How Well Do Regional Centre Properties Compare Against The CBD?

August 22, 2020

A short while back, we put out an article explaining how the Bugis – Beach Road area (district 7) has since become more expensive than Orchard. But those of you who follow Singapore’s private property scene may not be surprised; Singapore began decentralising as far back as the 1990s, in an attempt to have multiple business hubs rather than a single CBD.

This has resulted in the four planned regional centres: Woodlands, Jurong, Seletar, and Tampines.

In this article we’re going to take a look at the residential properties in these regional centres, and see how they compared to the CBD:

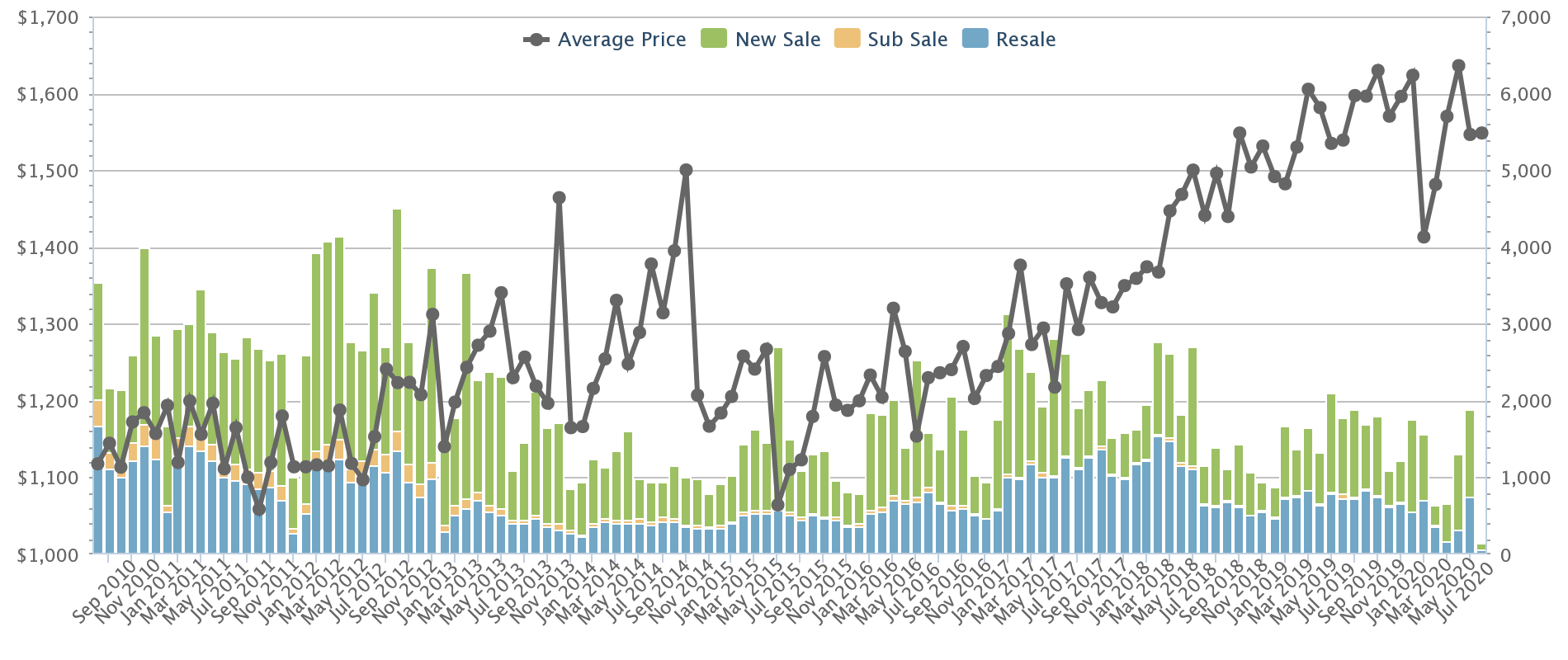

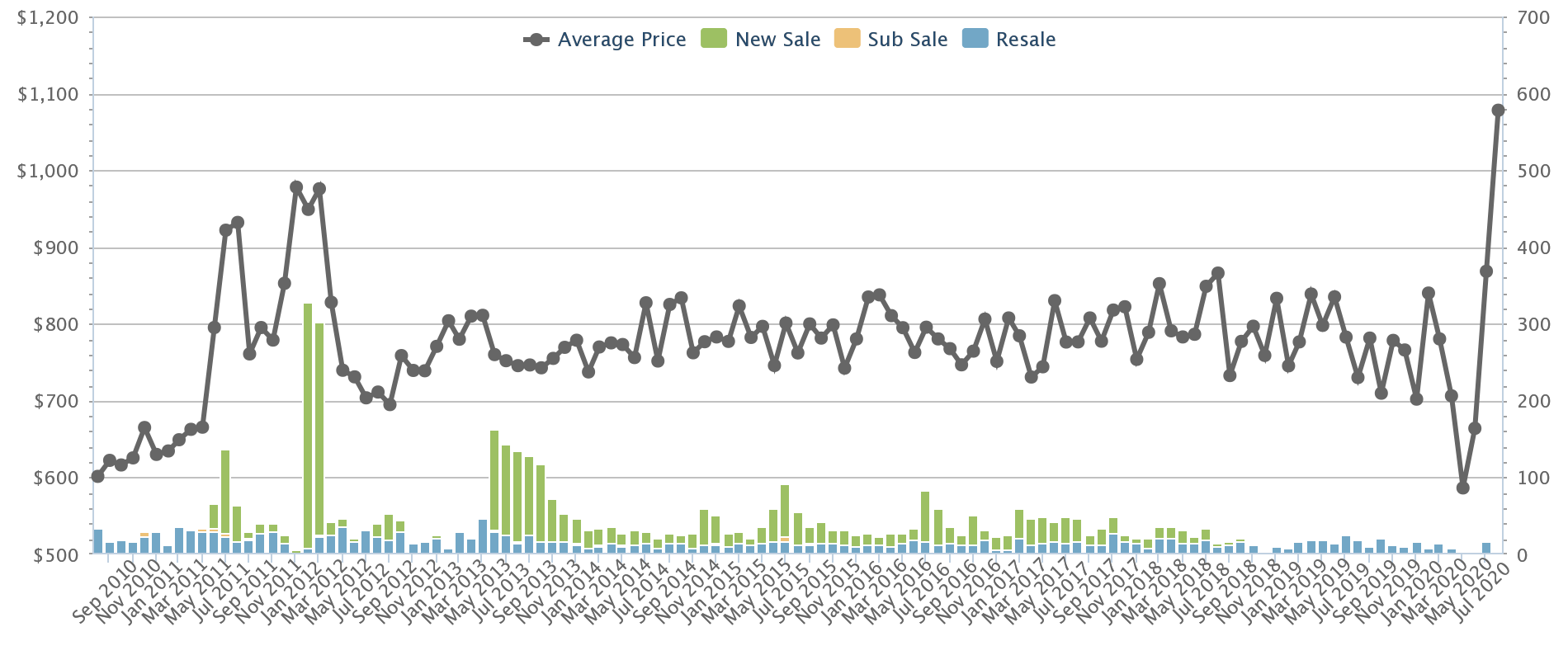

So how have prices moved in the CBD?

Over the past 10 years, prices have risen from an average of $1,118 psf, to $1,548 psf. This is a 38.4 per cent increase, or about 3.31 per cent per year.

