Selling Your Property? 6 Key Details To Check For A Smooth Sale

January 20, 2022

Whether or not you’ve engaged a realtor to sell your property, it pays to keep an eye on the process. The sale of your home can be a life-changing process; and even a seemingly minor slip-up can become an expensive mistake. In the following, we look at common mistakes among first-time home sellers, and ways to prevent them:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

For HDB upgraders or atypical property sales, it’s advised that you use a qualified realtor

Certain atypical properties – such as those in advanced stages of lease decay, walk-up apartments, mixed-use shophouse units, etc. – are tricky to sell without a realtor’s help. The same goes for unusual situations such as having to sell on short notice (e.g., to avoid losing your ABSD remission).

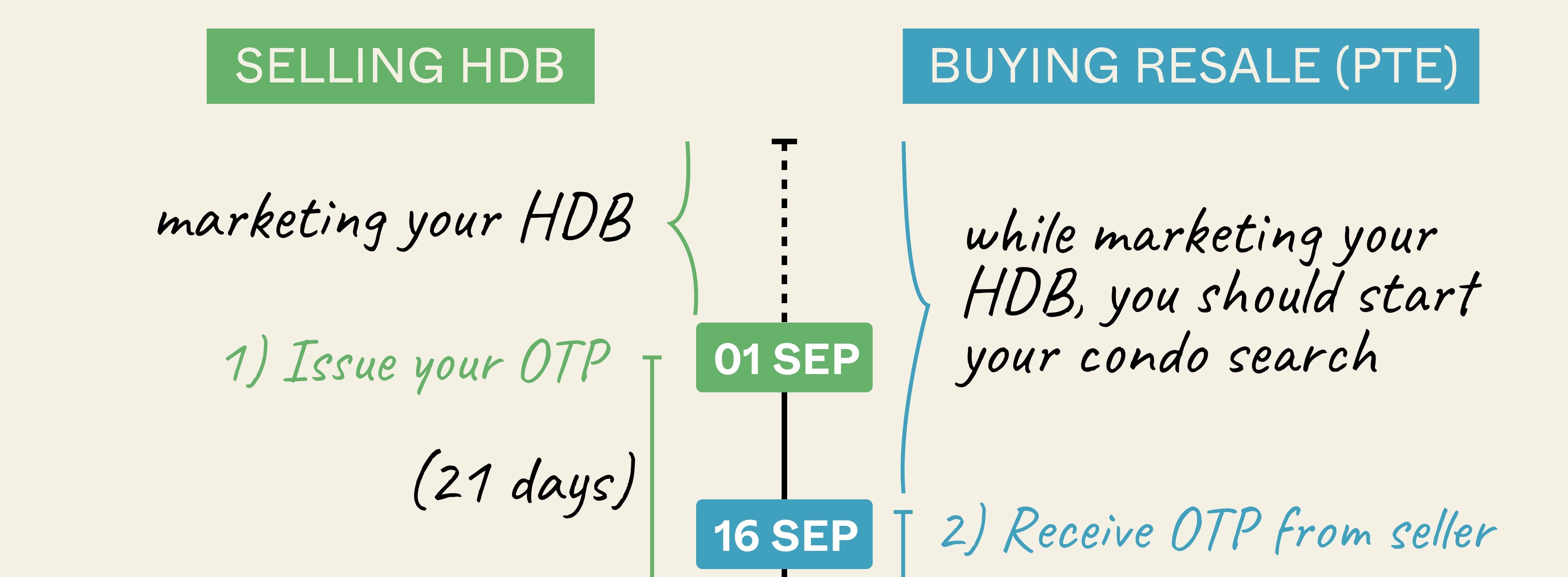

For upgrading, the timing issues can be more complex. It’s possible, for instance, to move only once rather than have interim accommodation; or to avoid situations where you’re serving two home loans at once.

But whether or not you use a realtor, look out for easily overlooked issues like these:

- Forgetting to check the manner of holding

- Prepayment penalties

- Taking a second mortgage before discharging the first

- Not clarifying what you’re taking or leaving behind

- Not using the “As Is Where Is” clause when needed

- Bargaining with the date of vacant possession

1. Forgetting to check the manner of holding

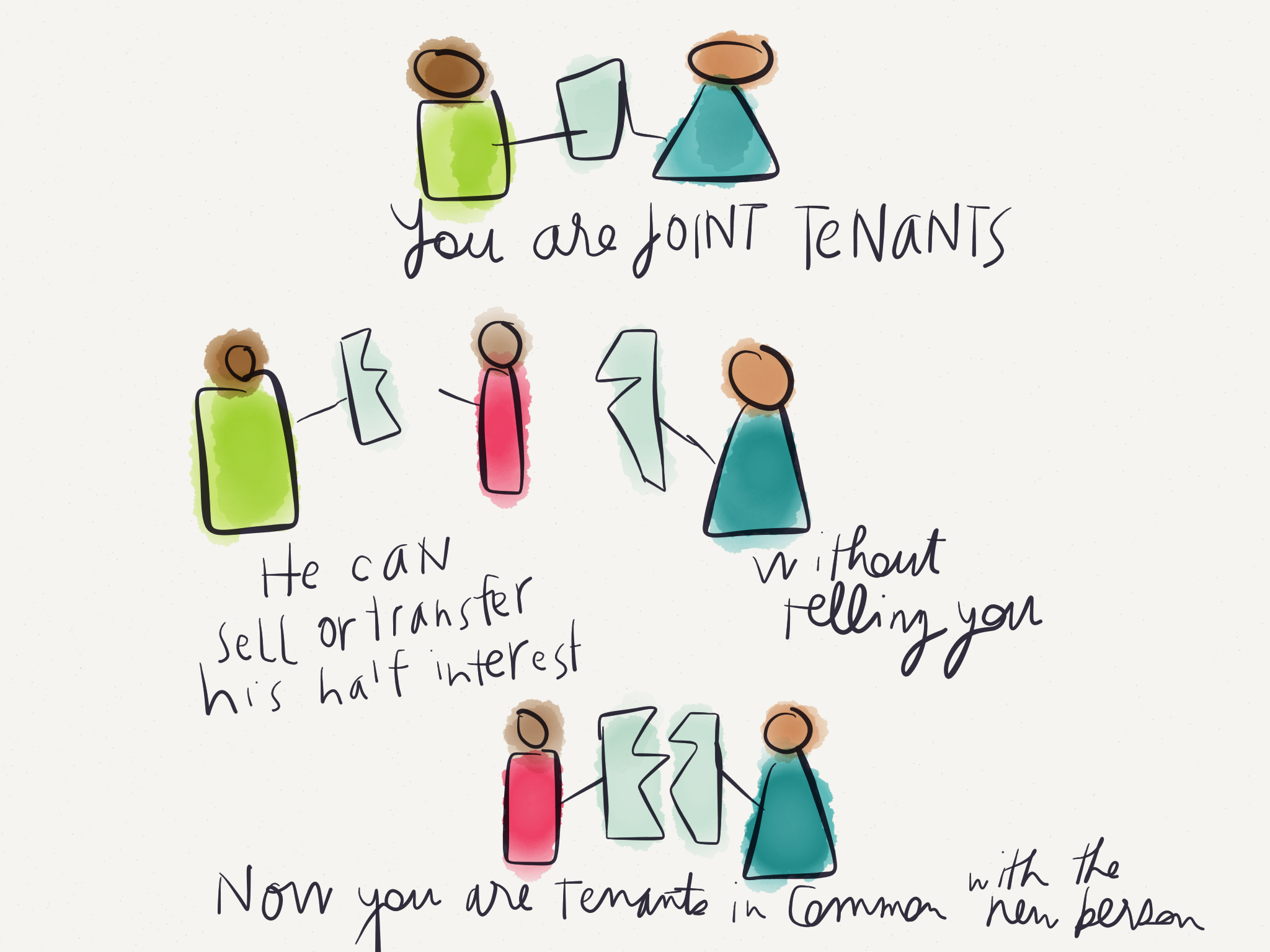

Most properties are held under a joint tenancy. However, if you have tenancy-in-common, then each of you owns a specific percentage of the property.

This gives rise to a common misconception: that the co-owner with the biggest percentage gets to decide on the sale (i.e., they can unliterally allow or block the sale). This is not the case; a common consensus is still required to sell the property. So even if another co-owner has just one per cent of the property, don’t assume you’re in a position to sell without their consent.

(Note: What you can do, if you have a tenancy-in-common, is to sell your percentage of the property to another party. None of the other co-owners can stop you from doing this).

Another commonly overlooked issue is stamp duties, when you’re transferring your share of the property to decouple*. Do keep in mind that Buyers Stamp Duty (BSD) is payable on the share of the property being transferred.

In some rare cases, it can be cheaper just to pay the ABSD, than to decouple – you need to crunch the numbers with the help of a conveyancing lawyer, realtor, or other professional, before decoupling.

*This is typically done to avoid paying Additional Buyers Stamp Duty (ABSD). See this article for further details. This is usually the whole point of having ownership splits like 99 per cent and one per cent; don’t forget about it when you’re selling or upgrading!

