39% to almost 51%—a considerable figure.

Next, let’s examine the potential affordability of HDB upgraders in the area.

Clementi Cascadia (SERS February 2011 – SBF May 2015)

| Unit type | Indicative price range | Median price |

| 3-room | $362,300 – $398,100 | $380,200 |

| 4-room | $516,300 – $588,500 | $552,400 |

| 5-room | $606,400 – $660,500 | $633,450 |

Resale transactions in the last 6 months

| Date sold | Block | Street | Level | Resale price | Average gains (resale price – median purchase price) |

| 3-room | |||||

| Nov 2024 | 440B | Clementi Ave 3 | 16 to 18 | $775,000 | $333,779 |

| Oct 2024 | 440A | Clementi Ave 3 | 22 to 24 | $840,000 | |

| Aug 2024 | 440A | Clementi Ave 3 | 10 to 12 | $780,188 | |

| 4-room | |||||

| Jan 2025 | 440B | Clementi Ave 3 | 10 to 12 | $1,100,000 | $547,600 |

| 5-room | |||||

| Jan 2025 | 440C | Clementi Ave 3 | 28 to 30 | $1,400,000 | $766,550 |

Clementi Gateway (Launched in July 2012)

| Unit type | Indicative price range | Median price |

| 3-room | $301,000 – 351,000 | $326,000 |

| 4-room | $430,000 – 514,000 | $472,000 |

Resale transactions in the last 6 months

| Date sold | Block | Street | Level | Resale price | Average gains (resale price – median purchase price) |

| 3-room | |||||

| Dec 2024 | 208A | Clementi Ave 6 | 25 to 27 | $696,000 | $352,667 |

| Nov 2024 | 208B | Clementi Ave 6 | 22 to 24 | $650,000 | |

| Oct 2024 | 208B | Clementi Ave 6 | 37 to 39 | $690,000 | |

| 4-room | |||||

| Aug 2024 | 208B | Clementi Ave 6 | 04 to 06 | $800,000 | $406,963 |

| Aug 2024 | 208A | Clementi Ave 6 | 16 to 18 | $930,000 | |

| Aug 2024 | 208A | Clementi Ave 6 | 10 to 12 | $906,888 | |

Estimated down payment required for the various unit types in ELTA

| Unit Type | Price based on 10% developer’s profit margin | 25% down payment** |

| 1BR + Study | $1,200,232 | $300,058 |

| 2BR (1 Bath) | $1,456,408 | $364,102 |

| 2BR (2 Bath) | $1,660,400 | $415,100 |

| 2BR + Study | $1,914,204 | $478,551 |

| 3BR | $2,196,472 | $549,118 |

| 3BR Premium | $2,426,556 | $606,639 |

| 4BR | $2,808,448 | $702,112 |

| 4BR + Study | $3,574,604 | $893,651 |

| 4BR Dual Key | $3,114,436 | $778,609 |

| 5BR | $4,212,672 | $1,053,168 |

**Does not include other payables like Buyer’s Stamp Duty and legal fees

Looking at the estimated gains from Clementi Cascadia and Clementi Gateway—two of the newest HDB clusters in Clementi—it appears feasible for owners of 3-room HDB flats to upgrade to a 2-bedroom unit at ELTA. Similarly, those with 4- or 5-room HDB flats could potentially upgrade to a 3-bedroom unit. However, upgrading to larger units such as the 4- or 5-bedroom options would require additional funds beyond the proceeds from selling their HDB flats.

With more HDB clusters, such as Clementi Peaks and Clementi NorthArc, reaching their Minimum Occupation Period (MOP) in the coming years, they will add to the pool of potential upgraders. This could further drive demand for private housing in the area.

Now, let’s consider the supply of private properties in the Clementi area.

Supply of private properties in Clementi

Although Clementi has a significant number of condominiums, a good number of them are situated in the West Coast area, which tends to attract a different buyer demographic compared to those located closer to the MRT station.

The West Coast condominiums often appeal to families and individuals looking for a more serene environment, whereas developments near Clementi MRT tend to attract buyers prioritising accessibility and convenience.