On the other hand, here’s how the other regional centres have kept pace:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

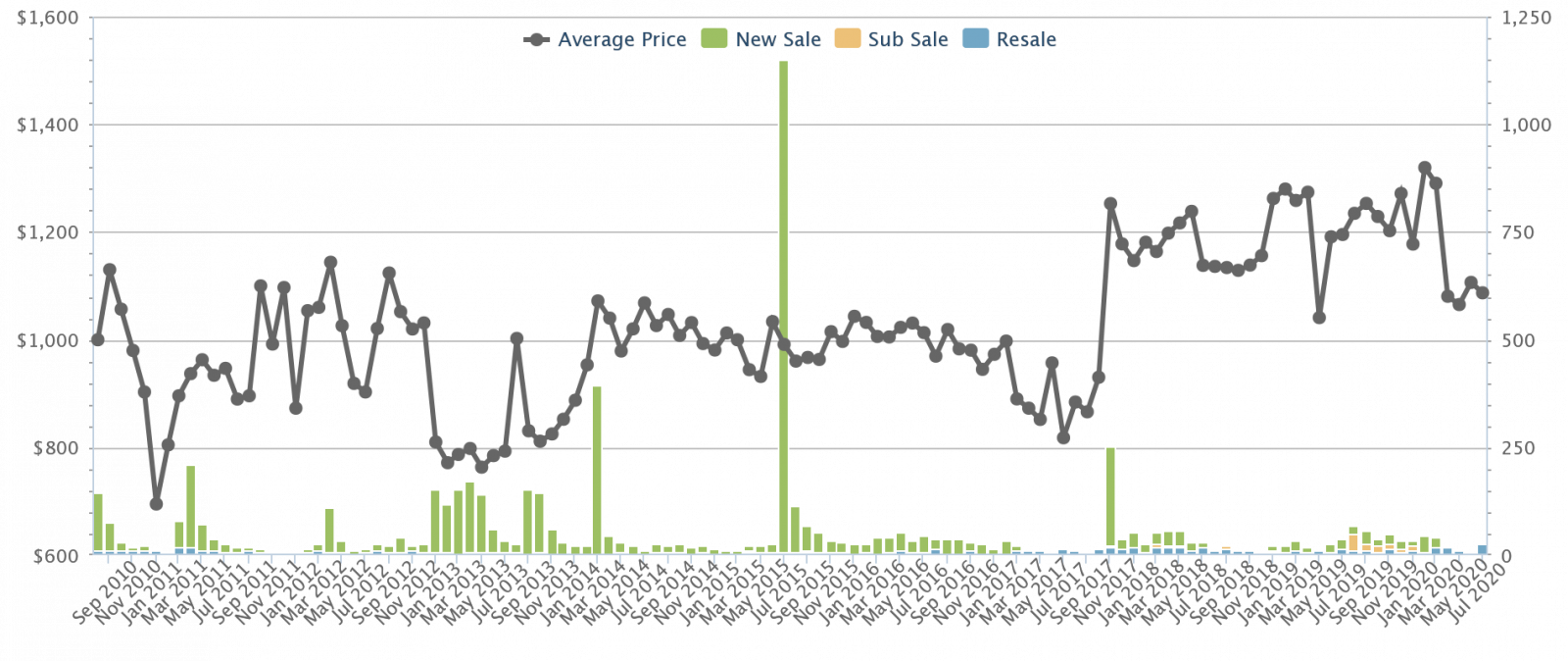

Jurong Lake District

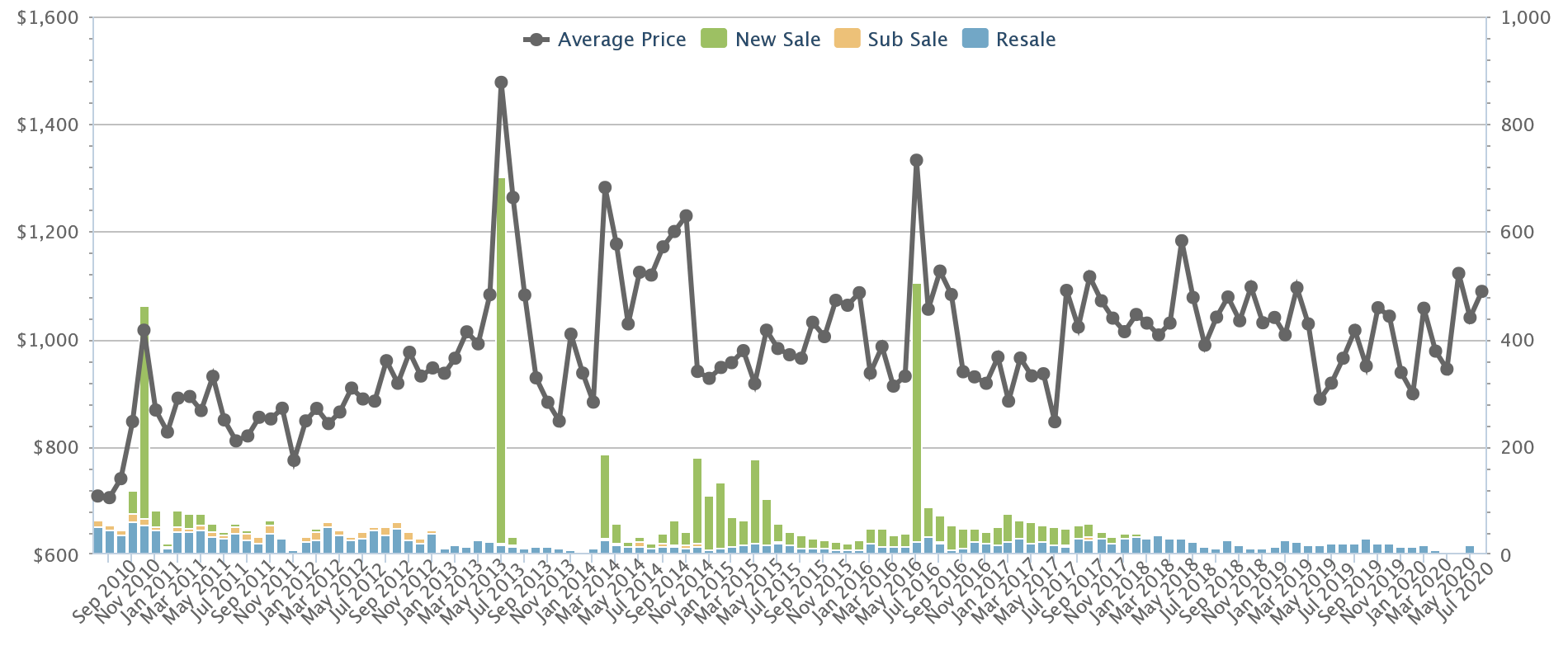

This is probably the best-known regional centre, and it’s often called the “second CBD”. Here’s how prices have moved:

Prices have appreciated from an average of $709 psf, to $1,089 psf over the past decade. This is an increase of 53.6 per cent, or about 4.39 per cent per annum.

Top three developments in price appreciation

| Project Name | Tenure | Completion | Capital Gain (%)* | Historical PSF | Current PSF |

| Lake Life | 99 years | 2016 | 25.3 | $878 | $1,100 |

| Westwood Residences | 99 years | 2017 | 12.8 | $789 | $890 |

| Lakeview | 99 years | 2017 | 12.7 | $1,253 | $1,412 |

*Capital gain calculation derived from the past 5 years.

Top three developments for rental yield

| Project Name | Tenure | Completion | Gross Yield (%) |

| Westville | 99 years | 1997 | 3.7 |

| The Floravale | 99 years | 2000 | 3.6 |

| The Mayfair | 99 years | 2000 | 3.6 |

Things to take note of:

- The HSR “roller-coaster”

- Strong retail scene

- Congestion issues

1. The High Speed Rail (HSR) “roller-coaster”

It was thought that the terminus for the HSR would be located in Jurong East, and provide a direct link to Kuala Lumpur. This briefly made Jurong East a hotspot among investors (thinking of Malaysian tenants), as well as home owners who see quick access to Malaysia as a major amenity.

