Resale HDB Or BTO In 2025: Why The Long Wait May Still Be Worth It

February 7, 2025

Despite high resale flat prices, many of the homebuyers we meet still want to start their property journey with a resale flat. The reasons are varied: from faster upgrading potential, to neighbourhoods they must live in, to simple frustration at balloting luck. In spite of this, however, there are good reasons why sighing and getting in the BTO launch queue may be the way to go in 2025. Here’s what to consider:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

First, let’s address the old notion that BTO flats are worse for upgraders

The main reason upgraders are urged to start with a resale flat is the Minimum Occupancy Period (MOP). The MOP begins from the time of key collection, not from the time you buy your flat. So if you buy a BTO flat that takes four years to complete, you’ll end up waiting nine years (four years of construction + five year MOP) before you can sell on the secondary market.

Because property prices usually trend upward each year, this raises the risk that – in nine years – you may find the appreciation of your flat doesn’t suffice to bridge the gap to a private property.

However, it may be time to review this concept, in light of the changing property market of 2025. Here are some more recent factors to consider:

Reasons it may now be okay or even better to start with a BTO flat:

1. The premium that a five-year-old flat can fetch

While a resale flat can be sold sooner, we shouldn’t forget that a BTO flat has an advantage which could even this out: a BTO flat that reaches its fifth year can command a significant premium.

Five-year-old flats can see a surge in value, because they have all the advantages with few of the drawbacks: they can be moved into immediately, but they still have negligible lease (and physical) decay. The renovations may even be fresh, thus saving the new owners a significant sum.

Back in 2021, we highlighted that 13.4 per cent of new flats were sold within a year of their MOP date; up from 12.2 per cent the year before, and up from 11.8 per cent compared to 2018. It’s clear that more upgraders are catching on, and realising the “price surge” of a BTO flat at the five-year mark could more than make up for the longer waiting time.

