Should You Buy A Resale Flat Or New Launch Condo First?

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

Even with HDB income ceilings raised ($14,000 per month for new flats and $16,000 per month for Executive Condominiums), there’ll always be a group of sandwiched Singaporeans who’ll feel trapped.

These are the ones who earn too much to buy a flat, but too little to comfortably buy a condo. Frankly, it’s quite a strange position to be in – you are in a comfortable enough situation that you can’t complain (or get scolded by others who say you should be content), yet you can barely reach the rungs of the private property ladder.

I recently covered a rent vs buy scenario for this sandwiched group.

But here’s another dilemma confronting this not-rich, not-poor crowd:

(1) Buy a resale flat first, hold it for five years, and then upgrade to a condo, or

(2) Buy a smaller new launch condo now, and then sell it and upgrade to a bigger one after it’s complete

One common theory is that, by the time a new launch condo is completed, you could potentially reap a financial gain that is a springboard to the next step; so it’s a better deal to start with a new launch condo. Let’s look at how true this is:

How much more do condos appreciate compared to resale HDB flats?

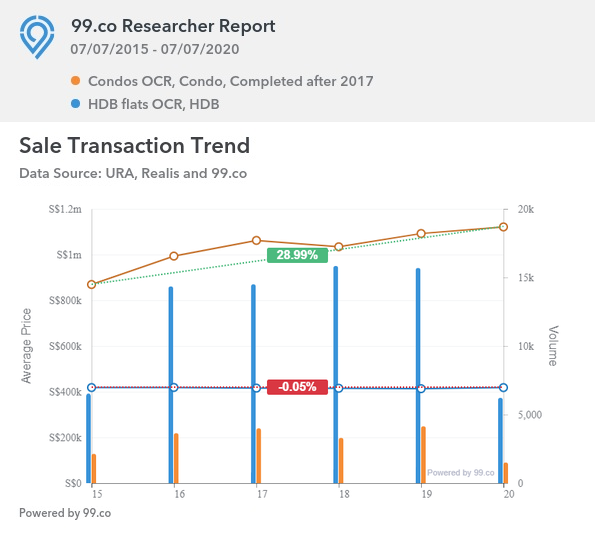

Given that these first homes are meant to be a “stepping stone” for sandwiched Singaporeans, we will look at the Outside of Central Region (OCR), where properties are more affordable; this is a good start point for a young couple looking to upgrade later.

This would be districts 16 to 28, minus district 20 (Bishan / Thomson is closer to the city centre). We will compare the median HDB prices to median condo prices in this region, over the past five years.

We’ll also restrict the condos to those that received their Temporary Occupancy Permit (TOP) between 2015 to 2017, to restrict it to condos that were considered new in this five-year stretch.

In terms of overall price, we can see HDB resale flats haven’t done too well over a short five-year period. They’ve dipped slightly, falling from an average price of $418,190 to $417,995.

Of course, you have to remember this is taking into account that this is a wide average of HDB resale flats in the OCR, if you’d like a more specific comparison please reach out to us here.

On the other hand, OCR condos have risen from an average of $869,000 to around $1,120,905; up by around 29 per cent.

However, it’s too simple to conclude from this alone that new condos beat resale flats.

While new condo prices may have risen faster than resale flats, we have to take into account the higher cost of buying the condos. We also need to account for costs such as:

- Stamp duties

- Rental costs (before your condo is complete)

- Maintenance fees

- Home loan interest repayments

- Renovation and furnishing

- Property taxes

- Various professional fees

For the next part of this example, we will compare between a resale flat valued at $418,190 in 2015, and a new launch condo valued at $869,000 in that same year.

We will assume you begin by paying 25 per cent of the flat and condo price (i.e. the maximum loan from the bank), and then see how much you would have earned compared to the amount spent.

1. Stamp duties

| Price or valuation of property (whichever is higher) | BSD rate applied |

| First $180,000 | 1% |

| Next $180,000 | 2% |

| Next $640,000 | 3% |

| Any remaining amount | 4% |

Based on the above, the Buyers Stamp Duty (BSD) for the flat would be $7,146.

The BSD for the condo would be $20,670.