This was what caused the average price to jump from $709 psf in 2010 – when the HSR was announced – to $1,478 psf during the property peak in 2013. But in 2018, the HSR was apparently cancelled; several analysts predicted a potential negative.

2. Strong retail scene

Jurong has seen the biggest pick-up in retail amenities over the past decade, compared to almost any other district. Major malls like JCube, Jem, and Westgate have joined older existing ones (like IMM); this has now replaced Jurong’s previous reputation as being purely industrial, and too isolated.

3. Congestion issues

Due to its transformation to a regional hub, Jurong’s congestion is the worst the area has seen in years. There are plans to create a road that allows residents in nearby Bukit Batok, Choa Chu Kang, and Jurong West to connect directly to the AYE, while bypassing Jurong Lake District; but until that happens, traffic is likely to keep frustrating residents.

URA is also aiming to cut down the number of delivery trucks during peak hours, by 65 per cent (there’s no recent news on how well this is going).

As for the large crowds on the MRT, this will be alleviated by the Jurong Region Line (est. completion 2025) and Cross Island Line (est. completion 2030); but until then, expect to squeeze into the MRT and get standing room only.

Tampines Regional Centre

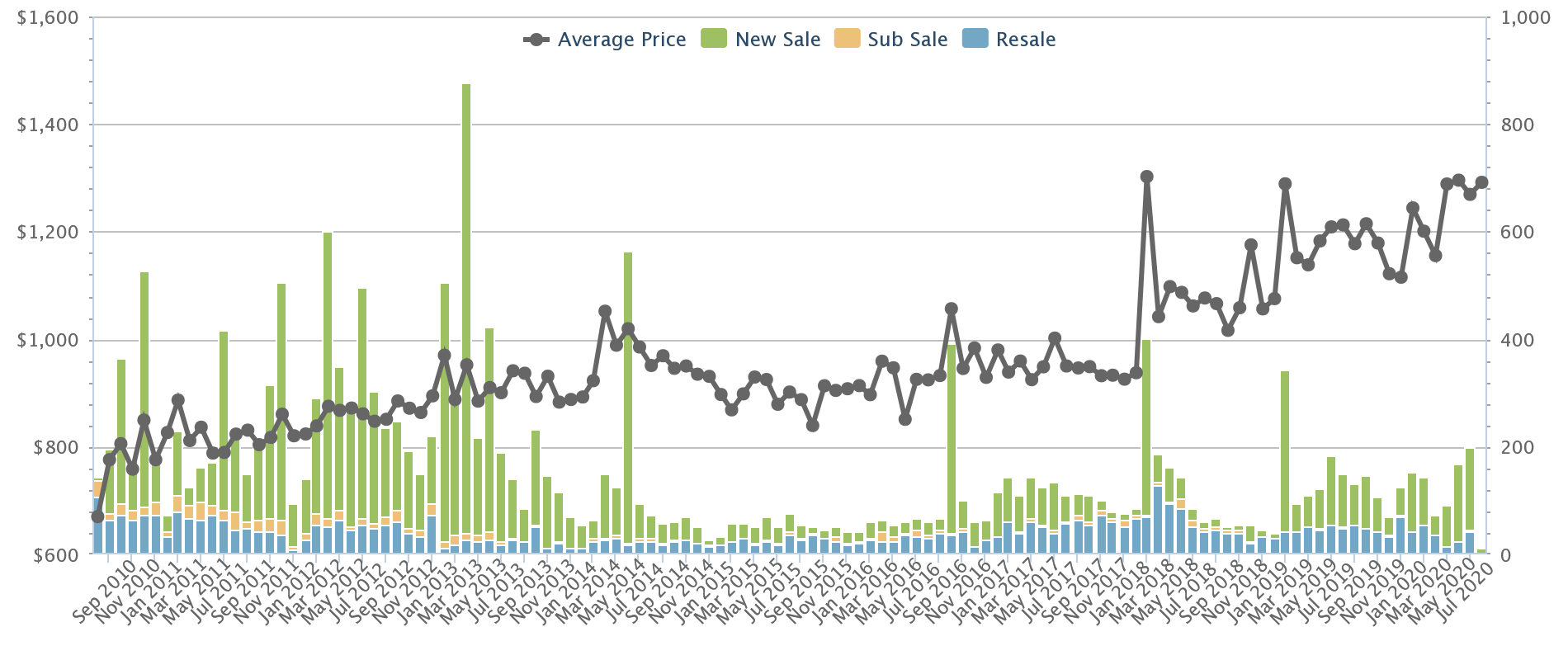

Many Singaporeans don’t realise that it’s Tampines – not Jurong – that was the first completed regional centre. Tampines as a regional centre was developed way back in 1992. As such, it’s often overshadowed by its newer counterparts:

Prices have appreciated from an average of $670 psf, to $1,292 psf over 10 years. This is an increase of 92.8 per cent, or around 6.79 per cent per year.

Top three developments in price appreciation

| Project Name | Tenure | Completion | Capital Gain (%)* | Historical PSF | Current PSF |

| Belysa | 99 years | 2014 | 29.5 | $701 | $908 |

| Coco Palms | 99 years | 2018 | 25.7 | $1,024 | $1,287 |

| Sea Horizon | 99 years | 2016 | 17.7 | $796 | $937 |

*Capital gain calculation derived from the past 5 years.

Top three developments for rental yield

| Project Name | Tenure | Completion | Gross Yield (%) |

| Melville Park | 99 years | 1996 | 4.2 |

| Eastvale | 99 years | 1999 | 3.8 |

| The Riverina | 99 years | 2000 | 3.8 |

Property Picks5 Condos With The Best Rental Yield And Lowest Maintenance Fees

by Ryan J. OngThings to take note of:

- The most developed of the regional centres