Given these differences, it may be more relevant to analyse the supply of condominiums within a 20-minute walking radius of Clementi MRT station. This will provide better insight into the competition and availability of private residential options for buyers who are looking to purchase a unit in ELTA’.

| Project | Tenure | Completion | Total number of units |

| Clavon | 99-years | 2024 | 640 |

| ELTA | 99-years | 2028 | 501 |

| Hundred Trees | 956-years | 2013 | 396 |

| NEWest | 956-years | 2016 | 136 |

| Parc Clematis | 99-years | 2023 | 1450 |

| Regent Park | 99-years | 1997 | 276 |

| The Clement Canopy | 99-years | 2019 | 505 |

| The Trilinq | 99-years | 2017 | 755 |

| Total | – | – | 4659 |

| Project | No. of 1-bedroom units | No. of 2-bedroom units | No. of 3-bedroom units | No. of 4-bedroom units | No. of 5-bedroom units | % of 1 and 2 bedders |

| Clavon | 72 | 284 | 141 | 107 | 36 | 55.63% |

| ELTA | 36 | 179 | 108 | 143 | 35 | 42.91% |

| Hundred Trees | 22 | 150 | 150 | 74 | – | 39.44% |

| NEWest | 30 | 26 | 3 | 77 | – | 41.18% |

| Parc Clematis | 204 | 445 | 493 | 203 | 105 | 44.76% |

| Regent Park | – | 164* | 112* | – | – | 62.02% |

| The Clement Canopy | – | 194 | 230 | 81 | – | 38.42% |

| The Trilinq | 112 | 192 | 346 | 105 | – | 43.62% |

| Total | 588 | 1961 | 1880 | 856 | 211 | – |

*Since Regent Park is an older development, the exact breakdown of its unit mix is unavailable online. This estimate is based on the best available information we could gather.

Number of resale transactions in recent years

| Project | 2021 | 2022 | 2023 | 2024 | % of project sold in 2024 |

| Clavon | 1 | 73 | 11.41% | ||

| Hundred Trees | 26 | 7 | 9 | 9 | 2.27% |

| Newest | 10 | 11 | 7 | 6 | 4.41% |

| Parc Clematis | 5 | 81 | 126 | 8.69% | |

| Regent Park | 12 | 9 | 10 | 13 | 4.71% |

| The Clement Canopy | 36 | 35 | 19 | 30 | 5.94% |

| The Trilinq | 64 | 55 | 43 | 40 | 5.30% |

| Total | 148 | 122 | 170 | 297 | 6.37% |

From the above tables, we can gather that despite there being a decent supply of private residential units within a 20-minute walking radius of Clementi MRT station, the overall percentage of units sold on the resale market remains relatively low at just 6% (as of 2024).

This could suggest that the area has a higher proportion of owner-occupiers rather than investors. Typically, investor-driven areas experience higher transaction volumes due to frequent buying, selling, or rental turnovers. However, the low resale activity here potentially indicates that many residents may have purchased their units for long-term personal use rather than short-term investment gains.

Clementi’s appeal as a mature estate with popular educational institutions, well-developed amenities, and good transport connectivity further supports this trend. Families and homeowners seeking stability are more likely to hold onto their properties for extended periods, contributing to the lower transaction rate. In contrast, areas with a higher concentration of investors tend to see more frequent sales due to speculative activity or rental market shifts.

A quick look at the new launch market

| Project | 1BR | 2BR | 3BR | 4BR | 5BR |

| North Gaia | $1,293,000 | $1,775,000 | |||

| Lumina Grand | $1,364,000 | $1,846,000 | $2,130,000 | ||

| The Shorefront | $1,471,000 | $1,739,000 | $2,797,000 | ||

| Kassia | $1,160,000 | $1,545,000 | $1,838,000 | $2,522,000 | |

| The Arden | $1,854,000 | $2,215,000 | |||

| Jansen House | $1,511,000 | $1,988,000 | $2,430,000 | ||

| Hillhaven | $1,616,560 | $2,032,146 | $2,730,234 | ||

| The Myst | $1,589,000 | $2,058,000 | $2,841,000 | $3,196,000 | |

| Parktown Residence | $1,070,000 | $1,330,000 | $2,070,000 | $2,850,000 | $3,780,000 |

| SORA | $1,544,000 | $2,094,000 | $3,225,000 | $3,542,000 | |

| Lentoria | $1,308,000 | $1,689,000 | $2,112,000 | $2,700,000 | |

| ELTA | $1,160,000 | $1,390,000 | $2,200,000 | $2,800,000 | $3,890,000 |

| The LakeGarden Residences | $1,470,000 | $1,568,100 | $2,240,400 | $2,755,500 | $3,289,600 |

| Hill House | $1,380,000 | $1,838,000 | $2,250,000 | ||

| Terra Hill | $1,884,000 | $2,361,000 | $3,469,000 | $5,511,000 | |

| Sceneca Residence | $2,378,000 | $3,148,000 | |||

| Koon Seng House | $1,807,000 | $2,387,000 | $2,780,000 | ||

| Hillock Green | $1,513,000 | $1,592,000 | $2,388,000 | $2,674,000 | |

| The Arcady at Boon Keng | $1,785,000 | $2,414,000 | $3,701,000 | ||

| Nava Grove | $1,901,000 | $2,432,700 | $3,180,200 | $4,329,100 | |

| Grand Dunman | $1,418,000 | $1,949,000 | $2,471,000 | $3,281,000 | $3,999,000 |