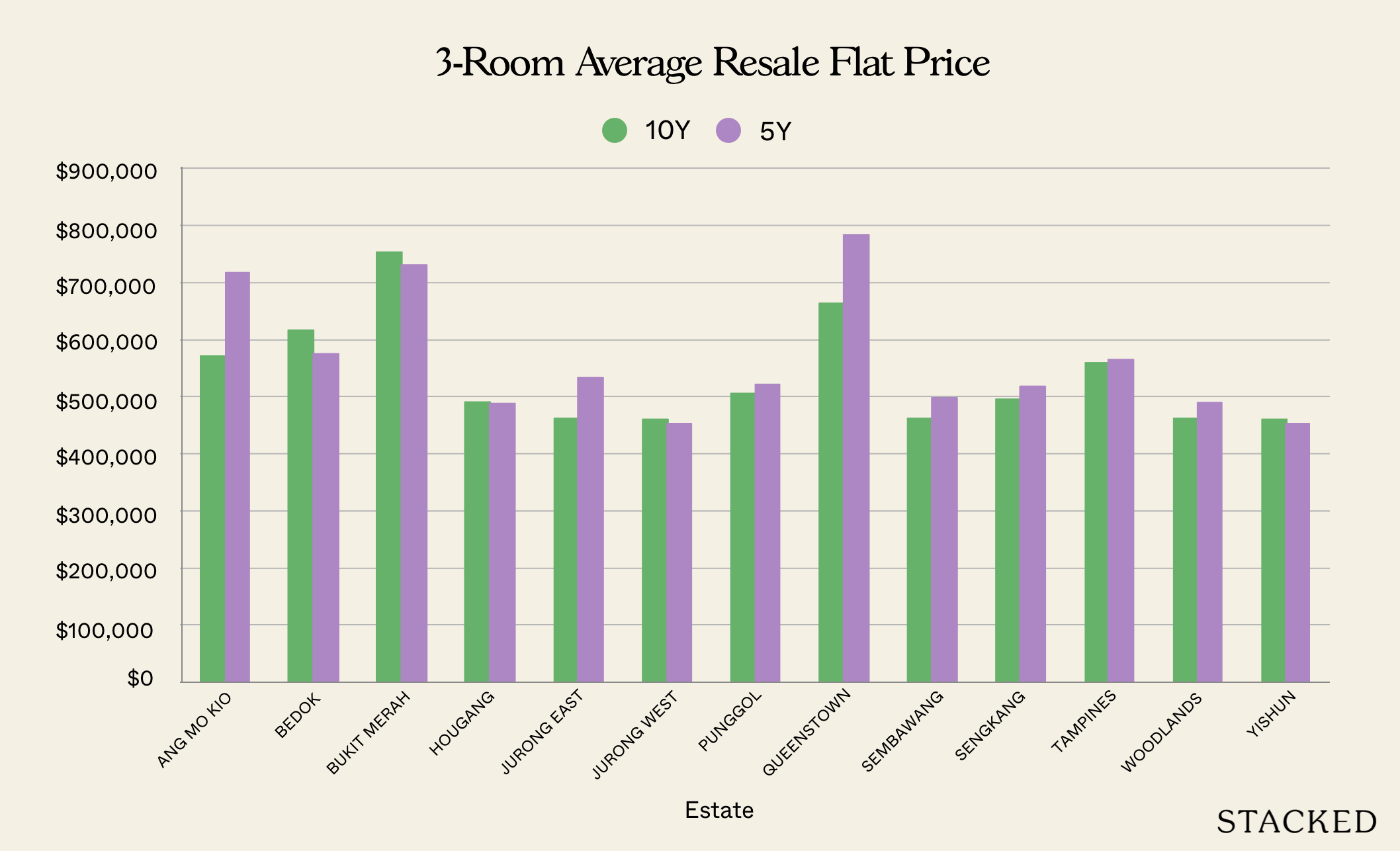

In our study of this price premium, which was just in January this year, we found it was even more pronounced for smaller flats. In Ang Mo Kio, for instance, we found that a five-year-old 3-room flat could fetch an average price that was 25.6 per cent higher than its 10-year-old counterpart (see the link above).

To be clear, this wasn’t uniform across every HDB estate. But it does show that, even if you have to wait another four years, it doesn’t necessarily mean your newer flat is always at a disadvantage. It may even bridge the gap better than a very old resale flat, where lease decay has weakened the price appreciation.

This is compounded by the other factors below, such as the higher quantum and steeper renovation costs of older resale flats.