- Major benefits from the proximity to Changi

- Will gain from the upcoming Cross Island Line

1. The most developed of the regional centres

Being the first, Tampines has had more time than the other three regional centres to develop. Tampines Central is noted for its cluster of three major malls (Century Square, Tampines Mall, Tampines 1), as well as the large number of banks and financial services.

However, this also mean further transformation may be limited when compared to the newer regional centres; buyers today may be coming in late (see the chart above, prices have practically doubled on a per-square-foot basis).

More from Stacked

How To Hunt For Affordable Landed Homes In The East: A Seasoned Landed Home Specialist Shares Her Tips

There's always been much debate between the East and West in Singapore, but other than food Singapore’s East side is…

2. Major benefits from the proximity to Changi

A key benefit for the Tampines regional hub is easy access to Changi airport, as well as Changi Business Park. It’s around 10 minutes’ drive from Tampines Central to Changi Business Park, and about an eight-minute drive to Changi airport.

As such, landlords often eye the ready demographic of expatriates working in logistics, aviation, or the many companies located in Changi Business Park.

3. Will gain from the upcoming Cross Island Line

The Cross Island Line (CRL) will improve general access to the MRT network. Phase 1 of the CRL will link Tampines North to the North-South Line, while Bright Hill station will provide a connection to the Thomson East-Coast Line (TEL).

The completion of the CRL is estimated to be around 2030, however, so it’s a little early to see much enthusiasm.

Woodlands Regional Centre

This will be the largest economic hub in the north, slated for completion in about 10 years. One of the standout features are Woodlands’ extensive waterfront views, as well as focus on agricultural technology:

Property prices averaged $601 psf a decade ago, and have now climbed to $1,078 psf. This is a 79.3 per cent increase, with prices going up around six per cent per year.

Top three developments in price appreciation

| Project Name | Tenure | Completion | Capital Gain (%)* | Historical PSF | Current PSF |

| Twin Fountains | 99 years | 2016 | 19.8 | $741 | $888 |

| Bellewoods | 99 years | 2017 | 12.3 | $764 | $858 |

| Woodgrove Condominium | 99 years | 1999 | 8.3 | $635 | $688 |

*Capital gain calculation derived from the past 5 years.