Total costs so far:

Average resale flat: $7,146

Average condo: $20,670

2. Rental costs (before your condo is complete)

We’ll assume you rent a resale flat while waiting for your new launch condo to be built (hopefully in two years or so). This is, of course, unnecessary if you buy a resale flat as it’s already built.

Average rent for a resale flat in the OCR would have been $2,147 per month. We’ll assume you need to rent for two years before the condo is built, coming to a total of around $51,528.

(We should point out that rental rates are dropping however, so it’s likely lower if you had to rent today compared to 2015. The current average is just $1,911 per month.)

Total costs so far:

Average resale flat: $7,146

Average condo: $72,198

3. Maintenance fees

If you buy a condo, you don’t need to start paying for these until after your condo receives the Temporary Occupancy Permit (TOP). The typical maintenance fee for an OCR condo is about $900 – $1,200 per quarter – we’ll go with the upper end here. We’ll assume you pay this for three years, before you sell your condo to upgrade. That comes to about $14,400.

Property AdviceAlways Factor Maintenance Fees into Your Condo-Buying Decision

by Ryan JHDB flats have conservancy fees, that typically average around $90 per month (for 4-room and 5-room flats). Over five years, this is around $5,400.

Total costs so far:

Average resale flat: $12,546

Average condo: $85,598

4. Home loan interest repayments

This is where it gets tricky.

At your “sandwiched” income level, you’ll need to use a bank loan, as you earn too much for an HDB loan. However, bank loan interest rates fluctuate all the time. In 2017, for instance, a bank loan rate of around two per cent per annum would have been the norm. At the time we’re writing this, the new norm is around 1.2 per cent, thanks to Covid-19.

So all we can do is use a simplified example

We’ll guesstimate an interest rate of about two per cent over the years. We’re also going to assume you use a loan tenure of 25 years.

The maximum loan on the condo (Building Under Construction) is $651,750. Over five years, you would pay a total interest of $60,512.

Inclusive of principal payments over five years, you will reduce the total outstanding condo loan to $597,512.79.

The loan on the resale flat is $313,642.50. Over five years, you would pay total interest (without including principal repayments) of about $28,906.

Inclusive of principal payments over five years, you will reduce the total outstanding resale flat loan to $262,785.

Total costs so far:

Average resale flat: $41,452

Average condo: $146,110

5. Renovation and furnishing

We will assume the cost of renovating the property to be around $30,000, as this is the cap on most renovation loans ($30,000 or six months of your income, whichever is higher).

We’re being conservative, as you’re expecting to move out in five years.

Total costs so far:

Average resale flat: $71,452

Average condo: $176,110

6. Property taxes

The IRAS property tax for owner-occupied properties can be found on their website. The amount of tax is based on the Annual Valuation (AV) of your property.

In 2015, the median AV of a flat was $10,080, while the median AV of a condo was $27,000.

The property tax for the flat is $83.20, or $416 over five years.

The property tax for the condo is $760 per year, and begins after the property is complete. Assuming two years to completion, you would pay $2,280 over three years.

Total costs so far:

Average resale flat: $71,868

Average condo: $178,390

7. Various professional fees

Property agent

Let’s say you use a property agent, when you sell your property in five years’ time. The fee is typically two per cent of the price you get.

We’ll assume that, as in the OCR prices shown above, the HDB flat sells for $417,995.

The condo sells for $1,120,905.

For the HDB flat, you’d pay your agent $8,359.90.

For the condo, you’d pay your agent $22,418.

Legal fees

In both cases, conveyancing fees will amount to between $2,500 to $3,000. We’ll assume you find the cheapest option at $2,500.

Misc. fees

There will usually be miscellaneous fees, such as breakage fees (related to your home loan), or agreeing to fix some things for the buyer (e.g. replace a door before they take ownership).

Assuming things don’t get too dramatic – such as having to redo the flooring, or paying a prepayment penalty to the bank – we can assume around $1,000 for this.

Total costs so far:

Average resale flat: $83,727.90

Average condo: $205,308

So assuming you were to sell on the fifth year to upgrade, which would have made you more money?

The HDB flat sells for $417,995. You’ve spent around $83,727.90, and repaid the outstanding principal of $262,785 (see point 4). Your net loss is about $33,065.76.