2. High prices of resale flats may stretch affordability

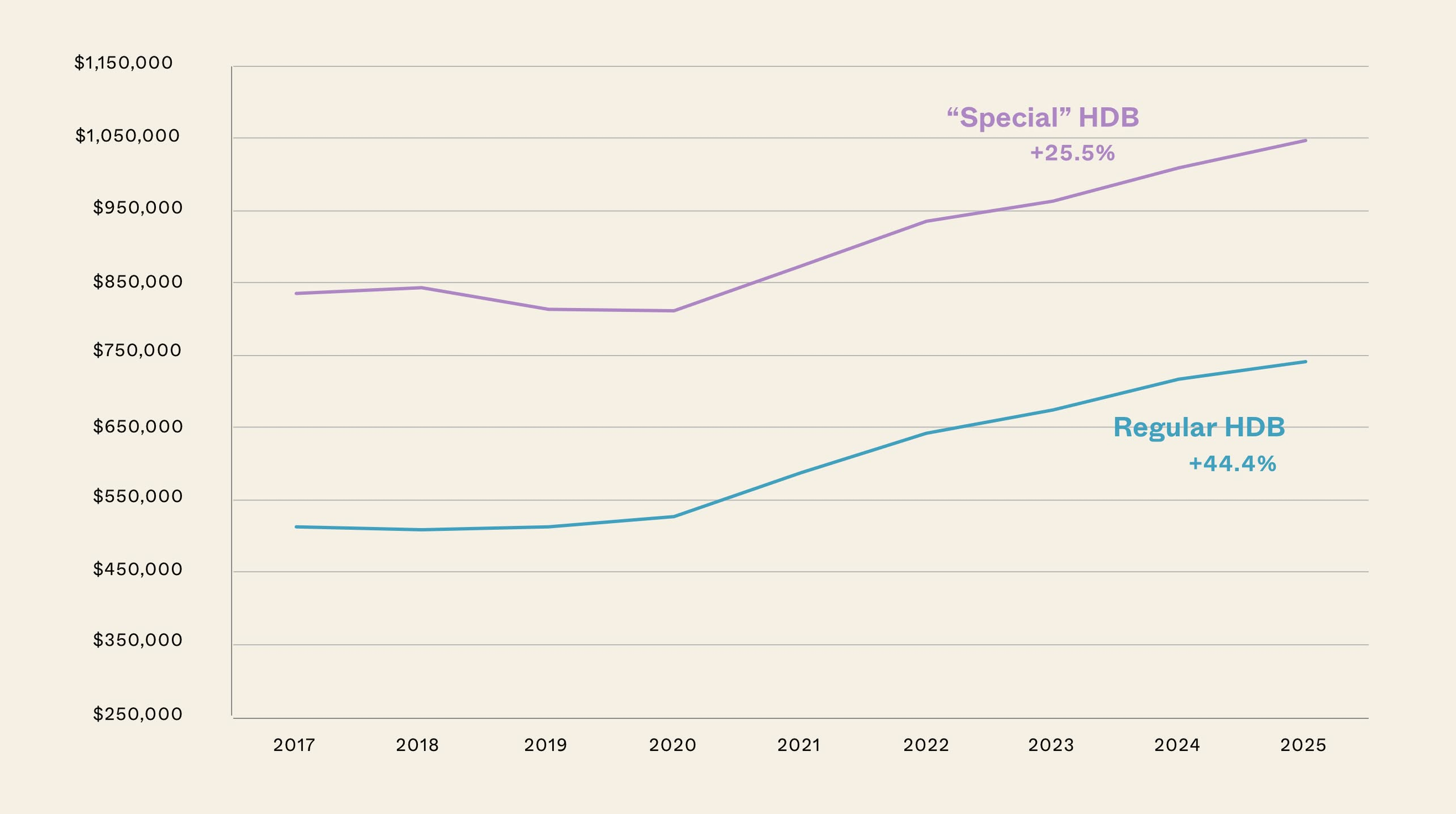

Even a cursory search of social media platforms will reveal concerns about the resale flat market. Some people may be surprised by the results of our last study, when we found resale flat prices had gone up by 40 to 50 per cent (and removing the special DBSS flats, maisonettes, etc. made the visible price growth even higher.)

Consider a 3-room BTO flat in Bukit Batok (West Brick Ville), which was launched in October 2024. The price range given was $247,000 to $329,000. By comparison, you can see from our study above that the average range for a 3-room resale flat could reach $460,289.

(We’re using a 3-room flat as an example because we assume that, if your intent is to upgrade, you’ll likely save by starting with a smaller flat)

More from Stacked

What next for Singapore housing market after July 6 cooling measures?

Residential property investment sales have collapsed in Singapore after another series of housing curbs halted 'en-bloc' redevelopment deals. The last round…

Now in August 2024, new cooling measures were passed to rein in the resale flat market. The maximum Loan To Value (LTV) ratio for an HDB loan is now 75 per cent of the price or valuation, whichever is lower.

Note that for BTO flats, there’s no such thing as a difference between price and valuation: HDB’s price is always the same as the value.

This means there’s no possibility of Cash Over Valuation (COV), which may occur for a resale flat. This is yet another advantage of buying a BTO.

For our BTO flat at West Brick Ville, this means a minimum down payment of $82,250, even at the highest price point. Between a couple, this is around $41,000 from each party’s CPF, for the down payment.

For the average 3-room resale flat, however ($460,289), the minimum down payment is around $115,072. This excludes any potential COV, which also has to be paid in cash on top of the loan, and which would raise the Buyers Stamp Duty (BSD).

(The BSD is based on the higher of the price or valuation. Again, not an issue for BTO flats, where the price is always the same as the value).

This could also be worsened by the tighter resale flat supply in 2025. This year may see the fewest number of flats entering the resale market in 11 years. This is likely to drive up the prices of resale flats even higher, and the cash outlays we’re seeing now (for resale flats) may get much worse in the near term.

So you need to consider if the higher cash outlay of a resale flat would, ultimately, be more destructive to your upgrading efforts than just waiting a bit longer for a BTO flat.

3. Waiting times are getting shorter

HDB has been picking up the pace. From 2024 onward, we’ll see more BTO launches with waiting times shorter than three years.

If HDB can get the wait times down, this will allow you to meet the MOP a lot sooner, and worry less about runaway private home prices. It also takes away some of the inconvenience, if renting or crashing with parents is part of the reason you want a resale flat. You won’t have to tolerate it for as long as previous BTO flat buyers.

4. The introduction of Plus and Prime flats may change things

Plus and Prime flats are very new, so we can’t be sure of their overall impact on the market yet. In the near term, however, these projects could likely push up resale flat prices in highly desirable areas.

This is an “across the road” effect: if a block of flats in Queenstown has a clawback and a 10-year MOP, and a bunch of resale flats 10 minutes away don’t, then the resale flats may see a boost in prices. This is yet another reason why resale may be getting pricier (although it will take much more time to observe and verify the effects).

The other effect of Plus and Prime flats is that it causes a self-selecting phenomenon. Buyers of these projects, which have 10-year MOPs, are far less likely to be upgraders; the MOP is simply too long to serve that purpose well. This means genuine home buyers separate themselves from aspiring upgraders.

As an upgrader, this means you have fewer genuine homebuyers to compete with when trying to secure a standard BTO flat. This could remove some of the frustration associated with balloting and failing.

This being said, upgrading has no “one-size-fits-all” strategy. Your lifestyle, time horizons, and eligibility all play a part in whether you should start with a BTO or resale flat. But you should consider the decision in light of today’s market changes; and if you need further help, you can reach out to us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Is it better to buy a resale flat or a BTO flat in 2025?

How does the five-year mark affect BTO flat prices?

Are resale flats becoming more expensive in 2025?

What are the advantages of buying a BTO flat over a resale flat in terms of costs?

Are waiting times for BTO flats getting shorter?

How might new flat types like Plus and Prime flats influence the resale market?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

0 Comments