Top three developments for rental yield

| Project Name | Tenure | Completion | Gross Yield (%) |

| Northoaks | 99 years | 2000 | 4.1 |

| Woodsvale | 99 years | 2000 | 3.8 |

| Parc Rosewood | 99 years | 2014 | 3.7 |

Things to take note of:

- RTS link to Johor Bahru

- Woodlands North Coast business park

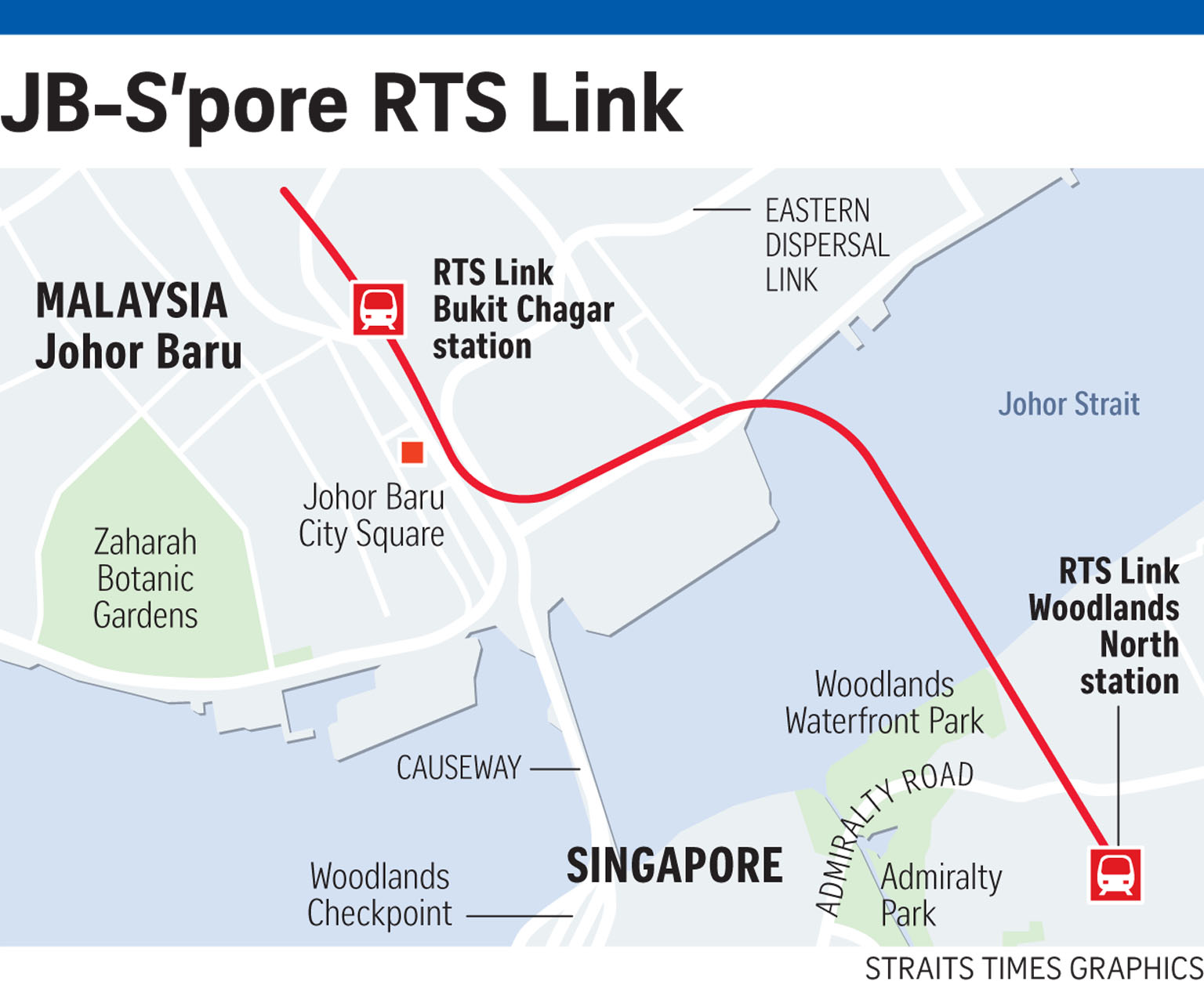

1. RTS link to Johor Bahru

The Singapore – Johor Bahru Rapid Transit Link System (RTS) will provide a direct train to Johor Bahru. The Singapore terminus is at the Woodlands North station, and the train will end at Bukit Chagar station in Johor.