The condo sells for $1,120,905. You’ve spent around $204,308, and repaid the outstanding loan principal of $597,512. Your net gain is around $100,834.21

Note that in the above, we haven’t differentiated between CPF monies, and actual cash in hand.

Home loan repayments can be made in cash or CPF, and 20 per cent of the initial down payment can be paid in CPF. However, anything that you take from CPF has to be returned, along with the 2.5 per cent interest it would accrue.

In the case of the resale flat, you do not have to top up the difference, if the amount refunded to CPF would exceed the total sales proceeds. However, you will be in a negative cash sale; that could mean everything is poured back into CPF, making it hard for you to cover the down payment on your next property.

Likewise, not all $100,834.21 in gains from the condo will be delivered to you in cash; you need to refund the CPF monies used first. Ideally, however, you will still have enough left after this to make the down payment on the next condo.

If you’re worried about a shortfall after refunding your CPF, contact us on Facebook, and we can have someone work out the numbers for you.

Also, all this assumes the situation over the past five years will more or less continue.

If there’s one thing we know about the Singapore property market, it’s that things can change fast.

For example, we don’t know what cooling measures may come in the future; or if resale flats will pick up when the government makes more moves to support them. We should also point out that individual properties might defy the wider market.

(For example, 2019 saw 71 resale flats breaching the $1 million mark, even though resale flat prices have mostly declined since 2013.)

As such, don’t assume that every flat or condo will behave how the wider market suggests. Location, amenities, and unusually low or high buy prices must still be taken into account.

*Cover image credit: Chuttersnap

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Advice

Property Advice We Ranked The Most Important Things To Consider Before Buying A Property In Singapore: This One Came Top

Property Advice Why Punggol Northshore Could Be The Next Hotspot In The HDB Resale Market

Property Advice How Much Is Your Home Really Worth? How Property Valuations Work in Singapore

Property Advice Why I Had Second Thoughts After Buying My Dream Home In Singapore

Latest Posts

Pro We Compared New Vs Resale Condo Prices In District 10—Here’s Why New 2-Bedders Now Cost Over $600K More

Singapore Property News They Paid Rent On Time—And Still Got Evicted. Here’s The Messy Truth About Subletting In Singapore.

New Launch Condo Reviews LyndenWoods Condo Review: 343 Units, 3 Pools, And A Pickleball Court From $1.39m

Landed Home Tours We Tour Affordable Freehold Landed Homes In Balestier From $3.4m (From Jalan Ampas To Boon Teck Road)

Singapore Property News Is Our Housing Policy Secretly Singapore’s Most Effective Birth Control?

Property Market Commentary Why More Young Families Are Moving to Pasir Ris (Hint: It’s Not Just About the New EC)

On The Market A 10,000 Sq Ft Freehold Landed Home In The East Is On The Market For $10.8M: Here’s A Closer Look

On The Market 5 Spacious Old But Freehold Condos Above 2,650 Sqft

Property Investment Insights We Compared New Launch And Resale Condo Prices Across Districts—Here’s Where The Price Gaps Are The Biggest

Pro Similar Layout, Same District—But Over $500K Cheaper? We Compare New Launch Vs Resale Condos In District 5

New Launch Condo Analysis The First New Condo In Science Park After 40 Years: Is LyndenWoods Worth A Look? (Priced From $2,173 Psf)

Editor's Pick Why The Johor-Singapore Economic Zone Isn’t Just “Iskandar 2.0”

Editor's Pick URA’s 2025 Draft Master Plan: 80,000 New Homes Across 10 Estates — Here’s What To Look Out For

Pro Analysing Forest Woods Condo at Serangoon: Did This 2016 Project Hold Up Over Time?

Property Market Commentary This Upcoming 710-Unit Executive Condo In Pasir Ris Will Be One To Watch For Families

Hi Ryan, to make the comparison fairer, I think you should factor in the time value of money of the difference in upfront cost. 150K today is not the same as 150K in 5 year’s time.

very useful and informative article. in some ways, an eye-opener. thanks

Hi Ryan,

the interest calculations for private condo does not seem to tally?

$651,750 (loan) – $597,512.79 (outstanding with principal paid inclusive) = $54,237.21

is less than the $60,512 interest payment only