2. Prepayment penalties

This is only applicable to private bank loans; HDB loans never have prepayment penalties.

Some home loan packages impose penalties, if you discharge the home loan early. The typical prepayment penalty is 1.5 per cent of the undisbursed loan amount. In most cases, the penalty applies only for a fixed duration, such as three to five years.

We have seen cases where sellers, had they waited just a month or so, would have been out of the prepayment penalty. It’s a simple slip-up, but it can result in a few thousand dollars being wasted.

If you don’t want to deal with these issues in the future, pick a bank loan that waives prepayment penalties in the event of a sale (check the loan terms and conditions).

3. Taking a second mortgage before discharging the first

If you’re buying your new home before selling the old one, you may find yourself in this situation. This is when you haven’t paid off your previous home loan yet, but have already taken up a second one for your new property. Do also remember if it’s private your LTV for the second property drops drastically.

You’ll have an early warning when this is about to happen – such as when a bank asks for proof that you’re selling your previous home*. Even if the loan application and financing succeeds, be aware that the financial demands are significant: you could be required to service both your old home loan, and the new one, for an interim period.

(Remember this also means paying interest on both loans)

If you’re upgrading to a new launch property, there are some ways to mitigate this. Most new launch properties use a Progressive Payment Scheme, where the initial loan repayments are lower; this can make it more manageable to service two home loans. If the property already has its Certificate of Statutory Completion (CSC), some developers offer a Deferred Payment Scheme (DPS) that can postpone initial loan repayments for as long as 24 months.

Property Market Commentary11 Proposed Developer Changes To Help Homebuyers: A Breakdown + How It Affects You

by Ryan J. OngRegardless, we advise sellers to avoid taking on multiple mortgages wherever possible.

*Your maximum loan amount is reduced if you have an outstanding home loan. A bank can only give you full financing if you provide the documents that show you’re in the process of selling your previous home, such as the signed Option To Purchase (OTP).

4. Not clarifying what you’re taking or leaving behind

Disputes can arise with regard to certain white goods, such as fridges and washers/dryers. Buyers may assume you intend to leave all this behind; so if you’re taking anything, you’ll want to clarify it in writing.

Don’t just rely on verbal communications – put it down in an email, on some form of documentation (black and white, to avoid disputes later on).

Conversely, your buyer may be expecting you to move out the white goods, because they have appliances of their own. This sometimes results in arguments and bad feelings, when buyers accuse sellers of leaving them to “dispose of the old trash”.

With regard to white goods that don’t work, such as non-functioning stoves, be clear on whether you’re the one expected to clear it.

5. Not using the “As Is Where Is” clause when needed

You might want to do this when selling an older or less-well maintained property, which may see continued degradation over the sale.

For example, you may be willing to let the property go at a discount, but do not want to be liable for further damage at the time the buyer receives it (e.g., the termite damage worsens in the days after the OTP is exercised).

If so, you may want to include the As Is Where Is clause, in the OTP. It should read something like this:

“The Purchaser is treated as having notice of the actual state and condition of the Property…and is deemed to have inspected the Property and no warranty or representation on the part of the Vendor or the Vendor’s agent or representative is given or to be implied as to the state, quality, fitness or anything whatsoever and accordingly the Purchaser shall not be entitled to make or raise any objection or requisition whatsoever in respect thereof.”

Note that this is not a typical inclusion of the standard Conditions of Sale document. The usual document requires that you deliver the property in the same condition as it was on the date of the OTP.

There’s also no guarantee a buyer will accept this, and they almost certainly won’t if they’re buying a property at full valuation. However, if you’re disposing of an old property, you could argue this as one of the factors for your discount.

6. Bargaining with the date of vacant possession

Being able to move in sooner is a big deal to many buyers. The sooner they can move into your old home, the shorter the time they need to rent (or squeeze into a home with the in-laws).

If you’re in a position to move out almost right away, don’t overlook this as a bargaining chip. It may be the tiebreaker, when a buyer is choosing between your unit and another very similar option. A lot of sellers forget to ask about the buyer’s urgency though, and hence forget to highlight that they can move out sooner.

If you’re very lucky, you may even be able to use this to get a slightly better price; that comes down to the negotiating skills of your realtor.

For more on buying or selling homes in the Singapore private property market, do follow us on Stacked. We’ll also provide you with in-depth reviews, of new and resale properties alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Pro Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

On The Market A Rare Pair Of Conserved Shophouses In Chinatown Just Hit The Market For $32.5M

Singapore Property News Some Units At This Freehold Riverfront Condo Could Lose Their Views — But Here’s How Prices Have Actually Moved

0 Comments