This will create further rental demand among Malaysians working or living in Singapore, although a fair number of them already rent in the Woodlands area (thanks to quick access via the causeway).

However, construction of the line has been stalled before; this happened in August 2017, when the Sultan of Johor called for a review of the design. The project only restarted in July this year, with a targeted completion date sometime in 2026.

Construction was meant to start in 2021, but we have not updated on whether this is affected by Covid-19 delays.

2. Woodlands North Coast business park

This business park is under the purview of Jurong Town Council (JTC), which was also behind the developments in Jurong, and in tech hubs like One-North. The business park is expected to provide up to 100,000 jobs, mainly for Small to Medium Enterprises (SMEs).

However, manufacturing companies are also to be a part of this. Current plans are to include only light manufacturing (i.e. low pollution); but some Woodlands residents may not like the thought of their neighbourhood now including industrial facilities.

Seletar Regional Centre

Seletar Regional Centre is mainly aimed at aerospace industries, as ST Aerospace and Europcopter are already based here. This is overall the newest of the regional centres, which is still far from its projected potential:

Private residential prices in Seletar haven’t moved much from a decade ago. They averaged $1,000 psf then, and are at about $1,087 psf. This is an 8.7 per cent increase, with prices rising just 0.84 per cent per year. Do note that transaction volumes are lower than most districts here.

Top three developments in price appreciation

| Project Name | Tenure | Completion | Capital Gain (%)* | Historical PSF | Current PSF |

| Saraca Gardens | Freehold | 1993 | 38.2 | 863 | 1,193 |

| Seletar Hills Estate | 999 years | 1996 | 34.2 | 978 | 1,312 |

| Luxus Hills | 999 years | 2020 | 29.3 | 1,531 | 1,979 |

*Capital gain calculation derived from the past 5 years.

| Project Name | Tenure | Completion | Gross Yield (%) |

| High Park Residences | 99 years | 2019 | 3.6 |

| Seletar Springs Condominium | 99 years | 2000 | 3.4 |

| Sunrise Gardens | 99 years | 1998 | 3.3 |

As this was the most recently announced regional centre, there’s not much to say yet.

If Seletar succeeds in drawing in new businesses and creating jobs, we’ll likely see prices climb in this otherwise quiet neighbourhood. Home buyers and investors will need to be tolerant however, as right now Seletar is a little light in terms of lifestyle / entertainment options.

Buying in regional centres can be a viable alternative to the CBD

The planned regional centres – even the more developed ones like Tampines and Jurong Lake District – are still far from CBD level prices of $1,548 psf.

However, we can see the regional centres have shown higher gains over the past decade than the CBD (barring Seletar, because it was the most recently announced). URA is quite consistent in its Master Plans, which is why that should remain the basic blueprint of property investing in Singapore.

If your focus is on resale gains, do consider the various regional centres instead of the usual CBD properties; it may also be more affordable for newer investors. You can check out in-depth reviews of properties in these areas on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How do property prices in Singapore's regional centres compare to the CBD?

Which regional centre in Singapore has experienced the highest price growth in the past 10 years?

What are some factors affecting property prices in Jurong Lake District?

What are the benefits of investing in Tampines regional centre?

How has property prices in Woodlands Regional Centre changed over the past decade?

Is Seletar Regional Centre a good investment option currently?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Pro This Popular 520-Unit Condo Sold 85% At Launch — Here’s What Happened To Prices After

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

0 Comments