| Claydence | $1,473,600 | $1,886,400 | $2,528,600 | $5,410,000 | |

| The Hillshore | $1,768,000 | $2,588,000 | $3,880,000 | ||

| Chuan Park | $1,933,235 | $2,625,550 | $3,522,508 | ||

| The Botany at Dairy Farm | $2,665,000 | ||||

| Pinetree Hill | $2,006,000 | $2,671,000 | $3,214,000 | $4,364,000 | |

| Lentor Hills Residences | $1,406,000 | $2,733,000 | |||

| Atlassia | $3,059,028 | $2,804,578 | |||

| 8@BT | $1,565,000 | $1,881,000 | $2,813,000 | $3,613,000 | |

| The Continuum | $1,502,000 | $1,935,000 | $2,922,000 | $3,388,000 | $5,567,000 |

| J’den | $2,970,000 | $3,312,000 | |||

| Ikigai | $3,395,974 | ||||

| Enchante | $3,398,700 | $3,748,300 | |||

| 10 Evelyn | $1,431,500 | $3,416,000 | |||

| Midtown Bay | $1,588,000 | $2,308,000 | $4,714,000 | ||

| Watten House | $5,038,000 | $4,956,000 | $7,958,000 | ||

| Wallich Residence | $3,728,000 | $5,288,000 | |||

| The Giverny Residences | $5,497,000 | $9,566,000 | |||

| One Bernam | $5,765,000 | $14,132,000 | |||

| 32 Gilstead | $13,016,000 | ||||

| Altura | $2,210,000 | ||||

| Bartley Vue | $1,725,000 | ||||

| Blossoms By The Park | $3,336,000 | ||||

| Boulevard 88 | $4,811,100 | ||||

| Canninghill Piers | $1,712,000 | $8,904,000 | |||

| Cuscaden Reserve | $2,086,000 | ||||

| Grange 1866 | $1,694,000 | $2,285,000 | |||

| Irwell Hill Residences | $9,452,000 | $11,080,000 | |||

| Lentor Mansion | $2,717,000 | $3,243,000 | |||

| Norwood Grand | $2,590,000 | ||||

| Orchard Sophia | $1,646,888 | ||||

| Straits at Joo Chiat | $2,196,520 | $3,022,240 | |||

| Tembusu Grand | $1,409,000 | $3,743,000 | $4,028,000 | ||

| TMW Maxwell | $1,420,000 | $2,404,000 |

Based on its starting price, ELTA appears competitive among new launch condos. For buyers considering a 2-bedroom unit, some options may be priced lower than those at SORA or LakeGarden Residences. Similarly, certain 4-bedroom units are also priced below these developments.

For those considering a 2 or 3-bedder, ELTA has a starting price higher than Parktown Residence, though the two are in different locations, with Parktown Residence situated in a newly developed area in Tampines.

With limited new launch options in the west, ELTA presents one of the few opportunities for buyers looking to enter the market in this area.

Conclusion

Overall, ELTA’s generous layouts, family-oriented design, and potential appeal for HDB upgraders position it as a strong contender in Clementi’s real estate landscape. The price premium—particularly for the 1-bedroom and larger 4- to 5-bedroom units—largely reflects higher land costs and a more modern development. Buyers may consider the smaller units to be a more reasonable upgrade, but given the larger unit sizes of the bigger bedroom types (and the corresponding larger price tag), may give some buyers pause, particularly when weighed against upcoming and existing alternatives in the market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is the starting price for a 1-bedroom unit at ELTA?

How does ELTA's land price compare to previous developments in the area?

What are the key differences between ELTA and Faber Walk development?

How does ELTA's potential resale price compare to nearby projects like Clavon?

What is the estimated developer's profit margin for ELTA based on recent projects?

Cheryl Teo

Cheryl has been writing about international property investments for the past two years since she has graduated from NUS with a bachelors in Real Estate. As an avid investor herself, she mainly invests in cryptocurrency and stocks, with goals to include real estate, virtual and physical, into her portfolio in the future. Her aim as a writer at Stacked is to guide readers when it comes to real estate investments through her insights.Need help with a property decision?

Speak to our team →Read next from New Launch Condo Analysis

New Launch Condo Analysis This New Dairy Farm Condo Starts From $998K — How the Pricing Compares

New Launch Condo Analysis This New Freehold CBD Condo Starts From $1.29M — Here’s How the Pricing Compares

New Launch Condo Analysis This Freehold New Launch Condo In The CBD Is Launching From Just $1.29M

New Launch Condo Analysis I Reviewed A New Launch 4-Bedroom Penthouse At Beauty World

Latest Posts

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

0 Comments